Gold v Stocks; Who will win?

On one side of the investing coin is the idea that you lay out money today to get more back later. The flipside is that buy purchasing today you forego consumption today for the ability to consume more later.

On one side of the investing coin is the idea that you lay out money today to get more back later. The flipside is that buy purchasing today you forego consumption today for the ability to consume more later.

They aren’t quite the same thing of course, because the latter idea introduces inflation and suggests the purpose of investing is to at least maintain purchasing power (generate returns in line with inflation) or increase purchasing power (generate real returns in excess of inflation). In a useful reminder Buffett observes:

“Even in the U.S., where the wish for a stable currency is strong, the dollar has fallen a staggering 86% in value since 1965, when I took over management of Berkshire. It takes no less than $7 today to buy what $1 did at that time. Consequently, a tax-free institution would have needed 4.3% interest annually from bond investments over that period to simply maintain its purchasing power. Its managers would have been kidding themselves if they thought of any portion of that interest as “income.””

Therefore an investment that is price stable but loses purchasing power is very risky (think US T-Bonds) while an asset that is volatile in price but almost certain to increase purchasing power over time is less risky than the conventional measures of risk would dictate.

This is how Buffett begins an excerpt of his forthcoming letter to Berkshire Hathaway shareholders HERE. One scenario his introduction does not contemplate of course is deflation. Japanese real estate and equity prices are fractions of their previous levels and a bond offering even a miniscule return would produce an increase in purchasing power. Like many readers, you might reach the conclusion that the absence of this scenario in his letter along with the knowledge of aggressive equity purchases in recent months, indicates he does not believe deflation is a possibility.

The other subject of his letter is Gold. Melted down all the gold in the world would amount to one 68 cubed foot of uselessness. Somewhat ironically he reflects on its purchasing power today – all the agricultural land in the United States, sixteen companies as valuable as Exxon and a trillion dollars in walking-around money.

But he points out that the companies will have thrown off dividends and the land would have produced food. And so the article leads to the defence of buying businesses as a superior strategy (to owning gold ‘that just sits there’) – as we believe at Montgomery Investment Management, and you might as Value.able graduates (after seeking and taking personal professional advice).

I believe Buffett’s take on the investing landscape is ultimately correct (bubbles are always followed by a bust and nothing goes up forever);

“What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As “bandwagon” investors join any party, they create their own truth — for a while.”

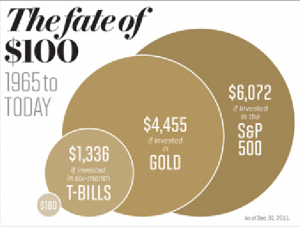

But I trust you can see the irony in claiming gold is useless and yet it can buy 16 Exxons and so on. As the chart shows, it has underperformed stocks over the long term and without boasting about it Buffett uses the S&P500 index to demonstrate the superiority of stocks. In a thinly veiled warning to gold bugs he likens the current enthusiasm for gold to the internet bubble and US housing speculation pre-2007.

In his enthusiasm for stocks being best able to retain purchasing power or increase it, I can’t but help remembering that Buffett was a more circumspect proponent of stocks in the seventies – a period of very high inflation. While in 1974, when Forbes asked Buffett how he felt about the stock market at the time, Buffett replied, “Like an oversexed guy in a whorehouse”, his 1979 letter to investors serves as a useful reminder of the limits of any asset to retain purchasing power during bouts of high inflation.

In his enthusiasm for stocks being best able to retain purchasing power or increase it, I can’t but help remembering that Buffett was a more circumspect proponent of stocks in the seventies – a period of very high inflation. While in 1974, when Forbes asked Buffett how he felt about the stock market at the time, Buffett replied, “Like an oversexed guy in a whorehouse”, his 1979 letter to investors serves as a useful reminder of the limits of any asset to retain purchasing power during bouts of high inflation.

“Just as the original 3% savings bond, a 5% passbook savings account or an 8% U.S. Treasury Note have, in turn, been transformed by inflation into financial instruments that chew up, rather than enhance, purchasing power over their investment lives, a business earning 20% on capital can produce a negative

real return for its owners under inflationary conditions not much more severe than presently prevail.

If we should continue to achieve a 20% compounded gain – not an easy or certain result by any means – and this gain is translated into a corresponding increase in the market value of Berkshire Hathaway stock as it has been over the last fifteen years, your after-tax purchasing power gain is likely to be very close to zero at a 14% inflation rate. Most of the remaining six percentage points will go for income tax any time you wish to convert your twenty percentage points of nominal annual gain into cash.

That combination – the inflation rate plus the percentage of capital that must be paid by the owner to transfer into his own pocket the annual earnings achieved by the business (i.e., ordinary income tax on dividends and capital gains tax on retained earnings) – can be thought of as an “investor’s misery index”. When this index exceeds the rate of return earned on equity by the business, the investor’s purchasing power (real capital) shrinks even though he consumes nothing at all. We have no corporate solution to this problem; high inflation rates will not help us earn higher rates of return on equity.”

Another warning to stick to high ROE businesses…

Finally remember that if you are buying stocks, unlike commodities, there exists management risk, execution risk, result risk, competitor risk, economic risk, currency risk etc. Anything can go wrong in a business and frequently does. And while Chalrie Munger has pointed out that “Almost all good businesses engage in ‘pain today, gain tomorrow’ activities”, you must know what you are doing.

I think stocks are indeed the best opportunity to retain and increase purchasing power but only the good quality ones. Knowing what you are doing and sticking to high rates of return on equity, little or no debt and A1 or A2 businesses increases your chances of doing even better than the both the stock market index of which they are constituents and inflation.

Posted by Roger Montgomery, Value.able and Skaffoldauthor and Fund Manager, 14 February 2012.

Matthew R

:

A simple question maybe, but I’m interested in people’s thoughts:

What resource related stocks will do well if China takes a tumble?

We are in a resources boom and demand has exceeded supply leading to higher prices. This has been great for resource companies and mining services.

However, supply will catch up with demand eventually (are we already there?). Volume will still be huge but prices will drop.

In this environment who does well? Resource companies, mining services, someone else, nobody?

We will certainly see which companies have competitive advantages. I don’t think it will be the shipping companies if the recent reports are true that you can not only hire a 45,000 tonne “Supramax” ship for free but the shipping company will also subsidise your fuel (http://www.businessweek.com/news/2012-02-14/glencore-gets-free-ship-with-fuel-discount-on-rates.html).

I’m asking this question because “it is very difficult to make predictions, especially about the future” and if you wanted to maintain upside while protecting your downside where would you invest?

SC

:

Hi all,

Interesting documentary on why India loves gold. Keep in mind this is a very young country with ~35% of its people still under 20. Plenty of weddings to come.

http://www.cbsnews.com/video/watch/?id=7398482n

Biwash

:

Hi Roger and all,

Very disappointing result from FGE today, any thoughts????????????

Roger Montgomery

:

Ploughing through the avalanche…

Ray H

:

What was it that you found disappointing Biwash? I thought the first half figures were quite good. Certainly in line with my expectations.

The market did not seem impressed. Not sure why, the result was in line with consensus. Perhaps it is the market you were disappointed with? Ignore it, unless it falls far enough to offer an opportunity to add to your holding.

adrian

:

hi roger and all.

first time poster long time lurker.

the whole gold thing has been of great interest to me lately. i mean if you bought at the top of the early 80’s you would probably feel the fool. but if you managed to ride the wild up trend and get out with a healthy profit. you would be quiet pround of yourself.

i mean with hind sight if i sold all my managed funds back in 07 and switched to gold i would be totally stoked now!

so my question is for roger, in an earlyer blog feb 6th with the abbott and costello skit. you say that you own gold companies that you have done quiet well on. but also at around christmas you brought more physical gold.

im just wondering what your rational for this was? and what is your point of view on both, holding physical gold and or just owning a golding producing company. where do you see it all headed?

thanks for your time, and i love what you have provided for us all here in the way of skaffold and your book.

regards adrian

Roger Montgomery

:

This bullion is novel but both are a hedge against the impact of the only tool central banks have at their disposal in a deleveraging.

Boon

:

Hi Roger,

This article in relation to gold is very interesting, as we all know, European debt crisis is more severe than we all thought, I am thinking that when the crisis gets worsened (due to the talk of Greece leaving the Euro zone becoming more transparent), gold price will again appreciate significantly like last Aug, therefore, gold production company’s value will also appreciate. I am exploring some potential small cap gold mining companies and I found KRM, it sounds fairly promising to me based on their production, gold price appreciation and debt crisis, they all go hand in hand. I just wonder if you could comment on this.

Roger Montgomery

:

The risk hedge is certainly one motivator for gold buyers, major currency debasement and loss of purchasing power is another…and yes I see the irony!

John C

:

Hi Boon, KRM is a good company (A1) that has no net debt. They fund their exploration out of cash-flow from their producing mine (Way Linggo). They have a second mine (Talang Santo) either already producing or about to produce. Their reserves are low due to the their policy of containing their drilling and expansion to within limits of existing cash-flow (without resorting to debt). Their cash costs are very low, currently around A$142/oz (website removed prior to checking). Some people believe that Indonesia presents some country risk, but there’s examples of various mines that have operated very successfully in Indonesia for many years. They’ve got Bill Phillips as a non-executive director and he has had a major role in the development of KRM. Bill has managed or been instrumental in the successful development of 16 mines; his most recent role was overseeing development, mining and production at Medusa Mining Limited’s highly sucessful Co-O gold mine in the southern Philippines. He is now focused solely on Kingsrose. Disclosure: I hold some KRM, and also RMS, RED, RCO, and intend to buy back into KCN, SAR and MML at some point. NST is also on my radar. There should be plenty of capital appreciation in such stocks if gold continues to appreciate. Most of those pay dividends too, and KRM plan to pay their maiden dividend this year. I’m bullish on gold prices, and therefore gold stock prices, but I prefer to concentrate on the mid-caps and micro-caps, where the most value is likely to reside.

Another one to consider is RED (RED 5), who have just completed commissioning of their gold processing plant in the Philippines where Medusa has a very succesful mining operation (Co-O). RED is in very good shape, and should also have low costs in the future.

Roger Montgomery

:

Interesting observation on reasons for low reserve reporting. Plenty of other reasons these companies don’t have debt…

Roger Montgomery

:

Just a quick fact; Gold it seems has been on Buffett’s mind for a long time…Buffett pointed out, “with no little agony”, that when he had taken over Berkshire the book value of one share could have bought one half-ounce of gold and that, after fifteen years in which he had managed to raise the book value from $19.46 to $335.85, it would still buy the same half ounce.” 1979 Berkshire Annual Report

Boon

:

Hi John,

Your review looks fairly similar to my findings but in a more comprehensive way. I also think SBM is worth a look too.

John C

:

Hi Boon

Yes, SBM have a nice ROE, and they are undervalued – there’s a MOS there – and they’ve been improving their MQR lately. I’ll keep an eye on them. I’ve got a couple ahead of them on my watchlist however.

I’m also watching SAR, TRY & IAU. If you’re reading this, Ash, do you have any comments or views on TRY or IAU (Troy or Intrepid)? Would very much appreciate any input you, Roger, or any other blog contributors may have on these stocks. Ta.

John C

:

I bought some Troy (TRY), but not SAR or IAU. I’ve also bought a little TBR (Tribune) which unfortunately Skaffold doesn’t like very much. TBR are small, illiquid, and the top 20 shareholders control over 80% of the share on issue, so they’re also hard for other campanies to try to take them over. They, with Rand, (together) have a 49% interest in the EKJV (East Kundana Joint Venture) near Coolgardie and Kalgoorlie in WA, which is majority owned (51%) and operated by Barrick. That (EKJV) mine is producing some of the lowest cost gold in Australia, and Tribune are mostly banking their share of the bullion (instead of selling it), which is showing up in their reports as decreasing (or low) profits, but a fast growing and strong asset base. It’s gets messy because TBR and RND (Rand Mining) both own reasonably size chunks of each other’s shares-on-issue,… And RND is putting together a deal for them to take over a company called Iron Resources from Resource Capital Limited (RCL), which would involve RND exercising an option that would involve handing over 8,000,000 shares in Tribune (currently held by Rand) to RCL in exchange for RCL’s Iron Resources assets. Moving into the Iron Ore business is a little bit of a worry, as their (TBR’s & RND’s) core competency (and high profit) appears to be in the gold industry.

Anyway, I’ve taken a small position in TBR, and I’m having a good look a RND now. Although Skaffold doesn’t like TBR, It regards RND as a different kettle of fish altogether; An A2 with an MOS of 32%. And lots of cash and/or gold bullion in the bank… Worth a glance I’d say. The lack of liquidity may be the biggest issue…

Anybody else taken a swing at any of these small gold producing stocks?

yavuz

:

I have been buying physical gold since 2001. So does that make me a speculator or investor? Does it really matter? I have not made the return I have made from investing (or speculating) in gold with shares. Having said that I still likes shares. I just wish I had bought more of that yellow metal. Maybe the time to sell is approaching (not yet).

paul

:

Buffets fondness for equities over all else and as we all know how hard it is to find good long term companies really says much for owning a good index fund eg STW . Bought slowly , during dips , it is hard to think of a better low risk , self cleansing way to own shares – particularliy if we consider all the mangement , industry and personal ( eg not keeping abrest of your portfolio) risks that there are. Matthew s analogy of the market being like a game of snakes and ladders seems very apt.

Andrew

:

The below might not add much to the discussion but for me personally, i will stick to stocks, it is what i understand. I will happily diversify my holdings into various top quality companies to manage risk. My brain just struggles to comprehend holding gold. I completley get the whole store of value and currency arguement, i also know it can be quite pretty to look at. But as i don’t really see much practical use for it, i just don’t see the point. I keep asking myself the following question.

If all the gold in the world dissapeared suddenly, would anyone really notice?

Perhaps jewellers and New Jersey based reality TV show contestents. I am no expert maybe there are many more uses of gold.

This is just my view personally, i get the arguements for gold as both a store of value and diversification measure but at the end of the day it just doesn’t fit with me. I would say it falls outside of my circle of competence. I can understand the risks of a business, the cashflows and the competitive environment, but those yellow bricks of metal just puzzle me. It doesn’t matter which way i look at it, it just sits there and does nothing.

I know, i know, i am looking at it in the wrong way, i should be looking at it as a currency or store of value. But my belief is that an investment is something that has an intrinsic value, and until i can see the day where we are back to buying our groceries with gold and silver coins or bars than i will leave it to the rest of you.

We can both be right on this one. There is no definitive answer.

John C

:

Hi Andrew – I read the following over the weekend and thought it would make a useful addition to this conversation: There was a little talk about the usefulness of PE ratios to value or compare industrial or non-mining companies (not something we all adhere to here), and then it goes on to explain the big difference…

But with resource stocks, the largest single asset of the company is usually the underground

ore. One million ounces of insitu gold is potentially worth around one billion dollars. There

is no other single asset that comes close. It would be like an industrial car assembly line

with 30 years worth of sales in an underground warehouse. PE ratios only capture next

years sales, not the next two to three decades of production. The rate that the gold will be

dug up at is only a minor part of the entire valuation. Investors who value gold shares as if

they were a ball-bearing factory miss the point of owning gold shares in turbulent economic

times.

Even compared to other mining stocks, gold is in its own class. Unlike any other

commodity, gold is not consumed. It’s barely used for any industrial, medical or research

purpose. Paradoxically, it’s this inedible, unreactive, non-catalytic quality that makes it the

ideal choice as a form of currency. Gold is money. (Paper money can’t be eaten, used for

transport, fertilizer or fuel either.) Because gold is a currency, and almost all the gold ever

mined is still in a tradeable form, its supply is very dependent on its price. Total yearly mine

production only increases world supply of gold by around 2% per year. In theory, if the

price rose far enough, all 150,000 tonnes ever mined would be ‘up for sale’. Platinum and

silver, in comparison, are mostly consumed, and much of the past production is now spread

thinly amoung roadside dirt (in the case of platinum) or a billion photo albums (in the case

of silver).

Because the price of gold moves for different reasons to prices of every other mineral or

commodity, gold stocks too, may move in the opposite direction to every other stock in the

market. While almost every other sector of the market has had a boom since 1980, gold has

languished, something that makes it more appealling as an investment now than if it had

kept up with inflation. There is more upside.

Gold companies tend to be the most extreme of resource stocks. Because silver has

historically also been used as currency, we include silver resources as gold-equivalent (at

the ratio of their prices), but we do not consider any other metal to be equivalent to gold.

It gave me a slightly different perspective.

BuffetAdmirer

:

I think Buffet is a fantastic investor but I disagree with him here about gold (he may be right over one or two years but 8-10 he is going to be far off the mark). Remember he hated gold initially and missed massive returns. He sold silver far too early (He sold silver at 14$ when its inflation adjusted high is over 100$ (did he do a statistical analysis over centuries analysing at which price silver peaked historically in relation to inflation adjusted highs; clearly he didnt) .

If you track back over his shareholder newsletters since the 1970s one thing Buffet has a problem with is when he gets it wrong he has serious troubles reversing and admitting mistakes quickly. His patience as an investor works against him in this respect. He rides the mistake into the ground (see: Conoco Phillips disaster — he bght at the oil price peak which demonstrated his ability to pick the direction of commodity prices (so this would imply he thinks oil will far exceed its inflation adjusted highs yet gold will struggle to go over its inflation adjusted highs?), and also not admitting the Berkshire aquisition was a disaster earlier). Granted Buffet has made many fantastic calls but his circle of competence is clearly not commodities. He has not made his fortune from commodities, but from stocks and buying businesses outright, so he is arguably biased. I would prefer listening to Jim Rogers or looking at a thorough analysis of commodity cycles since 1780 which statistically shows the commodity secular bull has at least 8 years to run.

Roger Montgomery

:

He did make a quick couple of billion from PetroChina…

BuffetAdmirer

:

But again that is based on stocks. Pure exposure to commodities and precious metals in terms of direction and/or magnitude of the move he has not been correct a few times now.

Name me one investment in direct commodities (apart from silver and excluding common stocks) where he has made substantial profits relative to his net worth at the time.

So he refused to buy gold when it was at substantially lower levels (stating similar reasons about gold ) and sold Silver far too early (which he has admitted himself) but now we should believe him that gold is in a bubble and that stocks will outperform gold over the long term.

He cant predict where commodity prices or precious metal prices will go with any great certainty because he may not have a system for determining the intrinsic value of such things.

Dont get me wrong I think the man is a genius, and I am a huge fan; I just think his comments about precious metals are outside his circle of competence which he advocated himself numerous times to stay within.

Actions not words ;).

Roger Montgomery

:

Anyone?

Rici Rici

:

By the way i listened to you on Ross Greenwoods show today.

You mentioned that as of last Friday, the ASX had just hit its ‘intrinsic value’.

Given the heavy weighting of resource companies in the ASX, out of curiosity what is your intrinsic value estimate for the ASX industrials?

Is the ASX industrials below or above its intrinsic value?

John C

:

Are you a Skaffolder Rici? There is an ASX200 (XJO) Skaffold Line screen which would suggest that it’s a little over the IV currently, but upper and lower IV estimates for XJO are rising moderately this year and the next… And it’s regularly updated. There’s a lot to like about Skaffold. The improvements to the filters are excellent by the way Roger. I’m looking forward to more

Roger Montgomery

:

Hi John, thanks for your feedback. I removed your suggestions… No need to tip off the plagiarists. The answer is yes.

Rici Rici

:

I think that when a ‘fundamental value investor’ like yourself starts to quantify ‘gold’ as a potential holding, it just shows how depressed the equity market it in terms of popularity.

I have also watched with interest Jim Cramer on ‘are you diversified’. Someone with an exposure to gold as part of a top 5 positioned portfolio with gold is now considered diversified (i have never seen this from cramer before)

For myself i will stick with Buffett, pure and simple. There is no gold in my portfolio, nor will there every be. I will hold a mixture of cash and shares, the relative holdings will be governed by the attractiveness of equities as an investment class.

Roger Montgomery

:

Good thinking Rici Rici. Not quite sure what was published was tantamount to ‘quantifying’ anything though.

Ilya

:

The ultimate problem is the fact that all modern currencies are backed with nothing but confidence. As confidence goes so does the value. Investors don’t necessary invest in order to own a piece of company, they invest to make money. If money gets systematically debased the returns are severely eroded. A 20% return may sound spectacular, but it is is anything but if inflation is running at 25%.

Gold does not suffer this problem. The quantity of gold is limited and therefore as the value of currency declines the price of gold must appreciate (supply and demand).

I find this sentence puzzling if not offensive – “Melted down all the gold in the world would amount to one 68 cubed foot of uselessness.” Gold is no more useful or useless than money. It is a store of value. But I rather have real money (gold) that has limited supply and is free from meddling politicians, than a bunch of paper notes that are being cranked out by central banks the world over.

In the end the question is this. Do you expect inflation or deflation? If one expects inflation, they would be prudent to keep at least some gold. I would also concede that because stocks have limited supply and are backed by real assets, stocks are also better than cash in inflationary environment.This said, for a regular Joe, owning gold is much easier and safer than picking stocks.

I own both assets and will continue to do so.

Lastly, it is impossible to compare US in the 70s to now. Back then US was still a creditor nation with massive trade surplus. Now it is not. It is day and night. Economically US is just not what it was in the 70s, which tells me that current situation cannot play out like the 70s.

Roger Montgomery

:

Thanks Ilya. An interesting counterpoint to Rici Rici’s logic.

Adam

:

Talking about gold at the moment is a bit like talking politics, religion or real estate – you’re bound to upset someone. I agree with your comments, Ilya and I don’t agree with Uncle Wazza. The fact that he’s a multi-billionaire doesn’t make him right. That doesn’t mean that we are right either, but it’ll be interesting to see how it plays out.

I’ve just started reading a book by Detlev Schlicter that you may be interested in. His book is called Paper Money Collapse.

Ross

:

Detlev Schlicter is a wonderful author and one of my ‘must-read-weekly’ financial commentators. It is rare for an economist to articulate his arguments and dissect those of others so precisely. His site is also well worth a visit.

Luke

:

Hi Roger and Bloggers,

I would not argue that the price of gold has potentially developed into a bubble, and I would not argue that high quality business’s will outperform gold, however I still think there is a case for gold in an investment portfolio.

Gold should be considered a currency, rather than a commodity with limited industrial uses. Gold has a demonstaratble track record of maintaing value over many thousands of years. It has survived the fall of various currencies and governments and is desired across the globe.

As an investor you need to manage your risks, and for me that means other assets such as property and precious metals are in the mix.

Regards

Luke

Ilya

:

Hi Luke,

I often hear the opinion that gold is currently in the bubble but I struggle to find any real evidence of this.

During the housing boom, everyone was buying houses. If they were not buying, they were talking about it. If they already owned a house, they were renovating or buying an investment property. Everyday folks were turning property developers and quit their jobs to become real estate agents. Shows like Current Affair and Today Tonight were full of stories about home renovators flipping houses for quick profit.

I don’t see anything remotely similar in the gold markets. Most people do not own any gold apart from jewellery. Most investors still shun gold in favour of other assets. In fact it seems to me that the “gold bubble” story is almost entirely driven by the folks that don’t own gold and don’t like gold.

Regards,

Ilya

Roger Montgomery

:

Nicely articulated.

Chris

:

But if gold was in a bubble, do you really think that conversely, those people who owned or liked gold would even be among the ones to admit it ?

During a boom or a bubble, everyone who already got on board has a vested interest in seeing it go higher. Everyone caught up in it in the middle also does. Everyone at the peak end of it still wants it to go higher, and everyone collectively is high or drunk or the emotion of greed.

Anyone who shouts down the mania (like Peter Schiff did versus Art Laffer on Youtube) is ridiculed and pilloried.

If it is in a bubble, it is poorly advertised, probably because people have no confidence in anything right now and so don’t know where to turn in case they lose money. “Gold’s in a bubble, gold is not. Safest thing to do is bed down into cash” but you’ll never hear that ‘cash’ is in a bubble. Top US companies are awash with cash that they cannot spend on M+A because of the climate of fear, China is also awash with USD.

I still remember the stupidity, 19 years ago, when European banks sold off huge amounts of gold to invest in….the Euro.

Roger Montgomery

:

I remember that too.

BuffetAdmirer

:

Great persuasive arguments Chris. Thank you.

Peter Kruckow

:

I remember when gold was $200 and now its been hovering around $1700 for a good while. Surely there’s some sort of bubbly sign in that

Cheers

Pete

Roger Montgomery

:

Thanks Peter