The world is volatile. Your financial future doesn’t have to be. Explore our private credit funds here.

-

Finding stability in uncertain times: private credit’s status grows

Roger Montgomery

November 10, 2023

In the current financial climate, retirees and those approaching retirement are often caught between the Scylla and Charybdis of relatively low-interest rates and equity market volatility. The quest for a stable income solution has never been more pressing. Continue…

by Roger Montgomery Posted in Aura Group, Market commentary.

- save this article

- POSTED IN Aura Group, Market commentary.

-

MEDIA

Firstlinks – Why the ASX 200 has gone nowhere in 16 years

Roger Montgomery

November 9, 2023

In my recent article with Firstlinks, I wanted to highlight why the S&P/ASX 200 has shown minimal capital gain over the past 16 years, with only a 0.02 per cent total capital gain and an annualised capital gain of 0.00182 per cent per annum. The main reason as to why this is the case, dividends. Continue…

by Roger Montgomery Posted in On the Internet.

- READ ONLINE

- save this article

- POSTED IN On the Internet.

-

Dividends do not make a good company – Part 2

Roger Montgomery

November 9, 2023

With annual general meeting (AGM) season underway, what is becoming clear, yet again, is that great managers are good at two things. The first is running the business, the second is allocating capital. Some might be able to run a business, but many managers are incompetent at allocating capital. Continue…

by Roger Montgomery Posted in Investing Education, Market commentary.

- 2 Comments

- save this article

- 2

- POSTED IN Investing Education, Market commentary.

-

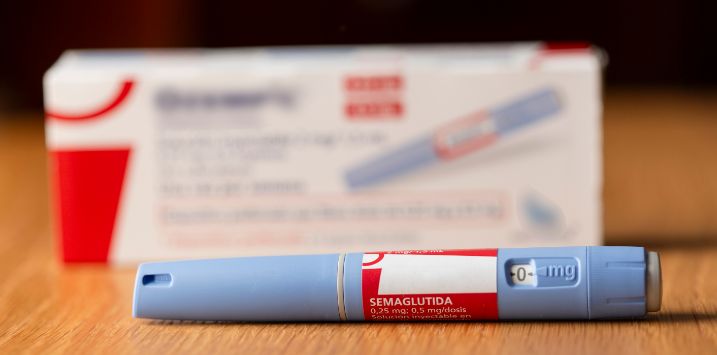

The market’s “weighty” overreaction

Roger Montgomery

November 8, 2023

Markets often resemble their participants, and the stock market is particularly vulnerable to the human psyche, prone to bouts of elation and despondency with each new trend. The recent euphoria surrounding a novel class of weight-loss and diabetes management drugs is a textbook example of this phenomenon. Continue…

by Roger Montgomery Posted in Companies, Editor's Pick, Health Care, Market commentary.

- save this article

- POSTED IN Companies, Editor's Pick, Health Care, Market commentary.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Why are property prices surging as rates are rising?

Roger Montgomery

November 8, 2023

In the thriving metropolises of Australia, the real estate horizon is gleaming brighter than ever. House prices have surpassed previous highs, putting a final nail in the coffin of those pessimistic forecasters who predicted 25-30 per cent declines. Continue…

by Roger Montgomery Posted in Editor's Pick, Market commentary, Property.

- save this article

- POSTED IN Editor's Pick, Market commentary, Property.

-

MEDIA

ABC The Business – Insights into Wesptac’s performance, RBA meeting, and Newcrest mining takeover

Roger Montgomery

November 7, 2023

During my recent interview on ABC’s The Business with Kirsten Aiken, I delved into several key topics. We explored Westpac’s (ASX: WBC) recent financial results, highlighting an overall improvement for the year, albeit with a slight decline from their first-half results. Additionally, we discussed the outlook in the context of the Reserve Bank of Australia’s (RBA) meeting and the consensus regarding potential rate increases. Furthermore, we touched upon the noteworthy takeover of Newcrest Mining by Newmont. Continue…

by Roger Montgomery Posted in Companies, Market commentary, TV Appearances.

- save this article

- POSTED IN Companies, Market commentary, TV Appearances.

-

Private Credit: Where collateral is king

Dean Curnow

November 7, 2023

Private credit, in your author’s opinion, will feature in the top ten most used investment phrases for 2023. My BBQ conversations on weekends this year have gone from penny stock recommendations to weird and wonderful ways to get exposure to private markets, notably through credit. Continue…

by Dean Curnow Posted in Investing Education, Market commentary.

- save this article

- POSTED IN Investing Education, Market commentary.

-

Pressure from the IMF to raise rates further

Brett Craig

November 6, 2023

The International Monetary Fund (IMF) have called on the Reserve Bank of Australia (RBA) to raise interest rates further. Continue…

by Brett Craig Posted in Aura Group, Market commentary.

- save this article

- POSTED IN Aura Group, Market commentary.