Finding stability in uncertain times: private credit’s status grows

In the current financial climate, retirees and those approaching retirement are often caught between the Scylla and Charybdis of relatively low-interest rates and equity market volatility. The quest for a stable income solution has never been more pressing.

And at the Australian Financial Review’s (AFR) Super and Wealth Summit in Melbourne on Tuesday, 31 October, that’s precisely the message from Australia’s biggest superannuation and pension funds managing the world’s fourth-largest retirement pool of $3.5 trillion.

As a hedge against inflation, thanks to the floating rate nature of private credit, as protection against the volatility experienced in equity markets amid monetary policy uncertainty and geopolitical anxieties, and for the relatively attractive cash returns available, private credit is fast becoming an essential component of a diversified portfolio.

This is especially true for retirees looking for reliable monthly income without the daily volatility experienced by equity markets.

At the AFR’s Summit, Aware Super ($160 billion), Australian Retirement Trust ($260 billion), Hostplus ($100 billion), and Uni Super ($124 billion) all noted their enthusiasm for the private credit asset class and each indicated their desire to increase their exposure.

As we have predicted many times this year, private credit will become an important addition to every retiree’s portfolio and an essential component of a well-rounded one.

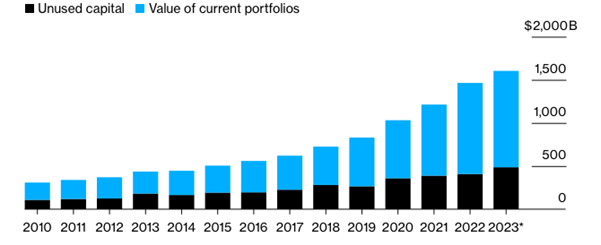

As reported by Bloomberg, “Money is pouring into private credit funds from wealthy investors, retirement plans, sovereign wealth funds, and even the banks that compete with them…private credit should become a permanent fixture in investment portfolios.”

Figure 1. Global private debt assets under management

Source: Bloomberg/Preqin Pro

Enter the Aura High Yield SME Fund (the Fund), available for wholesale investors. Since the Fund’s inception on 1 August 2017, which includes the COVID tumult, the Fund has been a beacon of stability amid the rough seas of investment markets. Aura’s private credit fund is increasingly being recognised as a strategic choice for those seeking to navigate a part of their portfolio away from the turmoil of equities towards the safer harbours associated with more consistent returns.

Importantly, unlike many other private credit funds, the Fund does not lend to distressed situations, venture capital, mezzanine finance or ‘special situations’.

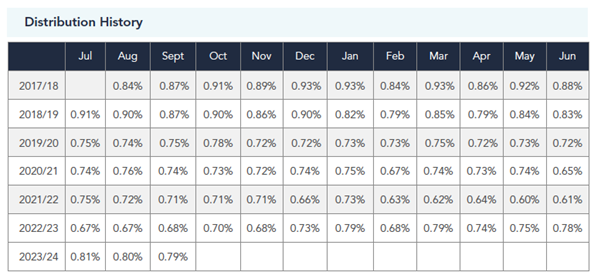

Table 1. Aura High Yield SME Fund monthly cash Returns to 30 September, 2023.

Source: Montgomery/Aura Credit Holdings

Table 1., reveals an average annual return of 9.61 per cent per annum since inception (1 August 2017), and no negative months, even during COVIDs hit to the economy to 30 September 2023.

The inflation hedge and interest rate resilience of private credit

The Aura High Yield SME Fund stands out with its floating-rate structure in a world where inflationary pressures loom large and interest rates are rising. This design inherently provides a buffer against inflation and elevates the Fund as an attractive alternative for retirees looking to protect their purchasing power. Meanwhile, the global private credit market, now at a robust $1.6 trillion, exemplifies the growing confidence in this financial sector.

Why retirees should consider the private credit path

For retiree investors, the private credit space, as seen with the Aura High Yield SME Fund, offers two benefits:

- The potential for higher yields;

- and a diversification tool that mitigates risk by providing uncorrelated returns to those from public markets.

Private credit in the portfolio: A newer and safer haven?

In the same vein as Australia’s largest pension funds, the Aura High Yield SME Fund provides an opportunity for retirees to partake in the same asset class and similar investment strategies used by institutional giants. It brings the sophistication of private credit within reach, offering a way to diversify across geographies and sectors, further reinforcing the strength of one’s investment portfolio.

Beyond the bank: How private credit surpasses traditional lending

With banks stepping back from more complex and capital intensive lending since the Global Financial Crisis, private credit funds including Aura’s High Yield SME Fund have stepped in to fill the void. This move not only serves to fortify the market but also affords retiree investors access to competitive returns that are less susceptible to the vagaries of the stock market.

The Aura High Yield SME Fund: An anchor in volatile times

For some retirees, the Aura High Yield SME Fund isn’t just another investment; it’s a solution that can provide not just returns but peace of mind too. The Fund’s focus on the flourishing small and medium-sized corporate sector offers a unique combination of high yield potential and resilience against the buffeting winds of economic change.

For those considering stability and an enhanced yield, the Aura High Yield SME Fund presents an option that aligns with prudent strategies employed by some of the world’s largest superannuation funds. Meanwhile, private credit’s rising status within institutional portfolios is a testament to its relevance as an investment choice, and as a bulwark against the unpredictable tides of global public markets.

For more information about The Aura High Yield SME Fund call David Buckland or Toby Roberts on (02) 8046 5000.

Disclaimer

Find out more about the Aura Private Credit Funds

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura High Yield SME Fund (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and Aura do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.