Value.able

-

Making Sense of Millennials

David Buckland

July 24, 2015

Millennials are broadly defined as anyone born between 1981 and 2000, and while there is a different daily reality between a 15 year old and a 34 year old, this “category” currently accounts for one-third of the global population and is projected to comprise 75 per cent of the global workforce by 2030. continue…

by David Buckland Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

A small cap gem

Scott Shuttleworth

July 10, 2015

Size has its advantages in funds management, especially from a scale point of view. However with the collective Montgomery Funds exceeding $700 million in funds under management, there are many stocks which elude our research efforts due to our inability to buy enough should our investment criteria be met. continue…

by Scott Shuttleworth Posted in Insightful Insights, Value.able.

-

MEDIA

Getting in shape to face 2015

Roger Montgomery

January 15, 2015

In Roger’s first column for Switzer in 2015, he gives a rundown of his favourites stocks. Read here.

by Roger Montgomery Posted in On the Internet, Value.able.

- READ ONLINE

- save this article

- POSTED IN On the Internet, Value.able

-

What captured your interest in Q2 2014?

Roger Montgomery

January 7, 2015

Over the next few days, we will take a look back at 2014 and highlight the most popular articles based on your views and comments.

The mention of house prices falling and negative gearing was a popular post.

In May, we talked Coca-Cola Amatil share price having declined by 40 per cent, and the duopoly that makes up Australia’s grocery retail landscape has putting the company on a strict diet of shrinking volumes, values and loss of market share to Schweppes and more particularly, the category known as “Private Label” soft drinks.

The forecast Australian population growth from 23 million to 40 million by 2060 bodes well for self-storage providers – and small-cap National Storage is no exception. We take a closer look at how the third-largest self-storage provider is positioned. Note, you will need to log in as a subscriber to see this paper.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, Investing Education, Property, Value.able.

-

Happy Christmas

Roger Montgomery

December 24, 2014

As we start to turn our minds to enjoying a well-earned break, we wanted to wish you all a happy, safe and peaceful Christmas.

Thank you sincerely for following us in 2014, and for inspiring to share our investing philosophy with you. We hope our insights have informed you, provoked you and generally kept you up to date.

We are now taking a short break, and the team will return here to the blog in early-January.

If you would like to share your ideas about the topics, industries or companies you would like us to cover in 2015, we’d be delighted to hear them. Be sure to leave a comment.

Until then, may your Christmas be all that you hoped it would and don’t forget to be sun smart.

by Roger Montgomery Posted in Value.able.

- 7 Comments

- save this article

- POSTED IN Value.able

-

What risk are they managing?

Tim Kelley

December 23, 2014

One of our peeves at Montgomery is fund managers who ‘hug’ the index. A manager might for example take an underweight position in BHP by allocating 5 per cent of a portfolio to it, when BHP makes up around 7 per cent of the index. This leaves them with a 2 per cent underweight position, which can fund an overweight position in some other large cap stock. If they charge investors a fee of 100 basis points for this type of ‘active’ management, the investors are getting a raw deal. continue…

by Tim Kelley Posted in Insightful Insights, Investing Education, Value.able.

-

It’s not all doom & gloom in retail

Scott Shuttleworth

December 11, 2014

Upmarket furniture seller Nick Scali (ASX: NCK) had an excellent financial year in 2014 with its success seemingly continuing into FY15. I’ve made a few notes on their outlook, whilst reading through the Chairman & Managing Director’s 2014 AGM addresses, which you can read in full here. continue…

by Scott Shuttleworth Posted in Companies, Consumer discretionary, Value.able.

-

Warning – don’t panic.

Tim Kelley

December 10, 2014

There have been volatile times recently on the ASX. With prices for oil, iron ore and coal falling sharply, the mood in the resources sector has turned decidedly sour. Further, the negative mood seems to have been adopted more broadly by the market, with a wide range of stocks showing meaningful price declines. continue…

by Tim Kelley Posted in Insightful Insights, Investing Education, Market Valuation, Value.able.

-

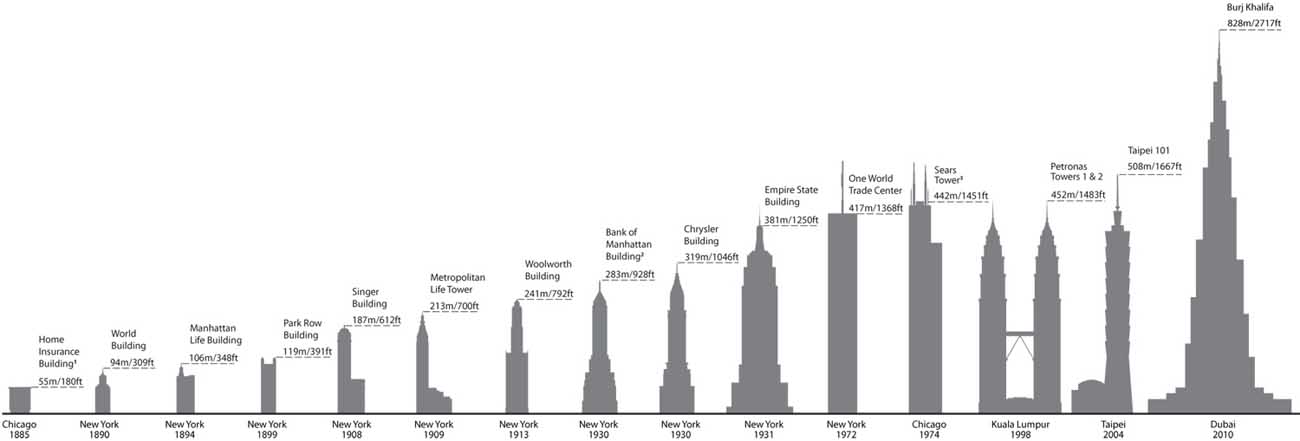

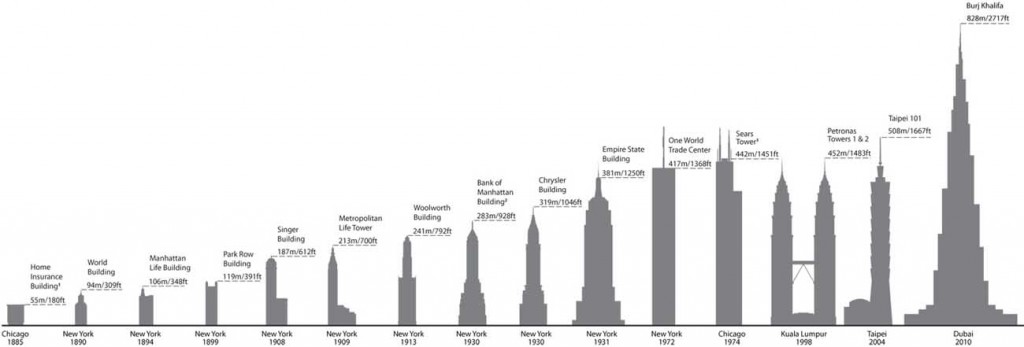

Bubble Watch #18 Tallest Buildings warns of impending stock market crash?

Roger Montgomery

December 7, 2014

There are all sorts of coincidences that can be mistaken for signs that a crash is imminent. We don’t put much store in those, however it is never uninteresting reading about them. One that is gaining a little traction is something known as the Edifice Complex.

In conventional terms, the Edifice Complex is the desire to build lasting edifices or buildings as a legacy to one’s greatness. In today’s context, the Edifice Complex represents the historically coincident construction/completion of these buildings with stock market crashes. continue…

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- 3 Comments

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

MEDIA

Why dividends are overrated

Roger Montgomery

December 4, 2014

In this column published in the December/January issue of Money magazine, Roger covers why the benefits of fully franked dividends may have been overstated, especially when compared to the long term advantages to company from the retention and profitable reinvestment of earnings. Read here.

by Roger Montgomery Posted in In the Press, Value.able.

- save this article

- POSTED IN In the Press, Value.able