Energy / Resources

-

Who’s really doing the coal mining?

Roger Montgomery

March 30, 2012

PORTFOLIO POINT: Delta SBD is weaker than its peer Mastermyne in many respects, but with an expansion in Queensland on the cards, things “might” change.

PORTFOLIO POINT: Delta SBD is weaker than its peer Mastermyne in many respects, but with an expansion in Queensland on the cards, things “might” change.Spec.u.li.tis (noun) 1. Inflation of one’s speculative stock-picking abilities.

In my line of work, I meet many finance industry professionals who generously forward their speculative tips unsolicited. A couple of them – the professionals, not the tips – are very good and have regularly mentioned stocks that have risen substantially. They tell me that some of these stocks will continue to rise substantially and because their track record is reasonably good – I believe one has funded an exotic car habit through speculation – and their research more in-depth than I would ever consider conducting on such speculative ventures, given the small amount of money involved for me, I occasionally weaken and succumb to their ‘trust me’ pleadings. Rarely does this end well for me, hence the small amounts of money involved and very infrequent ventures. I never expect to make anything from their high-risk speculative tips and I don’t view their current crop (NSE, COE, SEA, VMG and BTR, if you must know) any differently.

I do expect to do well building and maintaining a portfolio of extraordinary businesses bought at discounts to intrinsic value and that’s the philosophy I describe in detailed steps in Value.able, which you can only purchase online here.

I cannot value a company that currently makes no money, so my own brand of speculation (if that is what it should be called) would still need a business. That business needs to be generating a profit too and it needs to produce a reasonable return on equity, while trading at a discount to intrinsic value. This is as speculative as it gets for me (and it doesn’t sound much like speculation at all).

On a hiding to nothing, a refresher on intrinsic value is appropriate.

I use a proprietary model for calculating intrinsic value which you can learn by reading Value.able. In essence, if I have a bank account with $10 million and that bank account earns an interest rate return of 20%, and I decided to auction off the bank account in the public market, I am reasonably certain I would be able to secure more for that account than the $10 million of equity in it. Further, if I have two such accounts and one account pays all the interest out each year and the other pays no interest out but retains it, and each continues to earn 20% per annum, the account that paid no interest out would be worth more. Provided I cannot achieve a 20% return elsewhere, the latter account’s ability to compound earnings at 20% ensures its higher value.

But imagine a bank account that had $10 million of equity and was earning, say 12%, retaining and compounding 65% of that return, and was available for $9 million. That’s right, a discount to equity. I think I have found just such a company. It’s not perfect, as there is debt and arguably unjustified goodwill on the balance sheet involved. It’s both too small (about $100,000 worth of trades per month on average) and too risky for The Montgomery [Private] Fund, but it ticks a few boxes to warrant some speculative exposure for members of the Montgomery team, given its price.

Delta SBD (ASX: DSB) is a mining contractor and a peer to Mastermyne (MYE) – a company whose shares we do own, in very small quantity, through The Montgomery [Private] Fund and which I wrote about last week and which you can read about by clicking here.

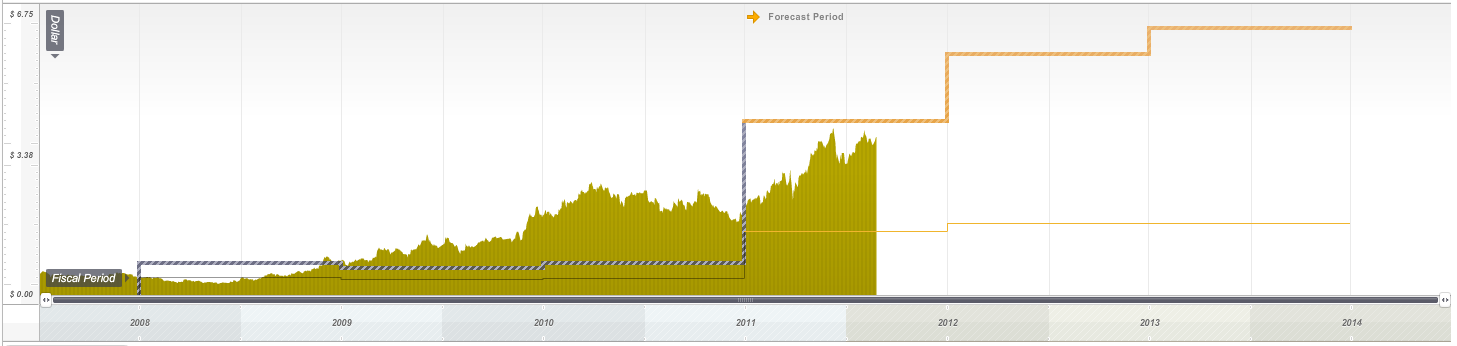

Figure.1 Skaffold Line screenshot of Mastermyne’s (ASX: MYE) share price and intrinsic value.

(Skaffold displays intrinsic value charts like Figure.1 for every ASX listed company and they are automatically updated for the latest information announced by companies every single day. To access Skaffold for 30 days click here)

Analysts have recently become very excited about the coal sector if not the entire mining services sector because it is enjoying healthy tender activity, contract wins and filling, if not full, order pipelines. Attention has turned to coal, not because there is any shortage of supply but because the nuclear disaster in Japan last year (which was indeed a tragedy for Japan and her extended family) caused many countries to rethink their nuclear power generation strategies. Cheap and with infrastructure in place, coal is once again a preferred if not desired source of energy. Australia also enjoys a reputation for relatively clean coal (note ‘relative’)

Coal 101:

There are two types of coal; Metallurgical or Coking Coal and Thermal coal. Thermal is used often to heat water to produce steam that turns turbines for power generation. Metallurgical or Coking coal is used in steel production. The impact on the price of both will be determined by demand from Japan, China and India.

“Two forms of coal are mined in Australia, depending on the region: high-quality black coal and lower-quality brown coal. Black coal is found in Queensland and New South Wales, and is used for both domestic power generation and for export overseas. It is generally mined underground before being transported by rail to power stations, or export shipping terminals. Black coal was also once exported to other Australian states for power generation and industrial boilers.Brown coal is found in Victoria and South Australia, and is of lower quality due a higher ash and water content. As a result Victoria adopted German power station and briquette technology in the 1920s to utilise the brown coal reserves of the Latrobe Valley. Today there are three open cut brown coal mines in Victoria used for baseload power generation.Australia is the largest exporter of coal in the world, with most of that going to Japan. Total production of raw black coal in Australia in financial year 2010-11 was 405 million tonnes (Mt.), down from 471 Mt. in 2009-10. This drop was largely as a result of the Queensland floods of January 2011 where production fell by some 30%.

According to the Australian Energy the reserves to production ratios for black and brown coal in Australia are 111 years and 539 years respectively, however these figures do not account for growth in production. Growth of Black coal exports in Australia has been growing at a rate of 5% (on average of the last 20 years). If this rate of growth was maintained to extinction all black coal in the country would be depleted in around 25 years, with the peak in production occurring in 2014.

Australia is the world’s largest exporter of coking coal – accounting for over one-half of global export supply, and the second largest exporter of thermal coal (see Table below). Some other countries are larger producers of these commodities than Australia, but they typically consume the bulk of their domestic production and hence have a less significant role in the global resource export market. This is particularly noteworthy for China, which is the largest producer of coking and thermal coal but also the largest global consumer of these commodities. Similarly, the United States and India are the second and third largest producers of thermal coal, but are significant consumers of their own coal as well.

Table 1. Global Market for Coal. Source: RBA Bulletin 2011

Coal mining in Australia is the subject of strident criticism from the environmental movement, because burning coal releases carbon dioxide, which is generally understood to contribute to climate change, global warming, sea level rise and the effects of global warming on Australia. Coal burning produces 42.1% of Australia’s greenhouse gas emissions, not counting export coal. As a result, coal is a politically charged subject and the proposed Carbon Pollution Reduction Scheme which followed the draft report of the Garnaut Climate Change Review has put a price on carbon. This would be likely to impact most heavily on brown coal usage within Australia (particularly in the Latrobe Valley in Victoria) for power generation.

Why the heightened activity in coal?

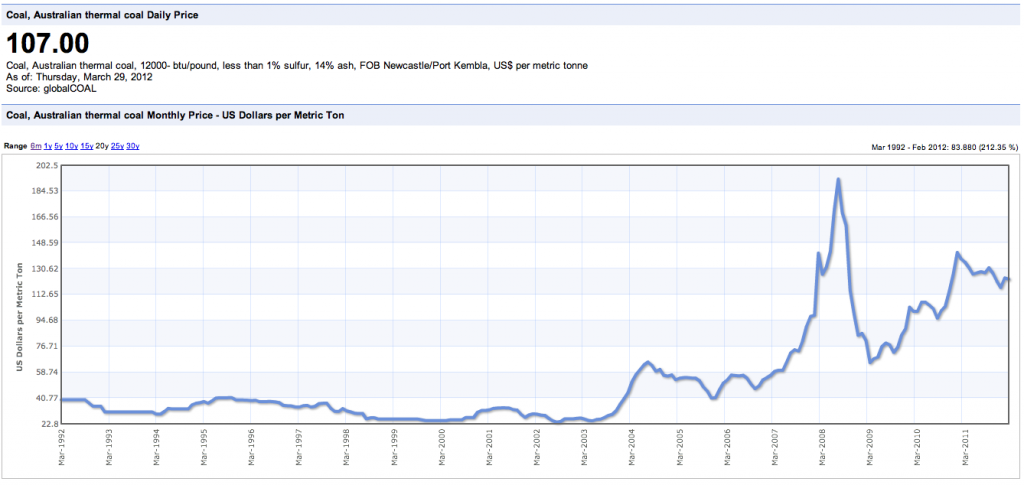

This 20 year price chart of Thermal Coal may help answer the question…

The chart for coking coal looks similar. In the near term however, US domestic demand is falling due to competition from shale gas for power generation and lower coking coal demand from steel mills. Consequently, central and inland US coal mines are seeing sales and prices weaken. Europe is looking even worse. South African cargoes, much of them destined for Europe, fell to $100 per ton in late 2011 from up to $120 per ton earlier last year.

China, on the other hand, has remained a robust importer of thermal and coking coal. Imports reached 13.3 million tons in August 2011 from 6.1 million tons in March that year.

HSBC expects India to be the fastest-growing importer of thermal coal with imports rising 32 percent to 79 million tons in 2011 and 19 percent or 94 million tons expected in 2012 despite rising domestic production.

In 2011 China has cut coking coal imports from Australia, due to the flooding in Queensland, and then because Mongolia – China’s large source – has lower delivery costs than Australia.

Weak demand in the rest of the world and stable yet slowing growth in China will put a cap on further price rises.

DSB’s mining contracting segment specialises in the provision of services for the underground coal mine industry, whole of mine operations, roadway development, longwall relocations and support, conveyor installations and maintenance, plant hire and maintenance, supplementary labour, and mine service. The latter includes secondary support installation, excavation, ventilation device installation and services/utility installation/recovery. In other words DSB provides labour and equipment for large blue chip coal miners. Its clients include BHP, Boral and Xstrata, some of whom have been clients for over a decade.

The company’s description sounds a lot like Mastermyne and the regions it operates in are also the same- providing mining services in the Illawarra, Hunter Valley and the Western regions of NSW (Gunnedah), and the Bowen Basin in Queensland.

These similarities do highlight an important risk – the relatively low barriers to replication and competition, which in turn are reflected in DSB’s lower returns on equity. Further, like Mastermyne, limited ‘through-the-cycle’ performance transparency means investors are right to be cautious about a company that is either new or newly-listed. Delta DSB floated was formed after the merger of two companies in 2007 and while services have been provided for 16 years, the company floated in Dec 2010 after raising $2.85 million, $750,000 of which paid for float costs, $570,000 went into the company’s bank account and $1.53 million was used to repay shareholder loans (went into incumbent’s pockets).

The founder and CEO Steve Bizzaca, own 33% of the business and collectively directors own 67.7% of the stock making the usual illiquidity of a small company even more accute.

Some of the differences between Matsermyne and Delta SBD are found in their price and operations. Mastermyne has almost three quarters of its contracts by number based in Queensland. It enjoys higher margins there. Delta SBD, on the other hand, has three-quarters of its contracts based in New South Wales. DSB is also more capital and labour-intensive than Mastermyne, reflecting its current capital expenditure programme. And the capital expenditure program has also caused divergent balance sheets. Mastermyne’s debt is falling and it generates positive free cash, while DSB has more debt and (currently) negative free cash flow.

You can see why Mastermyne is a small position in the Montgomery [Private] Fund and DSB is not. But as the company expands in Queensland, some of these price-limiting issues may abate. And that’s where any value could, with the low liquidity, quickly disappear just as the valuation starts rising.

For the first half of 2012, DSB reported revenue up 40% and a normalised net profit of $3.5 million, up 61.0% on the first half of 2011. Importantly, EBITDA margins improved compared to the previous corresponding period and the company announced a 1.5 cent dividend.

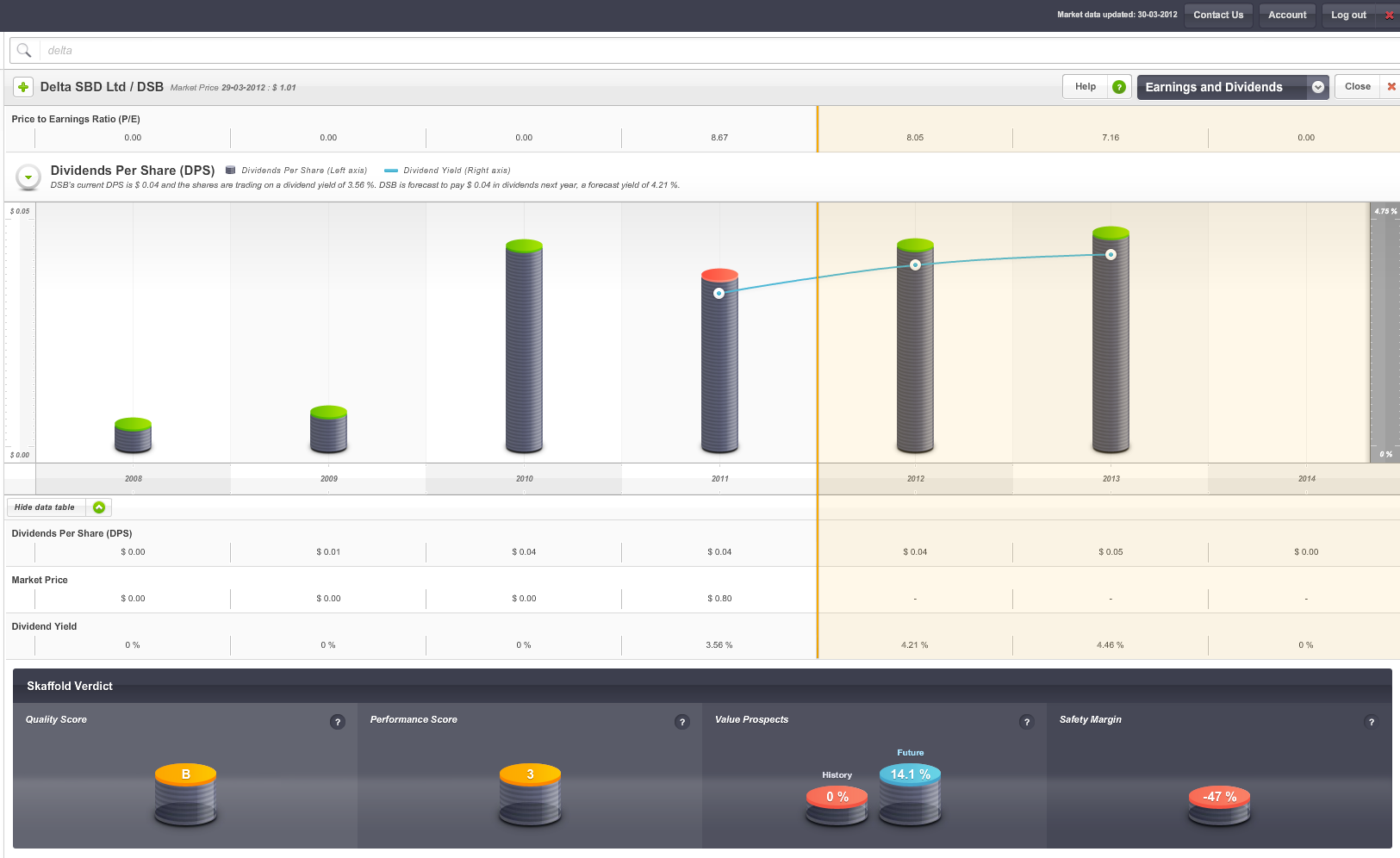

Figure.2 Skaffold screenshot, Delta SBD (ASX:DSB), Dividend Per Share including forecasts.

Like Mastermyne written about earlier, you have to watch cash flow, because capital expenditure increases in anticipation of equipment demand for new contract wins, but the ramp-up in the number of staff, from 418 to 489, indicates optimism on this front. DSB’s forward order book confirms work in hand for the second half of FY12 is $60M. $93M has is locked in for FY13 and $69M for FY14. DSB says it has also been “short listed” for a further $70M in new contracts, is negotiating about $7M and is tendering for an extra $333M.

While inexperienced and amateur investors may get excited by all this ‘activity’ and especially when a little company has big ‘blue-chip’ clients, experience has shown us time and time again that tender pipelines can dry,up or even mysteriously disappear when prices or economics are no longer attractive. This is best highlighted by a recent note in the Sydney Morning Herald:

Sydney Morning Herald – 5th Mar 2012 – Paddy Manning

“HUNTER VALLEY miner Gloucester Coal is struggling to shift stockpiles worth almost $40 million as demand for its semi-hard coking coal softens.

Gloucester, which will this week release details of its proposed $8 billion merger with Chinese-owned firm Yancoal, disclosed in its half-year earnings presentation that stockpiles at its Gloucester Basin operations remained high at the end of last year due to difficulty in shifting its coking product.

“In response to this sharp decline in demand for metallurgical coals, management took steps to change its production profile towards producing a higher percentage of thermal coal,” Gloucester said.

Gloucester would not comment on Friday but it is understood the soft demand is due to global economic uncertainty having an impact on Asian steel mills, which are themselves stockpiling coking coal.

A representative with coal industry analysts IHS McCloskey, Bruce Jacques, said Gloucester’s situation could be “atypical, because the type of coal they produce is sometimes not as easy to sell.”

Mr Jacques said transport bottlenecks could also be responsible at the “pretty congested” Newcastle port.

“There’s the best part of 40 vessels waiting off the terminal,” he said. “Companies are sitting on some allocation through Newcastle that they’re not going to be able to use.”

“It’s no secret that demand is easing. In fact, demand for both thermal and coking coal is easing. The coking coal price has been falling for three quarters and it’s likely to fall for the next quarter as well.”

It therefore makes sense to be conservative rather than optimistic in your estimates of value for DSB and remember high operating leverage and exposure to commodities means profits can quickly turn to sharp losses in this industry.

For now DSB enjoys a strong tender pipeline and the momentum from a generally rising tide in coal production. At the current price of 80 cents (APril 1 Price update: $0.99), the shares are trading at just seven times earnings and more importantly, at a discount to forecast 2012 equity, even though that equity generates a positive return of circa 12 per cent.

So there you have it – the first and last time you will hear about speculation from me.

This column was first published on March 21, 2012. Not a recommendation. Be sure to seek and take personal professional advice. Be sure to read the warnings.

P.S. The featured Chinese 1972 poster reveals China has been trying to solve the problem of coal transportation for more than 35 years. The inscription along the bottom reads, “Strive to eliminate the need to transport coal from North to South.”

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 31 March 2012.

If you enjoyed this post and would like to see more, and you are on Facebook be sure to click ‘like’ below. Thank you in advance for feeding the flame of value investing.

by Roger Montgomery Posted in Energy / Resources, Skaffold.

- 4 Comments

- save this article

- POSTED IN Energy / Resources, Skaffold

-

Guest Post: What’s the real BHP share price?

Roger Montgomery

March 29, 2012

Portfolio Point: BHP Billiton is well known to every Australian investor, but what you may not be aware of is the unique opportunity the corporate structure offers the trader and investor.

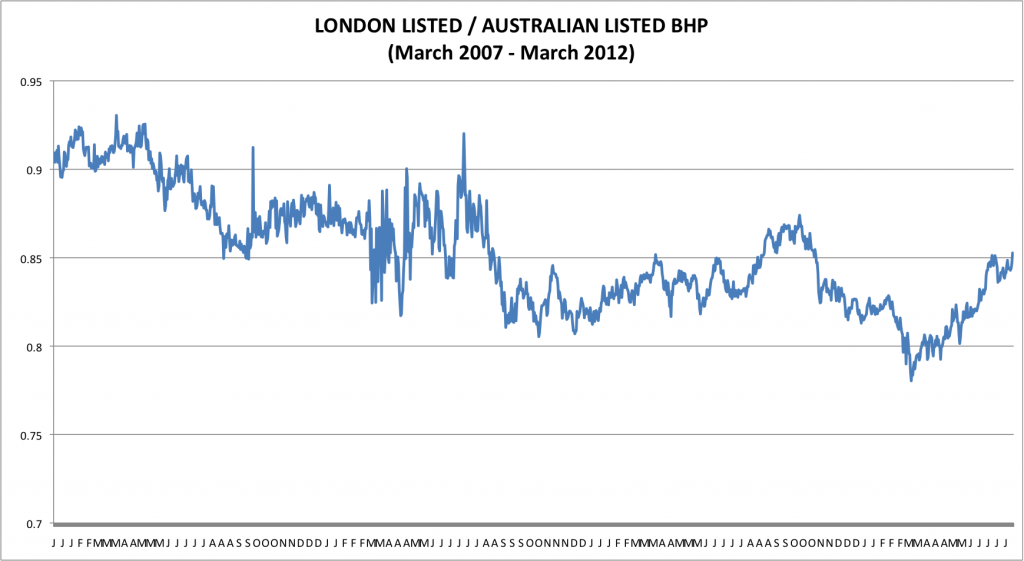

Portfolio Point: BHP Billiton is well known to every Australian investor, but what you may not be aware of is the unique opportunity the corporate structure offers the trader and investor. BHP Billiton was formed when BHP and Billiton merged in June 2001; following the merger the companies maintained their separate stock exchange listings. Australian investor know BHP Billiton Limited (ASX:BHP) traded on the Australian Stock Exchange, the other major listing is on the London Stock Exchange (LSE:BLT) BHP Billiton Plc. A share bought on either exchange has equal economic and voting rights, meaning you receive the same dividend payment and have equal claim to the company’s assets.

A logical person would assume that adjusted for the exchange rate a share of BHP Billiton Limited would trade very closely to BHP Billiton Plc, surprisingly this assumption is not correct. BHP Billiton Plc has traded at a discount every day for the last five years compared to the Australian listed BHP. If the shares were interchangeable between the exchanges the law of one price would remove the price difference, but in this case it is not possible to transfer a London listed BHP share to the Australian Stock Exchange, so there is not an arbitrage trade opportunity.

On the other hand, as the discount does not remain constant under all market conditions there is an opportunity to profit in the movement of the spread. To trade the spread a person buys one BHP and sells the other listed BHP, the trader is in a hedged position and is not concerned by the price movement of BHP they are just concerned by the movement of the discount/premium between the two shares.

As the shares are traded on different stock exchanges in different currencies, the exchange rate and the movement of the exchange rate needs to be considered if a trader is going to take a spread position. Fortunately in this case both are also traded on the New York Stock Exchange (NYSE) in US dollars through the use of American Deposit Receipts (ADR) an ADR traded on the NYSE represents shares in a foreign company. The ADR shares are interchangeable with the company it represents, so the law of one price keeps the price of the ADR adjusted for the exchange rate in line with the share it represents.

During the last five years the London listed BHP ADR (NYSE:BBL) has traded between 78% and 96% of the price of an Australian listed BHP ADR (NYSE:BHP), with an average of 86%.An excellent risk/return ratio is obtained if the trader can buy the spread near it historic low and sell when the spread moves up to its average and the timing to perform this trade is when the price of BHP is collapsing. In November 2008 when ASX:BHP hit the low of $20.10 the above spread moved 8% in 9 days, 8% might not sound like a great return but as the trade is a hedged position leverage is safely utilised to increase the return on invested capital.

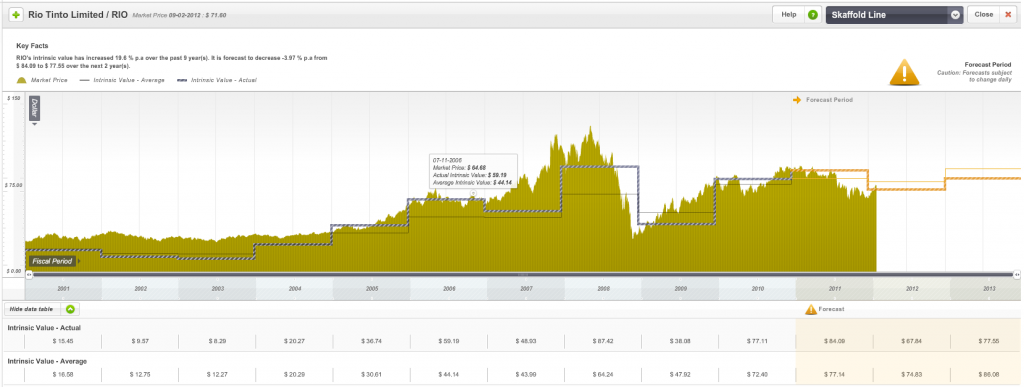

On the other hand, if you are an Australian value investor who wants to buy BHP shares at a discount to their intrinsic value there is a greater margin of safety in buying the London listed BHP for a 15% discount compared to buying the Australian listed BHP. If you follow Roger’s advice and only invest in the highly rated companies on Skaffold then BHP is not going to be a buy for you today at any price, but as the financial situation of every company is constantly changing one day in the future BHP may be rated A1 on Skaffold and at that time it might be worth you considering the London listed BHP.

Author: David Smith 13 March 2012

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights.

-

Is this company a master of the mine?

Roger Montgomery

March 26, 2012

PORTFOLIO POINT: Coal mining services provider Mastermyne is attractive if you consider its work in hand, revenue and earnings prospects. Cash flow, however, must be watched closely and value has recently taken flight.

Investors can be an irrational lot. When share prices are low, investors are reluctant to buy, preferring first a rise in prices to confirm their beliefs. Yet when those beliefs are confirmed and after share prices rise, the reluctance to buy remains; now the investor waits for lower prices to provide a more attractive entry point.

Mastermyne (ASX:MYE) has enjoyed a recent surge in its share price. Even though the rise has pushed its share price above a rational estimate of intrinsic value, it should not dissuade an investigation of MYE as conventional wisdom suggests favourable industry dynamics bode well for its earnings prospects over FY2012 and beyond. For now, turn the stockmarket off and focus on the business.

Mastermyne, established in 1996, is Queensland’s “leading” provider of specialist underground coal mining services. The company’s operations are primarily in the Bowen Basin, but the company also enjoys a growing presence in NSW’s Illawara. The company counts BHP, Rio, Vale and Anglo Coal among its Tier 1 customers. Demand for the company’s services is tied to coal production volumes and the short and medium-term outlook for coal production is positive, thanks to demand from emerging economies.

Bright prospects do assume the following: a benign environment for union action against coal miners (union action is currently underway for the BHP-Mitsubishi JV); no impact from litigation by the “Stopping the Coal Export Boom” movement that has also carefully planned and funded litigation action to delay development of port and rail infrastructure; and the spread of new production in Queensland’s Galilee Basin and NSW’s Hunter Valley.

Mastermyne’s three business segments are:

Mastermyne Underground (Mining Services) (>90% group revenue) (underground conveyor installation, extension and maintenance; underground roadway development; underground ventilation device installation).

Electrical and Mechanical Services (>1% of group revenue) (above ground electrical and mechanical services, including construction, maintenance and overhaul of draglines, wash plants, materials handling systems and other surface infrastructure).

Engineering and Fabrication (designs and fabricates attachments for underground equipment; general engineering and fabrication; supply of consumables for underground coal mines).

Since listing in May 2010 and under the direction of Tony Caruso (CEO since 2005, MD since 2008 – pictured above at far left during Mackay’s best business 2010 gala awards), MYE is off to a good start as a listed company. Importantly, investors should note that of the $40 million raised in the float, not a dollar went into the business. About $2.3 million went to the deal’s brokers and vendors received $37.7 million. Equally importantly, the company didn’t say in its prospectus that the proceeds had been used as ‘working capital’. I have seen plenty of companies that did, even though not a cent went in.

Supported by a strong order book, MYE exceeded its prospectus forecast revenue and earnings for 2010 by circa 4%, and earnings for 2011 by 10%.

Citing limited ‘through-the-cycle’ performance transparency, many investors get nervous about a company that is either new or newly listed. There is no escaping the argument in this case. Not only that, but the fact remains these types of mining contractors typically have high operating leverage and feast can quickly turn to famine, especially where barriers to entry are low (such as in this case) and competitors are willing to price irrationally when pickings get slim. However, between FY2007 and FY2010, MYE achieved compound annualised growth of 17% in earnings before interest, tax and amortisation. Encouragingly, the company grew operating earnings during the GFC and, in a more recent six-month period to August last year, grew its FY2012 contracted order book by 30% – this on top of the previously mentioned prospectus-exceeding growth for FY2011 and second-half 2011 operating earnings growth of 22%.

During MYE’s annual general meeting (AGM) late last year, a very strong start to the current financial year was also cited. Growth in the two smaller divisions is being targeted (expect strong growth off a low base) and the company is positioning to engage in larger projects that are coming online over the next three to four years. Specifically, Mastermyne said that demand for its services remains strong and is increasing.

While several analysts have cited MYE’s strong employee growth as evidence of its statements about pipeline growth, it also serves as a reminder of the operating leverage that engineering contractors typically display. A leading position is essential in the event that industry-wide revenue ever turns south.

Watch the cash

On a work-in-hand, revenue and earnings basis, this is a company with bright prospects. The one caveat, however, is cash flow. Ultimately, it is by cash flow that a company lives and dies. A company waiting for its customers to pay while growing fast must manage its cash flow very carefully.

As is typical in a capital-intensive business (note: reason to moderate any plans for grand portfolio allocations), growth requires significant capital expenditure, as well as more typical variable expense increases. For 2011, net operating cash flows declined from $15.1 million to $9.4 million (take a look at the $20 million jump in receivables for a partial explanation). However, after subtracting $2.6 million for capex, the company was still able to pay its borrowings down by $6.7 million (the apparent increase in ‘borrowings’ is due to finance leases – another cost associated with expansion). Finally, a dividend of $2.6 million arguably caused the bank balance to decline by $2.2 million in 2011.

Using my method to estimate business cash flow, an $8.7 million business cash outflow can be offset by an $11 million increase in property plant and equipment, but the company really needs some of those 1200 additional staff it has taken on to be working in the receivables management part of the back office.

I suspected the accrual accounting used to record revenue would be based on effort expended, and indeed, the annual report confirms this:

“Revenue from services rendered is recognised in profit or loss in proportion to the stage of completion of the transaction at the reporting date…”

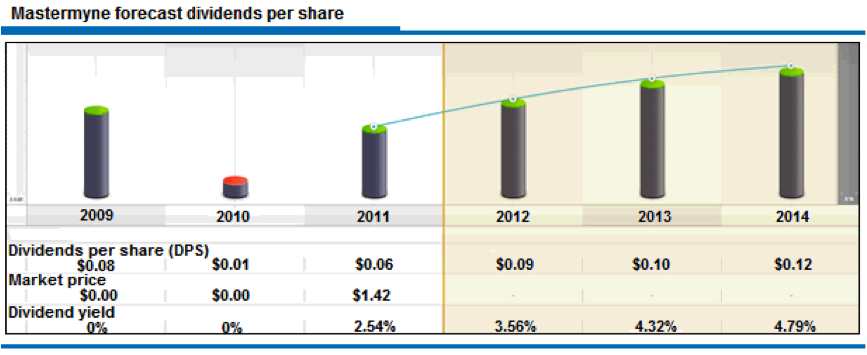

However, clients like BHP, Rio, Anglo Coal and Vale, while making a great looking CV, will also ensure Mastermyne won’t be dictating cash payment terms. The impact of this should not be underestimated, because Mastermyne will require cash to maintain and expand its equipment fleet, as well as maintain dividends (forecasts for per share dividends can be seen in the graph below).

Source: www.Skaffold.com

Only once you are comfortable with an understanding of how the cash flows through the company, its quality and its prospects do you move to analysing its intrinsic value.

Intrinsic value is a function of a company’s equity and the profitability of that equity, as well as a conservative required return.

The make-up of Mastermyne’s equity is therefore important and an examination of the balance sheet reveals that a not-insubstantial portion of the owner’s equity is comprised of intangibles, namely goodwill. The payment to the vendors of around $40 million was well in excess of the book value of net tangible assets, and so the accountants created a common control reserve to ensure the balance sheet balanced. The upshot is this would be a problem if the company were required to borrow meaningful funding. The combination of operating leverage and higher debt (if it were to grow) is itself less than perfect, and debt backed by goodwill leaves shareholders with precious little to support share prices if revenue or operating margins were to turn down.

That appears unlikely in the near term and so we move to the other element of the intrinsic value equation, which is return on equity. For the next two to three years, these returns are expected to remain high and stable at around 31%.

Based on these expectations, and turning the stockmarket back on, Mastermyne is trading at a premium to its current value. A pullback to $1.80, if it were to transpire and all else being equal, should be a trigger to pull the file out and conduct some due diligence on the company’s prospects at that time.

*Mastermyne (ASX:MYE, Score B1) is a small Montgomery [Private] Fund holding.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 26 March 2012.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Manufacturing, Skaffold.

-

Guest Post; A letter from Harley

Roger Montgomery

March 21, 2012

On 1 March, Harley sent me an email. Right in the guts of reporting season with up to 93 companies reporting in a single day, I have to confess to prioritising our work for the fund. But Harley put a lot of thought into his letter to me about Allmine Group and I would hate to see it not receive some feedback from the wider community. The price hasn’t changed so one suspects the arguments he puts forward remain unchanged also. Here’s Harley’s letter(s) in full. Remember Harley is not providing any advice nor are we. For those interested in researching the company and referring it to their advisor, you can find Allmine’s latest investor briefing Allmine March2012 Investor Presentation.

Hi Roger,

I have followed the blog virtually since inception and have written to you a few times (about NST when it was 42c and ZGL when it was 32c – Emails are below as proof. Just thought I’d point that out! :P)

I’ve said it before but thanks again for how open you are with what you practice and for being willing to teach those that are willing to learn. It is much appreciated and has made a significant impact on my own development both as an investor and in what I aim to do as a career.

In this email I just wanted to point out an interesting little stock. I have done a lot of homework on this one (and I promise it isn’t a stock ramp!) but I thought it was worth letting you know about it and writing my view, even though it is likely you are already aware of the company.

The company is called Allmine Group, (ASX:AZG), and is composed of three divisions: Arccon which is in mining services, Construction Industries Australia and Allmine maintenance. I apologise if this email becomes too long but the company has a very interesting story and I believe it is incredibly cheap.

Firstly, just looking at the numbers, the company reaffirmed its 2012 profit numbers of around $16.5m which puts it on a fully diluted EPS of around 5.5c. The SP is currently sitting at 15c. On my numbers, the per share value of Net Receivables, Net Cash and tangible assets for FY12 is 14c. The company is most certainly cheap on a number of metrics, and when using the formula from Value.able it becomes even more attractive.

The issue the market had with the company, and one that I believe is being resolved, is cashflow. The Sep quarter 4C showed OCF was negative and the company appeared to be relying on the banks to keep running. The obvious assumption was that a capital raising was on its way, something I didn’t agree with but believed still needed to be considered. Around that time I actually gave the company a call and spoke to Scott Walkem, CEO, about their CF situation. He basically said that the company was “essentially cash flow positive” and that short term negative CF was a result of the huge step change in the business, which I’ll expand upon in a moment.

I tried to gauge when he saw CF turning positive and his exact words were “I see no reason why we won’t be in a net cash position by June 2012.” While encouraged by this I didn’t want to act solely upon his words and so have waited until recently to take a position in the company (and am looking to buy more after the company reports). More encouraging was the fact that weeks after I spoke to Walkem he purchased $50k in shares, adding more skin in the game.

What I find most important is the fact that in the latest 4C the company was OCF positive. They were also able to establish a number of new contracts across all divisions and secured a new bank facility last December. So while I am not overly bullish on mining services as a whole in the short term, I am of the view that the value in AZG is enough to warrant an interest.

Even more interesting is the qualitative side of AZG. AZG acquired Arccon, a company founded by Robert Wilde and John McGowan, two highly successful and well respected men in the industry. Arccon was the brain child of these two men, and Construction Industries Australia (CIA) was born out of Arccon and these two companies have significant relationships with two of the Chinese giants in mining – MCC and China Non Ferrous Metals.

Basically what happened was that Robert Wilde went to MCC and told them he could promise substantial savings on their Sino Iron project. He ended up saving them $100m+ (according to Scott Walkem) and out of this CIA was born. As a result the two companies have strong relationships with MCC and its sister company China Non Ferrous Metals. As a result of this relationship Arccon and CIA are able to not only have access to some of the projects MCC and China Non Ferrous are working on (evident in recent contract announcements), but also have access to cheap project financing via the Chinese banks. In the meantime the Allmine maintenance division announced a new contract with Downer EDI worth $10m p.a. which is a substantial amount based on the $30m odd revenue of the previous year.

Since following the blog I have learnt so much and been given so many investment opportunities and ideas, that if possible, hopefully I can return the favour! AZG in my view is worth a look. It appears to me to be very cheap, has only recently become OCF positive and I believe there is minimal risk of a capital raising. Obviously one must consider some of the risks: slowdown in China, weakness in the Chinese banks impairing the relationship with MCC and NFC, commodity prices falling. In my view in an ironic way, thanks to the relationship with MCC and NFC Allmine is less exposed to a slowdown in China than other mining services companies. The Chinese desire for resources is not a short term play and without further lengthening this email I do not see Chinese exploration/acquisitions of resource projects slowing in the event of a commodity price fall, in fact I expect the opposite as they see cheap assets as an opportunity.

In terms of catalysts for SP appreciation if Allmine can reconfirm a $16.5m profit this month and put it on a PE of 3 I think that will be a shock to the market. The latest report will reveal a substantially different company to that shown in the previous report with the 100% acqusitions of both Arccon and CIA now being fully accounted for, and Skaffold will likely rerate the company too if I am correct!

Thanks again Roger.

Regards,

Harley

…Seperately Harley also wrote the following about the company…

Overview

Allmine Group provides a life of mine service to its clients via three divisions: engineering, construction and fixed and mobile maintenance services. The company is comprised of Allmine Maintenance, Arccon and Construction Industries Australia (CIA). But there is much more to Allmine Group than meets the eye. At first glance it is just another mining services company, but the story behind this company is an exciting one and one that completely changes your view of the company when you begin to understand it.

When AZG listed in March of 2011 they were entirely a maintenance services company. I remember looking at the prospectus when they listed at 20c and thinking it was an ok company but nothing outstanding. Since that time Allmine have made two significant acquisitions that have substantially changed the nature, growth profile and outlook of the group.

Firstly, Allmine bought Arccon Mining Services, an EPC/EPCM contractor for a maximum consideration of $22.8. The acquisition will be paid for in two tranches. The first tranche has been paid and involved an equity deal of 75 million shares at 20c/share, a total consideration of $15 million. The second tranche is performance and loyalty based, whereby Arccon must achieve NPAT of $5.55m in 2012. If the target is achieved another $7.8m worth of shares will be issued at the 5 day VWAP at June 30 2012. For the Arccon shareholders to receive this payment they will have to hold 75% of the shares issued to them in Allmine.

The second acquisition was for Allmine to purchase the remainder of Construction Industries Australia (CIA), which was 50% owned by Arccon and 50% by the original founders. The total consideration paid was $3m paid in shares at 20c strike price. In 2011 CIA achieved $10.5m NPAT. Yes, you read that correctly.

Now at first glance it seems impossible that such acquisitions could be made so cheaply, to good to be true in fact. The truth is that the initial payments being made do not fully reflect the price that will ultimately be paid for these companies. Instead, the rest of these payments will come through in the performance incentives program which provides for substantial benefits for management and original Arccon shareholders should they achieve key objectives. The details of the performance incentive plan are quite complex and are explored in depth later in this report.

Background

I took a closer look at this company around September last year. At the time it was very cheap based on its forecast earnings, but its operating cashflow (OCF) was negative. There was fear of an imminent capital raising as it appeared upon looking at the financial statements that the company was relying on the banks for survival. But that wasn’t the case.

What the market was missing was the company was essentially cash flow positive, but that cash flow timing issues were causing OCF to come out negative. I looked into the company and thought it’s story (which I will get into in a moment) was one of a company with incredible opportunity and its current share price was ridiculously cheap. So I got in contact with the company and, luckily enough, was able to speak to the CEO, Scott Walkem, over the phone. Much of the story that follows is direct from the CEO himself.

Allmine Group’s Story: Not Your Everyday Mining Services Company

When AZG bought Arccon and CIA they substantially changed the makeup of the company. Arccon and CIA have two significant competitive advantages: access to cheap project financing from Chinese banks and management with a proven track record.

Arccon was founded in 2003 by Robert Wilde and John McCowan, the two founders of the hugely successful Minproc Engineers which was taken over by AMEC plc., the UK mining services giant. These guys have a proven track record in growing a successful company, and they have significant ownership in AZG as well as performance related incentives. And shareholders can be more or less assured that they will remain at the company for at least the next three years, as the details of the acquisition state they must do so to receive their performance and loyalty bonuses.

It is their experience, as well as their connections to the Chinese companies China Metallurgical Group Corporation (MCC) and China Non-Ferrous Metal Industry’s Foreign Engineering Construction Co. Ltd (NFC), and as a result their access to cheap project financing from the Chinese banks, that presents a fantastic opportunity.

The story goes like this. Robert Wilde, then working at Arccon, got in contact with MCC and told them he could help them achieve sizable savings on the Sino Iron Ore project in the Pilbara (which MCC owns 20% and which AZG works on to this day). They agreed and in the end Arccon was able to save MCC $100m USD on the project. From this demonstration of ability CIA was born, and the company was introduced to MCC’s sister company, NFC.

MCC and NFC are big companies. They work on big projects around the world with Tier 2 (or below) mining companies. They are able anywhere between 70-100% of the project requirements through the Chinese banks at relatively cheap rates. Arccon now has a “significant pipeline of work across next the 1-4 year time horizon” (most recent Half Yearly Report) as a result of this relationship, while CIA is currently undertaking projects on a lump sum and cost recovery basis with MCC. Many of these big contracts involve financing arrangements through Chinese banks, something no other Western mining services company can offer their clients.

Allmine Group now has two clear competitive advantages:

1) Management with a proven track record.

2) Key relationships with MCC and NFC allowing large projects to be financed via the Chinese banks.

These two factors, particularly the latter, in my mind represent something the market may just latch onto when it realises how significant these competitive advantages are. I encourage you during the process of researching this company to look closely at some of the projects AZG has lined up as a result of these arrangements as they are indeed quite large and begin coming through in Q4 of this year.

Of course the maintenance division, while not as attractive as Arccon and CIA, is still a strong business. It is experiencing labour shortages, as Walkem said “the business could be twice as large tomorrow if we could find the people.” The company announced it had initiated an in-house training program to help alleviate this issue and that first signs were encouraging.

CIA is in the process of diversifying its client base away from MCC to reduce the reliance on the Chinese company, with positive news coming from its contract win with UGL. At the moment CIA is heavily dependent on contracts at the Sino Iron Ore Project, which as many of you will know has had its fair share of negative press, so any diversification can only be positive.

The Allmine Advantage

The main difference between Allmine and competitors is indeed the connection to the Chinese companies and through them the cheap financing of the Chinese banks. Firstly, mining companies will be attracted to the prospect of cheap financing on offer from MCC and NFC. In the past, and in recent news, Australian companies have not been satisfied with the performance of MCC, as was made clear when CITIC Pacific complained about the cost blow-outs on the Sino Iron Ore Project. It is therefore in the interests of MCC and NFC to have Arccon (and CIA) covering some of their contract requirements in Australia, as projects need to be completed to Australian standards. If MCC were to lose their relation with Arccon they would greatly reduce their chance of future contract wins (and therefore opportunities to secure resources) in Australia. The Chinese company relationship is very important to Allmine Group, but don’t think it’s a one way street as MCC and NFC benefit too.

From a client’s perspective working with MCC/NFC and Allmine Group offers project financing, access to cheaper Chinese materials and work completed according to Australian standards. To demonstrate this competitive advantage in action, read the following from an announcement by Reed Resources:

“The involvement of both NFC and Arccon in the EPC consortium enables Reed to access the cost benefits of a Chinese contractor, whilst retaining appropriate Australian expertise and experience, to ensure Australian standards and work practices are adhered to and construction of the Project can be executed smoothly.” (Nov 11 2010)

As has been demonstrated the management of Allmine clearly have a few things to show the big Chinese engineering companies when it comes to efficiency and cost management. For a small to mid tier company looking to go from explorer to producer, in an environment like today where the future of potential project financing seems uncertain (whether true or not), this is an attractive option.

It is also important to note that the projects Arccon tenders for via their relationship with MCC and NFC are not limited to Australia. In fact some of their biggest projects are overseas with two examples being the Yandera project in Papua New Guinea and the Citronen project in Greenland.

The goal of the Chinese is to eventually source half its imports of iron ore from owned or co-owned mines by 2015. They want to diversify away from their reliance on BHP, RIO and Vale, for obvious reasons. For this to occur the Chinese will need to continue to invest money into iron ore and other commodity projects worldwide, and to do so by buying/financing projects. If this is to occur, as I expect it will since the Chinese have made it a priority, then Allmine is well positioned to benefit from increased Chinese investment into iron ore and related commodity projects. Remember the Chinese will need more than just iron ore. Zinc, vanadium, copper, molybdenum, all are resources the Chinese need to secure. I expect to see more stories along the lines of small-medium sized Australian companies partnering up with companies like MCC to secure project financing while MCC (or other Chinese companies) take large stakes in the projects/companies themselves.

Then of course you have the proven track record of Wilde and McCowan, which should translate into further contract wins for Arccon and CIA outside of MCC and NFC. Continued diversification is a positive and it seems a focus of Allmine management.

The maintenance division, while smaller, should not be forgotten. If labour issues can be kept under control the business should stay relatively profitable. On top of this the synergies will only increase as the volume of work for Arccon and CIA picks up.

Cashflow Turnaround

Cash flow is key for this business. As it stands the balance sheet is not strong enough to withstand a significant shock should something unexpected occur. When OCF was negative last year, Scott Walkem insisted there was no need for a capital raising saying the company is essentially cash flow positive and backing it up by purchasing shares for his own account. He said that the company was undergoing a step change in growth and the changes in working capital were temporary and beneficial long term.

In the latest 4C he was proven right when OCF was reported as positive, albeit by only $2m. At December 31 2011 AZG had $2.5m cash at bank but had drawn down their bank overdraft to the tune of $7.7m. While they have plenty of room to draw down this facility under normal operating circumstances, should something unforeseen occur then the company will have little room to move.

Negating these risks somewhat are three key factors. The first is that the CEO is purchasing shares. He purchased $50k last year and another $100k earlier this year. Insider buying is always a good sign. The second is that the potential for cash flow to turn around, and to do so quickly, is certainly there. Around $36m in cash is coming in each quarter, and that is expected to increase in future. In the most recent quarters the company experienced significant growth, increasing total engineers from 5 to 50 as well as a significant jump in total employees.

And finally, the company has forecast for working capital needs to normalize in the fourth quarter of FY12 and for cash to start building up on the balance sheet. They still maintain their forecast of $17m cash by the end of FY12.

Is There An Issue With Dilution?

If you are going to invest in Allmine you need to be aware of the almost inevitable increase in total shares on issue. It is true that the total share count will likely increase substantially. What is not correct is the idea that this is a net negative for shareholder value.

While a number of new shares will likely be issued it will not cause a significant reduction in the value of this company so long as current performance is maintained. Today there are 280m shares on issue. There are 40m options at 20c, 2.5m at 25c and 2.5m at 30c. Each represents a price that is above current equity per share! Thus if these options were to be exercised it would actually be value accretive! As I write this the 20c options are at the money while the rest are out of the money and thus are unlikely to be exercised before a substantial share price rise.

One must keep in mind that if options were to be exercised it would inject over $8m into the company, which would entirely remove the negative cash flow position of the company. Options being exercised is actually a net benefit to the value of the shares!

The next issue of possible dilution relates to the second tranche of payment for the Arccon acquisition. Should Arccon achieve NPAT of $5.55m in FY 2012 $7.8m of shares will be issued at the 5 day VWAP as at 30/6/12. It is difficult to determine how many new shares will be issued because it depends on what the share price is at the time the VWAP is calculated. If the company can continue its strong performance it is entirely possible that the share price is substantially higher by June than it is today. But at the same time it could be cut in half tomorrow! It really is anyone’s guess. So for now let us assume the 5 day VWAP at 30/6/12 is near enough the current share price, or 20c. At 20c 39m shares will be issued, taking the fully diluted share count to 360m. Remember the total number of shares to be issued in this second tranche payment for the Arccon acquisition is highly sensitive to the share price in the 5 trading days prior to 30/6/12.

The final source of dilution relates to the performance incentives to be paid out to management and the CEO. In a moment we will look more closely at this, but for now take it that the maximum number of shares on issue for FY12 will be 400m. Provided the $16.5m NPAT is achieved, EPS will come to 4.1c and the current share price represents a PE of 4.8.

Performance Incentives For Key Management

On face value the total considerations paid for Arccon and CIA are ridiculously low, especially considering the calibre of management. The truth is that these acquisitions will be paid for over time and provided Robert Wilde and John McCowan achieve key objectives for the company. Personally I prefer this approach to simply overpaying upfront for a company, as at least this way any shareholder dilution is a trade off for increased performance.

The CEO, Scott Walkem, has his incentives tied to total market cap. According to the plan he receives no performance incentive if market cap is below $60m, $1.8m between $60 and $80m, $2.4 between $80m and $100m. If market cap is over $100m Walkem receives $3m plus 1% of the total market cap up to $200m. Again the payment is made in shares at the 5 day VWAP as of June 30 2012. Currently the market cap sits at $56m, but it I would not be surprised if options were exercised if the market cap does not break the $60m mark between now and then.

Robert Wilde is rewarded according to the NPAT achieved by Arccon in FY12. He receives $2.474m if NPAT is between $7m and $12m; and $4.2m if NPAT if it is above $12m. Again it is tied to the 5 day VWAP at 30/6/12. Unlike the shares to be issued upon exercise of options these shares will not result in any cash being injected into the company.

So let’s now calculate the maximum total of shares to be issued. We will assume the 5 day VWAP at the relevant time is equal to the current share price, or 20c.

45m shares can be issued through exercise of options, 39m shares will be issued for the second tranche payment for Arccon, the maximum realistic payout to Scott Walkem is 9m shares (since the CEO is rewarded based on market cap his bonus relies on the share price increasing, which would ultimately increase the VWAP used and thus reduce the total new shares to be issued.) and the maximum payout to Robert Wilde is 21m. This brings the maximum realistic total to 394m shares.

It is difficult to forecast the total shares to be issued, simply because no one can forecast the share price. But even assuming 394m shares are on issue by the end of this year, it would mean profit came in near guidance, or around $16.5m, which still puts the company on a PE in the 4’s. There are risks to this company but provided the profit numbers are hit dilution is not one of them.

Risks

As with any company there are some key risks one should consider. They are as follows:

Cashflow: This risk has been covered above. Some may avoid this company as cash flow in the recent past has been weak, which admittedly makes them vulnerable to key project risk. If this is you, consider waiting for the next few cash flow reports before investing.

Key Project Risk: This is in my view the biggest risk for Allmine. They are strengthening their balance sheet but are not in a solid enough position to withstand a number of key projects being delayed or cancelled. They have had one major project delayed due to weak vanadium prices already, which is something to keep an eye on. (In regards to this project the company is still in informal negotiations with Arccon and the project will likely go ahead. In what form will be revealed in April.) Because the big key projects don’t start coming through until FY13 the FY12 profit number is still uncertain and reliant on timing of projects. It is my view that this risk is negated by those big projects in the pipeline, but it does not prevent the possibility of a project delay causing the FY12 profit forecast to be missed.

Chinese Connection: While a significant strength, the risk of losing the relationship with MCC and NFC is indeed a risk and would damage the billions of dollars worth of projects in the pipeline. However, it is important to remember that the benefits are mutual, and MCC/NFC do indeed benefit from working with Arccon and CIA.

Profit Guidance Being Missed: As with any company the risk exists that profit falls short of guidance. This is true with Allmine. However, the margin of safety on offer reduces this risk. The company made clear they expect the second half of FY12 to be stronger than the first. If we consider the possibility that this doesn’t occur, and instead profit continues at the same pace as the first half then NPAT will come in around the $12-$13m mark, the increase in the second half being due to the profits from CIA having a full 6 months to come through, unlike in the first half. In this case, and assuming the maximum possible share dilution occurs EPS will come in at around 3.2c and if you were to purchase today you would still be paying a PE of only 6, which isn’t too bad for a downside scenario.

The Financials And A Valuation

Ok, here is where it gets really interesting. When I first noticed this company it had announced earnings guidance of $16.5m. As I have made clear if this were to be achieved the company is currently very cheap, which reflects its doubling in price since then.

In the latest half yearly report AZG reported NPAT around $5m in the half, but the key to the report was the reaffirmed earnings guidance. They stuck with the original $150m revenue and$16.5m NPAT but separated the guidance into two key parts. The company announced $13m from construction and maintenance services, with an additional $4-$8m in ‘at risk’ income due to uncertainty regarding timing of contracts. $13m NPAT for 2012 would represent a continued rate of performance over the first half, as the acquisition of CIA comes through to the bottom line. And there is now potential for upside as according to the company there is the possibility that NPAT comes in as high as $21m.

Forecasting profit for an EPC/EPCM services company is very difficult, and for the sake of company valuation I would rather be conservative and right than optimistic and wrong. So when valuing this company I have decided to assume NPAT of $15m, which would mean falling short of guidance by 10%. For me this takes into account the recent project delay as well as any other unforeseen risks. It also assumes $150m revenue comes through but that margins fall from historical levels, which is not impossible considering the labour issues currently present in the industry. The numbers that follow are in my opinion quite conservative. Suffice to say that if the upside of profit is achieved this company is ridiculously cheap, so in using conservative numbers I hope to demonstrate that even in such a case the company still presents value.

So assuming $15m NPAT let’s forecast equity per share. Equity was $54.4m at December 2011. Since no dividend will be paid retained earnings would increase by $9.8m. We will assume that the 40m options at 20c are converted, which is likely if the share price rallies going into reporting season. If this were to occur it would inject $8m into equity. Equity would now be equal to $73.6m and equity per share on a fully diluted basis (394m shares) would come to 18.6c. This means that if $15m NPAT is achieved (which would mean they are short on guidance, upside exists) that on a fully diluted basis the book value of the company is near the current share price. Average ROE would come to 23.4% and would be likely to remain stable or increase in future years as the larger projects with MCC and NFC start to come online. EPS will be 3.8c putting the current share price on a PE of 5.25.

So what does this mean for the value of the company?

Using these numbers and based on an average of three valuation models, I value Allmine Group at 40c.

Thanks Harley …As always be sure to conduct your own research and do not engage in any securities transactions of any description without seeking and taking personal professional advice.

by Roger Montgomery Posted in Energy / Resources, Investing Education, Skaffold, Value.able.

-

MEDIA

What future prospects does Roger see for Seek, Bluescope Steel and BHP Billiton?

Roger Montgomery

February 29, 2012

Do BHP Billiton (BHP), Fortescue Metals (FMG), Seek (SEK), Bluescope Steel (BSL), GR Engineering (GNG), CSL (CSL), Peak Resources (PEK), Harvey Norman, (HNN), Buru Energy (BRU), The Reject Shop (TRS), ASG Group (ASZ), Tatts Group (TTS) and Webject (WEB) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 29 February 2012 to find out. Watch here.

by Roger Montgomery Posted in Companies, Energy / Resources, Investing Education, TV Appearances, Value.able.

-

Gold Bugs…Nah

Roger Montgomery

February 26, 2012

Their is something prescient in the name John Deason and Richard Oates gave to their 1869 gold nugget the ‘Welcome Stranger’ and the one Kevin Hillier gave to his 875 troy ounce find ‘The Hand of Faith’. Today’s gold price is indeed very welcome to gold bugs and there is plenty of faith needed that prices will rise even further. But gold bugs have received a terse warning from none other than Warren Buffett who has just released Berkshire’s 2011 letter. For those of you who believe gold (A.K.A. the barbarous relic) is the best investment you won’t find any more support from Warren this year than any other (with the exception of his 1999 dalliance into silver) . You can find his complete letter here: Berkshire 2011 Annual Report.

Here’s the section on gold:

“The second major category of investments involves assets that will never produce anything, but that are purchased in the buyer’s hope that someone else – who also knows that the assets will be forever unproductive – will pay more for them in the future. Tulips, of all things, briefly became a favorite of such buyers in the 17th century.

This type of investment requires an expanding pool of buyers, who, in turn, are enticed because they believe the buying pool will expand still further. Owners are not inspired by what the asset itself can produce – it will remain lifeless forever – but rather by the belief that others will desire it even more avidly in the future.

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis.

As “bandwagon” investors join any party, they create their own truth – for a while. Over the past 15 years, both Internet stocks and houses have demonstrated the extraordinary excesses that can be created by combining an initially sensible thesis with well-publicized rising prices. In these bubbles, an army of originally skeptical investors succumbed to the “proof” delivered by the market, and the pool of buyers – for a time – expanded sufficiently to keep the bandwagon rolling. But bubbles blown large enough inevitably pop. And then the old proverb is confirmed once again: “What the wise man does in the beginning, the fool does in the end.”

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce – gold’s price as I write this – its value would be $9.6 trillion. Call this cube pile A. Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge).

Can you imagine an investor with $9.6 trillion selecting pile A over pile B? Beyond the staggering valuation given the existing stock of gold, current prices make today’s annual production of gold command about $160 billion. Buyers – whether jewelry and industrial users, frightened individuals, or speculators – must continually absorb this additional supply to merely maintain an equilibrium at present prices.

A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

Admittedly, when people a century from now are fearful, it’s likely many will still rush to gold. I’m confident, however, that the $9.6 trillion current valuation of pile A will compound over the century at a rate far inferior to that achieved by pile B.”

Before simply believing Warren WILL be right…There’s this in the annual report as well: “Last year, I told you that “a housing recovery will probably begin within a year or so.” I was dead wrong”

A much older quote that summarizes Buffett’s long-held view is this one “It gets dug out in Africa or some place. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

In my earlier post on this subject HERE, I note; “But I trust you can see the irony in claiming gold is ‘useless’ and yet it can buy [all the agricultural land in the United States, sixteen companies as valuable as Exxon and a trillion dollars in walking-around money].

For those of you who are interested in two alternative perspectives, (assuming the debasing of fiat money across the globe is not enough to encourage you), I thought you might find some of what you need in the following points, and also Warren Buffett’s father’s views. (Note: we only own three or four gold stocks all of which have rising production profiles and do not require ever increasing gold prices to support the returns on equity that justify much higher valuations. So we aren’t quite in the ‘carried-away’ camp even though some have doubled in price. This latter development delights us in this market).

And now a short commercial break…

Here are two Skaffold screenshots, each gold stocks we currently own. If you are a member of Skaffold, you should be able to pick them right away. If you aren’t a member, what are you waiting for? Head over to www.skaffold.com and become a member today.

And now back to our regular programming…

From gold’s mouth itself;

Let’s start with the basics of my enduring characteristics. I have some characteristics that no other matter on Earth has…

I cannot be:

Printed (ask a miner how long it takes to find me and dig me up)

Counterfeited (you can try, but a scale will catch it every time)

Inflated (I can’t be reproduced)I cannot be destroyed by;

Fire (it takes heat at least 1945.4° F. to melt me)

Water (I don’t rust or tarnish)

Time (my coins remain recognizable after a thousand years)I don’t need:

Feeding (like cattle)

Fertilizer (like corn)

Maintenance (like printing presses)I have no:

Time limit (most metal is still in existence)

Counterparty risk (remember MF Global?)

Shelf life (I never expire)As a metal, I am uniquely:

Malleable (I spread without cracking)

Ductile (I stretch without breaking)

Beautiful (just ask an Indian bride)As money, I am:

Liquid (easily convertible to cash)

Portable (you can conveniently hold $50,000 in one hand)

Divisible (you can use me in tiny fractions)

Consistent (I am the same in any quantity, at any place)

Private (no one has to know you own me)From an entirely different perspective on gold it may be worth reading the Hon. Howard Buffett. Congressman Buffett argues that without a redeemable currency, an individual’s freedoms both financial and more broadly is dependent on politicians. He goes on to observe that fiat (paper) money systems tend to collapse eventually, producing economic chaos. His argument that the US should return to the gold standard was not adopted.

Human Freedom Rests of Gold Redeemable Money

Posted Thursday, May 6, 1948By HON. HOWARD BUFFETT

U. S. Congressman from Nebraska

Reprinted from The Commercial and Financial Chronicle 5/6/48Is there a connection between Human Freedom and A Gold Redeemable Money? At first glance it would seem that money belongs to the world of economics and human freedom to the political sphere.

But when you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty.

Also, when you find that Lenin declared and demonstrated that a sure way to overturn the existing social order and bring about communism was by printing press paper money, then again you are impressed with the possibility of a relationship between a gold-backed money and human freedom.

In that case then certainly you and I as Americans should know the connection. We must find it even if money is a difficult and tricky subject. I suppose that if most people were asked for their views on money the almost universal answer would be that they didn’t have enough of it.

In a free country the monetary unit rests upon a fixed foundation of gold or gold and silver independent of the ruling politicians. Our dollar was that kind of money before 1933. Under that system paper currency is redeemable for a certain weight of gold, at the free option and choice of the holder of paper money.

Redemption Right Insures Stability

That redemption right gives money a large degree of stability. The owner of such gold redeemable currency has economic independence. He can move around either within or without his country because his money holdings have accepted value anywhere.For example, I hold here what is called a $20 gold piece. Before 1933, if you possessed paper money you could exchange it at your option for gold coin. This gold coin had a recognizable and definite value all over the world. It does so today. In most countries of the world this gold piece, if you have enough of them, will give you much independence. But today the ownership of such gold pieces as money in this country, Russia, and all divers other places is outlawed.

The subject of a Hitler or a Stalin is a serf by the mere fact that his money can be called in and depreciated at the whim of his rulers. That actually happened in Russia a few months ago, when the Russian people, holding cash, had to turn it in — 10 old rubles and receive back one new ruble.

I hold here a small packet of this second kind of money – printing press paper money — technically known as fiat money because its value is arbitrarily fixed by rulers or statute. The amount of this money in numerals is very large. This little packet amounts to CNC $680,000. It cost me $5 at regular exchange rates. I understand I got clipped on the deal. I could have gotten $2½ million if I had purchased in the black market. But you can readily see that this Chinese money, which is a fine grade of paper money, gives the individual who owns it no independence, because it has no redemptive value.

Under such conditions the individual citizen is deprived of freedom of movement. He is prevented from laying away purchasing power for the future. He becomes dependent upon the goodwill of the politicians for his daily bread. Unless he lives on land that will sustain him, freedom for him does not exist.

You have heard a lot of oratory on inflation from politicians in both parties. Actually that oratory and the inflation maneuvering around here are mostly sly efforts designed to lay the blame on the other party’s doorstep. All our politicians regularly announce their intention to stop inflation. I believe I can show that until they move to restore your right to own gold that talk is hogwash.Paper Systems End in Collapse

But first let me clear away a bit of underbrush. I will not take time to review the history of paper money experiments. So far as I can discover, paper money systems have always wound up with collapse and economic chaos.

Here somebody might like to interrupt and ask if we are not now on the gold standard. That is true, internationally, but not domestically. Even though there is a lot of gold buried down at Fort Knox, that gold is not subject to demand by American citizens. It could all be shipped out of this country without the people having any chance to prevent it. That is not probable in the near future, for a small trickle of gold is still coming in. But it can happen in the future. This gold is temporarily and theoretically partial security for our paper currency. But in reality it is not.Also, currently, we are enjoying a large surplus in tax revenues, but this happy condition is only a phenomenon of postwar inflation and our global WPA. It cannot be relied upon as an accurate gauge of our financial condition. So we should disregard the current flush treasury in considering this problem.

From 1930-1946 your government went into the red every year and the debt steadily mounted. Various plans have been proposed to reverse this spiral of debt. One is that a fixed amount of tax revenue each year would go for debt reduction. Another is that Congress be prohibited by statute from appropriating more than anticipated revenues in peacetime. Still another is that 10% of the taxes be set aside each year for debt reduction.

All of these proposals look good. But they are unrealistic under our paper money system. They will not stand against postwar spending pressures. The accuracy of this conclusion has already been demonstrated.The Budget and Paper Money

Under the streamlining Act passed by Congress in 1946, the Senate and the House were required to fix a maximum budget each year. In 1947 the Senate and the House could not reach an agreement on this maximum budget so that the law was ignored.On March 4 this year the House and Senate agreed on a budget of $37½ billion. Appropriations already passed or on the docket will most certainly take expenditures past the $40 billion mark. The statute providing for a maximum budget has fallen by the wayside even in the first two years it has been operating and in a period of prosperity.

There is only one way that these spending pressures can be halted, and that is to restore the final decision on public spending to the producers of the nation. The producers of wealth — taxpayers — must regain their right to obtain gold in exchange for the fruits of their labor. This restoration would give the people the final say-so on governmental spending, and would enable wealth producers to control the issuance of paper money and bonds.

I do not ask you to accept this contention outright. But if you look at the political facts of life, I think you will agree that this action is the only genuine cure. There is a parallel between business and politics which quickly illustrates the weakness in political control of money.

Each of you is in business to make profits. If your firm does not make profits, it goes out of business. If I were to bring a product to you and say, this item is splendid for your customers, but you would have to sell it without profit, or even at a loss that would put you out of business. — well, I would get thrown out of your office, perhaps politely, but certainly quickly. Your business must have profits.

In politics votes have a similar vital importance to an elected official. That situation is not ideal, but it exists, probably because generally no one gives up power willingly.

Perhaps you are right now saying to yourself: “That’s just what I have always thought. The politicians are thinking of votes when they ought to think about the future of the country. What we need is a Congress with some ‘guts.’ If we elected a Congress with intestinal fortitude, it would stop the spending all right!”

I went to Washington with exactly that hope and belief. But I have had to discard it as unrealistic. Why? Because an economy Congressman under our printingpress money system is in the position of a fireman running into a burning building with a hose that is not connected with the water plug. His courage may be commendable, but he is not hooked up right at the other end of the line. So it is now with a Congressman working for economy. There is no sustained hookup with the taxpayers to give him strength.

When the people’s right to restrain public spending by demanding gold coin was taken from them, the automatic flow of strength from the grass-roots to enforce economy in Washington was disconnected. I’ll come back to this later.

In January you heard the President’s message to Congress or at least you heard about it. It made Harry Hopkins, in memory, look like Old Scrooge himself.

Truman’s State of the Union message was “pie-in-the-sky” for everybody except business. These promises were to be expected under our paper currency system. Why? Because his continuance in office depends upon pleasing a majority of the pressure groups.Before you judge him too harshly for that performance, let us speculate on his thinking. Certainly he can persuade himself that the Republicans would do the same thing if they were In power. Already he has characterized our talk of economy as “just conversation.” To date we have been proving him right. Neither the President nor the Republican Congress is under real compulsion to cut Federal spending. And so neither one does so, and the people are largely helpless.

But it was not always this way.

Before 1933 the people themselves had an effective way to demand economy. Before 1933, whenever the people became disturbed over Federal spending, they could go to the banks, redeem their paper currency in gold, and wait for common sense to return to Washington.Raids on Treasury

That happened on various occasions and conditions sometimes became strained, but nothing occurred like the ultimate consequences of paper money inflation.

Today Congress is constantly besieged by minority groups seeking benefits from the public treasury. Often these groups. control enough votes in many Congressional districts to change the outcome of elections. And so Congressmen find it difficult to persuade themselves not to give in to pressure groups. With no bad immediate consequence it becomes expedient to accede to a spending demand. The Treasury is seemingly inexhaustible. Besides the unorganized taxpayers back home may not notice this particular expenditure — and so it goes.Let’s take a quick look at just the payroll pressure elements. On June 30, 1932, there were 2,196,151 people receiving regular monthly checks from the Federal Treasury. On June 30, 1947, this number had risen to the fantastic total of 14,416,393 persons.

This 14½ million figure does not include about 2 million receiving either unemployment benefits of soil conservation checks. However, it includes about 2 million GI’s getting schooling or on-the-job-training. Excluding them, the total is about 12½ million or 500% more than in 1932. If each beneficiary accounted for four votes (and only half exhibited this payroll allegiance response) this group would account for 25 million votes, almost by itself enough votes to win any national election.