Editor’s Pick

-

Quality growth – the recipe for success

Michael Gollagher

May 31, 2023

2023 has been a challenging year for stock markets, when we commenced in January we launched with a bang, with strong market returns occurring across the globe. By the time February approached volatility had set in and we find ourselves in a situation where like tropical weather, the forecast can change at a moment’s notice. continue…

by Michael Gollagher Posted in Companies, Editor's Pick, Stocks We Like, Technology & Telecommunications.

-

Not safe to re-enter still shark-infested (retail) waters

Roger Montgomery

May 24, 2023

Since rates commenced rising, we have been tracking the consumer closely, waiting for the inflection point where inflation and higher mortgage commitments meet the end of government financial support and savings dry up. continue…

by Roger Montgomery Posted in Consumer discretionary, Editor's Pick.

- save this article

- POSTED IN Consumer discretionary, Editor's Pick

-

MEDIA

ABC The Business: Afterpay and Zip could face tougher future under new laws

Roger Montgomery

May 23, 2023

I joined ABC’s The Business to discuss Buy Now Pay Later (BNPL) businesses including AfterPay and Zip. We always thought these companies were mediocre – they were over-valued, with unsustainable growth and increasing competition.

Way back in 2018 I warned investors about the BNPL space and continued to do so in 2019, and 2020, questioning how long the euphoria would last. Fast forward to today, BNPL providers are facing a raft of new regulations. Is their future now even more concerning?

by Roger Montgomery Posted in Editor's Pick, TV Appearances.

- save this article

- POSTED IN Editor's Pick, TV Appearances

-

Two stocks we currently like

Gary Rollo

May 19, 2023

In this week’s video insight I joined Montgomery’s head of distribution Scott Phillips to discuss two stocks we currently hold in the Montgomery Small Companies Fund including insurance broking, underwriting agency and risk management businesses AUB Group (ASX:AUB) and lithium producer Allkem (ASX:AKE). AUB Group falls into the category of stable compounders, those businesses with defensive growth characteristics. And we think Allkem is very attractive in the lithium sector. continue…

by Gary Rollo Posted in Editor's Pick, Stocks We Like, Video Insights.

- save this article

- POSTED IN Editor's Pick, Stocks We Like, Video Insights

-

Why Australian Eagle invested in AMP

Sean Sequeira

May 11, 2023

Back in the 1960s, AMP Limited (ASX:AMP) built the tallest building in Australia, with magnificent views over Sydney harbour. It was a symbol of the firm’s dominant place within the local financial sector. Fast forward 60 years, and AMP is a shadow of its former self, and its share price has suffered accordingly – down 91 per cent since listing in 1998. Subsequent to its fall from grace, Australian Eagle identified certain factors which gave the company the chance to evolve and if successful, continue to play a big part in the financial services industry. continue…

by Sean Sequeira Posted in Companies, Editor's Pick, Financial Services, Stocks We Like.

-

Why I think tech and small caps could rally this year

Roger Montgomery

May 10, 2023

With inflation finally coming down, it looks like the U.S. Fed Reserve could soon stop lifting interest rates and start cutting, possibly as early as this year. That’s great news for equity markets, which tend to rally when rates are lower. And it’s particularly good news for technology stocks and small caps. continue…

by Roger Montgomery Posted in Editor's Pick, Global markets, Market commentary.

-

Three transport stocks we like

Roger Montgomery

May 3, 2023

In this week’s video insight Roger discusses why calendar year 2023 could be a good year for investors. Disinflation has always been positive for stocks, particularly innovative growth stocks. And guess what? We’re in a disinflationary phase right now. Roger shares three transport companies that we currently have a positive view on including Transurban (ASX:TCL), Auckland International Airport (ASX:AIA) and Alliance Aviation Services (ASX:AQZ). continue…

by Roger Montgomery Posted in Companies, Editor's Pick, Stocks We Like, Video Insights.

-

MEDIA

Fear and Greed: Why this investor says dividends are overrated

Roger Montgomery

May 1, 2023

I joined Sean Aylmer on The Fear and Greed Podcast to discuss dividends. A lot of investors love getting dividends. But are you looking at this the wrong way? Businesses that have attractive dividend yields may not have much money left to reinvest in the business.

by Roger Montgomery Posted in Editor's Pick, Podcast Channel.

- save this article

- POSTED IN Editor's Pick, Podcast Channel

-

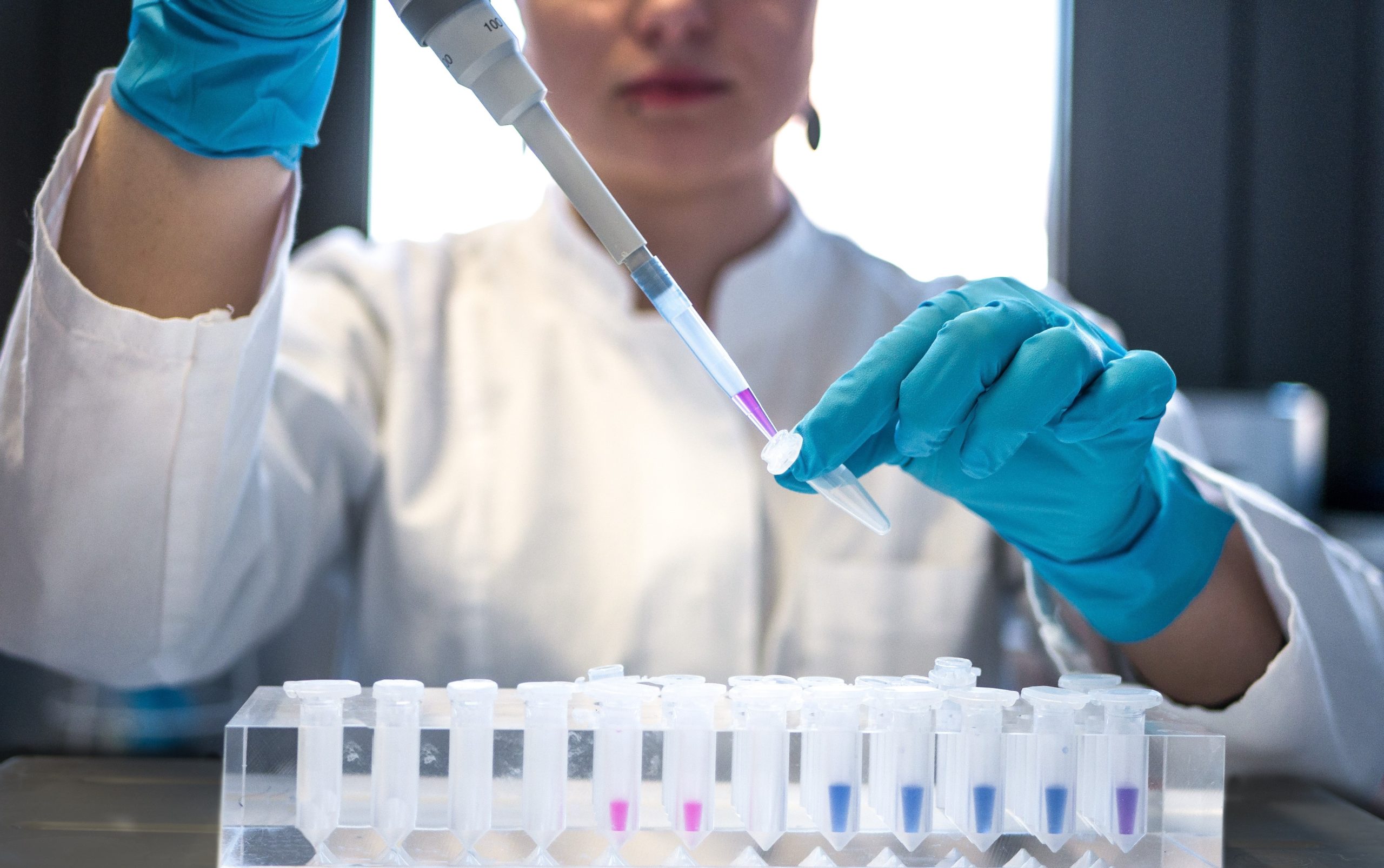

Why Australian Eagle believes CSL is a ‘dream company’

Sean Sequeira

April 27, 2023

CSL Ltd (ASX:CSL) – which labels itself as a multinational specialty biotechnology company – has long been one of the stars of the Australian market. Since listing in 1994, CSL has not missed a beat, with its share price soaring a massive 25,000 per cent. It’s a long-term holding in the Australian Eagle portfolio and, with great management and a solid growth outlook, we continue to like what we see.

by Sean Sequeira Posted in Companies, Editor's Pick, Health Care, Insightful Insights.

-

How the Australian Eagle Trust Long Short Fund has achieved its outperformance*

David Buckland

April 20, 2023

Australian Eagle Asset Management, one of Montgomery’s four business partners, launched the Australian Eagle Trust Long Short Fund on 1 July 2016. It is effectively a 150/50 Fund, “long” its best 25-35 stocks with an average weight of around 4.5 per cent, and “short” 12-25 stocks with an average weight of around 2.5 per cent. The Fund is appropriate for investors with a “Very High” risk and return profile. continue…

by David Buckland Posted in Companies, Editor's Pick, Market Valuation, Montgomery News and Updates.