How the Australian Eagle Trust Long Short Fund has achieved its outperformance*

Australian Eagle Asset Management, one of Montgomery’s four business partners, launched the Australian Eagle Trust Long Short Fund on 1 July 2016. It is effectively a 150/50 Fund, “long” its best 25-35 stocks with an average weight of around 4.5 per cent, and “short” 12-25 stocks with an average weight of around 2.5 per cent. The Fund is appropriate for investors with a “Very High” risk and return profile.

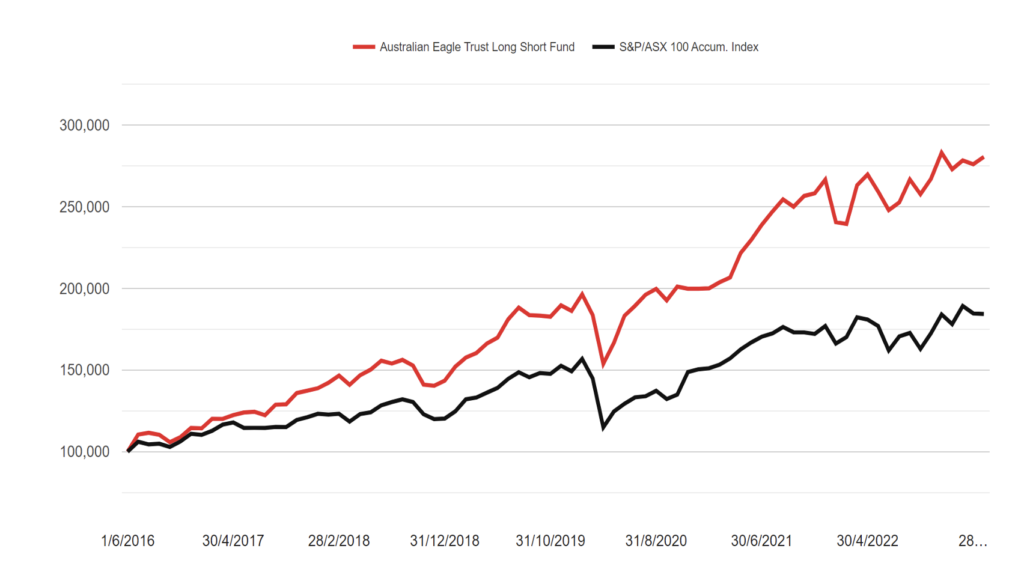

In net terms, the portfolio is always around 100 per cent long (plus or minus 10 per cent) and comparing the performance against the S&P/ASX 100 Accumulation Index over the 6 years and 9 months to March 2023, it has done a superb job for its investors. Over this period, the S&P/ASX 100 Accumulation Index recorded a compound annual return of 9.49 per cent, whilst the Australian Eagle Trust Long Short Fund recorded a compound annual return of 16.53 per cent, for annualised out-performance of 7.03 per cent, after all fees and expenses.*

Over the 6 years and 9-month period from inception (1 July 2016) to 31 March 2023, The Fund has delivered a negative return in 26 of the 81 months, or nearly one-third of the months. The risks are accentuated with any levered equities product, particularly when the “short portfolio” outperforms the “long portfolio”. A simple example was the month of November 2020, when the Fund delivered a negative return of 0.62 per cent, whilst the S&P/ASX 100 Index put on 10.22 per cent.

Australian Eagle Trust Long Short Fund performance to 31/03/2023 (after all fees)

Past performance is not indicative of future performance

How have the team at Australian Eagle Asset Management (AEAM), including Sean Sequeira, Alan Kwan, Daniel Chan and Mark Oliver, managed this outstanding result? The starting point is the team seeks to own superior quality businesses with a sensible risk buffer and hold those investments until their long-term advantages manifest in a superior rate of return. The focus is on identifying the market’s underappreciation of a quality company’s emerging or forthcoming change with respect to, for example, its quality or growth profile. Conversely, the team seeks to short companies that do not display these characteristics.

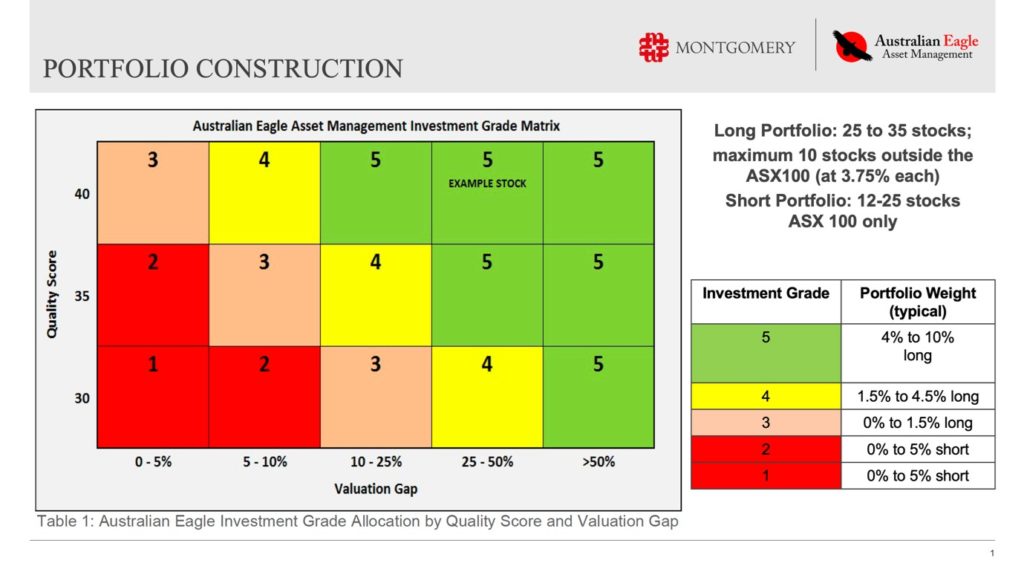

Each company receives a score out of 50, based on 10 different qualitative assessments including industry structure, barriers to entry, organic growth, cyclicality, competitive advantage, perceived change in competitive advantage, management track record, capital deployment, capital management and financial health.

A “Quality Score” / “Valuation Gap” matrix is established and only companies rated 1 or 2 (out of 5) make up the “Short Portfolio”. Typically, these companies are low quality, over-valued and their underlying business is in structural decline. The maximum weighting to an individual stock in the “Short portfolio” is 5 per cent. Conversely, companies which receive a score of 4 or 5 (out of 5) account for the vast majority of the “long portfolio” and the typical maximum weighting is 10 per cent.

This matrix and some of the portfolio construction rules follow.

You can learn more about the Australian Eagle Trust Long Short Fund here.

*Past performance is not indicative of future performance

The issuer of units in Australian Eagle Trust (ARSN 632 568 846) (Trust) is the Fund’s responsible entity The Trust Company (RE Services) Limited (ABN 45 003 278 831) (AFSL 235150), part of Perpetual Limited. Australian Eagle Asset Management Pty Limited (ABN 89 629 484 840) is the investment manager of the Trust. The Product Disclosure Statement (PDS) contains all of the details of the offer. Copies of the PDS and Target Market Definition (TMD) are available to download from the fund’s web page which you can access here: Australian Eagle Trust Long Short Fund