Companies

-

MEDIA

What are Tim Kelley’s insights into the Australian Banks?

Tim Kelley

October 10, 2012

Do Ten Network (TEN), Seven West Media (SWM), Aurora Oil (AUT), Origin Energy (ORG), Santos (STO), Cedar Woods (CWP), Slater and Gordon (SGH), IMF (IMF), Roce Oil (ROC), The Reject Shop (TRS), Challenger (CGF), Bluescope (BSL) or Adelaide Brighton (ABC) achieve the coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call 10 October 2012 program now to find out, and also hear Tim’s thoughts on the big Aussie banks. Watch here.

by Tim Kelley Posted in Companies, Financial Services, Insightful Insights, TV Appearances.

-

What is your best performing stock pick for the next 9 months?

Roger Montgomery

October 5, 2012

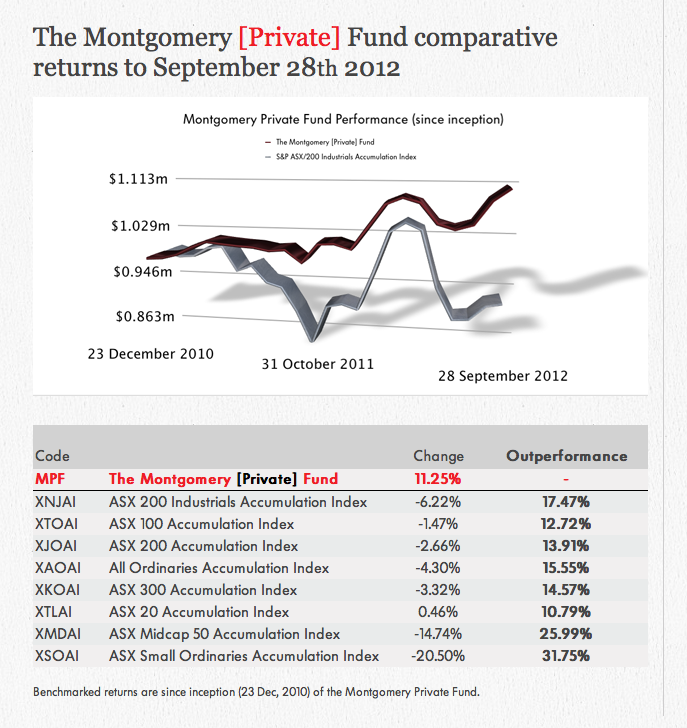

September was a challenging month for investors but Montgomery chalked up another outperformance in both The Montgomery [Private] Fund and The Montgomery Fund (see figure 1).

Of course in the short term the performance of share prices can be attributed to noise and randomness and so the bigger question is always; which businesses will be worth substantially more in the future?

What is your suggestion for the best performing stock for the next nine months to June 30, 2012?

Pick the best performing stock in the next nine months and gain fame and notoriety, kudos and credit.

Each month we’ll track the list and present the table until June 30, 2012.

All the best and stay tuned.

by Roger Montgomery Posted in Companies, Intrinsic Value, Investing Education.

-

Gunns collapse. If only they’d been Skaffold members!

Roger Montgomery

September 29, 2012

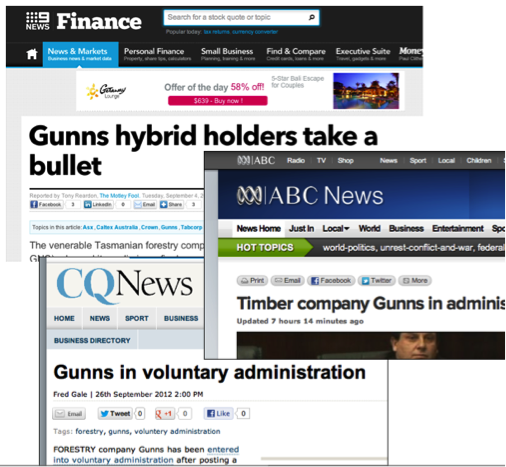

Chalk up another win for Skaffold members.

Substantial capital losses are difficult to make back and irrespective of whether you are still in accumulation mode, retiring or retired it is essential to avoid major losses. One way to do this of course is to diversify and ensure that losses are mitigated through position sizing. Another technique and the one we will discuss here, is to simply avoid the companies most likely to collapse.

This week Gunns (ASX:GNS), was placed into voluntary administration and happily for Skaffold members it is unlikely that anyone owned shares.

Gunn’s was never investment grade. Anyone who purchased the stock from 2003 onwards were taking a massive risk and Skaffold can explain why.

Skaffold’s Verdict (Figure. 1) is a picture of danger.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, Skaffold, Value.able.

-

MEDIA

What are Tim Kelley’s insights into Cabcharge’s prospects?

Roger Montgomery

September 25, 2012

Do Sedgman (SMD), Decmil Group (DCG), cochlear (COH), Seek (SEK), IAG (IAG), Resolute Mining (RSG), Magellan Financial Group (MFG), Syrah Resources (SYR), ASG (ASZ), Goodman Group (GMG), Silex Systems (SLX), AMP (AMP) or Service Stream (SSM) achieve Roger’s and Tim’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 25 September 2012 program now to find out, and also learn Tim’s insights to the outlook for Cabcharge (CAB). Watch here.

by Roger Montgomery Posted in Companies, TV Appearances.

- save this article

- POSTED IN Companies, TV Appearances

-

David Jones: Non retailers distracted by a takeover?

Roger Montgomery

September 21, 2012

This week David Jones announced their 2012 results and reported a 40% decline in profit. The only positive was that 4th quarter sales fell by just 1% on pcp whereas 1st quarter sales had fallen 11% on pcp. Actually there was another positive; the 35% decline in earnings per share was inline with expectations.

Separately the company also provided an update to its property strategy. Investors should understand that anything DJS does with its properties is simply a takeover defence against private equity (or Premier Investments perhaps) pulling off the same stunt that was done on Myer. That is; launch a takeover, succeed, sell off the property portfolio and get the business cheaper. if DJS shows it is proactive in this area it becomes much harder from Private Equity to argue that they are “adding value”.

DJS intrinsic value (see Fig. 1) has now not increased since 2004 and according to Skaffold.com DJS’s intrinsic value is not expected to rise at all over the next two years.

by Roger Montgomery Posted in Companies, Insightful Insights, Intrinsic Value, Takeovers.

-

MEDIA

What are David Buckland’s insights into the future of Australian retail?

Roger Montgomery

September 20, 2012

Do Silex Systems (SLX), Condor Blanco Mines (CDB), Codan (CDA), Webjet (WEB), Tasman Resources (TAS), M2 Telecommunications (MTU), Magellan (MPG), Iluka Resources (ILU), Arrium (ARI), TPG (TPM), ASG Group (ASZ), Incitec Pivot (IPL) and Sirius Resources (SIR) and achieve the Montgomery coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 20 September 2012 now to find out, and also learn David’s insights into the issues facing Australian retail. Watch here.

by Roger Montgomery Posted in Companies, TV Appearances.

- save this article

- POSTED IN Companies, TV Appearances

-

If Only They Had Skaffold

Roger Montgomery

September 20, 2012

Notch up another win for investors who use Skaffold. Back in August last year I was asked by a viewer on Sky Business what I thought of MacMahon Holdings (ASX:MAH).

Notch up another win for investors who use Skaffold. Back in August last year I was asked by a viewer on Sky Business what I thought of MacMahon Holdings (ASX:MAH).You can watch the video here at 5 mins 20 seconds.

When asked the question, I looked at Skaffold.com and noting the very small change in intrinsic value over many years I said “This business is not going to deliver sustainable long-term outperformance”.

Today’s near-40% share price decline, announcement of a cost blowout, a downgrade to previous earnings guidance and the immediate resignation of the CEO Nick Bowen is a blow to those investors who own the shares of MacMahon and do not own Skaffold.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Skaffold.

-

China growth fears (continued)

David Buckland

September 19, 2012

Yesterday’s Australian Financial Review highlighted comments from Mark Williams, Shell’s global downstream director.

“The global economy seems weaker to me than the numbers indicate”, said Mr Williams. “I still expected more suction out of China than we’re getting. I’m just a bit uneasy with what we are seeing in terms of fuel demand and chemical demand”.

by David Buckland Posted in Companies, Insightful Insights.

- save this article

- POSTED IN Companies, Insightful Insights

-

MEDIA

What are the ongoing prospects for Queensland Mining?

Roger Montgomery

September 12, 2012

Roger Montgomery discusses the new Qld Government levies on mining, and the likely impact on mining stocks with Ross Greenwood on Radio 2GB. Listen here.

This program was broadcast on 12 September 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Radio, Value.able.

- save this article

- POSTED IN Companies, Insightful Insights, Radio, Value.able

-

Is it all FUN and Games?

Harley Grosser

September 9, 2012

The following article was contributed by Harley, and gives a very detailed account of Funtastic as a possible turnaround story. If you have the skill to identify them, turnarounds can be very profitable investments, although its not an area of focus for us at Montgomery Investment Management. In 2006, Funtastic fell to a B5 on our quality and performance ratings, and since that time has been outside the range that we would normally consider “investment grade”. However, as Harley points out, Funtastic may enjoy better times ahead if its portfolio of toys appears on enough Christmas shopping lists.

Funtastic is in the business of fun. As a leading toy distributor with domestic and international operations, as well an entertainment arm, Funtastic (ASX:FUN) make money by selling products that make us happy. The question is, would an investment in Funtastic at today’s prices set us up for pleasant future returns or is this one turnaround story that is worth avoiding?

by Harley Grosser Posted in Companies, Insightful Insights, Manufacturing.