To visit the February 2026 reporting season calendar Click here .

-

Growth vs. governance: Navigating the ASX’s HY26 results

Roger Montgomery

February 16, 2026

Following the release of its Half-Year 2026 (HY26) results, the Australian Stock Exchange (ASX) finds itself at a crossroads, balancing record-breaking volumes with significant regulatory and management hurdles.

Volumes and new models

Despite the noise, the ASX’s core business is thriving. The HY26 results showed a significant growth beat, driven primarily by cash volumes, clearing, and bonds, with daily trading volumes having surged above $8 billion. Continue…

by Roger Montgomery Posted in Market commentary, Market Valuation, Stocks We Like.

- save this article

- POSTED IN Market commentary, Market Valuation, Stocks We Like.

-

Summing up the bear case for AI

Roger Montgomery

February 13, 2026

The artificial intelligence (AI) industry is currently grappling with what some experts call a ‘trillion-dollar math problem’. The numbers might not stack up because customers might simply lack the funds to spend on AI tools to allow hyperscalers to achieve a decent return on their AI infrastructure investment.

With hyperscalers projected to spend US$3 trillion on AI infrastructure by 2029, the market faces a substantial revenue gap. To justify current valuations and maintain reasonable margins, AI services would need to generate revenue equivalent to 10 per cent of the entire U.S. Gross Domestic Product (GDP) of US$30 trillion. This represents a massive commercial risk; if expectations of an adequate return on investment in two or three years evaporate, this historic capital expenditure risks producing a multi-trillion-dollar overcapacity. Continue…

by Roger Montgomery Posted in Market commentary, Market Valuation, Technology & Telecommunications.

-

MEDIA

ABC Newcastle Mornings – The AI investment reckoning

Roger Montgomery

February 11, 2026

I joined Paul Turton on ABC Mornings to discuss how AI is evolving beyond simple prompts into autonomous agents that can act on our behalf, but warned that market expectations may be getting ahead of reality. With trillions set to be spent on infrastructure, current valuations imply adoption levels that look ambitious, raising the risk of overcapacity and corrections, particularly as AI begins to disrupt the software as a service model and pressure established data and information providers.

Listen from 36:40 here: ABC Newcastle Mornings

by Roger Montgomery Posted in Market commentary, Radio, Technology & Telecommunications.

-

Commonwealth Bank 1H26 results and AI update

Roger Montgomery

February 11, 2026

Commonwealth Bank (ASX: CBA), under the guidance of CEO Matt Comyn, has once again proven why it’s considered the best Australian bank. Despite a muddy economic backdrop and fierce competition in the mortgage market, the bank’s half-year FY26 (1H26) results beat analyst expectations (again).

While the headline numbers were strong and will dominate today’s commentary, a more interesting story lies in the shifting dynamics of Australia’s largest lender. Continue…

by Roger Montgomery Posted in Companies, Financial Services, Market commentary, Market Valuation, Stocks We Like.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

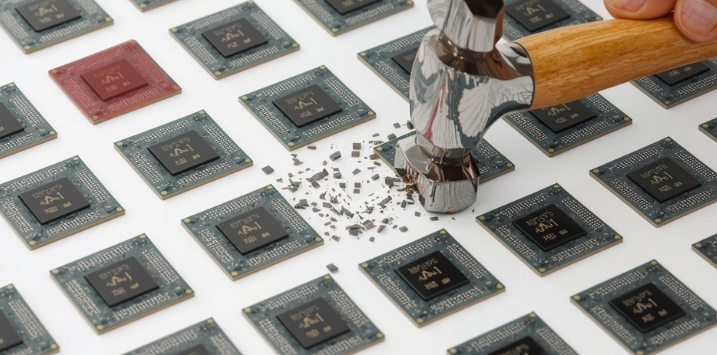

One more nail? Or is that it?

Roger Montgomery

February 11, 2026

Former CEO, public speaker and author, Jay Grewal once said, “When it comes to the final nail in your coffin, it doesn’t matter if it’s dull or sharp, it’ll still hold, because a lifetime of prior nails have helped seal that coffin shut.”

In what may prove to be merely another accumulated nail in the coffin of the artificial intelligence (AI) boom, the narrative on Wall Street shifted dramatically last week as the tech-driven optimism that has fueled the market for years hit a psychological and structural barrier. Continue…

by Roger Montgomery Posted in Market commentary, Technology & Telecommunications.

-

MEDIA

ABC The Business – Falling U.S. dollar and global uncertainty spark modern day gold rush

Roger Montgomery

February 10, 2026

by Roger Montgomery Posted in Foreign Currency, Market commentary, TV Appearances.

- save this article

- POSTED IN Foreign Currency, Market commentary, TV Appearances.

-

MEDIA

Ausbiz – has tech run its course?

Roger Montgomery

February 9, 2026

I joined Juliette Saly on Ausbiz to discuss how the AI trade has shifted from hype to reality. Adoption is proving more cyclical than expected, customers will not pay any price for AI tools, and data centre rollouts face delays from regulation and power constraints. At the same time, higher inflation, rising debt and the end of ultra-low rates are putting pressure on valuations. Software as a Service (SaaS) businesses are being repriced, and sectors like real estate and travel are also starting to feel the impact, prompting investors to reassess risk.

Tune into the full episode here: Ausbiz – Has tech run its course? Continue…

by Roger Montgomery Posted in Market commentary, TV Appearances.

- save this article

- POSTED IN Market commentary, TV Appearances.

-

Is the creative destruction phase beginning?

Roger Montgomery

February 6, 2026

Last year, I posted a blog entitled ‘But Nothing’s Changed’, describing how the artificial intelligence (AI) bubble and market boom could end. I explained how investors will realise that even though AI technology – hailed as the 4th Industrial Revolution – will change the course of human history, it probably won’t do so tomorrow. And therefore, share prices were at risk of setbacks because there will be commercial bumps (delays in data centre builds, changes in interest rates, shortages of energy and water, and not all companies can win) along the way to an AI ‘utopia’. While timing a change in sentiment is impossible, the hype surrounding general-purpose technologies, including AI, makes such a change inevitable. It’s always been so. Continue…

by Roger Montgomery Posted in Manufacturing, Market commentary, Technology & Telecommunications.