To visit the February 2026 reporting season calendar Click here .

-

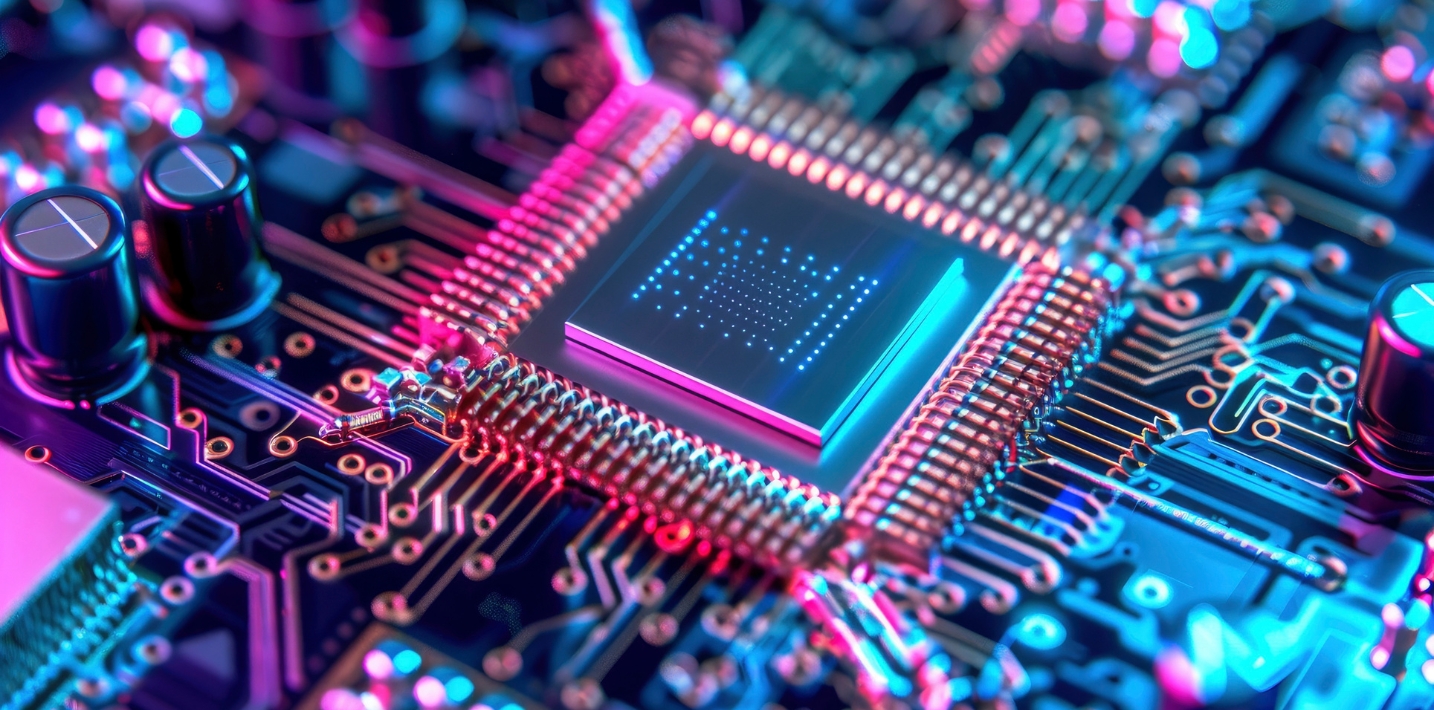

144-year-old mystery exposes an AI bubble

Roger Montgomery

March 4, 2026

While investors look to the next Nvidia earnings call or the latest OpenELM (Open-source Efficient Language Models) release to predict the future of artificial intelligence (AI), Michael Burry – made famous for making billions shorting markets ahead of 2008 subprime crisis – recently turned to an article entitled Thought without Language, The Narrative of a Deaf-Mute, His First Thoughts and Experiences, in the June 19, 1880, edition of the New York Times.

“The case study is of a teacher at the Columbia Institute for the Instruction of the Deaf and Dumb. This particular teacher, Melville Ballard, is also a deaf mute and a graduate of the National Deaf Mute College.” Continue…

by Roger Montgomery Posted in Market commentary, Technology & Telecommunications.

-

Domino’s Pizza Enterprises: Pivoting to franchisee prosperity

Roger Montgomery

March 3, 2026

The HY26 results for Domino’s Pizza Enterprises (ASX:DMP) mark a “reset” phase for the company, as it moves away from a decades-long reliance on deep discounting and volume growth toward a more sustainable, value-driven model.

While this transition will take time, the underlying focus on franchisee health and cost discipline is laying the groundwork for a leaner, more resilient business, perhaps explaining the nine per cent share price bounce at the time of writing (26 February 2026), following an 11 per cent drop the day before on the day of the result’s release. Continue…

by Roger Montgomery Posted in Companies, Market commentary.

- save this article

- POSTED IN Companies, Market commentary.

-

The risk of underspending in retirement

Roger Montgomery

March 3, 2026

I think a lot about how higher-yielding income products, such as the Aura Private Credit Income Fund and the Aura Core Income Fund, might fit in a retiree’s portfolio and how to articulate that.

It’s a challenge to explain, primarily because we don’t know the future. We don’t know how long we’ll live; we don’t know when/if the stock market might crash, and therefore we don’t know how much we can withdraw each year from our retirement savings because we don’t know how much we will spend in retirement, nor how much we’ll actually have left each year.

It leaves many investors paralysed; “I’ll worry about it tomorrow.” Continue…

by Roger Montgomery Posted in Aura Group, Investing Education.

- save this article

- POSTED IN Aura Group, Investing Education.

-

A new ASX-listed investment bank

Roger Montgomery

March 2, 2026

In a deal announced today, Magellan Financial Group (ASX: MFG) will buy Barrenjoey Investment Bank. For long-term investors, it could provide the opportunity to invest in another ASX-listed investment bank. Could it be the next Macquarie Bank?

Of course, there is a long way to go from Barrenjoey’s $1.6 billion valuation to Macquarie’s $76.3 billion market capitalisation, so this blog is limited to examining today’s deal without commenting on valuation or predicting share prices. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Data centre bottlenecks. Valuations at risk.

Roger Montgomery

March 2, 2026

As we have outlined here on the blog many times over the last year, there just doesn’t seem to be enough money in the hands of potential customers to pay for artificial intelligence (AI) tools that would give hyperscalers a decent return on their intended capital expenditure.

The more they spend, the more revenue and profit they must generate to produce a meaningful return on capital. But the more they invest through capital expenditure, the more competition there’ll be between them (lowering prices for their commoditised products) or the greater the level of overcapacity (also lowering prices).

And when you think about the companies in this race, the capital expenditure (capex) is transforming them from cash-generative, capital-light, high-margin businesses whose services have become verbs into capital-heavy, highly indebted businesses. Continue…

by Roger Montgomery Posted in Market commentary, Technology & Telecommunications.

-

MEDIA

Over the Money Fence – Calm Amid the Chaos: Building Money Confidence in 2026

Roger Montgomery

March 2, 2026

This week I join Nicola and Di for the first 2026 episode of Over The Money Fence. This series aims to help you take control of your finances with clarity and confidence.

In this episode, we take a look at the changes that are currently happening in the world, and how that could impact our finances. I explain how the tailwinds that have benefited the stock markets in the past, and have benefited the Baby Boomers and Gen X are shifting, and why that means investors may need to consider other investments. Continue…

by Roger Montgomery Posted in Aura Group, Digital Asset Funds Management, Investing Education, Market commentary, Podcast Channel.

-

Who’s right about the future of AI?

Roger Montgomery

February 27, 2026

Rodney Brooks is the Panasonic Professor of Robotics (emeritus) at MIT. For the last eight years, he has been publishing his predictions each year on self-driving cars, electric vehicles (EVs), robotics, artificial intelligence (AI)/machine learning, and human space travel. Each year, Brooks reviews his prior forecasts without fear or favour. Brooks has promised to review his predictions annually until 2050 (right after his 95th birthday), for a total of 32 years. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

MEDIA

Ausbiz– Beating the Bubble

Roger Montgomery

February 27, 2026

Many believe the era of easy investing is over and after several strong years in equity markets, opportunities are harder to find and valuations are less forgiving. So, with traditional 60/40 portfolios under pressure, investors are looking for diversification, income and resilience.

In this exclusive Ausbiz event, I joined Nadine Blayney for an in-depth discussion on equity alternatives and the strategies designed to help protect and grow your wealth.We explored

- The importance of rebalancing in the current market environment

- How to think about diversification, income and resilience

- How private credit works – and why investors can use it for a reliable income stream

- High-frequency trading and arbitrage funds: historically the domain of proprietary trading firms and institutions, now accessible to investors

- Key risks and what to look for when assessing these types of strategies

by Roger Montgomery Posted in Aura Group, Digital Asset Funds Management, Investing Education, Market commentary, Popular, TV Appearances.