Value.able

-

Are there still six value opportunities after the rally?

Roger Montgomery

February 6, 2012

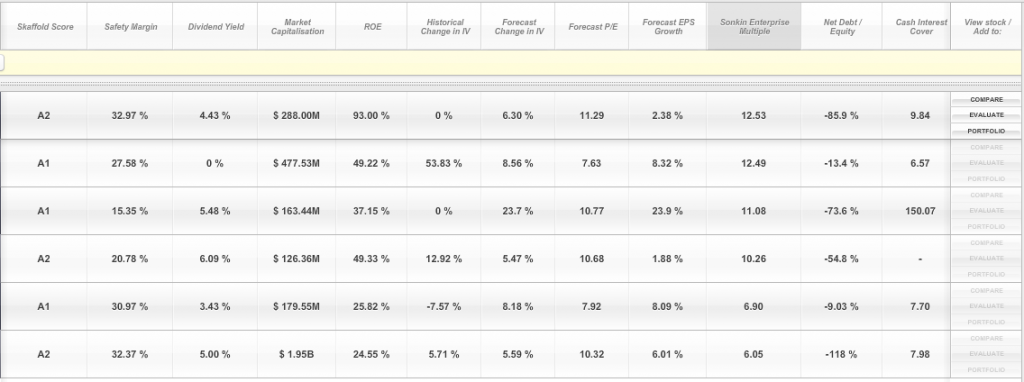

Click on the above IMAGE to see a larger and clearer version of the screenshot from Skaffold.

Click on the above IMAGE to see a larger and clearer version of the screenshot from Skaffold.The ability to turn off and tune out the noise of the market is a key to success. I don’t know whether the market will keep rallying amid improving US economic data in the short term while ignoring long term structural European banking and credit issues that is now ‘old news’. I do believe that the market reacts to new ideas while always keeping an eye on old ideas. European deterioration was new for a while and now its not. The ‘new news’ today is that the US economy is improving. Europe is, as I say, old news. But old news gets recycled when the new news the short termists are focusing on becomes old news itself. if you are keeping up, you are doing well. One expects that eventually the appetite for stocks could weaken when news of a resurgent US becomes old and unresolved structural issues return to become news again.

Putting that aside, here is a list of six companies that popped up in Skaffold (click here to join) today when I looked for A1, A2, A3 and B1 companies trading at a better than 15% discount to estimated intrinsic value. I then selected for no debt (net cash), forecast EPS growth and expected positive growth in estimated intrinsic value. You will note that I have left out the names of the companies that make the grade. There’s a good reason which I will discuss in a moment…

As an aside if you would like to see how the stocks in your portfolio compare to the Skaffold universe you can CLICK HERE and enter your five stocks directly into Skaffold. Once you have done that I imagine you won’t want to invest without it.

…To start a discussion about what is good value in the market right now, have a go at suggesting what the six stocks in the above list are. If you can get all six right in one go, I will ask the team to send a signed copy of my book Value.able to the first correct answer.

If you simply want to discuss a value opportunity you have uncovered go ahead by clicking the Leave a Comment button below.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 6 February 2012.

by Roger Montgomery Posted in Value.able.

- 50 Comments

- save this article

- POSTED IN Value.able

-

An upgrade amid the malaise!

Roger Montgomery

February 2, 2012

Reporting season has begun in ernest and a few companies we have been watching (and some of which we own in the Montgomery Private Fund) have reported. Today it was Credit Corp’s turn (ASX: CCP, SQR* A2). You can find the presentation here (be sure to read and agree to the ASX and our disclaimer).

Reporting season has begun in ernest and a few companies we have been watching (and some of which we own in the Montgomery Private Fund) have reported. Today it was Credit Corp’s turn (ASX: CCP, SQR* A2). You can find the presentation here (be sure to read and agree to the ASX and our disclaimer).Skaffold members are likely to have already seen CCP on the Aerial Viewer with an A2 rating and a discount to Skaffold’s estimate of Intrinsic Value. In the Montgomery Private Fund, we have owned the stock for some time now and I have mentioned it as a stock to investigate on many TV and Radio programs. Today’s 10 per cent gain is certainly a welcome boost to the gains already registered.

The highlights from the announcement of the half year results for us were 1) that earnings were at the top end of guidance, 2) a 12% increase in revenue translated to a 23% increase in NPAT, 3) a welcome reduction in debt to its lowest level since listing and 4) strong free cash flow after an increase in dividends and finally a conditional settlement of a “distracting” class action. This final point is particularly important for many investors who will now feel vindicated that it was not the investor who erred. The impact of the settlement on earnings will be immaterial thanks to insurances. At current rates of cash flow generation, debt could be extinguished completely by the end of the financial year.

Grant Duggan – a regular blog poster here – was kind enough to make the following comments below: “If i recall on YMYC a caller asked for one xmas stock to put under the tree for 2012, and much to your dislike [Roger] to only be able to pick one it was CCP, and i know two months don’t make a market but to me this is another indicator of value able investing starting to prove its worth. Thanks to Roger and all blog posts once again.”

I know I am harping on about it but if you have not joined as a member of Skaffold, how are you planning to find the best opportunities during reporting season? Join Skaffold who have done all the hard valuation and quality assessments for every single listed company so you don’t have to.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 2 February 2012.

by Roger Montgomery Posted in Companies, Investing Education, Skaffold, Value.able.

-

Will Facebook’s IPO be a one day Circus?

Roger Montgomery

February 2, 2012

Unless you live under a waterfall in the rainforests of South America, you will have heard that Facebook has lodged its S-1 (Prospectus) for a probably May 2012 IPO. Skaffold members can look forward to Facebook being available to view in Skaffold when the team loads up all the international stocks.

To become a Skaffold member today and discover how we have been investing click here

Back to our regular programming…

Hyped by the media around the world as the biggest internet IPO in history and asked whether we would ‘invest’ in Facebook, we note the following:

The company already has 500 shareholders and would have been required by the SEC to lodge financials in April.

Facebook Stock Code: FB

Maximum aggregate offering price: $5Bn

as yet, there is not sufficient valuation information listed in the S-1 filing with the SEC nor how many shares are being offered.

According to the S-1 cover:

845 million monthly active users (MAU)

483 million daily active users (DAU)

Users generated on average 2.7 billion Likes and Comments per day in Q4 2011.

100 billion friendships

250 million photos uploaded per day

Our observation: Not a mention of any dollars yet! “likes”, “friends” and ‘uploaded photos’ are today what ‘page impressions’ and ‘visitors’ where in the tech boom of 1999/2000.

FB generated $3.7 billion in Revenue in 2011, up from $2 billion in 2010. 12 percent of Facebook’s revenue in 2011 was linked to its relationship with online gaming giant Zynga.

FB generated $1 billion in net income in 2011, up from $606 billion in 2010, a 40% growth rate, compared to the 165% growth rate from 2009’s $229m.

EBIT margin peaked at 52.3% in 2010 ($1m in EBIT on $2 billion in revenue), has since declined to 47.3% or $1.756Bn on $3.711Bn in Revenue, still incredible.

$3.9 billion in cash and marketable securities

Western world user growth is slowing but thats the law of large numbers. Facebook says: “We believe that our rates of user and revenue growth will decline over time. For example, our annual revenue grew 154% from 2009 to 2010 and 88% from 2010 to 2011. Historically, our user growth has been a primary driver of growth in our revenue. Our user growth and revenue growth rates will inevitably slow as we achieve higher market penetration rates, as our revenue increases to higher levels, and as we experience increased competition.”

The company still reported +60% earnings growth rates in 2011. The key is whether users stay and whether they can be ‘monetized’ further. MAU additions peaked in 2010 when FB added 248m to a total of 608m; in 2011 it added 237MM to 845m.

On the subject of dividends FB says: “We do not intend to pay dividends for the foreseeable future. We have never declared or paid cash dividends on our capital stock. We currently intend to retain any future earnings to finance the operation and expansion of our business, and we do not expect to declare or pay any dividends in the foreseeable future. As a result, you may only receive a return on your investment in our Class A common stock if the market price of our Class A common stock increases. In addition, our credit facility contains restrictions on our ability to pay dividends.”

Here’s access to the S-1: http://www.sec.gov/Archives/edgar/data/1326801/000119312512034517/d287954ds1.htm

The map of the world connected by facebook users is intriguing. What are those pirates on the west coats of Africa doing on Facebook?

I have previously written about the forthcoming floats of internet and social media sites here: http://rogermontgomery.com/which-ipos-are-you-watching/

‘Paradigm changers’ (remember Yahoo?) have come and gone so it is essential you don’t get caught up in the hype and instead stick to the valuation approach that is the bedrock of our approach. If you don’t know it, buy a copy of Value.able today for just $49.95. Or to save yourself reading the last ten annual reports for every listed company, try Skaffold.

There were eight large and highly media-promoted IPOs in the last year or two (GRPN, ZNGA, LNKD, P, YOKU, DANG, AWAY, and FFN). One analyst reported that if you could get stock in the IPO (forget it if you weren’t a major client of the lead broker or a ‘friend’ of the company) there was an average gain of 50%. If you bought each IPO in the market on Day 1 you now have an average loss of 54% with incredibly only 1 of the 8 names (ZNGA) still holding on to gains (+11%) thanks to a rally of 15% in the last week.

We would like to go through the numbers for Facebook today and try to come up with a valuation for you. You can do it yourself if you have a copy of Value.able.

There’s about $5.2 billion in equity, including $1bln of retained earnings. There’s 4.1bln Class A shares and the same number of class B’s. The preferred’s will be converted and only Class A’s sold. We cannot calculate equity per share because the S-1 does not disclose how many shares will be issued. ROE is about 26 per cent. No dividends will be paid. The company states in its S-1 that it will continue to grow by acquisition as well as organically. But the company will takeover Earth if it continues to retain profits and generates 26% returns on the incremental equity. Assuming earnings grow at 40% and faster than the rate of return on equity, then you can expect ROE to rise. Using these favourable metrics we reckon Facebook is worth $26-$28bln in 2012 rising to $57-$63bln in 2014. If the IPO ‘values’ the company at $100bln as many media outlets suggest, watch out.

This paragraph from the S-1 is important:

“If you purchase shares of our Class A common stock in our initial public offering, you will experience substantial and immediate dilution.

If you purchase shares of our Class A common stock in our initial public offering, you will experience substantial and immediate dilution in the pro forma net tangible book value per share of $ per share as of December 31, 2011, based on an assumed initial public offering price of our Class A common stock of $ per share, the midpoint of the price range on the cover page of this prospectus, because the price that you pay will be substantially greater than the pro forma net tangible book value per share of the Class A common stock that you acquire. This dilution is due in large part to the fact that our earlier investors paid substantially less than the initial public offering price when they purchased their shares of our capital stock. You will experience additional dilution upon exercise of options to purchase common stock under our equity incentive plans, upon vesting of RSUs, if we issue restricted stock to our employees under our equity incentive plans, or if we otherwise issue additional shares of our common stock. For more information, see “Dilution”.

Note the blanks, which makes FB impossible to value on a per share basis, yet.

We’ll have to wait until the final days of the capital raising before we can come up with a firm valuation on a per share basis but for now, the circa $27bln valuation stands.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 2 February 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

MEDIA

What are Roger’s Value.able Insights into the float of Facebook?

Roger Montgomery

February 1, 2012

Do David Jones (DJS), Myer (MYR), ARB Corporation (ARP), Oroton (ORL), Billabong (BBG), JB Hi-Fi (JBH), Harvery Norman (HVN) or Campbell Brothers (CPB) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Switzer program broadcast 1 February 2012 to find out and also learn Roger’s views on the pricing of the upcoming Facebook IPO. Watch here.

by Roger Montgomery Posted in Intrinsic Value, Investing Education, Skaffold, TV Appearances, Value.able.

-

MEDIA

Why does Roger Montgomery think 2012 may be our toughest year yet?

Roger Montgomery

February 1, 2012

Roger Montgomery discusses why the global investing outlook for 2012 will be impacted by a variety of negative influences in this Money Magazine article published February 2012. Read here.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Market Valuation, On the Internet, Value.able.

-

Perhaps one of the most important charts?

Roger Montgomery

January 31, 2012

Late last year the Federal Bank of San Francisco’s research department published their findings about a relationship between the ageing baby boomers and P/E ratios. I have long held the view that when Australia’s baby boomers (the majority of whom are asset rich and cash poor) reach the age that they need to fund their retirement spending and healthcare, they will need to sell their assets (typically real estate). Given the next generation have long complained of being unable to afford a house, it seems logical that prices for homes will need to fall. Only if prices fall can a generation of sellers meet the generation of buyers who say they cannot afford to pay current prices.

Late last year the Federal Bank of San Francisco’s research department published their findings about a relationship between the ageing baby boomers and P/E ratios. I have long held the view that when Australia’s baby boomers (the majority of whom are asset rich and cash poor) reach the age that they need to fund their retirement spending and healthcare, they will need to sell their assets (typically real estate). Given the next generation have long complained of being unable to afford a house, it seems logical that prices for homes will need to fall. Only if prices fall can a generation of sellers meet the generation of buyers who say they cannot afford to pay current prices.If that is indeed true for one asset classes then perhaps it makes sense for other asset classes. Wealthier baby boomers with DIY share portfolios will also need cash. They may not sell the family home (although downsizing is a very real trend), instead they may use their share portfolios as their ATM. This could put pressure on the multiples of earnings, sales and book values that trade in a free market.

The FRBSF seems to agree…Zheng Liu and Mark M. Spiegel discovered a strong relationship between the age distribution of the U.S. population and stock market performance.

“A key demographic trend is the aging of the baby boom generation. As they reach retirement age, they are likely to shift from buying stocks to selling their equity holdings to finance retirement. Statistical models suggest that this shift could be a factor holding down equity valuations over the next two decades.

The baby boom generation born between 1946 and 1964 has had a large impact on the U.S. economy and will continue to do so as baby boomers gradually phase from work into retirement over the next two decades. To finance retirement, they are likely to sell off acquired assets, especially risky equities. A looming concern is that this massive sell-off might depress equity values.Many baby boomers have already diversified their asset portfolios in preparation for retirement. Still, it is disconcerting that the retirement of the baby boom generation, which has long been expected to place downward pressure on U.S. equity values, is beginning in earnest just as the stock market is recovering from the recent financial crisis, potentially slowing down the pace of that recovery.

We examine the extent to which the aging of the U.S. population creates headwinds for the stock market. We review statistical evidence concerning the historical relationship between U.S. demographics and equity values, and examine the implications of these demographic trends for the future path of equity values.

Demographic trends and stock prices: Theory

Since an individual’s financial needs and attitudes toward risk change over the life cycle, the aging of the baby boomers and the broader shift of age distribution in the population should have implications for capital markets (Abel 2001, 2003; Brooks 2002). Indeed, some studies attribute the sustained asset market booms in the 1980s and 1990s to the fact that baby boomers were entering their middle ages, the prime period for accumulating financial assets (Bakshi and Chen 1994).

However, several factors may mitigate the effects of this demographic shift. First, demographic trends are predictable and rational agents should anticipate the impact of these changes on asset demand. Consequently, current asset prices should reflect the anticipated effects of demographic changes. In addition, retired individuals may continue to hold equities to leave to their heirs and as a source of wealth to finance consumption in case they live longer than expected (e.g., Poterba 2001).

Foreign demand for U.S. equities might also reduce the downward pressure on asset prices. However, the effect is probably limited for two reasons. First, other developed nations have populations that are aging even more rapidly than the U.S. population (Krueger and Ludwig, 2007). Second, there is substantial evidence of home bias in equity holdings. Individual investors typically hold disproportionate shares of domestic assets in their portfolios. For example, in 2009, the foreign equity holdings of U.S. investors were only 27.2% of the share of foreign equities in global market capitalization. While the low level of international equity diversification is still not well understood (Obstfeld and Rogoff 2001), it suggests that foreign demand for U.S. equities is unlikely to offset price declines resulting from a sell-off by U.S. nationals.

Demographic trends and stock prices: Some evidence

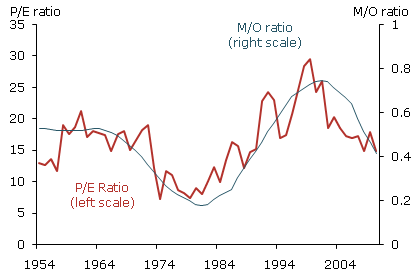

To examine the historical relationship between demographic trends and stock prices, we consider a statistical model in which the equity price/earnings (P/E) ratio depends on a measure of age distribution (for another example, see Geanakoplos et al. 2004). We construct the P/E ratio based on the year-end level of the Standard & Poor’s 500 Index adjusted for inflation and average inflation-adjusted earnings over the past 12 months. We measure age distribution using the ratio of the middle-age cohort, age 40–49, to the old-age cohort, age 60–69. We call this the M/O ratio.

We prefer our M/O ratio to the M/Y ratio of middle-age to young adults, age 20–29, studied by Geanakoplos et al. (2004). In our view, the saving and investment behavior of the old-age cohort is more relevant for asset prices than the behavior of young adults. Equity accumulation by young adults is low. To the extent they save, it is primarily for housing rather than for investment in the stock market. In contrast, individuals age 60–69 may shift their portfolios as their financial needs and attitudes toward risk change. Eligibility for Social Security pensions is also likely to play a first-order role in determining the life-cycle patterns of saving, especially for old-age individuals.

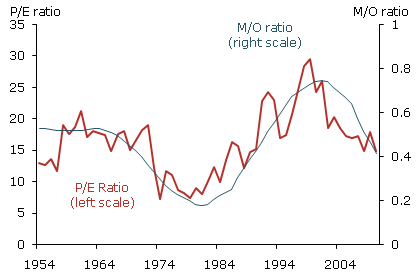

Figure 1 displays the P/E and M/O ratios from 1954 to 2010. The two series appear to be highly correlated. For example, between 1981 and 2000, as baby boomers reached their peak working and saving ages, the M/O ratio increased from about 0.18 to about 0.74. During the same period, the P/E ratio tripled from about 8 to 24. In the 2000s, as the baby boom generation started aging and the baby bust generation started to reach prime working and saving ages, the M/O and P/E ratios both declined substantially. Statistical analysis confirms this correlation. In our model, we obtain a statistically and economically significant estimate of the relationship between the P/E and M/O ratios. We estimate that the M/O ratio explains about 61% of the movements in the P/E ratio during the sample period. In other words, the M/O ratio predicts long-run trends in the P/E ratio well.

Figure 1.

This evidence suggests that U.S. equity values are closely related to the age distribution of the population.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 31 January 2012.

by Roger Montgomery Posted in Value.able.

- 20 Comments

- save this article

- POSTED IN Value.able

-

Dumped by the wave of Fashion

Roger Montgomery

January 31, 2012

There was a lot of surfing on the Montgomery annual holiday so I thought I’d publish these thoughts on Billabong International for you. Happy new year and all the best for 2012.

There was a lot of surfing on the Montgomery annual holiday so I thought I’d publish these thoughts on Billabong International for you. Happy new year and all the best for 2012.Billabong’s trading update in December attracted a great deal of attention – not only from shareholders who rushed the exits to sell their shares, but also from commentators who noted the result was a symptom of a cyclical and structural shift in the way retail goods, particularly fashion, is bought and sold in Australia.

That Billabong had downgraded its earnings guidance should not have come as a surprise: it is not the first time it has done this. In 2009-10, it announced a series of downgrades then failed to even meet the lowered figure in its full-year result. In 2010-11, it announced downgrades in October and December, then again in March 2011. Billabong is not a stranger to downgrades.

But downgrades aren’t the only reason I have never bought shares in this company. On a number of measures it has failed to live up to the high standards I set for a candidate to enter and remain in an A1 portfolio. On some of those measures it may be argued that Billabong has a “challenging road” ahead – a euphemism for the possibility of a serious structural change, which may include a capital raising, asset sales and/or write-downs.

Retailing in Australia has been doing it tough and I have written previously about the perfect storm facing conventional bricks and mortar retailers in this country.

Another retailer, JB Hi-Fi (ASX: JBH, SQR A3, $12.50), had been 5% of the Montgomery [Private] Fund portfolio until we sold out at $15.50. Our reasoning was simple: given present circumstances (the strong dollar and strong outbound tourism, and the consumer shift to online buying) and expectations for retailing (having spoken to many retailers recently), many retailers would have to revise their earlier outlook statements and this would produce lower future valuations.

Notwithstanding today’s speculation that the announced sale of Dick Smiths by Woolworths (ASX: WOW, Skaffold Quality Score B2, $24.45) will trigger a bid by the grocer for JB Hi-Fi, analysts’ forecasts are typically optimistic in the first half of the financial year (this year being no exception to that rule) and we should therefore be demanding much larger discounts and JB Hi-Fi’s shares were not offering that margin of safety.

I have also noted before that the deflation story – as explained by Gerry Harvey, who says selling plasma TVs for $399 last year means he has to sell three times the volume as last year to make the same money – would put pressure on profits because people already had enough plasma TVs.

Finally, we also believe ANZ’s reported profit growth last year, being dominated as it was by bad debt provisioning writebacks, meant that credit growth was non-existent. When you take away growth in credit card purchases that’s got to hurt discretionary retailers.

Billabong cannot be immune. And a long-winded, multipage analysis of the issues plaguing this company is not required because we’ve never suggested it as an investment.

Billabong reported that its first-half EBITDA in constant currency terms would be $4 million higher, but the company is a global retailer and its reported EBITDA is expected to be 20.8% to 26% lower. The company added that strong growth in constant currency terms in 2012 “is not expected”.

Tellingly, the company also noted that a full strategic review is required and a capital raising cannot be ruled out. The reason for this is simple: in light of deteriorating trading conditions the company has bitten off more than it can chew. This is best seen in the cash flow statement.

In 2010-11 Billabong reported profits of $119 million but cash flow from operations of just $24 million. Subtract dividends of $78 million (why pay dividends if you don’t have the cash?) and capex and investments of $266 million and you have a deficit that needs to be plugged with an equity raising or debt.

Turning to the balance sheet, you will find goodwill amounts to about $1.3 billion. That’s $1.3 billion of “oops-I-paid-too-much” and is more than half of the assets of the company. There’s also borrowings of $600 million and, despite the boost, the company is currently forecast to earn a return on equity of just 7%.

Given my bank is offering 90-day term deposits at 5.95%, I wonder how Billabong’s auditors can justify the carrying value of the goodwill on the balance sheet.

So there are two pretty good reasons you haven’t seen Billabong mentioned as a company to conduct more research on this year – or any year, for that matter.

Investing in 2012 could be largely about avoiding losses. To do that, you will need to watch out for companies whose structures are weak, whose performance is undesirable or whose price is too high. Obviously any stock that harbours all three conditions does not require my comment here.

Billabong’s debt has been rising, its return on equity falling, its balance sheet weakening and as an A4 on Skaffold’s quality scale, it was not investment-grade.

Skaffold’s Quality Score History for Billabong

If you are thinking about investing in retail in the coming year, be sure you know what to look for, even if mouth-watering prices are being offered.Finally, for Skaffold member’s I hope you enjoy update 1.1 you will be receiving today, making Skaffold even more powerful and user friendly. If you are not a member of Skaffold, what are you waiting for? Skaffold is the best way we know of to deal with the market’s main risks;

Don’t miss an opportunity – every stock is covered and updated daily and automatically.

Reduce the risk of paying a high price for a stock – Skaffold’s intrinsic values ten years back and three years forward for every company.

Reduce the risk of buying the wrong company and suffering permanent capital loss – Skaffold’s Quality Scores, cash flow information and projected intrinisic values are updated in real time, keeping you abreast of vital changes to a company’s prospects as an investment candidate.

If you have been thinking about becoming a ‘Skaffolder’ there are few better times to get started than just before companies start releasing their important Half Year results. Skaffold’s intrinsic values are updated live and daily so as company’s prospects are upgraded (or downgraded!) during reporting season, you are likely to find a multitude of opportunities for investigation. Go to www.skaffold.com to get started just as reporting season takes off.

All the best for 2012.

Posted by Roger Montgomery, Value.able author and Fund Manager, 31 January 2012.

by Roger Montgomery Posted in Value.able.

- 10 Comments

- save this article

- POSTED IN Value.able

-

Peace and Joy to all this Christmas.

Roger Montgomery

December 20, 2011

Thank you for your support in 2011 and for all of your wonderful contributions to the knowledge bank.

Thank you for your support in 2011 and for all of your wonderful contributions to the knowledge bank.I am delighted to finish the year on a positive note with Cochlear (see post below) announcing it has identified the source of the malfunction of its Nucleas CI500 cochlear implant. This will also be positive news for many Cochlear implant recipients who put their quality of life in the company’s hands.

I have also published a recent column on the possibility of a convergence of Eurozone default, economic slowdown, a decline in consensus earnings estimates and a throwing in of the towel by investors who are fed up with low returns and heightened volatility (see below).

Hopefully that will stimulate some serious contemplation over the Christmas break.

Next year I am hoping to reconfigure the Insights Blog. My idea is to create and share the publishing role with any number of you who wish to write 300-600 word columns of an investment topic of your choice. I will remain editor and I am looking for twenty six (26) Graduates who can contribute two columns each in 2012. Of course if you wish to contribute more, be my guest.

We also intend to restructure the blog to allow easier searching and viewing of multiple threads. Stay tuned and if you would like to contribute send an email to me at roger@rogermontgomery.com with “CONTRIBUTOR” in the subject heading.

I am delighted that, in 2011, so many investors have found Value.able and Skaffold so useful. Many Graduates have said the Skaffold approach to investing is at once easy to understand and rational. And according to Daman’s feedback, Value.able!

“On Friday the 16th Dec, Bendigo announced a takeover of the Australian arm of a Greek bank at purchase price reflecting a return on equity around the same as a 12 month term deposit with Ubank. Alongside this was a $96M or so write down to its Margin Lending Business (due to the poor economic conditions). Today, its appears upon recommencing trading and Mr Market being nervous in general the share price of BEN has fallen over 6%.

Good news is that I sold my holdings in BEN on the 7th of December. Thanks to your teachings on the importance of ROE I was able to recognise that this business does not have superior performance characteristics, among several other factors. As a result I secured a somewhat reasonable profit of 14% on my holdings and a 2,740% ROB (return on [your] book).”

If you have not already secured your copy of Value.able or become a member of Skaffold and want to kick 2012 off the Skaffold way, go to www.Skaffold.com.

To the Value.able Graduates and Skaffold members (Skaffolders?), thank you for taking the time to share with me just how much you have been impacted by each. I am delighted to hear your amazing stories of investing success and I am pleased we can look forward to 2012 with enthusiasm.

I will return in late January. Our team will continue to publish your comments here at the blog, post new videos to my YouTube channel, reply to your emails and take your calls.

We leave 2011 with one of the world’s most successful billionaire hedge fund managers telling his clients; “Trust has been lost, confidence in the system is being lost, and the ultimate consequence of this break down – sovereign defaults – are imminent.”

In the meantime may your Christmas be filled with the love of family and friends. I look forward to corresponding with you again beginning February 2012. I will always be enthralled by Caravaggio’s work. The Adoration was painted in 1609.

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Skaffold, Value.able.

- 39 Comments

- save this article

- POSTED IN Skaffold, Value.able

-

Are investors giving up?

Roger Montgomery

December 20, 2011

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.

We have talked here at the blog about hypothecation, re-hypotecation and hyper-hypothecation, about credit default swaps about a Chinese property bubble bursting, about lower iron ore prices, slower economic growth, increased savings and declining rates of credit expansion and a European sovereign default. Always the value investor, we are on the look out for anything that can impact the values of companies and those things that might offer the prospect of picking up a few bargains.If your portfolio still has some rubbish in it, then being able to identify it is a key part of preparing for cheaper prices if they eventuate.

I recently wrote a column for the ASX and pondered the possibility of a climactic event coinciding with a complete throwing in of the towel by equity investors who are simply fed up with poor medium term returns and increased volatility recently.

The ASX200 hasn’t generated a positive capital return since 2005 but quality companies have. The ASX200 contains stocks that are rubbish so it is no wonder that an index based on that rubbish has gone nowhere. Step 1 then is to clean up the portfolio and step 2 is to be ready for quality bargains when they arise.

This is just one of many scenarios and frameworks I am operating with and I wonder what would transpire if the poor returns or the recent heightened volatility continues for a little longer? Will investors simply throw in the towel, leave equities and believe all those advisors offering their own brand of ‘safe’, ‘secure’ and stable investments? On the one hand, I hope so. It would mean certain bargains.

Here’s the Column:

As global sharemarkets decline, remain volatile and produce poor historical returns compared to other asset classes, it will be easy to be swayed by the latest investment trend – to move out of shares. I believe the trend away from shares will gather pace soon as more and more “experts” use the rear-view mirror to demonstrate why sharemarket investors would have been better off somewhere else.

In 1974 US investors had just endured the worst two-year market decline since the early 1930s, the economy entered its second recessionary year and inflation hit 11 per cent as a result of an oil embargo, which drove crude oil prices to record levels. Interest rates on mortgages were in double digits, unemployment was rising, consumer confidence did not exist and many forecasters were talking of a depression.

By August 1979, US magazine BusinessWeek ran a cover story entitled ‘The Death of Equities’ and its experts concluded shares were no longer a good long-term investment.

The article stated: “At least 7 million shareholders have defected from the stockmarket since 1970, leaving equities more than ever the province of giant institutional investors. And now the institutions have been given the go-ahead to shift more of their money from stocks – and bonds – into other investments.”

But be warned. The time to get interested in share investing and make good returns is precisely when everyone else isn’t.

Your own once or twice-in-a-lifetime opportunity may not be that far away and Labor’s promised tax cut on interest earnings may sway even more to give up shares and put their money in a bank, providing the opportunity to obtain even cheaper share prices.

If prices do fall further – and they could – you will need to be ready and will need some cash. The very best returns are made shortly after a capitulation. Cleaning up your portfolio becomes crucial and this article looks at how to do that.

Rule one: Don’t lose money

The key to slowly and successfully building wealth in the sharemarket is to avoid losing money permanently. Sure, good companies will see their shares swing but the poor companies see the downswings more frequently.

Therefore, the easiest way to avoid losing money is to avoid buying weak companies or expensive shares. One of the simplest ways I have avoided losing money this year in The Montgomery [Private] Fund has been to steer clear of low-quality businesses that have announced big writedowns.

These are easy to spot using Skaffold.

Not-so-goodwill

I have often seen companies make large and expensive acquisitions that are followed by writedowns a couple of years later. Writedowns are an admission by the company that they paid too much for an asset.

When Foster’s purchased the Southcorp wine business in 2005 for $3.1 billion, or $4.17 per share, my own valuation of Southcorp was less than a quarter of that amount. Then in 2008 Foster’s wrote down its investment by about $480 million, and then again by another $700 million in January 2009 and a final $1.3 billion in 2010.

When too much is paid for an acquisition, equity goes up but profits do not and you can see that too much was paid because that ratio I have worked so hard to make popular, return on equity (ROE), is low.

These low rates of return are often less than you can get in a bank account, and bank accounts have much lower risk. Over time, if the resultant low rates of return do not improve, it suggests the price the company paid for the acquisition was well and truly on the enthusiastic side and the business’s equity valuation should now be questioned. If return on equity does not improve meaningfully, a large writedown could be in the offing. This will result in losses if you are a shareholder, and you have also paid too much.

Just remember one of the equations I like to share:

Capital raised + acquisition + low rate of return on equity = writedown.When return on equity is very low it suggests the business’s assets are overvalued on the balance sheet. That, in turn, suggests the company has not amortised, written down or depreciated its assets fast enough, which in turn means the historical profits reported by the company could have been overstated.

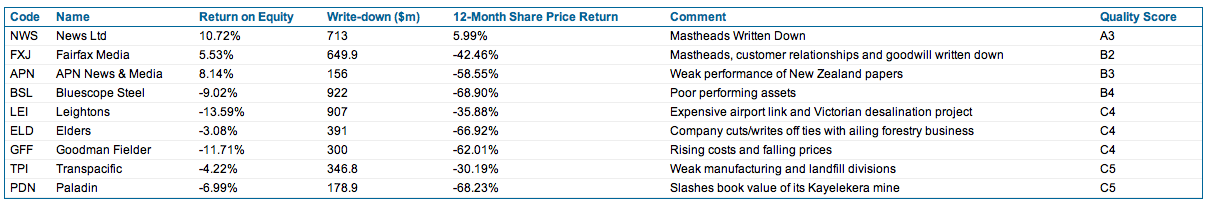

Scoring bad companies: B4, B5, C4 and below…

These sorts of companies tend to have very low-quality scores and often appear down at the poor end of the market – the left side of the screen shot in Figure 1 below.

Figure 1. The sharemarket in aerial view (Source; Skaffold.com)

Each sphere in Figure 1. represents a listed Australian company and there are more than 2000 of them. The diagram is taken from Skaffold. Their position on the screen can change daily as the price, intrinsic value and quality changes. The best quality companies and those with positive estimated margins of safety (the difference between the company’s intrinsic value and its share price) appear as spheres at the top right.

Companies that are poor quality (I call them B4, C4 and C5 companies, for example) are found on the left of the screen and if they have an estimated negative margin of safety, they are estimated to be expensive and will be located towards the bottom of the screen.

Highlighted with blue rings in Figure 1 are eight of the companies that announced this year’s biggest writedowns. Notice they tend to be at the lower left of the Australian sharemarket, according to my analysis.

If your portfolio contains shares that are red spheres and on the lower left, you could also be at risk because these companies tend to have low-quality ratings and are also possibly very expensive compared to their intrinsic value.

As is clear from Figure 1, this year’s biggest writedown culprits were all already located in the area to avoid.

The impact of owning such a business outright would be horrendous. Table 1 below reveals the size and details of these writedowns and as you can see, collectively the losses to shareholders amount to $4.6 billion.

Table 1. Predictable losses?

Warren Buffett once said that if you were not prepared to own the whole business for 10 years, you should not own a piece of it for 10 minutes.

Clearly you would not want to own businesses that pay too much for acquisitions and subsequently write down those assets. If you are not willing to own the whole business, don’t own the shares. Although in the short run the market is a voting machine and share prices can rise and fall based on popularity, in the long run the market is a weighing machine and share prices will reflect the performance of the business. Time is not the friend of a poor company, and companies Skaffold rates C4 or C5 are best avoided if you want the best chance of avoiding permanent losses.

Look at Figure 2 below. Those big writedown companies not only performed poorly but so did their shares. These companies (shown collectively as an index in the blue line below) produced bigger losses for investors than the poorly performing indices of which they are part. And that’s just over one year.

Figure 2. The biggest writedowns compared to the market

Take a look at the companies in your portfolio. Do they have large amounts of accounting goodwill on their balance sheet as a portion of their equity? Have they issued lots of shares to make acquisitions and are they producing low and single-digit returns on equity? If the answer to all these questions is yes, you may have a C5 company.

Cleaning up your portfolio not only lowers its risk but will produce cash that may just prove handy in coming months.

If you have made it this far then here’s evidence of the giving up I referred to in the column: http://www.smh.com.au/business/investors-turn-to-term-deposits-in-shift-away-from-equities-20111219-1p2ir.html

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, Skaffold, Value.able.

-

Cochlear update

Roger Montgomery

December 20, 2011

Aside from fears of reputational damage, one of the big concerns surrounding Cochlear’s recall earlier this year, was how long it would take to return to market. As you know we purchased shares after the announcement that it had recalled its Nucleus CI500 cochlear implant much to the chagrin of some investors who follow our musings here at the Insights blog.

In NSW every child receives a hearing test within two days of birth. Those identified as having profound hearing loss are often assisted by Cochlear. And thats just NSW. Cochlear sells its devices in 100 countries. Once implanted changing devices is not easy. Changing brands may be even harder. Audiologists and speech pathologists are involved and the devices are finetuned to ensure the device suits the individual.

As Matthew pointed out here on the blog a few days ago: “A family member [of Matthews’s] is a key member of a large Australian charity that does a lot of work with children that are deaf and many get the implants. All the equipment they use to “map” or finetune the device after implanting is specific to that company. For example the only brand they have is Cochlear. Recently they had a child from the US that they began to support that had a different brand implanted – they had to change many things to be able to help them. When thinking about market share with these devices I think it is important to know that the decision isn’t solely with the surgeon or specialist, because all of the support people have to change too. I don’t think market share will change quickly or by very much because of these barriers.”

Analysts at Macquarie recently surveyed 389 US-based Audiologists. Despite the product recall, Cochlear is still the world leader in CI devices and retains 60% market share selling into 100 countries. The broker also believes the market is growing at 12 per cent per year.

Many of you know we purchased shares in Cochlear after the September recall (see below), confident this was a temporary issue being treated as permanent by a perennially short-term-focused market.

That now appears to be the case as today’s announcement, posted on the ASX platform by the company reveals; 20122011_COH CI500 impant update

The company previously covered the subject in its AGM presentation here: http://www.cochlear.com/files/assets/corporate/pdf/agm_presentation_18102011.pdf

Analysts were subsequently concerned that 1500 units are going to have to be removed through surgery and another 2800 units have been pulled from shelves. They also worry that an inventory shortfall across the entire market will lead to market share losses from insufficient inventory as well as damage to reputation.

Today’s announcement reveals any small market share loss (we estimate five percent and some analysts suggest between five and ten per cent overall) will be now stemmed by the timely identification of the manufacturing issue that resulted in the failure of 1.9% of devices and their subsequent recall.

Cochlear has ramped up production and its early intervention has enhanced its reputation rather than damaged it as evidenced by several surveys with clinicians. In fact, 93% of doctors surveyed by Macquarie felt that Cochlear handled the recall well, while only 8% believe the company’s reputation has been tarnished.

Ultimately the company’s intrinsic value is determined by its profit and we expect there will be an impact on profit of some import. Cochlear has already created a provision of $130-$150 million and an after tax cash cost of $20 to $30 million. Given the news flow that will now transpire, one expects these costs may be treated by analysts as a ‘one-off’ and investors may have to wait for another temporary setback before being able to buy shares cheaply again…

For those of you interested in following our thoughts back in September 14 (COH $51.30), I wrote the following :

“Imagine spending years waiting patiently for the opportunity to buy that rare coin, vintage bottle of wine or celebrated painting, only to be outbid when it finally comes up for auction.

Sometime later the opportunity presents itself again and you are outbid once more, this time by much more. Successive auctions only take the price further out of your reach – if only you acted sooner!

Then one day you stumble across that very thing you desire being offered for sale by someone who appears to have no interest in its long-term value, for a price you regard as a fraction of its real worth.

Would you buy it?

That is the situation I find myself in today as the Cochlear share price plunges another 14% to $51.30, or about 40% since its April 2011 high of $85.

As Cochlear’s technicians work to isolate the problem with the Nucleus 5 range, the company will dust off the Nucleus Freedom range, which it has marketed successfully for many years against products such rivals as Advanced Bionics and Med-El.

Overnight one of those rivals received FDA approval to sell its product (which was itself recalled in November last year) into the US market. This turn of events is not unusual for the industry … but it is unusual for Cochlear and that’s why the news this week came as such a blow. Cochlear is one of the highest-quality companies trading on the ASX today. The company that almost never puts a foot wrong appears to have tripped itself up and investors are spooked.

The financial impacts of these events (and there will be an impact) have yet to be quantified so until they are why don’t we look at how the company has performed in the past and see if we can’t learn something about it in the interim.

Over the past decade, Cochlear has increased profits every year with the exception of 2004. Net profit was just $40 million in 2002 and last week the company reported profits of $180 million for 2011.

Operating cash flow over the same period has risen from less than a $1 million (an exception for 2002) to more than $201 million, allowing debt to decline to just $63 million from nearly $200 million in 2009. Net gearing is now minus 1.86%.

Those impressive economics have resulted in an intrinsic value that has risen by nearly 18% each year since 2004. If your job as a long-term investor is to find companies with bright prospects for intrinsic value appreciation – believing that in the long run prices follow values – then it quite possible that Cochlear is being served up on a plate.

The recently reported net profit figure of $180.1 million for 2011 was up 16% and in line with consensus analyst estimates, although this occurred despite sales of $809.6 million exceeding analysts’ estimates. It seems the analysts did not expect the EBIT and NPAT margins that were reported. These were flat, which given a very strong Australian dollar, suggests impressive efficiency gains in the operations.

If only that blasted “Australian peso” would go down and stay down!

Back on August 19, 2009, I wrote: “Fully franked dividends have risen every year for the past decade, growing by almost 500% (or 22% pa) since 2000. These are not numbers to be sneezed at; the company has produced an impressive and stable return on equity since 2004 of about 47% with very modest debt. Clearly this is a company worth some significant premium to its equity.”

Nothing changed really for 2011. A final dividend of $1.20 per share was 70% franked and up 14%.

Importantly, it seems Cochlear’s market is growing. Unit sales volumes were up 17% for the year and, given in the first half they were up 20%, it suggests the second half were up 14%. Double digit growth was reported in sales volumes for all major regions and Asia was the most impressive, rising more than 30% to the point where it makes up 16% of total revenues.

This really is impressive stuff. Just two years ago the company reported unit sales growth of only 2%, to 18,553 units, and many analysts were blaming slow China sales. Nobody expected the company to ever repeat its 2007 and 2008 volume growth of 24% and 14% respectively, and certainly not off a higher base.

Growth has always been viewed as is limited by the high cost of the devices and the reliance on insurance and healthcare schemes to subsidise the costs and those of surgery to implant to them.

According to the World Health Organization however, almost 280 million people suffer from moderate to profound hearing loss and an ageing population means this figure will rise. Cochlear is one of a handful of companies that actively contributes to improving the quality of life of its clients.

When great companies stumble, the impact can be exaggerated by the reaction of shareholders who never believed it could happen. Then comes a wave of selling amid doubts that the company will ever regain its mantle.

But strong market share and strong cash flow, high returns on equity and low debt, are rarely offered at bargain prices so I picked up some Cochlear stock yesterday for the Montgomery [Private] Fund. It is likely that I will to add to this position over the coming days and weeks when the full financial impact of the recall is known.

I must confess I didn’t bet the farm on this particular investment because the financial impact of the recall – and there will be one – remains unclear; when that changes it will impact my intrinsic value estimate (UBS has revised its forecast net profit for 2012 by 10.5% to $179.5 million).

Whatever the impact, it will be temporary, even though it won’t necessarily preclude lower prices from this point. During the GFC, Cochlear shares fell from $78 to $44. No company is immune to lower share prices and I don’t know when or in what order they will transpire.

What I do know is that in 2021 we aren’t likely to be thinking about this recall, just as nobody now talks about the Wembley Stadium delays that dogged Multiplex back in 2006. Mercifully, investors’ memories tend to be short.

Recalls, competition, marketing gaffes and wayward salary packages are all part of the cut and thrust of business and if lower prices ensue for Cochlear shares, it will be important to determine whether the recall will inflict permanent scars. My guess is that it will not.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Companies, Health Care, Investing Education, Value.able.