Property

-

WHITEPAPERS

Can anyone beat Realestate.com.au at their own game?

Roger Montgomery

April 5, 2013

Enjoy the next in our 2013 exclusive subscriber-only Whitepaper series.

by Roger Montgomery Posted in Property, Whitepapers.

- 16 Comments

- save this article

- POSTED IN Property, Whitepapers

-

Chinese bubble on the brink…..

Roger Montgomery

March 13, 2013

Question to the world’s biggest property developer: Is there a bubble [In China]?

Answer: Yes of course.

Watch this video broadcast by CBS last week.

Watch here.

by Roger Montgomery Posted in Insightful Insights, Property.

- 2 Comments

- save this article

- POSTED IN Insightful Insights, Property

-

MEDIA

GWA Group – not all beer and skittles

Roger Montgomery

February 27, 2013

In his Short Cut column for the Herald Sun published 27 February, Roger highlights how the buoyant share price of GWA Group is not supported by the company’s recent performance. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Property.

- save this article

- POSTED IN In the Press, Insightful Insights, Property

-

Gen Y will be buying cheaper houses soon

Roger Montgomery

September 4, 2012

Ben Hurley – the AFR journo typical of Gen Y – will soon be buying a house cheap from boomers who have no-one else to sell to.

Last week Ben (here) wrote:

“I would love to own a home. I could upgrade my crappy electric stove, get a hot water system that actually fills the bathtub, and stop asking the landlord for permission to put a nail in the wall.

But I’m reluctant because I think buying a home is a dud deal. And renting, while expensive, is less of a dud deal because renters typically give the landlord a return of about 3 per cent on the asset’s value. A lot of my friends in their early 30s feel the same way.”Ben goes on to explain why renting makes more sense than buying and I reckon he’s right, but for an entirely different reason.

by Roger Montgomery Posted in Market commentary, Property.

- 11 Comments

- save this article

- POSTED IN Market commentary, Property

-

Steve Keen has his supporters…..

Roger Montgomery

July 31, 2012

In late 2008 Steve Keen, Associate Professor of Economics and Finance at the University of Western Sydney had a bet with Rory Robertson, who at the time was Interest Rate Strategist at Macquarie Bank. The bet was Australian housing prices would decline by 40% in two years, and the loser would walk 200km from Canberra to Mt Kosciuszko. Despite losing the bet, Steve Keen still has his supporters. Last week, Dean Baker the co-founder of US based the Centre for Economic and and Policy Research said the housing bubbles of the United Kingdom, Canada and Australia, are larger, relative to the size of their economies, than the one that collapsed and wrecked the US economy. In each county, there has been a sharp increase in the sale price of homes that has not been matched by a corresponding increase in rents. In Australia’s case, Baker claims house prices rose by more than 80 per cent between 2001 and 2009, a period when rents rose by roughly 30%. Baker argues the price of the median house in Australia is 225 per cent of the median house in the US. Given that wages in the US are higher it is difficult to see how this huge gap in house prices can make sense, said Baker.

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

US Housing Starts – About to Mean Revert?

Roger Montgomery

July 27, 2012

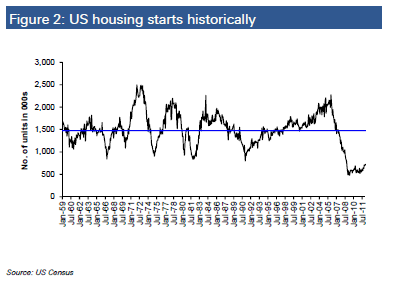

Over the past fifty years, US housing starts have averaged 1.5m per annum. Currently, starts are less than half the long term average.

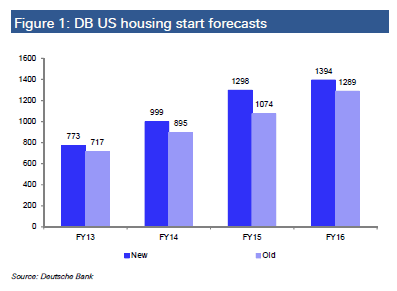

In recent months there have been some tentative signs of recovery from this record low base. According to the Economist, America’s houses on average “are now among the world’s most undervalued: 19% below fair value, according to our house-price index”.While Deutsche Bank have cut their 2013 and 2014 housing start expectations in Australia to 128,000 and 144,000, respectively,they are looking for a jump in US housing starts to 1.0m by 2014 and 1.4m by 2016, as follows.

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

Sinking like a brick? Are house prices really going to crash?

Roger Montgomery

April 20, 2012

One of the companies that is bound to suffer amid the western world’s slump in house prices, home starts and weak credit growth is Boral.

One of the companies that is bound to suffer amid the western world’s slump in house prices, home starts and weak credit growth is Boral.Today, Boral (BLD) cut their full year profit guidance by $22m after weak house activity and heavy rain in NSW and QLD have impacted their operations. BLD had forecast profit to be $150m-$175m and now expect $128m-$153m. Boral’s Mark Selway noted that Australia’s residential building sector is “aweful” and the construction and building materials company blamed continued wet weather and slow housing starts for cutting its profit forecast by the $22 million noted. In an interview with Dow Jones today Selways said; “The residential housing market looks tough and, by the way, I think it’s going to get a whole lot tougher,” and 2013 was likely to be “the tough year”.

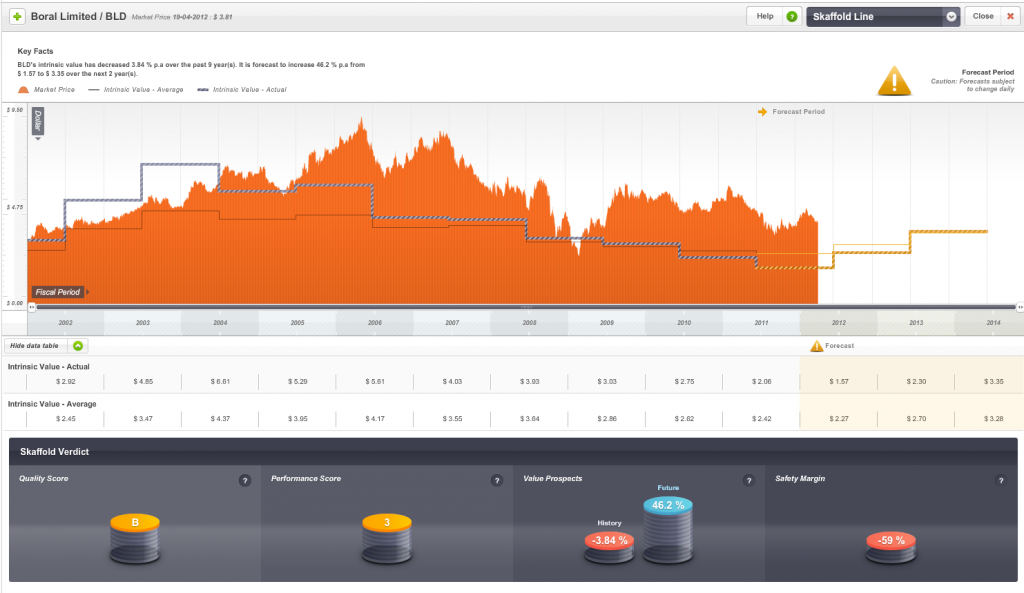

Below: Skaffold.com estimated Intrinsic Value for Boral.

The consensus analysts estimates that produce Skaffold’s current intrinsic value estimate will now decline further as will the estimate of value itself. Since 2003 Boral’s estimated intrinsic value has been in decline as can be seen in the Skaffold Line Evaluate Screen. You should also note the hockey stick – like increase from analysts earnings optimism.

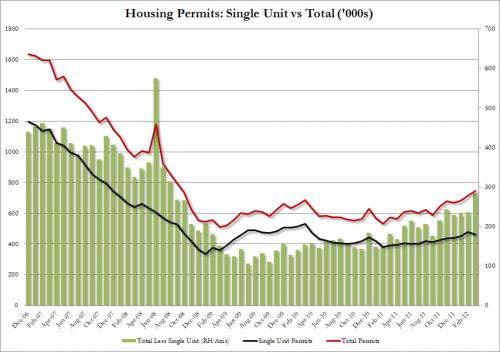

Over in the US the situation isn’t much better. After Warren Buffett noted his 2010/11 prediction of a bottom in housing “was dead wrong” one analyst said “March, housing starts, expected to print at 705K (which is crawling along the bottom as is, so it is all mostly noise anyway, but the algos care), came at a disappointing 654K, the lowest since October 2011, and a third consecutive decline since January. Want proof that the record warm Q1 pulled demand forward? This is it. As the chart below shows, the all important single-unit housing starts have not budged at all since June 2009. So was there any good news in today’s data? Well, housing permits, which means not even $1 dollar has been invested in actually ‘building’ a home soared to 747K, from 715K in February, and well above expectations of 710K – the highest since September 2008. That a permit is largley meaningless if unaccompanied by a start, not to mention an actual completion goes without saying.”

Total starts versus unit starts.

Apparently Harry S. Dent the author of various predictions of impending doom (and someone who’s rpredictions have been wrong as frequently as they have been right, is on Australia and said that we have a real estate bubble that is set to burst. He thinks there’ll be another worldwide economic downturn in 2012, and this will cause Australian real estate values to fall back to where they were 10 years ago.

“People in places like Sydney or Tokyo or Miami say, ‘Hey, real estate can never go down here, we’re a great place, everyone wants to move here, there’s not much land for development’, and what I say is that is exactly the kind of place that bubbles.” “Outside Hong Kong and Shanghai, Australia is the most expensive real estate market in the world compared to income.”

Thanks Harry! My own definition of a bubble is a debt fuelled asset purchasing binge where the income from the asset cannot pay for the interest on the debt that is funding it. Actually…that does sounds a whole lot like negative gearing????

Of course, some observers reckon the empty houses in Brisbane as sellers wait for prices to improve is a sign that the market is already crashing. Others suggest for a crash to happen home owners have to be willing to sell their property at that lower price. A lot of home owners are removing their property from the market if they can’t get the price they want. Whether the lower price gets a print or not however is not relevant. If my neighbour cannot sell his house for the price he wants, then the market price must be lower. We don’t need a transaction to occur to confirm it.

Gone are the days when the dream was to have one nice house with a Clark Pool, a BBQ and a new Holden in the carport. Now everyone wants to be a millionaire DIY developer and fixer-upper with his and hers BMW X5s. That simple progression leads to more volatility in the prices of assets those investors pursue. So what’s the impact on QBE and the banks now that Genworth have pulled their float? Would love to hear your thoughts, insights and observations. What are property prices doing in your area?

Posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 20 April 2012.

by Roger Montgomery Posted in Property.

- 124 Comments

- save this article

- POSTED IN Property

-

MEDIA

Why is the Value of a Property not necessarily what someone is prepared to pay?

Roger Montgomery

April 1, 2012

In the April 2012 issue of BrokerNews.com.au‘s EMag, Greg Campbell of ARAP discusses property valuation issues, and how Roger Montgomery’s Value.able approach to assessing asset values highlights that what someone is prepared to pay can bear very little relation to the true worth of an asset. Read here.

by Roger Montgomery Posted in In the Press, Investing Education, Property.

- save this article

- POSTED IN In the Press, Investing Education, Property

-

Is the bubble bursting?

Roger Montgomery

December 8, 2011

In 2010 here at the Insights Blog I wrote:

In 2010 here at the Insights Blog I wrote:“a bubble guaranteed to burst is debt fuelled asset inflation; buyers debt fund most or all of the purchase price of an asset whose cash flows are unable to support the interest and debt obligations. Equity speculation alone is different to a bubble that an investor can short sell with high confidence of making money.

The bubbles to short are those where monthly repayments have to be made. While this is NOT the case in the acquisitions and sales being made in the coal space right now, it IS the case in the macroeconomic environment that is the justification for the purchases in the coal space.

China.

If you are not already aware, China runs its economy a little differently to us. They set themselves a GDP target – say 8% or 9%, and then they determine to reach it and as proved last week, exceed it. They do it with a range of incentives and central or command planning of infrastructure spending.

Fixed asset investment (infrastructure) amounts to more than 55% of GDP in China and is projected to hit 60%. Compare this to the spending in developed economies, which typically amounts to circa 15%. The money is going into roads, shopping malls and even entire towns. Check out the city of Ordos in Mongolia – an entire town or suburb has been constructed, fully complete down to the last detail. But it’s empty. Not a single person lives there. And this is not an isolated example. Skyscrapers and shopping malls lie idle and roads have been built for journeys that nobody takes.

The ‘world’s economic growth engine’ has been putting our resources into projects for which a rational economic argument cannot be made.

Historically, one is able to observe two phases of growth in a country’s development. The first phase is the early growth and command economies such as China have been very good at this – arguably better than western economies, simply because they are able to marshal resources perhaps using techniques that democracies are loath to employ. China’s employment of capital, its education and migration policies reflect this early phase growth. This early phase of growth is characterised by expansion of inputs. The next stage however only occurs when people start to work smarter and innovate, becoming more productive. Think Germany or Japan. This is growth fuelled by outputs and China has not yet reached this stage.

China’s economic growth is thus based on the expansion of inputs rather than the growth of outputs, and as Paul Krugman wrote in his 1994 essay ‘The Myth of Asia’s Miracle’, such growth is subject to diminishing returns.

So how sustainable is it? The short answer; it is not.

Overlay the input-driven economic growth of China with a debt-fuelled property mania, and you have sown the seeds of a correction in the resource stocks of the West that the earnings per share projections of resource analysts simply cannot factor in.

In the last year and a half, property speculation has reached epic proportions in China and much like Australia in the early part of this decade, the most popular shows on TV are related to property investing and speculation. I was told that a program about the hardships the property bubble has provoked was the single most popular, but has been pulled.

Middle and upper middle class people are buying two, three and four apartments at a time. And unlike Australia, these investments are not tenanted. The culture in China is to keep them new. I saw this first hand when I traveled to China a while back. Row upon row of apartment block. Empty. Zero return and purchased on nothing other than the hope that prices will continue to climb.

It was John Kenneth Galbraith who, in his book The Great Crash, wrote that it is when all aspects of asset ownership such as income, future value and enjoyment of its use are thrown out the window and replaced with the base expectation that prices will rise next week and next month, as they did last week and last month, that the final stage of a bubble is reached.

On top of that, there is, as I have written previously, 30 billion square feet of commercial real estate under debt-funded construction, on top of what already exists. To put that into perspective, that’s 23 square feet of office space for every man, woman and child in China. Commercial vacancy rates are already at 20% and there’s another 30 billion square feet to be supplied! Additionally, 2009 has already seen rents fall 26% in Shanghai and 22% in Beijing.

Everywhere you turn, China’s miracle is based on investing in assets that cannot be justified on economic grounds. As James Chanos referred to the situation; ‘zombie towns and zombie buildings’. Backing it all – the six largest banks increased their loan book by 50% in 2009. ‘Zombie banks’.

Conventional wisdom amongst my peers in funds management and the analyst fraternity is that China’s foreign currency reserves are an indication of how rich it is and will smooth over any short term hiccups. This confidence is also fuelled by economic hubris eminating from China as the western world stumbles. But pride does indeed always come before a fall. Conventional wisdom also says that China’s problems and bubbles are limited to real estate, not the wider economy. It seems the flat earth society is alive and well! As I observed in Malaysia in 1996, Japan almost a decade before that, Dubai and Florida more recently, never have the problems been contained to one sector. Drop a pebble in a pond and its ripples eventually impact the entire pond.

The problem is that China’s banking system is subject to growing bad and doubtful debts as returns diminish from investments made at increasing prices in assets that produce no income. These bad debts may overwhelm the foreign currency reserves China now has.”

I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to bigs drops in margins for a sizeable portion of the market index…

Watch this video and decide for yourself.

Posted by Roger Montgomery, Value.able author and Fund Manager, 8 December 2011.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Market Valuation, Property, Value.able.

-

Is there any value in Property Trusts?

Roger Montgomery

April 9, 2010

The other day, Andrew Robertson interviewed me for ABC’s Lateline Business Program about property trusts (you can find the transcript in the Media Room, On TV). I thought you might benefit from an expanded précis.

The other day, Andrew Robertson interviewed me for ABC’s Lateline Business Program about property trusts (you can find the transcript in the Media Room, On TV). I thought you might benefit from an expanded précis.For a very long time, property trusts were described rather derisorily as the investments of widows and orphans – boring, uneventful and staid. Then with the advent of a name change to REITS (Real Estate Investment Trusts), cheap credit and a healthy dose of me-too-ism, property trust managers trotted down the path that took them to near extinction.

Managers of today’s REITS are falling over themselves to once again describe themselves as staid boring old property trusts. But don’t be fooled, while a decade of stable returns and the life savings of so many are gone, many of the managers responsible are not.

With some basic arithmetic, let me explain what has occurred. Company A has $10 of Equity per Share that is returning 7% to 11% year-in and year-out. Somewhere between 2005 and 2006, like a kid at a toy shop screaming “I want one too”, the managers of property trusts started expanding in a debt-fuelled binge to get bigger.

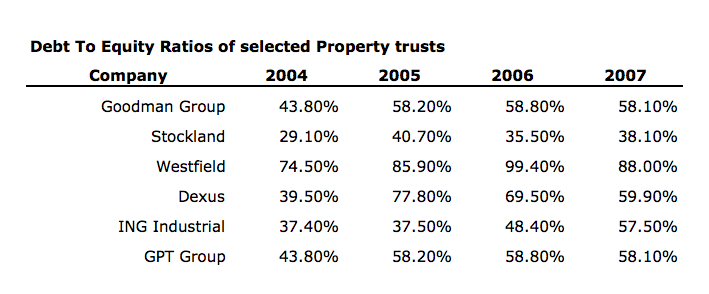

Arguably led by Westfield a year earlier in 2004, and as one might expect, the increased debt produced rising Returns on Equity. But it didn’t last.

The party’s last song may have been August 29, 2007. That’s when Westfield was leading again. It sold a half share of Doncaster Shoppingtown for $738 million to one of the world’s largest property managers, LaSalle, on a yield of 4.7% – a record low. Westfield also sold half of its Westfield Parramatta centre for $717 million at a time when Centro, for example, was still loading up on debt. It sold another $1.3 billion in property-linked notes, launched a UK wholesale fund into which it sold $1.3 billion of its inventory, and sold more than A$750 million of US assets. And while it was selling assets, it was raising $3 billion of capital through a rights issue ostensibly to acquire more assets.

Unfortunately for many investors, the managers of other property concerns thought they were smarter than the Lowys. Have a look at the debt to equity ratios in 2007 and compare them to the corresponding ratios in 2004. And the US was reported to be heading into recession.

While it would be some time before the revelers turned into pumpkins and mice, the band had packed up and gone home.

If you want to set your kids on the road to financial success, tell them this: “If you can’t afford to buy it with cash, you don’t deserve to have it.” Its harsh, but I grew up on that advice. There were a few lay-buys for Christmas, but there wasn’t a single card in my Mother’s glomesh purse.

The lesson however was lost on the property trust managers, and it wasn’t their money anyway!

Eventually everything did turn to pumpkins and mice, and what happened next saved the entities and protected many of the executive jobs but arguably did far fewer favours for the unit holders.

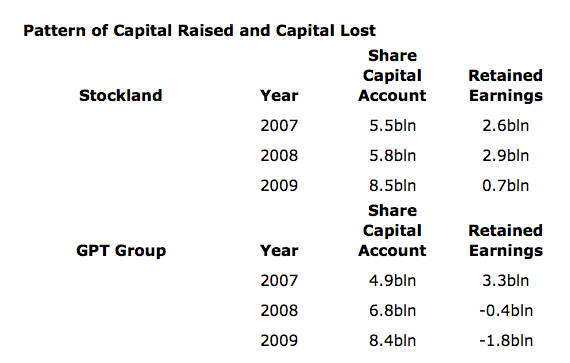

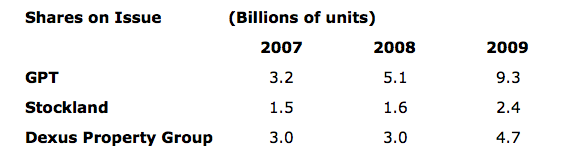

In 2008 Company A writes down its properties, triggering loan covenants and LVR limits. Debt to equity ratio explodes. Bank tells Company A to sort it out. Company A’s share price falls to meaningless price and far below even the written down NTA. Company A conducts a capital raising anyway and issues hundreds of millions of new shares at a discount to the price and in complete annihilation of the equity per share, as the following tables demonstrate.

The result of all this activity, quite apart from the corporate finance fees it generated, was a dilution of Equity per unit, Earnings per unit and Return on Equity.

GPT’s, ING’s and Goodman’s Returns on Equity are expected to average 5 per cent or less for the next two years – that’s less than a bank account. Stockland and Dexus are expected to average 7 or 8 per cent – a little better, but nothing to write home about.

And finally, you can’t dilute Equity per Share, Earnings per Share and Returns on Equity without a reduction in the intrinsic values of these entities, and that’s precisely what has happened.

Stockland’s intrinsic value has fallen from $4.00 in 2008 to $2.16 today. Westfield from $8.25 to $6.71, Dexus from $2.74 in 2007 to 15 cents today and GPT, from $4.10 in 2007 to 30 cents today. Those intrinsic values aren’t going anywhere in a hurry either, unless Returns on Equity can rise significantly, but with debt now substantially lower that appears less likely.

Posted by Roger Montgomery, 9 April 2010.

by Roger Montgomery Posted in Companies, Property.

- 20 Comments

- save this article

- POSTED IN Companies, Property