Insightful Insights

-

Thank you and Happy Christmas

Roger Montgomery

December 23, 2010

I am delighted that, in 2010, so many investors have found Value.able useful. Many Graduates have said the Value.able approach to investing is at once easy to understand and rational. And according to John, Scott, Brian, Peter, Andy, Martin and Steve’s feedback, Value.able!

Merry Christmas Roger! And a big thankyou for writing your book.

It never ceases to amaze me just how few professional investors actually stick to a winning investment formula. I recently reviewed the portfolio holdings of many well known Australian Equity managed funds available through a major online broker and could not find one “leading” fund manager that only invested in stocks that would come anywhere near to passing the MQR (Montgomery Quality Rating) test. Virtually all major funds hold stocks that are low ROE, highly capital intensive and debt laden. Unfortunately, I was not surprised to see that many of these funds holding large positions in non-investment grade stocks proudly highlight their 5 star ratings from asset consultants.

Have a well-earned break and may 2011 be an in-value.able year for you and yours,

Warmest regards,

JohnMerry Christmas everybody! And to you Mr Montgomery, a massive thank you.

Thanks to your wonderful book, and your insightful and thought provoking articles, posts and appearances. My SMSF has had the best year ever (that’s with 10 years of history).

In a lack lustre sideways market I was able to pinpoint and cut out the dead wood from previous poor decisions, and focus on quality businesses trading at a big discount to IV.

The difference in fund performance is simply startling.

Again thank you, I hope to be able to shake your hand again in 2011.

All the best

Scott THi Adam & Roger, … I’m pleased I’m getting the hang of these valuations. I’ve bought a few other A1’s also, MCE, SWL (A3) & FGE on my research following your valuation criteria Roger, as well as JBH. I’m getting rid of some rubbish (AMP,BFG,VMG,BYL) & feel confident I’m replacing them with quality shares. Thanks so much for sharing Roger, my retirement looks a little more hopeful now following the devastation of the GFC.

Brian

Hi Roger, Thanks for writing the book and your diligence in keeping the blog up to date. You’ve made a massive contribution to my awareness and knowledge. The book has already been paid for hundreds of times over.

Cheers, Peter

Roger, Thanks for all the great insights over the last year. I really had no idea how blindly I had been investing prior to reading your book and this blog. I’m still learning but at least I know what I should be looking at now.

Thanks again

Andy

Hi Roger, Just wanted to thankyou for sharing your knowledge and insights with everyone, your book was amazing to say the least!!! I’ve made a return of close to 20% in less than 6 months and your Value.able book has paid itself off by more than 200 times!!! Now that is what I call ROE. I would like to wish you and your family a Merry Christmas and a happy new year. Thank you so much for an extremely valuable year, congrats and best wishes.

Regards,

Martin

Hi Roger, I see many comments on the blog congratulating you on your book, but they don’t actually say why it is great. So I have done a book review.

Regards,

Sapporo Steve

If you have not already secured your copy of Value.able and want to kick 2011 off the Value.able way, go to www.RogerMontgomery.com. The First Edition sold out in just 14 weeks and with so many private and professional investors now buying multiple copies for friends and family, the Second Edition is set to sell out just as quickly. Don’t waste another minute!To the Value.able Graduates, thank you for taking the time to share with me just how much you have been impacted by my book. I am delighted to hear your amazing stories of investing success and I am pleased we can sign off 2010 with such an extraordinary investment track record.

I wish you all a safe, peaceful and Happy Christmas and my sincere best wishes for 2011. I have always been enthralled by Caravaggio’s work. The Adoration was painted in 1609.

My office will close today and reopen on Monday 10 January. I will return in late January. My team will continue to publish your comments here at the blog, post new videos to my YouTube channel and reply to your emails. Most importantly, my website will continue to accept your Value.able orders and my distribution house is working through the holiday season.

Posted by Roger Montgomery, 23 December 2010

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

Have you done your homework?

Roger Montgomery

December 22, 2010

As my last official day at the office draws near, I am delighted with the results we have achieved from combining my approach to quality (The Montgomery Quality Ratings “MQRs”) with Value.able‘s method of calculating intrinsic value. There will always be conjecture and disagreement with these, but that doesn’t matter to me and it shouldn’t bother you either. The market is wide enough and deep enough to cater for us all.

As my last official day at the office draws near, I am delighted with the results we have achieved from combining my approach to quality (The Montgomery Quality Ratings “MQRs”) with Value.able‘s method of calculating intrinsic value. There will always be conjecture and disagreement with these, but that doesn’t matter to me and it shouldn’t bother you either. The market is wide enough and deep enough to cater for us all.I am very proud of how far you – the Value.able Graduate Class of 2010 – have come and encourage you to continue questioning and challenging the things you read and learn. It was Elbert Hubbard who said “The recipe for perpetual ignorance is: Be satisfied with your opinion and content with your knowledge.”

Some of the most memorable results of 2010 for me where the gains in Matrix, Decmil and Forge, as well as the gains in Acrux, Thorn, Fleetwood, MMS, Data#3, and Oroton. I was also delighted to have left QR National alone – missing out on an 11.8% return, but selecting MACA instead, which has produced a 70 per cent return.

Elsewhere, fund managers have reported good results. But as one Graduate noted via email, when some portfolios, filled with debt-laden, low ROE businesses, rise, it is generally a function of a rising tide rather than sound investing principles. Of course when investing the Value.able way, it matters not what anyone else is doing. All that matters is that your analysis is right and that you are consistent.

There have been plenty of questions about the Value.able valuation formula this year and perhaps even a little obsession over the source of, reason for and disagreement with the formula/tables. If that resonates with you, I urge you to re-read pages 193 and 194 and consider the following parallel; In the sport of mountain biking, some riders obsess with the weight of their bicycles. Many shop around for a ceramic or titanium rear derailleur pulley so that they might save as few as 5 grams! Paying thousands for their obsession, they fail to realise that the weight of their fettucini carbonara the night before, the water bottle they carry with them and the mud that sticks to their tyres is far greater than the savings they make and that strength, fitness, endurance and momentum are all far more important. Don’t become too obsessed by the math when its the competitive advantage that is more important and, in any case, value slaps you in the face when it is obvious.

There are very good reasons why my valuations have differed from those you have produced, and I explain a major source of the difference on pages 193 and 194.

Far more important is that you are now carrying out your own analysis and focusing your attention on high quality companies, sustainable competitive advantages and intrinsic value. I believe you will continue to do well – as so many of you have shared with our community – if you stick to the disciplines outlined in Value.able. And if you haven’t purchased your copy yet, do it now!

Before I leave for the annual Montgomery family holiday, I promised to give you some homework. There are three tasks with a total of two challenges. You can choose those you’d like to complete. You are under no pressure to complete them all. It is the holidays after all!

Challenge 1, Task 1

The first task is to print out the Notes to the Financial Statements: Contributed Equity for the number of shares on issue, Balance Sheet, Profit and Loss statement and Statement of Changes in Equity for The Reject Shop for 2010. Links to the statements are below:

Notes to the Financial Reports: Contributed Equity for the Number of Shares on Issue – click here

Balance Sheet – click here

Profit and Loss – click here

Statement of Change in Equity (Dividends) – click here

Using the numbers circled on each of the statements and a Required Return of 11%, try your hand at calculating The Reject Shop’s 2010 Value.able Intrinsic Value. Follow Steps A through D on page 195 of Value.able. Be sure to list your outputs for Equity per Share, Return on Equity and Payout Ratio. Click here to download my Value.able Valuation Worksheet. Ken has also provided a great list of guidelines – click here.

Challenge 1, Task 2

If you want to obtain extra marks you can have a go at also calculating the 2010 cash flow for The Reject Shop using the method I outline in Value.able on page 152.

If you haven’t purchased Value.able, don’t worry. My website will continue to accept your orders and my distribution house is working through the holiday season.

Challenge 1, Task 3

The final task involves completing one or both challenges on the Christmas Holiday Spreadsheet. The first challenge is for Value.able Undergrads. Use the worksheet to fill out the spreadsheet, then rank the companies by their Safety Margin. The spreadsheet will download automatically to your computer. When I return in late January I will publish my table and we can compare results.

Challenge 2

The second challenge is for the Value.able Graduate Class of 2010 (and any Undergrads that fancy a challenge). Your task is to calculate the historical change in intrinsic value and price over the last ten years.

Don’t worry. You don’t have to calculate ten intrinsic values, just two. Estimate the intrinsic value a decade ago (2001) and compare it to the 2011 intrinsic value. To make things a little less onerous, maintain the same RR for a company for the two years. You can then rank the five companies by their rate of change and you can use the following formula in excel if you like:

((IVn/IVn-10)^(1/10))-1

Where, IVn is Intrinsic value for 2011 and IVn-10 is Intrinsic Value for 2001 and ^(1/10) is ‘to the power of 1/10’.

I expect it will take a few weeks for you to get all the your submissions and I will consider some form of recognition for the winners. In the meantime enjoy a peaceful and Value.able Christmas and all the very best to you and your loved ones.

Posted by Roger Montgomery, 22 December 2010

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Merry Christmas from the Value.able Graduate class of 2010

Roger Montgomery

December 21, 2010

It is my great pleasure to present a very special tribute (thank you to my team) for the Value.able Graduate Class of 2010.

Thank you Jesse, Michael (Bali), Young Les, Michael (Aussie Battler), Matthew, Justin, Lior, John, Rad, Gary in Paris, George, Dan’s Mum, Steven & Sophie, the Master Chefs, John and Paul for sharing your Value.able journey with our community. And a second thank you to Steven for posting his Value.able 12 Days of Christmas at Facebook!

Thank you for your support this year. We have created an incredibly valuable community of investors that share sound ideas and mentor those just beginning their value investing journey.

Thanks to you – the Value.able community – 2010 year has been a year of firsts…

The First Edition of Value.able was released, went global and sold out in just 14 weeks.

- – Montgomery Quality Ratings (MQR) are appearing in conversations all over the world.

– My value investing YouTube channel hit #2 Most Viewed in Australia.

– In aggregate, the companies I listed at my Insights blog, which met all the Value.able criteria, outperformed the market by a satisfactory margin.

Most excitingly, Value.able Graduates have applied their new skills and produced over 6,000 extraordinarily insightful comments here at the blog!

And one more thing… for those who have requested holiday homework, my soon-to-be-released blog post will most certainly provide a challenge.

Thank you once again for joining the Value.able community. I wish you and your family a safe and peaceful Christmas and a prosperous 2011.

Posted by Roger Montgomery, 21 December 2010

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

What are your Twelve Stocks of Christmas?

Roger Montgomery

December 9, 2010

I have an assignment for you.

Before we start, two things…

1. If you are looking for a gift that keeps on giving in 2011, give your loved ones a copy of Value.able. To guarantee your gift makes it into Santa’s sleigh, you must order before 5pm next Monday, 13 December.

2. Put Thursday 16 December @ 7pm in your diary. Sky Business has invited me to appear on their Summer Money program.

Within Summer Money, Sky is running a series called The Twelve Stocks of Christmas and I have been asked to present one of the twelve stocks. What I would like to do is let everyone on Sky Business know about you – the Value.able Graduate class of 2010!

You have been instrumental in contributing to the knowledge and awareness of value investing and I would like to say thank you by reviewing your suggestions on air.

So, what will it be? You can nominate one of the companies we have already discussed. More points can be earned by contributing a company of which you have industry-level knowledge. Think about your industry or business:

– Who is the strongest [listed] competitor in your industry?

– Who would you like to see out of business because they are an emerging threat?

– What are their competitive advantages, their opportunities for growth and why do you think they will sell more of their product or services in the future or at higher prices?

– Perhaps they are out of favour in the share market, but you believe it’s a case of a temporary set back being treated like a permanent impairment?

I encourage you all to post your contribution. There are just two rules:

1. One stock (your best pick) per Value.able Graduate. The more detailed your information, the better; and

2. Ideas must be submitted by Wednesday 15 December

Before the live show at 7pm next Thursday, 16 December, I will run my valuation eye over every suggestion and give each my Montgomery Quality Rating (MQR). But the list will be yours – a contribution from the Value.able Class of 2010.

Whilst only one stock will make it to the show, EVERY SINGLE STOCK contributed on this post with sufficient supporting detail will be subsequently listed in my final pre-Christmas post for 2010, complete with MQRs, current valuations and prospective valuations (I have decided to called these MVEs – see below).

Embrace this opportunity to practice what you have learned over the past twelve months, and get the official Montgomery Quality Rating (MQR) and Montgomery Value Estimate (MVE) for your favourite stock. You never know, your stock may just be the one I contribute on national television to The Twelve Stocks of Christmas.

Post your suggestion here at the blog by Wednesday 15 December 2010.

I look forward to reviewing your insights and hearing what you think of your classmates’ suggestions. Simply click the Leave a Comment button below.

Posted by Roger Montgomery, 9 December 2010.

Postscript: thank you for your kind words and birthday wishes. I’m thoroughly enjoying my time away and am very much looking forward to reading and replying to your comments when I return to the office next Monday.

Postscript #2: Steven posted his own Value.able 12 Days of Christmas at my Facebook page last Friday – brilliant!

On the twelfth day of Christmas,

My independent analyst’s blog gave to me

12 A1s humming

11 valuations piping

10 C5s a-sleeping

9 forecasts prancing

8 capital raisings milking

7 floats a-sinking

6 CEOs praying

5 golden A1s!!

4 C5 turds

3 emerging bubbles,

2 editions of Value.able

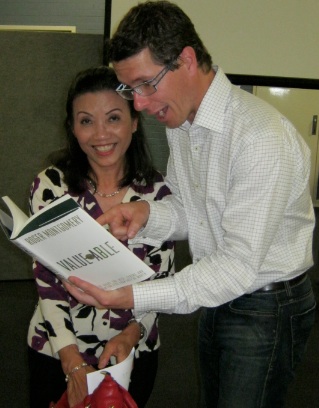

And a market leader with a high ROE!Here is Steven with his daughter Sophie.

Roger, you were good enough to sign my book…

“To Steven, Your guide to avoiding the dogs you told me you were so worried about, RM”.

Here I am reading Value.able to my little two year old Sophie at bedtime, holding her toy dogs. The moral of the story for Sophie? Roger shows dogs make fun toys and pets but must be avoided at all costs when investing in great businesses!”

Steven

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Why aren’t you answering my comments or emails Roger?

Roger Montgomery

December 8, 2010

At 7.30am this morning after inspecting a property, I found myself on the street being presented with a sealed envelope and cryptic directions to a taxi suspiciously parked just 10 metres from where I was standing.

At 7.30am this morning after inspecting a property, I found myself on the street being presented with a sealed envelope and cryptic directions to a taxi suspiciously parked just 10 metres from where I was standing.Turns out my family thought my upcoming 40th was a pretty good reason to celebrate and surprise me! They have whisked me away for a few days, as one of mates put it, for a ‘birthday soriee’.

I am completely unprepared. My laptop sits idle on my desk and iPhone charger is still in the power point (not turned on). I have been told there is an internet café where we are staying, however I’m not certain how reliable the connection will be.

I was planning to publish a new post today: What are the twelve stocks of Christmas? Thankfully all the post requires is one final proof read and then a click on ‘Publish’. I’ll venture down to the internet café this evening.

Please keep posting your comments here at the blog and on Facebook over the next few days and I will reply upon my return. I will be back in the office on Monday 13 December

Thank you in advance for your understanding and patience.

Posted by Roger Montgomery, 8 December 2010.

by Roger Montgomery Posted in Insightful Insights, Value.able.

-

Has 2010 been a good year for Value.able investing?

Roger Montgomery

December 7, 2010

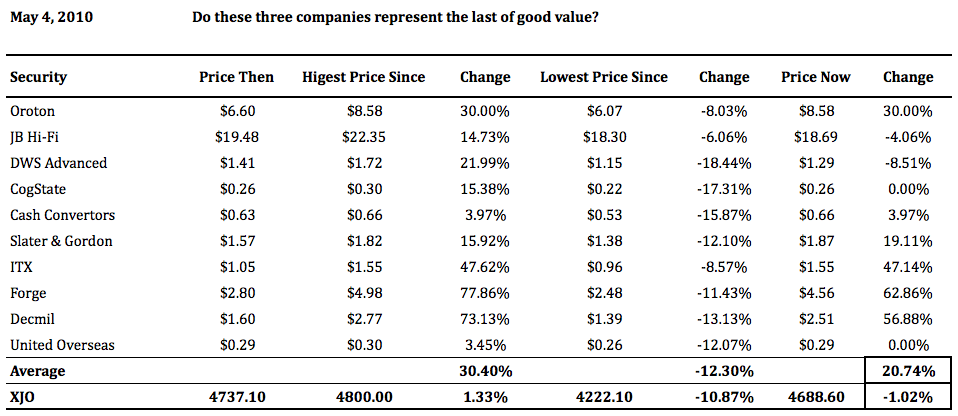

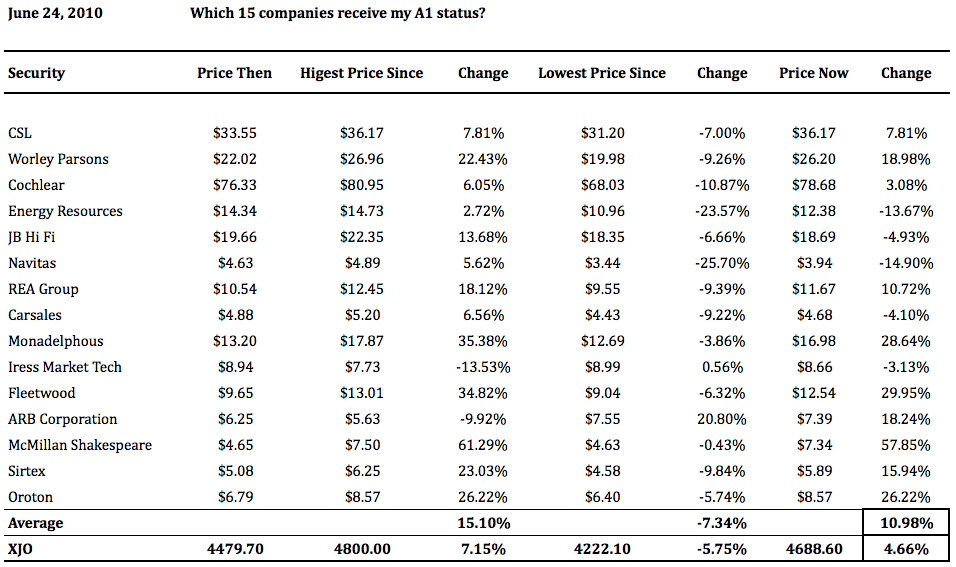

Christmas is about sharing and joyful memories. With just 18 days to go, I thought it would be educational, if not insightful, to share the performance of some of the securities Value.able Graduates have discussed here at my blog.

Christmas is about sharing and joyful memories. With just 18 days to go, I thought it would be educational, if not insightful, to share the performance of some of the securities Value.able Graduates have discussed here at my blog.Does the Value.able approach to investing, as advocated some of the world’s leading investors, have merit?

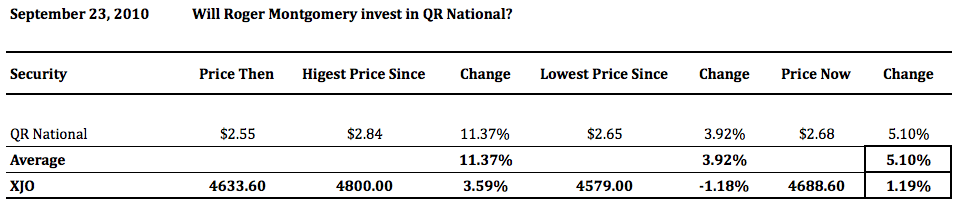

First Edition Graduates may not be surprised by the results posted below. The higher quality businesses, those scoring A1 and A2 Montgomery Quality Ratings (MQRs), and those at larger discounts to intrinsic value have, in aggregate, beaten the index. Some have trounced it. And with the exception of QR National, the companies that were labeled as poor quality (C4 and C5 MQRs) and overpriced, have under-performed. Some of the maturing higher quality companies (think JB Hi-Fi) have indeed performed.

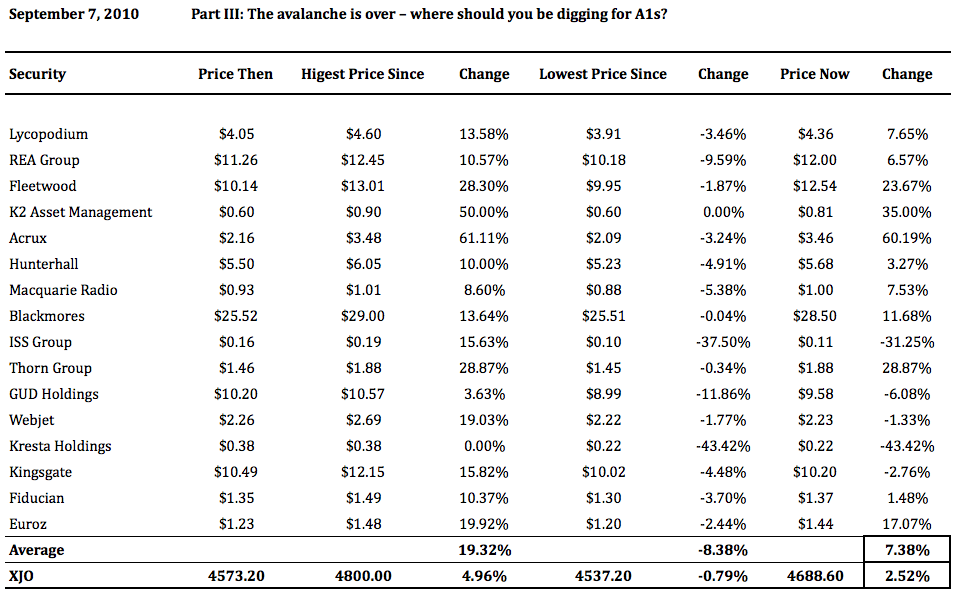

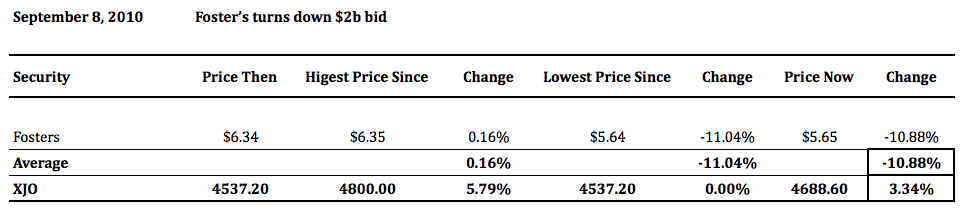

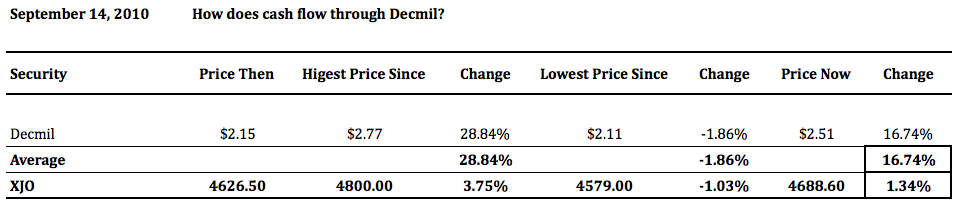

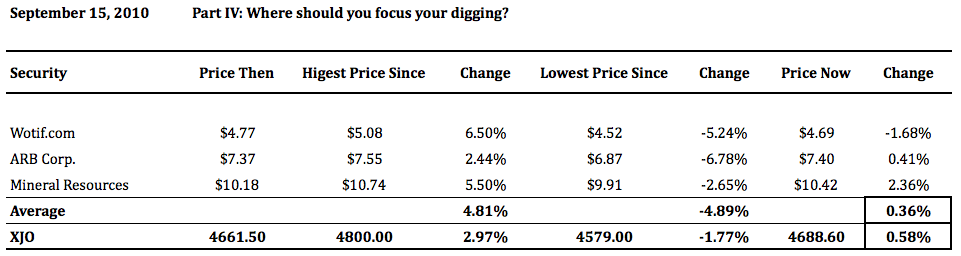

The following tables present some of the blog posts and the stocks that I have listed, mentioned or discussed in them. I have consistently suggested investigating an approach that seeks the highest quality businesses and prices that offer the biggest discounts to value.

Whilst the results are short-term (therefore nothing should be taken from them), they are nevertheless encouraging. The approach advocated in Value.able is worth investigating.

Many Value.able Graduates have suggested I start a newsletter or a stock market advice service. Thank you for the encouragement. I do enjoy the cross pollination of ideas and look forward to 2011 attracting even more investors to the patient and rational approach shared here at my blog.

Here are the tables (DO YOUR HOMEWORK AND RESEARCH. ENSURE YOU ARE COMPREHENSIVELY INFORMED. SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE).

Do these three companies represent the last of good value? Oroton, JB Hi-Fi, DWS, Cogstate, Cash Converters, Slater & Gordon, ITX, Forge, Decmil and United Overseas

Which 15 companies receive my A1 status? CSL, Worley Parsons, Cochlear, Energy Resources, JB Hi-Fi, Navitas, REA Group, Carsales, Mondaelphous, Iress, Fleetwood, ARB, McMillian Shakesphere, Sirtex, Oroton.

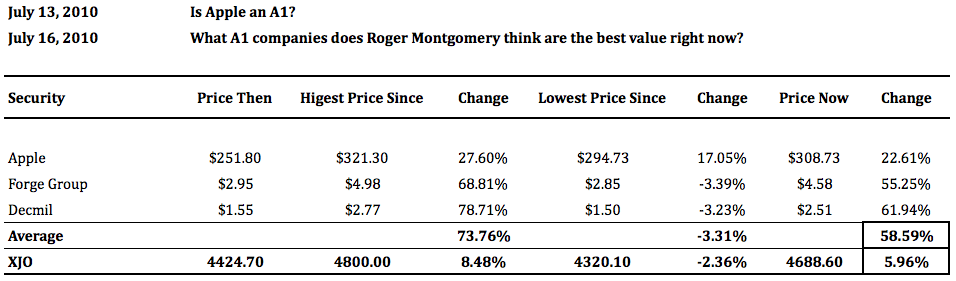

Is Apple an A1? What A1 companies does Roger Montgomery think are the best value right now? Apple, Forge and Decmil.

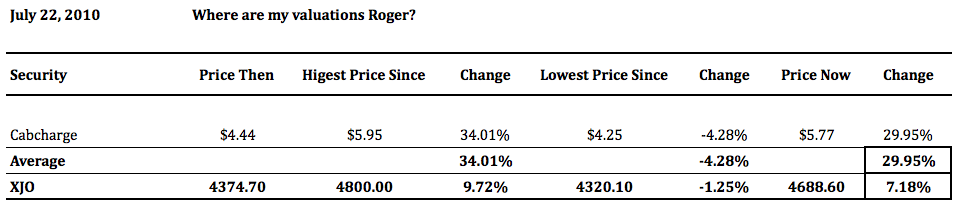

Where are my valuations Roger? Cabcharge.

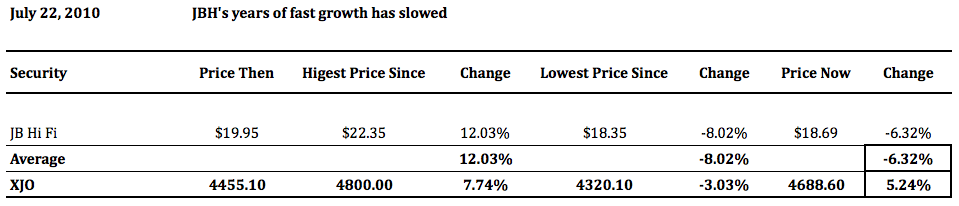

JBH’s years of fast growth has slowed.

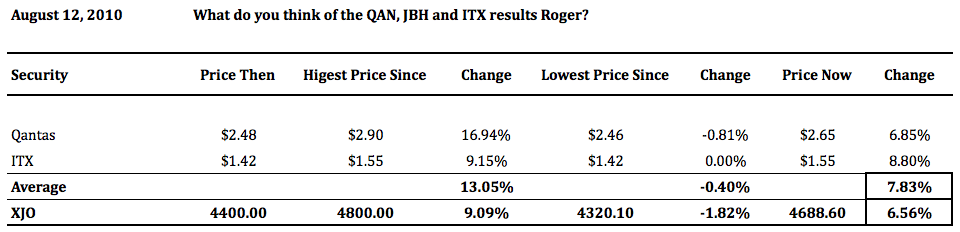

What do you think of the QAN, JBH and ITX results Roger? Qantas and ITX

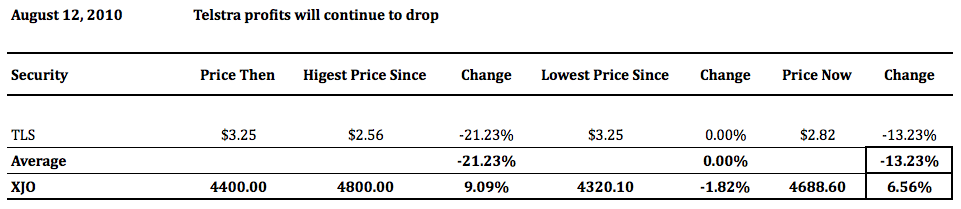

Telstra profits will continue to drop

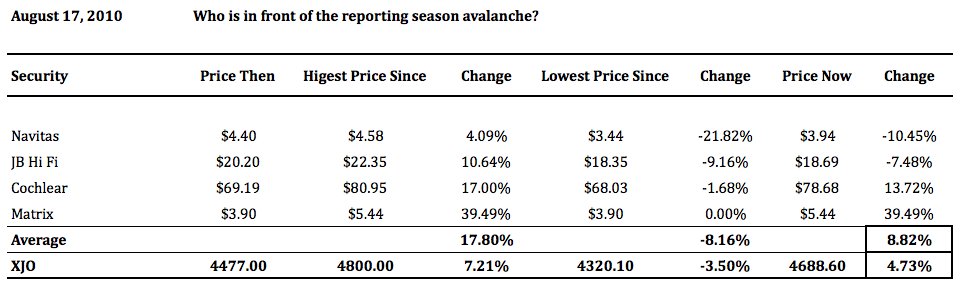

Who is in front of the reporting season avalanche? Navitas, JB Hi-Fi, Cochlear and Matrix.

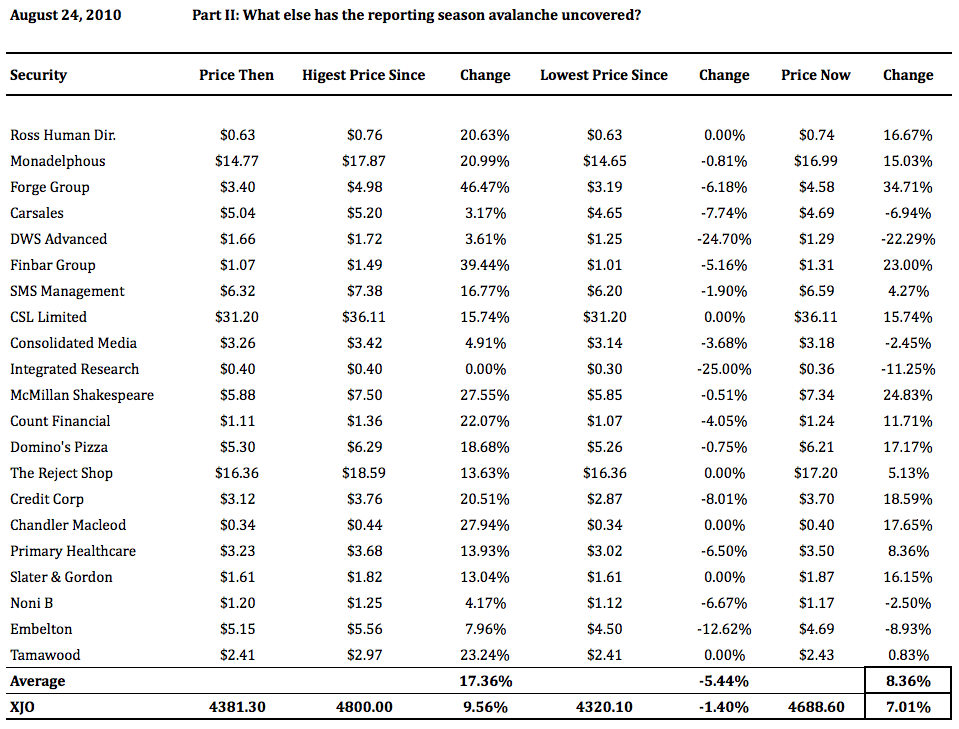

Part II: What else has the reporting season avalanche uncovered? Ross Human Directions, Monadelphous, Forge, Carsales, DWS, Finbar, SMS Management, CSL, Consolidated Media, Integrated Research, McMillian Shakesphere, Count Financial, Domino’s Pizza, The Reject Shop, Credit Corp, Chandler Macleod, Primary Healthcare, Slater & Gordon, Noni B, Embelton and Tamawood.

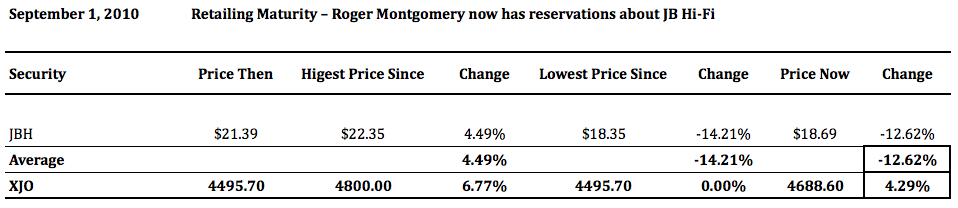

Retailing Maturity – Roger Montgomery now has reservations about JB Hi-Fi.

Part III: The avalanche is over – where should you be digging for A1s? Lycopodium, REA Group, Fleetwood, K2 Asset Management, Acrux, Hunterhall, Macquarie Radio, Blackmores, ISS Group, Thorn Group, GUD Holdings, Webjet, Kresta Holdings, Kingsgate, Fiducian and Euroz.

How does cash flow through Decmil?

Part IV: Where should you focus your digging?

Will Roger Montgomery invest in QR National?

I thought the performance of Fosters after the wine bid was knocked back was interesting, but only another year or two will confirm whether the opportunity to add value was passed up. Some higher quality businesses also underperformed the market, thanks in part to deteriorating short-term prospects rather than deteriorating quality.

Remember to look for bright long-term prospects. Of course, in the short-term prospects will swing around – that is business, but longer-term prospects of businesses with true sustainable competitive advantages tend to win out.

Keep an eye on the blog before Christmas as I will be posting a couple of very handy lists (and possibly some homework) before the annual Montgomery Family Christmas break.

Posted by Roger Montgomery, 7 December 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Where else has Value.able been?

Roger Montgomery

December 1, 2010

It has been a month or so since I last shared with you photographs from Value.able Graduates. These pics are from Gary, who has been travelling through Europe. He wrote “Read the book while traveling through Europe. Have attached some shots you may be able to use in your where in the world has Value.able been? One at the Louvre and the other at a little coffee with the Eiffel tower behind. Enjoyed the book, hoping to pay for the trip with the knowledge, Gary“.

I was in Perth last month to speak for the ASX and Australian Investors’ Association. This picture is from Dan (with his Mum).

I was in Perth last month to speak for the ASX and Australian Investors’ Association. This picture is from Dan (with his Mum).Dear Roger,

I just wanted to give a big Thank You for your presentation at the Wembley Tennis Club in Perth recently! I wasn’t able to attend because I live 450km North of Perth and have been busy with work, but I told my parents to attend and they said they had a fantastic night! Also, a huge thank you for signing my copy of your book and for taking the time to have a photo with Mum! We all love the book and have benefited greatly from your wisdom. I’m relatively new to the stock market (I’m 26 years old) but I feel as though I have learnt a great deal during the last year. I started getting interested in the stock market approximately 5 years ago, and back then I had the desire to own things that were (are still) considered to be “Blue Chip”, e.g. Incitec Pivot, Westfield, Santos, Babcock and Brown, Virgin Blue, etc. Now I have a far greater sense of how to approach investing in a more rational way, and how to identify companies that are actually of high quality. Now I spend my spare time on focusing only on quality businesses and have done really well using your solid and sensible approach. Thank you for the Value.able education! Maybe one day I’ll have the courage to post a comment on your blog (which is fantastic). I hope to see you when you’re next in Perth for a presentation so that I can thank you in person. All the best, Dan

And whilst Mark didn’t include photos of his Value.able journey, he has certainly impressed me with his enthusiasm.

“Hi Roger, Loved your book. You may be distressed or impressed but I have underlined highlighted and read separate chapters often. Dog eared sections etc. etc. I feel like I’m back in school and I’m 53. Seriously tremendous. Well done. Congrats, Mark”

A little ‘off topic’ was this email from Ken. Thanks Ken…

Roger,

Half the battle, getting started with any sort of analysis is being confident that one is not wasting one’s time going about things the wrong way. You have indeed given me a ‘leg-up’ with a range of aspects of my investing and thank you. My early career (and still a component of my work) involved collecting field data to calibrate and validate a pasture model (I’m still collecting validation data each year – 25 years since starting and training people, although engaged in quite different work now). I have spent years working with this model and with the scientist who built the model. There was never, in the early days, a definitive manual – just a mutual sharing of insights, late hours, passion and pain.

The modelling is now second nature and I’m more concerned with the flaws with the model than anything. But there was a huge barrier to entry – no manual could ever replace that research and effort that I put in to become confident and eventually proficient with what I was doing. It helped though, to have a more experienced person there for guidance – often just pointing out a reference to read etc. In turn I try to help people with their efforts where I can but it is up to the individual to get their own hands dirty, begin their own journey but, in our case, now as part of a ‘college’ of users. You are right in your approach – offering us a generous ‘leg up’ with your book and a means to share insights (your blog). By putting things into practice for ourselves, the keen will learn both the art and the science and, hopefully, slowly, become better investors and more value.able to both you and fellow bloggers. In many respects, this is how our team at work has operated for so long. As a team, we have become well respected both nationally and internationally – the college itself knows no institutional boundary.

In the preface to your book, Simon Hoyle notes:

“By helping to equip investors with the right set of skills, Roger is, either consciously or unconciously, waging a war against those who would seek to profit from the naivety or misplaced trust of others”.

Along the same lines, Alan Kohler, in “Why I started EUREKAreport” states:

“But it’s important to understand that investing is work. It is not gambling, or wishing and hoping, or trying to get the inside dope: it is work; a second job. Nevertheless with the right kind of support, you can do it and you can beat the pros. Eureka Report is the beginning of an attempt to provide that support and to redress the balance – to give ordinary people the tools and the knowledge to become independent and reclaim the control – and the money! – that is rightfully theirs.”

Roger, you are indeed forming an ‘investment college’ and it is good to be a part of it. I look forward to your latest blog and happy for you to reference anything.

Cheers

Ken

Thank you to everyone who has gone to so much trouble to demonstrate just how profound an effect my book has been having on your travel plans – if not your investing plans. I am genuinely encouraged and humbled at the same time by your support. Thank you again.

Posted by Roger Montgomery, 1 December 2010

by Roger Montgomery Posted in Insightful Insights, Value.able.

-

How many of your Chips are Blue?

Roger Montgomery

November 26, 2010

If you are new to the stock market, I believe it is possible that you have been lulled into a false sense of security. I say this because I regularly hear well-meaning advice that goes something like this; “just buy a portfolio of blue chips and hold for the long term”

If you are new to the stock market, I believe it is possible that you have been lulled into a false sense of security. I say this because I regularly hear well-meaning advice that goes something like this; “just buy a portfolio of blue chips and hold for the long term”But what is a blue chip? Here are some of the definitions I have found around the place:

“a common stock of a nationally-known company whose value and dividends are reliable; typically have high price and low yield; blue chips are usually safe investments”

“A blue chip stock is the stock of a well-established company having stable earnings and no extensive liabilities. Blue chip stocks pay regular dividends, even when business is faring worse than usual. …”

“A large company. Blue chip shares are generally lower risk. FTSE 100 constituents are generally considered blue chips”

“Shares of companies that are considered to be particularly solid and with a high capitalisation level. Their purchase is presumably associated with minor risk when the Stock Exchange falls”

And my new favourite definition;

“Blue Chip is the third album by Acoustic Alchemy, released under the MCA Master Series label in 1989, and again under GRP in 1996.”

Clearly there is only rough consensus around what a ‘blue chip’ actually is, but I get the distinct impression that a lack of understanding about what truly constitutes ‘high quality’ has meant the resultant definitions are clumsy at best. And if advisors can’t define quality/blue chip with some consensus, then its quite possible new investors are plunging into a blind-leading-the-blind situation.

Here at my Insights blog, I don’t talk about blue chips. Why? Because they don’t exist. There is no such thing.

I define quality through my A1-C5 Montgomery Quality Ratings (the MQRs) using a raft of measures and scenarios, combined with measures of the financial relationship a company has articulated over the years with its shareholders and its competitive position.

Warren Buffett once observed that time is the friend of the wonderful business but the enemy of a poor one. You don’t want to put the shares of a bad business, even if it’s a big one, in the bottom drawer and forget about them. Long term buy-and-hold investing then should only apply to the truly high quality companies – A1 companies.

To that end I would like to share with you an early Christmas gift (until Value.able arrives under your Christmas tree).

One of the definitions noted above and a commonly held one is that blue chips have to be large companies. Companies that inhabit the S&P/ASX 50, for example, may be considered Blue Chips. Putting aside for a moment the fact that there are plenty of large companies that have gone to the wall, it is possible to re-rank the so called Blue Chips – the large capitalisation companies – and find out if any are more blue than the rest.

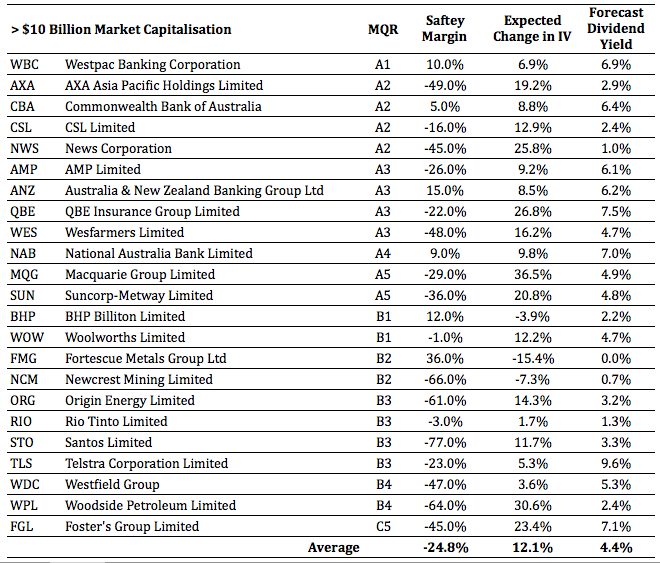

So in the pursuit of ‘blueness’, below you will find all companies with a current market capitalisation of more than $10 billion sorted by my MQR (followed by Safety Margin for good measure). I have also included my current expected (annual) rate of change in Value.able Intrinsic Value over the next three years and thrown in dividend yields because I know how adored they are.

Of course, all of this is purely didactic and not intended as advice. YOU MUST SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE. Also remember that I do not know what share prices are going to do, they could all halve or double and my MQRs andValue.able Intrinsic Values could all change tomorrow, possibly by a lot. They could go up or down and I am under no obligation to keep you updated. So please DO NOT RELY ON THE INFORMATION PROVIDED.

Having made that clear, and I am not joking about such serious matters, here is the list:

So its seems not all blue chips are entirely blue. As one of my friends – who likes to occasionally catch the amber light – says, “there’s still a bit of green left!”

Lumping all large companies into the ‘Blue Chip’ camp may not lead you to secure returns. Indeed, it could more likely see you merely lurch from one crisis to the next. If that is an experience you would like to change or avoid, then understanding the factors that indicate good quality is vital.

Value.able Graduates would have read the chapters about identifying extraordinary businesses in my book. If you haven’t yet secured your copy of Value.able you can do so at my website, www.rogermontgomery.com.

Posted by Roger Montgomery, 26 November 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Value.able.

-

What A1 stocks am I looking at right now?

Roger Montgomery

November 17, 2010

If you saw my post titled ‘Are you drowning in a sea of complexity‘, you will recognise the A1 businesses I shared with Peter’s viewers on Monday night. Whilst the list of A1s isn’t new, I did share some fresh insights into my Montgomery Quality Ratings, and my thoughts about Oroton CEO Sally Macdonald selling shares.

Part I: What is the secret of Roger Montgomery’s A1 Montgomery Quality Rating?

Part II: What are Roger Montgomery’s Top 20 A1 stocks?

Part III: What are Roger Montgomery’s cheapest A1 businesses?

Visit Roger Montgomery’s YouTube Channel to watch more of his TV appearances.

Posted by Roger Montgomery, 17 November 2010.

by Roger Montgomery Posted in Insightful Insights.

- 78 Comments

- save this article

- POSTED IN Insightful Insights

-

Have you been getting your daily dose?

Roger Montgomery

November 9, 2010

If only it worked that well all the time!

If only it worked that well all the time!Last Thursday evening (4 November) on Peter’s Switzer TV I listed, amongst other companies, Credit Corp and Forge Group as two I would have in the hypothetical Self Managed Super Fund Peter challenged me to set up that day.

Why did I nominate CCP and FGE? Both receive my A1 or A2 MQR and both have been trading at a discount to their intrinsic value.

If you are a regular reader of my blog you would have read my insights for some months on these companies. And if you saw today’s announcements, you can imagine why I am a little happier than usual.

Credit Corp’s previous 2011 NPAT guidance was $16-$18 million. Today the company announced FY11 would likely produce an NPAT result of $18-$20 million.

Forge Group’s announcement states “The Board wishes to advise that the company forecasts net profit before tax for the half year ending 31st December 2010 to be in the range of $25-$27 million. This represents an improvement on the previous corresponding period (pcp $19.04m) of up to 42%.”

As I fly to Perth for a presentation and company visit, I am encouraged that several of the companies Value.able graduates mentioned in our lists are also hitting new 52-week highs. In a rising market that lifts all boats, it is perhaps unsurprising, but nevertheless it should be an encouragement to Value.able graduates and value investors that companies like FLT, DCG, MIN, FWD, FGE, CCP, NCK, DTL, MCE, MTU and TGA have all hit year highs – some of them yesterday. More importantly those prices are perhaps justified by their intrinsic values.

Of course I am not here to predict where those prices will go next, because I simply don’t know. Short-term prices are largely a function of popularity and the market could begin a QE2-inspired correction, an Indian infrastructure-inspired bubble or a China liquidity-inspired bubble tomorrow. I have no way of telling and instead, I focus on intrinsic values and only pay cursory attention to share prices.

So, as I always say, seek and take personal professional advice before taking any action and remember that 1) I don’t know where the share price is going 2) I am under no obligation to keep you up-to-date with my thoughts about these or any company, my Montgomery Quality Ratings or my valuations and I might change my views, values and MQRs at any time so don’t rely on them and 3) I may buy or sell shares in any company mentioned here at any time without informing you.

And so I remind you one more time. Please seek and take personal professional advice and always conduct your own research.

Posted by Roger Montgomery, 9 November 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.