Insightful Insights

-

MEDIA

What are Roger’s insights into the Banking sector?

Roger Montgomery

August 1, 2012

Do Newcrest Mining (NCM), Breville Group (BRG), Commonweath Bank (CBA), Westpac (WBC), Wotif.com (WTF) and CSL (CSL) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 1 August 2012 to find out, and also learn Roger’s current insights into the Mining Services sector. Watch here

by Roger Montgomery Posted in Companies, Insightful Insights, Intrinsic Value, TV Appearances.

-

MEDIA

Running out of puff

Roger Montgomery

August 1, 2012

In his August 2012 Money Magazine article Roger discusses how company weighting in Australian market indices distort the overall performance. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Intrinsic Value.

-

China Rongsheng Heavy Industries – the good, the bad and the ugly…

Roger Montgomery

August 1, 2012

Earlier this year we had the opportunity to visit China Rongsheng Heavy Industries, one of China’s leading shipbuilding companies. Rhongsheng was founded in 2005 and floated in November 2010 on the back of winning an enormous order from Vale to build twelve ore carrier vessels each 360 metres long, 65 metres wide and 30.4 metres deep with a deadweight tonnage of 400,000. The ambitious founder, 46% shareholder and Chairman, Zhang Zhi Rong, was desperate to challenge the global leaders, South Korean based, Hyundai Heavy Industries and Daewoo Shipbuilding & Marine.

Back in 2008, Rongsheng represented all that is good and bad in China. With Government support, Chinese corporate support, recently announced offshore diversification and the cost of shipping dry goods such as grain, coal and iron-ore at US$55,000 per day, the outlook was superb.

Let’s fast forward to July 2012 and the price of Rhongsheng’ shares have declined from HK$8 to HK$1. For the six months to June 2012, China’s 1,536 shipyards have announced a combined 50% decline in orders. The cost of shipping dry goods has crashed to sub US$10,000 per day (-82%), and Rhongsheng is experiencing a number of operational and credibility issues.

With the global slump in ship orders caused by a glut of vessels, Rongsheng is trying to diversify from shipbuilding and earlier this year they won a contract to build an offshore support vessel for CNOOC, one of China’s largest government controlled oil production and exploration companies.

Last week CNOOC announced a US$15 billion offer to acquire Nexen, a US listed Canadian based oil company. Nexen rose 52% on the announcement. The US Securities and Exchange Commission (SEC) just announced various traders had stockpiled shares of Nexen in the days leading up to the takeover bid. The SEC has claimed US$13m of illegal profit was realized and the finger is being firmly pointed to a Hong Kong based company controlled by none other than Zhang Zhi Rong.

The development of China has seen some extraordinary national champions in industries like ship building, however we wonder how many of these companies will ultimately become global champions. With several front page newspaper disasters associated with misfeasance, we continue to be wary of China’s corporate governance record.

In the meantime we believe a lot of companies in commoditized industries like shipbuilding, steelmaking and cement production are likely use their upcoming results presentation as an avenue to downgrade their outlook.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Manufacturing.

-

Deflation of fresh produce masks volume growth from Woolies and Coles

Roger Montgomery

July 31, 2012

The Woolworths Food and Liquor Division reported 3.8% sales growth to $37.5 billion for the year to June 2012. Same store sales growth increased by 1.3% for the year. For the June Quarter, sales growth was 3.8%, year on year, while same stores sales grew by 1.3%.

In comparison, Coles reported sales growth of 6.1% to $33.7b and same store sales growth of 3.7%. For the June Quarter, sales growth was 4.6%, year on year, while same store sales grew by 3.0%.

Both organisations reported price deflation of approximately 4% in fresh produce, and this masked both their strong volume growth and the increasing consolidation of the Australian supermarket industry.

The Montgomery (Private) Fund is a shareholder in Woolworths, and likes its 26% average return on equity.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights.

-

Steve Keen has his supporters…..

Roger Montgomery

July 31, 2012

In late 2008 Steve Keen, Associate Professor of Economics and Finance at the University of Western Sydney had a bet with Rory Robertson, who at the time was Interest Rate Strategist at Macquarie Bank. The bet was Australian housing prices would decline by 40% in two years, and the loser would walk 200km from Canberra to Mt Kosciuszko. Despite losing the bet, Steve Keen still has his supporters. Last week, Dean Baker the co-founder of US based the Centre for Economic and and Policy Research said the housing bubbles of the United Kingdom, Canada and Australia, are larger, relative to the size of their economies, than the one that collapsed and wrecked the US economy. In each county, there has been a sharp increase in the sale price of homes that has not been matched by a corresponding increase in rents. In Australia’s case, Baker claims house prices rose by more than 80 per cent between 2001 and 2009, a period when rents rose by roughly 30%. Baker argues the price of the median house in Australia is 225 per cent of the median house in the US. Given that wages in the US are higher it is difficult to see how this huge gap in house prices can make sense, said Baker.

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

Selling the farm

Roger Montgomery

July 28, 2012

Shareholders in the 135 year old London Metal Exchange (“LME”) voted overnight to sell to Hong Kong Exchanges & Clearing for US$2.1 billion. The LME will help the HKEx, whose focus has until now been almost exclusively on equity markets, challenge the Chicago Metals Exchange (CME) and the Intercontinental Exchange (ICE) for dominance in commodity markets.

The CME and ICE and the NYSE Euronext were all trying to acquire the LME in a wave of consolidation that has swept the global exchanges industry.

The concept of traders gathering in the coffee houses in the City of London (in 1877) with an open outcry system is rapidly being taken over by 24 hour electronic trading!

by Roger Montgomery Posted in Insightful Insights, Investing Education, Takeovers.

-

US Housing Starts – About to Mean Revert?

Roger Montgomery

July 27, 2012

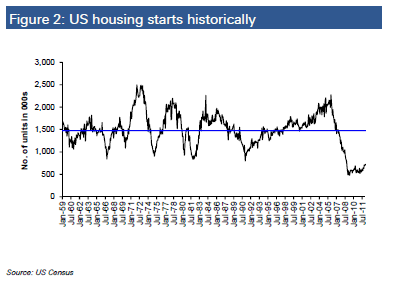

Over the past fifty years, US housing starts have averaged 1.5m per annum. Currently, starts are less than half the long term average.

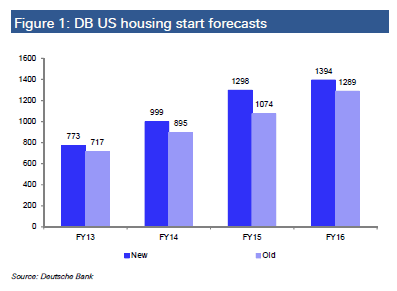

In recent months there have been some tentative signs of recovery from this record low base. According to the Economist, America’s houses on average “are now among the world’s most undervalued: 19% below fair value, according to our house-price index”.While Deutsche Bank have cut their 2013 and 2014 housing start expectations in Australia to 128,000 and 144,000, respectively,they are looking for a jump in US housing starts to 1.0m by 2014 and 1.4m by 2016, as follows.

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

The Conference call with Consequences?

Roger Montgomery

July 26, 2012

On Monday night I attended a conference call with the exceptionally articulate George Papandreou, Prime Minister of Greece from October 2009 to November 2011. He said a sudden exit from the European Union would be chaotic. Greek GDP could quickly decline by 20% and the cost of major imports of oil and foodstuffs would go through the roof.

While Greece accounts for only 2% of the European Union GDP, Papandreou felt the threat of kicking Greece out could set a precedent for Portugal, Italy and Spain, which together account for 23% of European Union GDP. It would mean the beginning of the unraveling of Europe and create further weakness with massive consequences.

by Roger Montgomery Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

MEDIA

Is Weaker Chinese Demand a Worry?

Roger Montgomery

July 21, 2012

Roger Montgomery certainly thinks so, and he explains why in this Weekend Australian article published 21 July 2012. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Investing Education, Value.able.

-

MEDIA

Is Darwin the next Asia-Pacific Financial Capital?

Roger Montgomery

July 18, 2012

Roger Montgomery thinks not – and in this interview with Radio 2GB’s Ross Greenwood he discusses why Singapore’s pervasive attractiveness for investors is likely to remain for some time. Listen here.

This interview was broadcast 18 July 2012.

by Roger Montgomery Posted in Insightful Insights, Radio.

- save this article

- POSTED IN Insightful Insights, Radio