Insightful Insights

-

Steve Keen has his supporters…..

Roger Montgomery

July 31, 2012

In late 2008 Steve Keen, Associate Professor of Economics and Finance at the University of Western Sydney had a bet with Rory Robertson, who at the time was Interest Rate Strategist at Macquarie Bank. The bet was Australian housing prices would decline by 40% in two years, and the loser would walk 200km from Canberra to Mt Kosciuszko. Despite losing the bet, Steve Keen still has his supporters. Last week, Dean Baker the co-founder of US based the Centre for Economic and and Policy Research said the housing bubbles of the United Kingdom, Canada and Australia, are larger, relative to the size of their economies, than the one that collapsed and wrecked the US economy. In each county, there has been a sharp increase in the sale price of homes that has not been matched by a corresponding increase in rents. In Australia’s case, Baker claims house prices rose by more than 80 per cent between 2001 and 2009, a period when rents rose by roughly 30%. Baker argues the price of the median house in Australia is 225 per cent of the median house in the US. Given that wages in the US are higher it is difficult to see how this huge gap in house prices can make sense, said Baker.

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

Selling the farm

Roger Montgomery

July 28, 2012

Shareholders in the 135 year old London Metal Exchange (“LME”) voted overnight to sell to Hong Kong Exchanges & Clearing for US$2.1 billion. The LME will help the HKEx, whose focus has until now been almost exclusively on equity markets, challenge the Chicago Metals Exchange (CME) and the Intercontinental Exchange (ICE) for dominance in commodity markets.

The CME and ICE and the NYSE Euronext were all trying to acquire the LME in a wave of consolidation that has swept the global exchanges industry.

The concept of traders gathering in the coffee houses in the City of London (in 1877) with an open outcry system is rapidly being taken over by 24 hour electronic trading!

by Roger Montgomery Posted in Insightful Insights, Investing Education, Takeovers.

-

US Housing Starts – About to Mean Revert?

Roger Montgomery

July 27, 2012

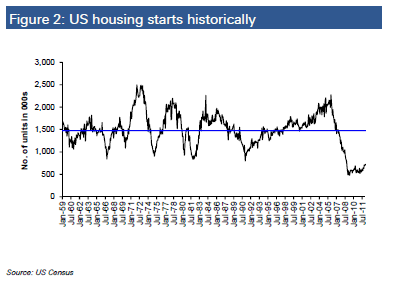

Over the past fifty years, US housing starts have averaged 1.5m per annum. Currently, starts are less than half the long term average.

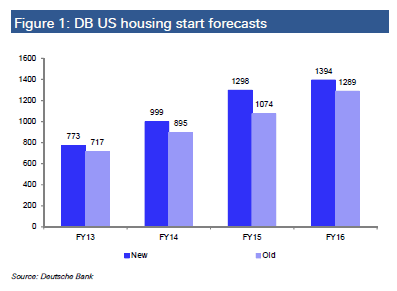

In recent months there have been some tentative signs of recovery from this record low base. According to the Economist, America’s houses on average “are now among the world’s most undervalued: 19% below fair value, according to our house-price index”.While Deutsche Bank have cut their 2013 and 2014 housing start expectations in Australia to 128,000 and 144,000, respectively,they are looking for a jump in US housing starts to 1.0m by 2014 and 1.4m by 2016, as follows.

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

The Conference call with Consequences?

Roger Montgomery

July 26, 2012

On Monday night I attended a conference call with the exceptionally articulate George Papandreou, Prime Minister of Greece from October 2009 to November 2011. He said a sudden exit from the European Union would be chaotic. Greek GDP could quickly decline by 20% and the cost of major imports of oil and foodstuffs would go through the roof.

While Greece accounts for only 2% of the European Union GDP, Papandreou felt the threat of kicking Greece out could set a precedent for Portugal, Italy and Spain, which together account for 23% of European Union GDP. It would mean the beginning of the unraveling of Europe and create further weakness with massive consequences.

by Roger Montgomery Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

MEDIA

Is Weaker Chinese Demand a Worry?

Roger Montgomery

July 21, 2012

Roger Montgomery certainly thinks so, and he explains why in this Weekend Australian article published 21 July 2012. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Investing Education, Value.able.

-

MEDIA

Is Darwin the next Asia-Pacific Financial Capital?

Roger Montgomery

July 18, 2012

Roger Montgomery thinks not – and in this interview with Radio 2GB’s Ross Greenwood he discusses why Singapore’s pervasive attractiveness for investors is likely to remain for some time. Listen here.

This interview was broadcast 18 July 2012.

by Roger Montgomery Posted in Insightful Insights, Radio.

- save this article

- POSTED IN Insightful Insights, Radio

-

MEDIA

Are Broker valuations too high?

Roger Montgomery

July 18, 2012

Roger Montgomery certainly thinks so, and he discusses with Ticky Fullerton how his Value.able investing strategy provides much lower valuations of the current market in this interview on ABC’s The Business broadcast 18 July 2012. Watch here.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, TV Appearances.

-

Is the slow-down finally gaining momentum Down-Under?

Roger Montgomery

July 11, 2012

Monday’s announcement of total ANZ job ads falling by 8.9% year on year in June 2012 indicates the slowdown in many Western world economies is gaining momentum Down Under.

Monday’s announcement of total ANZ job ads falling by 8.9% year on year in June 2012 indicates the slowdown in many Western world economies is gaining momentum Down Under.The ANZ Australian job ad market series (combined newspaper and online) fell by 1.2% in June 2012 on May 2012. In turn, May’s figure was down 2.6% from April.

The 8.9% year on year decline was driven by 8.5% and 17.5% year on year declines in online and newspaper job advertisements, respectively.

by Roger Montgomery Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

Are Chinese construction lay-offs a bad omen for Iron Ore prices?

Roger Montgomery

July 9, 2012

Sani Group, China’s biggest maker of construction machines has announced a cut to its workforce.

Given lay-offs did not occur in the down cycles of 2005 and 2008, this is a clear sign some pain is being experienced in China’s industrial heartland.

Sany’s 60,000 staff produces concrete machinery, excavators, cranes, pile drivers and road machinery. Its revenue exceeds RMB80 billion or US$12.5 billion.

With the tripling in demand for machinery in China since 2001, it appears Sany has recently been selling machines on generous credit terms. As a result the machinery maker saw its net receivables double over 2011.

The slowdown in Chinese construction activity is not a good omen for the iron-ore price, currently US$135/tonne. China’s demand accounts for 63% of iron-ore’s global seaborne trade.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights.

-

MEDIA

Will Fairfax Media’s restructure provide real profitable change?

Roger Montgomery

June 18, 2012

Fairfax Media’s restructure announcement has been welcomed by the market, but what prospects does their revised business model have for future profitability? Roger Montgomery provides his Value.able insights to ABC1’s Ticky Fullerton in this edition of ‘The Business’ broadcast on 18 June 2012. Watch here.

by Roger Montgomery Posted in Insightful Insights, Takeovers, TV Appearances, Value.able.