Insightful Insights

-

Steady as she goes

Ben MacNevin

December 10, 2012

Few Australian management teams and their boards have been successful over long periods of time in ‘rolling’ up businesses under one roof. Inevitably, too much is paid; they struggle to deploy systems to drive scale and efficiencies; and retaining key management becomes a key problem once their lock-in period expires. It’s why we are so cautious of business strategies that revolve largely around acquisitions to grow the business. While it is easy to ‘grow’ by simply purchasing another business’ earnings, unless the return on the equity employed remains stable or improves, such capital allocation decisions will erode shareholder wealth over time.

by Ben MacNevin Posted in Companies, Insightful Insights, Insurance.

- save this article

- POSTED IN Companies, Insightful Insights, Insurance

-

RBA Cash Rate to the lowest level in 53 years?

David Buckland

December 6, 2012

Prior to 1990 the Reserve Bank of Australia did not publish an official cash rate setting and cash rates going back to 1960 was a proxy of the current measure. Historical data shows the lowest cash rate proxy was 2.89% in January 1960.

As detailed in yesterday’s blog, “data points from manufacturing, the job market and the terms of trade are all pointing to weaker GDP growth”.

Assuming the Reserve Bank of Australia cuts the cash rate from the current “emergency low” level of 3.0% to 2.75% in early 2013 this will be the lowest level in 53 years.

by David Buckland Posted in Insightful Insights.

- 2 Comments

- save this article

- POSTED IN Insightful Insights

-

More choice and lower prices? Fat chance.

Roger Montgomery

December 6, 2012

Rising costs, lower productivity and a strong Australian dollar will inevitably be blamed for the collapse of another food manufacturer in Australia this week.

Gourmet Group, the company that owns the iconic Rosella Brand of tomato sauce has been placed in receivership with reports it owes as much as $50 million.

But this additional nail in the coffin of our collapsing food manufacturing industry is exactly what the government wants, it may also be what the ACCC wants and it is what Australian consumers want. And if they all complain that they don’t want it, it’s what they’re going to get.

by Roger Montgomery Posted in Insightful Insights, Manufacturing.

-

Cash rates do the round trip to 3.0% on slowing growth

David Buckland

December 5, 2012

Yesterday, the Reserve Bank of Australia cut their cash rate to 3.0%, down from 4.75% at October 2011, and the lowest level since mid-2009. Data points from manufacturing, the job market and the terms of trade are not cheery reading – all pointing to weaker GDP growth – and we expect the cash rate to fall further in 2013.

by David Buckland Posted in Insightful Insights.

- save this article

- POSTED IN Insightful Insights

-

MEDIA

How to invest with low interest rates

Roger Montgomery

December 4, 2012

In this 4 December 2012 edition of Ross Greenwood’s 2GB radio show, Roger discusses how finding great quality businesses will provide an exceptional alternative to investing in high dividend yield stocks in the current period of low interest rates. Listen here.

by Roger Montgomery Posted in Insightful Insights, Radio.

- save this article

- POSTED IN Insightful Insights, Radio

-

Rising US housing starts – the multiplier effect to add 1.5% to US GDP growth?

David Buckland

December 3, 2012

On 27 July 2012 I wrote “over the past fifty years, US housing starts have averaged 1.5m per annum. Currently starts are less than half the long-term average. Deutsche Bank is looking for US housing starts to jump to 1.0m by 2014 and to 1.4m by 2016 as follows”.

by David Buckland Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

Pacific round voyage (PRV) lease rates – off the canvas?

David Buckland

November 29, 2012

The daily lease rates for bulk carriers have risen by 20% to 25% in the past three months. The graph below details those daily rates for two categories of bulk carriers over the past two years; 28,000 dry weight tonnes which are around 170 metres long and 45,000 dry weight tonnes which are around 230 metres long.

The daily rates are currently US$6,550 and US$7,250, respectively, and reflect the perception China’s imports have recently recovered. For example, after three months of decline, China’s total coal imports hit 16.8 million tonnes in October 2012, up 13% from 14.9 million tonnes in September, and up 7% year on year.

by David Buckland Posted in Insightful Insights.

- save this article

- POSTED IN Insightful Insights

-

Surprising on the Upside

Tim Kelley

November 27, 2012

We’re delighted to see CSL announce this morning that it expects NPAT in FY13 to be 20% higher (in constant currency terms) than in FY12. Previous guidance was for 12% growth.

CSL is exactly the sort of business we like at Montgomery. Its impressive balance sheet and financial performance have earned it a Montgomery quality rating of A1 or A2 for each of the last 6 years. In addition, the strong financial position of the business has allowed it to buy back shares. As a result, earnings per share will grow faster in FY13 than the estimated 20% rate of profit growth.

High quality businesses tend to be rewarding investments for long-term investors. While the broader market sits currently at about the same level it held in 2005, CSL shares are some 250% higher. The Montgomery [Private] Fund is happy to own shares in this excellent business.

by Tim Kelley Posted in Insightful Insights, Technology & Telecommunications.

-

Unearthing informed Mining Services research

Russell Muldoon

November 26, 2012

Although it has taken a while for our alert earlier this year to flow through, project delays, cancellations and profit downgrades are mounting as the mining services sector confronts its post-capex-boom. To name a few: Macmahon is shedding staff and cutting pay rates, Emeco’s hiring rates have collapsed with an industry wide surplus of idle heavy machinery, Diploma Group is no longer proceeding to build a 244 man camp near Tom Price for Rio Tinto, ALS is reporting no growth, Ausdrill severed its earnings guidance and Orica wrote down the value of its equipment finance division, Minova, by $367m.

by Russell Muldoon Posted in Energy / Resources, Insightful Insights.

-

Lamenting the Australian Index

Tim Kelley

November 24, 2012

One of the strategies available to people who lack the time or inclination for active portfolio management is to “buy the index”. This is normally done via an index fund, which invests in companies according to their index weights. These funds have a certain intuitive appeal, as they typically charge low fees and are easy to understand.

However, if you step back and think about it, we think some serious issues arise. In essence, an index fund invests in a company, simply because it is there. This may be a satisfactory rationale for climbing a mountain, but we think it falls short as an investment strategy, particularly in the Australian context.

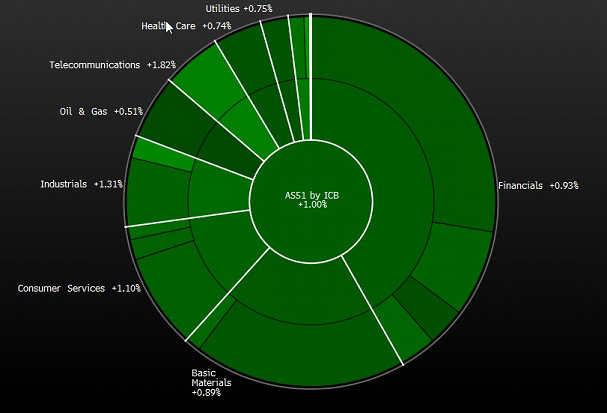

The chart below shows the industry composition of the ASX200 index. Ignore the % numbers – they are the daily price changes from yesterday – and look at the size of the slices. What stands out is that financials and basic resources together account for more than 60% of the total. If you buy the Australian index, your returns will be dominated by the big 4 banks and a handful of large resources companies. This doesn’t look like a sensible portfolio construction to us, and the rationale “because they’re there” doesn’t provide much comfort.

ASX200 Index Composition

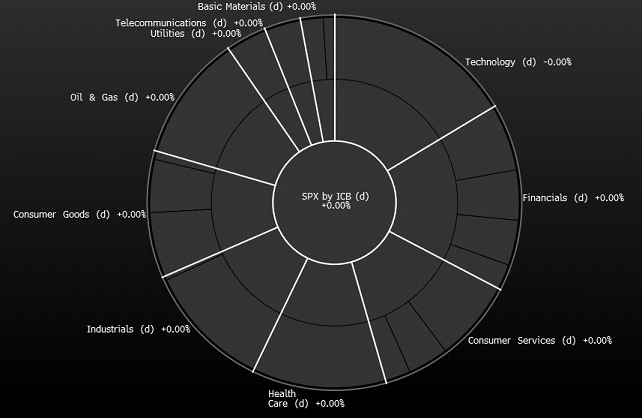

For comparison, the second chart, below, shows the composition of the US S&P500 index. A few things to note:

– Firstly, the US index has a much more even distribution, with 7 different industry groups representing a material part of the whole.

– Secondly, it’s interesting to note that technology is the largest single component of the US index, but is nothing more than a rounding error in the Australian index. In an age where commerce is being transformed by technology, is it good enough for Australian investors to have a <1% allocation to this sector ?

S&P500 Index Composition

by Tim Kelley Posted in Insightful Insights, Technology & Telecommunications.