Insightful Insights

-

Chinese share market up 10% in 8 business days

David Buckland

December 18, 2012

The Chinese share market, as measures by the Shanghai Composite Index, spent forty months between late-July 2009 and early- December 2012 declining 44% from 3,478 points to 1,949 points.

In the past eight business days the Index has rallied 200 points or 10% to 2,150.The preliminary HSBC China Manufacturing Purchasing Managers Index, released Friday, rose to a 14 month high in December, at 50.9 This is the second consecutive month the Index is in expansion territory (i.e. above 50).Some headwinds remain with pressure on new export orders. China’s export growth decelerated from an annual rate of 11.6 per cent in October to 2.9 per cent in November due to reduced demand from their major customers.by David Buckland Posted in Insightful Insights.

- 1 Comments

- save this article

- POSTED IN Insightful Insights

-

Are Large Caps Becoming Expensive?

Tim Kelley

December 17, 2012

We have the luxury of a broad mandate in the Montgomery Fund. We are not tied to small caps or large caps, but can allocate capital to the best opportunities we find, wherever they may be.

Recently, we have found better value at the smaller end of the market, and the chart below may help explain why.

continue…by Tim Kelley Posted in Insightful Insights.

- 6 Comments

- save this article

- POSTED IN Insightful Insights

-

The shifting focus from inflation to jobs

Ben MacNevin

December 14, 2012

The Federal Open Market Committee stated in its latest release that it is willing to continue with its easing measures until the unemployment rate is below 6 ½ per cent. This is remarkable, as is it officially states that the Federal Reserve is using its monetary policy tools to bring down the unemployment rate to below a certain level, when historically its focus has been on maintaining stable inflation – effectively, if inflation is maintained at a certain rate, unemployment should take care of itself.

continue…by Ben MacNevin Posted in Insightful Insights.

- save this article

- POSTED IN Insightful Insights

-

Webjet expands its footprint in the fast growing Asian travel market

David Buckland

December 14, 2012

Yesterday, Webjet announced the acquisition of Zuji for US$25m, or 4.6X estimated EBITDA of $5.4m, from Sabre Holdings.

Zuji adds $300m of Total Transaction Value (TTV) and expands Webjet’s footprint in the fast growing Asian travel market. For context, Webjet’s TTV for the year to June 2012 was $768m, up 30% year on year.

by David Buckland Posted in Companies, Insightful Insights, Tourism.

- save this article

- POSTED IN Companies, Insightful Insights, Tourism

-

Successful Branding: Bulls vs Dinosaurs

Ben MacNevin

December 13, 2012

Players at next week’s Australian PGA Championship have been reminded to be careful of their comments of the event with social media. Ironically, it has become one of the most talked about events in Australian sport – and this all due to the erection of a few dinosaurs around the golf course.

With all the comments about whether this detracts from the traditional form of the game or whether it is good for the game itself, it is generating “buzz”. And in business, sustainable value can be generated by transforming “buzz” into intangible assets – just look at the story of Red Bull.

continue…by Ben MacNevin Posted in Insightful Insights.

- 1 Comments

- save this article

- POSTED IN Insightful Insights

-

Heads in the Sand on LNG Economics?

Tim Kelley

December 12, 2012

One of the issues attracting media and analyst commentary recently is the potential impact of American shale gas exports to the economics of Australia’s large LNG projects.

The theme of many of the comments is that there is no cause for alarm, at least for the time being. Some of the reasons advanced include: the reluctance of US policymakers to permit exports; the time taken to ramp up supply if the US does export; and the fact that LNG contracts tend to be linked to oil, rather than gas prices.

by Tim Kelley Posted in Energy / Resources, Insightful Insights, Value.able.

-

NOT FUNNY!

Roger Montgomery

December 11, 2012

In my late twenties I stopped listening to commercial radio. It was ‘breakfast radio’ that turned me off. As a bit of a fan of music in all its forms, all I wanted to hear was the next song. Inevitably I arrived (at my destination) long before any music did. But worse it was the nonsense proffered as humour by some amateur comedian hosting the breakfast show that was the last straw.

Spend a bit of time listening to comedians and the very best make you laugh at no-one’s expense. Its a special skill that not many have. The very worse do the opposite. With the exception of a few, breakfast hosts are simply not funny and so the only way they can attract an audience is to make fun of others. It is puerile.

by Roger Montgomery Posted in Insightful Insights.

- 8 Comments

- save this article

- POSTED IN Insightful Insights

-

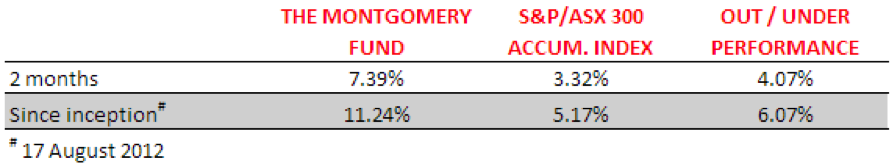

Montgomery Funds’ Performance to 30 November 2012

Roger Montgomery

December 11, 2012

We are again delighted to provide an update on the results for The Montgomery Fund.

Whilst it is still early days and you must understand that past results are not a reliable guide to future returns, we continue to be encouraged by the combined performance of The Montgomery Fund’s 33 constituents.

by Roger Montgomery Posted in Insightful Insights, Value.able.

- 1 Comments

- save this article

- POSTED IN Insightful Insights, Value.able

-

Creating the perception of a superior product

Ben MacNevin

December 10, 2012

It was pleasing to see figures released last week by Tourism Research Australia that revealed Chinese tourists were still flocking to Australia’s shores. According to the report, there were 573,071 Chinese arrivals in the 12 months to September, which was a 17 per cent increase over the previous corresponding period.

While there has been a lot of commentary on the state of the tourism industry, there is one company that is frequently cited as the shining example of a group that can successfully capture the opportunities in this growing tourism market, and that is Crown Ltd.

by Ben MacNevin Posted in Insightful Insights, Tourism.

- 1 Comments

- save this article

- POSTED IN Insightful Insights, Tourism

-

What is the ‘new normal’ for housing?

Russell Muldoon

December 10, 2012

A few months ago we commented here on an article in the AFR speculating that Gen Y may soon be buying a house cheap from boomers who have no-one else to sell to and why renting makes more sense than buying. Since Roger bought the bigger family home in 2006,he has argued that house prices would cease rising to new highs – especially the six and seven bedroom variety.

Whilst the mere mention of Australian housing and prices can stir up passionate and spirited argument for and against house price rises, just this morning I stumbled across the below series of charts produced by Citigroup’s Matt King.

Similar to the M/O ratio which plots P/E ratios against the ratio of the middle-age cohort, age 40–49, to the old-age cohort, age 60–69 from 1954 to 2010, Matt looks at the relationship between the inverse dependency ratio (the proportion of population of working age relative to old and young) and maps that against real house prices over time. This produces a longer-term measure of prices home owners are willing to (or have to) pay for housing.

The charts are a powerful representation of a force driving all economies and prices: demographics. Whilst prices have somewhat lagged the dependency ratio on the way up, give or take a number of years and almost every country here shows that the peak in real estate prices is highly correlated with the peak in dependency ratio.

Its worth contemplating whether the recent past, characterised by rising gearing levels and falling price to income ratios (affordability) is the new normal, or whether, as we transition into an environment where there are more pensioners than workers and therefore fewer people to ‘downsize’ too,what may transpire in the future in Australia is anything like the experience in the US, Japan, Ireland, Spain and the UK.

As always, delighted to hear your thoughts.

by Russell Muldoon Posted in Insightful Insights.

- 6 Comments

- save this article

- POSTED IN Insightful Insights