The Real cost of capital

Kyle Bass is a recently minted billionaire investor. But he didn’t gain prominence for the billions he made presciently trading credit default swaps and collateralised debt obligations in the US sub prime markets, nor for the billions more he made by levering his subprime profits and trading credit default swaps on Greece. He because famous for being the hedge fund manager Michael Lewis left out of his book because Lewis thought Bass was a bit of a nutter.

The results, however, speak for themselves and now Kyle Bass is a fixture on the business circuit, on CNN and Bloomberg and feted as a speaker at conferences globally.

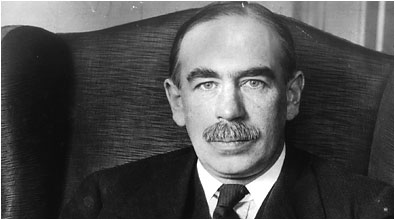

Each month he pens a thought or two on the current malaise gripping the world’s finances and this month he gave the most chilling account of Keynesian economics (the model western governments have embraced). Sadly, it was chilling because it came from John Maynard Keynes himself. It reads like Revelation, the last book of the Bible and it reveals Keynes as a somewhat recusant thinker, whilst also giving central banks a recipe for the destruction of your wealth.

“In the Kenyesian bible (The general Theory of Employment, Interest and Money), there is a very interesting Tidbit of Keyne’s conscience in the last chapter titled “Concluding Notes” from page 376:

[I]t would mean the euthanasia of the renter, and, consequently, the euthanasia of the cumulative oppressive power of the capitalist to exploit the scarcity value of capital. Interest today rewards no genuine sacrifice, any more than does the rent of land. The owner of capital can obtain interest because capital is scarce, just as the owner of land can obtain rent because land is scarce. But whilst there may be intrinsic reasons for the scarcity of land there are no intrinsic reasons for the scarcity of capital.

Thus we might aim in practice (there being nothing in this which is unattainable) at a increase in capital until it ceases to be scarce, so that the functionless investor will no longer receive a bonus[.] (Emphasis mine)

“This is nothing more than a chilling prescription for the destruction of wealth through the dilution of capital by monetary authorities.

Central Banks have become the great enablers of fiscal profligacy. They have removed the proverbial policeman from the bond market highway. If central banks purchase the entirety of incremental bond issuance used to finance fiscal deficits, the checks and balances of “normal” market interest rates are obscured or even eliminated altogether. This market phenomenon does nothing to encourage the body politic to take the foot off the accelerator. It is both our primary fear and unfortunately our prediction that this quixotic path of spending and printing will continue ad-infinitum until real cost push inflation manifests itself…Given the enormity of the existing government debt stock, it will not be possible to control the very inflation that the market is currently hoping for. As each 100 basis points in cost of capital costs the US federal government over $150 billion, the US simply cannot afford for another Paul Volker to raise and contain inflation once it begins.”

Kelvin Ng

:

Hi Roger, yes I too have been a fan of Kyle Bass for a while now.

Further to the question you raised in your latest video “The Current Market Conundrum”, personally I don’t think we need to worry about global markets running away from us and getting more overvalued – if Kyle Bass is right about Japan (as detailed in his latest newsletter from which you quoted) or if he is right about Germany (see http://www.businessinsider.com/kyle-bass-germany-could-exit-euro-in-3-4-years-2012-11), there will be plenty of triggers for downside volatility, of which I believe Japan and Germany will be just two of many.

Kind regards,

Kelvin

Dennis Bergmans

:

If inflation is inevitable, rather than run around, flapping their arms in a panic, investors should search for the best investment vehicle to protect their wealth.

Warren Buffett rule: Don’t lose money.

I know America has inflation protected bonds – does Australia have something similar?

Roger, with regards to common stocks, what businesses have the most inflation protection in your opinion?

Roger Montgomery

:

Those with the ability to raise prices with a detrimental impact on unit sales volume, those able to raise prices even in the face of excess capacity and those with the lowest costs. These are the companies we look for and own and I doubt investing this way is a flash-in-the-pan technique you should be sceptical of.

Andrew Legget

:

“…..because Lewis thought Bass was a bit of a nutter.”

How very often i see things like this. Apparently Marconi’s friends got him psychiatrically assessed due to him talking about being able to send messages through the air.

One important lesson i have learned on my investing journey is to listen to as many viewpoints as possible, especially those that say something different to the crowd. I don’t have to agree with it but i at least should consider it as sometimes these “outsiders” are actually the ones with the most important thing to be said.

I would imagine you Roger, received some similar comments after your various views on companies like ABC and Qantas etc came out in the press.

I actually hope that when i move down my investing journey and path that perhaps people in a way say the same thing about my views. It would mean that i at least can be assured of using my independent thought and not the market mind which is a very valuable asset to have some times.

I will need to add Kyle Bass to my list of people to keep an eye out for. I already have a very eclectic master mind group but they are accomodating people and i am sure wouldn’t mind one more to the list.