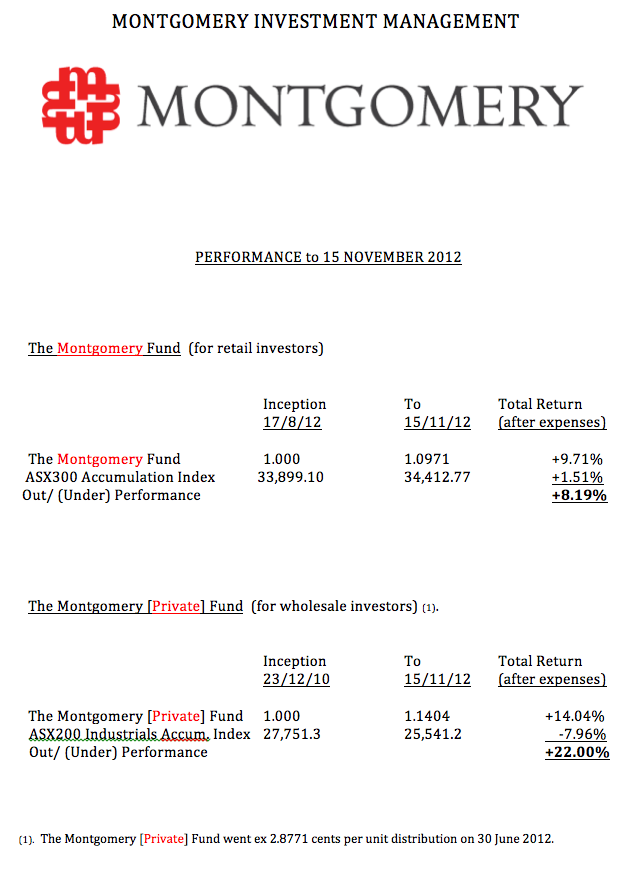

Montgomery Funds’ Performance to 15 November 2012

Recently you may have received a copy of the first bi-monthly Investment report for The Montgomery Fund along with a copy of Tim Kelley’s White Paper “What’s Under the Bonnet?”. We are of course enormously proud of the very early results The Montgomery Fund has achieved and we won’t be resting here. For those who missed out however and are interested in the latest performance numbers, please find them below.

To invest $25,000 or more in The Montgomery Fund, you will need to click here and request a copy of the Product Disclosure Statement, which includes the Application Form. Don’t invest in any security that is not appropriate for you of course and to determine that you must seek and take personal professional advice.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

alan ferguson

:

Hello Roger,

I am so impressed by the start that you and your team have got the Montgomery Fund. Tim’s article gave a real sense of having assured hands on the stern, that there is an intelligently considered strategy, and that it is being followed to maximize shareholder benefits – and for that I thank you.

I know and accept that you won’t be revealing and sharing the actual make-up and balance of either the Private or the Retail Funds, however, occasionally you and your colleagues will reference that you have a specific holding in one fund or the other, or in some instances – both.

My question is, if the principles of Value Investing are as they are, what determines the point of differentiation between the funds, and the purchases made to each? I am guessing, timing, opportunity and available funds at the time, but I would be interested to hear a bit more about your approach and if there is more to it than that.

I ask because on a number of occasion I have heard your people enthusiastically recommending a stock, and then revealing that it is in the other Fund.

Kind Regards as ever

Alan

Roger Montgomery

:

Hi Alan,

That too is proprietary. Feel free to give us a call and be sure to have your investor number handy!

Rob Nossiter

:

Curious as to whether you still hold Vocus Communications in either fund

Andrew Legget

:

Congratualtions Roger and team, i am sure there will be people who will have all sorts of problems with your comparison to indicies etc, i am sure you have heard it all before. At the end of your day a dollar invested in your funds is worth more than it was at the start so i am sure your lucky clients are all very pleased as that is all investors really want isn’t it. Someone to manage their money where it is best protected and invested so that they get a good return.

Look forward to hearing more about how your fund progresses Roger.

Any thoughts of ever doing a world wide fund? I know there are extra issues with doing so, time zones, currency risk, different regulations, governments etc.

Roger Montgomery

:

A world wide fund would be interesting but would stretch our present resources. For now we refer people to Magellan. As you know Chris and Hamish who run Magellan are good friends and investors in our business through Magellan.