Foreign Currency

-

How low can you go? Deflation and negative bond rates

Roger Montgomery

February 10, 2015

With everyone getting very hot under the collar or excited (depending on whether you are a borrower or a lender) about the prospect of Australia’s cash rate falling below two per cent, we thought it might be interesting to point to something even more interesting that transpired last week in Europe. continue…

by Roger Montgomery Posted in Economics, Foreign Currency, Insightful Insights.

-

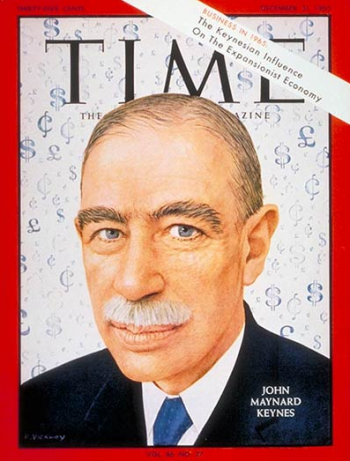

We’re all in this together

Scott Shuttleworth

February 9, 2015

For the historically minded reader you will note that this title was a famous quote attributed to John Maynard Keynes, the grandfather of Keynesian economics. The quote is said to have been made by Keynes as he commented on the harsh post-war conditions placed on Germany at Versailles in 1919. In short, one condition required that Germany repay the Allies for the cost of the war. continue…

by Scott Shuttleworth Posted in Economics, Foreign Currency, Insightful Insights, Market commentary.

-

Investing Overseas: Time to buy Greece?

Roger Montgomery

February 4, 2015

There is a definite element of contrarianism to value investing. Not always of course, but sometimes the market’s negative reaction, to news that is of a temporary nature, prices the shares of a company as if the problem were permanent. Going against the tide in these cases can produce very satisfactory investment outcomes. continue…

by Roger Montgomery Posted in Foreign Currency, Insightful Insights, Investing Education.

-

Eastern Europe – the epicenter of our next crisis?

David Buckland

January 29, 2015

It’s official. European consumer prices fell an annual 0.2 per cent in December 2014. German five-year bonds and Swiss ten-year bonds are now paying a “negative rate of interest.” European Central Bank (ECB) president Mario Draghi continues to “do whatever it takes” with last week’s announcement of the 1,100 billion euro (US$1,250 billion) bond purchase program over 2015 and 2016. Mario thinks this will steer the Euro area away from deflation by convincing investors his latest strategy is audacious enough to stimulate their relatively fragile economy. continue…

by David Buckland Posted in Foreign Currency, Insightful Insights.

-

The oil price slump and the declining rate of inflation

David Buckland

January 27, 2015

The slump in the oil price since mid-2014 has seen global inflation rates continue to trend down. European consumer prices fell an annual 0.2 per cent in December 2014 and European Central Bank president continues to “do whatever it takes” by unveiling a 1,100 billion Euro (US$1,250 billion) bond buying program over 2015-2016. continue…

by David Buckland Posted in Energy / Resources, Foreign Currency, Insightful Insights.

-

What can we learn from Bitcoin?

Tim Kelley

January 19, 2015

Bitcoin is one of the more interesting innovations we have seen in financial markets in recent years. The digital currency shot to prominence in late 2013 when the price rocketed to above US$1000, and a whole new industry of ‘bitcoin mining’ emerged in response to the elevated prices.

Websites that allow “investors” to trade currencies and commodities have also moved to capitalise on the excitement by offering their customers the ability to trade Bitcoins at the click of a mouse. More recently, the way to profit from Bitcoins has been to go short, with the price falling back to around $200 more recently. continue…

by Tim Kelley Posted in Foreign Currency, Insightful Insights.

-

Farewell 2014, Hello 2015

David Buckland

January 2, 2015

With 2014 behind us, let’s take a look at the year that was, and consider what could be in store for 2015. continue…

by David Buckland Posted in Economics, Foreign Currency.

- 1 Comments

- save this article

- POSTED IN Economics, Foreign Currency

-

Punting a turnaround?

Roger Montgomery

December 19, 2014

Macau gaming revenues look set to go from bad to worse. According to reports in The South China Morning Post yesterday, Beijing is giving its Ministry of Public Security powers to crack down on illegal money laundering through Macau, in what is described as an unprecedented move.

Money laundering through Macau has, it is speculated, been a primary channel through which wealthy Chinese channel money out from the mainland. continue…

by Roger Montgomery Posted in Foreign Currency, Insightful Insights.

- save this article

- POSTED IN Foreign Currency, Insightful Insights

-

Crash landing or turbulence?

Roger Montgomery

October 20, 2014

As you would be well aware, nobody is able to control share prices. Even the very best quality companies, purchased at steep discounts to intrinsic value, can fall in price over a week or a month or even a year. And so we aren’t surprised to see the share price of one of our holdings – Flight Centre Travel Group Ltd (ASX: FLT) – not flying as high as we’d like. continue…

by Roger Montgomery Posted in Foreign Currency, Insightful Insights, Tourism.

-

Aussie dollar exposure

Ben MacNevin

September 26, 2014

Team Montgomery has long warned the Australian dollar, at near parity to the US dollar, has a fair bit of downside risk (see here, here and here). With that hypothesis now playing out – and commentators starting to crow – you may be wondering which companies may benefit from a stronger US dollar. continue…

by Ben MacNevin Posted in Foreign Currency, Insightful Insights.

- save this article

- POSTED IN Foreign Currency, Insightful Insights