Energy / Resources

-

Does your adviser agree with these stocks?

Roger Montgomery

February 9, 2012

The ability to pick stocks that never go down, is NOT one of our skills. Plenty of you can attest to that. Value investing using the method we advocate in Value.able and using Skaffold.com cannot prevent losses, it is about minimising the cases of permanent impariment.

The ability to pick stocks that never go down, is NOT one of our skills. Plenty of you can attest to that. Value investing using the method we advocate in Value.able and using Skaffold.com cannot prevent losses, it is about minimising the cases of permanent impariment.Asked by BRW’s Tony Featherstone which small caps we liked we nominated a few. Here’s the list and if you cannot read it properly or would like to also read about the TOP 10 Start Ups of 2011, grab this week’s copy of the BRW.

Remember to seek and take personal professional advice before engaging in any security transactions.

Posted by Roger Montgomery, Value.able and Skaffold author and Fund Manager, 9 February 2012.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights, Skaffold.

-

MEDIA

Are the Big Miner’s really good value investments?

Roger Montgomery

February 7, 2012

Roger Montgomery thinks not, and discusses why in this article published in The Sydney Morning Herald on 7th February 2012. Read here.

by Roger Montgomery Posted in Energy / Resources, In the Press, Intrinsic Value, Investing Education.

-

Is the bubble bursting?

Roger Montgomery

December 8, 2011

In 2010 here at the Insights Blog I wrote:

In 2010 here at the Insights Blog I wrote:“a bubble guaranteed to burst is debt fuelled asset inflation; buyers debt fund most or all of the purchase price of an asset whose cash flows are unable to support the interest and debt obligations. Equity speculation alone is different to a bubble that an investor can short sell with high confidence of making money.

The bubbles to short are those where monthly repayments have to be made. While this is NOT the case in the acquisitions and sales being made in the coal space right now, it IS the case in the macroeconomic environment that is the justification for the purchases in the coal space.

China.

If you are not already aware, China runs its economy a little differently to us. They set themselves a GDP target – say 8% or 9%, and then they determine to reach it and as proved last week, exceed it. They do it with a range of incentives and central or command planning of infrastructure spending.

Fixed asset investment (infrastructure) amounts to more than 55% of GDP in China and is projected to hit 60%. Compare this to the spending in developed economies, which typically amounts to circa 15%. The money is going into roads, shopping malls and even entire towns. Check out the city of Ordos in Mongolia – an entire town or suburb has been constructed, fully complete down to the last detail. But it’s empty. Not a single person lives there. And this is not an isolated example. Skyscrapers and shopping malls lie idle and roads have been built for journeys that nobody takes.

The ‘world’s economic growth engine’ has been putting our resources into projects for which a rational economic argument cannot be made.

Historically, one is able to observe two phases of growth in a country’s development. The first phase is the early growth and command economies such as China have been very good at this – arguably better than western economies, simply because they are able to marshal resources perhaps using techniques that democracies are loath to employ. China’s employment of capital, its education and migration policies reflect this early phase growth. This early phase of growth is characterised by expansion of inputs. The next stage however only occurs when people start to work smarter and innovate, becoming more productive. Think Germany or Japan. This is growth fuelled by outputs and China has not yet reached this stage.

China’s economic growth is thus based on the expansion of inputs rather than the growth of outputs, and as Paul Krugman wrote in his 1994 essay ‘The Myth of Asia’s Miracle’, such growth is subject to diminishing returns.

So how sustainable is it? The short answer; it is not.

Overlay the input-driven economic growth of China with a debt-fuelled property mania, and you have sown the seeds of a correction in the resource stocks of the West that the earnings per share projections of resource analysts simply cannot factor in.

In the last year and a half, property speculation has reached epic proportions in China and much like Australia in the early part of this decade, the most popular shows on TV are related to property investing and speculation. I was told that a program about the hardships the property bubble has provoked was the single most popular, but has been pulled.

Middle and upper middle class people are buying two, three and four apartments at a time. And unlike Australia, these investments are not tenanted. The culture in China is to keep them new. I saw this first hand when I traveled to China a while back. Row upon row of apartment block. Empty. Zero return and purchased on nothing other than the hope that prices will continue to climb.

It was John Kenneth Galbraith who, in his book The Great Crash, wrote that it is when all aspects of asset ownership such as income, future value and enjoyment of its use are thrown out the window and replaced with the base expectation that prices will rise next week and next month, as they did last week and last month, that the final stage of a bubble is reached.

On top of that, there is, as I have written previously, 30 billion square feet of commercial real estate under debt-funded construction, on top of what already exists. To put that into perspective, that’s 23 square feet of office space for every man, woman and child in China. Commercial vacancy rates are already at 20% and there’s another 30 billion square feet to be supplied! Additionally, 2009 has already seen rents fall 26% in Shanghai and 22% in Beijing.

Everywhere you turn, China’s miracle is based on investing in assets that cannot be justified on economic grounds. As James Chanos referred to the situation; ‘zombie towns and zombie buildings’. Backing it all – the six largest banks increased their loan book by 50% in 2009. ‘Zombie banks’.

Conventional wisdom amongst my peers in funds management and the analyst fraternity is that China’s foreign currency reserves are an indication of how rich it is and will smooth over any short term hiccups. This confidence is also fuelled by economic hubris eminating from China as the western world stumbles. But pride does indeed always come before a fall. Conventional wisdom also says that China’s problems and bubbles are limited to real estate, not the wider economy. It seems the flat earth society is alive and well! As I observed in Malaysia in 1996, Japan almost a decade before that, Dubai and Florida more recently, never have the problems been contained to one sector. Drop a pebble in a pond and its ripples eventually impact the entire pond.

The problem is that China’s banking system is subject to growing bad and doubtful debts as returns diminish from investments made at increasing prices in assets that produce no income. These bad debts may overwhelm the foreign currency reserves China now has.”

I now wonder whether we are seeing the bubble slip over the precipice? Falling property prices (10 per cent of the Chinese economy) leads to lower construction activity, leads to declining demand for Australian commodities, leads to falling commodity prices, leads to bigs drops in margins for a sizeable portion of the market index…

Watch this video and decide for yourself.

Posted by Roger Montgomery, Value.able author and Fund Manager, 8 December 2011.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Market Valuation, Property, Value.able.

-

What are our thoughts on MCE’s results? And Big Air?

Roger Montgomery

August 24, 2011

What is the value of a company that wakes up to find it has sold very little or even nothing in the last six months? My very long-term outlook for the price of oil hasn’t changed, but I can make the argument that the shares of Matrix C&E cannot currently be valued as a going concern any more confidently than I can a speculative exploration company.

While its a very harsh interpretation and its not the only interpretation, there are things to be concerned about.

Before I go into what disappointed me about the result, let me make an observation about the short term share price action. It appears that many short term investors could be overreacting to the report. Management are very confident that they will win new business and if they do, the share price represents and opportunity.

First, cash flow. Its something I have mentioned here at the blog previously – as have others.

Submitted on 2011/07/05 at 1:08am: “The short and mid term outlook for Matrix will be dependent on them securing some contracts and their cash flow will be dependent on them getting a few deposits paid. We have put a call into the company to see if we can get an answer but they may soon be in blackout so we’ll have to wait and see.”

Submitted on 2011/06/24 at 1:46pm: “Great stuff Ash. Good to challenge and shake things up. Any opposing views, go right ahead and put them up. I know that lots of you are concerned about Matrix. Watch their cash flows…”

There were many useful insights provided here at the blog about Matrix and their cash flow.

Prior to those comments, in April in fact, I noted we had participated in the capital raising at $8.50. But our holdings were small and hadn’t exceeded 1% of our portfolio because of our concerns about cash flow. You may also remember I demonstrated declining intrinsic values for Matrix in the future, which triggered some concerned responses. You really do need to understand the business, and the benefits of diversification.

Many might throw their hands up and give up on the intrinsic value approach, and while I would be delighted to see fewer value investors, this is as much an overreaction as the plunging share price may be today. There are critics who suggest there’s a problem with the intrinsic value approach. Gloating is predictable, but they do fail to understand that any shortcoming is not the approach but its application; You need to understand cash flow (heck, there’s a whole chapter in Value.able!) and you need to understand the business (it’s what Value.able is all about).

So here are some of the facts, thoughts and reasons I think the market is reacting the way it is. Don’t forget, in the short run, the market is a voting machine.

First:

MCE missed analysts’ expectations. Thats the first reason for a negative reaction by the market. I should point out that the share price has been declining significantly for two trading sessions prior to this blog post and has fallen 50% from its highs in April.

Second:

Profit grew 85 per cent (but not by as much on a per share basis). While the question should be if an analyst’s forecast is missed, is it the company’s fault or the analyst’s, in this case those forecasts are a function of company guidance. Guidance was $40 million at the start of the year, then $36 million. This week profit came in at $33.6 million. Earnings per share grew 56 per cent (less than the 85% growth in total NPAT) thanks to a capital raising that was used to construct a facility that hasn’t yet generated returns.

Third:

Fifty six percent growth in earnings is stunning. Make no mistake about that. Again, all things being equal, if such growth were to continue it would almost certainly cause intrinsic values to rise and materially.

Fourth:

The company is forecasting revenue growth of 20 per cent. This is “company guidance”. If NPAT margins can be maintained – duplication costs could be removed next year, which would be positive for margins – profit will equate to 52 cps. But in the face of few or no new contract wins in the last 12 months, are management being optimistic? Thats probably the key to working out if the current price is an overreaction and therefore an opportunity.

To grow revenue by 20 per cent to $224m, they need $114m of new work, on top of the current order book of $110m, which declined 70m in the last six months. Note the zero balance under Deposits in the Balance Sheet too. There’s $500 million of work in the tender pipeline. If they win 30% of that (a figure the company suggests is reasonable) that is $150 million and if won this year, will help the company achieve its target.

Fifth:

Analysts were forecasting 2012 EPS of 66 cents in July. Using these numbers, MCE’s valuation is over $10.00. But your valuation is only as good as your inputs. Those analysts are now forecasting earnings of 61 cents per share for 2012 and my own number is now closer to 51 cents (see above). In the absence of any announcements of contract wins, expect further downgrades from analysts.

Sixth:

Significant contract wins would have the opposite impact on intrinsic value and it could rise again.

Seventh:

If they achieve 52 cents of earnings per share, my intrinsic value becomes $6.80 – still significantly higher than the current share price but well down on the previous estimates of intrinsic value. The fact that $6.80 is above the current share price is one of the reasons I am keen to talk to the company!

But don’t forget, they have to win some contracts, because at the moment the [declining] order book is just 58 per cent of last year’s revenue. More importantly, in the absence of any contract wins, that intrinsic value could fall precipitously. As I say above; “There’s $500 million of work in the tender pipeline. If they win 30% of that (a figure the company suggests is reasonable) that is $150 million and if won this year, will help the company achieve its target.” Its important the company make clear (at the AGM for example) details about the length of the tendering and commissioning cycle for all shareholders.

Eighth:

Aaron Begley is confident that they will convert about 30% of the work they tender for. With $500 million in tender work thats will satisfy their revenue growth targets.

Ninth:

In the first half of last year cash declined, despite the fact the company borrowed more money and raised more capital. In the second half, the business generated just $900,000 of cash. There is no way to dress this up though and its not impressive for a company with a market cap earlier in the year of over $700 million and $350 million now. As mentioned in some of the posts, it could merely be a function of the long lead cycles of commissioning oil rigs, in which case there may be an opportunity worth investigating.

Tenth:

In conclusion, the results revealed this: Order book fell from $180m in the first half to $110m now. The $70 m decline is matched by the cash receipts in the second half. Given the fact that deposits in liabilities on the balance sheet fell to zero, we can assume the company made little or no new sales in the second half. Its with this in mind that you need to consider whether the companies forecasts are bullish or not. They need to win some business to justify the estimate of intrinsic value

As at June 30, 2011, MCE’s quality rating is A2. There is virtually zero chance of a liquidity event. But non manufacturing overheads are running at $750k a month, so the cash will be diminishing if there are no contract wins. That is what is driving the share price lower.

THEY NEED TO WIN SOME CONTRACTS OR SHAREHOLDERS NEED TO BETTER UNDERSTAND THE TENDERING CYCLE LENGTH.

Finally:

It is quite fair for critics to point out the one-eyed focus many investors have on the Value.able intrinsic value formula. The formula is a good one, but it is only as good as the inputs you feed it and they must come from an understanding of the business. I took a call from an share market investor who didn’t understand why the share price for Matrix was falling after reporting such strong profit growth. If that sounds like you, take a break and get back to the books to understand the business and its prospects. At the very least, it will help to either, 1) temper your enthusiasm for a company that is at a discount to your intrinsic value estimate, 2) change your estimate of intrinsic value or, 3) give you a better understanding of whether that intrinsic value is rising or declining.

On a separate note, there is a very real chance of a downside overreaction too, something we are always on the lookout for!

General and Educational Information only. Not a solicitation to act or trade in any security in any way. Always seek and take personal professional advice.

BigAir Group?

Digging in a little deeper to BigAir’s financials and you may notice a few things to be cautious about too – always important to read past what management tell you about revenue numbers climbing to the moon and do your own thinking.

These are all symptoms of a fast growing business, and a business which has grown by acquisition.

Firstly, a little cash strapped? Current Liabilities > Current Assets by 400k. This is mainly due to the $3.6m they owe on their acquisitions in the next 12 months. They have announced the acquisitions but hadn’t paid for them at June 30. Don’t forget that they also owe $1.375m, which is in non-current liabilities – a total of $5m in payments are still to be made for past acquisitions already announced. See note 18 to the accounts for more.

The next 12 months are important, and with Current Liabilities > Current Assets, its not an not an ideal position to be in, although they may be able to cover this by working their working capital. What you now need to work out is if future cash flow and of course CAPEX, which seems to run @ $2.5-$3.2m, will provide enough free cash for them to self fund their operations and liabilities. It is of course is hard to work out because maintenance CAPEX and growth CAPEX is harder to separate when a company grows quickly through acquisitions.

The university business may prove distracting, but some serious players in the industry really like fixed wireless broadband.

General and Educational Information only. Not a solicitation to act or trade in any security in any way. Always seek and take personal professional advice.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 24 August 2011.

by Roger Montgomery Posted in Energy / Resources.

- 176 Comments

- save this article

- POSTED IN Energy / Resources

-

Is shale gas ‘drilling fast and conning Wall Street’?

Roger Montgomery

June 27, 2011

For those interested in Shale Gas stocks, an interesting article was published in the New York Times at the weekend.

For those interested in Shale Gas stocks, an interesting article was published in the New York Times at the weekend.Here’s an excerpt or two from the article…

“Money is pouring in” from investors even though shale gas is “inherently unprofitable,” an analyst from PNC Wealth Management, an investment company, wrote to a contractor in a February e-mail. “Reminds you of dot-coms.”

“And now these corporate giants are having an Enron moment,” a retired geologist from a major oil and gas company wrote in a February e-mail about other companies invested in shale gas. “They want to bend light to hide the truth.”

…and here is the link to the story: http://www.nytimes.com/2011 and a link to more than 480 pages of leaked insider emails and reports: http://www.nytimes.com/interactive

And more recently, in this e-mail chain from April 2011, United States Energy Information Administration officials express concerns about the economic realities of shale gas production.

I am not allowing any comments on this subject. Do your own research and seek personal professional advice.

Please continue contributing to the two prior posts, listing the companies you think we should be watching this reporting season (Scroll Down).

Posted by Roger Montgomery, author and fund manager , 27 June 2011.

by Roger Montgomery Posted in Energy / Resources, Investing Education, Value.able.

-

When to sell? Matrix and other adventures in Value.able Investing

Roger Montgomery

March 18, 2011

In August 2010 Matrix Composites & Engineering, when we first began commenting on the company, was trading around $2.90. Thirty days later the share price was at $4.48. Today MCE is trading at just over $9.00 and has a market capitalisation of more than half a billion dollars. It’s no longer just a little engineering business. Like the Perth industrial precinct of Malaga in which its headquarters are based, MCE is growing rapidly (according to Wikipedia there are currently 2409 businesses with a workforce of over 12,000 people in Malaga. The 2006 census listed only 28 people living in the suburb).

But has MCE’s share price risen beyond what the business is actually worth?

Stock market participants are very good at telling us what we should buy and when. When it comes to selling, it seems silence is the golden rule.

If you receive broker research, take out a report and turn to the very back page – the one beyond the analyst’s financial model. You will often find a table that lists every company covered by that broker’s research department. Now look to the right of each stock listed. What do you notice?

Buy… Buy… Hold… Buy… Buy… Accumulate… Hold…

What about sell?

There aren’t many companies in Australia worthy of a buy-and-hold-forever approach. And if you have invested in a company with a previous BUY recommendation, the luxury of a subsequent Ceasing Coverage announcement by the analyst is not helpful.

So then, when should you sell? It is a question I have been asked, to be honest, I can’t remember how many times. Because I have been asked so many times, it’s a question I answered in Chapter 13 of Value.able – a chapter entitled Getting Out.

Value.able Graduates will recognise a sell opportunity. Yes, it is an opportunity. Fail to sell shares and you could eventually lose money.

Of course, any selling must be conducted with a certain amount of trepidation, particularly when capital gains tax consequences are considered. But not selling simply because of tax consequences is unwise.

We pay tax on our capital gains because we make a gain. Yes, its difficult handing over part of our investment success to the Tax Man for seemingly no contribution, but without success our bank balance would remain stagnant forever.

When then should you sell? In Value.able I advocate five reasons. For now I would like to share with you a possible reason. Based on any of the other reasons I may be selling Matrix so make sure you understand this is a review based on one of five reasons.

Eventually share prices catch up to value. In some cases it can take ten years, but in the case of Matrix, it has taken far less time for the share price to approach intrinsic value.

One signal to sell any share is when the share prices rise well above intrinsic value.

There are no hard and fast rules around this. And don’t believe you can come up with a winning approach with a simple ‘sell when 20% above intrinsic value’ approach either.

What you MUST do is look at the future prospects. In particular, is the intrinsic value rising? I believe it is for Matrix (and I am not the only fund manager who does – you could ask my mate Chris too).

Here’s some of his observations: Risks associated with the timing of getting Matrix’s facility at Henderson up and running are mitigated by keeping Malaga open. And Malaga is producing more units now than it was only a few months ago. Matrix could also produce more units from Henderson than they have suggested (the plant is commissioned to produce 60 units per day) and I believe the cost savings will flow through much sooner than they say. Recall the company has indicated Henderson could save circa $13 million in labour, rent and transport costs (see below analyst comment). Excess build costs are now largely spent and if the company can ramp up to 70 units a day, HY12 revenue could double.

Why do I believe this? Because a recent site visit for analysts suggested it. As one analyst told me: “Production of macrospheres has started from Henderson with 7 of the 22 tumblers in operation. This is a good example of the labour savings to come as it’s now a largely automated process – there were only 3 people working v >20 on this process at Malaga.”

(Post Script: My own visit to WA at the weekend revealed a company capable of producing just over 100 units per day – Henderson + Malaga) Moreover, the sad events unfolding in Japan will force a rethink on Nuclear. If nuclear energy – recently hailed as a green solution to global warming – reverts to being a relic of an old world order, demand for oil will increase. Oil prices will rise. Deep sea drilling will be on everyone’s radar even more so.

And the risks? Well, one is pricing pressure from competitors. This is something that needs to be discussed with management, but preferably with customers!

Some Value.able Graduates may be reluctant to place too much emphasis on future valuations. Indeed I insist on a discount to current valuations. If it is your view that future valuations should be ignored, then you should sell.

Personally I believe one of my most important contributions to the principles of value investing is the idea of future valuations. Nobody was talking about them at the time I started mentioning 2011 and 2012 Value.able valuations and rates of growth. They are important because we want to buy businesses with bright prospects. And a company whose intrinsic value is rising “at a good clip” demonstrates those bright prospects.

If you have more faith and conviction that the business will be more valuable in one, two and three years time, you may be willing to hold on. On the basis of this ONE reason I am currently not rushing to sell Matrix (of course I may sell based on any of the other four reasons), however notwithstanding a change to our view (or one of the other four criteria for selling being met) I do hope for much lower prices (buy shares like you buy groceries…)

I cannot, and will not, tell you to sell or buy Matrix and I might ‘cease coverage’ at any time. As I have said many times here, do not use my comments to buy or sell shares. Do your own research and seek and take personal professional advice.

What I do want to encourage you to do is delve deeply into the company’s history, its management, their capabilities, recent announcements and any other valuable information you can acquire.

And in the spirit demonstrated by so many Value.able Graduates, feel free to share your findings here and build the value for all investors.

When the market values a company much more highly than its performance would warrant, it is time to reconsider your investment. Looking into the prospects for a business and its intrinsic value can help making premature decisions. Premature selling can have a very costly impact on portfolio performance not only because the share price may continue rising for a long time, but also because finding another cheap A1 to replace the one you have sold, is so difficult. At all times remember that my view could change tomorrow and I may not have time to report back here so do your own research and form your own opinions. Also keep in mind that we do not bet the farm on any one stock so even if MCE were to lose money for us (and we will get a few wrong) we won’t lose a lot.

Posted by Roger Montgomery, author and fund manager, 18 March 2011.

by Roger Montgomery Posted in Companies, Energy / Resources, Investing Education, Value.able.

-

Is UNV a diamond or destroyer of wealth?

Roger Montgomery

March 8, 2011

Last month on Your Money Your Call John asked for my insights on Universal Coal (ASX:UNV)l.

UNV is not currently investment grade. It is a business that would not receive an adequate MQR.

Section 3.13 of the Prospectus reads: “The directors… believe that they do not have a reasonable basis to forecast future earnings on the basis that the operations of the company are inherently uncertain”.

Given this statement by management, any investment in Universal Coal appears to be speculative.

Without confidence in the future of the business, estimating its Value.able valuation is nearly impossible and investing is risky.

Turn the stock market off, focus on extraordinary businesses (re-read Chapters 5 – 9 of Value.able), calculate what the business is truly worth and buy them for less than they’re worth. And if you haven’t already done so, pick up your copy of Value.able at my website, www.rogermontgomery.com (there aren’t many Second Edition copies left).

Sky Business Channel have been invited to appear on Your Money Your Call this Thursday, 10 March. Tune in from 8pm Sydney time.

Posted by Roger Montgomery, author and fund manager, 8 March 2011.

by Roger Montgomery Posted in Companies, Energy / Resources.

- 17 Comments

- save this article

- POSTED IN Companies, Energy / Resources

-

Peter Switzer interviews Matrix CEO Aaron Begley

Roger Montgomery

March 4, 2011

Peter Switzer called me earlier this week. He was travelling to Perth and asked me to recommend a CEO to invite on his show. Matrix CEO Aaron Begley instantly came to mind.

Value.able graduates will recall I discovered Matrix a long time ago. It was the first business to achieve my coveted A1 Montgomery Quality Rating (MQR). I have written about Martix in Money magazine and here at the blog, and also shared my insights with Peter on the Sky Business Channel.

Here are the highlights of Peter’s recent interview with Aaron Begley.

I often meet with CEOs and advocate you do the same. Attend AGMs and EGMs, or better yet, call the company. If management isn’t willing to speak to shareholders, that’s a fairly good indication to me of what they think of their owners.

Aaron and the board of Matrix check all the boxes I seek in Value.able companies. Re-read Chapter 6 of Value.able for more of my thoughts. And to watch another CEO interview, click here.

Posted by Roger Montgomery, author and fund manager, 4 March 2011.

by Roger Montgomery Posted in Companies, Energy / Resources.

- 143 Comments

- save this article

- POSTED IN Companies, Energy / Resources

-

Will Iron Ore and Base Metals continue to drive BHP?

Roger Montgomery

February 24, 2011

It has been six months since my last BHP update. With so much smoke surrounding the half-year results, I thought it worth reviewing whether anything – particularly my Value.able valuation, had changed.

It has been six months since my last BHP update. With so much smoke surrounding the half-year results, I thought it worth reviewing whether anything – particularly my Value.able valuation, had changed.You may recall back on 31 August 2010 last year BHPs shares were trading at $42.30. At the time my Value.able intrinsic valuation for BHP was $45-$50 per share. As I write today the shares are trading at $46.09 (they have traded as high as $47.63). Gains of 8.2% over the past 6 months are satisfying, but not spectacular. Gains in MLD, MCE, FGE and DCG have been more impressive.

Since I shared my insights, BHP has of course announced their half-year results and exceeded all prior forecasts. Fifty seven per cent earnings growth was forecast for BHP and 50% per cent for the resource sector as a whole in 2011. This was eclipsed by 71.5 per cent earnings growth.

Booming commodities and record Iron Ore and base metal prices, which account for roughly half of the group’s revenue (see table below), has boosted their result. Having moved away from yearly pricing to a monthly pricing benchmark, BHP has been able to take full advantage of rapid commodity price appreciation.

BHP’s reported revenue from Iron Ore sales in FY11 was up 109.5 per cent. Given its largely fixed production costs, Iron Ore was also the largest contributor from an EBIT perspective, with a 177.90 per cent increase. This is the happy side of operating leverage, which I have discussed previously. And remember, Iron Ore is China’s second largest import, after crude oil.

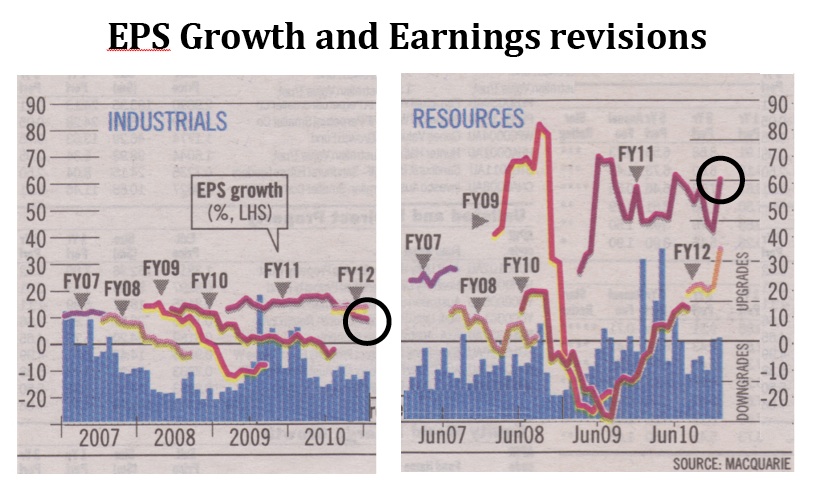

With growth rates and margins of this magnitude, analysts have become even more bullish on our resource sector. Earnings growth for 2011 is now forecast to be 60 per cent (previously 50 per cent) – that’s a 20 per cent increase in just six months. Estimates for 2012 are 30-40 per cent.

Compare this to earnings growth forecasts for the Industrials Sector. The difference of 10 per cent clearly indicates where Australia’s economy will derive its strength.

But can it last? I have said many times that I have no predictive ability. I will leave that for others to determine.

I will however take onboard recent comments from Marius Kloppers, who stated that high Iron Ore pricing should continue for a further 6-9 months. Whilst the Iron Ore market remains in tight supply, I note the many expansion projects currently underway will swell supplies from 2014 onwards – an excellent example of how boom-time profits entice others to enter the market and compete – the very definition of a commodity.

Over the longer-term, BHP’s aggressive $80b growth plan suggests confidence in the markets in which it operates. More importantly, $80b should give investors in mining services businesses cause to celebrate!

With analysts becoming more bullish and being contrarian by nature, I’m more comfortable adopting a conservative approach when it comes to resource companies. So while others continue upgrading their numbers and forecasts based on current market pricing, I will retain my previous AUD $22b profit forecast (hopefully this is conservative enough) for 2011 and my Value.able valuation of AUD $45-$50.

As always, I will also further my conservative approach by seeking substantial margins of safety. There are some A1 opportunities available at present, however they are the exception rather than the rule.

Posted by Roger Montgomery, author and fund manager, 24 February 2011.

ON ANOTHER NOTE… The SMSF Review, along with Alan’s Eureka Report and my team, are delighted to announce an event where 100 per cent of the net proceeds will be donated to those affected by the recent spate of natural disasters. The SMSF Strategy Event – for charity, includes some of the country’s most respected Self Managed Superannuation Fund experts. Tickets are $77 and can be purchased online at www.thesmsfreview.com.au. Click here to view the full event brochure. If you are based in Sydney and manage your own super fund, I encourage you to join me at this very special event.

by Roger Montgomery Posted in Companies, Energy / Resources.

- 119 Comments

- save this article

- POSTED IN Companies, Energy / Resources

-

Is cash made from Sandalwood?

Roger Montgomery

October 28, 2010

A number of Value.able Graduates have asked me to share my view on TFS Corporation Ltd (ASX:TFC), the owner and manager of Indian sandalwood plantations in the east Kimberley region of Western Australia (an area I have visited and can’t wait to get back to).

A number of Value.able Graduates have asked me to share my view on TFS Corporation Ltd (ASX:TFC), the owner and manager of Indian sandalwood plantations in the east Kimberley region of Western Australia (an area I have visited and can’t wait to get back to).The first comment is from SI:

“I just had a look at TFS… wow is all I can say. I agree this is a monopoly in the making. They have control over customers with many signing up to a % of production years in advance and $$ to be set at point of sale. There appears to be medical interest developing, significant cosmetic and industry demand and cultural/religious needs not wants. So demand is very strong and lacking substitutes. On the supply side I see world supply is dwindling and TFS is really the only viable source – also natural/sustainable and green! There also appears to be huge barriers to entry for any competition and TFS is 15 years ahead of any rivals! So using Porters 5 forces: they have power over customers, power of suppliers, no realistic substitute, huge barriers to entry and a monopoly position… WOW they are also vertically integrated soil to end product! Also trading on a PE of approx 5, making money now growing trees, paying a dividend and yet to benefit from revenue from harvest….which appears to offer huge revenue flows starting in 2 years.”

And from James:

“… Their ROE is good, payout low and currently well under value.”

Putting aside the more than slight promotional tone of SI’s comments – thanks SI, it appears on first blush that TFS has several things going for it: bright prospects, possible competitive advantages, high levels of profitability and a valuation greater than the current price. Thanks SI for openly sharing your thoughts on the business.

To add my two cents worth, it would be useful to revisit a very important chapter of Value.able: Cashflow and Goodwill. I fear its importance may have been overlooked by readers. There are been precious few questions about, or discussion, of cashflow at my blog, even though it occupies a very large part of my time analysing companies. For TFS, in the current stage of its lifecycle, this chapter has many considerations for investors to take on board before jumping onto the Sandalwood bandwagon.

Let me start on page 147, third paragraph, bold font: “The cashflow of a company that you invest in must be positive rather than negative”. The reason I have emphasised this statement is because I want to make something very clear – reported accounting profits often bears little resemblance to the cash profits or cashflow of a company.

In business you can only spend cash. Indeed, cash is ‘king’. Try going to the local grocer, showing him an empty wallet and offering instead some accounting surplus to pay for the weeks fruit and veg. You will get just as far in business without real cash – unless the business has access to external funding to plug the gap. Please make sure you re-visit Chapter 9 of Value.able.

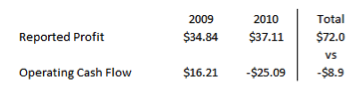

With re-reading from page 145 in mind, focus your attention to the profits and operating cash flows reported by TFS in 2009 and 2010.

TFS has not generated a single dollar of cumulative positive cash flow in the past two years. Despite reporting $72m in profits, TFS actually experienced a cash outflow of -$8.9m. In 2010, a record $37.11m in profits is matched by negative operating cash flows of -$25.09m. Remember page 147, third paragraph, bold font?

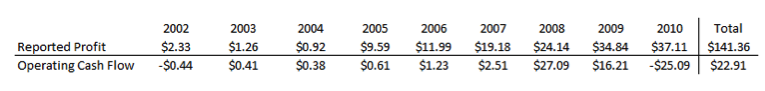

It could however be that the cash flow disparity is merely a timing issue. No problem; a longitudinal study will help. Turning our attention to the past 10 years, is the situation any better?

Total reported profits over this period equate to $141.36m, but this is money TFS cannot spend. The total of operating cash flows produced over the same period, money the business can spend, is significantly lower at $22.91m.

What if I now told you that over the same 10 years, the business had spent $77.43m on investments including property, plant and equipment, and paid $29.94m in dividends!

And all this from Cash Flow of only $22.91m? This is generally only achievable if a business has very accommodating shareholders and financiers – who, to date, have tipped in $61.14m in equity and $43.19m in debt to plug the hole.

Does this business meet Chapter 9’s description of a Value.able business?

Extraordinary businesses don’t have to wait for cash flow. Their already-entrenched competitive position ensures that cash flows readily into management’s hands to be re-deployed/re-invested (with shareholders best interests at heart), or returned.

TFS and many other businesses listed on the ASX are able to utilise various accounting standards to depict the appearance of a profitable business when they are in actual fact heavily reliant on external financing to fund and grow operations.

I am not saying in any way, shape or form that TFS is a business that will head down the same path as many in the sector before it – remember Great Southern Plantations and Timbercorp? TFS may soon produce fruit (so to speak). And if SI and management are right, the business offers “huge revenue flows starting in 2 years”, is a “monopoly in the making” and 2011 will see a significant increase in positive operating cash flow as settlement of institutional sales occurs throughout the year. If this occurs, the business may achieve an investment grade Montgomery Quality Rating (MQR).

I prefer to see runs on the scoreboard – a demonstrated track record – and profits being backed up by uninhibited cash streaming through the door before I open my wallet. Yes, one will miss opportunities adopting this approach but those fish you do catch are generally very good eating.

So until such time as TFS’s cash starts to flow, there are other cash-producing listed A1 businesses to choose from.

This brings up an important point to consider; make sure reported profits are backed up by cash flowing into the business. If it isn’t, be very conservative in your assumptions. Better still, move on to valuing businesses that are extraordinary, those with an MQR of A1, A2 and B1. TFS is a B3.

I will watch this one from the sidelines for now, even if I miss out on returns in the meantime.

Posted by Roger Montgomery, 28 October 2010.

by Roger Montgomery Posted in Companies, Energy / Resources.

- 78 Comments

- save this article

- POSTED IN Companies, Energy / Resources