Monthly Archives: May 2012

Is Japan the Next Black Swan?

Roger Montgomery

May 22, 2012

Forget Europe. That’s old news. The next surprise might just be a bursting of Japan’s bond bubble. Nay, a bursting of Japan itself?

Forget Europe. That’s old news. The next surprise might just be a bursting of Japan’s bond bubble. Nay, a bursting of Japan itself?

According to Fitch, gross general government debt of Japan is likely to reach 239 percent of GDP by end-2012, the highest for any Fitch-rated sovereign. Moreover, Japan’s Fiscal Management Strategy envisages declines in the government debt/GDP ratio only from fiscal year 2021.

Would you lend Japan money (or any country with these financials) at rates approaching zero?

Strong private savings contribute to the country’s persistent current account surpluses. But that’s all going to change as ageing baby boomers (who the government has been borrowing money from at near zero rates – its called financial repression) start to ‘dissave’. As they get older they will stop saving and start needing the cash to finance retirement and healthcare. The result is that the government will need to turn to foreign investors for cash and they are not going to accept zero rates when the country has debt of 240% of GDP.

According to Bloomberg: “How low can bond yields go without triggering a meltdown?

“This question gains urgency as 10-year government yields disappear before the world’s eyes. At 0.83 percent, the lowest level since 2003, they hardly compensate investors for the risks inherent in buying IOUs from the most indebted nation. Public debt is more than twice the size of the $5.5 trillion economy. Worse, it’s still growing. Fitch Ratings today lowered the sovereign-credit rating by one step to A+ with a negative outlook because of Japan’s “leisurely” efforts to cut debt.

“Ignore news that gross domestic product rose an annualized 4.1 percent from the final three months of 2011. The only reason Japan is growing at all is excessive borrowing and zero interest rates. The moment Japan trims its debt, growth plunges, deflation deepens and politicians will demand that the Bank of Japan do more. That’s been Japan’s lot for 20 years now.

Yet what if the BOJ isn’t just setting Japan up for the mother of all crises, but holding the economy back?

“A bizarre dynamic is dominating Japan’s financial system, one evidenced by two-year debt yields falling to about 0.095 percent. That is below the upper range of the BOJ’s zero-to-0.1 percent target for official borrowing costs. It’s below the 0.1 percent interest rate the BOJ pays banks for excess reserves held at the central bank. Such rates raise serious questions.

“The BOJ does reverse auctions where it buys government debt from the market. Last week, it failed to get enough offers from bond dealers. Now think about that: The BOJ prints yen and uses it to buy government debt from banks, which typically hoard the stuff. Last week, banks essentially said: “No, thank you. We’d rather have these dismal interest-bearing securities than your cash, because there’s really nowhere to put that cash anyway.” Banks certainly aren’t lending.

“Politicians are pounding the table demanding that the BOJ expand its asset-purchase program. That, of course, isn’t possible. The BOJ can hardly force banks to swap their bonds for cash. So Japan is left with a problem unique to modern finance. Banks like to keep more cash on deposit at the BOJ than they need to in order to earn a 0.1 percent rate of return, which is pretty good by Japan standards. To pay that rate, the BOJ creates new money, which does nothing to help the economy.

“This dynamic keeps Japan’s monetary engine in neutral at best, and at times running in reverse. Japan’s central bank is essentially now there to support bond prices. It’s a huge intervention that gets little attention. Headlines roll every time the Ministry of Finance sells yen in currency markets. The BOJ’s debt manipulation barely registers.”

Why today?

Last year it was Iron Ore and recently it was minings services for which we suggested conventional wisdom should be questioned. I am posting this topic today because Fitch Ratings lowered Japan’s credit ratings citing rising risks to the sovereign credit profile due to higher public debt ratios.

The long-term foreign and local currency Issuer Default Ratings were lowered to ‘A+’ from ‘AA’ and ‘AA-‘ respectively. The Negative outlook on ratings was maintained.

“The country’s fiscal consolidation plan looks leisurely relative even to other fiscally-challenged high-income countries, and implementation is subject to political risk,” Andrew Colquhoun, Head of Asia-Pacific Sovereigns at Fitch.

The agency warned that a lack of new fiscal policy measures aimed at stabilizing public finances amid continued rises in government debt ratios could lead to a further downgrade.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 22 May 2012.

by Roger Montgomery Posted in Foreign Currency, Global markets, Market Valuation.

What are Russell Muldoon’s Value.able Insights into Seven West Media and Qantas?

Roger Montgomery

May 22, 2012

Do Jumbo Interactive (JIN), Seven West Media (SWM), Matrix Composites (MCE), Toll Holdings (TOL), Blackmores (BKL), Seek (SEK), Silverlake resources (SLR), Paladin Energy (PDN) and Qantas (QAN) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 22 May 2012 to find out. Watch here.

by Roger Montgomery Posted in Airlines, Companies, Investing Education, TV Appearances, Value.able.

- save this article

- POSTED IN Airlines, Companies, Investing Education, TV Appearances, Value.able.

Is the Qantas shake-up promoting transparency, or just shuffling the economic deck?

Roger Montgomery

May 22, 2012

In Radio National’s PM program Roger Montgomery provides his Value.able insights into the short-term economics of the Australian airline industry to the ABC’s David Taylor. Read/Listen here.

This program was broadcast on 22nd May, 2012.

by Roger Montgomery Posted in Airlines, Companies, In the Press, Radio.

- 3 Comments

- save this article

- 3

- POSTED IN Airlines, Companies, In the Press, Radio.

What is HFT and Algo trading?

Roger Montgomery

May 21, 2012

Facebook floated last week and amazingly it has been holding above its IPO price of $38 per share. I say amazingly because I reckon its value to be substantially lower. I will publish my completed calculations in the near future

Facebook floated last week and amazingly it has been holding above its IPO price of $38 per share. I say amazingly because I reckon its value to be substantially lower. I will publish my completed calculations in the near future

Here’s a taster: “For a purchaser of Facebook shares today and wanting 15 percent per year over the next five years (doubling your money), Facebook’s market capitalization has to double to $200 billion without any additional shares being issued (options to be exercised will put paid to any fairy tale notions about that). Google is valued by the market today at $200 billion. Both businesses are similar in terms of margins etc so arguably Facebook needs to increase its sales tenfold in the next five years to achieve the same valuation as Google today. But keep in mind, Google has about $40 billion of cash in its accounts. Facebook has nothing like that.”

For now I thought the trading in Facebook on its first day was a useful entrée to the world of High Frequency and Algorithmic trading and I also thought that comic Andy Borowitz’s tongue-in-cheek look at Facebook provided a welcome break from the doom and gloom pervading investment markets.

From: http://www.borowitzreport.com/

MENLO PARK, CA (The Borowitz Report) – On the eve of Facebook’s IPO, Founder and CEO Mark Zuckerberg published the following letter to potential investors:

Dear Potential Investor:

For years, you’ve wasted your time on Facebook. Now here’s your chance to waste your money on it, too.

Tomorrow is Facebook’s IPO, and I know what some of you are thinking. How will Facebook be any different from the dot-com bubble of the early 2000’s?

For one thing, those bad dot-com stocks were all speculation and hype, and weren’t based on real businesses. Facebook, on the other hand, is based on a solid foundation of angry birds and imaginary sheep.

Second, Facebook is the most successful social network in the world, enabling millions to share information of no interest with people they barely know.

Third, every time someone clicks on a Facebook ad, Facebook makes money. And while no one has ever done this on purpose, millions have done it by mistake while drunk. We totally stole this idea from iTunes.

Finally, if you invest in Facebook, you’ll be far from alone. As a result of using Facebook for the past few years, over 900 million people in the world have suffered mild to moderate brain damage, impairing their ability to make reasoned judgments. These will be your fellow Facebook investors.

With your help, if all goes as planned tomorrow, Facebook’s IPO will net $100 billion. To put that number in context, it would take JP Morgan four or five trades to lose that much money.

One last thing: what will, I, Mark Zuckerberg, do with the $18 billion I’m expected to earn from Facebook’s IPO? Well, I’m considering buying Greece, but that would still leave me with $18 billion. LOL.

Friend me,

Mark

Following that lighthearted distraction, if you are interested in how High Frequency Trading and [some examples] of Algorithmic (Algo) Trading looks in the real world, watch this:

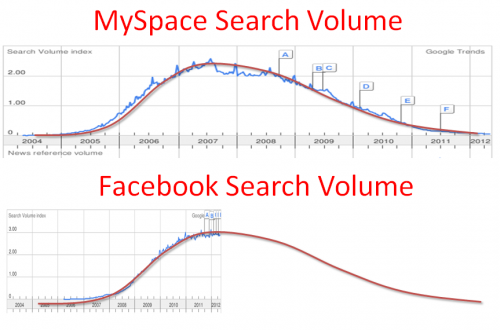

As the following chart reveals (you will have to suspend reality and imagine that the future always looks exactly the same as the past) some analysts think Facebook’s growth will mimic that of other high profile social networks. No doubt the underwriters of Facebook will hope they’re wrong.

Either way it will be more than a little interesting to watch. Did you buy shares in Facebook? If not, why not? And if you did, what were the reasons?

Posted by Roger Montgomery, Value.ableauthor, SkaffoldChairman and Fund Manager, 21 May 2012.

by Roger Montgomery Posted in Insightful Insights, Value.able.

- 16 Comments

- save this article

- 16

- POSTED IN Insightful Insights, Value.able.

What’s the big Idea?

Roger Montgomery

May 21, 2012

Matthew was so disappointed about the April takeover offer for a company he owned, that he wrote a letter to his rep – the CEO

More of us should be doing likewise, remembering the words of Richard Puntillo; “in theory, publicly traded corporations have shareholders as their kings, boards of directors as thesword–wielding knights who protect the shareholders and managers as the vassals who carry out orders. In practice, in the past decade, managers have become kings who lavish gold upon themselves, boards of directors have become fawning courtiers who take coin in return for an uncritical yes-man function and shareholders have become peasants whose property may be seized at management’s whim.”

Has a company you owned shares in been taken over and left you disappointed rather than elated? Its simplistic and a sign of immaturity as an investor to celebrate a takeover when the price paid does not justify the prize. Its far too easy for investors to do the ‘Wall Street walk’ when a bid is received. Matthew’s actions serve as a reminder that their are issues beyond the immediate return that must also be considered.

Hi Roger and team,

I sent the following letter to the CEO of a company today that I am a shareholder in called IDEAS International. They are a small company but very successful and operate in an area that is experiencing huge growth. They are little known, very thinly traded and not appropriate for most investors. Perfect for me!

IDEAS International was formed in 1981 and listed on the ASX in 2001. The IDEAS business is essentially one of analysing computer resource usage. This is important for companies who operate servers because this information allows these companies to increase efficiency and get value for money from their IT purchases. In a commodity like business (i.e. cloud servers) companies that can assist you to squeeze out another 1% in efficiency or when buying $20m of hardware to buy the correct servers for the job, paying a small fee to a company like IDEAS is a no-brainer. They provide independent advice based on real-world scenarios. They collect this information from the other part of their business which is in providing independent monitoring and analysis services to the same companies. Cloud computing is a huge growth area at the moment and it will get bigger. IDEAS is only just making a dent in this business and the demand for their services will grow as the cloud computing business is increasingly commoditised.

On wednesday they went in to a trading halt pending the release of information regarding a control transaction. Today they released a takeover bid by a large international IT outfit called Gartner with the full support of the board. No premium to current prices has been offered, the takeover is at $1.40, the same as the trading price for the last month. The quality of this company is high, it is cheap and Gartner are getting away with robbery.

The below letter doesn’t fit the theme of the recent “Guest Posts” but I thought you might consider it anyway. I won’t be at all concerned if you don’t think it is appropriate.

Kind Regards,

Matthew Rackham

**********

IDEAS InternationalASX Code: IDE“Takeover Disappointment”

Dear Mr Bowhill,

I read with interest the takeover proposal by Gartner for IDEAS released to the ASX this morning.

I am a private investor and I will be up front and say that I am very disappointed to hear that you are recommending the proposal.

IDEAS is a fantastic business. There are very few businesses as good as IDEAS in Australia, let alone on the ASX. Not only is this a fantastic business but by what I have read it seems to be run very well by management. Overlay this on the growth in the server space which IDEAS is in and my impression is this company has many exciting years of growth ahead of it.

In comparison Gartner looks to me to be a lousy business. Significant debt, slim profit margins and poor return on assets are the lot of Gartner’s management and shareholders.

But maybe these could be forgiven if the sale price rewarded current shareholders equally to future shareholders. Sadly however, it does not. If something close to recent performance continues I expect IDEAS to be worth in excess of $3 per share and maybe up to $4.20 in four years time. If the AUD drops this figure will be higher. Looking at your financial statements IDEAS will have the capacity to pay much larger dividends in the very near future as well. Net of cash Gartner are buying our company for $13.1 million and with earnings of $1.9 million and cash flow of $2.8 million – Gartner are making a steal. I expect Gartner will get their purchase outlay back within 4 years, and much earlier when they leverage their much larger distribution network.

I have to ask the question: Why if Gartner are so keen to use the resources of IDEAS do the management of IDEAS not license Gartner as a reseller/agent/partner ? This would ensure the value of IDEAS stays with the shareholders of IDEAS, allow IDEAS management to achieve their aspirations of making IDEAS a globally significant business and Gartner can continue on as, albeit slightly less so than before, a lousy performing business. In this scenario everyone gets the value they are entitled to.

Longstanding shareholders of IDEAS may feel that the performance of IDEAS share price has not been all that great for many years and this is a chance to “cash out” at a good price. What I would say to them is that (1) this is not the time to “cash out” given IDEAS is on the cusp of a large ramp up in use of it’s services – if they have waited this long surely they can hold on a few more years to realise the benefits of their patience and (2) higher share prices in normal circumstances result in greater liquidity in the shares so if they want to cash out they will be able to in a few years anyway. New shareholders from the GFC period have nothing to lose either way (good luck to them!).

I am very frustrated by this opportunistic offer for our company,

Kind Regards,

Matthew Rackham

by Roger Montgomery Posted in Insightful Insights, Value.able.

- 26 Comments

- save this article

- 26

- POSTED IN Insightful Insights, Value.able.

Will increased supply will generate reduced value in commodities?

Roger Montgomery

May 21, 2012

In TheBull.com.au Roger Montgomery discusses his insights into the outlook for Australian commodities share prices over the near future. Read here.

by Roger Montgomery Posted in Companies, Energy / Resources, In the Press.

- 1 Comments

- save this article

- 1

- POSTED IN Companies, Energy / Resources, In the Press.

The G-8 or a win in Race 7 at Moonee Valley?

Roger Montgomery

May 20, 2012

Its hard to tell from the photo, but these are the world’s leaders – those at the centre of the current financial crisis anyway – at the weekend’s G-8 Summit at Camp David Maryland USA.

Its hard to tell from the photo, but these are the world’s leaders – those at the centre of the current financial crisis anyway – at the weekend’s G-8 Summit at Camp David Maryland USA.

Sadly structural change, when foisted on a country, industry sector or company is often hard to discern from the usual cyclical changes. Hopes of a near term recovery persist but are nothing but hope.

The G-8 didn’t agree on next steps to calm the euro zone debt crisis (although money printing has to be on the agenda).

As Famed hedge fund founder Ray Dalio noted at the weekend in an interview with Barrons: “At the moment, there is a tipping toward slowing growth and a question of whether there will be a negative European shock, and that will favor low-risk assets. But to whatever extent we have negative conditions, central banks will respond by printing more money. There will be a big spurt of printing of money, and that will cause a rally and an improvement in the stock markets around the world. It’s like a shot of adrenaline: The heart starts pumping again and then it fades. Then there is another shot of adrenaline. Everybody is asking, “Are we going to have a bull market or a bear market?” I expect we will have both with no big trend. Typically, in these up and down cycles, the upswing will last about twice as long as a down swing. We are now in the higher range of the up-cycle.”

You can read more of Ray’s interview here:

Back to Camp David and the forthright language of point 31 seems sufficiently united to suggest its a topic that we may see in the headlines more because it has a tone of imminence to it…

Here’s the official statement for your ‘leggera’ reading pleasure.

Camp David Declaration

Camp David, Maryland, United States

May 18-19, 2012

Preamble

1. We, the Leaders of the Group of Eight, met at Camp David on May 18 and 19, 2012 to address major global economic and political challenges.

The Global Economy

2. Our imperative is to promote growth and jobs.

3. The global economic recovery shows signs of promise, but significant headwinds persist.

4. Against this background, we commit to take all necessary steps to strengthen and reinvigorate our economies and combat financial stresses, recognizing that the right measures are not the same for each of us.

5. We welcome the ongoing discussion in Europe on how to generate growth, while maintaining a firm commitment to implement fiscal consolidation to be assessed on a structural basis. We agree on the importance of a strong and cohesive Eurozone for global stability and recovery, and we affirm our interest in Greece remaining in the Eurozone while respecting its commitments. We all have an interest in the success of specific measures to strengthen the resilience of the Eurozone and growth in Europe. We support Euro Area Leaders’ resolve to address the strains in the Eurozone in a credible and timely manner and in a manner that fosters confidence, stability and growth.

6. We agree that all of our governments need to take actions to boost confidence and nurture recovery including reforms to raise productivity, growth and demand within a sustainable, credible and non-inflationary macroeconomic framework. We commit to fiscal responsibility and, in this context, we support sound and sustainable fiscal consolidation policies that take into account countries’ evolving economic conditions and underpin confidence and economic recovery.

7. To raise productivity and growth potential in our economies, we support structural reforms, and investments in education and in modern infrastructure, as appropriate. Investment initiatives can be financed using a range of mechanisms, including leveraging the private sector. Sound financial measures, to which we are committed, should build stronger systems over time while not choking off near-term credit growth. We commit to promote investment to underpin demand, including support for small businesses and public-private partnerships.

8. Robust international trade, investment and market integration are key drivers of strong sustainable and balanced growth. We underscore the importance of open markets and a fair, strong, rules-based trading system. We will honor our commitment to refrain from protectionist measures, protect investments and pursue bilateral, plurilateral, and multilateral efforts, consistent with and supportive of the WTO framework, to reduce barriers to trade and investment and maintain open markets. We call on the broader international community to do likewise. Recognizing that unnecessary differences and overly burdensome regulatory standards serve as significant barriers to trade, we support efforts towards regulatory coherence and better alignment of standards to further promote trade and growth.

9. Given the importance of intellectual property rights (IPR) to stimulating job and economic growth, we affirm the significance of high standards for IPR protection and enforcement, including through international legal instruments and mutual assistance agreements, as well as through government procurement processes, private-sector voluntary codes of best practices, and enhanced customs cooperation, while promoting the free flow of information. To protect public health and consumer safety, we also commit to exchange information on rogue internet pharmacy sites in accordance with national law and share best practices on combating counterfeit medical products.

Energy and Climate Change

10. As our economies grow, we recognize the importance of meeting our energy needs from a wide variety of sources ranging from traditional fuels to renewables to other clean technologies. As we each implement our own individual energy strategies, we embrace the pursuit of an appropriate mix from all of the above in an environmentally safe, sustainable, secure, and affordable manner. We also recognize the importance of pursuing and promoting sustainable energy and low carbon policies in order to tackle the global challenge of climate change. To facilitate the trade of energy around the world, we commit to take further steps to remove obstacles to the evolution of global energy infrastructure; to reduce barriers and refrain from discriminatory measures that impede market access; and to pursue universal access to cleaner, safer, and more affordable energy. We remain committed to the principles on global energy security adopted by the G-8 in St. Petersburg.

11. As we pursue energy security, we will do so with renewed focus on safety and sustainability. We are committed to establishing and sharing best practices on energy production, including exploration in frontier areas and the use of technologies such as deep water drilling and hydraulic fracturing, where allowed, to allow for the safe development of energy sources, taking into account environmental concerns over the life of a field. In light of the nuclear accident triggered by the tsunami in Japan, we continue to strongly support initiatives to carry out comprehensive risk and safety assessments of existing nuclear installations and to strengthen the implementation of relevant conventions to aim for high levels of nuclear safety.

12. We recognize that increasing energy efficiency and reliance on renewables and other clean energy technologies can contribute significantly to energy security and savings, while also addressing climate change and promoting sustainable economic growth and innovation. We welcome sustained, cost-effective policies to support reliable renewable energy sources and their market integration. We commit to advance appliance and equipment efficiency, including through comparable and transparent testing procedures, and to promote industrial and building efficiency through energy management systems.

13. We agree to continue our efforts to address climate change and recognize the need for increased mitigation ambition in the period to 2020, with a view to doing our part to limit effectively the increase in global temperature below 2ºC above pre-industrial levels, consistent with science. We strongly support the outcome of the 17th Conference of the Parties to the U.N. Framework Convention on Climate Change (UNFCCC) in Durban to implement the Cancun agreements and the launch of the Durban Platform, which we welcome as a significant breakthrough toward the adoption by 2015 of a protocol, another legal instrument or an agreed outcome with legal force applicable to all Parties, developed and developing countries alike. We agree to continue to work together in the UNFCCC and other fora, including through the Major Economies Forum, toward a positive outcome at Doha.

14. Recognizing the impact of short-lived climate pollutants on near-term climate change, agricultural productivity, and human health, we support, as a means of promoting increased ambition and complementary to other CO2 and GHG emission reduction efforts, comprehensive actions to reduce these pollutants, which, according to UNEP and others, account for over thirty percent of near-term global warming as well as 2 million premature deaths a year. Therefore, we agree to join the Climate and Clean Air Coalition to Reduce Short-lived Climate Pollutants.

15. In addition, we strongly support efforts to rationalize and phase-out over the medium term inefficient fossil fuel subsidies that encourage wasteful consumption, and to continue voluntary reporting on progress.

Food Security and Nutrition

16. For over a decade, the G-8 has engaged with African partners to address the challenges and opportunities afforded by Africa’s quest for inclusive and sustainable development. Our progress has been measurable, and together we have changed the lives of hundreds of millions of people. International assistance alone, however, cannot fulfill our shared objectives. As we move forward, and even as we recommit to working together to reduce poverty, we recognize that our task is also to foster the change that can end it, by investing in Africa’s growth, its expanding role in the global economy, and its success. As part of that effort, we commit to fulfill outstanding L’Aquila financial pledges, seek to maintain strong support to address current and future global food security challenges, including through bilateral and multilateral assistance, and agree to take new steps to accelerate progress towards food security and nutrition in Africa and globally, on a complementary basis.

17. Since the L’Aquila Summit, we have seen an increased level of commitment to global food security, realignment of assistance in support of country-led plans, and new investments and greater collaboration in agricultural research. We commend our African partners for the progress made since L’Aquila, consistent with the Maputo Declaration, to increase public investments in agriculture and to adopt the governance and policy reforms necessary to accelerate sustainable agricultural productivity growth, attain greater gains in nutrition, and unlock sustainable and inclusive country-led growth. The leadership of the African Union and the role of its Comprehensive Africa Agriculture Development Program (CAADP) have been essential.

18. Building on this progress, and working with our African and other international partners, today we commit to launch a New Alliance for Food Security and Nutrition to accelerate the flow of private capital to African agriculture, take to scale new technologies and other innovations that can increase sustainable agricultural productivity, and reduce the risk borne by vulnerable economies and communities. This New Alliance will lift 50 million people out of poverty over the next decade, and be guided by a collective commitment to invest in credible, comprehensive and country-owned plans, develop new tools to mobilize private capital, spur and scale innovation, and manage risk; and engage and leverage the capacity of private sector partners – from women and smallholder farmers, entrepreneurs to domestic and international companies.

19. The G-8 reaffirms its commitment to the world’s poorest and most vulnerable people, and recognizes the vital role of official development assistance in poverty alleviation and achieving the Millennium Development Goals. As such, we welcome and endorse the Camp David Accountability Report which records the important progress that the G-8 has made on food security consistent with commitments made at the L’Aquila Summit, and in meeting our commitments on global health, including the Muskoka initiative on maternal, newborn and child health. We remain strongly committed to reporting transparently and consistently on the implementation of these commitments. We look forward to a comprehensive report under the UK Presidency in 2013.

Afghanistan’s Economic Transition

20. We reaffirm our commitment to a sovereign, peaceful, and stable Afghanistan, with full ownership of its own security, governance and development and free of terrorism, extremist violence, and illicit drug production and trafficking. We will continue to support the transition process with close coordination of our security, political and economic strategies.

21. With an emphasis on mutual accountability and improved governance, building on the Kabul Process and Bonn Conference outcomes, our countries will take steps to mitigate the economic impact of the transition period and support the development of a sustainable Afghan economy by enhancing Afghan capacity to increase fiscal revenues and improve spending management, as well as mobilizing non-security assistance into the transformation decade.

22. We will support the growth of Afghan civil society and will mobilize private sector support by strengthening the enabling environment and expanding business opportunities in key sectors, as well as promote regional economic cooperation to enhance connectivity.

23. We will also continue to support the Government of the Islamic Republic of Afghanistan in its efforts to meet its obligation to protect and promote human rights and fundamental freedoms, including in the rights of women and girls and the freedom to practice religion.

24. We look forward to the upcoming Tokyo Conference in July, as it generates further long-term support for civilian assistance to Afghanistan from G-8 members and other donors into the transformation decade; agrees to a strategy for Afghanistan’s sustainable economic development, with mutual commitments and benchmarks between Afghanistan and the international community; and provides a mechanism for biennial reviews of progress being made against those benchmarks through the transformation decade.

The Transitions in the Middle East and North Africa

25. A year after the historic events across the Middle East and North Africa began to unfold, the aspirations of people of the region for freedom, human rights, democracy, job opportunities, empowerment and dignity are undiminished. We recognize important progress in a number of countries to respond to these aspirations and urge continued progress to implement promised reforms. Strong and inclusive economic growth, with a thriving private sector to provide jobs, is an essential foundation for democratic and participatory government based on the rule of law and respect for basic freedoms, including respect for the rights of women and girls and the right to practice religious faith in safety and security.

26. We renew our commitment to the Deauville Partnership with Arab Countries in Transition, launched at the G-8 Summit last May. We welcome the steps already taken, in partnership with others in the region, to support economic reform, open government, and trade, investment and integration.

27. We note in particular the steps being taken to expand the mandate of the European Bank for Reconstruction and Development to bring its expertise in transition economies and financing support for private sector growth to this region; the platform established by international financial institutions to enhance coordination and identify opportunities to work together to support the transition country reform efforts; progress in conjunction with regional partners toward establishing a new transition fund to support country-owned policy reforms complementary to existing mechanisms; increased financial commitments to reforming countries from international and regional financial institutions, the G-8 and regional partners; strategies to increase access to capital markets to help boost private investment; and commitments from our countries and others to support small and medium-sized enterprises, provide needed training and technical assistance and facilitate international exchanges and training programs for key constituencies in transition countries.

28. Responding to the call from partner countries, we endorse an asset recovery action plan to promote the return of stolen assets and welcome, and commit to support the action plans developed through the Partnership to promote open government, reduce corruption, strengthen accountability and improve the regulatory environment, particularly for the growth of small- and medium-sized enterprises. These governance reforms will foster the inclusive economic growth, rule of law and job creation needed for the success of democratic transition. We are working with Partnership countries to build deeper trade and investment ties, across the region and with members of the G-8, which are critical to support growth and job creation. In this context, we welcome Partnership countries’ statement on openness to international investment.

29. G-8 members are committed to an enduring and productive partnership that supports the historic transformation underway in the region. We commit to further work during the rest of 2012 to support private sector engagement, asset recovery, closer trade ties and provision of needed expertise as well as assistance, including through a transition fund. We call for a meeting in September of Foreign Ministers to review progress being made under the Partnership.

Political and Security Issues

30. We remain appalled by the loss of life, humanitarian crisis, and serious and widespread human rights abuses in Syria. The Syrian government and all parties must immediately and fully adhere to commitments to implement the six-point plan of UN and Arab League Joint Special Envoy (JSE) Kofi Annan, including immediately ceasing all violence so as to enable a Syrian-led, inclusive political transition leading to a democratic, plural political system. We support the efforts of JSE Annan and look forward to seeing his evaluation, during his forthcoming report to the UN Security Council, of the prospects for beginning this political transition process in the near-term. Use of force endangering the lives of civilians must cease. We call on the Syrian government to grant safe and unhindered access of humanitarian personnel to populations in need of assistance in accordance with international law. We welcome the deployment of the UN Supervision Mission in Syria, and urge all parties, in particular the Syrian government, to fully cooperate with the mission. We strongly condemn recent terrorist attacks in Syria. We remain deeply concerned about the threat to regional peace and security and humanitarian despair caused by the crisis and remain resolved to consider further UN measures as appropriate.

31. We remain united in our grave concern over Iran’s nuclear program. We call on Iran to comply with all of its obligations under relevant UNSC resolutions and requirements of the International Atomic Energy Agency’s (IAEA) Board of Governors. We also call on Iran to continuously comply with its obligations under the Nuclear Non-Proliferation Treaty, including its safeguards obligations. We also call on Iran to address without delay all outstanding issues related to its nuclear program, including questions concerning possible military dimensions. We desire a peaceful and negotiated solution to concerns over Iran’s nuclear program, and therefore remain committed to a dual-track approach. We welcome the resumption of talks between Iran and the E3+3 (China, France, Germany, Russia, the United Kingdom, the United States, and the European Union High Representative). We call on Iran to seize the opportunity that began in Istanbul, and sustain this opening in Baghdad by engaging in detailed discussions about near-term, concrete steps that can, through a step-by-step approach based on reciprocity, lead towards a comprehensive negotiated solution which restores international confidence that Iran’s nuclear program is exclusively peaceful. We urge Iran to also comply with international obligations to uphold human rights and fundamental freedoms, including freedom of religion, and end interference with the media, arbitrary executions, torture, and other restrictions placed on rights and freedoms.

32. We continue to have deep concerns about provocative actions of the Democratic People’s Republic of Korea (DPRK) that threaten regional stability. We remain concerned about the DPRK’s nuclear program, including its uranium enrichment program. We condemn the April 13, 2012, launch that used ballistic missile technology in direct violation of UNSC resolution. We urge the DPRK to comply with its international obligations and abandon all nuclear and ballistic missile programs in a complete, verifiable, and irreversible manner. We call on all UN member states to join the G-8 in fully implementing the UNSC resolutions in this regard. We affirm our will to call on the UN Security Council to take action, in response to additional DPRK acts, including ballistic missile launches and nuclear tests. We remain concerned about human rights violations in the DPRK, including the situation of political prisoners and the abductions issue.

33. We recognize that according women full and equal rights and opportunities is crucial for all countries’ political stability, democratic governance, and economic growth. We reaffirm our commitment to advance human rights of and opportunities for women, leading to more development, poverty reduction, conflict prevention and resolution, and improved maternal health and reduced child mortality. We also commit to supporting the right of all people, including women, to freedom of religion in safety and security. We are concerned about the reduction of women’s political participation and the placing at risk of their human rights and fundamental freedoms, including in Middle East and North Africa countries emerging from conflict or undergoing political transitions. We condemn and avow to stop violence directed against, including the trafficking of, women and girls. We call upon all states to protect human rights of women and to promote women’s roles in economic development and in strengthening international peace and security.

34. We pay tribute to the remarkable efforts of President Thein Sein, Daw Aung San Suu Kyi, and many other citizens of Burma/Myanmar to deliver democratic reform in their country over the past year. We recognize the need to secure lasting and irreversible reform, and pledge our support to existing initiatives, particularly those which focus on peace in ethnic area, national reconciliation, and entrenching democracy. We also stress the need to cooperate to further enhance aid coordination among international development partners of Burma/Myanmar and conduct investment in a manner beneficial to the people of Burma/Myanmar.

35. We recognize the particular sacrifices made by the Libyan people in their transition to create a peaceful, democratic, and stable Libya. The international community remains committed to actively support the consolidation of the new Libyan institutions.

36. We condemn transnational organized crime and terrorism in all forms and manifestations. We pledge to enhance our cooperation to combat threats of terrorism and terrorist groups, including al-Qa’ida, its affiliates and adherents, and transnational organized crime, including individuals and groups engaged in illicit drug trafficking and production. We stress that it is critical to strengthen efforts to curb illicit trafficking in arms in the Sahel area, in particular to eliminate the Man-Portable Air Defense Systems proliferated across the region; to counter financing of terrorism, including kidnapping for ransom; and to eliminate support for terrorist organizations and criminal networks. We urge states to develop necessary capacities including in governance, education, and criminal justice systems, to address, reduce and undercut terrorist and criminal threats, including “lone wolf” terrorists and violent extremism, while safeguarding human rights and upholding the rule of law. We underscore the central role of the United Nations and welcome the Global Counterterrorism Forum (GCTF) and efforts of the Roma-Lyon Group in countering terrorism. We reaffirm the need to strengthen the implementation of the UN Al-Qaida sanctions regime, and the integrity and implementation of the UN conventions on drug control and transnational organized crime.

37. We reaffirm that nonproliferation and disarmament issues are among our top priorities. We remain committed to fulfill all of our obligations under the Nuclear Nonproliferation Treaty and, concerned about the severe proliferation challenges, call on all parties to support and promote global nonproliferation and disarmament efforts.

38. We welcome and fully endorse the G-8 Foreign Ministers Meeting Chair’s Statement with accompanying annex.

Conclusion

39. We look forward to meeting under the presidency of the United Kingdom in 2013.

Indeed!

Posted by Roger Montgomery, Value.ableauthor, SkaffoldChairman and Fund Manager, 20 May 2012.

by Roger Montgomery Posted in Economics.

- 9 Comments

- save this article

- 9

- POSTED IN Economics.

Is this what they mean?

Roger Montgomery

May 16, 2012

When pundits talk of blood in the streets, is this what they mean?

When pundits talk of blood in the streets, is this what they mean?

The chart above is a Market Heat Map for the All Ordinaries. The brightest green is a move up of more than 6% on the day. Not many fit that bill today. The brightest red is a move down of more than 6%. The size of each box is related to market capitalisation. You can see the four big boxes in the lower middle of the heat map – thats the big four banks.

And if you are wondering what the little bright green stock is at the lower right of the Heat Map, that’s Industrea (ASX: IDL, Skaffold Quality Score A3). A year ago IDL was trading at $1.57 but its intrinsic value in Skaffold was just $1.13. Based on expected 2012 results Skaffold’s intrinsic value was just 83 cents and on May 9 this the share price fell to 80 cents. So it a took a year to get there but the price traded at a 4% discount to intrinsic value – admittedly not a very wide discount. And today IDL is bright green in a sea of red ink because it received a takeover offer from GE at $1.27.

Turning back to the Heat Map and the red appearing everywhere (it could all be very bright green tomorrow – we are not in the business of predicting prices) the fact is that it’s not common for us to look at prices with this much interest unless things are indeed getting interesting. We know the companies we’d like to own and the prices we’d like to pay – all that’s left to do is to turn the market on and see if anyone is prepared to do something silly today.

Today might just have been one of those days. Only time will tell and of course never bet the farm on one throw of the dice. So are we looking at a market on the precipice (the same precipice many of you have indicated you believe house prices are sitting on)? Or if you are reading this after the close, have you missed the boat? WHat are your advisers telling you?

There are some incredibly learned and articulate readers that regularly visit and I’d be delighted to hear your thoughts.

Posted by Roger Montgomery, Value.ableauthor, SkaffoldChairman and Fund Manager, 16 May 2012.

by Roger Montgomery Posted in Investing Education, Value.able.

- 76 Comments

- save this article

- 76

- POSTED IN Investing Education, Value.able.

Pumpkins and Mice 2012?

Roger Montgomery

May 16, 2012

In light of my recent posts about China slowing, the price of iron ore under pressure from a gigantic supply response, our avoidance of BHP/RIO/FMG as investments and our profit taking last month in our mining services holdings…

In light of my recent posts about China slowing, the price of iron ore under pressure from a gigantic supply response, our avoidance of BHP/RIO/FMG as investments and our profit taking last month in our mining services holdings…

In April, we warned more frequently than before that the mining boom appeared to be on shaky ground. Of particular interest to us has been the support for Iron Ore prices even in the face of a very great supply response.

If you are keen to study our thoughts on Iron Ore and why we don’t own BHP currently and why we have already sold the bulk of our mining services holdings you can read the following links:

April 3) http://rogermontgomery.com/mining-services-a-crowded-trade/

April 18) http://rogermontgomery.com/building-heaps-piles-at-bhp/

APril 11) http://rogermontgomery.com/will-china-demand-iron-or/

In 2010-11, world iron ore production grew 8.1% or 227mt to 2.8bt. Assuming similar growth levels in 2011-12 – in a classic supply response BHP production is forecast to grow by 20%, RIO by 30%, FMG 25% – iron ore production will grow to 3,037bt, an increase of 237mt.

And assuming China consumes 60% of global production again (highly optimistic), their demand would increase by 136.2mt. However moderating growth means current estimates for China’s iron ore requirements are half this level. With few other countries growing or competing heavily with China, who will pick up that supply overhang in a low growth environment?

By 2015 we estimate that two entire Pilbara regions (700mt) in supply terms will come onto the market. It’s a far stretch to expect China to absorb 420mt (60%) of that. The impact we expect is pressure on iron ore prices.

And finally, just days after BHP and RIO said they are reassessing their development plans…This just flashed across our screens:

*DJ BHP Chairman: World Faces Increasing Volatility, Uncertainty

(MORE TO FOLLOW) Dow Jones Newswires

May 15, 2012 23:37 ET (03:37 GMT)

*DJ BHP’s Jacques Nasser: Australia One Of Higher-Cost Countries For Miners

(MORE TO FOLLOW) Dow Jones Newswires

May 15, 2012 23:38 ET (03:38 GMT)

*DJ BHP Chairman: Shareholders Have Lost Confidence In Health Of World Economy

(MORE TO FOLLOW) Dow Jones Newswires

May 15, 2012 23:39 ET (03:39 GMT)

*DJ BHP Chairman: Tailwind Of Higher Commodity Prices Moderating

(MORE TO FOLLOW) Dow Jones Newswires

May 15, 2012 23:40 ET (03:40 GMT)

*DJ BHP Chairman: Will Redirect Capital If Any Product, Geography Doesn’t Suit

(MORE TO FOLLOW) Dow Jones Newswires

May 15, 2012 23:44 ET (03:44 GMT)

DJ BHP Chairman Says Commodity Price Tailwind To Ease Further

SYDNEY (Dow Jones)–The tailwind of high commodity prices, which have helped the mining

sector report record growth in recent years, is moderating and is expected to ease

further, the chairman of BHP Billiton Ltd. (BHP) said Wednesday.

The sector also faces continuing global volatility and uncertainty since the global

financial crisis, which has led shareholders to lose confidence and focus more on cash

returns and dividend yields, Jacques Nasser said at a business lunch in Sydney.

“Rather than the world settling down, we will face increasing volatility and

uncertainty,” he said. “It is really going to feel as if the ground is shifting

under our feet.”

Nasser described the 2008 crisis as a structural shift and said ongoing developments in

the eurozone were a short time ago “almost unthinkable.”

-By Rhiannon Hoyle, Dow Jones Newswires; 61-2-8272-4625

(END) Dow Jones Newswires

May 15, 2012 23:49 ET (03:49 GMT)

Copyright (c) 2012 Dow Jones & Company, Inc.

Posted by Roger Montgomery, Value.ableauthor, SkaffoldChairman and Fund Manager, 16 May 2012.

by Roger Montgomery Posted in Energy / Resources.

- 3 Comments

- save this article

- 3

- POSTED IN Energy / Resources.

The Buffett & Munger Show 2012

Roger Montgomery

May 16, 2012

A broker sent us a copy of these notes taken at the 2012 Berkshire Annual general meeting. The media has taken excerpts and they’ve gone viral but we like the completeness of the document we were sent. Have a read and feel free to share your thoughts.

A broker sent us a copy of these notes taken at the 2012 Berkshire Annual general meeting. The media has taken excerpts and they’ve gone viral but we like the completeness of the document we were sent. Have a read and feel free to share your thoughts.

2012 Berkshire Hathaway Notes Annual Meeting Notes

Posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 16 May 2012.

by Roger Montgomery Posted in Companies, Insightful Insights.

- 9 Comments

- save this article

- 9

- POSTED IN Companies, Insightful Insights.