The world is volatile. Your financial future doesn’t have to be. Explore our private credit funds here.

-

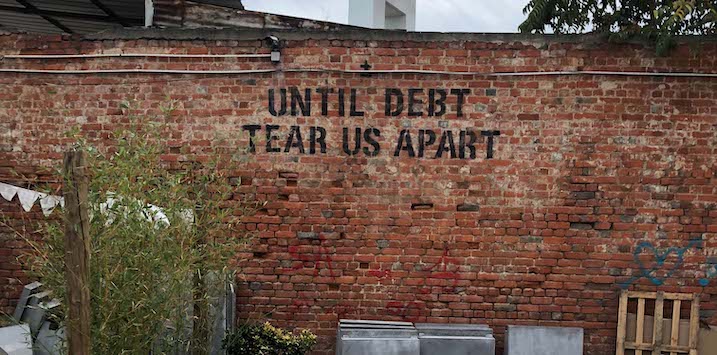

Does debt no longer matter?

Joseph Kim

June 2, 2020

As countries look to re-open their economies, the narrative from financial media circles has been one of re-opening and “V-shaped” recoveries to explain the recent rally in equity markets, despite the significant uncertainty that dominates real world events. Continue…

by Joseph Kim Posted in Investing Education.

- save this article

- POSTED IN Investing Education.

-

EML looks set to thrive as economies reopen

Dominic Rose

June 1, 2020

EML Payments (ASX:EML) is an exciting Fintech that delivers innovative payment processing technologies to organisations operating within many industries and countries. The business has weathered the COVID-19 lockdown much better than feared, and is now ideally placed to benefit as global economies reopen and the structural migration trend towards digital payments accelerates. Continue…

by Dominic Rose Posted in Companies, Editor's Pick, Stocks We Like.

- save this article

- POSTED IN Companies, Editor's Pick, Stocks We Like.

-

Are we about to see the end of the CBD?

Andreas Lundberg

June 1, 2020

I remember some years back hearing a ‘futurist’ predict that high-rise office buildings could end up being like the pyramids of Egypt – large relics for future generations to ponder. The COVID-19 work-from-home restrictions have made this prediction worth considering. Investors now need to ask: is there trouble ahead for real estate investment trusts (REITs) with big office portfolios? Continue…

by Andreas Lundberg Posted in Companies.

- 5 Comments

- save this article

- 5

- POSTED IN Companies.

-

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

-

-

Avita Medical – a small cap with big potential

Joseph Kim

May 28, 2020

Around 12 months ago, we noted that Avita Medical (ASX:AVH) – which provides a novel approach to skin regeneration – was a business worth keeping tabs on. Although its share price has felt the effects of the COVID-19 market sell-off, our positive view of the company has not changed. Continue…

by Joseph Kim Posted in Companies, Editor's Pick, Stocks We Like.

- 10 Comments

- save this article

- 10

- POSTED IN Companies, Editor's Pick, Stocks We Like.

-

Our take on Aristocrat Leisure’s recent results

Stuart Jackson

May 27, 2020

Investors in Australian slot machine and mobile games developer, Aristocrat Leisure (ASX:ALL), have enjoyed stellar returns over the past 10 years, with the share price up over 500 per cent in that time. However, its results for the 6 months to the end of March were patchy, and it remains to be seen how strongly the business can emerge from the coronavirus lockdown. Continue…

by Stuart Jackson Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like.