Avita Medical – a small cap with big potential

Around 12 months ago, we noted that Avita Medical (ASX:AVH) – which provides a novel approach to skin regeneration – was a business worth keeping tabs on. Although its share price has felt the effects of the COVID-19 market sell-off, our positive view of the company has not changed.

For those unfamiliar with Avita, the company produces a medical device called RECELL, which produces a “suspension” of spray-on skin cells using a small sample of the patient’s own skin to help treat burn patients and skin defects. The primary purpose of RECELL is to initially treat patients with acute and severe burns with longer-term aspirations to penetrate other skin-related addressable markets such as wound care (trauma, ulcers) and vitiligo. The company has secured FDA approval in the form of a Pre-Market Approval (PMA) for use of RECELL in its primary US market and is looking to conduct trials to broaden RECELL’s label indications for new applications.

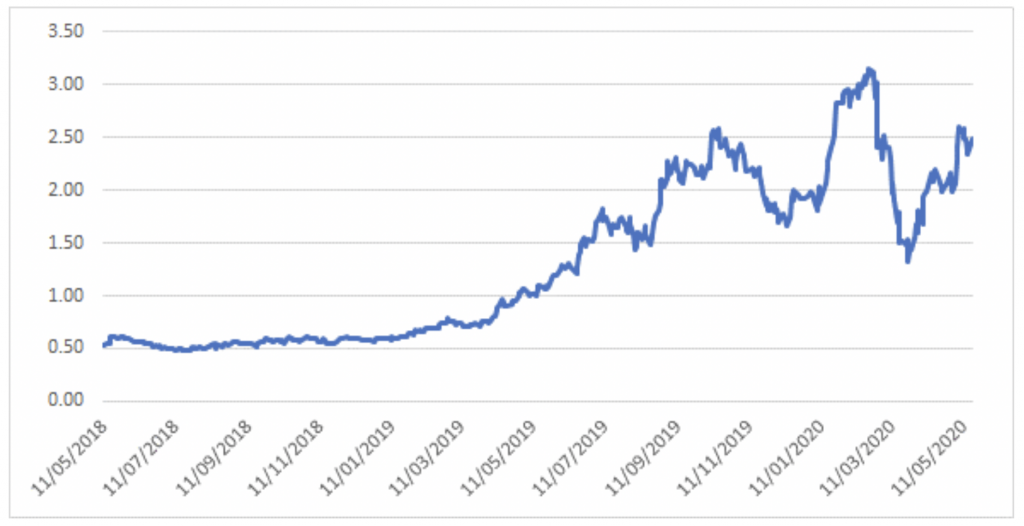

Recent share price performance

The share price has been quite a ride over the past 2 years – the stock was trading at 5 cents in May 2018 before FDA approval in September 2018 led to a fundamental re-rating of the share price. It was one of the top performers in the ASX in 2019, with the share price rising almost 8-fold despite issuing around 10 per cent new shares to accelerate development of potential wider indication and label use. After peaking with the market in February 2020, the share price has been caught up in broader COVID-19 selling like many other growth companies, and is now sitting at 47 cents per share.

Avita Medical – 2 year share price history

Source: Montgomery Investment Management, Bloomberg

Notably, the recent bounce in Avita has lagged that of its most commonly referred to peer PolyNovo, which may be a function of the uncertainty from Australian investors as a result of the company’s announcement to re-domicile its primary listing to the US.

Polynovo – 2 year share price history

Source: Montgomery Investment Management, Bloomberg

We view re-domiciliation as sensible and necessary given benefits of eliminating duplication of compliance related activities and costs, with potential forgone costs of approximately $400,000 per annum. Also, it is important to note re-domiciliation is not a de-listing – the company has outlined the formation of Chess Depository Receipts (CDIs) in Avita which will ensure no disruption to trading in AVH’s Australian listing – we point to Resmed (RMD AU) as a successful example of such an arrangement.

What is the impact of COVID-19?

Like most companies, Avita is unlikely to be immune from the broader impacts of coronavirus. While the company is shielded to some degree given burns are non-elective surgeries, the company may see a reduction in burns incidents given stay-at-home orders in the US lead to lower levels of activity. For example, the company has indicated potential declines in the number of burn patients from zero to 20 per cent.

There is also a re-shifting of focus of the US medical system to COVID-19 to preserve capacity for coronavirus patients.

The more obvious impact has been on AVH’s efforts to ramp up burn centre coverage and product penetration within existing accounts given movement restrictions on its sales team. This will likely slow the trajectory of sales over the near-term. The company does however appear well positioned from a supply perspective with inventory on hand in case of disruption at its manufacturing facilities in California.

There has also been an impact on the pace of enrolment of investigational studies as resources are prioritised for coronavirus patients, which will delay results from pivotal trials in soft tissue reconstruction, paediatric patrial thickness and vitiligo feasibility.

What is coronavirus’s future impact on the company?

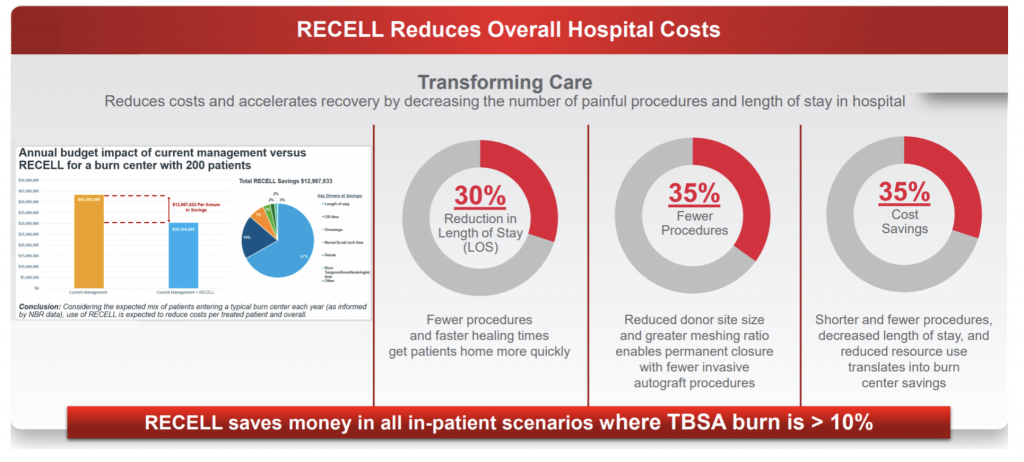

While coronavirus in the US is undoubtedly a setback for the company, we expect these to be temporary in nature given RECELL’s unique product proposition in terms of clinically proven benefits (significantly reduced donor skin requirements). Peer-reviewed studies have also supported RECELL’s favourable cost-benefit profile for hospitals given reduced patient length of stay.

For example, our survey of US surgeons indicates that over 85 per cent of users have noticed a somewhat or significant beneficial impact on time to healing for patients, with additional positive outcomes on patient comfort (more than 75 per cent), scarring (more than75 per cent) and satisfaction (more than 70 per cent). The survey helps to confirm a number of the claims by the company with regards to length of stay, fewer procedures and cost savings, while the key claim on reduction of donor skin is the basis for FDA approval.

Most of these surgeons also expect potential for expanded use of RECELL in areas such as trauma and paediatric scalds (more than 75 per cent), suggesting readily addressable markets should clinical trials and effective reimbursement support these indications in future.

Key metrics we are monitoring

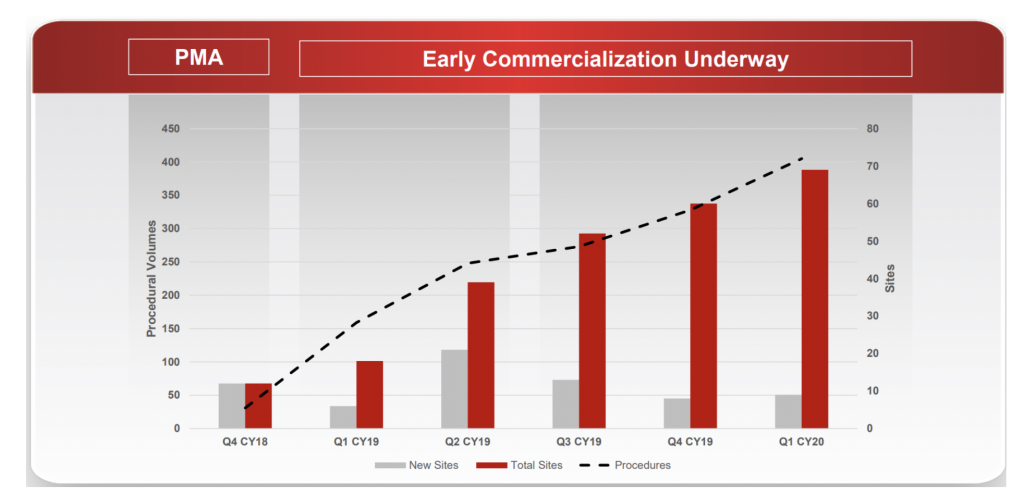

With RECELL commercialisation still at a relatively early stage, there are three key metrics we are monitoring:

- Growth in procedural volumes;

- Account numbers (new and cumulative; and

- Certified physicians (new and cumulative).

These three metrics provide insight into the breadth and depth of adoption across burn surgeons. For example, the company has demonstrated very good progress in account penetration since commercial launch with 69 cumulative accounts compared to AVH’s initial target market of 132 high-volume Burn Centres in the US.

However, a significant pick-up in sales will require greater adoption on smaller burns (our research suggests current use is skewed towards higher degree burn patients, consistent with the most favourable cost-benefit and healing outcomes). Despite the COVID-19 disruptions, we expect this to be a key focus of the company and its field staff in the coming periods.

Financial metrics

Despite the more recent pull-back in the share price, traditional short-hand valuation techniques (ex-DCF) would still indicate “lofty” multiples on the company’s near-term financial metrics versus market capitalisation.

For example, the current 12-month run-rate of sales of around $21 million (ex-BARDA) would indicate more than 40x enterprise value to sales. The company remains loss making on an EBITDA level, as it has recently raised capital to ramp up sales initiatives, invest in R&D and expand indications over the next 12-24 months. Along with device sales and BARDA reimbursement, development activity will be funded by the aforementioned $120 million equity raising from November 2019, which sees the company well capitalised over the medium term.

Our research suggests continued inroads into “taking share” off the existing standard of care (skin autografting) and clinical success on new indications (paediatrics, trauma, vitiligo etc) is expected to present an addressable market opportunity and subsequent earnings profile that has the potential for Avita to comfortably justify and exceed its current market capitalisation over time.

This also excludes longer-term potential in geographic expansion.

Key to RECELL’s success will be surgeon acceptance (underpinned by clinical data), as well as a level of product reimbursement that promotes wide-scale adoption. For example, favourable outcomes on outpatient reimbursement will not only increase the addressable market, but greatly accelerate the trajectory of sales given a higher number of burns patients.

The Montgomery Fund and Montgomery [Private] Fund owns shares in Avita Medical. This article was prepared 27 May with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Avita Medical you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Trent Russell

:

Hi Joesph,

I bought shares in this company a few years ago and have bought some more since. I think the company has a lot of potential. However I recently read an article that it was one of the top 20 shorted companies on the ASX, whilst I have a basic understanding of the shorting of a stock, I don’t understand why it appears on the list, is it because they think the company is way over priced and if so why? Im concerned because I think its good value at the moment and not sure what Im missing?

Joseph Kim

:

Hi Trent,

There are numerous reasons for why a company may be shorted, with an investor thinking the company is overpriced just one of those. In the case of Avita, it is probably more to do with the current level of cash burn being seen as unsustainable, albeit I note it is elevated to some extent given the COVID disruptions and AVH undergoing several key trials which are clearly investment for potential future revenue opportunities.

I agree the company – and the RECELL device – has a lot of potential. Unfortunately for AVH, COVID in the US has been very disruptive for its roll-out plans given the impact it has had on the US medical system. Should the company be able to extend into new indications and surgeons are able to re-focus on improving patient outcomes post vaccine roll-out, I anticipate significant revenue growth in the future.

Trent Russell

:

Thanks Joseph,

As always your team are extremely helpful in explaining complex issues to the average investor, like me.

Thanks

Trent

Joseph Kim

:

Thanks for your kind words Trent.

david klumpp

:

Hi Joseph: As outlined in your article, I agree AVH is an interesting company with a lot of potential. However, I think there are a couple of matters that are of concern with this company. Firstly, when one compares this company with the similar-themed (biosynthetic treatment of wounds) Polynovo (PNV), the management pay themselves extremely generously (and compared with the revenue generated). AVH CEO was paid US$17.3M in 2020 on revenue of $US14.3M in June 2020. The CFO similarly gets a generous $5.8M. Am I missing something here? PNV CEO received $A2.1M yet generated revenue of $A22.2M, and is close to being profitable (2021 likely), unlike AVH that is at least 3 years from generating positive free cash flow. The second matter is the IP protection provided by patents that are held by AVH. As I understand it these were granted a number of years ago, and are in effect for 10 years. What is to stop other companies from replicating these ideas and competing with AVH? I realize that AVH has first-mover advantage in it’s long history of R&D and the regulatory approvals given or in the pipeline. Be interested in your feedback on these concerns. As I understand AVH is still significant holding in the MF?

Joseph Kim

:

Hi David,

I agree the CEO pay does look unsustainably especially relative to the size of the company – while this is partly a function of a rapidly increasing share price (relative to the share price when they were issued for various vesting hurdles), we understand there has also been an adjustment for prior year’s in terms of opportunity cost and unlikely to be repeated going forward.

In terms of patents – you are right in terms of patent protection, but the timeline for trials and regulatory approvals is generally a multi-year process (the world’s pursuit of a COVID-19 vaccine being an outlier). The second element is generally physician acceptance – which may also take considerable time, so first mover advantage is very important in this regard.

Julian Male

:

Hi Joe,

I noted from the consolidated reports there was a significance increase in revenue, EBITDA Current assets in 2019 from 2018. At the same there were also signicsnt losses in 2018 of $1.77 per share to $2.78 in 2019.How do we reconcile the performance of the companywith difference in figures please? Or am I missing something.

Many thanks

Joseph Kim

:

Hi Julian,

The losses per share increased despite increases in revenue as the company is gearing up its Research & Development and sales and marketing spend in anticipation of broader roll-out and pursuing different indications.

Hope that helps

Thanks

Daniel

:

Thanks for the update on this interesting company.

I recently sold my AVH shares as I don’t want to inadvertently end up with US shares and the extra paperwork/ hassle that can entail. Was this the right thing to do, or would my ASX shares continue to be listed on the ASX?

I’m a little confused how this works. I have held other similar companies like Mesoblast and Resmed but never while the re-domicil takes place.

Thanks

Joseph Kim

:

Hi Daniel,

As I understand, you will end up owning shares in a US domiciled company, but it will be listed on the Australian Stock market via a Chess Depositary Instrument (CDI). The scheme documents should explain in full, but the likely sequence of events is that your AVH shares will be exchanged for CDIs at a ratio of 20:1, so for every 20 AVH shares, you will get 1 AVH CDI, valued at 20x the current share price (so $9.40 per CDI at the current 47c AVH share price). You will be able to trade these instruments the same way as your prior AVH shares.

The alternative is you can always wait for the redomiciliation to take place (assuming it is approved by shareholders) and buy AVH CDIs after it has taken place.

Hope that helps Daniel.