To visit the February 2026 reporting season calendar Click here .

-

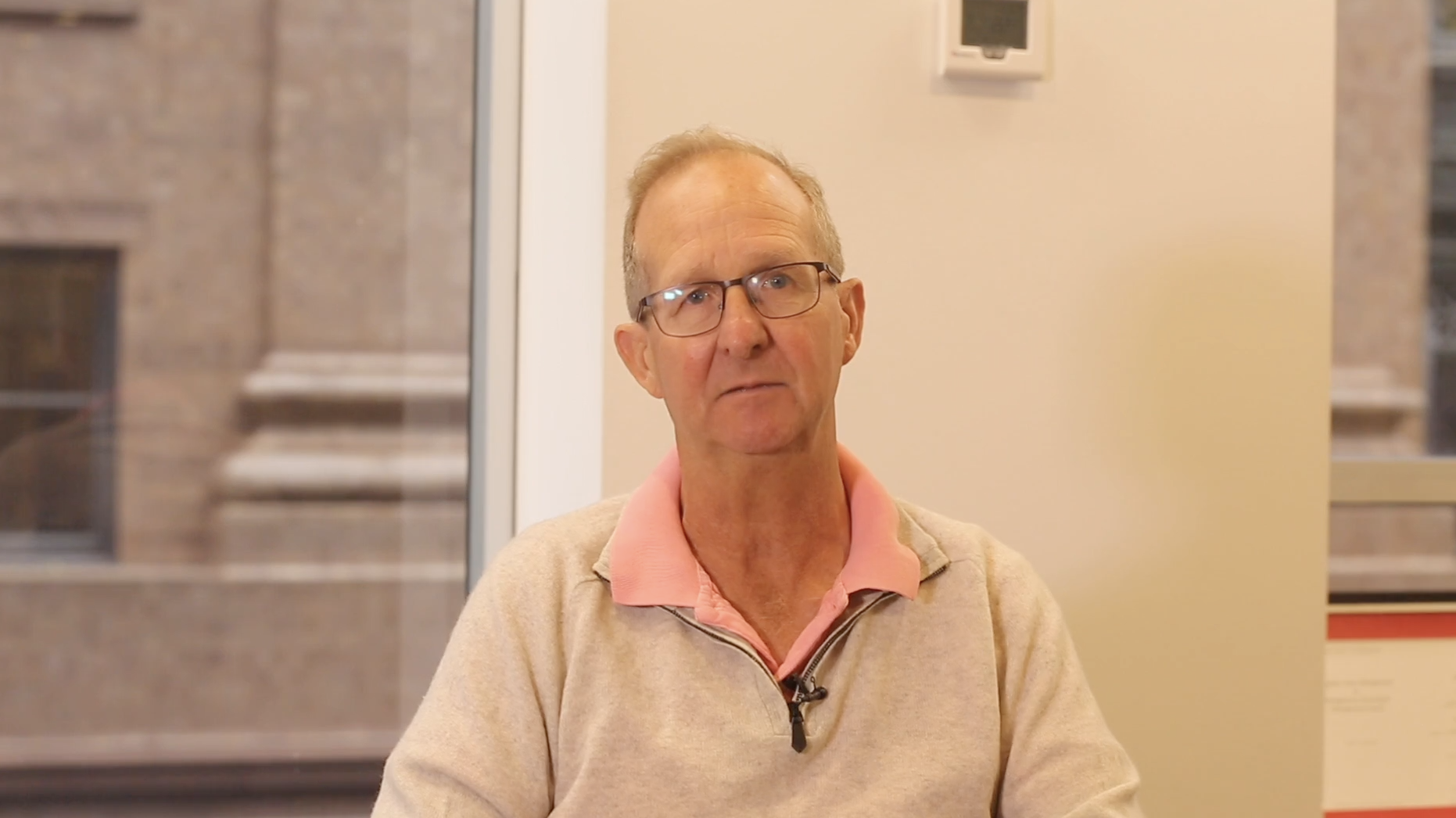

Are Central Banks tightening too late as inflation hits 30 to 40 year highs?

David Buckland

May 2, 2022

In this week’s video insight David discusses how rising interest rates will impact indebted households and the knock-on-effect. The psychological boost and wealth effect enjoyed from strongly rising house prices will likely be missing in the foreseeable future and this means indebted households are more vulnerable to Central Bank tightening late in this inflationary cycle. Continue…

by David Buckland Posted in Market commentary, Video Insights.

-

The Polen Capital Global Growth Strategy is now available via BT Panorama

Dean Curnow

April 29, 2022

Our partnership with the U.S. based Polen Capital has evolved since we formally announced the relationship in March last year. Since then, we have launched two of their strategies in Australia with a third, the Polen Capital Global Emerging Markets Growth Fund, in the works. The first strategy, the Polen Capital Global Growth Fund, is now accessible to investors via the BT Panorama platform. The fund is accessible to investors via Netwealth and HUB24 IDPS and Super/Pension. Continue…

by Dean Curnow Posted in Montgomery News and Updates.

- save this article

- POSTED IN Montgomery News and Updates.

-

Montgomery Small Companies Fund and investing over the longer term

Scott Phillips

April 28, 2022

We all know that equity markets don’t travel in a straight line, and that has been the case for equity markets over the last couple of years. Looking back at some of the major events that investors and equity markets have had to contend with, and we can list a global pandemic, massive monetary and fiscal stimulus in response, lock-downs like never seen before, then re-opening, supply constraints coupled with strong demand, a Russian invasion on Ukraine, now inflationary pressures across the globe, interest rates on the rise and meanwhile companies are adapting to the changing environment but ultimately trying to execute on delivering the best products or services to their customers and generate growing profits. Continue…

by Scott Phillips Posted in Montgomery News and Updates.

- 2 Comments

- save this article

- 2

- POSTED IN Montgomery News and Updates.

-

Share Prices within The Buy Now Pay Later Sector continue to struggle

David Buckland

April 27, 2022

Two months ago, I wrote about the tough conditions gripping the Buy Now, Pay Later sector and asked whether the agreed takeover scrip bid by Zip Co Limited (ASX: ZIP) for Sezzle Inc (ASX: SZL) at 0.98 ZIP shares for 1.00 SZL shares was a marriage of convenience or a marriage of necessity. Since then, the share prices of both companies have more than halved from $2.21 to $1.02 for ZIP and from $1.78 to $0.84 for SZL. Continue…

by David Buckland Posted in Companies.

- 2 Comments

- save this article

- 2

- POSTED IN Companies.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

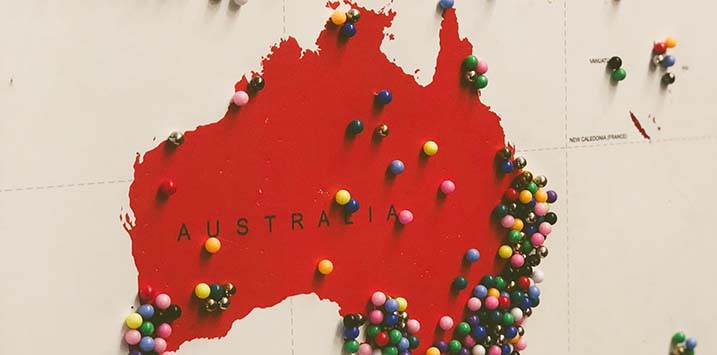

Macquarie’s economic update part 3 – Will mining save the Aussie economy?

Roger Montgomery

April 27, 2022

As highlighted in the preceding two articles, Macquarie Bank economists, Ric Deverell and Hayden Skilling, see darker times ahead for the US economy and equity market. But their outlook for our economy and equities is more nuanced. Australia will benefit from the race to decarbonise, with some commodities doing particularly well. For investors, it means careful stock selection will be the order of the day. Continue…

by Roger Montgomery Posted in Market commentary.

- 2 Comments

- save this article

- 2

- POSTED IN Market commentary.

-

Macquarie’s economic update Part 2 – In the US, winter is coming

Roger Montgomery

April 26, 2022

In their latest global economic update, Macquarie Bank economists, Ric Deverell and Hayden Skilling, paint a far from rosy picture of the year ahead. For the US they see rising interest rates, a slowing economy and a strong chance of a recession. And their views on returns in equity markets are bleak. If they are correct, then it’s time for investors to be extra cautious, and to focus their portfolios on quality and growth. Continue…

by Roger Montgomery Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary.

-

Macquarie’s economic update part 1 – Inflation, war and COVID

Roger Montgomery

April 22, 2022

Recently, Macquarie Bank economists, Ric Deverell and Hayden Skilling, provided their much anticipated global economic update. It includes insights into how COVID and Russia’s invasion of Ukraine are impacting supply chains, inflation and interest rate expectations. It also includes their somewhat bleak views on the outlook for property and equity markets. I’ve summarised the key take-outs in four blog posts. Here is the first one. Continue…

by Roger Montgomery Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary.

-

What to make of KKR’s bid for Ramsay Health Care

Andreas Lundberg

April 21, 2022

As you’ve probably read in the press, a consortium led by US-based investment behemoth, KKR & Co, has just lobbed a $20 billion bid for Ramsay Health Care (ASX:RHC), Australia’s dominant private hospital business. This values each RHC share at an all-time high of $88, well above the previous day’s close of around $64. So it’s potentially good news for RHC investors – including The Montgomery Fund. But what are the chances of the deal going through? Continue…

by Andreas Lundberg Posted in Companies, Editor's Pick, Stocks We Like.

- save this article

- POSTED IN Companies, Editor's Pick, Stocks We Like.