To visit the February 2026 reporting season calendar Click here .

-

JB Hi-Fi’s result tells us the consumer slowdown has already begun

Roger Montgomery

February 15, 2023

Consumer electronics and home appliances retailer, JB Hi-Fi (ASX:JBH), has just released its first-half results for FY23. For the six months to December 2022, there was a lot to like. But sales figures for January paint a picture of a more cash-strapped consumer and, by extension, a slowing economy. Continue…

by Roger Montgomery Posted in Companies, Consumer discretionary.

- save this article

- POSTED IN Companies, Consumer discretionary.

-

Three reasons for liking Transurban

Sean Sequeira

February 14, 2023

Since starting life in 1996 as the operator of Melbourne’s CityLink, Transurban (ASX:TCL) has come a long way. Taking advantage of falling interest rates, TCL has expanded its portfolio and now operates lucrative urban toll roads in Sydney, Melbourne, Brisbane, Canada and the U.S. The company is a strong dividend payer and continues to be a rewarding long-term investment. Continue…

by Sean Sequeira Posted in Companies, Stocks We Like.

- 2 Comments

- save this article

- 2

- POSTED IN Companies, Stocks We Like.

-

Aura Private Credit: Letter to investors 13 February 2023

Brett Craig

February 13, 2023

Last week, the Reserve Bank of Australia (RBA) lifted interest rates off the back of the heightened inflation data that came in for the December 2022 quarter. Continue…

by Brett Craig Posted in Aura Group.

- save this article

- POSTED IN Aura Group.

-

Why paying down your mortgage could be your best investment

Roger Montgomery

February 13, 2023

With interest rates rising, many of you are probably wondering if it would be beneficial to pay more off your mortgage. The good news is that if you have sufficient funds, and you are in a high personal tax bracket, it could be your best investment right now. Let me explain why. Continue…

by Roger Montgomery Posted in Editor's Pick, Property.

- 4 Comments

- save this article

- 4

- POSTED IN Editor's Pick, Property.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

MEDIA

ABC The Business: Can the stock market rally continue?

Roger Montgomery

February 10, 2023

Roger joined Kathryn Robinson on ABC The Business to discuss current market conditions. With sharemarkets rallying around the world, does this make economic sense and can the rally be sustained? Meanwhile, predictions of recession leave investors in fear about company earnings growth.

by Roger Montgomery Posted in On the Internet, TV Appearances.

- READ ONLINE

- save this article

- POSTED IN On the Internet, TV Appearances.

-

Nick Scali is the latest retailer hit by the consumer pull-back

Roger Montgomery

February 10, 2023

On first blush, the much-anticipated consumer slowdown does not appear to have impacted Nick Scali (ASX:NCK), which reported half-year 2023 results earlier this week. But delving more deeply into the trading update reveals a different story. Continue…

by Roger Montgomery Posted in Companies, Consumer discretionary.

- 4 Comments

- save this article

- 4

- POSTED IN Companies, Consumer discretionary.

-

MEDIA

Ausbiz: In the markets, last year’s losers are this year’s winners

Roger Montgomery

February 9, 2023

The Australian market was dragged higher in January by roaring global markets. It has really been a case of last year’s losers being this year’s winners. By way of example US-listed Facebook’s peak-to-trough drawdown described a fall of 76 per cent. Facebook shares rose 55 per cent in January. However, I am not too excited, Facebook shares are still down 52 per cent from their high. Watch: In the markets, last year’s losers are this year’s winners

by Roger Montgomery Posted in On the Internet.

- READ ONLINE

- save this article

- POSTED IN On the Internet.

-

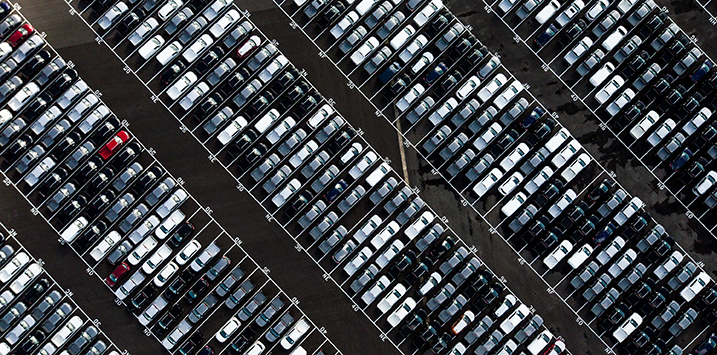

Has Carsales paid too much to buy Trader Interactive?

Roger Montgomery

February 9, 2023

Since its founding in Melbourne in 1997, carsales.com (ASX: CAR) has grown its footprint to now operate in digital marketplaces across Oceania, Asia and the Americas. This has largely been done via acquisitions. However, I’m scratching my head over its recent acquisition of the US marketplace, Trader Interactive. To my mind, they have simply paid too much. Continue…

by Roger Montgomery Posted in Companies, Investing Education.

- save this article

- POSTED IN Companies, Investing Education.