The market suffered a serious case of sticker shock overnight

Stick.er’-Shock’, noun. shock or dismay experienced by the potential buyers of a particular product on discovering its high or increased price. The market suffered a serious case of sticker shock overnight after the U.S. Federal Reserve Chairman, Jerome Powell, addressed the U.S. Senate Banking Committee in the first of two hearings on Capitol Hill this week, opening the door to raising rates higher and faster than recently anticipated.

Powell’s comments overnight were, in fact, the first public acknowledgment by the Fed Chair, that strong labour and inflation data may force the Fed to go harder and higher.

Back in December, U.S. Fed officials estimated rates would rise to a peak of 5 to 5.25 per cent. Only a small minority of members suggested 5.25 to 5.5 per cent.

Overnight, Powell indicated expectations for the peak rate would need to be adjusted by more, noting the Fed’s inflation targeting is “very likely” to come at a cost to the labour market.

Powell told the Committee, “The process of getting inflation back down to two per cent has a long way to go and is likely to be bumpy,” adding “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated”, and “if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate rises.”

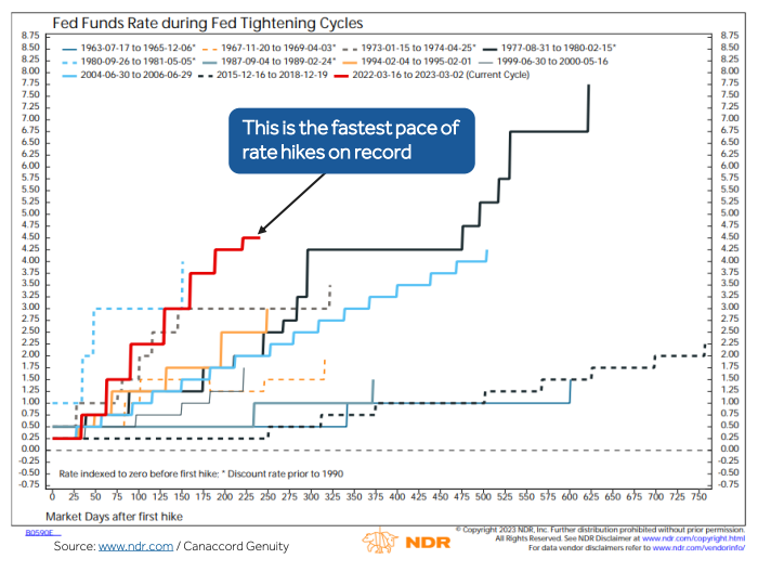

Investors may recall the U.S. Fed raised rates by three-quarters of a point repeatedly last year, slowed to 50 basis points in December and then slowed again to 25 basis points in early February. The consequence was the fastest pace of rate rises since the 1980s.

Initially, the policy appeared to be slowing consumer spending and inflation, but recent data suggests inflation hasn’t weakened as much as expected. Indeed, January inflation rose faster than expected. Meanwhile, the labour market remains tight and consumer spending has picked up again. Powell said the unexpected strength would probably require a stronger policy response.

Figure 1. U.S. Rate rises already fastest on record

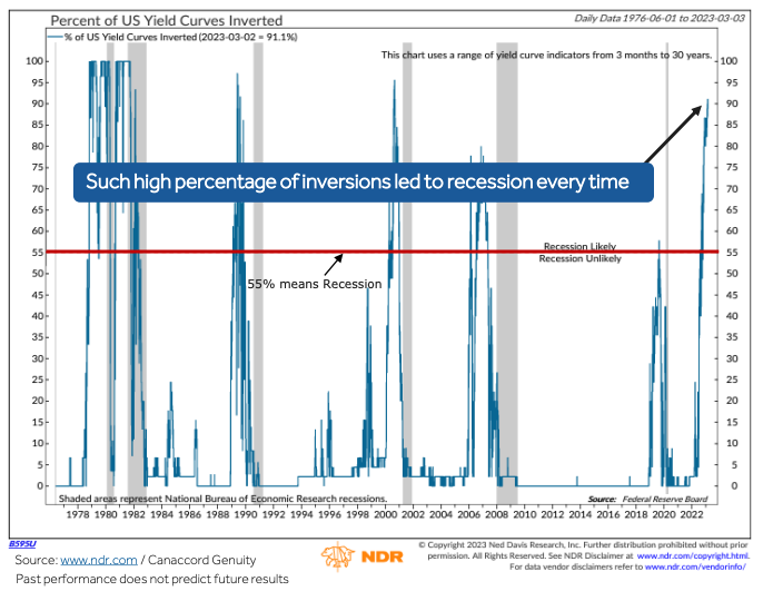

Understandably, U.S. equities fell sharply, and the bond market saw 2-year yields higher and the 10-year yield down, resulting in the yield curve inversion – a sign of impending recession – reaching a full percentage point for the first time since 1981. The comments saw the yield on two-year Treasury notes hit 5 per cent for the first time since July 2007.

Figure 2. Inverted U.S. Yield curves and recessions

Powell’s comments have some investors now anticipating a terminal monetary policy rate above six per cent. Consequently, those stocks and assets that benefited from enthusiasm about recent disinflation have either lost momentum or reversed.

Financial stocks, particularly the banks, which are especially sensitive to rising rates, reversed sharply. Wells Fargo and M&T Bank declined almost five per cent. The S&P 500’s financial sector dropped 2.4 per cent.

Broker Canaccord Genuity perhaps summed up the renewed bearish sentiment best; “Still all about [the] recession call. Of course, there can be oversold bounces in risk assets along the way, but the combination of (1) historically high level of U.S. Treasury Yield Curve inversions, (2) record low money availability, (3) manufacturing contraction, and (4) probable rise in the unemployment rate strongly points to recession in late 2023.”