To visit the February 2026 reporting season calendar Click here .

-

Tuas still growing at a strong clip in Singapore

Roger Montgomery

September 27, 2023

Back in June we provided an executive summary and results update for Tuas Ltd (ASX: TUA), the David Teoh-led Singapore mobile phone service provider spun out of the merger between TPG and Vodafone in 2020 and formerly known as TPG Telecom Pte Ltd (TPG Singapore). Continue…

by Roger Montgomery Posted in Companies, Editor's Pick.

- 2 Comments

- save this article

- 2

- POSTED IN Companies, Editor's Pick.

-

The investment thesis behind Workday – a holding in the Polen Capital Global Growth Fund

David Buckland

September 26, 2023

In this week’s video insight I joined Damon Ficklin, Head of Team and Portfolio Manager from Polen Capital to shed some insight into the strategy behind the Polen Capital Global Growth Fund. Damon highlights how the Fund invests across the growth spectrum owning companies like Amazon or Workday, higher growth businesses although it is also happy to own companies on the other end of the spectrum like a L’Oreal or an Abbott Laboratories. Damon also shares how the investment thesis behind Workday and why it is currently a holding in the Fund. Continue…

by David Buckland Posted in Editor's Pick, Polen Capital, Stocks We Like, Video Insights.

-

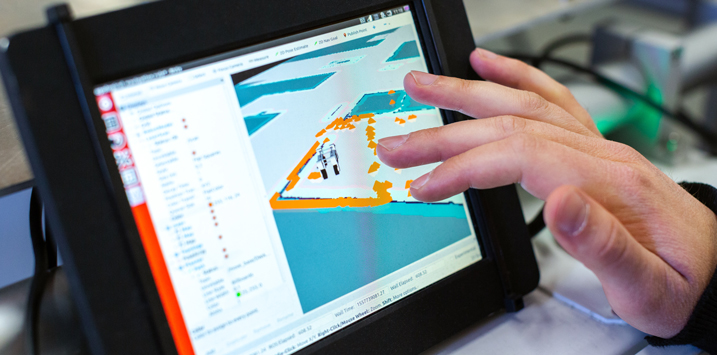

Generative AI’s growing impact on businesses

Roger Montgomery

September 25, 2023

Over recent years, artificial intelligence (AI) has gained considerable traction. And on the back of the resultant excitement, price-earnings (P/E) ratios for stocks even remotely related have soared. Is the excitement premature? Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

MEDIA

Ausbiz – How AI can fundamentally change the business landscape

Roger Montgomery

September 22, 2023

In my recent interview with Ausbiz, I wanted to delve into the potential of artificial intelligence (AI) in transforming various fields like e-commerce and workforce optimisation by streamlining repetitive tasks and boosting overall productivity. In lieu of this, I emphasised the need for the investment landscape to adapt to this impending disruption. Listen to the full interview here

by Roger Montgomery Posted in TV Appearances.

- save this article

- POSTED IN TV Appearances.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

The OECD says core inflation remains persistent in many countries

David Buckland

September 22, 2023

With forecasters failing to predict the acceleration of inflation from 2021, and its subsequent persistence, it is unsurprising that the U.S. ten-year treasury bonds now exceeds 4.4 per cent, the highest yield recorded in 16 years. Continue…

by David Buckland Posted in Economics, Market commentary.

- save this article

- POSTED IN Economics, Market commentary.

-

Who will emerge as the winners and losers of AI?

Roger Montgomery

September 21, 2023

In the ever-evolving landscape of technology, the rise of artificial intelligence (AI) has become an undeniable force of change. Amidst the hype and speculation, one question stands out: who will emerge as winners and losers as AI adoption accelerates among consumers? While many uncertainties remain, it is increasingly clear that AI has the potential to revolutionise the way we interact with the digital world. Continue…

by Roger Montgomery Posted in Market commentary, Polen Capital.

- 2 Comments

- save this article

- 2

- POSTED IN Market commentary, Polen Capital.

-

Revving up: Australian auto market hits historic high in August

Roger Montgomery

September 20, 2023

In a remarkable surge, the Australian automotive market witnessed a historic high in August with 109,966 new vehicles sold. This momentous spike has been attributed to an upsurge in pent-up demand and a resurgence in supply. Notably, this August performance broke previous records, following on the heels of similarly ground-breaking sales in May and July this year. Continue…

by Roger Montgomery Posted in Editor's Pick, Market commentary.

- save this article

- POSTED IN Editor's Pick, Market commentary.

-

Increasing the yield on the fixed interest component of your portfolio

David Buckland

September 19, 2023

According to the Australian Bureau of Statistics (ABS), 700,000 Australians are expected to retire over the next five years, taking the total number of retired Australians to 5 million, or around 18 per cent of a forecasted 27.5 million population[1]. The demographic shift is forcing a rethink in terms of retirees’ superannuation and savings. Continue…

by David Buckland Posted in Investing Education.

- save this article

- POSTED IN Investing Education.