Is it time to reconsider investing in an ASX 200 ETF?

In this week’s video insight, I explore why the Australian S&P/ASX 200 index has shown no capital growth in the last 16 years. Australia’s taxation system is a unique creature. It heavily incentivises dividends mainly through the mechanism of franking credits. But is it time to reconsider some of your investments?

Transcript:

Hi, I’m Roger Montgomery and welcome to this week’s video insight.

Today, we embark on a brief analytical journey into the heart of the Australian market. The S&P/ASX 200 index and we seek to answer the question, why has it done nothing in sixteen years?

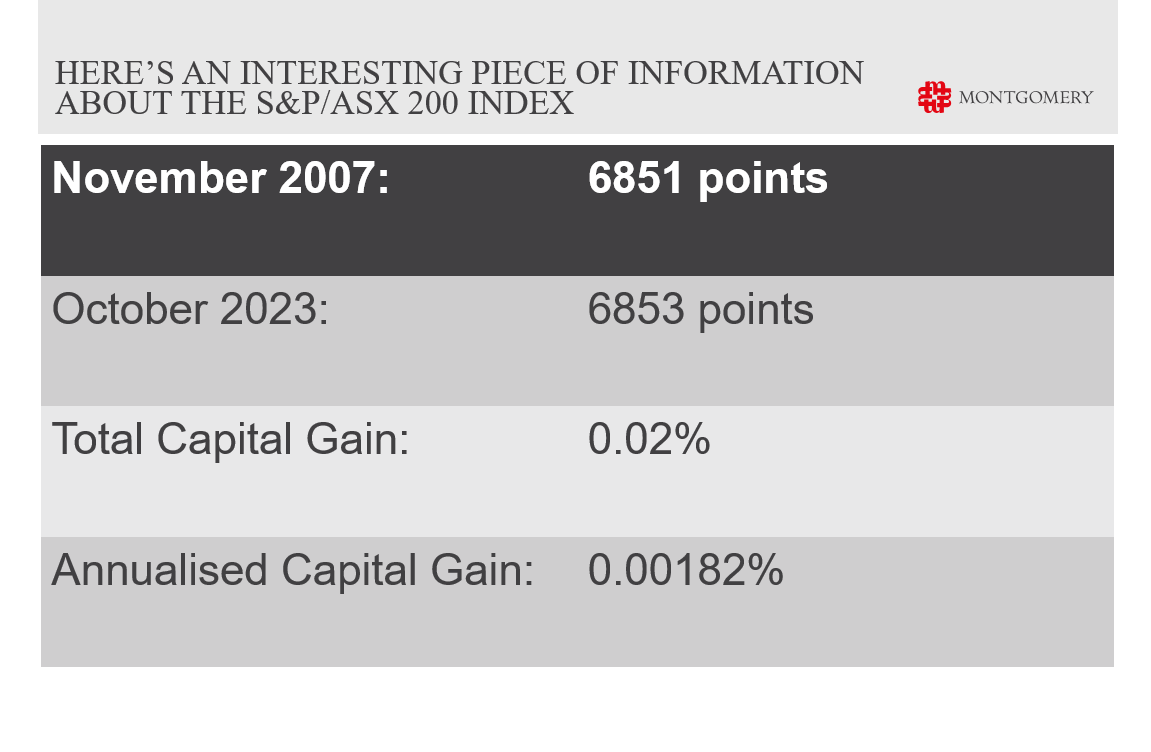

Have a look at this first slide.

In November 2007, just before the beginning of the global financial crisis, the ASX 200 was at 6851 points. Today 16 years later, it’s at, wait for it, 6853 points. Just a two-point difference. That’s a return of less than 0.02 per cent, and on an annual compounded capital gain of just 0.00182 per cent per annum.

If you think that’s underwhelming, you’re overselling it.

That observation has been made elsewhere but the question we seek to answer is why? So, let’s dive in. It’s tempting of course to look at the big picture, the broader macroeconomic landscape.

You might argue interest rates have been volatile. Well, yes, there’s been movement, but it’s all been down since the GFC. Interest rates have been a tailwind for equities because those rates have been declining precipitously over the last 16 years. And in the background, central banks have thrown more money at economies and markets than they even had in 2007.

You might also argue we’ve had economic setbacks. Well, we haven’t. In fact, we haven’t had a single recession over that 16-year period, so what gives?

In any other country, these factors would have had an impact on capital appreciation. But in Australia, the story has a different protagonist.

Enter dividends.

Australia’s taxation system is a unique creature. It heavily incentivizes dividends mainly through the mechanism of franking credits and because franking credits have enormous value to shareholders on lower tax rates than the corporate tax rate and zero value to a company, Australian boards are incentivized to pay out the bulk of their earnings as dividends.

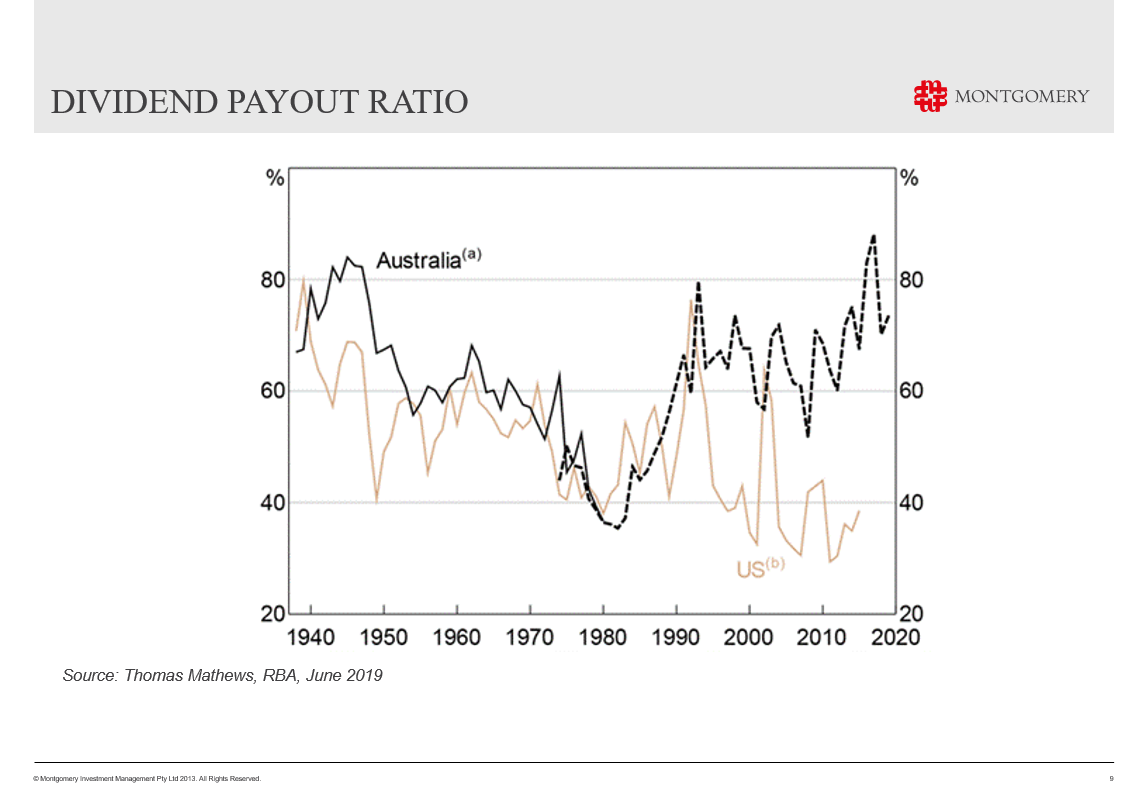

Now you can see that on this chart from the RBA. That almost eighty percent of the profits of Australia’s largest companies are paid out as dividends.

The chart also contrasts the Australian experience with the U.S. where less than 40 per cent of earnings are paid out. Now, when a company pays out most of its profits as a dividend, it results in most of the return coming from dividends. In fact over the last 16 years, the only return investors have generated from the ASX 200 has been from dividends and why? Well, because when a company pays out almost all of its earnings as a dividend, there’s nothing left to reinvest for growth. And if a company’s equity doesn’t grow, through the retention of profits, then its intrinsic value can’t grow unless of course ROE rises which, for Australia’s largest companies, that hasn’t happened. And if intrinsic value doesn’t rise, over time, neither will the share price.

So, the decision to pay the bulk of earnings out as a dividend has a serious financial consequence. That consequence is best demonstrated by looking at Warren Buffett’s Berkshire Hathaway. It’s a prized example of the dividend decision in in action. Berkshire has generated circa 20 per cent returns on equity for over 50 years and it’s never paid a single cent as a dividend.

Most income investors would be aghast, but the result is that the equity grows each year by 20 per cent and if the ROE stays at twenty percent, the earnings grow by 20 per cent per annum two. And that’s why Berkshire’s share price today is U.S.$512,000 per share. If an investor wants some income, they can sell a share. If they want to have a really fun year, they can sell two shares.

When a company consistently dishes out dividends, there’s less left for reinvesting in growth.

Our taxation structure and its unwavering emphasis on dividends isn’t a temporary blip. It’s an established pattern and it’s not going away anytime soon. So what does this revelation mean for you as an astute investor? It’s more than just a titbit of information. It’s a clarion call, It signifies a need to strategize.

Rather than sailing at the mercy of the wind, sometimes we need to adjust our sales investing in an ASX 200 ETF? It may be time to reconsider their inherent design bound by the same dividend centric limitations could restrict potential capital gains. But as always, every cloud has a silver lining. The Australian market is vast with numerous opportunities and the secret?

Look for those rare gems, businesses that exhibit robust growth and a promising vision. Businesses that don’t merely lean on dividends but reinvest for a brighter future. Amid the ASX 200 there are plenty and, among small caps there’s even more. Secondly, think about returns available from private credit. Many funds have produced better returns than the ASX 200 even with dividends included, and they’ve achieved it with less volatility.

Private credit won’t dominate a portfolio. You still need equities for growth, but private credit will feature more prominently as investors and their advisors realize future returns for the ASX 200 index are inescapably influenced by the structure of our taxation system.

Remember, the goal is not just to invest but to invest wisely.

In a world of constant change, our guiding principle remains quality and growth. By focusing on these two pillars, we can navigate the complexities of our Australian market and pave our way to financial prosperity.