Value.able

-

MEDIA

What are the characteristics of Sustainable Competitive Advantage?

Roger Montgomery

May 1, 2012

Roger Montgomery discuss how Sustainable Competitive Advantage is the platform for exceptional company performance in this Money Magazine article published in May 2012. Read here.

by Roger Montgomery Posted in Insightful Insights, Investing Education, On the Internet, Value.able.

-

MEDIA

What’s the Big Advantage in a high return on equity?

Roger Montgomery

May 1, 2012

In the May 2012 edition of the ASX Investor Update Email Newsletter, Roger Montgomery outlines his Value.able framework for successfully investing in the share market. Read here.

by Roger Montgomery Posted in Intrinsic Value, Investing Education, On the Internet, Value.able.

-

Welcome

Roger Montgomery

April 30, 2012

Montgomery Investment Management would like to make the following important announcement.

Montgomery Investment Management would like to make the following important announcement.Mr David Buckland will be joining Montgomery Investment Management as CEO shortly. David brings a wealth of experience to Montgomery including 11 years as CEO of ethical fund manager Hunter Hall. To view the announcement click on the image at left or click this link: Montgomery Press Release

Montgomery intends to continue to deepen and strengthen its management and investment teams to ensure that clients of the wholesale Montgomery [Private] Fund and its institutional mandates can always rely on impeccable service as we focus on continuing to achieve reliable outperformance.

To register your interest in Montgomery Investment Management or to apply to invest visit www.montinvest.com

Posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 30 April 2012.

by Roger Montgomery Posted in Value.able.

- 15 Comments

- save this article

- POSTED IN Value.able

-

MEDIA

How can you beat the market?

Roger Montgomery

April 14, 2012

For many, beating the market indices is the hold grail of share market investing. In this Australian article published 14 April 2012 Roger Montgomery discusses how you too can beat the market using his Value.able investing strategy. Read here.

by Roger Montgomery Posted in Companies, In the Press, Investing Education, Value.able.

- save this article

- POSTED IN Companies, In the Press, Investing Education, Value.able

-

MEDIA

What are Roger Montgomery’s Value.able insights into Mining Services?

Roger Montgomery

April 14, 2012

Do New Hope Corporation (NHC), Northern Star Resources (NST), Mt Gibson Iron (MGX), Navarre Minerals (NMC), Allmine Group (AZG), Credit Corp Group (CCP), Matrix composites (MCE), Coffey International (COF), Data #3 (DTL), Breville Group (BRG), UGL (UGL), QR National (QRN) and Seymour Whyte (SWL) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 14 April 2012 to find out, and also learn Roger’s current insights into the Mining Services sector. Watch here.

by Roger Montgomery Posted in Companies, Energy / Resources, Intrinsic Value, Investing Education, TV Appearances, Value.able.

-

MEDIA

In April 2012 where does Russell Muldoon see good Value.able investments? (Part 2)

Roger Montgomery

April 10, 2012

Do Lonrho Mining (LOM), Integrated Research (IRI), Hawkley Oil and Gas (HOG), Boart Longyear (BLY), Forge (FGE) and Environmental CleanTechnologies (ESI) achieve Roger and coveted A1 grade? Watch Part 2 of Sky Business’ Your Money Your Call 10 April 2012 program now to find out. Watch here.

by Roger Montgomery Posted in Companies, Investing Education, TV Appearances, Value.able.

-

Mining Services; a crowded trade?

Roger Montgomery

April 3, 2012

We have been prattling on about the value in mining services businesses for a long time and I am sure you are familiar with names like Forge, Decmil and Maca. What concerns me a little is that these names are now familiar not only to the few that read this blog and keep up to date on my facebook page here: https://www.facebook.com/montgomeryroger but also to just about every broker with an analyst team. There are now analysts solely dedicated to mining services and if the widely expected M&A/IPO wave hits later in the year, I wonder whether it won’t be full of mining services contractors.

We have been prattling on about the value in mining services businesses for a long time and I am sure you are familiar with names like Forge, Decmil and Maca. What concerns me a little is that these names are now familiar not only to the few that read this blog and keep up to date on my facebook page here: https://www.facebook.com/montgomeryroger but also to just about every broker with an analyst team. There are now analysts solely dedicated to mining services and if the widely expected M&A/IPO wave hits later in the year, I wonder whether it won’t be full of mining services contractors.Make no mistake, on the one hand there appears to be some real value in this sector. On the other, these businesses suffer from the ‘feast or famine’ syndrome, require a mining boom to be able to generate a sufficient rate of return to cover their cost of capital (and therefore increase there intrinsic value) and finally, their operating leverage ensures that any turn down in activity will have a significant impact on EBIT, EBITDA cash flow etc…

One to keep a close eye on…

I was interviewed on CNBC about this very subject and you can watch the video here.

What do you think? Do you own any of the mining services companies? Can the high rates of return on equity be maintained? What do you think Australia’s future looks like in the event the mining boom ends?

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 3 April 2012.

by Roger Montgomery Posted in Value.able.

- 48 Comments

- save this article

- POSTED IN Value.able

-

MEDIA

Is there gold in ‘them-there hills’ for investors in Red5

Roger Montgomery

April 1, 2012

Roger Montgomery discusses the prospects for Gold-Miner Red5 (RED) in this Money Magazine article published in April 2012. Read here.

by Roger Montgomery Posted in Energy / Resources, Investing Education, On the Internet, Value.able.

-

Are the pizzas better at Dominos?

Roger Montgomery

March 27, 2012

PORTFOLIO POINT: Despite the headwinds facing retailers in Australia, Domino’s Pizza is growing and expanding its margins. But is that growth already be priced in?

PORTFOLIO POINT: Despite the headwinds facing retailers in Australia, Domino’s Pizza is growing and expanding its margins. But is that growth already be priced in?Retailers in Australia are facing a perfect storm of weak consumer spending, online competition and a rising Australian dollar. But despite these headwinds, there’s one company that is not only expanding its physical footprint, but is becoming a serious force online. It’s also notching up double-digit growth in Europe, in spite of the economic climate, and breaking records to boot. You may be surprised to learn that this success story is in fact Domino’s Pizza Enterprises (ASX: DMP).

Domino’s Pizza listed on the Australian stock exchange in May 2005, and opened its 400th store in the same year. The company is the largest pizza chain in Australia and enjoys a growing presence in France – a country that, with the exception of the United States, consumes more pizza per head than anywhere else in the world – Belgium and the Netherlands, having bought existing operations in those countries in 2006 and becoming the largest Domino’s franchisee in the world. Domino’s Pizza now operates more than 889 stores, employs more than 16,500 people and, according to one report, makes more than 60 million pizzas per year. And all of this is run by a Lamborghini-driving CEO, who is as obsessed about Domino’s today as he was when he merged his 17-store franchise company into what is now Domino’s Pizza Enterprises.

The company’s online strategy has been a raging success, not only for pizza ordering but also for recruitment. When the company launched its iPhone App in 2009, it became the number one free app on the iTunes site within five days. Today, 40% of orders are made online and the company expects this to be 50% in the next six months, with a third of these orders to come from mobile devices.

Domino’s recently reported its half-year results and saw an improvement on almost every KPI. Same-store sales growth was strong, exceeding expectations in both Australia and Europe; margins improved and stall rollouts continued; the balance sheet strengthened, as did free cash flow; and, despite even lower debt, returns on equity increased. Domino’s concluded by upgrading its full-year 2012 guidance.

My friends at American Express should be able to confirm that while fashion retailing is one of the hardest gigs to be in, restaurants and cafes are one of the best. This is something Domino’s Pizza CEO Don Meij would know only too well. Despite challenging economic conditions, particularly in Victoria and New South Wales, same-store sales grew by almost 9% and total sales were up 11.2%. In Europe, where conditions are arguably much worse and youth unemployment is in the high double-digits, Domino’s recorded 12.6% total sales growth and 7.5% same-store sales growth. By the end of financial year 2012, another 60 to 70 stores will have been opened, net profit is expected to grow by 20% (despite adverse currency movements), and same-store sales growth is expected to be in the order of 5 to 7%.

In the last three years, earnings per share have doubled (no doubt the company has also taken market share from its peers, such as KFC) and despite a substantial decline in borrowings, return on equity has increased from 17% to 23% (see Skaffold.com screenshot below)Rising returns on equity, with little or no debt, is an indication of powerful business economics. Generally, as a company gets larger, its returns on equity stabilise or decline. Domino’s, however, enjoys an ability to raise prices and, some say, reduce pizza sizes without a detrimental impact on volume sales. This is, in my estimation, the most valuable competitive advantage it has. Granted, it’s a surprising conclusion to put forward for a franchisee (for a look at how things can go wrong for a franchisee company, look no further than Collins Foods).

Dominos displays declining debt (red columns), rising equity (grey columns), rising return on equity (blue line) and rising profits (green line). Source: Skaffold.com

Since 2004, Domino’s profits have increased 40.11% p.a. from $1.954 million to $20.7 million. To generate this $18.759m increase in profit, shareholders have tipped in an additional $64.37 million of equity and left in earnings of $34.82 million. In other words every additional dollar contributed and retained has returned around 19%. During the period under review the company has also reduced its borrowings by $9.11 million from $24.65 million it held in 2004 to $15.54 million at the end of FY2011.

Analysts worry about the risks associated with growing a business in Europe in the present climate. Rising commodity input prices, including oil for delivery vehicles and wheat for flour, and the stronger Australian dollar are also points of concern. In the face of these perceived challenges, the company continues to grow and expand its margins. It also expects greater than 25% profit growth from Australia within three years. Clearly, Domino’s competitive advantages are proving those analysts who said Australia was ‘ex-growth’ wrong. And the company is also moving to electric delivery scooters to hedge against higher fuel prices.

Domino is a high quality business – Source: Skaffold.com

I have not been able to buy Domino’s shares – as much as I would like to – because they have not been cheap enough for me. My valuation is based on the idea that I want to reduce my risks as much as possible by ensuring I obtain a bargain. DMP has simply never traded at a bargain price. But with a price close to $9.00 today, you could (admittedly with the benefit of hindsight) put forward the argument that the $2.65 the shares traded at in 2009 was every bit a bargain. The issue is simply the discount rate that I am willing to use to arrive at my valuation. If I use 8% to 9%, my valuation approximates the lower historical prices. But is 8-9% enough? I think not.

What would you pay for a business earning $25 million this year and $29 million next year, perhaps $35 million the year after that? If you said $300 million or $350 million, I’d label you a value investor, but today the market capitalisation is more than half a billion dollars. At that kind of multiple, I would guess the growth has been ‘priced in’. I would rather be certain of a modest return than hopeful of a great one, and at current prices – despite the obvious track record of the company and the very great skill of its management – I think buyers are being hopeful. Unless, of course, they know a takeover is imminent.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 27 March 2012.

by Roger Montgomery Posted in Companies, Consumer discretionary, Investing Education, Value.able.

-

Guest Post: Forcing Bright Prospects

Roger Montgomery

March 23, 2012

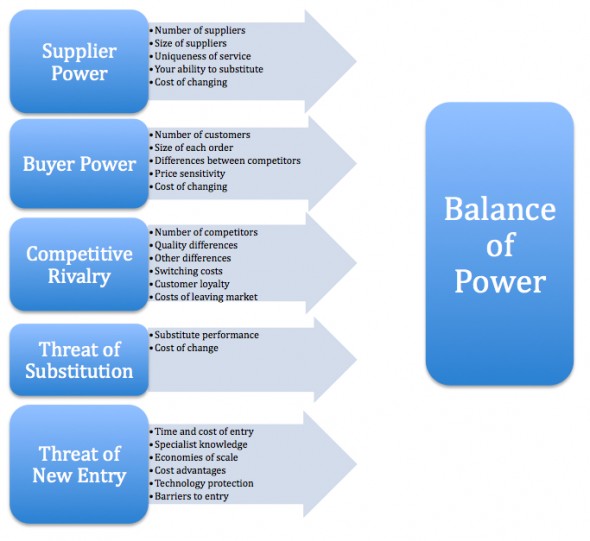

Created by Harvard Business School professor Michael Porter to analyze the attractiveness and likelihood of profitability of an industry, Porter’s Five Forces are a simple but powerful tool for understanding where power lies in any business situation. Using this tool, you can gain insight into the competitive strength of an investee candidate.

Created by Harvard Business School professor Michael Porter to analyze the attractiveness and likelihood of profitability of an industry, Porter’s Five Forces are a simple but powerful tool for understanding where power lies in any business situation. Using this tool, you can gain insight into the competitive strength of an investee candidate.While these Five Forces are typically used by companies to determine whether new products, services or businesses may be profitable, investor’s can use them to analyze the competitive position of any industry member.

The importance of ROE and buying companies with bright prospects is sacrosanct here at the Insights Blog but why? Return on equity is an important explanatory variable for superior share price performance and so we want businesses that can sustain high rates of return. When I talk about bright prospects it is the sustainability of these high rates of return that I am referring to. Whether the bright prospects relate to a rising tide of customers, the ability to pass on rising costs, the ability to be the low cost provider or the changing competitive landscape, how these factors serve to produce a high rate of return on equity is what we care about.

Numerous economic studies have shown that different industries can sustain different levels of profitability. This can be attributed to differences in industry structures. Within those industries however there is a pecking order of companies and Kathy’s column on Porter’s five forces reinforces the need to understand where your investee candidate sits and whether that high ROE being produced today can be sustained.

Porter’s Five Forces model is made up by identification of 5 fundamental competitive forces:

Barriers to entry

Barriers to entry measure how easy or difficult it is for new entrants to enter into the industry.Threat of substitutes

Every top decision makes has to ask: How easy can our product or service be substituted?Bargaining power of buyers

the question is how strong the position of buyers is. For example, can your customers work together to order large volumes to squeeze your profit margins?Bargaining power of suppliers

This relates to what your suppliers can do in relationship with you.Rivalry among the existing players

Finally, we analyze the level of competition between existing players in the industry.Kathy writes…

Calculating the ROE or debt levels of a company is the easy part. But how does one determine if a company has bright prospects? The Porter’s Five Forces model is a tool that I have found to be helpful when picking companies in which to invest. I came across this model while I was studying an Information Systems subject at University.

The Porter’s Five Forces model was developed by Michael Porter to help understand a company’s competitive advantage. The five “forces” that are identified by Porter are:

1) Threat of new entrants

New entrants can increase market competition between companies. In the absence of a dominant player, this can lead to erosion of profit margins.

The threat of new entrants is highly dependent on the barriers to entry. For example, it is relatively easy to start a small pizza business, but it would be difficult to compete with or replicate Cochlear’s business due to the massive R&D costs and intellectual property that is hard to obtain.

2) Power of suppliers

Suppliers can place pressure on margins if they are dominant players in the market. This can be observed in the computer chip manufacturing space where Intel and AMD are the dominant manufacturers. These two companies arguably control the technology that is available to consumers because the manufacturers of computers must build them to accommodate AMD and Intel’s CPUs.

The power of suppliers can also be witnessed in the building industry where suppliers increase their prices as a result of rising commodity costs. These price increases are difficult for builders to pass on in the current subdued climate as consumers are already stretched with high housing costs.

3) Power of customers

A profitable company depends on attracting and retaining customers. However, customers hold the power when they can easily switch to a competitor’s product or service.

In a competitive market where there is little product differentiation, particularly in industries where products have become commoditised, customers have the power to force businesses to compete on price. This is evident with online book stores, where consumers have the ability to search for and compare the cheapest prices across online retailers such as Amazon, eBay, Book Depository and Booktopia, forcing traditional bricks and mortar book stores to compete.

4) Availability of substitutes

In the majority of industries there are substitutes that a customer might use if prices become prohibitively high. Substitutes can be seen in the energy sectors, for example, petrol is increasingly being substituted with ethanol in cars.

New technologies also create substitutes. The introduction of electronic downloadable music has been very popular with consumers who wish to purchase and download music at their convenience. CD sales have dwindled much to the dismay of record labels. Companies need to be agile and adapt to new trends. Kodak is a classic example of a company that did not move with the times.

5) Existing competitors

Competitors all fight for market share by developing their brands and by attempting to attract customers. Increased competition can lead to the erosion of profit margins. Innovation can help, however this is difficult for businesses that operate in a commodity-type business. Retailers (e.g. Coles, Woolworths, Myer) typically sell the same products as their competitors, and perhaps their private label products are a means for them to differentiate themselves from their competitors.

I hope this has given everyone some food for thought. These are the things

I try to think about before I invest my hard earned money.Thanks Kathy for your post. If you would like to list a couple of companies that you believe dominate their industry and will sustain high rates of return on equity, simply click on the Leave A Comment link below.

by Roger Montgomery Posted in Companies, Insightful Insights, Value.able.