Value.able

-

Results to 30 June 2012

Roger Montgomery

August 8, 2012

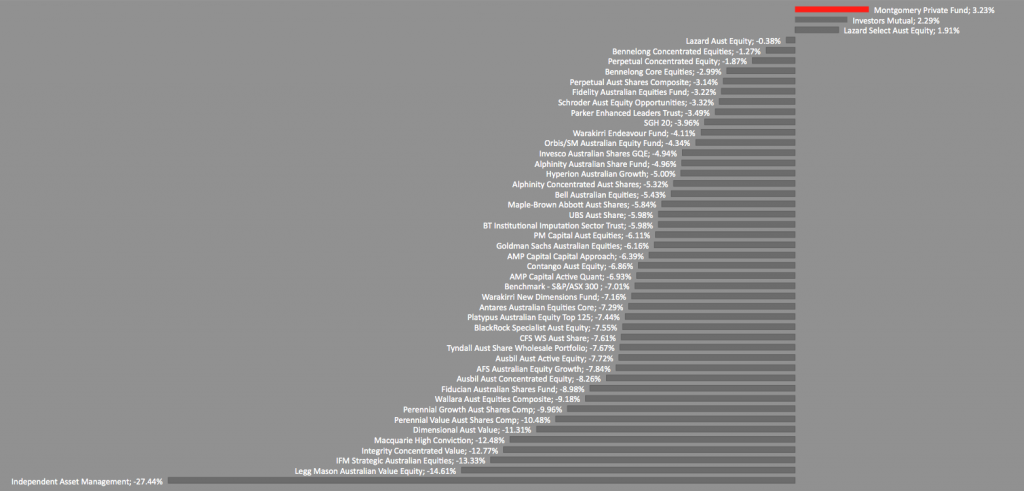

On behalf of the Montgomery Investment Management Team, I am delighted to display the full year results for the Montgomery [Private] Fund as measured and ranked against the 98 funds surveyed by Mercers.If you would like to discuss an investment in The Montgomery [Private] Fund please contact The Office by email at Office@montinvest.com or call (02) 9692 5700.Alternatively, if you would like to pre-register to be contacted when the fund re-opens to investment visit www.montinvest.com and select Apply to Invest.

Fig 1. Selected Australian Long Only Equity Funds as reported by Mercers and compared to The Montgomery [Private] Fund.

NB. The Montgomery Private Fund was not included in the Mercer Survey however the below chart reveals the fund’s comparative performance as if it were.by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

The mining boom IS over

Roger Montgomery

August 2, 2012

Roger Montgomery discusses how the latest data reveals that the mining boom has ended, and he discusses the implications of this on mining stocks with Ticky fullerton on ABc1’s The Business. Watch here.

This program was broadcast 1 August 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Manufacturing, Value.able.

- save this article

- POSTED IN Companies, Insightful Insights, Manufacturing, Value.able

-

China Rongsheng Heavy Industries – the good, the bad and the ugly, part 2

Roger Montgomery

August 2, 2012

We had a wry smile this morning after reading Macquarie Equities daily newsletter.

China Rongsheng Heavy Industries’ net earnings have been downgraded by 37% in 2012, 68% in 2013 and an astonishing 79% in 2014. Forecast 2014 profitability is now one-sixth of the the level recorded in 2011.

A significant factor which had come to light is the fact that Rongsheng has provided highly attractive pre-delivery finance to customers to win market share.

As Rongsheng has had operational (and credibility) issues, it has had to increase its working capital and gearing to meet expenses during during the shipbuilding construction period. With the fast decline in their order book, from US$6.6 billion in 2011 to an estimated US$3.6 billion in 2014, cash flows are under pressure.

The extraordinary rise and fall of Rongsheng and the outlook for the Chinese shipbuilding industry lends support to Montgomery’s caution with respect to the materials industry.

We will become more positive on materials stocks when the outlook from the Chinese steelmaking, cement and shipbuilding industries is less pessimistic.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Manufacturing, Value.able.

-

Steve Keen has his supporters…..

Roger Montgomery

July 31, 2012

In late 2008 Steve Keen, Associate Professor of Economics and Finance at the University of Western Sydney had a bet with Rory Robertson, who at the time was Interest Rate Strategist at Macquarie Bank. The bet was Australian housing prices would decline by 40% in two years, and the loser would walk 200km from Canberra to Mt Kosciuszko. Despite losing the bet, Steve Keen still has his supporters. Last week, Dean Baker the co-founder of US based the Centre for Economic and and Policy Research said the housing bubbles of the United Kingdom, Canada and Australia, are larger, relative to the size of their economies, than the one that collapsed and wrecked the US economy. In each county, there has been a sharp increase in the sale price of homes that has not been matched by a corresponding increase in rents. In Australia’s case, Baker claims house prices rose by more than 80 per cent between 2001 and 2009, a period when rents rose by roughly 30%. Baker argues the price of the median house in Australia is 225 per cent of the median house in the US. Given that wages in the US are higher it is difficult to see how this huge gap in house prices can make sense, said Baker.

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

US Housing Starts – About to Mean Revert?

Roger Montgomery

July 27, 2012

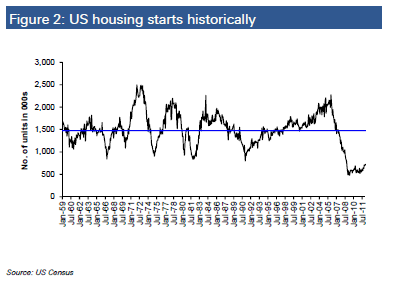

Over the past fifty years, US housing starts have averaged 1.5m per annum. Currently, starts are less than half the long term average.

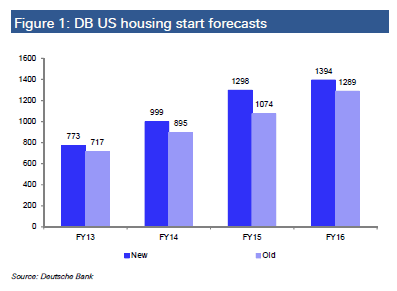

In recent months there have been some tentative signs of recovery from this record low base. According to the Economist, America’s houses on average “are now among the world’s most undervalued: 19% below fair value, according to our house-price index”.While Deutsche Bank have cut their 2013 and 2014 housing start expectations in Australia to 128,000 and 144,000, respectively,they are looking for a jump in US housing starts to 1.0m by 2014 and 1.4m by 2016, as follows.

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

The Conference call with Consequences?

Roger Montgomery

July 26, 2012

On Monday night I attended a conference call with the exceptionally articulate George Papandreou, Prime Minister of Greece from October 2009 to November 2011. He said a sudden exit from the European Union would be chaotic. Greek GDP could quickly decline by 20% and the cost of major imports of oil and foodstuffs would go through the roof.

While Greece accounts for only 2% of the European Union GDP, Papandreou felt the threat of kicking Greece out could set a precedent for Portugal, Italy and Spain, which together account for 23% of European Union GDP. It would mean the beginning of the unraveling of Europe and create further weakness with massive consequences.

by Roger Montgomery Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

MEDIA

Is Weaker Chinese Demand a Worry?

Roger Montgomery

July 21, 2012

Roger Montgomery certainly thinks so, and he explains why in this Weekend Australian article published 21 July 2012. Read here.

by Roger Montgomery Posted in In the Press, Insightful Insights, Investing Education, Value.able.

-

Is the slow-down finally gaining momentum Down-Under?

Roger Montgomery

July 11, 2012

Monday’s announcement of total ANZ job ads falling by 8.9% year on year in June 2012 indicates the slowdown in many Western world economies is gaining momentum Down Under.

Monday’s announcement of total ANZ job ads falling by 8.9% year on year in June 2012 indicates the slowdown in many Western world economies is gaining momentum Down Under.The ANZ Australian job ad market series (combined newspaper and online) fell by 1.2% in June 2012 on May 2012. In turn, May’s figure was down 2.6% from April.

The 8.9% year on year decline was driven by 8.5% and 17.5% year on year declines in online and newspaper job advertisements, respectively.

by Roger Montgomery Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

What do the most widely held stocks in Australia all have in common?

Roger Montgomery

June 29, 2012

EXCLUSIVE CONTENT

subscribe for free

or sign in to access the articleby Roger Montgomery Posted in Financial Services, Skaffold, Value.able.

- 9 Comments

- save this article

- POSTED IN Financial Services, Skaffold, Value.able

-

New Retail Fund Coming Soon

Roger Montgomery

June 18, 2012

Click on image to enlarge

Recently Mercer released their 1 year fund manager tables to the end of May 2012 (see above table). We decided to compare our returns to the sixty -odd covered in the survey. The red line marks the return and relative ranking of the Montgomery [Private] Fund to those of other managers. If The Montgomery [private] Fund had been covered in the survey, it would rank No#2 all things being equal. The median manager return -9.3%.

As many of you know Montgomery Investment Management recently hired Mr David Buckland as CEO and Mr Tim Kelley as Head of Research. I have linked the Press Releases of their appointments with their names and you can simply click on their names above to see their backgrounds and credentials.

David has wasted no time preparing a new Product Disclosure Statement for The Montgomery Fund. The Montgomery Fund will be a Retail Fund that will continue in the value investing tradition already employed here with great success for the very small group of investors we work for in the wholesale The Montgomery [Private] Fund.

With the hiring of Mr David Buckland and Mr Tim Kelley we now have the capacity to offer the benefits of our unique value investing style to all investors for the first time. Of course investments will only be able to be made through the form that accompanies the Product Disclosure Statement, which will also disclose other material information such as fees and charges and personnel.

Prospective investors should seek and take personal professonal advice before making any investment decision.

At our meeting today, we discussed an anticipated August launch date as well as providing access to investment insights exclusively to The Montgomery Fund investors.

If you have been interested in investing but felt the $1 million minimum for The Montgomery [Private] Fund is not appropriate for your circumstances, then the retail The Montgomery Fund could be worth discussing with your adviser or accountant. We currently anticipate offering a minimum investment application of $25,000.

Once again please be sure to read the PDS in its entirety and seek and take personal professional advice.

I will soon be sending you correspondence to pre-register your interest.

If however you feel you might miss that correspondence, your email has recently changed or you will be away, you can pre-register at www.montinvest.com and click the APPLY TO INVEST button. The above form will appear and after completing it, be sure to select the button “Retail Investor < $500,000”.

You will then receive an automated email from my office and be registered to receive the PDS as soon as it’s received all of its approvals. If you decide to proceed and/or your advisor approves, we look forward to working for you.

If you are a planner or advisor or responsible for dealer group approved lists or you are an executive at a research house or ratings agency and would like to discuss next steps feel free to call the Mr David Buckland at the office on (02) 9692 5700.

Please Note: Investments can only be able to be made through the form that accompanies the Product Disclosure Statement, which will also disclose other material information such as fees and charges and personnel.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 18 June 2012.

by Roger Montgomery Posted in Intrinsic Value, Value.able.

- 40 Comments

- save this article

- POSTED IN Intrinsic Value, Value.able