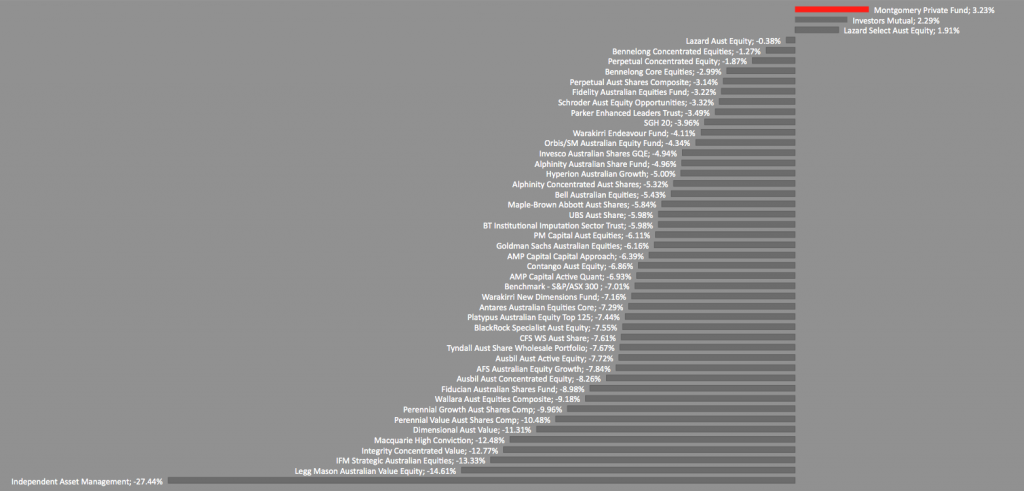

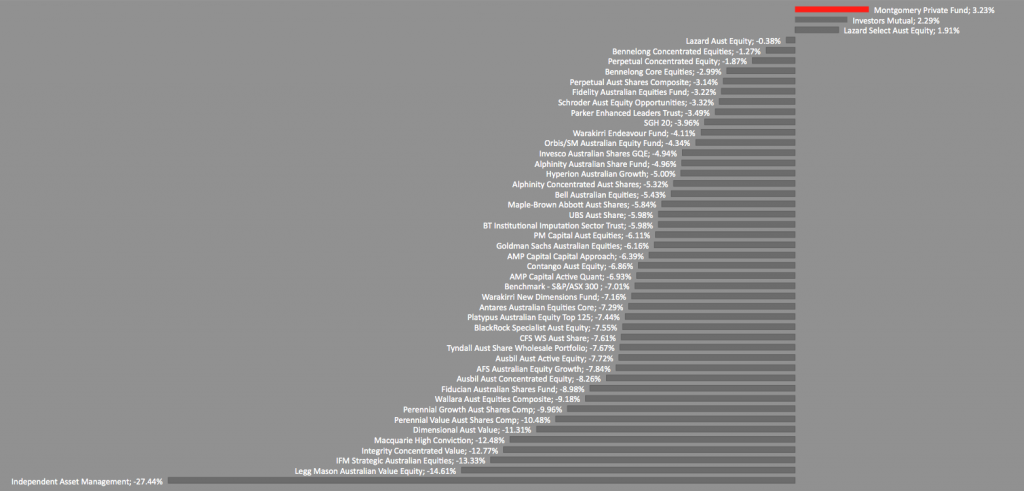

Results to 30 June 2012

On behalf of the Montgomery Investment Management Team, I am delighted to display the full year results for the Montgomery [Private] Fund as measured and ranked against the 98 funds surveyed by Mercers.If you would like to discuss an investment in The Montgomery [Private] Fund please contact The Office by email at

Office@montinvest.com or call (02) 9692 5700.

Alternatively, if you would like to pre-register to be contacted when the fund re-opens to investment visit www.montinvest.com and select Apply to Invest.

Fig 1. Selected Australian Long Only Equity Funds as reported by Mercers and compared to The Montgomery [Private] Fund.

NB. The Montgomery Private Fund was not included in the Mercer Survey however the below chart reveals the fund’s comparative performance as if it were.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking.

Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

wanglingdarma

:

Roger,

Congratulations! You have done well

While you have been ramping up you retail fund promotion, I am interested to know from your perspective the following:

– When you run your Montgomery Private Fund, what sort of annual return you are aiming for year in year out over the long term – say 7-10 years? What sort of return you would be happy with if you are an investor in a managed fund like the Montgomery Private Fund?

– Because your fund is flexible – you can go 100% cash or 100% long equities, do you benchmark your Fund’s performance against an index? or against managed fund with similar mandates as yours? Or would you consider your fund as more an absolute return fund i.e. aiming to generate positive return regardless of the markets cycles over the long term?

Very much appreciate your thoughts

cheers