Market commentary

-

Wrecking Australia: Part one

Roger Montgomery

September 20, 2013

Mr Andrew Robb was on the front page of the Australian Financial Review on Wednesday as the new minister for Trade and Investment.

Now, I reckon most of us at Montgomery lean a little to the right. We certainly believe business is an important engine of our nation and a very important source of prosperity (if ‘prosperity’ is measured by how much stuff we can afford to buy). Personally, according Vote Compass, I sit squarely in the middle, which might explain why I don’t believe that economists got it right when they decided to use consumption as a proxy for ‘happiness’.

That aside, we know that the LNP is supportive of big business. I mentioned as much on the ABC this week with Ros Childs and Ticky Fullerton. Their logic is simple; big business can employ the most people quickly and make all the economic performance measures such as employment and GDP look good. Sadly this short-term window dressing will ultimately produce an emperor with no clothes. continue…

by Roger Montgomery Posted in Economics, Market commentary.

- 31 Comments

- save this article

- POSTED IN Economics, Market commentary

-

On yer bike

Tim Kelley

July 12, 2013

Lest you read Tim’s comments below and err by drawing the incorrect conclusion that we are against good financial advice and planning…Keep in mind, every industry has their good and bad. Sadly, because the bad get all the press so it is easy to conclude from reading the papers and watching the news that an industry as a whole is rotten. This, in my personal experience, is not true. I have met a great many planners with a passion for their clients and a strong spirit of independence. I have met those who have left their firms when they believed their clients needs were not being best served. The standard of research I have witnessed is extraordinary and the investment being made in systems and processes is in inspiring. I am delighted to be an external advisor on the investment committee of one such group…Roger Montgomery

Back to Tim…

Early this morning I went for a bike ride with a former colleague from the investment banking industry (let’s call him “Bud” for short). We rode at what is known as “conversational pace”, and chatted about a range of things along the way. continue…

by Tim Kelley Posted in Market commentary.

- 37 Comments

- save this article

- POSTED IN Market commentary

-

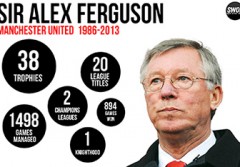

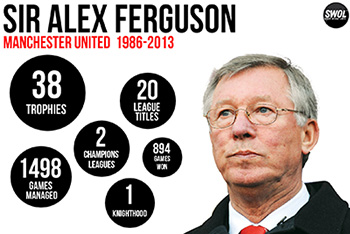

Getting the best out of the team

David Buckland

May 16, 2013

After 27 seasons at the helm of Manchester United Football Club, Sir Alex Ferguson has announced his retirement. Winning thirteen Premier League titles, five FA Cups and 2 UEFA Champions League titles in the ‘up-this-year, out-the-next’ world of professional sport is an extraordinary result.

continue…by David Buckland Posted in Market commentary.

- 5 Comments

- save this article

- POSTED IN Market commentary

-

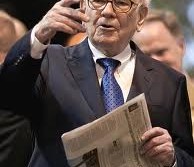

Is yesterday’s news tomorrow’s profits?

Roger Montgomery

March 5, 2013

At this time each year, we look forward to the release of Warren Buffett’s missive to his Berkshire Hathaway shareholders. Most interesting to me is this year’s discussion about Newspapers. It is interesting because there was a time, not that long ago, when Warren Buffett had said he would not buy a newspaper at any price. As you read this year’s Letter, you quickly discover Warren Buffett can quickly change his view…

It may interest you to know that during the past fifteen months, he and Charlie acquired 28 daily newspapers at a cost of $344 million.

continue…by Roger Montgomery Posted in Market commentary, Media Companies.

-

WHITEPAPERS

Three Microcaps to Consider

Roger Montgomery

December 8, 2012

One of the advantages that retail investors enjoy over institutional investors is that they can more readily invest in smaller and less liquid issues. While the larger fund managers may have a relatively limited set of companies into which they can deploy meaningful chunks of capital, enterprising small investors are free to roam, and roam they should: research indicates that their investment returns can be significantly enhanced by focusing some attention on the smaller end of the market.

The challenge for the enterprising retail investor is sifting through large numbers of lackluster small companies to find the few that deserve their investment capital. Good broker research at the smaller end can be scarce, and the company names (as well as their products or services) may be unfamiliar.

by Roger Montgomery Posted in Market commentary, Whitepapers.

- 7 Comments

- save this article

- POSTED IN Market commentary, Whitepapers

-

Gen Y will be buying cheaper houses soon

Roger Montgomery

September 4, 2012

Ben Hurley – the AFR journo typical of Gen Y – will soon be buying a house cheap from boomers who have no-one else to sell to.

Last week Ben (here) wrote:

“I would love to own a home. I could upgrade my crappy electric stove, get a hot water system that actually fills the bathtub, and stop asking the landlord for permission to put a nail in the wall.

But I’m reluctant because I think buying a home is a dud deal. And renting, while expensive, is less of a dud deal because renters typically give the landlord a return of about 3 per cent on the asset’s value. A lot of my friends in their early 30s feel the same way.”Ben goes on to explain why renting makes more sense than buying and I reckon he’s right, but for an entirely different reason.

by Roger Montgomery Posted in Market commentary, Property.

- 11 Comments

- save this article

- POSTED IN Market commentary, Property

-

Reporting season avalanche turns up another gem

Roger Montgomery

August 21, 2012

Since reporting season rolled into full swing, we have covered 130 individual annual reports of companies we like to varying degrees.

Twenty-four of those have made the grade for further research and modelling. Some of them we have purchased in the past few weeks and some we have already been holding for a while. This update concerns one of Montgomery’s holdings McMillan Shakespeare (ASX MMS).Management just reported (after the market close) NPAT of $54.3m – up 25% from last year and diluted earnings per share (EPS) growth of 21%. This is significantly ahead of market expectations for the full year and management’s focus on Salary Packing and Fleet Management Services continues to pay off.

continue…by Roger Montgomery Posted in Companies, Market commentary.

- 2 Comments

- save this article

- POSTED IN Companies, Market commentary

-

What is the impact of the latest ASX Capital raising Rule changes?

Roger Montgomery

July 27, 2012

We are delighted to note that the ASX has made significant improvements to its original proposal to change the capital raising rules for ASX listed companies.

The ASX’s original “placement mandate” would have authorised boards of sub-$300 million companies to issue up to 25% of equity in 12 months on a non-pro rata basis. We don’t need to explain the dilutionary impact that could have on smaller shareholders.

The following table outlines elements of the ASX’s new proposal and why I agree that the changes represent an improvement.

The changes have received regulatory approval and will be effective immediately.

Just watch out for companies seeking general approval to raise the money for no stated commercial purpose. If they seek a general approval I would ‘generally’ vote against it.

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary

-

Are these the best value stocks right now?

Roger Montgomery

September 8, 2011

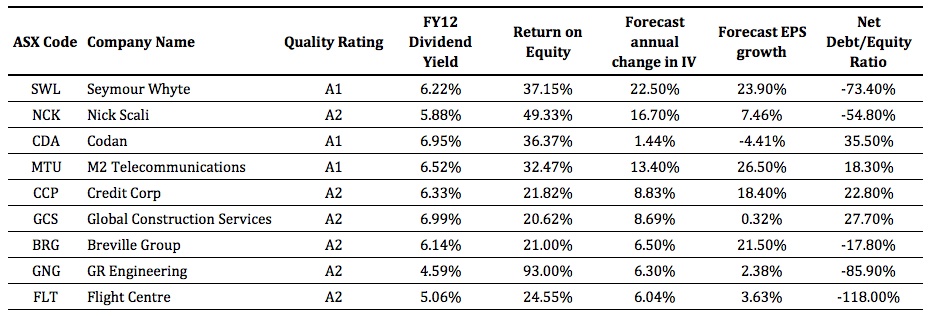

With reporting season over, and armed with the Value.able mantra, how are you uncovering the very best stocks worthy of your attention?

With reporting season over, and armed with the Value.able mantra, how are you uncovering the very best stocks worthy of your attention?Lifebuoy soap was once marketed as Floating Above the Rest. Are there any companies post reporting season doing the same?

While many of my peers believe 2012 could be a very difficult year for investors, there are currently a selection of companies that appear to be both high quality and trading at prices offering a rational safety margin compared to our estimates of their intrinsic value.

Each reporting season we present a short-list of companies worthy of careful analysis. This reporting season is no different. As always, the list is not exhaustive. You are free to agree, disagree or append the list. Indeed, I encourage you to do so. For debate often brings A1 ideas.

I decided to look for Large Caps, Mid Caps, Small Caps, Micro Caps and Nano Caps with an A1 or A2 Quality Score across all sectors and industry groups.

I’m also interested in companies for which there are analyst forecasts for at least one year ahead and whose current market price offers a safety margin of more than 10 per cent.

From over 2080 listed companies, 17 meet the criteria.

An attractive and sustainable Return on Equity is also important, so let’s seek out companies whose ROE is greater than 20 per cent in the most recent financial year, have a forecast dividend yield of more than four per cent and whose intrinsic value that is forecast to rise at least six per cent per annum.

The result?

Nine companies trading at a discount to intrinsic value that may be worthy of your attention.

Here they are: Seymour Whyte (ASX:SWL), Nick Scali (NCK), Codan (CDA), M2 Telecommunications (MTU), Credit Corp (CCP), Global Construction Services (GCS), Breville Group (BBG), GR Engineering (GNG) and Flight Centre (FLT).

If we were in a bull market, I suspect a stampede to get ‘set’ may ensue, without proper research. With the luxury of a market where the tide may still be going out, you may just have the indulgence of time to conduct plenty of research. Regardless, independent research is essential. As is seeking personal, professional financial advice.

So, what have you been researching? Go ahead and list your “Top 5”. We’ll put together a worthy riposte.

Alternatively, put forward your A1 suggestions and we’ll compile a list of intrinsic valuations and Skaffold® Quality Ratings for the next blog post.

Finally, keep in mind that I cannot predict where the share prices for these companies are headed. They could all halve, or worse. And remember, seek and take personal professional advice.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 8 September 2011.

by Roger Montgomery Posted in Companies, Market commentary.

- 317 Comments

- save this article

- POSTED IN Companies, Market commentary

-

Who is being watched this reporting season?

Roger Montgomery

July 1, 2011

Now on the cusp of reporting season, it is worth reviewing our expectations for Value.able intrinsic valuations and double-checking those that belong to higher quality (MQR: A1, A2, B1, B2) businesses.

Now on the cusp of reporting season, it is worth reviewing our expectations for Value.able intrinsic valuations and double-checking those that belong to higher quality (MQR: A1, A2, B1, B2) businesses.There were more than 107 suggestions! Thank you.

Our new A1 service allows us to whip up all the data required for all your nominated stocks in less than a minute (soon you can too!). For now, let’s put stakes in the ground for those which achieved at least three nominations.

In order of mentions…

Matrix C&E, followed by JB Hi-Fi, Forge, Vocus, BigAir, Credit Corp, Woolworths, Thinksmart, BHP, M2 Telecommunications, Zicom, Oroton, ANZ, CSL, ARB Corporation, Thorn Group and Cash Convertors. The remaining companies received less than 5 mentions each. The companies with only a single mention (and therefore arguably least followed) were: ILU, RFG, SMX, KRS, AMA, LNC, RQL, COU, TBR, CPB, AVM, BDR, REA, AIR, CKL, AJJ, FXL, CTD, STU, MIN, TGR, CXS, CMI, CDA, CGX, DGX, RCO, MND, CIX, MOC, RHD, DLX, RMS, MYE, SEA, DPG, SFR, NCK, SRX, NCM, CLV, NFK, CLX, NOE, CMG, NST, IPP, CDD, WTF, OGC, KNH, DWS, FRI and KCN.

Well without further delay, here’s the list with our 2012 forecast Value.able intrinsic valuations.

<Temporarily removed for updating and additional stocks and data columns>

Over the next few weeks we will build on the list, include some additional useful information and data and generally prepare you for reporting season.

Stay tuned. This is a period when even developed markets can be inefficient.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 1 July 2011.

by Roger Montgomery Posted in Companies, Market commentary.

- 179 Comments

- save this article

- POSTED IN Companies, Market commentary