Investing Education

-

Would a dash of income and yield help you survive?

Roger Montgomery

September 29, 2011

It’s not unusual for stock market investors, including Value.able Graduates, to assume, incorrectly, that I’m against high dividends.

It comes from the position I take: companies that generate high rates of return on equity would make their shareholders a lot more money in the long term if they retained their profits (rather than paid them out as dividends) and continued to earn those high rates.

Not all companies, however, have the ability to sustain high rates of return on incremental equity, and so not all companies have the ability to retain all their profits at high rates of return.

A man with a hammer thinks every problem is a nail, and so given large amounts of cash, a CEO may go and do something silly. Understandably, many Australian investors prefer their Boards of Directors to pay the cash out in the form of a dividend.

There is another method that produces similarly attractive returns as retaining and compounding, but allows for the distribution of accumulated franking credits. For investors on tax rates lower than the corporate tax rate, it makes sense for a company to pay out all of its profits (to the extent that they are fully franked, which rules out a few companies) and replace the capital by way of a renounceable rights issue.

Arguably, a non-renounceable rights issue would be less dilutive on your stake in the business, but may fail to replace all the capital paid out.

As a Value.able Graduate confirmed recently, this only works where the costs associated with the capital raising are less than the tax benefit from paying fully franked dividends out. But that is not the subject of this post.

Don’t get me wrong, I like dividends!

Simply, I prefer to see companies with the ability to generate high rates of return on incremental equity (i.e. strong growth opportunities) retain more capital, borrow less and raise less capital. Borrowing increases risk and capital raisings (acknowledging of the above discussion) dilute ownership.

Dividends are Boring

Stepping aside from the stock market rollercoaster and taking the long-term view, a ‘growing dividends’ route to wealth is hardly an exciting proposition. Indeed, it’s akin to walking around Ikea without a wallet.

Yet many investors who lose money on the stock market, going for the quick buck, keep going back for more (akin to going back to Ikea again) and fail to realise that there is a slow but sure way to riches.

Did you know the stock market is trading about where it was in December 2004? Googling that shocked me – nearly seven years of zero appreciation… it seems zero is indeed the new normal!

Over those same seven years many companies have significantly increased their dividends (I should say that comparison is commonly used by the advisory community and the commentariat but it fails to recognise that there are many companies whose share prices are up three, four and seven fold in the last seven years).

Notwithstanding the weak comparison, it is indeed true that some companies have grown dividends significantly, despite a generally lacklustre market. The Reject Shop grew dividends by 394 per cent between 2005 and 2010 from 17 cents per share to 67 cents; M2 by 800 per cent from 2 cents to 16 cents and JB Hi-Fi by 1100 per cent from 7 cents to 77 cents.

Identifying extraordinary companies – those that generate lots of cash – has the power to make you very happy, just not overnight. In that sense it’s pretty unexciting. Mind you, I am yet to find a book or manual that says investing has to be exciting.

When it comes to investing, what is exciting is the effect of compounding. If you could find a portfolio of companies that paid a 5 per cent dividend yield and was able to grow those dividends by 10 per cent per year, your initial $20,000 portfolio earning $1000 would be generating $6,727 in 20 years – a 34 per cent yield on the initial purchase price. And if The Reject Shop could keep growing dividends at 31 per cent per year (unlikely without hiccoughs), they’d be generating dividends of $53.95 in another 15 years (you see why I said unlikely).

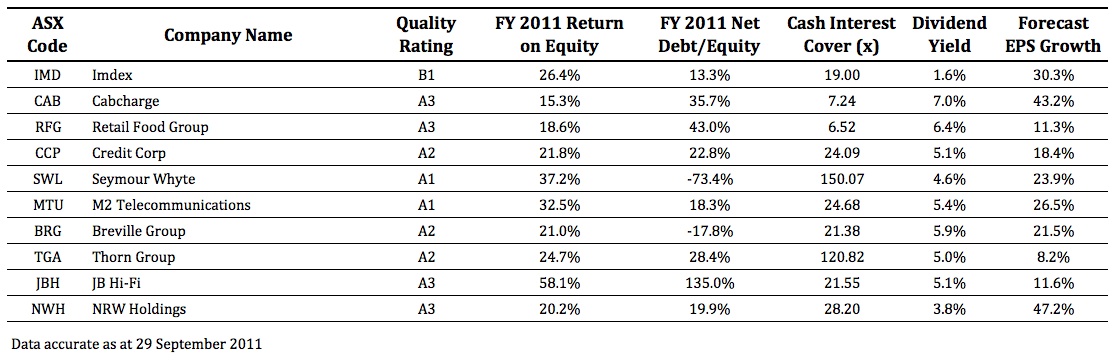

Extraordinary businesses paying attractive dividends

Following you will discover ten extraordinary companies that meet the criteria for high return on equity combined with attractive dividend yields: Imdex (B1), Cabcharge (A3), Retail Food Group (A3), Credit Corp (A2), Seymour Whyte (A1), M2 Telecommunications (A1), Breville Group (A2), Thorn Group (A2), JB HiFi (A3), NRW Holdings (A3).

How did I produce this list?

The goal was to find companies with the potential to significantly increase their dividends in the future. I logged into Skaffold® and refined my search to companies that generate high rates of return on equity (>15 per cent), have little or no debt (interest cover of more than 4 times) and have the strongest expected growth in earnings for at least the next year (EPS growth > 5 per cent).

And because I simply cannot advocate paying more than intrinsic value, I have also selected those that appear to be trading at a rational price (Safety Margin > 15 per cent).

For the record, I only selected A1, A2 A3, B1, B2 and B3 companies. From 1 November, you will be able to conduct searches like this yourself – high ROE, low debt, specified safety margin – the parameters are endless. Your resultant list of companies will quickly help you navigate the 2080 listed companies to find your own income champions.

What other companies make your income champion list?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 29 September 2011.

Skaffold® is a registered trademark of Skaffold Pty Limited.

by Roger Montgomery Posted in Investing Education.

- 35 Comments

- save this article

- POSTED IN Investing Education

-

Should you be readying yourself?

Roger Montgomery

September 23, 2011

If you’re sitting at home or in your office wondering if the party is over and it’s all turned to pumpkins and mice, allow me to offer you a few insights.

If you’re sitting at home or in your office wondering if the party is over and it’s all turned to pumpkins and mice, allow me to offer you a few insights.I know of seasoned market practitioners that have deferred the upping of stumps to set up new businesses because they believe there is worse to come. I also know of prominent Australians that are cashing up and I have met with many professional investors who liken the current conditions to those preceding a severe recession or even depression. Berkshire Hathaway shares are trading below $100,000 for the first time in a while (not that it matters). And Bill Gross at Pimco reckons the fact that you can get a better yield over two years by ‘barbelling’ – putting 10 per cent into 30 year bonds and 90 per cent into cash – and beat the yield on 2yr T-Notes is destroying credit creation and so low yields are having the opposite effect to the stimulation they are intended to generate.

Ok. So what do I think?

These are the times to prepare yourself for the possibility of another rare opportunity to buy extraordinary businesses at even more extraordinary discounts to intrinsic value. You have to be ready, you have to have your Value.able intrinsic valuations prepared and your preferred safety margins calculated.

In the short term (6-12 months), on balance, I think shares could get even cheaper (As I write those words, I log on to see the European markets down five per cent and the Dow Jones opening down more than 3 per cent and I am conscious of the fact that an outlook can be tainted by the most recent price direction). But our large cash proportion/position in The Montgomery [Private] Fund since the start of the calendar year has reflected for some time the impact of this possibility on future valuations and our requirement for larger discounts to intrinsic value.

Longer term, I like some of the research put out by McKinsey. The new infrastructure, such as roads, ports, railways and terminals that developing countries such as China, India and South America will need, will require tens of trillions of dollars. McKinsey Global Institute analysis reckons that by 2030 the supply of capital could fall short of demand to the tune of $2.4 trillion – a credit crunch that will slow global GDP growth by a percentage point annually. Even if China and India cool off, a similar gap could occur.

Back to the immediate outlook and there is a simple mental framework that I have been using to think independently about all the ructions impacting our portfolios.

I am no economist, but its pretty easy to see that if trend line US economic growth is barely 1 per cent, then any slowdown in the business cycle will push the economy towards the zero growth line. One per cent is quite simply very close to zero and the business cycle can push growth rates around more than the difference between them. Every time there is a whiff of a slowdown, there will, at the very least ,be fears of another recession. Again, I am not forecasting a recession nor am I forecasting slow growth. Indeed, I am not forecasting at all. I am simply pointing out the fact that tiptoeing on the edge of a precipice (the US at 1 per cent growth) is more frightening than doing circle work in a paddock a long way from any edge at all (China at 7, 8 or 9 per cent growth). Bill Gross’s comments about the destruction of credit further feeds the idea of a slowdown.

On balance I believe there will be some very attractive buying opportunities in the next six to twelve months. Before you read too much into this statement, I should alert you to the fact that I say it every year.

Analysts are prone to optimism too.

I think it’s also appropriate to remember that analysts typically are generally optimistic about earnings forecasts at the start of a financial year. This can be seen in another McKinsey research note (as well as thousands of other similar studies), where analysts commented:

“No executive would dispute that analysts’ forecasts serve as an important benchmark of the current and future health of companies. To better understand their accuracy, we undertook research nearly a decade ago that produced sobering results. Analysts, we found, were typically overoptimistic, slow to revise their forecasts to reflect new economic conditions, and prone to making increasingly inaccurate forecasts when economic growth declined.

Alas, a recently completed update of our work only reinforces this view—despite a series of rules and regulations, dating to the last decade, that were intended to improve the quality of the analysts’ long-term earnings forecasts, restore investor confidence in them, and prevent conflicts of interest. For executives, many of whom go to great lengths to satisfy Wall Street’s expectations in their financial reporting and long-term strategic moves, this is a cautionary tale worth remembering.”

And concluded: “McKinsey research shows that equity analysts have been overoptimistic for the past quarter century: on average, their earnings-growth estimates—ranging from 10 to 12 percent annually, compared with actual growth of 6 percent—were almost 100 percent too high. Only in years of strong growth, such as 2003 to 2006, when actual earnings caught up with earlier predictions, do these forecasts hit the mark.”

Demand bigger discounts

Those thoughts provide the ‘Skaffolding‘ in my mind around which I construct an opinion of where the landmines and risks may be for an investor. I tend to 1) look for much bigger discounts to intrinsic values that are based on analyst projections for earnings and 2) lower our own earnings expectations for those companies we like best.

Cochlear is one example of this. Many analysts have forecast a 10-20 per cent NPAT decline from the recent recall of their Cochlear implant. Only one analyst has considered and forecast a 40-50 per cent NPAT decline. The truth will probably be somewhere in between. Such a decline however would come as a shock to many investors if it were to transpire. And so it is important to be aware of that possibility when calibrating the size of any position in your portfolio. In other words, be sure to have some cash available for such an event because intrinsic value based under that scenario is between $23 and $30.

Your “Top 5”

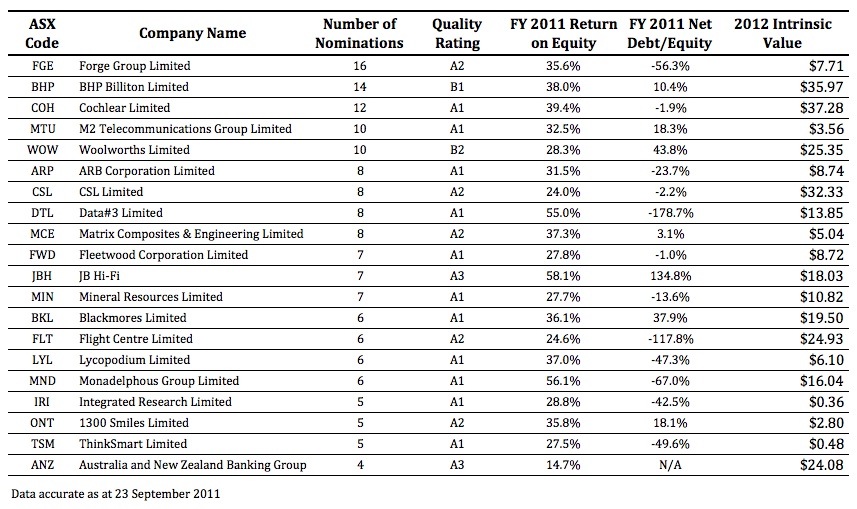

Earlier this month I asked you to list your “Top 5” value stocks – those that you believed represented good value at present. I was delighted to receive so many contributions.

On behalf of the many Value.able Graduates and stock market investors who read our Insights blog thank you for sharing with us the result of all your fossicking, digging and analysis.

There were more than 115 suggestions. The most popular was Forge Group with 16 mentions.

The following table presents the Quality Score, FY2011 ROE, FY2011 Net Debt/Equity and 2012 Value.able Intrinsic Value for Forge Group (FGE), BHP, Cochlear (COH), M2 Telecommunications (MTU), Woolworths (WOW), ARB Corp (ARP), CSL , Data#3 (DTL), Matrix (MCE), Fleetwood (FWD), JB Hi-Fi (JBH), Mineral Resources (MIN), Blackmores (BKL), Flight Centre (FLT), Lycopodium (LYL), Monadelphous (MDN), Integrated Research (IRI), 1300 Smiles (ONT), ThinkSmart (TSM) and ANZ.

As you know these quality scores and the estimates for intrinsic values can change at a moments notice (just ask those working at Cochlear!) so be sure to conduct your own research into these and any company you are considering investing in and as I always say, be sure to seek and take personal professional advice.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 23 September 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Market Valuation.

-

Have you truly made up YOUR mind?

Roger Montgomery

September 23, 2011

I’m always looking for Value.able contributions that will enahnce the value of our Insights blog.

I’m always looking for Value.able contributions that will enahnce the value of our Insights blog.Scott’s comparison of the performance of a Value.able A1 portfolio and a conventional portfolio promoted by a large bank over the last six months is one such example. Nick’s contribution here about independent thinking is another. Take it away Nick…

“Most people would rather die than think, in fact they do so.” Bertrand Russell

The title of this post which Roger has kindly let me write for his blog may seem like such elementary and common sense advice that it need not be written at all – kind of like telling a friend to make sure he looks both ways before crossing the freeway.

Is thinking independently when it comes to investing really so obvious? And do people practice it consistently? I would say not. Just because something is obvious does not mean it will be practiced and not thinking independently, by which I mean not thinking for yourself and making up your own mind on an issue (not necessarily having a contrary opinion for the sake of having a contrary opinion), is one of the surest ways to destroy wealth and end up dissatisfied as an investor (aside from the strong likelihood of losing money you will also lack autonomy over your future). I have made this mistake in the past and can speak from experience.

Ben Graham once said “You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right.”

And in the 1985 Berkshire Hathaway Annual Letter to Shareholders, Warren Buffett shares with his readers this story passed down from Ben Graham which illustrates the lemming-like behaviour of the crowd: “Let me tell you the story of the oil prospector who met St. Peter at the Pearly Gates. When told his occupation, St. Peter said, “Oh, I’m really sorry. You seem to meet all the tests to get into heaven. But we’ve got a terrible problem. See that pen over there? That’s where we keep the oil prospectors waiting to get into heaven. And it’s filled – we haven’t got room for even one more.” The oil prospector thought for a minute and said, “Would you mind if I just said four words to those folks?” “I can’t see any harm in that,” said St. Pete. So the old-timer cupped his hands and yelled out, “Oil discovered in hell!”. Immediately, the oil prospectors wrenched the lock off the door of the pen and out they flew, flapping their wings as hard as they could for the lower regions. “You know, that’s a pretty good trick,” St. Pete said. “Move in. The place is yours. You’ve got plenty of room.” The old fellow scratched his head and said, “No. If you don’t mind, I think I’ll go along with the rest of ’em. There may be some truth to that rumour after all.”

This is not the fate you want for yourself!

And don’t let hubris get in the way. Intelligence alone will not keep you away from the dangers of crowd behavior and emotion. One of history’s most gifted minds and scientists, Sir Isaac Newton, was caught up in the emotion and chaos of crowd behavior which resulted in him losing his fortune in the South Sea Shipping Company Bubble. Sir Isaac Newton had previously made a packet on this very same company although after selling and watching the share price continually keep rising, he reinvested everything he had before the crash. For as long as he lived he forbid the words South Sea Shipping Company to ever be mentioned in his presence. It was not a lack of intelligence which brought Sir Isaac unstuck, it was, I argue, his lack of independent thought on the merits of the South Sea Shipping Company as a suitable investment.

“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” Ben Graham.

Once you have determined to think independently and make up your own mind on a company’s current strengths and weaknesses, and its current and future earnings prospects, how do you best do this? Perhaps the most effective way is to follow the advice of the famous algebraist Carl Jacobi who said ‘Invert, always invert.’ So if from your reading you believe company XYZ to be possible investment material (either from Roger’s blog, the newspaper, a friend, your stockbroker) read everything you can and formulate as strong a case as you can on why it would make a lousy investment. If, after having made as strong a case against the company as the information allows, it still looks pretty good and is selling at an attractive price, then it is worthy of further consideration. It has also been useful to me in the past having friends help me out with this. Usually before making an investment I’ll ask my most intelligent and able friends for their opinion on why I shouldn’t invest in company XYZ. This will not mean that you’ll never make a mistake again, although when you do at least you’ll be able to understand why (having studied the reasons against making the decision in the first place).

“I want to be able to explain my mistakes. This means I do only the things I completely understand.” Warren Buffet

Charlie Munger, in a speech given at USC (which you can all view on YouTube) says “I have what I call an iron prescription that helps me keep sane when I naturally drift to preferring one ideology over another and that is I say I am not entitled to have an opinion on this subject unless I can state the arguments against my position better than the people who are supporting it.” This is great advice, and to tailor it to investing all you need to do is replace the word ‘subject’ with ‘company.’

Charlie Munger also likes to talk about the importance of having a latticework of mental models in your head and how the big ideas from across a broad range of disciplines can often be used in sync to best analyse a particular problem. I won’t expand on this now, although can recommend his speeches and essays which are easily available on the internet.

Having a great interest in investing, I find this blog is a wonderful source of ideas and learning and really enjoy reading the comments written every day. That said, one way in which I believe it could be improved is for there to be more argument and questioning, something which is happening more and more as the share price of recent blog favorites has dropped. If someone says they believe XYZ to be a great quality company without providing reasons they should be held to account and asked why? If the only response is that Roger has it as an A1 then a fail grade would be mandatory. If someone says they believe that company XYZ has excellent earnings prospects they should again be asked why? And if their response is that the analysts consensus on Comsec says so then again, another F.

I hope that this post may have been of some interest and if you have some stories of success as a result of independent thinking, I would be very interested in reading them.

Nick Mason

Roger’s Note: And if you have a similarly lucid and instructive idea that you would like share here at our Insights blog, go ahead and submit. Not every contribution can be published as a post, but we will certainly post those we like.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 23 September 2011.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Value.able.

-

Your next-generation A1 invitation

Roger Montgomery

September 6, 2011

My team and I are delighted to invite Value.able Graduates to pre-register for Skaffold®, our next-generation A1 service.

Skaffold is the stock market like you’ve never seen it before – the world’s best visuals combined with its most reputable information and ideas.

Amazing, incredible, simple. That’s Skaffold.

Those who have already seen Skaffold called it “the missing piece”.

Value.able Graduates will receive a personal invitation today. Keep an eye out for an email from me with the subject line “Your next-generation A1 invitation. Here it is”.

IMPORTANT: It has come to our attention that some @optusnet.com.au email addresses did not receive my invitation. Rest assured, if you have contacted us, posted a comment here at the blog or on my Facebook page, or simply not received your invitation, my team will be in touch.

Posted by Roger Montgomery, Skaffold® member #1.

Skaffold® is a registered trademark of Skaffold Pty Limited.

by Roger Montgomery Posted in Companies, Investing Education.

- 87 Comments

- save this article

- POSTED IN Companies, Investing Education

-

What has probing the reporting season avalanche revealed?

Roger Montgomery

August 24, 2011

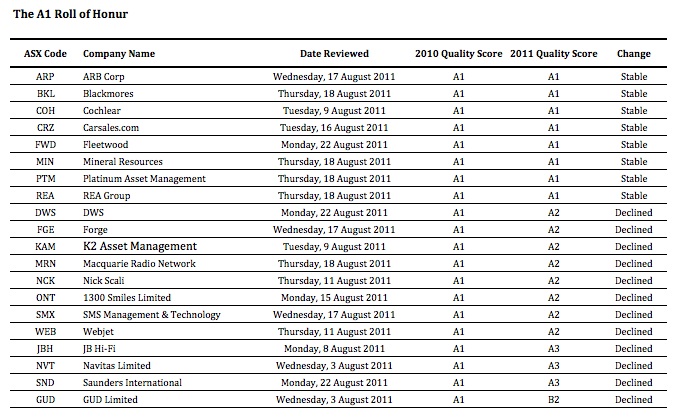

With reporting season in full swing, I would like to share my insights into whose Quality Score has improved, and whose has deteriorated. Remember, none of this represents recommendations. It is intended to be educational only. You must seek and take personal professional advice before acting or transacting in any security.

To date, 232 companies have reported their annual results. I am sure you can understand why we feel snowed under. With almost 2,000 companies listed on the ASX, the avalanche still has a way to roll.

We have updated all of our models for each of the 164 companies that we are interested in. As you know, we rank all listed companies from A1 down to C5. The inputs for those rankings always come from the company themselves. I would hate to think how bipolar they would be if we allowed our emotions and personal preferences to infect those ratings (or be swayed by analyst forecasts)!

Rather than arbitrary and subjective assessments, we download some 50-70 Profit and Loss, Balance Sheet and Cash Flow data fields from each annual report to populate five templates. All of these templates employ industry specific metrics to calculate the Quality Scores. This allows us to rank every ASX-listed business from A1 – C5. Its our objective way to sort the wheat from the chaff.

For Value.able Graduates not familiar with our scoring system, company’s that achieve an A1 Score are those we believe to be the best businesses, and the safest. C5s are the poorest performers and carry the highest risk of a possible catastrophic event.

A1 does not mean nothing bad will ever befall a company. A1 simply means to us that it has the lowest probability of something permanently catastrophic. Further, ‘lowest probability’ doesn’t mean ‘never’. A hundred-to-one horse can still win races, even though the probability is low. Similarly, an A1 business can experience a permanently fatal event. In aggregate however, we expect a portfolio of A1 businesses to outperform, over a long period of time, a portfolio of companies with lesser scores.

With that in mind, we are of course most interested in the A1s and – on a declining scale – A2, B1 and B2 businesses.

So, who has managed to retain their A1 status this reporting season? And which businesses have achieved the coveted A1 status? If you hold shares in any of the companies whose scores have declined (based of course on their reported results), please read on.

Of the companies that have reported so far, last year 20 of them were A1s, 28 were A2s, one was a B1 and 13 scored B2. That’s an encouraging proportion, although we tend to discover each reporting season that the better quality businesses and the better performing businesses are generally keen to get their results out into the public domain early.

Its towards the end of every reporting season where the quality of the businesses really drops off. This is always something to watch out for – companies trying to hide amongst the many hundreds reporting at the end of the season. It’s always a good idea to turn up to a big fancy dress party late, if you aren’t in fancy dress.

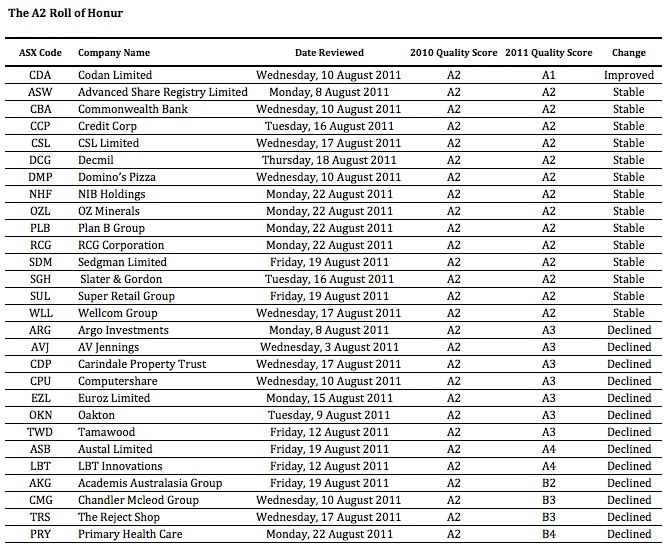

This year we have seen the number of existing A1s fall to nine from 20, A2s from 28 to 24, B1s rise from one to two and B2s fall from 13 to six.

The first table shows all twenty 2009/2010 A1 companies that have reported to date. You’ll see a number of very familiar names in here, including ARB Corp (ARP), Blackmores (BKL), Cochlear (COH), Carsales.com (CRZ), Fleetwood (FWD), Mineral Resources (MIN), Platinum Asset Management (PTM), REA Group (REA), DWS (DWS), Forge (FGE), K2 Asset Management (KAM), Macquarie Radio Network (MRN), Nick Scali (NCK), 1300 Smiles Limited (ONT), SMS Management & Technology (SMX), Webjet (WEB), JB Hi-Fi (JBH), Navitas Limited (NVT), Saunders International (SND) and GUD Limited (GUD). Nine have maintained their A1 rating this year.

Now, before you go jumping up and down, a drop from A1 to A2 is like downgrading from Rolls Royce to Bently. When we talk about A2s, its not a drop from RR Phantom to a Ford Cortina, not that there’s anything wrong with the old Cortina (if you are too young to know what I am talking about Google it!).

The only big rating decline is GUD Holdings, which made a large acquisition (Dexion) during the year. Indeed, a common theme amongst the higher quality and cashed up businesses this reporting season has been the deployment of that cash towards, for example, acquisition or buybacks (think JB Hi-Fi).

Moving onto the 2009/2010 A2 honour roll: Codan Limited (CDN), Advanced Share Registry Limited (ASW), Commonwealth Bank (CBA), Credit Corp (CCP), CSL Limited (CSL), Decmil (DCG), Domino’s Pizza (DMP), NIB Holdings (NHF), OZ Minerals (OZL), Plan B Group (PLB), RCG Corporation (RCG), Sedgman Limited (SDM), Slater & Gordon (SGH), Super Retail Group (SUL), Wellcom Group (WLL), Argo Investments (ARG), AV Jennings (AVJ), Carindale Property Trust (CDP), Computershare (CPU), Euroz Limited (EZL), Oakton (OKN), Tamawood (TWD), Austal Limited (ASB), LBT Innovations (LBT), Academis Australasia Group (AKG), Chandler Mcleod Group (CMG), The Reject Shop (TRS) and Primary Health Care (PRY).

The businesses that make up this list showed slightly more stability. The biggest fall in quality this year was Primary Healthcare (PRY),which is still struggling to digest the large purchases it made a few years ago. The Reject Shop (TRS) also declined, to B3. TRS is still investment grade and we would lean towards believing this is a short-term decline, given the floods in QLD that caused the complete shutdown of their new distribution center and the massive disruptions subsequently caused. As the company said, you can’t sell what you haven’t got!

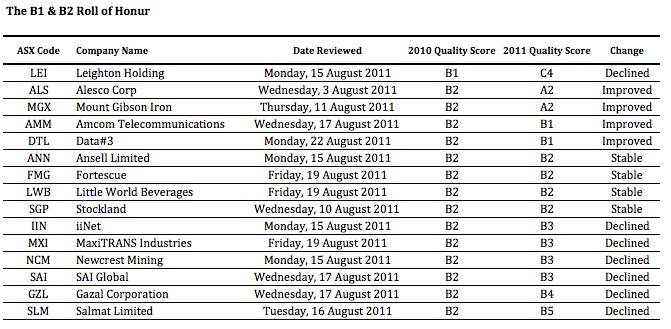

Finally, B1 and B2 companies: Leighton Holdings (LEI), Alesco Corp (ALS), Mount Gibson Iron (MGX), Amcom Telecommunications (AMM), Data#3 (DTL), Ansell Limited (ANN), Fortescue (FMG), Little World Beverages (LWB), Stockland (SGP), iiNet (IIN), MaxiTRANS Industries (MXI), Newcrest Mining (NCM), SAI Global (SAI), Gazal Corporation (GZL) and Salmat (SLM).

About half the companies in the B1/B2 list retained or improved their ratings from last year. Mind you, half also saw their rating decline!

The clear fall from grace is Leighton Holdings, whose problems have been well documented in the media and via company presentations.But once again, like The Reject Shop, this could be a temporary situation. If the forecast $650m profit comes through, I expect LEI’s quality score will improve. What the dip will do, however, is remain a permanent reminder that Leighton is a cyclical business. Getting the quote right on a job is important, even more a massive enterprise like Leightons.

Are you surprised by any of the changes? We certainly were!

Sticking to quality is vitally important. That’s what my team and I do here at Montgomery Inc, and its what our amazing next-generation A1 service is all about. Value.able Graduates – your invitation is pending.

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Remember, you must do your own research and remember to seek and take personal professional advice.

We look forward to reading your insights and will provide another reporting season update soon.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 24 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Is iiNet worth two Bob?

Roger Montgomery

August 15, 2011

iiNet’s full-year results have been released. I have taken particular interest because communications and data is one sector of the marketplace I believe is relatively less affected, in terms of share-of-wallet, by the ructions in the US Europe.

iiNet’s full-year results have been released. I have taken particular interest because communications and data is one sector of the marketplace I believe is relatively less affected, in terms of share-of-wallet, by the ructions in the US Europe.The results released today (15 August 2011) were marginally below the expectations of several analysts we correspond daily with. Underlying EBITDA was up just shy of 30 per cent to $104.8 million (some analysts were expecting $106 million and a little more).

With DSL (Digital Subscriber Line) – the technology that significantly increases the digital capacity of ordinary telephone lines, and excluding HFC (Hybrid Fiber-Coax network – CABLE) – iiNet is now the number two competitor and the leading “challenger “in the Australian residential telecommunications market. As an investor, I am always interested in the number 1 or 2 player in town. However the gap between number 1 (Telstra) and iiNet (#2) is enormous. iiNet have 641,000 paid DSL subscribers (up 19 per cent). Telstra has 2.4 million.

The company reported its underlying Net Profit After Tax was $39.0m, up 12.4 per cent on FY10, while reported NAPT fell 3.7 per cent to $33.4m (FY10 $34.7m). On a quick glance, I reckon underlying profit was $37 million (you have to add back $3.9 million in deal costs, redundancy costs of $1.2 million and legal costs of $1.4 million but tax effect it). Stripping out the impact of the acquisition, I also estimate cash flow was close to $40 million.

The reason for the less than stellar growth in reported net profit was because iiNet’s tax bill was much higher than last year. The increase in tax wiped out all of the increase in the net profit before tax.

Whilst many analysts will look at the growth in operating profit (EBITDA), I’d look at the net profit before tax. If I add the legal costs in 2010 back to that year’s profit-before-tax and then add the one-offs for 2011, I get a jump in net profit before tax from $43.85 to $53.4 million and a reduction in margins from 9.25 per cent to 7.6 per cent. Hopefully the company’s expected ‘synergies’ (an extra $10 million from porting AAPT customers across to the iiNet billing system?) raise this to 8.5 per cent.

Net debt increased to $96.4m from $56.3m as a result of the AAPT Consumer division. This has had an impact on our Quality Score (the A1-C5 system), which was B2 previously. Gearing will be 40 per cent. And the the balance sheet? It now contains $302 million of goodwill compared to $242 million of equity.

Revenue and operating cash flow was up significantly with the full year’s benefit of the Netspace acquisition and a nine month benefit of the AAPT consumer division. What really would be interesting however is an estimate of what like-for-like revenue and operating cash flow is. Sure iiNet has no ‘stores’, but acquisitions and synergy extraction doesn’t have the same whiff of sustainability as a business that can grow organically. I would like to see how the old business (excluding the acquisitions) is travelling. Value.able Graduates – would you?

And when I hear company say that it is “Ideally positioned for the future“, I want answers as to whether they were previously ideally positioned for ‘now’.

The 19 per cent growth in DSL subscribers includes AAPT’s consumer division, so it doesn’t give us much insight into the organic growth of the company. With ARPU (Average Revenue Per User) largely unchanged, yet network and carrier costs up 56 per cent – above the 47 per cent increase in revenue – some insights into organic growth would be helpful. I suspect subscriber growth will reflect slow organic growth in FY12, and any margin/profit improvement will come from ‘synergies’. While these may be significant ($9 – $12 million from migrating AAPT customers onto iinet billing system), they are not a long-term delivery platform for profit growth.

It is clear that management’s confidence is high. They have significantly increased the dividend from $12.1 million last year to $16.7 million this year and have announced separately a share buy-back of up to 7.6 million shares, or about 5 per cent of the issued capital (about $17 million at current prices), despite the fact that debt has risen substantially by a net $52 million. Perhaps when you have $766 million coming through the door you can afford to be a bit fancy-free with your capital allocation? Thoughts anyone?

I hear whispers in the background… Roger, how do you know all this? Yes, I do listen to company presentations and we do read investor briefings. But nothing compares to the clarity that comes from using our A1 service. It is, quite literally, extaordinary. And we can’t wait to share it with you. Value.able Graduates – expect to receive your invitation very soon. Now, back to the program…

If organic growth is slow and acquisitions begin to thin out, one would expect debt repayment followed by an increase in the payout ratio. Or perhaps the other way around, if share price support is contemplated?

The prices paid for acquisitions does not immediately cause concern for me, because the returns on equity being reported aren’t poor. But they aren’t A1 either.

Investors have tipped in $223 million and left in $15 million. On those amounts, iiNet’s Return on Equity is about 16 per cent.That’s not bad, but are there better opportunities out there. Before you suggest Telstra, keep in mind it is 140 per cent geared and profits are boosted by the failure of the company to recognise software development expenses in the year they are incurred.

The old fashioned Value.able investor in me doesn’t like looking at a balance sheet that reveals the debt-funded acquisition of goodwill. I have witnessed far too many examples of this turning out poorly. Sure, some of you may say that MMS did the same thing? But while debt rose significantly there, the corresponding asset was PP&E, not goodwill. You may instead point out that interest cover is still high at 9 times (20 times last year). That, I accept.

Finally, the NBN. What does it mean for iiNet?

First, some background. An ‘Off-net’ customer is provided a DSL service through another network – usually Telstra wholesale. An ‘On-net’ customer is one that is provided a DSL service through the iiNetwork (iiNet’s own broadband network). The NBN is expected to reduce the average monthly cost of broadband + Voice bundling to $33, which compares favourably to the current off-net cost of $57. This is a potentially major saving, but the reason I am not as excited about this as the company is because as the transition is made, there will be some leakage. It will occur over an unexciting period of time and any number of offsetting factors could adversely impact revenues, costs and profits during that time.

I am more excited about other companies at the moment. A growth by acquisition strategy may offer wonderful potential in the short-term, but it can also be used to mask slow organic growth. The buy-back can be a sign that cashflow will be strong, but it can also be used to merely ‘display’ confidence and support the share price. At Montgomery HQ, we reckon the shares are very close to their Value.able intrinsic value, but iiNet’s fall in quality, from A3 to B2, suggests shifting your attention to other opportunities.

You should be practising your own Value.able valuations. So what do you get for iiNet for 2011, 2012 and 2013?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 15 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Technology & Telecommunications, Value.able.

-

What’s your stock market survival story?

Roger Montgomery

August 10, 2011

Last night, First Edition Value.able Graduate Scotty G shared his stock market story at our blog. Scotty’s story is far too value.able to not receive its own, very special post! Over to you Scotty…

A Tale of Two Crashes

by Scotty G

2008/2009

An ‘investor’, whom we’ll call Scotty G for anonymity purposes, has woken for work at 05:00 to see that the Dow is off 700 points. He nervously heads in to work to check what it means for his portfolio of ‘blue chips’. He’s down badly and it’s only made worse by the fact that he is in a margin loan, which he kept at a ‘conservative’ 50 per cent level of gearing.

His ‘great’ stock picks are not holding up well in this environment and his ‘genius’ ‘value plays’ like buying Babcock and Brown at $7 because ‘its fallen from $28 and surely at a quarter of the price it represents value’ no longer looks like genius at all. He had imagined himself some sort of Buffet-ian hero, stepping into a falling market and making the tough buy call that would surely pay off. No actual analysis is done to back up these calls.

Finally he is 1 per cent off a margin call. He is tense at work, snapping at friends and chewing a red pen so hard it stains his lips and chin. He capitulates, calls his broker and sells out, including his ‘value pick’ Babcock and Brown at 70c. He feels relieved to be out, but is bruised and jaded by his experience. He vows to return to the stock market some day and do better, but doesn’t know how.

2010

Our ‘hero’ comes across a beacon of light in a sea of information. It is the Value.able column in Alan Kohler’s Eureka Report, penned by a knight known as Roger M (name changed to protect the innocent). He follows the link to the Insights blog and is astounded that the information he has been searching for is all here. He eagerly orders the Tome of Wisdom (known as Value.able to some). Upon receiving it, he reads it in one sitting. Wheels click in his head and light shines in the dark. Could it be so simple? Knowing what something is worth and then refusing to pay above it? In fact, demanding a discount? He set off onto his journey for the Grail.

2011

Our hero is now equipped with a spreadsheet devised from the Value.able rule book. He can value companies quickly and decisively. Many don’t make it onto the spreadsheet, as he can now spot a ‘Babcock and Brown’ coming from a mile away. Stock ‘tips’ from colleagues can now be waved away. When they ask why, he tells them. If they say he’s crazy, he smiles and feels at peace. He knows he is still not perfect, but he’s a darn sight better than he was three years back.

The markets turn down. The spreadsheet is rechecked. MCE and FGE are added as they shift below his 20 per cent discount rate. JBH is added soon after. The markets shift lower. But reassured by the facts this time, and not the hype, he buys more of the above.

Markets shift lower still. Figures are checked and rechecked as more great businesses come within range. The panic of a fall is now replaced by a calmness and certainty that an anchor of value provides.

The market finally slides steeply over several days.

Finally! Some of his best targets are in range.

VOC falls, then MTU (a company he has waited ages to acquire), and finally DCG. Sadly, ARP refuses to come within range, but he his patient and does not chase it.

He retires to his castle (lounge/bar), content with the work he has done and happy to await the next chance to hunt and switches on the sport, deftly ignoring the news and business channels hosting ‘experts’ eager to proffer their take on why things were the way they were. He feels at peace and sleeps soundly that night.

“Ok, stripping out all the ‘poetic’ and imaginative stuff, this is pretty much how it went in real life. I suffered a loss due to poor decisions with no research. I found Value.able, I converted (or got innoculated as some of the greats say) and took advantage of the recent situation. And I do sleep soundly at night.

“Thank you Roger for your willingness to share and to all on the blog for the same spirit of camaraderie. I look forward to many years of sleeping soundly at night.

To Value.able and to Value!”

Thanks Scotty.

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have; 1. read Value.able and 2. Like Scotty, changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our very-soon-to-be-released next-generation A1 service).

Posted by Roger Montgomery and his A1 team (on behalf of Scotty G), fund managers and creators of the next-generation A1 service for stock market investors, 10 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Are there really five bargains to research further?

Roger Montgomery

July 29, 2011

With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.

With markets falling on fears that political brinkmanship in the US may result in an embarrassing default on the country’s extraordinary debt obligations (not to mention a reputationally damaging event), I wondered whether we could dig anything up with a more-than-slightly different approach to finding value.As you would know from reading Value.able, I am not a fan of the Price to Earnings Ratio. Nothing has changed on that front. Nevertheless, value may just be in the eye of the beholder and not only is the P/E Ratio common in literature about investing and in market commentary, it is, whether rightly or wrongly, in wide use.

Indeed, if you are like many Baby Boomers now on the cusp of selling your business, you will be spending a great deal of time in negotiations and assisting in due diligence to arrive at a simple multiple of earnings.

The humble P/E Ratio may be misused, misunderstood and relied on far too heavily, but popular it remains.

One version of the earnings multiple that is adopted for comparison purposes by private equity buyers is the enterprise model. The enterprise model takes the market value of the equity (market cap) and debt, less cash, and divides the whole lot by the EBITDA (earnings before interest tax depreciation and amortisation). Of course, if you have a company with high operating margins but lots of property, plant and equipment (PP&E) to maintain, you may find the results a little optimistic.

Simply take a standard price to earnings approach, but subtract the cash the company has in the bank.

If you were to buy a business outright, you may take into account the cash the company has in its bank accounts. After buying the business you may be able to access this cash and withdraw it to lower the purchase price. Alternatively, if you are selling a business, in an IPO for example, you may be just as keen to take the cash out before selling it to maximise the return to you and reduce the return available to otherwise anonymous share market investors (this latter strategy is very popular).

The arithmetic result of taking out the cash is a lower P/E multiple. And that is what I thought you may be interested to discuss.

Are there any companies listed in Australia that are trading on very low multiples of earnings once their cash is taken into consideration? The broad based market declines have ensured there are indeed a few.

Step 1

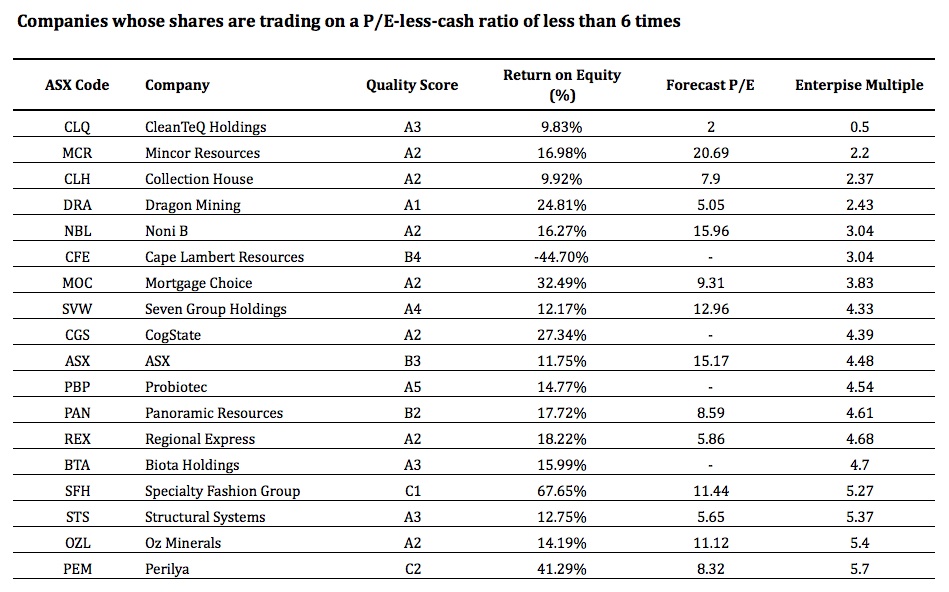

My search began by opening our next-generation A1 service (Value.able Graduates – your exclusive invitation to pre-register is not far away). I applied a filter to discover those companies whose shares were trading at a P/E-less-cash ratio of less than 6 times. From the more than 2000 companies reviewed, there are 18 such companies that meet the criteria today. Keeping in mind some businesses have cash on their balance sheet that would NOT be accessible to a buyer (legislated, regulation or simply working capital needs), here are the eighteen:

Step 2

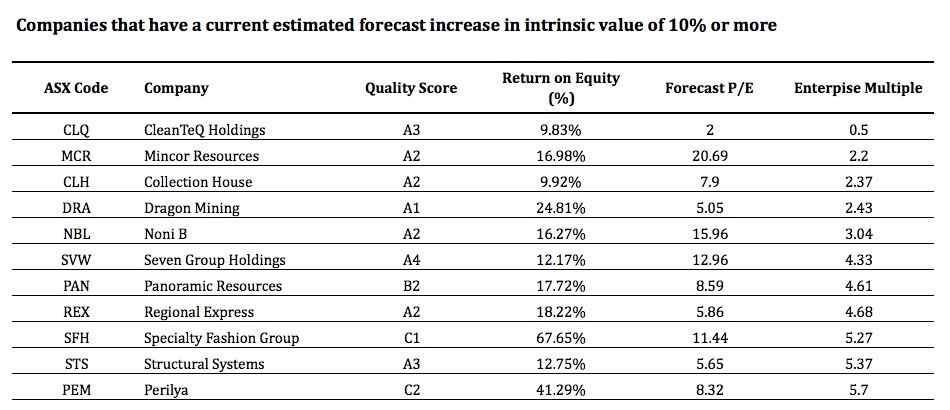

Next, I retained only those companies that have a current estimated forecast increase in intrinsic value of 10% or more. This filter reduced the field to just 11 companies, removing ASX, OZL, CGS, CFE, BTA, PBP AND MOC. Here are the eleven:

Step 3

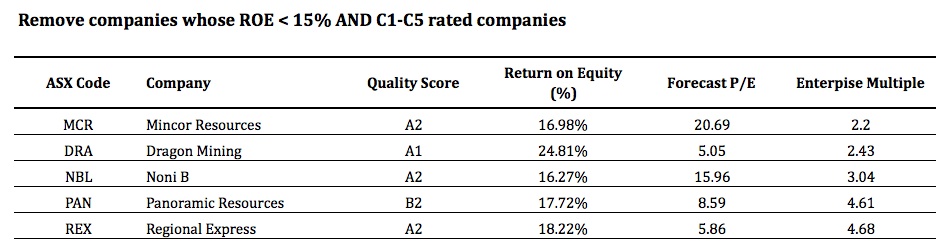

Finally, I removed companies whose previous year’s ROE was less than 15%. I also removed any companies with a C1-C5 Quality Score. Low ROE stocks removed were; CLQ, CLH, SVW AND STS and C-rated companies removed were; SFH AND PEM. That left just five companies. Here they are:

And there you have it, companies trading at enterprise multiples that may be attractive to a buyer who could potentially use the cash on the balance sheet to reduce their purchase price.

Amazing, incredible simple. No manual calculations required (ever again).

Remember, this exercise did not incorporate any of the traditional Value.able investing considerations we usually discuss at the Insights Blog… safety margin, intrinsic value.

For the record, only two of the listed businesses look cheap on the Value.able score today. With reporting season about to begin in ernest, keep in mind the results and cash balances of these companies will all change.

You must do your own research into their prospects and remember to seek and take personal professional advice.

Very soon, finding extraordinary A1 companies offering large safety margins will become simple and even fun. Our next-generation A1 service that my team and I have been tirelessly working on will inspire your investing and re-energise your portfolio.

Value.able Graduates – stay tuned. Your exclusive invitation to pre-register will arrive in your inbox very soon. If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Back to the program… this reporting season, who do you think will surprise with better than expected earnings?

Who do you think will struggle?

And what stocks are looking cheap to you right now?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 29 July 2011.

by Roger Montgomery Posted in Companies, Investing Education.

- 87 Comments

- save this article

- POSTED IN Companies, Investing Education

-

MEDIA

How does Roger Montgomery construct his share portfolio?

Roger Montgomery

July 12, 2011

A couple of weeks ago Tony and Stevo made the following suggestion at my Facebook page: If given $100,000 to invest in the stock market, would I spread my money equally across the portfolio or invest a larger percentage in the very best stocks that are trading at prices less than they’re worth?

Here are the highlights from that appearance on Peter’s Switzer TV.

Peter has invited me to join him again this Thursday from 7pm on the Sky Business Channel (Channel 602).

What’s your portfolio construction strategy?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 12 July 2011.

by Roger Montgomery Posted in Investing Education, TV Appearances.

-

Is shale gas ‘drilling fast and conning Wall Street’?

Roger Montgomery

June 27, 2011

For those interested in Shale Gas stocks, an interesting article was published in the New York Times at the weekend.

For those interested in Shale Gas stocks, an interesting article was published in the New York Times at the weekend.Here’s an excerpt or two from the article…

“Money is pouring in” from investors even though shale gas is “inherently unprofitable,” an analyst from PNC Wealth Management, an investment company, wrote to a contractor in a February e-mail. “Reminds you of dot-coms.”

“And now these corporate giants are having an Enron moment,” a retired geologist from a major oil and gas company wrote in a February e-mail about other companies invested in shale gas. “They want to bend light to hide the truth.”

…and here is the link to the story: http://www.nytimes.com/2011 and a link to more than 480 pages of leaked insider emails and reports: http://www.nytimes.com/interactive

And more recently, in this e-mail chain from April 2011, United States Energy Information Administration officials express concerns about the economic realities of shale gas production.

I am not allowing any comments on this subject. Do your own research and seek personal professional advice.

Please continue contributing to the two prior posts, listing the companies you think we should be watching this reporting season (Scroll Down).

Posted by Roger Montgomery, author and fund manager , 27 June 2011.

by Roger Montgomery Posted in Energy / Resources, Investing Education, Value.able.