Intrinsic Value

-

MEDIA

Why someone has to pull the HFT “Kill Switch”

Roger Montgomery

November 20, 2012

In typically comprehensive style Roger provides his insights on Dark pools, high frequency trading, foreign investment, reserve currency and Nathan Tinkler in this interview with Ticky Fullerton on ABC1’s The Business broadcast 20 November 2012. Watch here.

by Roger Montgomery Posted in Energy / Resources, Intrinsic Value, TV Appearances.

-

Where is the value? Let Skaffold keep you posted!

Roger Montgomery

October 22, 2012

Last week on 2GB I didn’t speak to Ross Greenwood as I normally do. He was off in New York for Channel Nine. Instead I had a terrific chat with my friend and former fund manager Matthew Kidman.

As usual we didn’t have a great deal of time but I asked Matthew whether he was seeing much value and his reply was telling. Like me, it seems to Matthew that value was getting thin on the ground, particularly among the higher quality companies.

There is still a few pockets of value and we named a few stocks. Matthew mentioned that he also predicted that the market would now strengthen and stocks that are fairly valued may continue to rally well beyond fair value.

I am less able to predict stocks and their short term price direction. To reduce risk what we do is simply analyse those companies that come into value as their prices, values and quality scores change.

by Roger Montgomery Posted in Companies, Insightful Insights, Intrinsic Value, Skaffold.

-

MEDIA

What is Russell Muldoon’s outlook on Commodities?

Roger Montgomery

October 17, 2012

Do CSL (CSL, Silverlake (SLR), FKP (FKPDA), Breville Group (BRG), Codan (CDA), QBE Insurance (QBE), NAB (NAB), Wesptac (WBC), AMP (AMP), ALS (ALQ), Prima (PRR), Rio Tinto (RIO), Lynas (LYC), or Mesoblast (MSB) achieve the coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call 17 October 2012 program now to find out, and also learn Russell’s insights into the commodities sector. Watch here.

by Roger Montgomery Posted in Companies, Financial Services, Insightful Insights, Intrinsic Value, TV Appearances.

-

Did TPG take a look at Skaffold?

Roger Montgomery

October 12, 2012

On Friday TPG pulled their offer for Billabong. We have written about Billabong extensively here at the Insights blog and while TPG pulling out may come as a surprise to many investors and commentators, that’s not the case here.

Skaffold has had BBG sub-investment grade since June 2011 – eighteen months and worse, its earnings, return on equity and intrinsic value have been in decline since 2007.

TPG have made a sensible decision irrespective of whether it was their own decision influenced by the loss CVC are taking on Nine or by investors suggesting they might not support the next fund if TPG proceed.

Fig 1. Billabong Intrinsic value Chart (Courtesy: Skaffold.com)

Perhaps if CVC had Skaffold when they bought Nine they might have been in a different position today.

Bottom line, the higher the price you pay, the lower your return. BBG reported equity of $1 billion in June this year and it is forecast to earn just 3.47%. A decent return at present rates of earnings could only occur if the purchase price was a third of the equity (and that’s excluding hundreds of millions in debt), which is about $315 million.

TPG weren’t proposing to pay $315 million, they were proposing to pay $694 million! The higher the price you pay, the lower your return. You can see in Figure 1 that the intrinsic value is not only substantially lower than the current price, but it has been in decline since 2007. We prefer businesses with rising intrinsic values – they’re the ones that are easier to sell at a profit down the track.

Now two bidders have walked away after seeing the books. What could small share market investors know (that private equity does not) that warrants their confidence to purchase shares? We reckon some of them might be mistaking speculation for investing. Thanks Skaffold.

by Roger Montgomery Posted in Insightful Insights, Intrinsic Value, Manufacturing.

-

What is your best performing stock pick for the next 9 months?

Roger Montgomery

October 5, 2012

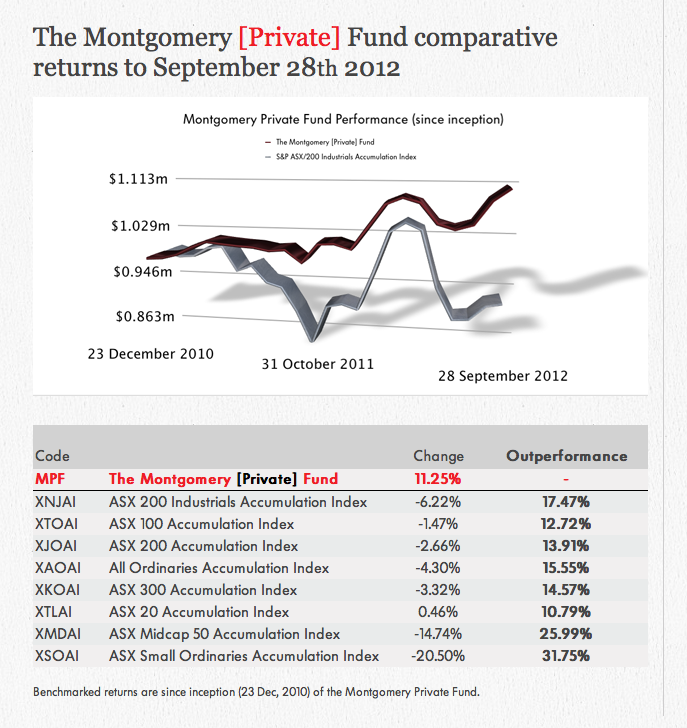

September was a challenging month for investors but Montgomery chalked up another outperformance in both The Montgomery [Private] Fund and The Montgomery Fund (see figure 1).

Of course in the short term the performance of share prices can be attributed to noise and randomness and so the bigger question is always; which businesses will be worth substantially more in the future?

What is your suggestion for the best performing stock for the next nine months to June 30, 2012?

Pick the best performing stock in the next nine months and gain fame and notoriety, kudos and credit.

Each month we’ll track the list and present the table until June 30, 2012.

All the best and stay tuned.

by Roger Montgomery Posted in Companies, Intrinsic Value, Investing Education.

-

MEDIA

Roger Montgomery on Investor Education

Roger Montgomery

October 3, 2012

Roger Montgomery discusses how he engages with his investors in this Professional Planner Online video. Watch here.

by Roger Montgomery Posted in Insightful Insights, Intrinsic Value, TV Appearances.

-

Takeover bids distract from questions over steelmakers viability

David Buckland

October 3, 2012

The $0.75 bid for Arrium Limited (ARI), formerly One Steel, by a Korean Consortium including their largest steelmaker, Posco, values the company at $1.0 billion. Including the $2.2 billion of debt, Arrium has an Enterprise Value of $3.2 billion. Forecasts for the year to June 2013, has Revenue of $8.7 billion, Net Profit of $210m and an after tax return on equity of 4.6%. The Arrium share price has declined from more than $7.00 in mid-2008. A number of brokers are now valuing the Company north of $1.00 per share.

This bid is also raising the question as to whether BlueScope Steel (BSL) will propose a merger with Arrium. “Mergeco” would have $17 billion of annualised revenue.

BlueScope has also seen its share price smashed, down from $8.00 in mid-2008 to the current $0.43 per share. Its market capitalisation is $1.44 billion, and with a forecast net debt of $380 million, BlueScope’s Enterprise value is $1.82 billion. BlueScope has recorded an extraordinarily disappointing four year period to June 2012, with after tax losses aggregating to $2.5 billion while the tripling of their shares on issue to 3329 million shares has been associated with an additional $2.7 billion of capital put into the company.Arrium and BlueScope were downgraded to below “investment grade” by the Skaffold screening process in 2005 and 2008, respectively.

by David Buckland Posted in Insightful Insights, Intrinsic Value, Manufacturing, Skaffold.

-

MEDIA

Cash in on the Gold Dream

Roger Montgomery

October 1, 2012

Roger provides his insights on gold miner Codan’s shiny prospects in his October 2012 Money Magazine article. Read here.

by Roger Montgomery Posted in Energy / Resources, Intrinsic Value, On the Internet.

-

David Jones: Non retailers distracted by a takeover?

Roger Montgomery

September 21, 2012

This week David Jones announced their 2012 results and reported a 40% decline in profit. The only positive was that 4th quarter sales fell by just 1% on pcp whereas 1st quarter sales had fallen 11% on pcp. Actually there was another positive; the 35% decline in earnings per share was inline with expectations.

Separately the company also provided an update to its property strategy. Investors should understand that anything DJS does with its properties is simply a takeover defence against private equity (or Premier Investments perhaps) pulling off the same stunt that was done on Myer. That is; launch a takeover, succeed, sell off the property portfolio and get the business cheaper. if DJS shows it is proactive in this area it becomes much harder from Private Equity to argue that they are “adding value”.

DJS intrinsic value (see Fig. 1) has now not increased since 2004 and according to Skaffold.com DJS’s intrinsic value is not expected to rise at all over the next two years.

by Roger Montgomery Posted in Companies, Insightful Insights, Intrinsic Value, Takeovers.

-

New ASX Investment Talk – Beating the Index

Roger Montgomery

September 14, 2012

Join Roger as he explains how the long-standing principles of value investing can be applied so that you too can identify A1 businesses for your portfolio and beat the index. Watch here.

by Roger Montgomery Posted in Insightful Insights, Intrinsic Value, Investing Education, Market Valuation.