Insightful Insights

-

Where to for the Aussie dollar?

Tim Kelley

December 12, 2014

Like many things in financial markets, exchange rate movements are very difficult to predict. At Montgomery, we don’t claim to possess unique insight into future exchange rates, and so they typically don’t play much of a role in our investment process.

Having said that, in recent years it has seemed to us – as well as many others, including Glenn Stevens – that the $A was at levels that would be difficult to sustain long term, and in structuring our portfolios we have tended to look a little more kindly on high quality businesses that generate significant revenues offshore. continue…

by Tim Kelley Posted in Insightful Insights.

- 2 Comments

- save this article

- POSTED IN Insightful Insights

-

Are you spending more or less this Christmas?

Roger Montgomery

December 12, 2014

As you know we cannot predict where share prices are going next week, next month or next quarter. Valuing a business is simply not the same as predicting its price. What we do know however, is that over the long run, the price of a company’s shares will follow the economic performance of that business. ARB fell 40 per cent or more during the GFC, but its shares have increased almost four-fold over eleven or twelve years. It’s a similar story for CBA. Its shares also slumped during the GFC, but step back and the true picture of performance appears. Our estimate of CBA’s intrinsic value and the company’s share price have tripled over a decade. continue…

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights.

-

Navigating 2014 – the winners and losers

Ben MacNevin

December 11, 2014

A key requirement to generating long-term returns is minimising losses, or what we like to call avoiding the landmines. As the latest results demonstrate, The Montgomery Fund has done a superb job at navigating the minefield that was 2014.

There was a clear divergence in the sectoral performances of the S&P/ASX 200 in 2014. Let’s first examine the sectors that are trading below the levels from the start of the year. continue…

by Ben MacNevin Posted in Insightful Insights, Investing Education.

-

Warning – don’t panic.

Tim Kelley

December 10, 2014

There have been volatile times recently on the ASX. With prices for oil, iron ore and coal falling sharply, the mood in the resources sector has turned decidedly sour. Further, the negative mood seems to have been adopted more broadly by the market, with a wide range of stocks showing meaningful price declines. continue…

by Tim Kelley Posted in Insightful Insights, Investing Education, Market Valuation, Value.able.

-

Eco growth, is it slowing?

Russell Muldoon

December 10, 2014

In the past few months, we have noted that retailing – among other sectors that make up the Australian economy – slowed dramatically in the June quarter of 2014. The September quarter reports from many companies over AGM season saw a continuation of that trend.

Further to our recent observations, Australia GDP just printed at 0.3 per cent for the September quarter. By contrast, 0.5 per cent for the June quarter 2014, confirms that economic growth is waning in Australia and the RBA might be forced to cut rates further. continue…

by Russell Muldoon Posted in Economics, Energy / Resources, Insightful Insights, Investing Education.

-

Looking for value in TPG

Scott Shuttleworth

December 9, 2014

I recently attended TPG Telecom Limited’s Annual General Meeting in Macquarie Park. Below is an ‘over-the-shoulder’ view of my notes which you may find useful. continue…

by Scott Shuttleworth Posted in Insightful Insights, Investing Education, Technology & Telecommunications.

-

Who holds the keys to health?

Ben MacNevin

December 8, 2014

Having recently returned from a comprehensive tour of healthcare companies with our friends at UBS, we gleaned a highly important understanding of where the bargaining power lies in the industry. From this tour, it was abundantly clear whose interests matter most.

In essence, every element of the health care sector is dependent upon the doctors – this is across hospitals, health funds, pathology, service providers and medical device distributors. continue…

by Ben MacNevin Posted in Health Care, Insightful Insights, Investing Education.

-

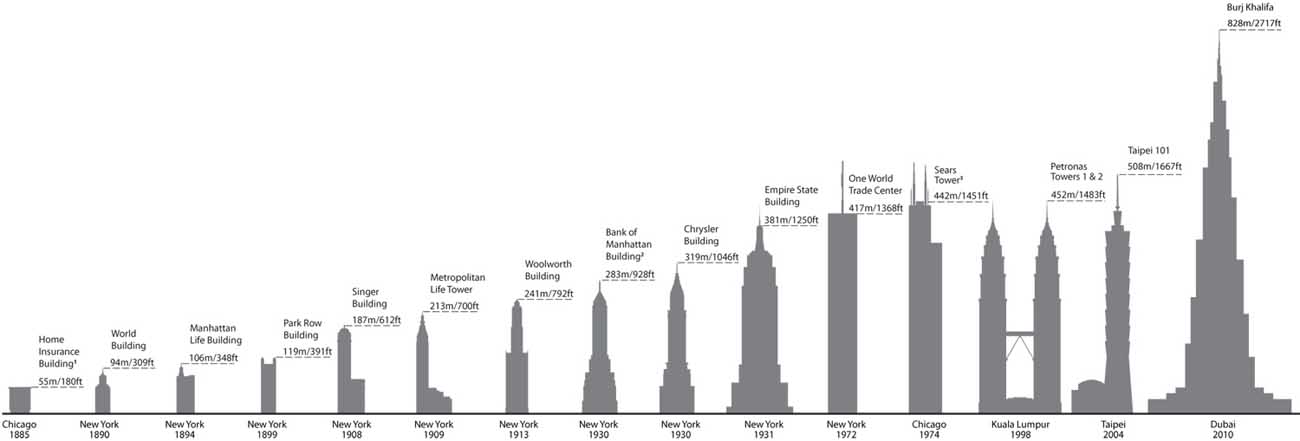

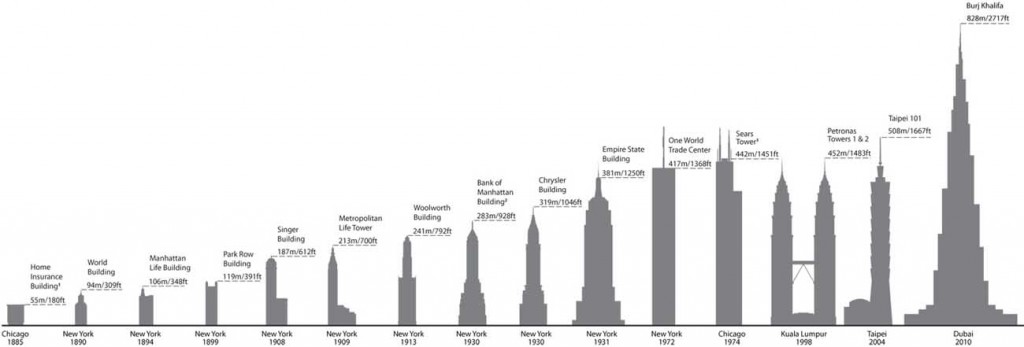

Bubble Watch #18 Tallest Buildings warns of impending stock market crash?

Roger Montgomery

December 7, 2014

There are all sorts of coincidences that can be mistaken for signs that a crash is imminent. We don’t put much store in those, however it is never uninteresting reading about them. One that is gaining a little traction is something known as the Edifice Complex.

In conventional terms, the Edifice Complex is the desire to build lasting edifices or buildings as a legacy to one’s greatness. In today’s context, the Edifice Complex represents the historically coincident construction/completion of these buildings with stock market crashes. continue…

by Roger Montgomery Posted in Insightful Insights, Property, Value.able.

- 3 Comments

- save this article

- POSTED IN Insightful Insights, Property, Value.able

-

Is it true: are we always better off with lower prices?

Roger Montgomery

December 6, 2014

Sadly, we live in a country where the overwhelming belief is that people are almost always better off with lower prices. It’s short-term ideology that fails to recognise the long-term damage suffered by Australian businesses when they simply cannot match the prices offered by better-resourced and more competitive foreign businesses. And it’s ideology again that suggests these businesses should be left to fail.

The result of course is that local businesses do go broke or are bought out by foreign businesses. And as we have seen with Ford and Holden, selling out to foreign enterprises does not secure jobs nor does it guarantee ongoing ‘investment’. We should think of this is we sell off our land, our farms and our infrastructure. continue…

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, Investing Education.

-

Does a lower price mean the shares are cheap?

Russell Muldoon

December 5, 2014

Following on from our recent blog post here and our Head of Research, Tim Kelley’s video blog – on the changing supermarket industry landscape – we are naturally watching the developments in the sector closely (from the sidelines), taking a keen interest in the half year result reported this week by Metcash Limited (ASX:MTS).

To quickly summarise: their half year results showed continued deterioration to which the market has reacted accordingly, with their share price down circa 27 per cent since. continue…

by Russell Muldoon Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education.