Insightful Insights

-

Guest Post: What’s the real BHP share price?

Roger Montgomery

March 29, 2012

Portfolio Point: BHP Billiton is well known to every Australian investor, but what you may not be aware of is the unique opportunity the corporate structure offers the trader and investor.

Portfolio Point: BHP Billiton is well known to every Australian investor, but what you may not be aware of is the unique opportunity the corporate structure offers the trader and investor. BHP Billiton was formed when BHP and Billiton merged in June 2001; following the merger the companies maintained their separate stock exchange listings. Australian investor know BHP Billiton Limited (ASX:BHP) traded on the Australian Stock Exchange, the other major listing is on the London Stock Exchange (LSE:BLT) BHP Billiton Plc. A share bought on either exchange has equal economic and voting rights, meaning you receive the same dividend payment and have equal claim to the company’s assets.

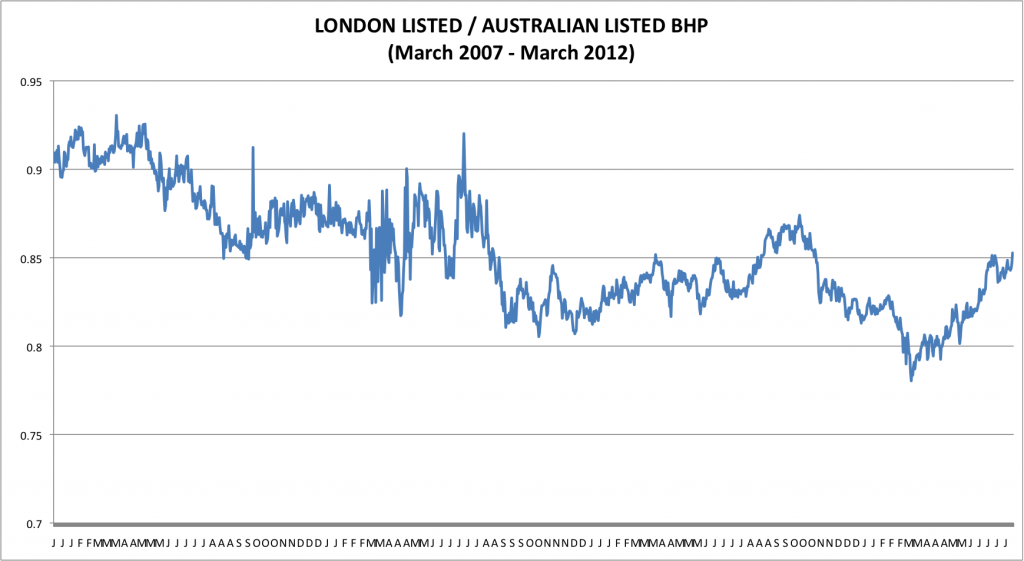

A logical person would assume that adjusted for the exchange rate a share of BHP Billiton Limited would trade very closely to BHP Billiton Plc, surprisingly this assumption is not correct. BHP Billiton Plc has traded at a discount every day for the last five years compared to the Australian listed BHP. If the shares were interchangeable between the exchanges the law of one price would remove the price difference, but in this case it is not possible to transfer a London listed BHP share to the Australian Stock Exchange, so there is not an arbitrage trade opportunity.

On the other hand, as the discount does not remain constant under all market conditions there is an opportunity to profit in the movement of the spread. To trade the spread a person buys one BHP and sells the other listed BHP, the trader is in a hedged position and is not concerned by the price movement of BHP they are just concerned by the movement of the discount/premium between the two shares.

As the shares are traded on different stock exchanges in different currencies, the exchange rate and the movement of the exchange rate needs to be considered if a trader is going to take a spread position. Fortunately in this case both are also traded on the New York Stock Exchange (NYSE) in US dollars through the use of American Deposit Receipts (ADR) an ADR traded on the NYSE represents shares in a foreign company. The ADR shares are interchangeable with the company it represents, so the law of one price keeps the price of the ADR adjusted for the exchange rate in line with the share it represents.

During the last five years the London listed BHP ADR (NYSE:BBL) has traded between 78% and 96% of the price of an Australian listed BHP ADR (NYSE:BHP), with an average of 86%.An excellent risk/return ratio is obtained if the trader can buy the spread near it historic low and sell when the spread moves up to its average and the timing to perform this trade is when the price of BHP is collapsing. In November 2008 when ASX:BHP hit the low of $20.10 the above spread moved 8% in 9 days, 8% might not sound like a great return but as the trade is a hedged position leverage is safely utilised to increase the return on invested capital.

On the other hand, if you are an Australian value investor who wants to buy BHP shares at a discount to their intrinsic value there is a greater margin of safety in buying the London listed BHP for a 15% discount compared to buying the Australian listed BHP. If you follow Roger’s advice and only invest in the highly rated companies on Skaffold then BHP is not going to be a buy for you today at any price, but as the financial situation of every company is constantly changing one day in the future BHP may be rated A1 on Skaffold and at that time it might be worth you considering the London listed BHP.

Author: David Smith 13 March 2012

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights.

-

Is this company a master of the mine?

Roger Montgomery

March 26, 2012

PORTFOLIO POINT: Coal mining services provider Mastermyne is attractive if you consider its work in hand, revenue and earnings prospects. Cash flow, however, must be watched closely and value has recently taken flight.

Investors can be an irrational lot. When share prices are low, investors are reluctant to buy, preferring first a rise in prices to confirm their beliefs. Yet when those beliefs are confirmed and after share prices rise, the reluctance to buy remains; now the investor waits for lower prices to provide a more attractive entry point.

Mastermyne (ASX:MYE) has enjoyed a recent surge in its share price. Even though the rise has pushed its share price above a rational estimate of intrinsic value, it should not dissuade an investigation of MYE as conventional wisdom suggests favourable industry dynamics bode well for its earnings prospects over FY2012 and beyond. For now, turn the stockmarket off and focus on the business.

Mastermyne, established in 1996, is Queensland’s “leading” provider of specialist underground coal mining services. The company’s operations are primarily in the Bowen Basin, but the company also enjoys a growing presence in NSW’s Illawara. The company counts BHP, Rio, Vale and Anglo Coal among its Tier 1 customers. Demand for the company’s services is tied to coal production volumes and the short and medium-term outlook for coal production is positive, thanks to demand from emerging economies.

Bright prospects do assume the following: a benign environment for union action against coal miners (union action is currently underway for the BHP-Mitsubishi JV); no impact from litigation by the “Stopping the Coal Export Boom” movement that has also carefully planned and funded litigation action to delay development of port and rail infrastructure; and the spread of new production in Queensland’s Galilee Basin and NSW’s Hunter Valley.

Mastermyne’s three business segments are:

Mastermyne Underground (Mining Services) (>90% group revenue) (underground conveyor installation, extension and maintenance; underground roadway development; underground ventilation device installation).

Electrical and Mechanical Services (>1% of group revenue) (above ground electrical and mechanical services, including construction, maintenance and overhaul of draglines, wash plants, materials handling systems and other surface infrastructure).

Engineering and Fabrication (designs and fabricates attachments for underground equipment; general engineering and fabrication; supply of consumables for underground coal mines).

Since listing in May 2010 and under the direction of Tony Caruso (CEO since 2005, MD since 2008 – pictured above at far left during Mackay’s best business 2010 gala awards), MYE is off to a good start as a listed company. Importantly, investors should note that of the $40 million raised in the float, not a dollar went into the business. About $2.3 million went to the deal’s brokers and vendors received $37.7 million. Equally importantly, the company didn’t say in its prospectus that the proceeds had been used as ‘working capital’. I have seen plenty of companies that did, even though not a cent went in.

Supported by a strong order book, MYE exceeded its prospectus forecast revenue and earnings for 2010 by circa 4%, and earnings for 2011 by 10%.

Citing limited ‘through-the-cycle’ performance transparency, many investors get nervous about a company that is either new or newly listed. There is no escaping the argument in this case. Not only that, but the fact remains these types of mining contractors typically have high operating leverage and feast can quickly turn to famine, especially where barriers to entry are low (such as in this case) and competitors are willing to price irrationally when pickings get slim. However, between FY2007 and FY2010, MYE achieved compound annualised growth of 17% in earnings before interest, tax and amortisation. Encouragingly, the company grew operating earnings during the GFC and, in a more recent six-month period to August last year, grew its FY2012 contracted order book by 30% – this on top of the previously mentioned prospectus-exceeding growth for FY2011 and second-half 2011 operating earnings growth of 22%.

During MYE’s annual general meeting (AGM) late last year, a very strong start to the current financial year was also cited. Growth in the two smaller divisions is being targeted (expect strong growth off a low base) and the company is positioning to engage in larger projects that are coming online over the next three to four years. Specifically, Mastermyne said that demand for its services remains strong and is increasing.

While several analysts have cited MYE’s strong employee growth as evidence of its statements about pipeline growth, it also serves as a reminder of the operating leverage that engineering contractors typically display. A leading position is essential in the event that industry-wide revenue ever turns south.

Watch the cash

On a work-in-hand, revenue and earnings basis, this is a company with bright prospects. The one caveat, however, is cash flow. Ultimately, it is by cash flow that a company lives and dies. A company waiting for its customers to pay while growing fast must manage its cash flow very carefully.

As is typical in a capital-intensive business (note: reason to moderate any plans for grand portfolio allocations), growth requires significant capital expenditure, as well as more typical variable expense increases. For 2011, net operating cash flows declined from $15.1 million to $9.4 million (take a look at the $20 million jump in receivables for a partial explanation). However, after subtracting $2.6 million for capex, the company was still able to pay its borrowings down by $6.7 million (the apparent increase in ‘borrowings’ is due to finance leases – another cost associated with expansion). Finally, a dividend of $2.6 million arguably caused the bank balance to decline by $2.2 million in 2011.

Using my method to estimate business cash flow, an $8.7 million business cash outflow can be offset by an $11 million increase in property plant and equipment, but the company really needs some of those 1200 additional staff it has taken on to be working in the receivables management part of the back office.

I suspected the accrual accounting used to record revenue would be based on effort expended, and indeed, the annual report confirms this:

“Revenue from services rendered is recognised in profit or loss in proportion to the stage of completion of the transaction at the reporting date…”

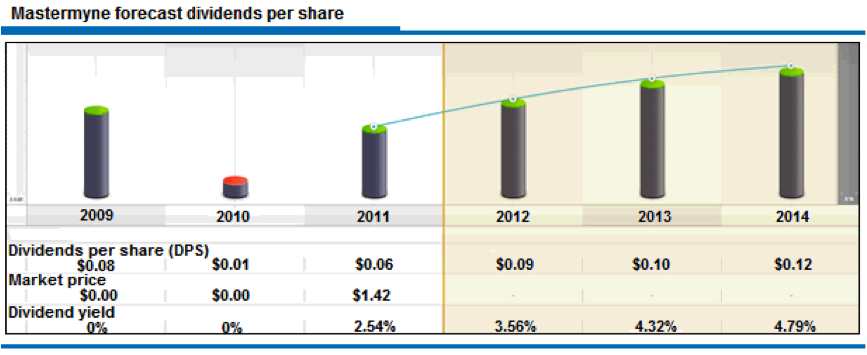

However, clients like BHP, Rio, Anglo Coal and Vale, while making a great looking CV, will also ensure Mastermyne won’t be dictating cash payment terms. The impact of this should not be underestimated, because Mastermyne will require cash to maintain and expand its equipment fleet, as well as maintain dividends (forecasts for per share dividends can be seen in the graph below).

Source: www.Skaffold.com

Only once you are comfortable with an understanding of how the cash flows through the company, its quality and its prospects do you move to analysing its intrinsic value.

Intrinsic value is a function of a company’s equity and the profitability of that equity, as well as a conservative required return.

The make-up of Mastermyne’s equity is therefore important and an examination of the balance sheet reveals that a not-insubstantial portion of the owner’s equity is comprised of intangibles, namely goodwill. The payment to the vendors of around $40 million was well in excess of the book value of net tangible assets, and so the accountants created a common control reserve to ensure the balance sheet balanced. The upshot is this would be a problem if the company were required to borrow meaningful funding. The combination of operating leverage and higher debt (if it were to grow) is itself less than perfect, and debt backed by goodwill leaves shareholders with precious little to support share prices if revenue or operating margins were to turn down.

That appears unlikely in the near term and so we move to the other element of the intrinsic value equation, which is return on equity. For the next two to three years, these returns are expected to remain high and stable at around 31%.

Based on these expectations, and turning the stockmarket back on, Mastermyne is trading at a premium to its current value. A pullback to $1.80, if it were to transpire and all else being equal, should be a trigger to pull the file out and conduct some due diligence on the company’s prospects at that time.

*Mastermyne (ASX:MYE, Score B1) is a small Montgomery [Private] Fund holding.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 26 March 2012.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Manufacturing, Skaffold.

-

Guest Post: Forcing Bright Prospects

Roger Montgomery

March 23, 2012

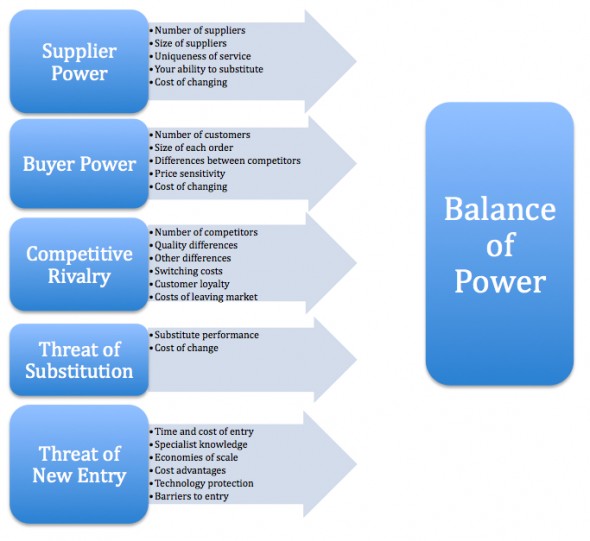

Created by Harvard Business School professor Michael Porter to analyze the attractiveness and likelihood of profitability of an industry, Porter’s Five Forces are a simple but powerful tool for understanding where power lies in any business situation. Using this tool, you can gain insight into the competitive strength of an investee candidate.

Created by Harvard Business School professor Michael Porter to analyze the attractiveness and likelihood of profitability of an industry, Porter’s Five Forces are a simple but powerful tool for understanding where power lies in any business situation. Using this tool, you can gain insight into the competitive strength of an investee candidate.While these Five Forces are typically used by companies to determine whether new products, services or businesses may be profitable, investor’s can use them to analyze the competitive position of any industry member.

The importance of ROE and buying companies with bright prospects is sacrosanct here at the Insights Blog but why? Return on equity is an important explanatory variable for superior share price performance and so we want businesses that can sustain high rates of return. When I talk about bright prospects it is the sustainability of these high rates of return that I am referring to. Whether the bright prospects relate to a rising tide of customers, the ability to pass on rising costs, the ability to be the low cost provider or the changing competitive landscape, how these factors serve to produce a high rate of return on equity is what we care about.

Numerous economic studies have shown that different industries can sustain different levels of profitability. This can be attributed to differences in industry structures. Within those industries however there is a pecking order of companies and Kathy’s column on Porter’s five forces reinforces the need to understand where your investee candidate sits and whether that high ROE being produced today can be sustained.

Porter’s Five Forces model is made up by identification of 5 fundamental competitive forces:

Barriers to entry

Barriers to entry measure how easy or difficult it is for new entrants to enter into the industry.Threat of substitutes

Every top decision makes has to ask: How easy can our product or service be substituted?Bargaining power of buyers

the question is how strong the position of buyers is. For example, can your customers work together to order large volumes to squeeze your profit margins?Bargaining power of suppliers

This relates to what your suppliers can do in relationship with you.Rivalry among the existing players

Finally, we analyze the level of competition between existing players in the industry.Kathy writes…

Calculating the ROE or debt levels of a company is the easy part. But how does one determine if a company has bright prospects? The Porter’s Five Forces model is a tool that I have found to be helpful when picking companies in which to invest. I came across this model while I was studying an Information Systems subject at University.

The Porter’s Five Forces model was developed by Michael Porter to help understand a company’s competitive advantage. The five “forces” that are identified by Porter are:

1) Threat of new entrants

New entrants can increase market competition between companies. In the absence of a dominant player, this can lead to erosion of profit margins.

The threat of new entrants is highly dependent on the barriers to entry. For example, it is relatively easy to start a small pizza business, but it would be difficult to compete with or replicate Cochlear’s business due to the massive R&D costs and intellectual property that is hard to obtain.

2) Power of suppliers

Suppliers can place pressure on margins if they are dominant players in the market. This can be observed in the computer chip manufacturing space where Intel and AMD are the dominant manufacturers. These two companies arguably control the technology that is available to consumers because the manufacturers of computers must build them to accommodate AMD and Intel’s CPUs.

The power of suppliers can also be witnessed in the building industry where suppliers increase their prices as a result of rising commodity costs. These price increases are difficult for builders to pass on in the current subdued climate as consumers are already stretched with high housing costs.

3) Power of customers

A profitable company depends on attracting and retaining customers. However, customers hold the power when they can easily switch to a competitor’s product or service.

In a competitive market where there is little product differentiation, particularly in industries where products have become commoditised, customers have the power to force businesses to compete on price. This is evident with online book stores, where consumers have the ability to search for and compare the cheapest prices across online retailers such as Amazon, eBay, Book Depository and Booktopia, forcing traditional bricks and mortar book stores to compete.

4) Availability of substitutes

In the majority of industries there are substitutes that a customer might use if prices become prohibitively high. Substitutes can be seen in the energy sectors, for example, petrol is increasingly being substituted with ethanol in cars.

New technologies also create substitutes. The introduction of electronic downloadable music has been very popular with consumers who wish to purchase and download music at their convenience. CD sales have dwindled much to the dismay of record labels. Companies need to be agile and adapt to new trends. Kodak is a classic example of a company that did not move with the times.

5) Existing competitors

Competitors all fight for market share by developing their brands and by attempting to attract customers. Increased competition can lead to the erosion of profit margins. Innovation can help, however this is difficult for businesses that operate in a commodity-type business. Retailers (e.g. Coles, Woolworths, Myer) typically sell the same products as their competitors, and perhaps their private label products are a means for them to differentiate themselves from their competitors.

I hope this has given everyone some food for thought. These are the things

I try to think about before I invest my hard earned money.Thanks Kathy for your post. If you would like to list a couple of companies that you believe dominate their industry and will sustain high rates of return on equity, simply click on the Leave A Comment link below.

by Roger Montgomery Posted in Companies, Insightful Insights, Value.able.

-

Is there beauty in boring?

Roger Montgomery

March 15, 2012

Making winches and bullbars for four-wheel drives sounds boring, but the latest figures from ARB offer exciting reading.

Making winches and bullbars for four-wheel drives sounds boring, but the latest figures from ARB offer exciting reading.

I am most excited about companies that are in boring industries. You might recall my column (here) enthusiastically discussing Embelton, a manufacturer and distributor of … wait for it … hardwood flooring. Since that article the stock has surged to new all-time highs. Great companies that are run by reliable and trustworthy managers can produce returns that are anything but boring.Right now, retail and other sectors such as property have declined in prominence in the various indices. As a result, fund managers worried about their “tracking error” don’t need to own as much of these companies’ shares, which in turn means brokers don’t receive sufficient brokerage fees to warrant an analyst covering them. The net result is that analysts are made redundant, and coverage of the stocks declines along with the price multiples being asked for the shares. For a long-term value investor, this is bliss.

And with that we turn to the results of another of my candidates for most boring industry award: ARB Corporation. ARB manufactures and distributes 4WD aftermarket accessories. Think bull bars, snorkels, fridge-freezers and winches (among other items) manufactured in Thailand and Kilsyth and distributed around the world, now through 43 stores (16 company owned – think of the long-term store rollout potential!) from Africa and the Emirates to Mongolia.

Strong local demand has protected ARB from the impact of Thai floods on vehicle supply and a very strong previous corresponding period (thanks to a large order). And just as local demand in January (holidays) and February (job losses) will trim sales, a restoration of car manufacturing supply chains offshore will offset it.

In the most recent half, ARB increased sales 2.3% to $132.1 million, maintained its EBIT of $24.9 million, increased its net profit by 1.6% to $18.3 million and its earnings per share by 1.6% to 25.2¢. The interim dividend also rose by one cent to 11¢ a share.

Many investors might be concerned about the flat EBIT. Don’t be. This reflects increased staffing and in particular staff in the research & development department. It’s this department that is responsible for the company’s innovative product lineup that included the release of the Sahara bull bar range (2000), the Emu Dakar leaf springs (2005), the recovery strap range (2007) and the fridge freezer (2008). While the cost is expensed, investors should think of it as an investment in the future. EBIT was also flat thanks to store expansion and the NPAT increase merely reflected an increased interest income item. Like I said, don’t get too excited!

Some of our “informers” have, however, explained that price rises have been possible and if you have read my book Value.able (click here), you will discover just why I think this is the most valuable competitive advantage.

The resource boom in Queensland and WA is having a positive impact on smoothing the company’s revenues and earnings in addition to the obvious direct impact on aftermarket product sales. The company’s production facilities have been running full-tilt and this appears to have resulted in some buildup of inventory, which in turn has had an impact (not material) on cash flows and the value of materials and consumables used compared to sales.

Full capacity production facilities add to inventory that has become backlogged as a result of slow vehicle throughput, due to the Thai floods and Japanese earthquake. I expect the inventory will run down again as deliveries of post-flood vehicles overseas ramps up.

I am encouraged by the Thai facility being at full production so soon after commissioning, because it suggests that management were unduly conservative in their estimation of their global reputation. I expected more cash to be needed for an upgrade or expansion and that has been announced. With returns on equity the envy of their listed peers, I am delighted to see the company invest more.

At an ASX seminar I presented yesterday, one attendee asked about the impact of currency on the company. This was a very good question: It’s important to note that for ARB there are two impacts. The first is a strong Australian dollar is great for margins when inputs are purchased from overseas. The flipside is that marked-up revenues earned offshore are impacted negatively as the dollar strengthens and those revenues are repatriated.

Historically, the company has a record of paying special dividends and, with $32 million in the bank, it is understandable that many analysts would use this line to woo investors into the stock (as an owner of the stock; “go for it” I say!). But the large cash balance is partly the result of $7 million raised in 2010 (through an underwritten DRP if I recall correctly) and special dividends will also be dependent on the level of investment the company makes in plant:

Such an outcome is not beyond the realms of possibility but neither is a permanently higher dividend payout ratio. The latter of course reduces the intrinsic value of the company – better that MD Roger Brown keeps the money in ARB and reinvests it at near 30% returns on equity.

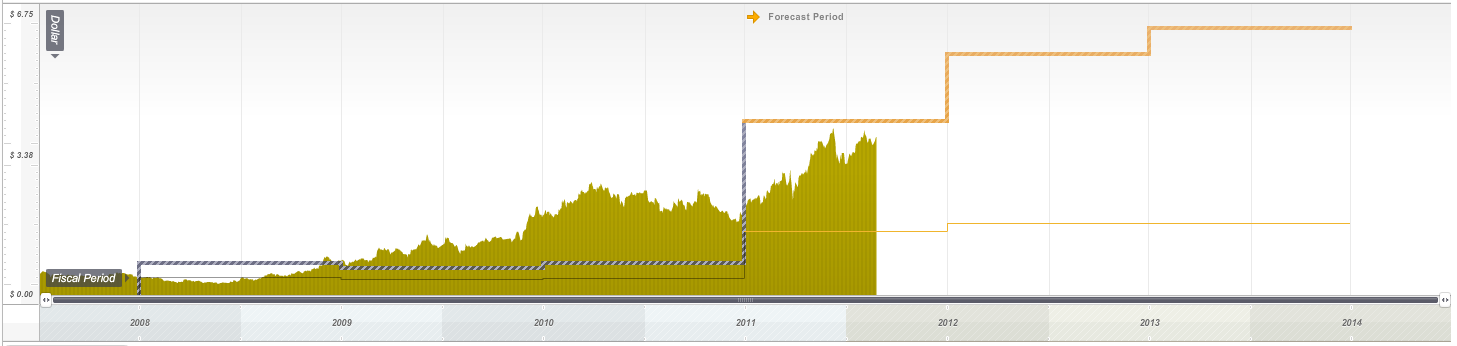

At the current price of about $8.63, ARB is trading just above its 2012 intrinsic value estimate (see above Skaffold chart). With only 43 stores globally and only 16 company owned, fully utilised production facilities however suggest the company has plenty of scope to grow while sustaining high rates of return on incremental capital for decades – notwithstanding management’s energy to do so. It seems boring but slow and steady seems to be winning the 4WD race.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 15 March 2012.

by Roger Montgomery Posted in Companies, Insightful Insights.

- 13 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

Is the rally over?

Roger Montgomery

March 8, 2012

At the outset, let me say I am not going forecast anything. I don’t know whether the market will rise or fall next. Andy Xie however, in his column entitled; A world flying blind wrote: “Playing with expectations works temporarily. The risk-on trade is in a mini bubble, as today’s, buyers want to be ahead of the slower ones. The buying trend is sustainable only if the global economy strengthens, which is unlikely. The stocks aren’t cheap. Desirable consumer stocks are selling for 20 times earnings. Banks are cheap for a reason. Internet stocks suggest another bubble in the making. The Fed is trying to inflate an expensive asset. The rally, hence, is quite fragile. As soon as a shock like Greece defaulting or bad economic news unfolds, the market will quickly head south.”

At the outset, let me say I am not going forecast anything. I don’t know whether the market will rise or fall next. Andy Xie however, in his column entitled; A world flying blind wrote: “Playing with expectations works temporarily. The risk-on trade is in a mini bubble, as today’s, buyers want to be ahead of the slower ones. The buying trend is sustainable only if the global economy strengthens, which is unlikely. The stocks aren’t cheap. Desirable consumer stocks are selling for 20 times earnings. Banks are cheap for a reason. Internet stocks suggest another bubble in the making. The Fed is trying to inflate an expensive asset. The rally, hence, is quite fragile. As soon as a shock like Greece defaulting or bad economic news unfolds, the market will quickly head south.”In the great de-leveraging we are witnessing, cutting interest rates (monetary policy) doesn’t spur economic activity because businesses and individuals are simply trying to get out from under a mountain of debt first. The next option is to simply hand over money (quantitative easing) and then if that doesn’t work expand budget deficits through government spending (fiscal policy). A positive by-product of the money printing is that lower long-term bond rates guarantee a negative real yield – How can bonds be seen as ‘safe’ if they are 100% guaranteed to result in less purchasing power? – and investors are forced to buy other assets like stocks and pile into the “risk on” trade referred to above. Sadly, just as the money being printed isn’t finding its way into the economy – its being hoarded by the zombie banks who should have been allowed to collapse and/or write off their bad loans – the rally in the stock market isn’t helping the masses and indeed may itself be fading.

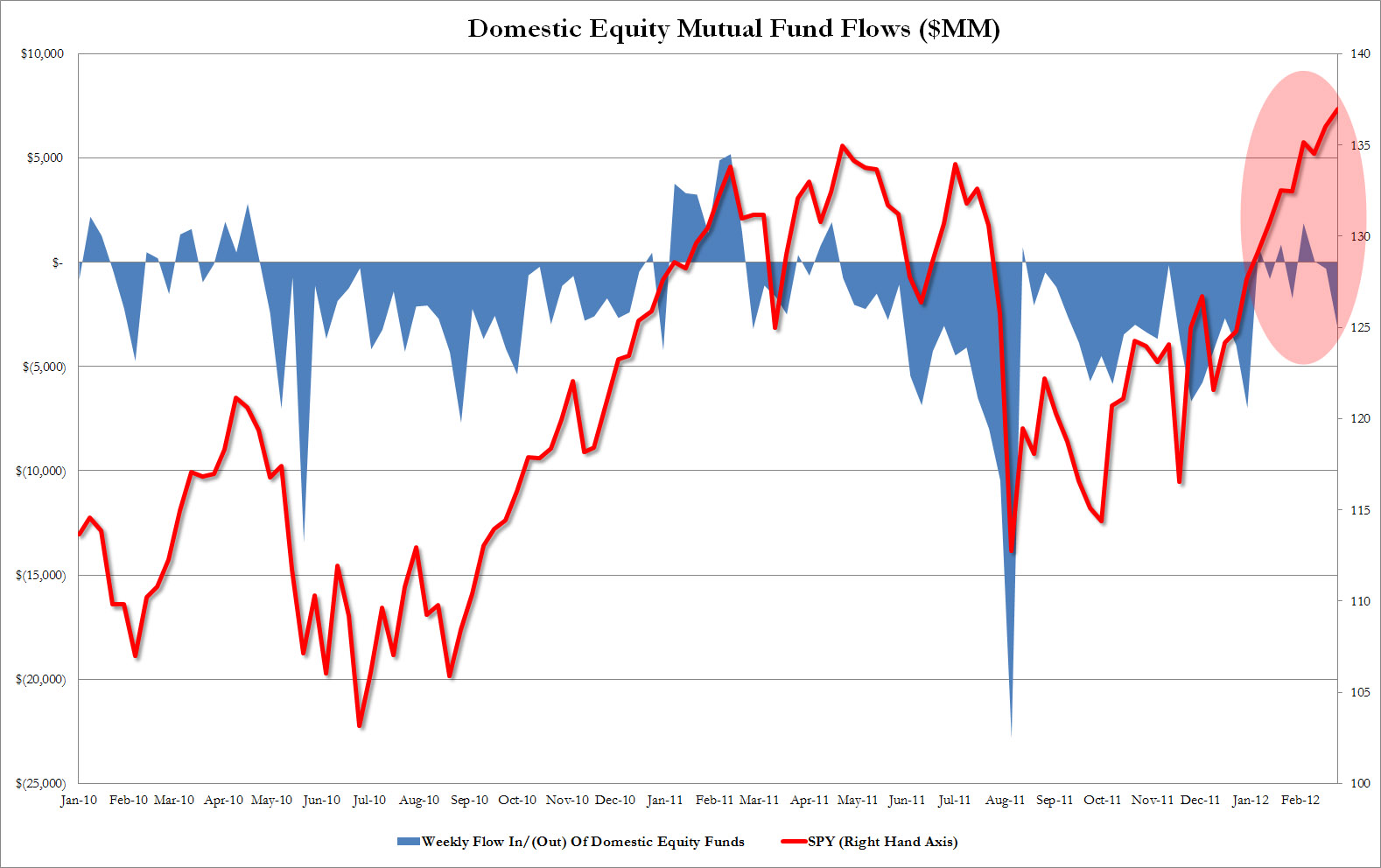

Chart 1 suggests to some investors that the latest attempt to encourage participation in the stock market hasn’t worked.

Chart 1 reveals that not only have retail investors continued to pull out cash from US equity mutual funds (about $66 billion since October), but the market peak of the week of February 29 coincided with the biggest weekly outflow for 2012 – $3 billion.

The Globe&Mail reported: “Retail investors, after gutting it out through years of awful returns, have finally fled. In a normal market, retail participation – Mr. and Mrs. Public trading their personal accounts – should be about 20 per cent. That plunged in November and December, traders say…

Traders Magazine noted: “On Wall Street, risk is suddenly a four-letter word. Retail investors can’t stomach it. Pension plan sponsors are allocating away from it.

“That’s bad news for stocks. Volume has been dropping almost nonstop for three years and shows no signs of improvement. The situation is worse than it was following the crash of 2000. It’s worse than it was after the crash of 1987. Fearful of the future and still wincing from 2008, investors are moving funds into bonds, commodities, cash, private equity, hedge funds and even foreign securities-anything but U.S. stocks.

“Our bread and butter is the retail investor,” Scott Wren, a senior equity strategist at Wells Fargo Advisors, one of the country’s four largest retail brokerages, told Bloomberg Radio recently. “They’re not jumping into the market. They’re not chasing it. Those who have been around for a little bit have been probably burned twice here in the last 10 years or so. They’re definitely gun-shy. They’re not believers. I’m not sure what it’s going to take to get them back in the market.”

As an aside, the reference to declining volumes over the last three years reminds me to republish the chart that I first published here: http://rogermontgomery.com/perhaps-one-of-the-most-important-charts/

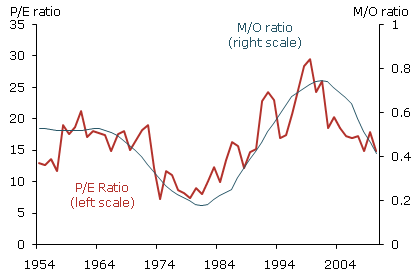

We wrote back in February; “A key demographic trend is the aging of the baby boom generation. As they reach retirement age, they are likely to shift from buying stocks to selling their equity holdings to finance retirement. Statistical models suggest that this shift could be a factor holding down equity valuations over the next two decades.

“The baby boom generation born between 1946 and 1964 has had a large impact on the U.S. economy and will continue to do so as baby boomers gradually phase from work into retirement over the next two decades. To finance retirement, they are likely to sell off acquired assets, especially risky equities. A looming concern is that this massive sell-off might depress equity values.”Chart 2. Ratio of accumulators to dissavers plotted against P/E ratios

Back to more recent observations and the 20% stock market rally over the last four months has been described as a completely artificial “ramp” by some and has been driven entirely by the global liquidity injections of the US, UK, European and Japanese central banks. The conclusions for some investors is that the smart money – those that have bought in anticipation of retail ‘follow-through’ will soon scramble for the exits. What do you think?

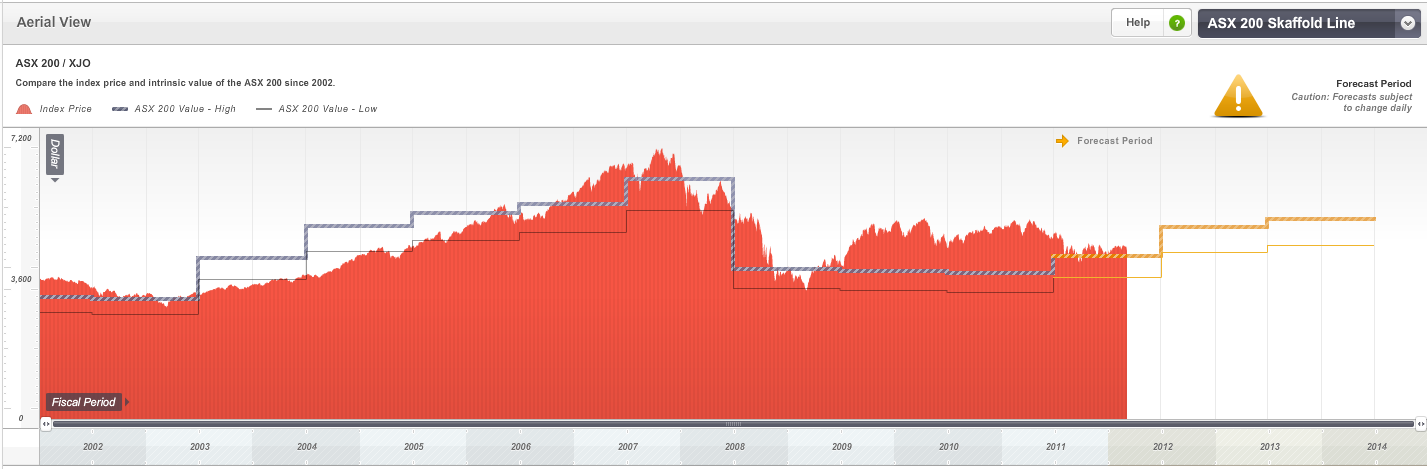

Skaffold’s ASX200 Value Indicator is a live and automatically-updated valuation estimate of the ASX200. It updates and changes every day. The future valuation estimates are based on the the constantly updated forecasts for earnings and dividends of the biggest 200 companies. You can’t beat it as a guide to the overall market level and whether you should be enthusiastic or not about looking more deeply for value.

Chart 3. ASX200 Value Indicator

Source: Skaffold.com

Based on current forecasts for 2012 you can see that the market looks about fair value. It isn’t overly expensive but neither is it, in aggregate, cheap. Based on 2013 forecasts however the market appears to be reasonable value. So the question is whether those 2013 forecasts are reasonable. Typically, forecasts are optimistic. We have previously written here of the persistence of optimism in forecasts by analysts. If that is again the case for 2013, then you wouldn’t be getting overly enthusaistic about our market unless there was a pull back. And according to those referenced above, a pull back is on the cards. What do you think?

I believe there are individual companies that have produced amazing results this reporting season and in an upcoming post we will list the very best. I also think that there is still some value among these companies. The challenge for those new to long term value investing is to be able to stick to your guns, accumulate positions in extraordinary companies at deep discounts to rational estimates of intrinsic value and stand apart from the daily gyrations of fear and rumour about default, money printing and recession.

Looking forward to your comments.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 8 March 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation.

-

GUEST POST: A PRIMER ON GOLD EQUITY INVESTING

Roger Montgomery

March 7, 2012

By Praveen J on 9th January 2012 and updated Feb 20 2012

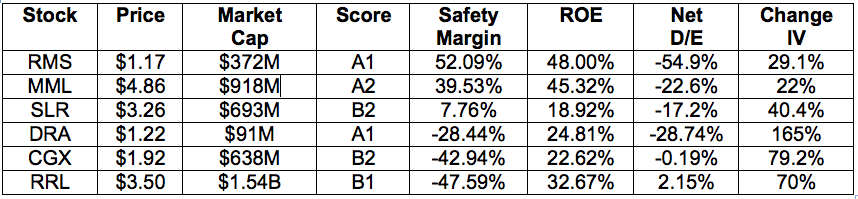

By Praveen J on 9th January 2012 and updated Feb 20 2012This year I have been given an opportunity to write about my experiences in applying what I have learnt as a Value.able graduate and Skaffold member. At the moment I am looking to invest in stocks with a market capitalisation under $2 billion (small to micro caps). Key MINIMUM criteria for me include: Return on Equity > 15%, Net Debt/Equity < 50%, and forecast change in Intrinsic Value > 5%. I will also be focussing on investment grade companies across ALL Industry Sectors/Groups that have Skaffold Quality Scores between A1 to A3, and B1 to B3. This will encompass my “investment universe” of stocks on the ASX. I will of course require a decent margin of safety, but I will be watching stocks that are trading close to their Intrinsic Value or at a small premium, in the event of a decline in price over the next 3 to 6 months. Initial screening using Skaffold reveals over 100 stocks, a more aggressive filter would reduce this number even further. Amongst the results are 10 stocks in the Basic Materials Sector and Gold & Silver Group, 6 of which are predominantly involved in gold exploration, development and production:

• Ramelius Resources (ASX:RMS)

• Medusa Mining Limited (ASX:MML)

• Silver Lake Resources (ASX:SLR)

• Dragon Mining (ASX:DRA)

• CGA Mining (ASX:CGX)

• Regis Resources Limited (ASX:RRL)Table 1. Stocks listed by safety margin (highest to lowest, 9th January 2012) (Source: Skaffold):

Although Ramelius Resources (RMS) meets my initial screening criteria and is an A1 company, it has a NEGATIVE forecast EPS growth. So in this blog post I will be discussing and comparing Medusa Mining Limited (MML) and Silver Lake Resources (SLR). Here we have two companies that have commenced production of gold (they are making money), they are fundamentally healthy, they have good prospects for Intrinsic Value appreciation, AND are both trading at a discount to their Intrinsic Value. Being commodity businesses, the question I have to ask is whether either really have any competitive advantage. I will discuss this later.

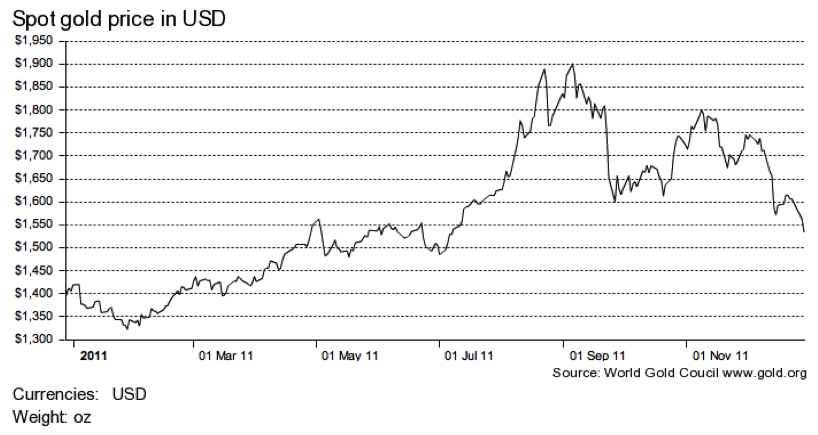

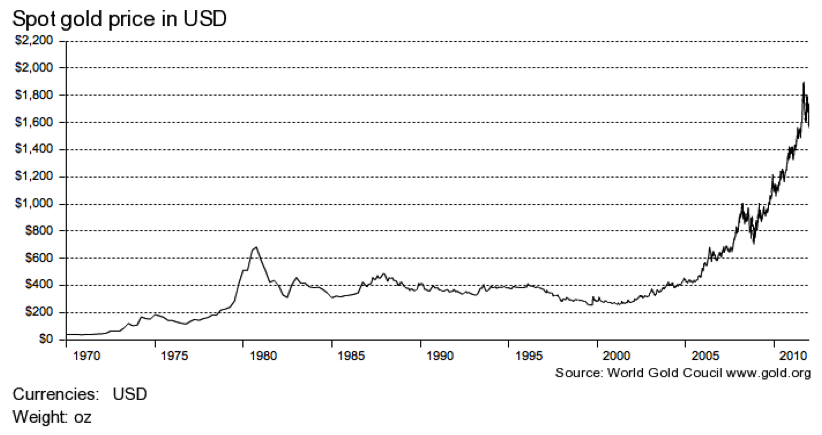

Now in the context of the European sovereign debt crisis, anaemic growth in the US, and concerns of a slowdown in the Chinese economy, I am wary about investing directly in a small cap Australian mining company. However, in this case we are dealing with a commodity that may benefit in this time of uncertainty, with gold long being regarded as a “safe-haven”. Having said that, the future price of gold is still a significant element of risk. At the time of writing the price had dropped down to around US$1600/ounce, after a peak of close to US$1900/ounce in September 2011. Below are some charts of historical gold prices, I’m not going to try and analyse them, but they may serve as a point of discussion. Certainly investing in gold equities requires a bullish stance on the future price of gold in the medium to long term.

Figure 1. Spot gold price chart last 1 year:

Figure 2. Spot gold price chart long-term:

GOLD PRIMER:

Annual reports and AGM presentations for gold and other mining companies assume a level of pre-existing knowledge. Without this, they really make no sense at all. So let me start with some bare basics before I discuss each stock in detail:

What is an Element? An element is a pure chemical substance. You may have heard of something called the periodic table (maybe in your high school science class), this is actually a list of all chemical elements. Examples of elements include carbon, oxygen, aluminum, iron, copper, lead, and of course gold.

What is a Mineral? A mineral is a naturally occurring solid chemical substance that is a combination of elements.

What is an Ore? An Ore is a type of rock that contains minerals. Most individual elements are found in the form of a mineral, though there are some elements that can be found in their elemental state, gold is one of them. Gold is also found in combination with silver and occasionally copper.

What is an Ore Deposit? This is an accumulation of Ore.

JORC? This is the Joint Ore Reserves Committee. The Code for Reporting of Mineral Resources and Ore Reserves (the JORC Code) is widely accepted as a standard for professional reporting purposes.

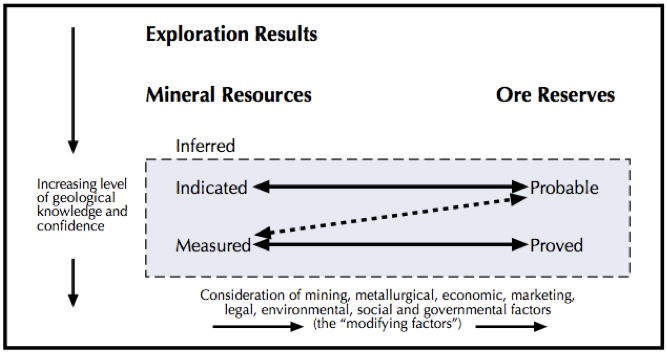

What is a Mineral “Resource” and what is an Ore “Reserve”? These terms are often incorrectly used interchangeably, the exact JORC definitions are below:

Figure 3. Resources versus Reserves (Source: JORC):

RESOURCE; “A CONCENTRATION OR OCCURRENCE OF MATERIAL OF INTRINSIC ECONOMIC INTEREST IN OR ON THE EARTH’S CRUST IN SUCH FORM, QUALITY AND QUANTITY THAT THERE ARE REASONABLE PROSPECTS FOR EVENTUAL ECONOMIC EXTRACTION. THE LOCATION, QUANTITY, GRADE, GEOLOGICAL CHARACTERISTICS AND CONTINUITY OF A MINERAL RESOURCE ARE KNOWN, ESTIMATED OR INTERPRETED FROM SPECIFIC GEOLOGICAL EVIDENCE AND KNOWLEDGE. MINERAL RESOURCES ARE SUB-DIVIDED, IN ORDER OF INCREASING GEOLOGICAL CONFIDENCE, INTO INFERRED, INDICATED AND MEASURED CATEGORIES.”

RESERVE; “THE ECONOMICALLY MINEABLE PART OF A MEASURED AND/OR INDICATED MINERAL RESOURCE. IT INCLUDES DILUTING MATERIALS AND ALLOWANCES FOR LOSSES, WHICH MAY OCCUR WHEN THE MATERIAL IS MINED. APPROPRIATE ASSESSMENTS AND STUDIES HAVE BEEN CARRIED OUT, AND INCLUDE CONSIDERATION OF AND MODIFICATION BY REALISTICALLY ASSUMED MINING, METALLURGICAL, ECONOMIC, MARKETING, LEGAL, ENVIRONMENTAL, SOCIAL AND GOVERNMENTAL FACTORS. THESE ASSESSMENTS DEMONSTRATE AT THE TIME OF REPORTING THAT EXTRACTION COULD REASONABLY BE JUSTIFIED. ORE RESERVES ARE SUB-DIVIDED IN ORDER OF INCREASING CONFIDENCE INTO PROBABLE ORE RESERVES AND PROVED ORE RESERVES.”What is the difference between high and low-grade gold Resource? There aren’t any fixed definitions that I could find, but generally < 4.0 grams/tonne is low-grade, >8.0 grams/tonne is high-grade, and everything in between is about average. A large amount of low-grade gold could be just as profitable as having high-grade gold, as it could be cheaper and easier to mine the low-grade gold (for example low-grades in “open pit” or near surface mines, versus high-grades in “narrow vein” or deep underground mines).

Stages of mining: exploration, development, or production? Exploration involves primarily drilling activity in order to discover ore deposits and then define the Resource and Reserve levels, as well as feasibility studies, development involves primarily engineering / construction work, and production involves the mining, processing at the mill, and selling of the commodity.

Junior, mid-tier, or senior gold producers? Junior gold producers are generally considered as those producing under 200,000 ounces per annum of gold, seniors over 1,000,000 ounces, and the mid-tier producers in between.

What is a mining tenement? This is basically a license/permit granted by the Government to undertake exploration, development, and/or mining activities in a specific area.

What are royalties? Royalties are an expense that needs to be paid to the State Government in Australia for any minerals that are mined. In Western Australia for example, royalties are 2.5% of the value of gold produced.

What are cash costs? This is the operating cost required to produce one ounce of gold. Average worldwide cash costs are around US$620/ounce. Cash costs do not include capital expenditure. TOTAL cash costs include royalties.

What is hedging? Agreeing on the sale price of a certain volume of gold ahead of producing it, it is done to protect the company from the short-term volatility of the market gold price, but will reduce return when the price is rising.

Quick comparison of gold producing companies… First of all, make sure you compare similar companies, i.e. a junior producer with another junior producer, not a junior with a senior. Look at the total amount of resources they have, quoted in ounces, look at the cash costs, and look at how much ounces they have produced per year, and what level is expected in the future. Look for companies that are actively drilling to expand their resource base and find new ore deposits. A company may have one site producing gold, another being developed, and several others under exploration. This ensures that when Resources deplete at one site, there are other potential mines in the wings.

ANALYSIS: MEDUSA MINING LIMITED (ASX:MML)

MML is an un-hedged gold producer listed on the ASX and LSX and is currently operating in the Philippines.

Figure 4. MML’s Skaffold Line (Source: Skaffold 6th January 2012):

Looking at the figure above we can see that the share price has been on the climb since early 2009. The ACTUAL Intrinsic Value (which is based on analyst forecasts) has also followed suit since then, and has generally remained above market price. Market price reached a peak of $8.35 in September 2011 but has since been on a downward slope. More importantly though, the ACTUAL Intrinsic Value is expected to continue rising. In this instance however, the AVERAGE Intrinsic Value (a more conservative estimate), which is based on past performance with an emphasis on the last 3 years, is not expected to rise as strongly. As this value does not necessarily take into account all possible future events, what I need to find out is what future prospects the company has that could have contributed to the analyst’s forecasts. Another important thing to consider is why has the market price dropped almost 50% in just a few months? I’ll come back to this last point later…

Currently MML’s production is focussed on the Co-O mine in the Mindanoa Island area. A second potential gold production centre is under exploration at the Bananghilig deposit. MML currently have JORC code compliant mineral Resource of 21.3 million tonnes, at a grade of 9.6 grams/tonne (g/t) at Co-O and 1.3 g/t at Bananghilig, for a total of 2.6 million ounces (mOz). The company aims to keep Resource and Reserve levels at the Co-O mine stable year to year (by replacing whatever is used up each year), and in doing so avoid spending too much money on expanding this base to levels that will not get mined for several years. Exploration budget for 2012FY is US$27 million. Gold production for 2011FY was 101,474 ounces. Total cash costs for 2011FY were an extraordinarily low US$189/ounce (includes royalties). This could be due to the fact that mining is done predominantly via hand-held equipment, and labour costs are low. The site is also adjacent to a highway with close access to the port, and has grid power via hydropower.

Production for 2012FY was expected to be around 90,000 to 100,000 ounces. This will be ramped up to 200,000 ounces per annum by 2014FY after completion of the Co-O mine expansion. Exploration continues at Bananghilig, MML are targeting production of 200,000 per annum at this site by 2016FY. Near future expansion related capital expenditure will be funded from existing cash rather than through capital raisings and debt facilities, which is great and not surprising given their huge operating margins. Having said that, with regards to Bananghilig, no announcement has been made yet regarding whether feasibility studies are to take place, and whether this deposit will go into production phase at all. Further to this, based on current Reserves at Co-O, its mine life is only about 5 years. The risk here is if they are unable to continue replenishing the Resource and Reserve base over the coming years to extend the mine life further. However published analyst research reports are suggesting a possible mine life of over 25 years, indeed a similar mine south of Co-O (Diwalwal) has been mining for 20 years. There is also the risk of political/social instability in this country. MML is targeting 400,000 ounces per annum of production of gold by 2016FY.

Figure 5. Production timetable in ounces (Source: MML AGM Presentation November 2011):

ANALYSIS: SILVER LAKE RESOURCES (ASX:SLR)

SLR is also an un-hedged gold producer that currently operates in 2 key regions of Mount Monger and Murchison in Western Australia, approximately 50km south east of Kalgoorlie.

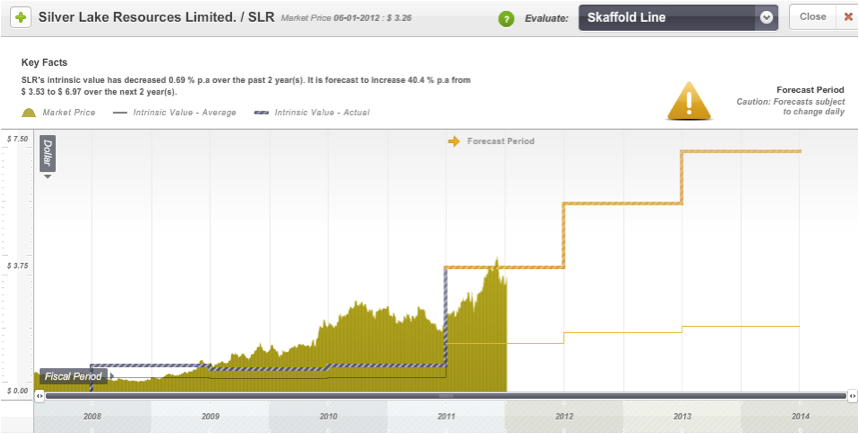

Figure 6. SLR’s Skaffold Line (Source: Skaffold 6th January 2012):

From the figure above what I can see is that the market price has generally been above the ACTUAL Intrinsic Value, although it appears that a great opportunity to buy would have been at the start of 2011. The ACTUAL Intrinsic Value has increased significantly since then, and looks like rising quite rapidly over the coming few years. Market price reached a peak of $3.87 in December 2011, and in fact SLR was one of the best performing stocks on the ASX for the year, significantly outperforming the S&P ASX 200 Index. However, the market price has since dipped down, and a buying opportunity has once again presented itself! The AVERAGE Intrinsic Value is also rising, but as with MML, the growth here is more conservative. Note that as these two lines become closer together, our confidence in the Intrinsic Value estimate is increased.

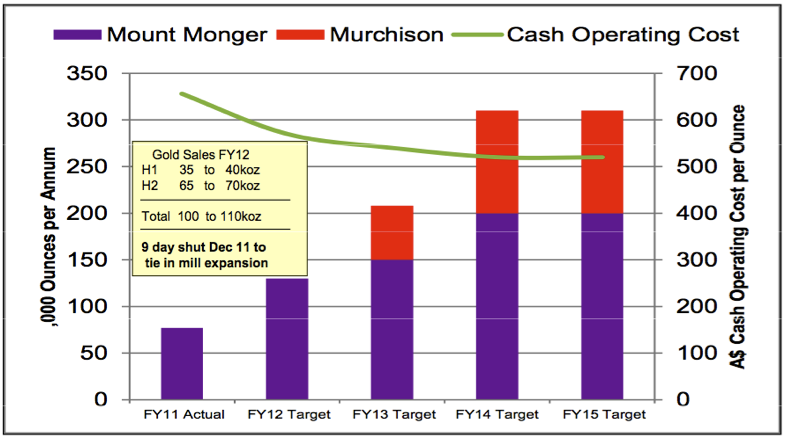

SLR currently has 24.1 million tonnes of JORC Resource at grades of 8.9 (g/t) at Mount Monger and 2.8 g/t at Murchison for a total of 3.3 mOz as at June 2011. The company is aiming to build the Resource base for 2012FY to 5 mOz. In the last 2 financial years, they have increased this Resource base by 1 mOz each year. This has been via an extensive drilling programme each year that is part of their long-term exploration budget ($18 million per annum). Total production of gold for 2011FY was 63,425 ounces. Total cash costs for 2011FY were US$674/ounce (includes royalties). The Mount Monger operations are targeting production of 100,000 to 110,000 ounces for 2012FY. The company expects to ramp up production here to 200,000 ounces per annum by 2014, with an expected mine life > 10 years. The Murchison operations will start production in Q3 2013FY, and is expected to produce 100,000 ounces per annum (from 2014FY) with an 8-10 year mine life. Mining at these locations is predominantly underground. Open pit productions have recently commenced at their Wombola Dam site. SLR has also recently reported high-grade copper discoveries at their Hollandaire site within the Eelya Complex that could provide added value. SLR is targeting 300,000 ounces per annum of production of gold by 2014FY.

Figure 7. Production timetable in ounces (Source: SLR AGM Presentation November 2011):

REVENUE, NET PROFIT, CASH FLOW, RETURN ON EQUITY:

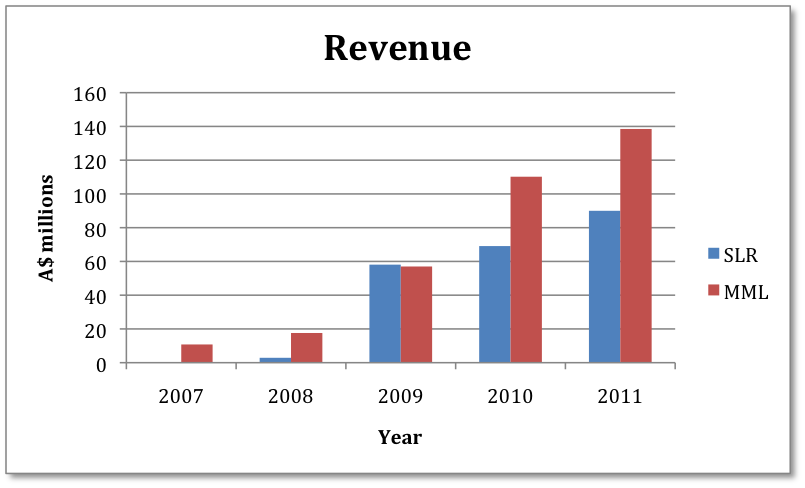

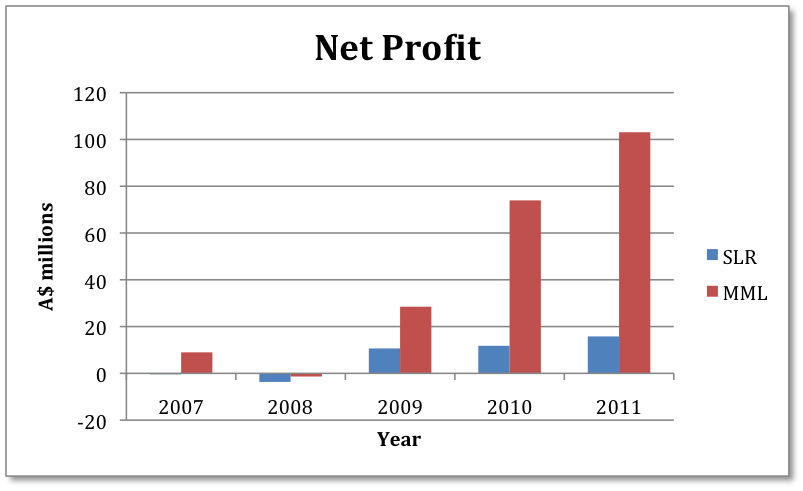

Figures 8 & 9. Comparison of Annual Revenue & Reported Net Profit:

Revenue levels for both companies look excellent, but we can clearly see that MML’s net profit figures are significantly larger than SLR’s, and is a reflection of their low operating costs. But as with any business, we need to delve deeper and look at their overall cash flow. With an impending “credit crunch” in 2012, and a degree of caution in the market with equity investing, a healthy cash flow could be essential in order for junior companies to be able to confidently fund their exploration and development activities.

Figure 10. MML Skaffold Cash Flow (Source: Skaffold 30th December 2011):

Figure 11. SLR Skaffold Cash Flow (Source: Skaffold 30th December 2011):

Both companies have rising levels of cash flow from operations (blue line). MML has an overall funding surplus (green line) that is increasing, and has also managed to pay dividends for 2011FY. Whilst at SLR the overall funding surplus is decreasing, to the point that there is now a funding GAP. This suggests that they have used up more cash in investments and financing than they have received directly from their operations. According to Skaffold, money to account for this spending has come from shareholder equity raisings and increased debt or a reduction in the cash at bank (if there is any). Looking at the Skaffold Data Table sheds more light on recent cash movements for each company…

MML generated a net cash flow of $90 million from its operating activities for 2011FY. However, it also spent a net cash flow of $49 million on investment activities, as well as $18 million for dividend payments (un-franked, low payout ratio). Investment activities were predominantly capital expenditure related to exploration, evaluation, and development activities. Despite the large amount of cash flow invested outside operating activities, after taking into account foreign exchange effects and equity capital movements (add ~ $5 million total), the company was able to increase it’s Bank Account balance by $28 million dollars. This left a 2011FY balance of $58 million (UP from $30 million 2010FY). SLR generated a net cash flow of $33 million from its operating activities for 2011FY. It also spent a net cash flow of $46 million on investment activities, clearly more than it’s operating cash flow. This is once again predominantly capital expenditure related to exploration, evaluation, and development activities. Consequently, despite a rise in revenue, net profit, and operating cash flow, the company actually had a net decrease in its Bank Account balance of $13 million, which left the 2011FY balance at $16million (DOWN from $29 million 2010FY).

MML’s last capital raising was in February 2009 for $20 million, about 3 years ago now. SLR’s last capital raising was as recently as November 2011 for $70 million, this was to help develop their Murchison project and accelerate copper exploration activities. Prior to this it had conducted capital raisings of $19 million during 2010FY and $30 million during 2008FY. Although neither company has significant debt, I think this reiterates that MML is in a better cash flow position at this stage. It appears that continued capital raisings have been required by SLR to help meet ongoing investment demands, unfortunately this could dilute shareholder ownership. Even if capital raisings were issued at a price above equity per share, I would prefer if they were able to fund their investments predominantly from existing cash flow.

A LITTLE ABOUT CAPITAL EXPENDITURE:

As I learnt with these examples, gold mining companies spend a great deal of their retained earnings and cash flow on exploring for gold and developing new mines. These expenses do not go immediately into the Income Statement, instead you will see the total expenditure in the Balance Sheet, as an Asset! These companies may have exploration happening at multiple different sites at any one time, if drilling results prove unsatisfactory, or mining is deemed not technically or financially feasible, part of these expenses will be written-down, and will affect future reported Net Profit. Similarly, cumulative exploration and development expenses will become incurred or amortised only once the mine goes into production. All this capital expenditure is not yet generating any profit, yet it adds to the equity. So unless the company is generating sufficiently higher profits each year from the mines that are in production (e.g. by producing more ounces of gold, at a higher average price, or doing it more efficiently), the Return on Equity will decline. From looking at the annual reports, I noted that MML had listed capital expenditure of US$116 million for 2011FY, and SLR A$76 million. Cleary these are highly capital-intensive businesses, though at the very least it gives their competition a high barrier to entry.

RETURN ON EQUITY:

Figure 12. MML Skaffold Capital History (Source: Skaffold 6th January 2012):

Figure 13. SLR Skaffold Capital History (Source: Skaffold 6th January 2012):

The Skaffold Capital History for MML tells me that although its Net Profits (green line) are forecast to rise over from the next few years, the shareholder equity is expected to rise even more, and thus Return on Equity (blue line) is forecast to decline from 45% 2011FY to 33% in 2014FY. Although a Return on Equity of 33% is still excellent. On the other hand, SLR’s Return on Equity is forecast to rise from 19% 2011FY, and remain stable at around 36% until 2014FY. I suspect that a stable Return on Equity is difficult to achieve in this industry given that there are often several projects on the go at different stages, some generating profits and others not, but at the very least the overall returns must always be high.

FINAL COMMENTS:

What attracts me to MML are its high margins and excellent cash flow that should insulate it against any significant changes in the gold price. A number of things may have contributed to the fall in market price, macroeconomic factors aside. Certainly the market price plunge happened not long after a mining fatality in October 2011. This, along with increased development to prepare the Co-O mine for higher production has resulted in lower production guidance for 2012FY. There was also some weather damage from a tropical storm to parts of their mill in December 2011, the scope of the effect on production will be available in the December 2011 Quarterly. Regardless, these are abnormal once-off events that should not impact on the long-term prospects of the company. For me the key is whether the Bananghalig deposit has a large enough Resource base, and whether it will be mined, as this will determine whether MML can grow from a junior to a mid-tier producer.

The advantage that SLR offers is that it already has a second mine that has progressed further in the development phase, and will commence production earlier. Though there are two things that concern me at this stage. The first being the relatively high operating costs that make SLR far more sensitive to gold price volatility. And the second is the company’s cash flow, and in particular its requirement for capital raisings to fund exploration and development activities. Having said that, forecast EPS Growth is 217%, and I expect that this should improve cash flow over the coming few years. Further to this, as with MML, the management team appears to have significant experience behind it, and in SLR’s case I noted that all the Directors hold significant shareholdings in the company, each owning over 4 million fully paid ordinary shares each.

But is either of these companies truly extraordinary? What does this mean? Well Chapter 5 in Value.able tells me that in an extraordinary business I must find the following factors; Bright long-term prospects, high Return on Equity driven by sustainable competitive advantage, solid cash flow, little or no debt, and first-class management. I think that MML comes closest to meeting all these factors, but others might disagree. The key factor for me is having a sustainable competitive advantage. In the Co-O mine they are sitting on a Resource that could last over 25 years, is extraordinarily low in operating cost, and could generate an enormous amount of cash that could easily fund future expansions, and perhaps even acquisitions. In a business that can be highly capital-intensive, the ability to fund exploration and development with cash flow rather than capital raisings and debt is a great advantage. The question mark of course is how sustainable this will be. And of course, I am no Geologist! What I do know is that this is a fundamentally healthy and profitable business, and despite this, the market is significantly undervaluing it. If I were to invest in this business, I would need to accept that there is level of risk involved, but by buying it at a significant margin of safety, and allocating such an investment in a reasonable manner within my portfolio, I think this risk could be significantly reduced.

POD’s (points of discussion):

1. Has gold’s bull run come to an end, or will it rise to new highs?

2. In your opinion, do MML or SLR have any sustainable competitive advantage?

3. What are the benefits/risks of mining in the Philippines versus Australia?Since writing this post there have been a number of key announcements made by each company. Their share price’s and safety margins have also changed. Most notably, MML has now downgraded its 2012FY production guidance to 75,000 ounces, citing delays due to effects of tropical storms and torrential rain in December 2011 and January 2012. Also, SLR has announced a the acquisition of Phillips River Mining.

LINKS:

Skaffold

www.skaffold.comWorld Gold Council

www.gold.orgJORC

www.jorc.orgDISCLOSURE:

I do not hold any shares in any of the companies mentioned in this blog post.

by Roger Montgomery Posted in Insightful Insights, Value.able.

-

Another strong result from small Co.

Roger Montgomery

February 26, 2012

We have been delighted with the reports coming out from the smaller industrial companies and note again the growing divergence in the performance of the XJO versus the XNJ (ASX 200 versus All Industrials). We attribute this to a declining enthusiasm for the ‘resource story’ and the fact that many of the industrial companies we like (and own, including MTU) are producing such fantastic results despite evidence of a terrible domestic economic backdrop.

Headline revenue was down 14% as a result of the reduction of unprofitable EDirect business activity. Thats good. Underlying revenue (excluding the zero margin Edirect business) rose 8% and the dividend was up 29%. Business cash flow was $17.5mln compared to reported profit of $16.7mln. The impact on valuations should be positive again but ultimately will be determined by the returns generated on the $21.8mln paid for the two acquisitions made in the current half.

Since 2003 (the year before MTU listed) the company has increased profits by more than 91% per annum and is forecast to grow profits again to $36 mln in 2012. To generate the increase in profits (of $27mln to 2011) $60 million has been raised and $30 million borrowed. The return on incremental equity is about 50% suggesting the acquisitions made thus far have reflected an astute allocation of capital. We’ll be keeping an eye on the debt but reckon a recovery in the local economy (as interest rates are lowered and hopefully passed on by the banks) will give MTU another boost.

According to one of our brokers who has a buy recommendation on the stock, the following stocks are at risk of reducing their dividends: Examining for factors…”forecast earnings revisions, payout ratios, stock price stability and free operating cashflows, the companies that are most at risk of further dividend cuts are SWM, GWA, TTS, HVN, QBE and MYR. Those that have reduced dividends but continue to pose a risk include BBG, CSR, DJS, GFF, HIL, MQG, OST, PPT, PBG, PTM, TAH, and TEN.”

Not a recommendation of course. Seek and take personal professional advice before engaging in ANY securities transactions.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 27 February 2012.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Skaffold.

-

Gold Bugs…Nah

Roger Montgomery

February 26, 2012

Their is something prescient in the name John Deason and Richard Oates gave to their 1869 gold nugget the ‘Welcome Stranger’ and the one Kevin Hillier gave to his 875 troy ounce find ‘The Hand of Faith’. Today’s gold price is indeed very welcome to gold bugs and there is plenty of faith needed that prices will rise even further. But gold bugs have received a terse warning from none other than Warren Buffett who has just released Berkshire’s 2011 letter. For those of you who believe gold (A.K.A. the barbarous relic) is the best investment you won’t find any more support from Warren this year than any other (with the exception of his 1999 dalliance into silver) . You can find his complete letter here: Berkshire 2011 Annual Report.

Here’s the section on gold:

“The second major category of investments involves assets that will never produce anything, but that are purchased in the buyer’s hope that someone else – who also knows that the assets will be forever unproductive – will pay more for them in the future. Tulips, of all things, briefly became a favorite of such buyers in the 17th century.

This type of investment requires an expanding pool of buyers, who, in turn, are enticed because they believe the buying pool will expand still further. Owners are not inspired by what the asset itself can produce – it will remain lifeless forever – but rather by the belief that others will desire it even more avidly in the future.

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis.

As “bandwagon” investors join any party, they create their own truth – for a while. Over the past 15 years, both Internet stocks and houses have demonstrated the extraordinary excesses that can be created by combining an initially sensible thesis with well-publicized rising prices. In these bubbles, an army of originally skeptical investors succumbed to the “proof” delivered by the market, and the pool of buyers – for a time – expanded sufficiently to keep the bandwagon rolling. But bubbles blown large enough inevitably pop. And then the old proverb is confirmed once again: “What the wise man does in the beginning, the fool does in the end.”

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce – gold’s price as I write this – its value would be $9.6 trillion. Call this cube pile A. Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge).

Can you imagine an investor with $9.6 trillion selecting pile A over pile B? Beyond the staggering valuation given the existing stock of gold, current prices make today’s annual production of gold command about $160 billion. Buyers – whether jewelry and industrial users, frightened individuals, or speculators – must continually absorb this additional supply to merely maintain an equilibrium at present prices.

A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

Admittedly, when people a century from now are fearful, it’s likely many will still rush to gold. I’m confident, however, that the $9.6 trillion current valuation of pile A will compound over the century at a rate far inferior to that achieved by pile B.”

Before simply believing Warren WILL be right…There’s this in the annual report as well: “Last year, I told you that “a housing recovery will probably begin within a year or so.” I was dead wrong”

A much older quote that summarizes Buffett’s long-held view is this one “It gets dug out in Africa or some place. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

In my earlier post on this subject HERE, I note; “But I trust you can see the irony in claiming gold is ‘useless’ and yet it can buy [all the agricultural land in the United States, sixteen companies as valuable as Exxon and a trillion dollars in walking-around money].

For those of you who are interested in two alternative perspectives, (assuming the debasing of fiat money across the globe is not enough to encourage you), I thought you might find some of what you need in the following points, and also Warren Buffett’s father’s views. (Note: we only own three or four gold stocks all of which have rising production profiles and do not require ever increasing gold prices to support the returns on equity that justify much higher valuations. So we aren’t quite in the ‘carried-away’ camp even though some have doubled in price. This latter development delights us in this market).

And now a short commercial break…

Here are two Skaffold screenshots, each gold stocks we currently own. If you are a member of Skaffold, you should be able to pick them right away. If you aren’t a member, what are you waiting for? Head over to www.skaffold.com and become a member today.

And now back to our regular programming…

From gold’s mouth itself;

Let’s start with the basics of my enduring characteristics. I have some characteristics that no other matter on Earth has…

I cannot be:

Printed (ask a miner how long it takes to find me and dig me up)

Counterfeited (you can try, but a scale will catch it every time)

Inflated (I can’t be reproduced)I cannot be destroyed by;

Fire (it takes heat at least 1945.4° F. to melt me)

Water (I don’t rust or tarnish)

Time (my coins remain recognizable after a thousand years)I don’t need:

Feeding (like cattle)

Fertilizer (like corn)

Maintenance (like printing presses)I have no:

Time limit (most metal is still in existence)

Counterparty risk (remember MF Global?)

Shelf life (I never expire)As a metal, I am uniquely:

Malleable (I spread without cracking)

Ductile (I stretch without breaking)

Beautiful (just ask an Indian bride)As money, I am:

Liquid (easily convertible to cash)

Portable (you can conveniently hold $50,000 in one hand)

Divisible (you can use me in tiny fractions)

Consistent (I am the same in any quantity, at any place)

Private (no one has to know you own me)From an entirely different perspective on gold it may be worth reading the Hon. Howard Buffett. Congressman Buffett argues that without a redeemable currency, an individual’s freedoms both financial and more broadly is dependent on politicians. He goes on to observe that fiat (paper) money systems tend to collapse eventually, producing economic chaos. His argument that the US should return to the gold standard was not adopted.

Human Freedom Rests of Gold Redeemable Money

Posted Thursday, May 6, 1948By HON. HOWARD BUFFETT

U. S. Congressman from Nebraska

Reprinted from The Commercial and Financial Chronicle 5/6/48Is there a connection between Human Freedom and A Gold Redeemable Money? At first glance it would seem that money belongs to the world of economics and human freedom to the political sphere.

But when you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty.

Also, when you find that Lenin declared and demonstrated that a sure way to overturn the existing social order and bring about communism was by printing press paper money, then again you are impressed with the possibility of a relationship between a gold-backed money and human freedom.

In that case then certainly you and I as Americans should know the connection. We must find it even if money is a difficult and tricky subject. I suppose that if most people were asked for their views on money the almost universal answer would be that they didn’t have enough of it.

In a free country the monetary unit rests upon a fixed foundation of gold or gold and silver independent of the ruling politicians. Our dollar was that kind of money before 1933. Under that system paper currency is redeemable for a certain weight of gold, at the free option and choice of the holder of paper money.

Redemption Right Insures Stability

That redemption right gives money a large degree of stability. The owner of such gold redeemable currency has economic independence. He can move around either within or without his country because his money holdings have accepted value anywhere.For example, I hold here what is called a $20 gold piece. Before 1933, if you possessed paper money you could exchange it at your option for gold coin. This gold coin had a recognizable and definite value all over the world. It does so today. In most countries of the world this gold piece, if you have enough of them, will give you much independence. But today the ownership of such gold pieces as money in this country, Russia, and all divers other places is outlawed.

The subject of a Hitler or a Stalin is a serf by the mere fact that his money can be called in and depreciated at the whim of his rulers. That actually happened in Russia a few months ago, when the Russian people, holding cash, had to turn it in — 10 old rubles and receive back one new ruble.

I hold here a small packet of this second kind of money – printing press paper money — technically known as fiat money because its value is arbitrarily fixed by rulers or statute. The amount of this money in numerals is very large. This little packet amounts to CNC $680,000. It cost me $5 at regular exchange rates. I understand I got clipped on the deal. I could have gotten $2½ million if I had purchased in the black market. But you can readily see that this Chinese money, which is a fine grade of paper money, gives the individual who owns it no independence, because it has no redemptive value.

Under such conditions the individual citizen is deprived of freedom of movement. He is prevented from laying away purchasing power for the future. He becomes dependent upon the goodwill of the politicians for his daily bread. Unless he lives on land that will sustain him, freedom for him does not exist.

You have heard a lot of oratory on inflation from politicians in both parties. Actually that oratory and the inflation maneuvering around here are mostly sly efforts designed to lay the blame on the other party’s doorstep. All our politicians regularly announce their intention to stop inflation. I believe I can show that until they move to restore your right to own gold that talk is hogwash.Paper Systems End in Collapse

But first let me clear away a bit of underbrush. I will not take time to review the history of paper money experiments. So far as I can discover, paper money systems have always wound up with collapse and economic chaos.

Here somebody might like to interrupt and ask if we are not now on the gold standard. That is true, internationally, but not domestically. Even though there is a lot of gold buried down at Fort Knox, that gold is not subject to demand by American citizens. It could all be shipped out of this country without the people having any chance to prevent it. That is not probable in the near future, for a small trickle of gold is still coming in. But it can happen in the future. This gold is temporarily and theoretically partial security for our paper currency. But in reality it is not.Also, currently, we are enjoying a large surplus in tax revenues, but this happy condition is only a phenomenon of postwar inflation and our global WPA. It cannot be relied upon as an accurate gauge of our financial condition. So we should disregard the current flush treasury in considering this problem.

From 1930-1946 your government went into the red every year and the debt steadily mounted. Various plans have been proposed to reverse this spiral of debt. One is that a fixed amount of tax revenue each year would go for debt reduction. Another is that Congress be prohibited by statute from appropriating more than anticipated revenues in peacetime. Still another is that 10% of the taxes be set aside each year for debt reduction.

All of these proposals look good. But they are unrealistic under our paper money system. They will not stand against postwar spending pressures. The accuracy of this conclusion has already been demonstrated.The Budget and Paper Money

Under the streamlining Act passed by Congress in 1946, the Senate and the House were required to fix a maximum budget each year. In 1947 the Senate and the House could not reach an agreement on this maximum budget so that the law was ignored.On March 4 this year the House and Senate agreed on a budget of $37½ billion. Appropriations already passed or on the docket will most certainly take expenditures past the $40 billion mark. The statute providing for a maximum budget has fallen by the wayside even in the first two years it has been operating and in a period of prosperity.

There is only one way that these spending pressures can be halted, and that is to restore the final decision on public spending to the producers of the nation. The producers of wealth — taxpayers — must regain their right to obtain gold in exchange for the fruits of their labor. This restoration would give the people the final say-so on governmental spending, and would enable wealth producers to control the issuance of paper money and bonds.

I do not ask you to accept this contention outright. But if you look at the political facts of life, I think you will agree that this action is the only genuine cure. There is a parallel between business and politics which quickly illustrates the weakness in political control of money.

Each of you is in business to make profits. If your firm does not make profits, it goes out of business. If I were to bring a product to you and say, this item is splendid for your customers, but you would have to sell it without profit, or even at a loss that would put you out of business. — well, I would get thrown out of your office, perhaps politely, but certainly quickly. Your business must have profits.

In politics votes have a similar vital importance to an elected official. That situation is not ideal, but it exists, probably because generally no one gives up power willingly.

Perhaps you are right now saying to yourself: “That’s just what I have always thought. The politicians are thinking of votes when they ought to think about the future of the country. What we need is a Congress with some ‘guts.’ If we elected a Congress with intestinal fortitude, it would stop the spending all right!”

I went to Washington with exactly that hope and belief. But I have had to discard it as unrealistic. Why? Because an economy Congressman under our printingpress money system is in the position of a fireman running into a burning building with a hose that is not connected with the water plug. His courage may be commendable, but he is not hooked up right at the other end of the line. So it is now with a Congressman working for economy. There is no sustained hookup with the taxpayers to give him strength.

When the people’s right to restrain public spending by demanding gold coin was taken from them, the automatic flow of strength from the grass-roots to enforce economy in Washington was disconnected. I’ll come back to this later.

In January you heard the President’s message to Congress or at least you heard about it. It made Harry Hopkins, in memory, look like Old Scrooge himself.

Truman’s State of the Union message was “pie-in-the-sky” for everybody except business. These promises were to be expected under our paper currency system. Why? Because his continuance in office depends upon pleasing a majority of the pressure groups.Before you judge him too harshly for that performance, let us speculate on his thinking. Certainly he can persuade himself that the Republicans would do the same thing if they were In power. Already he has characterized our talk of economy as “just conversation.” To date we have been proving him right. Neither the President nor the Republican Congress is under real compulsion to cut Federal spending. And so neither one does so, and the people are largely helpless.

But it was not always this way.

Before 1933 the people themselves had an effective way to demand economy. Before 1933, whenever the people became disturbed over Federal spending, they could go to the banks, redeem their paper currency in gold, and wait for common sense to return to Washington.Raids on Treasury

That happened on various occasions and conditions sometimes became strained, but nothing occurred like the ultimate consequences of paper money inflation.