Insightful Insights

-

MEDIA

What are the characteristics of Sustainable Competitive Advantage?

Roger Montgomery

May 1, 2012

Roger Montgomery discuss how Sustainable Competitive Advantage is the platform for exceptional company performance in this Money Magazine article published in May 2012. Read here.

by Roger Montgomery Posted in Insightful Insights, Investing Education, On the Internet, Value.able.

-

Guest Post: Who’s on the Phone?

Roger Montgomery

April 29, 2012

Harley takes his pen to My Net Fone and impresses even the company’s management with his results.

Harley takes his pen to My Net Fone and impresses even the company’s management with his results.Take a look at any of the financial media channels or websites and you will likely notice the prevalence of brokers, advisors and commentators claiming that Australian stocks are currently cheap when viewed on a P/E basis. There is no denying that at the present time investors in the Australian stock market are willing to pay considerably less for the earnings of a company than they were just a few years ago. There are a number of possible explanations for this from the risk of external shocks to the increased demand for fixed income securities but there is no doubt that one of the main drivers of the lower market multiple is that investors are pricing in an expectation of lower growth rates in the majority of industries. The earnings of companies in retail, mining, property and construction just to name a few are all expected to experience low to moderate growth, if not stagnation, in the foreseeable future.

In an environment where opportunities for growth are sparse, when a true opportunity presents itself investors have demonstrated their willingness to pay up. There is no better example of this than the substantially higher industry average P/E in the telecommunications sector, where internet growth and new technological developments are driving rates of growth unrivaled elsewhere in the market. As a result investors have their eyes set on discovering the next rising star in the telecommunications world. My Net Fone Ltd may be about to have its turn in the limelight.

My Net Fone (ASX:MNF)

In the words of the company:

“My Net Fone Limited, (ASX:MNF) is Australia’s leading provider of hosted voice and data communications services for residential, business and enterprise users. My Net Fone was first founded in 2004, was listed on the ASX in mid 2006, has 52.5 million shares on issue, has operated profitably since 2009 and has paid dividends to its shareholders every six months since September 2010.

The company has a reputation for quality, value and innovation, having won numerous awards including the Deloitte Technology Fast 50 (2008, 2009, and 2010), PC User Product of the Year (2005), Money Magazine Product of the Year (2007) and many others.

My Net Fone’s wholly owned subsidiary, Symbio, owns and operates Australia’s largest VoIP network, providing wholesale carrier services to the Australian industry, including number porting, cloud‐based hosted PBX services, call termination, call origination and many other infrastructure enabled services. The Symbio network carries over 1.5 Billion minutes of voice per annum.”

What is VoIP? A Look At The Industry

Before looking closer at MNF, it is helpful to have a sound understanding of the industry in which the company operates. Indeed one should first gain a complete and comprehensive understanding of the injdustry and the competitive landscape.

VoIP, or Voice Over Internet Protocol, in its simplest form refers to the group of services that use the internet as a means for communication rather than the standard phone line. A phone call via VoIP involves the call conversation being split into data packets, transmitted over the internet and then reassembled at the other end. The primary benefit as a result is that there is no need for line rental, which provides significant savings to consumers and businesses alike. While cost reduction is generally seen as the most attractive feature of VoIP services the benefits are not limited solely to reduced expenses with a range of other products and services offered by MNF including Virtual PBX, number porting, SIP trunking and hosted services. While their terms may sound complicated they all fit under the catch all term of ‘VoIP.’

The VoIP market is highly competitive and the battle is generally fought over price. For a retail customer, the main reason you would choose VoIP over your traditional provider would of course be the cost savings that occur as a result. But for small and medium businesses, while cost is also of primary importance, other factors come into consideration including product offering, service quality and the ability of the provider to continually innovate and develop new products and services.

VoIP is not new nor is it only just now gaining popularity. If you have ever used Skype or a similar service, you have used VoIP (in fact Skype is a client of MNF’s wholesale division). But there are different VoIP service types and the kind you use when you Skype your family while away on holiday is very different to the kind you would install in your small to medium sized business of 50 full time employees. The two do not directly compete with each other. Sure, businesses may use Skype for video conferencing, but they will still need a communications system, multiple phone numbers, 1300 numbers, fax over IP, remote access to their VoIP number and a host of other services provided by MNF and their competitors. Customers of MNF have reported cost savings on phone bills of up to 50% and in the current business environment it seems likely that businesses will continue to look at ways to reduce costs while still maintaining or even increasing productivity. VoIP services have much to offer small to medium businesses in this regard.

In the early years of VoIP the main restriction was (and at times still is) the issue of low quality broadband. If the broadband connection was weak then the quality of the VoIP service would follow suit, thus making the adoption of VoIP unworthy of the investment for anyone without the highest quality broadband connection. It is no surprise then that in the case of Europe those countries with a high rate of strong broadband connection to homes and businesses (eg France) saw a higher uptake of VoIP than European countries with lower rates of high quality broadband access.

As broadband speeds improve, so too will the quality and available range of VoIP services in Australia. The roll out of the NBN will provide significant opportunities for MNF across all divisions of their business. As more people have access to fast, high quality broadband the potential market for MNF will grow. In the transition period there is likely to be a strong push for new customer acquisition by service providers as retail and business customers alike consider changing from their service type and/or service provider (See MNF’s current marketing program offering significant savings for customers to sign up prior to the roll out of the NBN). While this could result in greater competition in the business and retail markets, as we will see the wholesale division is well positioned to benefit from more service providers setting up shop creating higher demand for wholesale services.

Historic Performance – A Demonstrated Track Record Of Growth

Many investors require a demonstrated track record, which is seen as a way to further reduce the risk one takes in any given investment. As a result there are those who will take one look at the financial reports of MNF, notice the accumulated losses and be frightened away, preferring to wait until MNF has had a few years of strong returns, improving margins and profit growth under its belt. For some, turnaround stories are no go zones.

There is nothing wrong with this method of investing, in fact it can be incredibly successful (witness one W.E. Buffett) but in the case of MNF it is important to understand why the company experienced losses in its early years and why the profits are about to start rolling in.

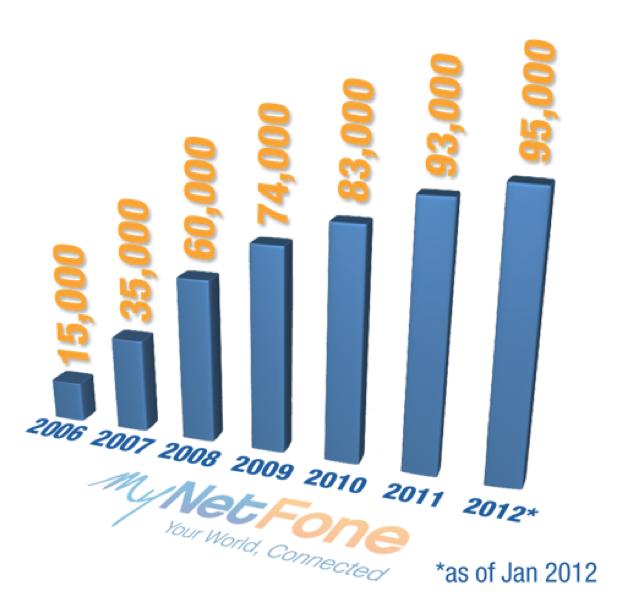

First of all, MNF does possess a proven track record in regards to consistent revenue growth. MNF was started from scratch and has since grown to become a company that currently has 95000 subscribers. Any business owner will know that in the early years of operation profits can take time to come to fruition and a period of investment and cash outflows inevitably precedes growth in scale and subsequent cash inflows. In the case of MNF the company was operating in a brand new industry where the majority of individuals and businesses were still becoming aware of the potential for VoIP services, not to mention the fact that only the tech savvy had the necessary high speed broadband connection to make VoIP worthy of investment in the first place. In 2006, a year that VoIP uptake experienced rapid growth, 19 percent of small to medium businesses in Australia used VoIP services. But of those that didn’t, 35% were completely unaware it existed and another 7% did not understand how it could be implemented into their business.

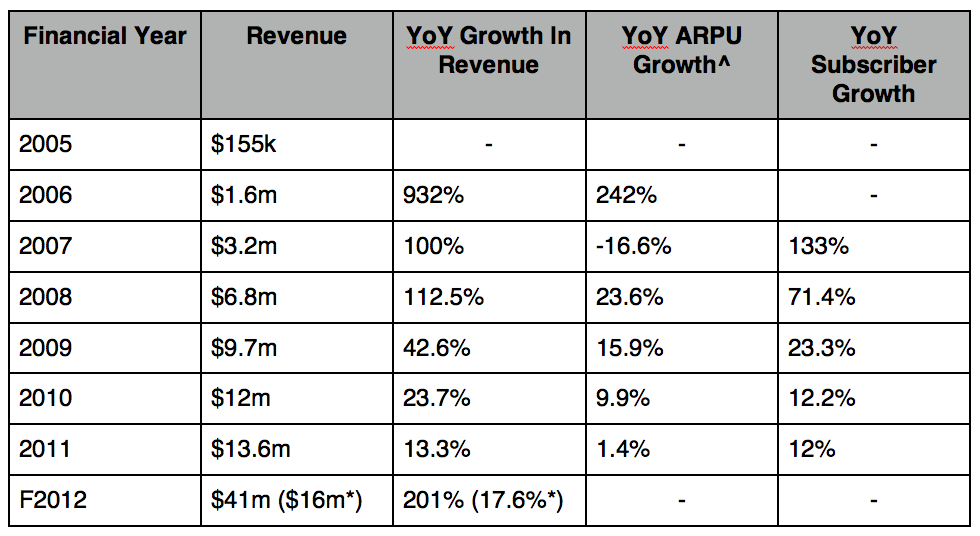

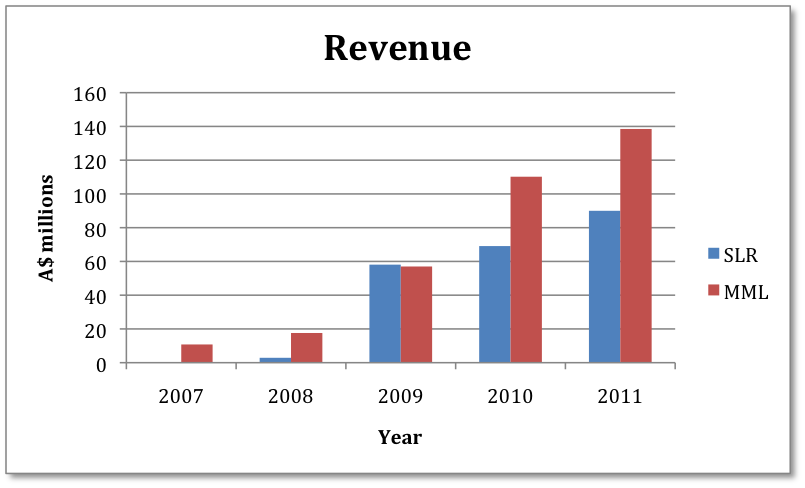

Having said that the growth in revenues (shown in the table below) since MNF listed as a public company is very impressive.

^Provides general summary; figures are not broken down into individual or small to medium business customers

*Minus the contribution of the newly acquired Symbio Networks

Similarly impressive is the year on year growth in MNF’s total customer base, as shown both in the table above and below in a graphic from the company’s website.

Today consumer awareness regarding VoIP is strong and growing. The uptake amongst small and medium businesses is gaining considerable traction due to the significant cost savings and continually developing services on offer. While MNF’s subscriber growth rate is declining from its dizzying heights the company now has access to the potentially lucrative wholesale market through their acquisition of Symbio Networks. And to top things off the government is about to gift MNF with a once in a lifetime opportunity.

NBN – Opportunities Abound For MNF

As previously mentioned, in the past one of the restrictions holding back individuals and businesses from subscribing to VoIP based services was the lack of access to high quality broadband. While broadband penetration in Australia is not particularly low (we were ranked 21st out of OECD countries for fixed broadband penetration and 8th for wireless broadband penetration as at 30 June 2011) the roll out of the National Broadband Network (NBN) will only serve to increase the equality of access to high speed broadband across Australia. What this means is that MNF’s potential market will grow as the NBN roll out progresses.

The capability of MNF’s services are enhanced by any increase in computer power, software/hardware development or internet speeds. Furthermore since product innovation is a demonstrated strength of the company, as technology progresses the range of potential product and service offerings that MNF can deliver to their market will increase. Product and service innovation is a vital differentiating factor in any highly competitive market.

The NBN, in the company’s own words is “a once in a lifetime opportunity” for new customer acquisition as their is a mass transition from the current copper fibre network to the NBN. If the NBN achieves its objectives 93% of Australian households, schools and businesses will have access to broadband services. This will increase the up take potential for residential and SMB VoIP services significantly, and while MNF will likely have to deal with the arrival of many, many new competitors as a result of the expanding market, their wholesale division is likely to benefit from general growth of the VoIP market regardless of which service providers win market share.

(on the flip side, note the higher costs to all competitors/participants after the NBN rolls out and consider the implications of the NBN possibly becoming fibre to the node if Labour loses the next election)

The Importance Of Scale and Differentiation

As an investor it is certainly advantageous to focus on industries experiencing rapid growth. As they say, ‘A rising tide lifts all boats’ and to an extent this will be seen in the performance of internet and VoIP service providers for years to come as the tremendous growth rates are forecast to continue into the foreseeable future. But a market experiencing rapid growth breeds intense competition and if a company cannot differentiate itself from the pack it will be left to fight solely on the basis of being the lowest cost provider, which very rarely ends well for those involved.

There are two things that can separate a company from the pack and ensure it achieves financial performance above the industry average. The first is the presence of scale. MNF’s margins have historically been quite tight, but as revenue grows the margins will naturally improve. The VoIP service industry, while intensely competitive, is such that those who are able to achieve economies of scale have the potential to experience strong margin expansion as each incremental dollar of revenue generates a higher proportion of value to the bottom line. Symbio Networks, the wholesale division of MNF, currently operates at 50% utilisation leaving significant room for margins to be increased at little incremental cost to the company. So while revenue growth will likely taper off to more sustainable growth rates it is highly likely that NPAT growth will outpace revenue growth over the next few years.

In order to reach and sustain a level where economies of scale begin to benefit the bottom line, a company like MNF needs to be able to differentiate itself from competitors. There needs to be a reason why individuals and businesses will choose MNF over other VoIP providers if we, as investors, can be confident that the current high rates of return being generated by the company can be sustained.

The first differentiating factor relates to the vision of MNF management and their focus since the founding of the company. Unlike some of their larger competitors who are being forced to make the transition from older technologies and offer VoIP in addition to their current services, MNF is coming off a lower cost base and with sole focus on New Generation Networks and innovation within the VoIP market. Since the founding of MNF the goal has been “to be the leading VoIP provider in Australia.” The acquisition of the owner of the largest supplier of VoIP wholesale and managed services in Australia also helps separate MNF from the pack.

A quick read through MNF’s past annual reports will give you an idea of the demonstrated ability of the company to come up with new and innovative product offerings. In the past this has no doubt served to enhance the ability of MNF to grab market share, and is reflected in their many industry awards for exceptional products and services. As an investor your job is to determine whether or not MNF will be able to sustain the current high rates of return well in to the future. Start by researching the company’s product offering, read testimonials and compare it with those of MNF’s competitors. Sometimes the best way to form a view over the future of a company is not to approach things as an investor, but to view the business from the perspective of a potential customer.

Perhaps the most attractive feature of MNF’s business model and that which most effectively differentiates MNF from its competitors is the fact that the company is not simply a reseller of VoIP services. A large proportion of VoIP providers are in the business of buying from a wholesaler and reselling the product to the end consumer. Prior to the acquisition of Symbio, this is what it appeared as though MNF was doing when Symbio Networks was external but in actual fact the company was creating these voice services using Symbio’s VoIP technology, adding value through internally developed software and delivering a unique product offering to their customers. The company places a great deal of importance on the development of software and intellectual property to ensure they add value to the services they sell to customers. In the words of the CEO, Rene Sugo, “Today our advantage is largely technical – in terms of scalability, quality, reliability and innovative intellectual property. That is what has driven our growth, and will continue to do so in the medium term.”

Ultimately there is no negating the fact that for a company like MNF (where product development and technological advancement happens faster than most of us can fathom) we are heavily reliant on the competence of management.

The Founders – Interests aligned with shareholders

The two founders, Andy Fung and Rene Sugo, own just over 50% of the company between them. In the first quarter of this year Andy Fung retired from his position as CEO and Rene Sugo took his place. Fung is staying on as a non-executive director and retains his significant holding in the company. Both have strong backgrounds in the telecommunications industry, as well as experience and in depth knowledge in the area of Next Generation Networks. In the ever developing industry of VoIP service providers, experienced and business savvy management is integral to a company’s success.

There is more than just their significant shareholdings in the company that indicates management’s strong desire for MNF to succeed. In the early stages the directors performed services for the company at no or low cost and salaries were kept artificially low as the company dealt with the low capital base nature of a start up business. Similarly, the company was “supported by the low cost provision of services, technology and business support from Symbio Networks Pty Ltd during the start up and early growth phase of the business.” Andy Fung and Rene Sugo were the founders of Symbio Networks, and the company is now wholly owned by My Net Fone after the (related party?) acquisition was finalised earlier this year.

When MNF listed in 2006 they raised $2.5m. Unlike so many of the companies that list on the ASX these funds were not used to repay loans to related parties or to line the pockets of directors, but to fund an expanded marketing program and increase sales and support staff, which was no doubt a raging success evidenced by the growth in total customer numbers of those early years.

Management have also shown their ability to innovate and stay one step ahead of the market. They were the first to remove the pay-for-time model of pricing on international calls and pioneered the move to the now prevalent flat charge for international VoIP calls. The development of ‘On-the-Go’ services which allowed customers to access VoIP services on their mobile in 2007, ‘Meet-Me Conferencing’ in 2010 and the regularly introduced new service plans available to customers are all examples of MNF’s commitment to continually innovating their product offering.

In the process of conducting your research on MNF, do as Roger has suggested frequently here and read each financial report from the prospectus through to the most recent half yearly report. No doubt you will notice the trend of management promising something one year and delivering the next. This is, I believe, exactly what you should be looking for in the management of companies you choose to invest in. In the announcements regarding the Symbio acquisition, and in related articles, the CEO of MNF regularly described the increase in growth that he believed the company was about to experience. On the 23rd of April the company delivered yet again with a profit upgrade that they attributed to the “outstanding performance across the group,” particularly in the March quarter.

The interests of management appear strongly aligned with those of shareholders and as investors our money seems in more than capable hands. Do take the time to read the past annual reports of MNF. Not only will you better understand the growth path that management have in mind for the company but you will most certainly notice the way in which management come across as genuinely interested in the future of the company, its customers and its shareholders, something which is unfortunately rare in many ASX listed companies.

Symbio Networks – A Game Changer For My Net Fone

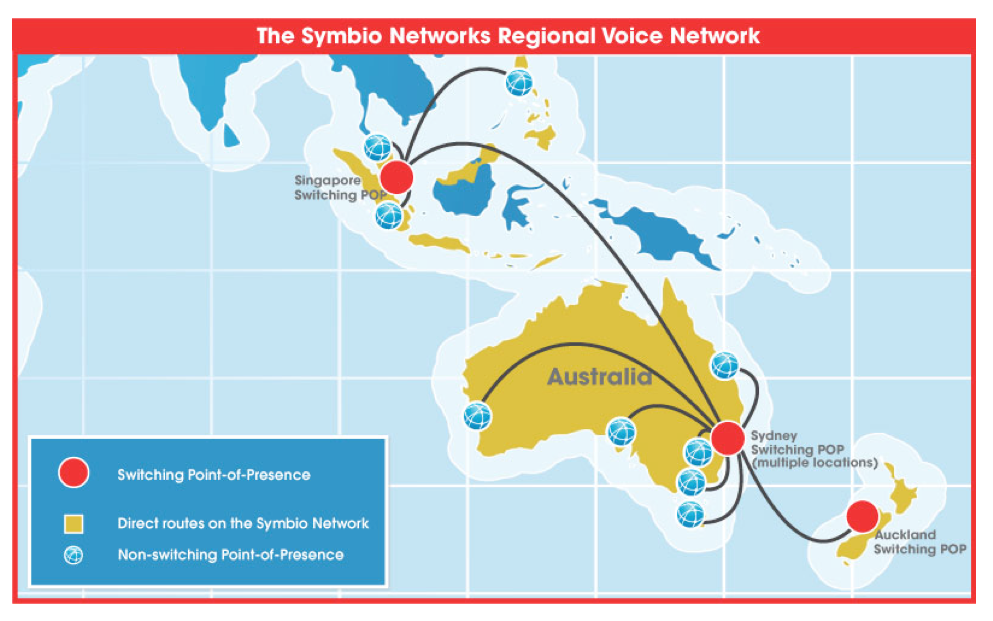

In September of last year MNF announced they were acquiring Symbio Networks for a maximum consideration of $6m. Symbio Networks is Australia’s largest supplier of VoIP wholesale and managed services. The company was founded by Andy Fung and Rene Sugo, the same founders of My Net Fone. The acquisition of Symbio significantly changes the dynamics of MNF as it means the company is now positioned to benefit from the entry of more VoIP providers.

Management plans to run Symbio as a wholly owned subsidiary, separate to the day to day business of My Net Fone. This is important as some of Symbio’s customers are direct competitors with the retail and business division of MNF. Symbio is actually larger than My Net Fone when comparing on the basis of revenues, with $25m of MNF’s FY12 revenue expected to come from Symbio.

The wholesale operations Symbio brings with it is a game changer for MNF. It means that the company is effectively diversified from the inevitable increase in competition that is sure to arise if and when VoIP uptake continues to grow. While the business and retail division benefits only if customers choose MNF over its competitors, Symbio, as the owner and operator of Australia’s largest VoIP network, is positioned to benefit from any overall increase in competition.

Because Symbio has clients across the Asia Pacific the company will not only benefit from the NBN in Australia, but are also positioned to do well from any further increase in broadband penetration or VoIP uptake in Singapore, New Zealand and Malaysia. As such the growth potential for Symbio, and thus MNF, is not limited solely to the Australian market.

The story of both Symbio Networks and My Net Fone are evidence of in my opinion, the visionary skills of the founders of both companies, Andy Fung and Rene Sugo. What we are seeing in the market today with increased uptake of VoIP, new VoIP related products and services being developed and the beginnings of the transition of VoIP to mobile applications, were all envisioned by Fung and Sugo as early as 2002. Today, Rene Sugo is the CEO of the merged entity and Andy Fung will remain as an advisor, consultant and significant shareholder. If their current views on the potential growth in the wholesale, retail and business divisions of their company is half as accurate as their views from ten years ago then it appears MNF is well positioned for the future.

Key Risks (may not be exhaustive)

While the prospects for MNF appear very attractive, like any investment there are risks one needs to consider:

- The NBN: While the NBN is expected to be a fantastic opportunity for MNF there are risks that surround its ultimate effect on the company. These risks include potential increases in costs that favour the larger ISPs, the possibility of substantial changes to the NBN between now and final rollout and of course the fact that the opposition intends to scrap the plan altogether. The first of these risks is reduced by the merger of My Net Fone and Symbio and the fact that MNF’s customer base, while not among the largest, is substantial at around 100,000 customers. The risk of any changes to the details of the NBN that may negatively impact MNF is negated somewhat by management’s active and ongoing correspondence with government and the fact that as the largest VoIP network operator in Australia MNF does indeed have some say in negotiations. And finally if the NBN were to be scrapped, business would go on as usual and if the recent past is anything to go by MNF will continue to grow both revenues and subscribers.

- With the acquisition of Symbio, MNF is liable to pay up to $6m depending on the performance of the now wholly owned subsidiary. The risk here is that if cash flows are impaired for whatever reason the company may need to reduce its dividend payment to fulfill its obligations. With current strong operating cash flows, growing profits and no debt this risk appears minimal.

- External shocks. While MNF is not immune to financial crises occurring in Europe, China or even here in Australia, to some degree their business is defensive in nature. The worse the economic environment becomes the more likely businesses and consumers will decide to cut costs. MNF’s services offer cost reductions in conjunction with improved efficiency and so will benefit from more Australian businesses looking to reduce their overheads.

- VoIP failing to grow and/or the introduction of a new disruptive technology. VoIP itself is a disruptive technology and one that old generation service providers are now finding themselves forced to deal with. But that does not mean a new, more efficient technology won’t come along and steal some of VoIP’s market share, so this risk is certainly one to keep in mind.

- Some other risks may be covered by watching for director’s selling of stock

The Financials

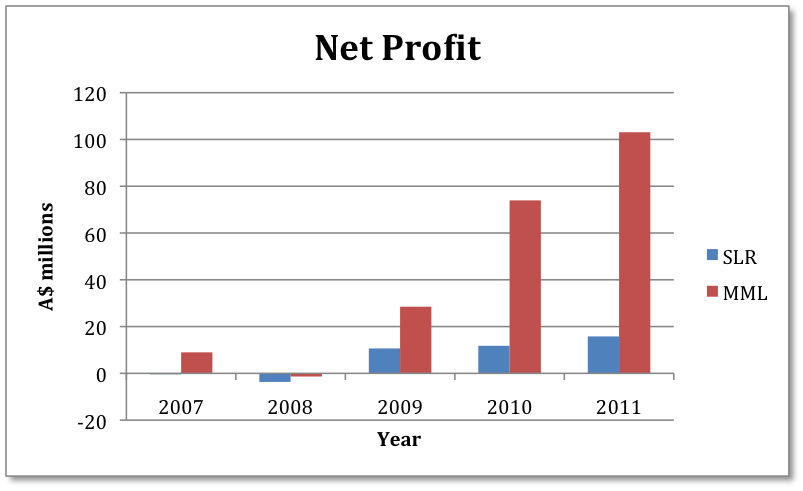

As outlined earlier MNF have grown revenues consistently since listing on the ASX. This year they are forecast to generate $41m in revenue, with $25m coming from the recently acquired Symbio Networks. In their recent earnings upgrade management forecast FY12 NPAT to come in between $2.75m and $3m, with FY13 NPAT guidance for $4m (Note: as a result of past losses the company has tax assets of $930k). If we assume the lower end of guidance then on a fully diluted basis MNF will earn around 5c per share in FY12. In the past the company has paid a dividend around half of the total earnings and with operating cash flows remaining strong there seems no reason why that will stop any time soon. Under these assumptions the company is currently trading on a PE of 7.5 and is paying a respectable dividend. What multiple should the market attribute to a company undergoing strong growth in earnings, paying a healthy dividend and operating in the rapidly expanding internet industry? That is anyone’s guess but there are numerous examples of similar companies currently trading on the ASX that the market has priced on a P/E multiple in the mid-teens, and there is no reason why MNF will not or should not be priced accordingly.

While the company appears to be cheap on a P/E multiple basis the most attractive feature of MNF’s financial performance for me, is its ability to continue to generate fantastic returns on incremental capital for many years to come. The current returns on equity are unsustainably stratospheric – a result of the accumulated losses on the balanced sheet. But even if we calculate return on equity with total contributed capital from shareholders, ignoring the reduction in equity that has resulted from accumulated losses, the company will still generate a return on equity in excess of 50% for FY12 and FY13. The nature of this business is such that provided success continues, high returns on equity can be sustained.

I believe the market is yet to factor in that MNF is now a significant player in the wholesale VoIP market and while its business and retail division will continue to face growing competition, the company has demonstrated its ability to differentiate itself from its competitors. With what seems like highly competent management, bright industry prospects and the ability to sustain current high rates of return My Net Fone currently appears to tick all of my value investing boxes.

Let Harley know what you think of his work and share your own insights. Please note the views of the author are his own and may not represent those of the publisher. It is a must that you conduct your own research and seek and take personal professional advice before undertaking any security transactions. The sources of data Harley relied upon to produce this post may or may not be accurate so readers must investigate and satisfy themselves that are are completely aware of and accept all risks before undertaking any securities transactions they conduct after they have sought advice from a licence adviser familiar with their needs and circumstances.

Authored by Harley and posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 29 April 2012

by Roger Montgomery Posted in Insightful Insights, Technology & Telecommunications.

-

Guest Post: Thoughts on Risk.

Roger Montgomery

April 19, 2012

RISK: Successful investing is all about managing risk and, as luck would have it, this is one of the things that we, as a species are not particularly good at.

It is demonstrably true that humans are terrible at evaluating the complex risks associated with modern environments. This is not new information and there are plenty of oft referred examples which you can probably bring to mind; how we assess the actual probability of death from road vehicles vs. the perceived risk of death from spiders, snakes, sharks and aircraft (1,414 deaths vs. 32 in Australia 2009), the detrimental health risks of nuclear power vs. the dangers of fossil fuels (for every nuclear power linked death, there are an estimated 4,000 coal related deaths. Both candles and wind power are linked to more deaths than nuclear energy), or the real risk of bacterial infection vs. swine flu or mad cow disease (septicaemia alone was responsible for 993 Australian deaths in 2009).

Even if we acknowledge this shortcoming and integrate this knowledge to inform our everyday decisions, humans are hardwired to act on perceived risk, and are thus influenced to varying degrees by emotion. This is an evolutionary thing, and was suitable during the times that most of our transition to the dominant species occurred, but far less so now. The data necessary to evaluate complex risk often requires computers to calculate, and gut feel just won’t cut it anymore. To make it worse, we (as an aggregated faceless mass of humanity) are more inclined to trust information that reinforces existing beliefs (a well established phenomena known as confirmation bias). In a world where prominent politicians (and others) oppose the use of vaccines responsible for the eradication of polio and smallpox, in direct contradiction of peer reviewed science, finding someone who will tell us that we are right about pretty much anything is not challenging.

In summary, our natural instinct is to assess risk using our perception rather than facts, our perception is very often wrong, and even if we go looking for facts, we are inclined to assign more validity to data that supports our predisposition rather than to conduct an objective assessment.

You want more? In an apparent contradiction, this inability to overestimate our abilities may even confer an evolutionary advantage. Unfortunately, this would work at a species level, rather than for the wealth of the individual, and is a complex topic for another day (more about it here van Veelen,M. and Nowak,M.A. (2011) Evolution: Selection for positive illusions. Nature, 477, 282-283)

So, why is this important, and how is it relevant to investment?

Investment, as we all know, is about accurately assessing risk, and requiring an appropriate return to compensate for these risks to our capital. The more accurately we can assess risk in our investments AND act accordingly, the more likely we are to maximize returns. Knowing that investment is about managing risk however, is VERY different, and a lot easier than doing the work that this understanding requires.

Risk is managed using facts and knowledge. There is no place for gut feel. The more relevant facts we have about an investment, and the more knowledge we have about how to integrate this mass of data, the more accurately we can ascertain risk. As investors, we are looking for opportunities where professionals, with millions of dollars allocated to data collection, and which have analysts with years of experience, have mispriced this risk.

It could be argued that this is not necessarily so, that we could accept the average rate of return, such as with an index ETF. In this case we are accepting the risk premium applied by the market, and the inferred risk premium is out of our control. Historically, the 10 year compound annual rate of return for the ASX is 2.4% (excluding dividends), and for 5 years -3.1%. Even going back 22 years to 1990 only gets you just over 4%. In my opinion, the reward over any of these time frames is clearly inadequate, even allowing for dividends. These returns are comparable or worse than much lower risk investments including cash (not accounting for tax).

This leaves us competing against experienced, well resourced professionals and, more dangerously, many not-so-great investors as we try to outperform the market. In this context a quick look at P/E ratios is unlikely to yield the stocks that will lead to suitable returns. We need to be able to value businesses, find those that are mispriced and, most importantly, identify and assess the risks inherent in our calculations.

There are many tools for valuing businesses, such as the intrinsic value method described by James E Walter and explained much more accessibly in Valu.able, and even some for assessing risk (such as the Macquarie Quality Rating). The research necessary to even partially determine such metrics for all of the companies on the ASX (let alone internationally) with any accuracy is far beyond that available to the average retail investor, so historically we have had to only work on a handful of stocks recommended by professional researchers or investment publications, or use our gut as a first pass.

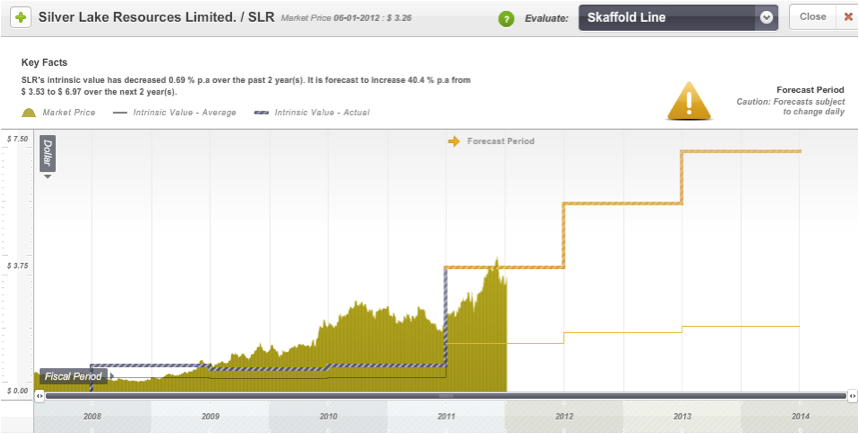

Like so many other things, the information age has turned this on its head. These days, a single service can value, and assess the quality of, the entire ASX, identifying companies worthy of further, thorough analysis. And this is exactly what products like Skaffold are useful for, and why they always come with a disclaimer.

When you make an investment, it is your cash, and your decision. You will reap the rewards if you get the risks right and pay the price if you do not. Tools like Skaffold (as an implementation of the MQR and intrinsic method) simply remove the noise, and allow you to find gold without having to pan too much gravel. When I first came across the MQR, both Forge Group and JB Hi-Fi were A1 and trading at a discount to estimated I.V. The decision to invest in the former and not the latter was not a function of luck, but an exercise in risk management.

The reason I invested in Forge was, that I know the industry, because I worked in it. I know the way high ROE is achieved in construction and mining services, the kind of businesses that can maintain it, and how such businesses generally grow. After carefully considering all of the available data and quantifying what I did not, or could not know, I felt I really did understand the risk and the potential reward, and as such made the investment.

In contrast, I did not understand how JB Hi-Fi would continue its level of growth, even in the medium term. I also work in the technology industry, and the threat to margins from online retailers was obvious, even two years ago. (This threat and the maturing nature of JBH was written about by Roger Montgomery some years ago) The discount to I.V was there, but the risk that ROE could not be maintained was too high for me. This is not a comment on the quality of JB Hi-Fi as a company, but on its valuation as a growth stock using historical ROE.

Generally, the more we know about managing businesses, the industries in which they operate and the products they are selling, the better we are at identifying and managing risks associated with these activities. If we were running the business we would be assessing strengths, weaknesses, opportunities and threats, barriers to entry, competitive advantage, brand awareness, and R&D just for starters. If we are considering about buying even a small part of a company, we should be doing the same.

In my opinion, I would rather have large investments in a smaller number of companies where I have control of the risk than rely on the brute force of diversification where I accept the risk premium of the market in general. I miss out on a lot of really good stories as a result (I don’t invest in mining exploration stocks for example) but at least I sleep well at night. My capital has been the result of far too much work for me to treat it cheaply.

There will be times when you can’t accurately assess risk, and times when no high quality stocks whose risks you understand are trading at a discount to their intrinsic value. It is times like this that it is hardest to hold your nerve. Remember, you don’t have to invest in the stock market, you can assess other asset classes, or alternatively you can follow Arnold Rothstein’s advice to Nucky Thompson (Boardwalk Empire – I recommend it if you haven’t seen it) for when the path forward isn’t immediately clear or the risks too great.

Do nothing.

Postscript:

- What is more common in Australia, suicide or homicide

- Motor vehicles are the most common cause of deaths attributable to “external causes”, what are the next 3 most likely

- What is the more common cancer in Australian women? Respiratory, digestive or breast?

Answers

- Suicide represents 24% of all deaths by “external causes” compare to 2.4% for deaths attributable to assault. While this probably didn’t surprise you suicide is also far more common in the USA.

- In order; Suicide, Falls and Accidental Poisoning (Snakes, spiders, jellyfish and crocs hardly rate a mention. There were not deaths attributable to snakes on a plane).

- In order; Digestive (4,917), Respiratory (3,080) and Breast (2,722)

Data from ABS census 2009

http://abs.gov.au/AUSSTATS/abs@.nsf/mf/3303.0/

1. van Veelen,M. and Nowak,M.A. (2011) Evolution: Selection for positive illusions. Nature, 477, 282-283, 10.1038/477282a. Available at: http://www.ncbi.nlm.nih.gov/pubmed/21921904 [Accessed September 15, 2011].

“Dividend policies and common stock prices” James E Walter

Author: Dennis Gascoigne is, or has at some time been; a Civil Engineer, Application Developer, Molecular Biologist, Management Executive and Professional Musician. He has held senior management roles in international Australian construction companies, has founded successful businesses in both civil engineering and information technology, and more importantly, played at the Big Day Out. These days he splits his time between genome research, and working on his cattle farm at Tenterfield in the NSW tablelands.

by Roger Montgomery Posted in Insightful Insights.

- 28 Comments

- save this article

- POSTED IN Insightful Insights

-

They may never be needed but are there enough?

Roger Montgomery

April 18, 2012

Republished: PORTFOLIO POINT: Leighton’s recent performance issues have been exacerbated by a poor relationship between management and staff.

Republished: PORTFOLIO POINT: Leighton’s recent performance issues have been exacerbated by a poor relationship between management and staff.The 15th of April will mark the 100-year anniversary of the tragic sinking of the Titanic on its maiden voyage from Southampton England to New York. Owned by The Oceanic Steam Navigation Company or White Star Line of Boston Packets, the tragedy was not that her advanced safety features, which included watertight compartments and remotely activated watertight doors malfunctioned. The tragedy was the operational failure and that the Titanic lacked enough lifeboats to accommodate any more than a third of her total passenger and crew capacity.

It occurred to me on this anniversary that there are many lumbering, giant business boats listed on the Australian stock exchange today, whose journeys have been equally eventful, if not fatal, and whose management is no less responsible for operational failures and for providing lifeboats only for themselves.

Take the situation over at Leighton (ASX: LEI) – a company I wrote about here some time ago, saying: “There is a significant risk of downward revisions to current forecasts for the 2012 profit.” On March 30, the company wrote a further $254 million off its two biggest projects – Airport Link and the Victorian desalination plant. More broadly, Leighton downgraded its FY12 profit guidance to $400 million-$450 million from $600 million-$650 million, taking the company’s writedown tally to almost $2 billion in the past two years. This will reduce the return on equity from 22% to 15% for 2012, and significantly reduce the 2012 intrinsic value, which now sits below $14.00 (see graph below).

Source: Skaffold.com

Back when I wrote my prediction, I also noted that workers at the desalination plant had cited ‘safety concerns’ causing them to work more cautiously (read slowly) to ensure their physical safety and the safety of their $200,000 per year wage, which of course would not continue beyond the project’s completion.

This week, it was revealed that similar problems have emerged at Brisbane’s Airport Link project. According to one report, “an increasing level of aggressive behaviour” from unionised workers who wanted to “get paid for longer” was an attempt to “leverage this finishing phase” of the project.

Leighton must construct to a deadline, and liquidated damages clauses cost the company about $1.1 million per day for every day that the Airport Link project is delayed. My guess is that as a result of the workforce’s alleged ‘go slow’, Leighton is forced to bring in hundreds of sub-contractors such as sparkies (with “specialist commissioning skills and experience”, according to John Holland) to complete the work. Either way, it costs Leighton more. A 25% blow-out on a multi-billion dollar project can amount to $1 billion.

On top of these problems, Leighton has a $200 million deferred equity commitment to make two years after Airport Link opens. And if my speculation that the operator may be broke before Christmas comes to fruition, Leighton will be forced to write off another $63 million – the amount remaining to be written down.

But before you jump to attack the unions reported to be responsible for Leighton’s woes – something I believe is often justified, not because of what the unions represent, which is honourable, but because of the tactics they sometimes use to seek redress – you should remember that there are many companies whose more humble management works in harmony with its workforces, unionised or otherwise.

Management is an important part of the investment analysis mix and while I firmly believe, as Buffett does, that the business boat you get into is far more important than the man doing the rowing, I do also believe that management will make the bed that ultimately every stakeholder must lie in.

Any company whose management drives flash cars to the office, pays herculean salaries to themselves and/or takes advantage of company relationships for self-gain is always going to be the target of unrest and distrust from its staff. This is driven often by envy, a sense of unfairness or lack of equity, and while I am not saying this is the case at Leighton, clearly there’s something amiss that is the root cause of this much trouble.

Over the last decade, Leighton has generated cash flow from operations of $8.3 billion, but its capital expenditure has now exceeded $7.5 billion. This would leave $800 million for dividends, but the company has paid dividends of over $2 billion (perhaps to appease non-unionised, income-seeking shareholders who support the share price upon which management’s lucrative remuneration is based). Given the cash to fund this dividend largesse was not generated by business operations, $850 million of ownership-diluting equity has been raised and $1.3 billion of debt borrowed. And for this less-than-spectacular performance, the top 10 current executives were paid almost $20 million last year. Eight of those were paid more than $1.2 million in 2011, four were paid more than $2.3 million, and the year before, three of the 10 were paid more than $4.5 million each.

Forecast profits for 2012 will not be any higher than five years ago, and the company workforce has doubled to 51,281 employees at June 30, 2011. But $190 million in salaries for 15 senior executives (excluding van der Laan’s $47,000) between 2007 and 2011 (see table), while overseeing such performance does not sit well with staff (or vocal but ineffectual minority shareholders) and it’s the relationship between management and staff that is more than partly to blame for the company’s ills.

Whether or not the CFMEU’s Dave Noonan’s claim in The Australian Financial Review this week is correct – specifically that “the markets were the last to know [about Airport Link], everybody else in the industry knew that the company were going to drop hundreds of millions of dollars and obviously they chose to tell the stock market very late in the piece” – is less significant than whether a carcinogenic tumour has grown between management and staff. The former can be resolved but the latter is potentially more permanent, and therefore damaging to shareholder returns.

Leighton is a fixture in the portfolios of thousands of superannuants nearing retirement and their disappointment with their investment returns can be at least partly attributed to the poor wealth-creating contribution of this company and its management. In turn, this can be attributed to the motivation and satisfaction of staff.

Shareholders are also the owners and have a right to know how management is performing, but now the majority shareholder’s demands will hold sway and the majority shareholder is Spain’s Grupo ACS, not the many Australian super funds who thought the company’s management was working for them. Oh, and I am guessing there is the risk of further writedowns on projects that haven’t yet hit the headlines.

Like the Titanic, where only the executives at White Star Line were truly safe, minority shareholders may find there aren’t enough lifeboats for them either.

First Published at Eureka Report April 11. Republished and Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 19 April 2012.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights, Investing Education, Manufacturing, Skaffold.

-

Guest Post: What’s the real BHP share price?

Roger Montgomery

March 29, 2012

Portfolio Point: BHP Billiton is well known to every Australian investor, but what you may not be aware of is the unique opportunity the corporate structure offers the trader and investor.

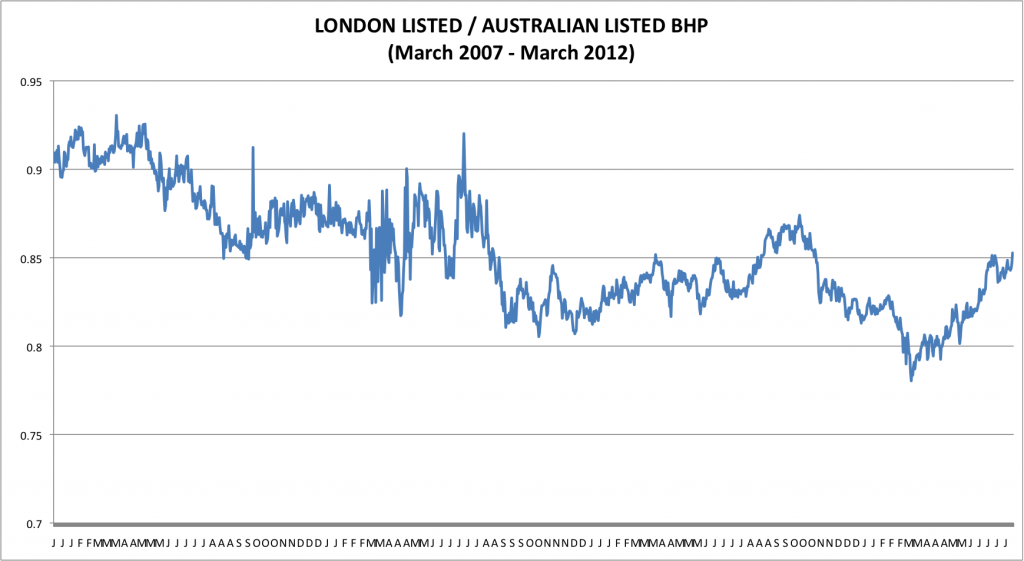

Portfolio Point: BHP Billiton is well known to every Australian investor, but what you may not be aware of is the unique opportunity the corporate structure offers the trader and investor. BHP Billiton was formed when BHP and Billiton merged in June 2001; following the merger the companies maintained their separate stock exchange listings. Australian investor know BHP Billiton Limited (ASX:BHP) traded on the Australian Stock Exchange, the other major listing is on the London Stock Exchange (LSE:BLT) BHP Billiton Plc. A share bought on either exchange has equal economic and voting rights, meaning you receive the same dividend payment and have equal claim to the company’s assets.

A logical person would assume that adjusted for the exchange rate a share of BHP Billiton Limited would trade very closely to BHP Billiton Plc, surprisingly this assumption is not correct. BHP Billiton Plc has traded at a discount every day for the last five years compared to the Australian listed BHP. If the shares were interchangeable between the exchanges the law of one price would remove the price difference, but in this case it is not possible to transfer a London listed BHP share to the Australian Stock Exchange, so there is not an arbitrage trade opportunity.

On the other hand, as the discount does not remain constant under all market conditions there is an opportunity to profit in the movement of the spread. To trade the spread a person buys one BHP and sells the other listed BHP, the trader is in a hedged position and is not concerned by the price movement of BHP they are just concerned by the movement of the discount/premium between the two shares.

As the shares are traded on different stock exchanges in different currencies, the exchange rate and the movement of the exchange rate needs to be considered if a trader is going to take a spread position. Fortunately in this case both are also traded on the New York Stock Exchange (NYSE) in US dollars through the use of American Deposit Receipts (ADR) an ADR traded on the NYSE represents shares in a foreign company. The ADR shares are interchangeable with the company it represents, so the law of one price keeps the price of the ADR adjusted for the exchange rate in line with the share it represents.

During the last five years the London listed BHP ADR (NYSE:BBL) has traded between 78% and 96% of the price of an Australian listed BHP ADR (NYSE:BHP), with an average of 86%.An excellent risk/return ratio is obtained if the trader can buy the spread near it historic low and sell when the spread moves up to its average and the timing to perform this trade is when the price of BHP is collapsing. In November 2008 when ASX:BHP hit the low of $20.10 the above spread moved 8% in 9 days, 8% might not sound like a great return but as the trade is a hedged position leverage is safely utilised to increase the return on invested capital.

On the other hand, if you are an Australian value investor who wants to buy BHP shares at a discount to their intrinsic value there is a greater margin of safety in buying the London listed BHP for a 15% discount compared to buying the Australian listed BHP. If you follow Roger’s advice and only invest in the highly rated companies on Skaffold then BHP is not going to be a buy for you today at any price, but as the financial situation of every company is constantly changing one day in the future BHP may be rated A1 on Skaffold and at that time it might be worth you considering the London listed BHP.

Author: David Smith 13 March 2012

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights.

-

Is this company a master of the mine?

Roger Montgomery

March 26, 2012

PORTFOLIO POINT: Coal mining services provider Mastermyne is attractive if you consider its work in hand, revenue and earnings prospects. Cash flow, however, must be watched closely and value has recently taken flight.

Investors can be an irrational lot. When share prices are low, investors are reluctant to buy, preferring first a rise in prices to confirm their beliefs. Yet when those beliefs are confirmed and after share prices rise, the reluctance to buy remains; now the investor waits for lower prices to provide a more attractive entry point.

Mastermyne (ASX:MYE) has enjoyed a recent surge in its share price. Even though the rise has pushed its share price above a rational estimate of intrinsic value, it should not dissuade an investigation of MYE as conventional wisdom suggests favourable industry dynamics bode well for its earnings prospects over FY2012 and beyond. For now, turn the stockmarket off and focus on the business.

Mastermyne, established in 1996, is Queensland’s “leading” provider of specialist underground coal mining services. The company’s operations are primarily in the Bowen Basin, but the company also enjoys a growing presence in NSW’s Illawara. The company counts BHP, Rio, Vale and Anglo Coal among its Tier 1 customers. Demand for the company’s services is tied to coal production volumes and the short and medium-term outlook for coal production is positive, thanks to demand from emerging economies.

Bright prospects do assume the following: a benign environment for union action against coal miners (union action is currently underway for the BHP-Mitsubishi JV); no impact from litigation by the “Stopping the Coal Export Boom” movement that has also carefully planned and funded litigation action to delay development of port and rail infrastructure; and the spread of new production in Queensland’s Galilee Basin and NSW’s Hunter Valley.

Mastermyne’s three business segments are:

Mastermyne Underground (Mining Services) (>90% group revenue) (underground conveyor installation, extension and maintenance; underground roadway development; underground ventilation device installation).

Electrical and Mechanical Services (>1% of group revenue) (above ground electrical and mechanical services, including construction, maintenance and overhaul of draglines, wash plants, materials handling systems and other surface infrastructure).

Engineering and Fabrication (designs and fabricates attachments for underground equipment; general engineering and fabrication; supply of consumables for underground coal mines).

Since listing in May 2010 and under the direction of Tony Caruso (CEO since 2005, MD since 2008 – pictured above at far left during Mackay’s best business 2010 gala awards), MYE is off to a good start as a listed company. Importantly, investors should note that of the $40 million raised in the float, not a dollar went into the business. About $2.3 million went to the deal’s brokers and vendors received $37.7 million. Equally importantly, the company didn’t say in its prospectus that the proceeds had been used as ‘working capital’. I have seen plenty of companies that did, even though not a cent went in.

Supported by a strong order book, MYE exceeded its prospectus forecast revenue and earnings for 2010 by circa 4%, and earnings for 2011 by 10%.

Citing limited ‘through-the-cycle’ performance transparency, many investors get nervous about a company that is either new or newly listed. There is no escaping the argument in this case. Not only that, but the fact remains these types of mining contractors typically have high operating leverage and feast can quickly turn to famine, especially where barriers to entry are low (such as in this case) and competitors are willing to price irrationally when pickings get slim. However, between FY2007 and FY2010, MYE achieved compound annualised growth of 17% in earnings before interest, tax and amortisation. Encouragingly, the company grew operating earnings during the GFC and, in a more recent six-month period to August last year, grew its FY2012 contracted order book by 30% – this on top of the previously mentioned prospectus-exceeding growth for FY2011 and second-half 2011 operating earnings growth of 22%.

During MYE’s annual general meeting (AGM) late last year, a very strong start to the current financial year was also cited. Growth in the two smaller divisions is being targeted (expect strong growth off a low base) and the company is positioning to engage in larger projects that are coming online over the next three to four years. Specifically, Mastermyne said that demand for its services remains strong and is increasing.

While several analysts have cited MYE’s strong employee growth as evidence of its statements about pipeline growth, it also serves as a reminder of the operating leverage that engineering contractors typically display. A leading position is essential in the event that industry-wide revenue ever turns south.

Watch the cash

On a work-in-hand, revenue and earnings basis, this is a company with bright prospects. The one caveat, however, is cash flow. Ultimately, it is by cash flow that a company lives and dies. A company waiting for its customers to pay while growing fast must manage its cash flow very carefully.

As is typical in a capital-intensive business (note: reason to moderate any plans for grand portfolio allocations), growth requires significant capital expenditure, as well as more typical variable expense increases. For 2011, net operating cash flows declined from $15.1 million to $9.4 million (take a look at the $20 million jump in receivables for a partial explanation). However, after subtracting $2.6 million for capex, the company was still able to pay its borrowings down by $6.7 million (the apparent increase in ‘borrowings’ is due to finance leases – another cost associated with expansion). Finally, a dividend of $2.6 million arguably caused the bank balance to decline by $2.2 million in 2011.

Using my method to estimate business cash flow, an $8.7 million business cash outflow can be offset by an $11 million increase in property plant and equipment, but the company really needs some of those 1200 additional staff it has taken on to be working in the receivables management part of the back office.

I suspected the accrual accounting used to record revenue would be based on effort expended, and indeed, the annual report confirms this:

“Revenue from services rendered is recognised in profit or loss in proportion to the stage of completion of the transaction at the reporting date…”

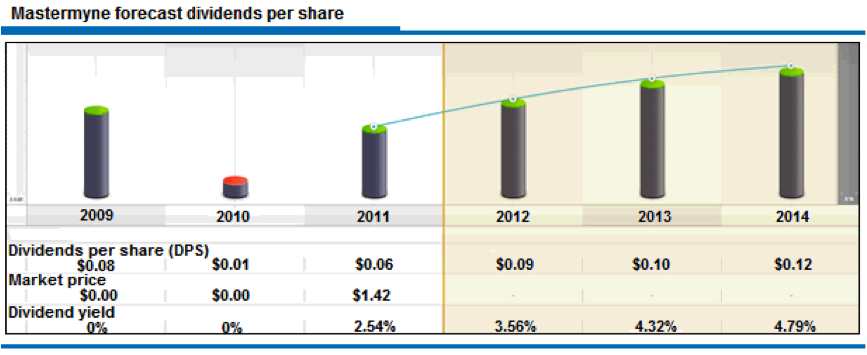

However, clients like BHP, Rio, Anglo Coal and Vale, while making a great looking CV, will also ensure Mastermyne won’t be dictating cash payment terms. The impact of this should not be underestimated, because Mastermyne will require cash to maintain and expand its equipment fleet, as well as maintain dividends (forecasts for per share dividends can be seen in the graph below).

Source: www.Skaffold.com

Only once you are comfortable with an understanding of how the cash flows through the company, its quality and its prospects do you move to analysing its intrinsic value.

Intrinsic value is a function of a company’s equity and the profitability of that equity, as well as a conservative required return.

The make-up of Mastermyne’s equity is therefore important and an examination of the balance sheet reveals that a not-insubstantial portion of the owner’s equity is comprised of intangibles, namely goodwill. The payment to the vendors of around $40 million was well in excess of the book value of net tangible assets, and so the accountants created a common control reserve to ensure the balance sheet balanced. The upshot is this would be a problem if the company were required to borrow meaningful funding. The combination of operating leverage and higher debt (if it were to grow) is itself less than perfect, and debt backed by goodwill leaves shareholders with precious little to support share prices if revenue or operating margins were to turn down.

That appears unlikely in the near term and so we move to the other element of the intrinsic value equation, which is return on equity. For the next two to three years, these returns are expected to remain high and stable at around 31%.

Based on these expectations, and turning the stockmarket back on, Mastermyne is trading at a premium to its current value. A pullback to $1.80, if it were to transpire and all else being equal, should be a trigger to pull the file out and conduct some due diligence on the company’s prospects at that time.

*Mastermyne (ASX:MYE, Score B1) is a small Montgomery [Private] Fund holding.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 26 March 2012.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Manufacturing, Skaffold.

-

Guest Post: Forcing Bright Prospects

Roger Montgomery

March 23, 2012

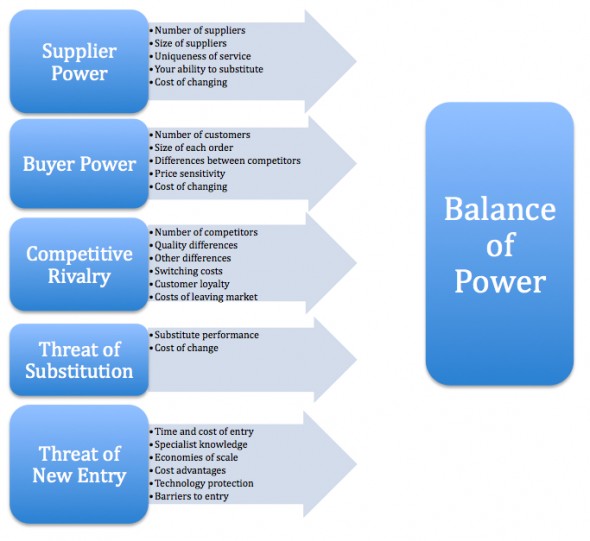

Created by Harvard Business School professor Michael Porter to analyze the attractiveness and likelihood of profitability of an industry, Porter’s Five Forces are a simple but powerful tool for understanding where power lies in any business situation. Using this tool, you can gain insight into the competitive strength of an investee candidate.

Created by Harvard Business School professor Michael Porter to analyze the attractiveness and likelihood of profitability of an industry, Porter’s Five Forces are a simple but powerful tool for understanding where power lies in any business situation. Using this tool, you can gain insight into the competitive strength of an investee candidate.While these Five Forces are typically used by companies to determine whether new products, services or businesses may be profitable, investor’s can use them to analyze the competitive position of any industry member.

The importance of ROE and buying companies with bright prospects is sacrosanct here at the Insights Blog but why? Return on equity is an important explanatory variable for superior share price performance and so we want businesses that can sustain high rates of return. When I talk about bright prospects it is the sustainability of these high rates of return that I am referring to. Whether the bright prospects relate to a rising tide of customers, the ability to pass on rising costs, the ability to be the low cost provider or the changing competitive landscape, how these factors serve to produce a high rate of return on equity is what we care about.

Numerous economic studies have shown that different industries can sustain different levels of profitability. This can be attributed to differences in industry structures. Within those industries however there is a pecking order of companies and Kathy’s column on Porter’s five forces reinforces the need to understand where your investee candidate sits and whether that high ROE being produced today can be sustained.

Porter’s Five Forces model is made up by identification of 5 fundamental competitive forces:

Barriers to entry

Barriers to entry measure how easy or difficult it is for new entrants to enter into the industry.Threat of substitutes

Every top decision makes has to ask: How easy can our product or service be substituted?Bargaining power of buyers

the question is how strong the position of buyers is. For example, can your customers work together to order large volumes to squeeze your profit margins?Bargaining power of suppliers

This relates to what your suppliers can do in relationship with you.Rivalry among the existing players

Finally, we analyze the level of competition between existing players in the industry.Kathy writes…

Calculating the ROE or debt levels of a company is the easy part. But how does one determine if a company has bright prospects? The Porter’s Five Forces model is a tool that I have found to be helpful when picking companies in which to invest. I came across this model while I was studying an Information Systems subject at University.

The Porter’s Five Forces model was developed by Michael Porter to help understand a company’s competitive advantage. The five “forces” that are identified by Porter are:

1) Threat of new entrants

New entrants can increase market competition between companies. In the absence of a dominant player, this can lead to erosion of profit margins.

The threat of new entrants is highly dependent on the barriers to entry. For example, it is relatively easy to start a small pizza business, but it would be difficult to compete with or replicate Cochlear’s business due to the massive R&D costs and intellectual property that is hard to obtain.

2) Power of suppliers

Suppliers can place pressure on margins if they are dominant players in the market. This can be observed in the computer chip manufacturing space where Intel and AMD are the dominant manufacturers. These two companies arguably control the technology that is available to consumers because the manufacturers of computers must build them to accommodate AMD and Intel’s CPUs.

The power of suppliers can also be witnessed in the building industry where suppliers increase their prices as a result of rising commodity costs. These price increases are difficult for builders to pass on in the current subdued climate as consumers are already stretched with high housing costs.

3) Power of customers

A profitable company depends on attracting and retaining customers. However, customers hold the power when they can easily switch to a competitor’s product or service.

In a competitive market where there is little product differentiation, particularly in industries where products have become commoditised, customers have the power to force businesses to compete on price. This is evident with online book stores, where consumers have the ability to search for and compare the cheapest prices across online retailers such as Amazon, eBay, Book Depository and Booktopia, forcing traditional bricks and mortar book stores to compete.

4) Availability of substitutes

In the majority of industries there are substitutes that a customer might use if prices become prohibitively high. Substitutes can be seen in the energy sectors, for example, petrol is increasingly being substituted with ethanol in cars.

New technologies also create substitutes. The introduction of electronic downloadable music has been very popular with consumers who wish to purchase and download music at their convenience. CD sales have dwindled much to the dismay of record labels. Companies need to be agile and adapt to new trends. Kodak is a classic example of a company that did not move with the times.

5) Existing competitors

Competitors all fight for market share by developing their brands and by attempting to attract customers. Increased competition can lead to the erosion of profit margins. Innovation can help, however this is difficult for businesses that operate in a commodity-type business. Retailers (e.g. Coles, Woolworths, Myer) typically sell the same products as their competitors, and perhaps their private label products are a means for them to differentiate themselves from their competitors.

I hope this has given everyone some food for thought. These are the things

I try to think about before I invest my hard earned money.Thanks Kathy for your post. If you would like to list a couple of companies that you believe dominate their industry and will sustain high rates of return on equity, simply click on the Leave A Comment link below.

by Roger Montgomery Posted in Companies, Insightful Insights, Value.able.

-

Is there beauty in boring?

Roger Montgomery

March 15, 2012

Making winches and bullbars for four-wheel drives sounds boring, but the latest figures from ARB offer exciting reading.

Making winches and bullbars for four-wheel drives sounds boring, but the latest figures from ARB offer exciting reading.

I am most excited about companies that are in boring industries. You might recall my column (here) enthusiastically discussing Embelton, a manufacturer and distributor of … wait for it … hardwood flooring. Since that article the stock has surged to new all-time highs. Great companies that are run by reliable and trustworthy managers can produce returns that are anything but boring.Right now, retail and other sectors such as property have declined in prominence in the various indices. As a result, fund managers worried about their “tracking error” don’t need to own as much of these companies’ shares, which in turn means brokers don’t receive sufficient brokerage fees to warrant an analyst covering them. The net result is that analysts are made redundant, and coverage of the stocks declines along with the price multiples being asked for the shares. For a long-term value investor, this is bliss.

And with that we turn to the results of another of my candidates for most boring industry award: ARB Corporation. ARB manufactures and distributes 4WD aftermarket accessories. Think bull bars, snorkels, fridge-freezers and winches (among other items) manufactured in Thailand and Kilsyth and distributed around the world, now through 43 stores (16 company owned – think of the long-term store rollout potential!) from Africa and the Emirates to Mongolia.

Strong local demand has protected ARB from the impact of Thai floods on vehicle supply and a very strong previous corresponding period (thanks to a large order). And just as local demand in January (holidays) and February (job losses) will trim sales, a restoration of car manufacturing supply chains offshore will offset it.

In the most recent half, ARB increased sales 2.3% to $132.1 million, maintained its EBIT of $24.9 million, increased its net profit by 1.6% to $18.3 million and its earnings per share by 1.6% to 25.2¢. The interim dividend also rose by one cent to 11¢ a share.

Many investors might be concerned about the flat EBIT. Don’t be. This reflects increased staffing and in particular staff in the research & development department. It’s this department that is responsible for the company’s innovative product lineup that included the release of the Sahara bull bar range (2000), the Emu Dakar leaf springs (2005), the recovery strap range (2007) and the fridge freezer (2008). While the cost is expensed, investors should think of it as an investment in the future. EBIT was also flat thanks to store expansion and the NPAT increase merely reflected an increased interest income item. Like I said, don’t get too excited!

Some of our “informers” have, however, explained that price rises have been possible and if you have read my book Value.able (click here), you will discover just why I think this is the most valuable competitive advantage.

The resource boom in Queensland and WA is having a positive impact on smoothing the company’s revenues and earnings in addition to the obvious direct impact on aftermarket product sales. The company’s production facilities have been running full-tilt and this appears to have resulted in some buildup of inventory, which in turn has had an impact (not material) on cash flows and the value of materials and consumables used compared to sales.

Full capacity production facilities add to inventory that has become backlogged as a result of slow vehicle throughput, due to the Thai floods and Japanese earthquake. I expect the inventory will run down again as deliveries of post-flood vehicles overseas ramps up.

I am encouraged by the Thai facility being at full production so soon after commissioning, because it suggests that management were unduly conservative in their estimation of their global reputation. I expected more cash to be needed for an upgrade or expansion and that has been announced. With returns on equity the envy of their listed peers, I am delighted to see the company invest more.

At an ASX seminar I presented yesterday, one attendee asked about the impact of currency on the company. This was a very good question: It’s important to note that for ARB there are two impacts. The first is a strong Australian dollar is great for margins when inputs are purchased from overseas. The flipside is that marked-up revenues earned offshore are impacted negatively as the dollar strengthens and those revenues are repatriated.

Historically, the company has a record of paying special dividends and, with $32 million in the bank, it is understandable that many analysts would use this line to woo investors into the stock (as an owner of the stock; “go for it” I say!). But the large cash balance is partly the result of $7 million raised in 2010 (through an underwritten DRP if I recall correctly) and special dividends will also be dependent on the level of investment the company makes in plant:

Such an outcome is not beyond the realms of possibility but neither is a permanently higher dividend payout ratio. The latter of course reduces the intrinsic value of the company – better that MD Roger Brown keeps the money in ARB and reinvests it at near 30% returns on equity.

At the current price of about $8.63, ARB is trading just above its 2012 intrinsic value estimate (see above Skaffold chart). With only 43 stores globally and only 16 company owned, fully utilised production facilities however suggest the company has plenty of scope to grow while sustaining high rates of return on incremental capital for decades – notwithstanding management’s energy to do so. It seems boring but slow and steady seems to be winning the 4WD race.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 15 March 2012.

by Roger Montgomery Posted in Companies, Insightful Insights.

- 13 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

Is the rally over?

Roger Montgomery

March 8, 2012

At the outset, let me say I am not going forecast anything. I don’t know whether the market will rise or fall next. Andy Xie however, in his column entitled; A world flying blind wrote: “Playing with expectations works temporarily. The risk-on trade is in a mini bubble, as today’s, buyers want to be ahead of the slower ones. The buying trend is sustainable only if the global economy strengthens, which is unlikely. The stocks aren’t cheap. Desirable consumer stocks are selling for 20 times earnings. Banks are cheap for a reason. Internet stocks suggest another bubble in the making. The Fed is trying to inflate an expensive asset. The rally, hence, is quite fragile. As soon as a shock like Greece defaulting or bad economic news unfolds, the market will quickly head south.”

At the outset, let me say I am not going forecast anything. I don’t know whether the market will rise or fall next. Andy Xie however, in his column entitled; A world flying blind wrote: “Playing with expectations works temporarily. The risk-on trade is in a mini bubble, as today’s, buyers want to be ahead of the slower ones. The buying trend is sustainable only if the global economy strengthens, which is unlikely. The stocks aren’t cheap. Desirable consumer stocks are selling for 20 times earnings. Banks are cheap for a reason. Internet stocks suggest another bubble in the making. The Fed is trying to inflate an expensive asset. The rally, hence, is quite fragile. As soon as a shock like Greece defaulting or bad economic news unfolds, the market will quickly head south.”In the great de-leveraging we are witnessing, cutting interest rates (monetary policy) doesn’t spur economic activity because businesses and individuals are simply trying to get out from under a mountain of debt first. The next option is to simply hand over money (quantitative easing) and then if that doesn’t work expand budget deficits through government spending (fiscal policy). A positive by-product of the money printing is that lower long-term bond rates guarantee a negative real yield – How can bonds be seen as ‘safe’ if they are 100% guaranteed to result in less purchasing power? – and investors are forced to buy other assets like stocks and pile into the “risk on” trade referred to above. Sadly, just as the money being printed isn’t finding its way into the economy – its being hoarded by the zombie banks who should have been allowed to collapse and/or write off their bad loans – the rally in the stock market isn’t helping the masses and indeed may itself be fading.

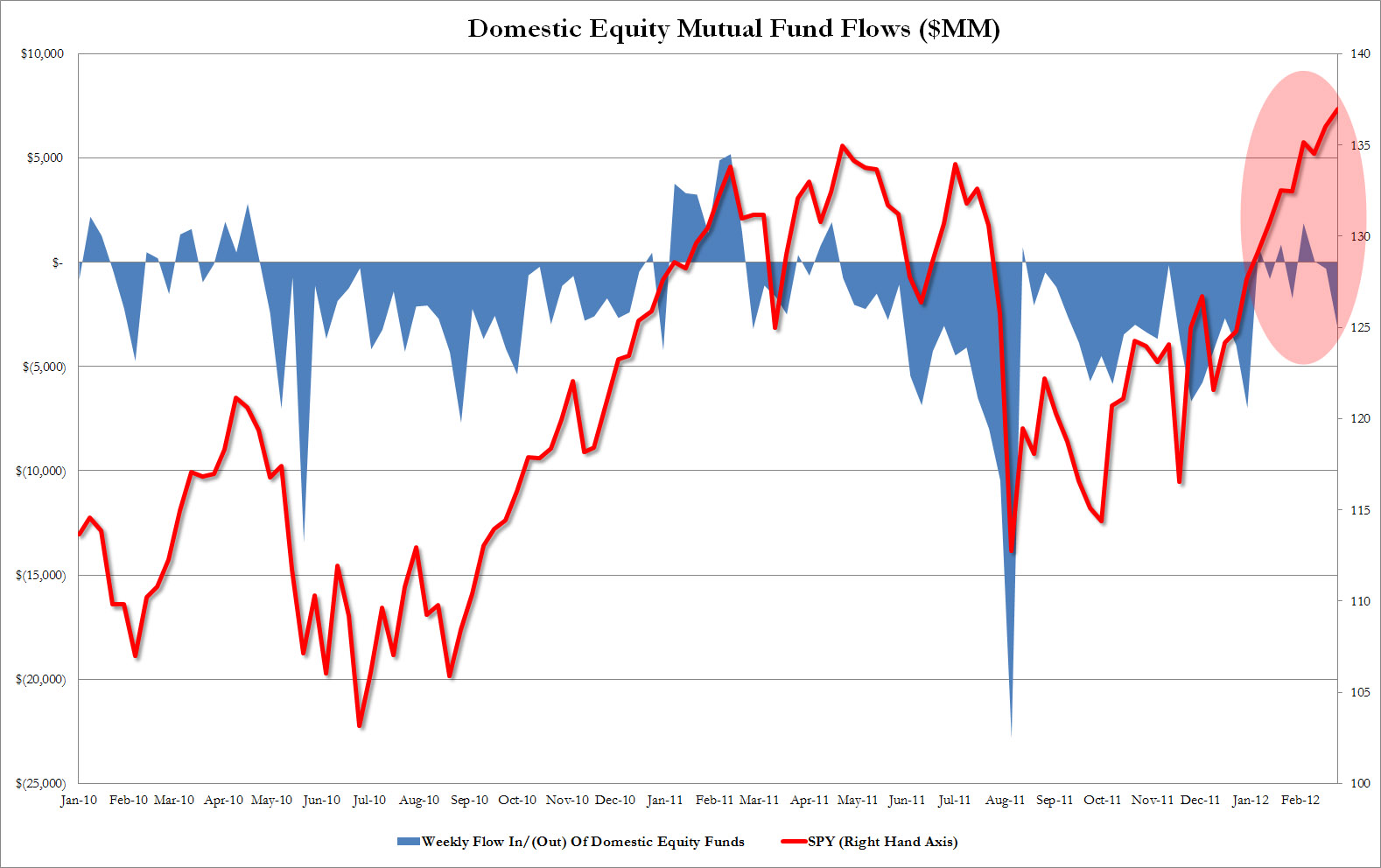

Chart 1 suggests to some investors that the latest attempt to encourage participation in the stock market hasn’t worked.

Chart 1 reveals that not only have retail investors continued to pull out cash from US equity mutual funds (about $66 billion since October), but the market peak of the week of February 29 coincided with the biggest weekly outflow for 2012 – $3 billion.

The Globe&Mail reported: “Retail investors, after gutting it out through years of awful returns, have finally fled. In a normal market, retail participation – Mr. and Mrs. Public trading their personal accounts – should be about 20 per cent. That plunged in November and December, traders say…

Traders Magazine noted: “On Wall Street, risk is suddenly a four-letter word. Retail investors can’t stomach it. Pension plan sponsors are allocating away from it.

“That’s bad news for stocks. Volume has been dropping almost nonstop for three years and shows no signs of improvement. The situation is worse than it was following the crash of 2000. It’s worse than it was after the crash of 1987. Fearful of the future and still wincing from 2008, investors are moving funds into bonds, commodities, cash, private equity, hedge funds and even foreign securities-anything but U.S. stocks.

“Our bread and butter is the retail investor,” Scott Wren, a senior equity strategist at Wells Fargo Advisors, one of the country’s four largest retail brokerages, told Bloomberg Radio recently. “They’re not jumping into the market. They’re not chasing it. Those who have been around for a little bit have been probably burned twice here in the last 10 years or so. They’re definitely gun-shy. They’re not believers. I’m not sure what it’s going to take to get them back in the market.”

As an aside, the reference to declining volumes over the last three years reminds me to republish the chart that I first published here: http://rogermontgomery.com/perhaps-one-of-the-most-important-charts/

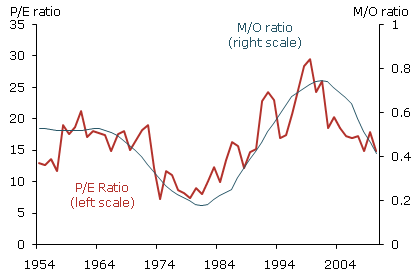

We wrote back in February; “A key demographic trend is the aging of the baby boom generation. As they reach retirement age, they are likely to shift from buying stocks to selling their equity holdings to finance retirement. Statistical models suggest that this shift could be a factor holding down equity valuations over the next two decades.

“The baby boom generation born between 1946 and 1964 has had a large impact on the U.S. economy and will continue to do so as baby boomers gradually phase from work into retirement over the next two decades. To finance retirement, they are likely to sell off acquired assets, especially risky equities. A looming concern is that this massive sell-off might depress equity values.”Chart 2. Ratio of accumulators to dissavers plotted against P/E ratios

Back to more recent observations and the 20% stock market rally over the last four months has been described as a completely artificial “ramp” by some and has been driven entirely by the global liquidity injections of the US, UK, European and Japanese central banks. The conclusions for some investors is that the smart money – those that have bought in anticipation of retail ‘follow-through’ will soon scramble for the exits. What do you think?

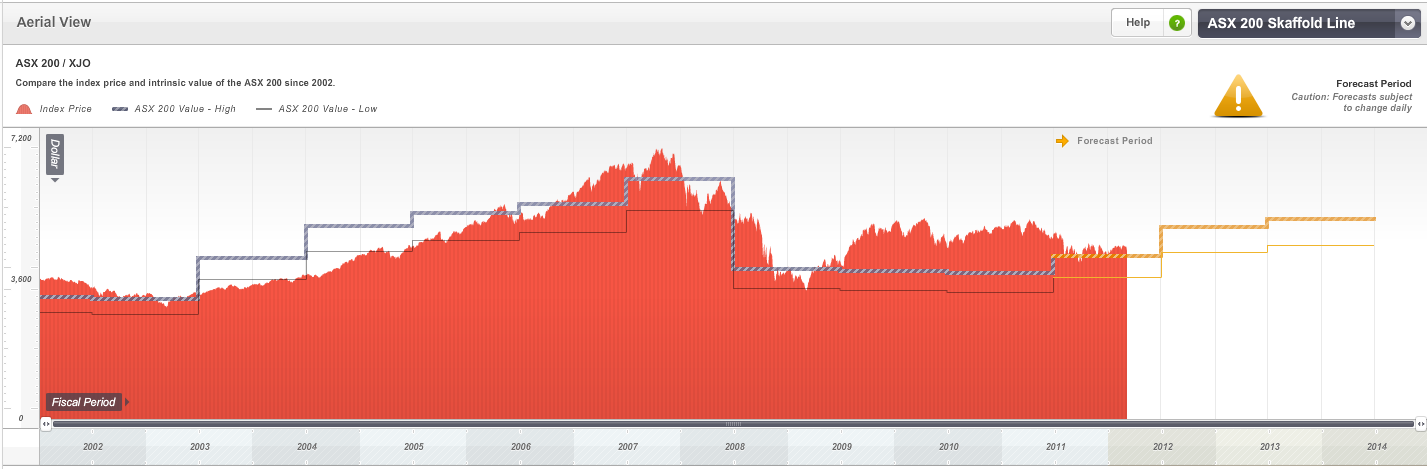

Skaffold’s ASX200 Value Indicator is a live and automatically-updated valuation estimate of the ASX200. It updates and changes every day. The future valuation estimates are based on the the constantly updated forecasts for earnings and dividends of the biggest 200 companies. You can’t beat it as a guide to the overall market level and whether you should be enthusiastic or not about looking more deeply for value.

Chart 3. ASX200 Value Indicator

Source: Skaffold.com