Consumer discretionary

-

Is Oroton Australia’s best retailer?

Roger Montgomery

April 12, 2011

Oroton, JB Hi-Fi, The Reject Shop, Woolworths, Nick Scali, Cash Converters. If you have seen me on Sky Business or visited my YouTube channel recently, these names will be familiar. David Jones, Country Road, Harvey Norman, Myer, Super Retail Group (think Super Cheap Auto), Strathfield Group (Strathfield Car Radios), Noni B and Kathmandu also spring to mind, albeit for different reasons.

As a business, retailers are relatively easy to understand. The best managers are easy to spot (think Oroton’s Sally MacDonald) and it is also easy to separate the businesses with earnings power from those without (compare JB Hi-Fi and Harvey Norman).

But generally speaking even the best retailers may not be companies you want to hold forever. Why? Because they quickly reach saturation and so must constantly reinvent themselves.

Barriers to entry are low. There are always new concepts with young, intelligent and energetic entrepreneurs eager to develop a new brand and offering. Big red SALE signs are replacing mannequins as permanent window fixtures in Australian shop fronts, driving down revenue and margins. And for those who choose to defend brand value, sales revenue is also often sacrificed.

Then there’s the twin-speed economy, a string of natural disasters, soaring oil prices, growing personal savings, higher interest rates, Australia’s small population and one that is increasingly adept at shopping online for a getter price. Hands up who wants to be a retailer?

Retailers are attractive businesses – at the right price and the right stage in their life cycle. So, in retailing, who is Australia’s good, bad and just plain ugly?

Remember, these comments are not recommendations. Conduct your own independent research and seek and take professional personal advice.

Harvey Norman

ASX:HVN, MQR: A3, MOS: -19%A decade ago Gerry’s retail giant earned $105 million profit on $484 of equity that we put in and left in the business. That’s a return of around 19 per cent. Fast-forward to 2010 and we’ve put in another $117 million and retained an additional $1.5 billion. Despite this tripling of our commitment, however, profits have little more than doubled to $236 million. Return on equity has fallen by a third and is now about 12%. One decade of operating and the intrinsic value of Harvey Norman has barely changed. HVN is a mature business, but be warned… Harvey Norman is what JB Hi-Fi and The Reject Shop would see if they used a telescope to look forward through time.

OrotonGroup Limited

ASX:ORL, MQR: A1, MOS: -21%Sally MacDonald is a brilliant retailer. I highly recommend watching this interview – click here. Sally took over Oroton in 2006. In just five years she has cut loss making stores and brands, sliced overheads, improved both the quality and diversity of the range. The result? Surging revenues and return on equity in 2010 of circa 85 per cent. Try getting that in a bank account or even a term deposit! Asia offers even brighter prospects for Oroton while their product offering is sufficiently attractive and appealing that the company has the ability to weather the retail storm and protect its brand.

Woolworths Limited

ASX: WOW, MQR: B1, MOS: -17%You don’t get any bigger than Woolworths (its one of the 20 largest retailers on the planet!). It has a utility-like grip on consumers only, with earnings power that would put any utility to shame. The latter can be seen in the near 30% annualised increase in intrinsic value. Competitive position and size means suppliers and customers fund the company’s inventory. Challenges included professed legislative changes to poker machine usage (WOW is the largest owner of poker machines and any drag in revenue will have an exponential impact on profits), and the rollout of a competitor to Bunnings.

David Jones Limited

ASX: DJS, MQR: A2, MOS: -35%A beautiful shop makes not a beautiful business. I remember when David Jones floated. Shoppers who enjoyed the ‘David Jones’ experience and were loyal to the brand bought shares with the same enthusiasm as scouring the shoe department at the Boxing Day sales. Since 2007 DJS has reduced its Net Debt/Equity ratio from 108 per cent to just under 12 per cent. We are yet to see if Paul Zahra can lead DJs with the same stewardship as former CEO Mark McInnes but as far as department stores can possibly be attractive long-term investments, DJs isn’t it.

Myer

ASX: MYR, MQR: B1, MOS: -27%In 2009, following the release of that gleaming My Prospectus, I wrote:

“With all the relevant data to value the business now available and using the pro-forma accounts supplied in the prospectus, I value the company at between $2.67 and $2.78, substantially below the $3.90 to $4.90 being requested [by the vendors]. It appears to me that the float favours existing shareholders rather than new investors.”

My 2011 forecast value for Myer is just over $2. According to My Value.able Calculations, Myer will be worth less in 2013 than the price at which it listed in September 2010. If competitors like David Jones, Just Jeans, Kmart, Target, Big W, JB Hi-Fi, Fantastic Furniture, Captain Snooze, Sleep City, Harvey Norman, Nick Scali and Coco Republic were removed, Myer may just do alright.

Noni B

ASX: NBL, MQR: A2, MOS: -51%Noni B’s intrinsic value is the same as when Alan Kindl floated the company in 2000 (the family retained a 40% shareholding). Return on Equity hasn’t changed either. Shares on issue however have increased 50 per cent yet profits have remained relatively unchanged.

Kathmandu Holdings Limited

ASX: KMD, MQR: A3, MOS: -56%Sixty per cent of Kathmandu’s revenues are generated in the second half of the year. Will weather patterns continue to feed this trend? I sense premature excitement following the implementation of KMD’s newly installed intranet. The system may streamline store-to-store communications, reducing costs and creating inventory-related efficiencies for the 90-store chain, however what’s stopping a competitor replicating the same out-of-the-box system?

Fantastic Furniture

ASX: FAN, MQR: A3, MOS: -24%Al-ways Fan-tas-tic! Once upon a time it was. Low barriers to entry are seeing online retro furniture suppliers like Milan Direct and Matt Blatt are forcing Fantastic and other traditional players to reinvent the way they display, price and stock inventory.

Billabong

ASX: BBG, MQR: A3, MOS: -49%Billabong’s customers are highly fickle, trend conscious and anti-establishment. Like Mambo, as one of my team told me, Billabong is “so 1999 Rog”. Apparently Noosa Longboards t-shirts fall into the “cool” category, now. Groovy!

Eighty per cent of Billabong’s revenues are derived from offshore. Every one-cent rise in the Australian dollar has a half percent negative impact on net profits. Fans of the trader Jim Rogers believe the AUD could rise to USD$1.40! Then there’s the 44 stores affected by Japan’s earthquake (18 remain closed) and another three in the Christchurch earthquake.

Country Road

ASX: CTY, MQR: A3, MOS: -63%).Like the quality of their clothing, Country Road’s MQR has been erratic. So too has its value. Debt is low however cash flow is not attractive. Very expensive.

Cash Convertors

ASX: CCV, MQR: A2, MOS: +26%.Value.able Graduates Manny and Ray H nominated CCV as their A1 stock to watch in 2011. Whilst its not yet an A1, Cash Convertors is a niche business with bight prospects for intrinsic value growth.

Other retailers to watch

I have spoken about JB Hi-Fi, Nick Scali and The Reject Shop many times on Peter Switzer’s Switzer TV and Your Money Your Call on the Sky Business Channel. Go to youtube.com/rogerjmontgomery and type “retail”, “JBH”, “TRS” or “reject” into the Search box to watch the latest videos.

In October 2009 the RBA released the following statistics:

16 million. The number of credit cards in circulation in Australia;

$3,141. The average monthly Australian credit card account balance;

US$56,000. The average mortgage, credit card and personal loan debt of every man, woman and child in Australia;

$1.2 trillion. The total Australian mortgage, credit card and personal loan debt;

$19.189 billion. The amount spent on credit and charge cards in October 2009.Clearly we are all shoppers… what are your experiences? Who do you see as the next king of Australia’s retail landscape?

Posted by Roger Montgomery, author and fund manager, 12 April 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education, Value.able.

-

What is your WOW Value.able valuation now Roger?

Roger Montgomery

February 14, 2011

With food prices on the way up and Woolies share price on the way down, I have received many requests for my updated valuation (my historical $26 valuation was released last year). Add to that Woolworths market announcement on 24 January 2011, and you will understand why I have taken slightly longer than usual to publish your blog comments.

With food prices on the way up and Woolies share price on the way down, I have received many requests for my updated valuation (my historical $26 valuation was released last year). Add to that Woolworths market announcement on 24 January 2011, and you will understand why I have taken slightly longer than usual to publish your blog comments.With Woolworths’ shares trading at the same level as four years ago (and having declined recently), I wonder whether your requests for a Montgomery Value.able valuation is the result of the many other analysts publishing much higher valuations than mine?

Given WOW’s share price has slipped towards my Value.able intrinsic value of circa $26, understandably many investors feel uncomfortable with other higher valuations (in some cases more than $10 higher),

Without knowing which valuation model other analysts use, I cannot offer any reasons for the large disparity. What I can tell you is that no one else uses the intrinsic valuation formula that I use.

So to further your training, and welcome more students to the Value.able Graduate class of 2011, I would like to share with you my most recent Value.able intrinsic valuation for WOW. Use my valuation as a benchmark to check your own work.

Based on management’s 24 January announcement, WOW shareholders can expect:

– Forecast NPAT growth for 2011 to be in the range of 5% to 8%

– EPS growth for 2011 to be in the range of 6% to 9%The downgraded forecasts are based on more thrifty consumers, increasing interest rates, the rising Australian dollar and incurring costs not covered by insurance, associated with the NZ earthquakes and Australian floods, cyclones and bush fires. The reason for the greater increase in EPS for 2011 than reported NPAT is due to the $700m buyback, which I also discussed last year.

Based on these assumptions and noting that WOW reported a Net Profit after Tax of $2,028.89m in 2010, NPAT for 2011 is likely to be in the range of $2,130.33 to $2,191.20. Also, based on the latest Appendix 3b (which takes into account the buyback), shares on issue are 1212.89m, down from 1231.14m from the full year.

If I use my preferred discount rate (Required Return) for Woolies of 10% (it has always deserved a low discount rate), I get a forecast 2011 valuation for Woolworths of $23.69, post the downgrade. This is $2.31 lower than my previous Value.able valuation of $26.

If I am slightly more bullish on my forecasts, I get a MAXIMUM valuation for WOW of $26.73, using the same 10% discount rate.

So there you have it. Using the method I set out in Value.able, my intrinsic valuation for WOW is $23.69 to a MAXIMUM $26.73.

Of course, I only get excited when a significant discount exists to the lower end of these valuations and until such a time, I will be sitting in cash.

Posted by Roger Montgomery, author and fund manager, 14 February 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education.

-

MEDIA

Valueline: The retailers

Roger Montgomery

October 27, 2010

Retailers with competitive advantage make big profits. Here are my top picks. Read Roger’s article at www.eurekareport.com.au.

by Roger Montgomery Posted in Consumer discretionary, On the Internet.

-

Has BHP and WOW survived the reporting season snow storm?

Roger Montgomery

August 31, 2010

The final reporting season avalanche has coincided with a serious amount of snow in the high plains. No matter where one turns, there’s no escaping heavy falls. More than 300 companies have reported in five days and I am completely snowed under. If you haven’t yet received my reply to your email, now you understand why.

The final reporting season avalanche has coincided with a serious amount of snow in the high plains. No matter where one turns, there’s no escaping heavy falls. More than 300 companies have reported in five days and I am completely snowed under. If you haven’t yet received my reply to your email, now you understand why.To put my week into perspective, up until last Monday morning, around 200 companies had reported (see my Part I and Part II reporting season posts). This week’s 300-company avalanche brought the total to 500. I’m sorry to report that without a snowplough, I have fallen behind somewhat. Around 200 are left in my in-tray to dig through. I will get to them!

Thankfully, there are only a few days left in the window provided by ASX listing Rule 4.3B in which companies with a June 30 balance date must report, and by this afternoon, I will be able to appreciate the backlog I have to work through. So not long to go now…

Nonetheless, today I would like to talk about two companies which I am sure many of you are interested in: BHP and Woolworths. Both received the ‘Montgomery’ B1 quality score this year.

For the full year, BHP reported a net profit of around A$14b and a 27% ROE – a big jump on last years $7b result, which was impacted by material write-offs. Backing out the write-offs, last years A$16b profit and ROE of 36% was a better result than this years. The fall in the business’s profitability has likewise seen my 2010 valuation fall from $34-$38 to around $26-$30 per share, or a total value of $145b to $167b (5.57 billion shares on issue).

With the shares trading in a range of $35.58 to $44.93 ($198b to $250b) for the entire 52 weeks, it appears that the market and analysts expected much better things. While they didn’t come this year, are they just around the corner? I will let you be the judge.

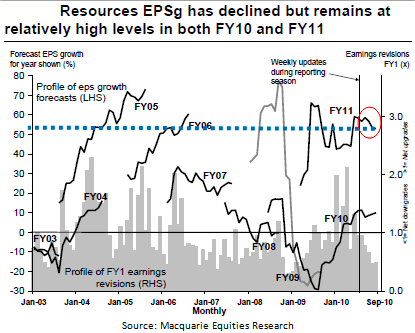

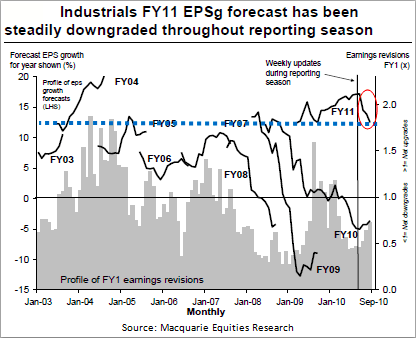

The “market” (don’t ask who THAT is!) estimates resource company per share earnings growth of 50 per cent for 2011. I have drawn a thick blue line to show this on the left hand side of the following graph so you can see where my line intersects.

BHP has a large weighting in the resources sector, so the forecast increase in net earnings by 57 per cent to A$22b is having a material impact on the sector average. Importantly, the forecast growth rate is similar to those seen in 2005 and 2006 when the global economy was partying like there was no GFC. Call me conservative, but I reckon those estimates are a little optimistic in todays environment.

As you know I leave the forecasting of the economy and arguably puerile understandings of cause-and-effect relationships to those whose ability is far exceeded by their hubris. Its worth instead thinking about what BHP has itself stated; “BHP Billiton remains cautious on the short-term outlook for the global economy”.

Given my conservative nature when it comes to resource companies and the numerous unknowns you have to factor in, I would be inclined to be more conservative with my assumptions when undertaking valuations for resource companies. If you take on blind faith a A$22b profit, BHP’s shares are worth AUD $45-$50 each.

But before you take this number as a given, note the red circle in the above chart. Earnings per share growth rates are already in the process of being revised down. I would expect further revisions to come. And if my ‘friends-in-high-places’ are right, it’s not out of the realm of possibilities to see iron ore prices fall 50 per cent in short order. You be the judge as to how conservative you make your assumptions.

A far simpler business to analyse is Woolworths and for a detailed analysis see my ValueLine column in tonight’s Eureka Report. WOW reported another great result with a return on shareholders’ funds of 28% (NPAT of just over $2.0b) only slightly down from 29% ($1.8b) last year. This was achieved on an additional $760m in shareholders’ funds or a return on incremental capital of 26% – and that’s just the first years use of those funds. This is an amazing business given its size.

My intrinsic value rose six per cent from $23.71 in 2009 to $25.07 in 2010. Add the dividend per share of $1.15 and shareholders experienced a respectable total return.

Without the benefit of the $700 million buyback earnings are forecast by the company to rise 8-11 per cent. However, the buyback will increase earnings per share and return on equity, but decrease equity. The net effect is a solid rise in intrinsic value. Instead of circa $26 for 2011, the intrinsic value rises to more than $28.

But it’s not the price of the buyback that I will focus on as that will have no effect on the return on equity and a smaller-than-you-think effect on intrinsic value (thanks to the fact that only around 26 million shares will be repurchased and cancelled). What I am interested in is how the buyback will be funded. You see WOW now need to find an additional $700m to undertake this capital management initiative. So where will the proceeds come from? That sort of money isn’t just lying around. The cash flow statement is our friend here.

In 2010 Operating Cash Flow was $2,759.9 of which $1,817.7m was spent on/invested in capital expenditure, resulting in around $900m or 45% of reported profits being free cash flow – a similar level to last year. A pretty impressive number in size, but a number that also highlights how capital intensive owning and running a supermarket chain can be.

From this $900m in surplus cash, management are free to go out and reinvest into other activities including acquisitions, paying dividends, buybacks and the like. So if dividends are maintained at $1.1-$1.2b (net after taking into account the DRP), that means the business does not have enough internally generated funds to undertake the buyback. They are already about $200-$300m short with their current activities. In 2010 WOW had to borrow $500m to make acquisitions, pay dividends and fund the current buyback.

Source: WOW 2010 Annual Report

Clearly the buyback cannot be funded internally, so external sources of capital will be required. In the case of the recently announced buyback it appears the entire $700m buyback will need to be financed via long-term debt issued into both domestic and international debt capital markets, which management have stated will occur in the coming months. They also have a bank balance of $713m, but this has not been earmarked for this purpose.

Currently WOW has a net debt-equity ratio of 37.4 per cent so assuming the buyback is fully funded with external debt, the 2011 full year might see total net gearing rise to $4.250b on equity of $8,170b = 52 per cent.

A debt-funded buyback will be even more positive for intrinsic value than I have already stated, but of course the risk is increased.

While 52 per cent is not an exuberant level of financial leverage given the quality of the business’s cash flows, I do wonder why Mr Luscombe and Co don’t suspend the dividend to fund the buyback rather than leverage up the company with more debt? This is particularly true if they believe the market is underpricing their shares.

Yes, it’s a radical departure from standard form.

I will leave you with that question and I will be back later in the week with a new list of A1 and A2 businesses. Look out for Part Three.

Posted by Roger Montgomery, 31 August 2010.

by Roger Montgomery Posted in Companies, Consumer discretionary, Energy / Resources.

-

Is Oroton an amazing A1 business?

Roger Montgomery

July 12, 2010

Peter Switzer invites me every Thursday fortnight to join him on the Sky Business Channel. 4 June was like any other show. Except once Peter and I had finished discussing investing and stocks and the market, he invited me to stay on for his interview with OrotonGroup CEO Sally Macdonald.

For readers of my blog, you will know that Oroton is one of my A1 businesses. And I have often said that Sally Macdonald is a first-class manager.

Below are the highlights from that interview.

Each time a new video is uploaded to my YouTube channel I post a note at my Facebook page. On Facebook will also find my upcoming talks, editorial features, TV interviews, radio spots and the latest news about Value.able.

If you are yet to pick up the latest issue of Money magazine find it at the newsstand now, there are a bunch of terrific columns. Click here to read my monthly column. This month I write about ‘Great Retail Stocks’.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education.

-

Toothpaste and lounge chairs – which is the easier investment decision?

Roger Montgomery

June 5, 2010

“Roger, would you buy Nick Scali (NCK) over the likes of TRS, ORL and JBH?” This last week, its been a frequently asked question.

“Roger, would you buy Nick Scali (NCK) over the likes of TRS, ORL and JBH?” This last week, its been a frequently asked question.Let me start by saying that I consider Nick Scali to be a high quality business. While the business listed in May 2004, I have run my ruler over the business financials since the year 2001. In every single year its been an A-Class company and an A1 in most. This is impressive. Few businesses have such an excellent track record, which speaks highly of management.

Indeed, given my tough quality and performance criteria, NCK would be in the top 5% of all companies listed on the ASX.

But are high quality financials and a good track record of performance enough to justify buying a business?

Let’s consider the businesses of NCK and The Reject Shop – another high quality retailer.

NCK is engaged in sourcing and retailing of household furniture and related accessories. The Company’s product portfolio includes chairs, lounges, outdoor, dining, entertainment – what are called ‘big-ticket’ items as well as and furniture care products. It has 28 showrooms located in New South Wales, Victoria, Queensland and South Australia under the Nick Scali brand, and additional showrooms in Adelaide under the Scali Living and Scali Leather brand.

TRS on the other hand is engaged in discount variety retailing. Its footprint of around 187 ‘convenience’ stores is focused on low price points, offering a wide variety of merchandise. Stores are spread throughout Australia.

TRS has an exceptional history of quality and performance, and in that respect is not dissimilar to NCK.

While NCK and TRS both have top tier fundamentals, there is one major difference; their business models. And this is the important difference that puts TRS far ahead of NCK in my mind from an investor’s perspective.

Consider the economic cycle and the impact it could have on each business; NCK is a retailer of ‘big ticket’ items and TRS is a retailer of ‘low price point items’. Cast your mind back just a few years to when the stock market was crashing, and depression talk filled the media. Do you think spending on big-ticket items like a sofa or a $2 tube of parallel imported toothpaste selling at a cheaper price than a major supermarket, would have been reined in first? This is where TRS offers arguably a more stable and slow-changing revenue stream. TRS of course has its own issues and risks, just as any business has, but the stability of earnings is perhaps superior to that offered by NCK.

TRS has positioned itself as providing ‘low price points’ on everyday goods. Things you always need – daily essentials. I’m guessing you wouldn’t stop brushing your teeth, even during a credit crunch, but you may defer the purchase of that new sofa or outdoor furniture. TRS gets you in by offering really low prices on the daily essentials and then tempts you to fill your basket with other cheap items that have a higher margin for the retailer.

The problem for investors deciding between TRS and NCK is therefore not the quality of each business – they are both very high quality and have excellent management teams – it lies in the cyclical nature of NCK’s earnings.

After determining the quality and risks for a business, the next step is determining its intrinsic values. If you don’t complete this step, you are not investing, you are speculating.

Now to me, investing in a business like TRS is a fairly straight-forward decision. An investment decision in NCK on the other hand requires much more thought about consumer sentiment toward big-ticket discretionary purchases and how susceptible leveraged households are to increases in interest rates. Buffett once said find the one-foot hurdles that you can step over.

I’m not saying I would never buy shares in NCK. There is always a time and a price at which even a cyclical business is cheap, provided its of the highest quality of course. I just prefer to stick to the one-foot hurdles rather than trying to jump over seven footers.

I’m off to brush my teeth. Don’t forget to leave your thoughts.

Posted by Roger Montgomery, 5 June 2010.

by Roger Montgomery Posted in Companies, Consumer discretionary.

-

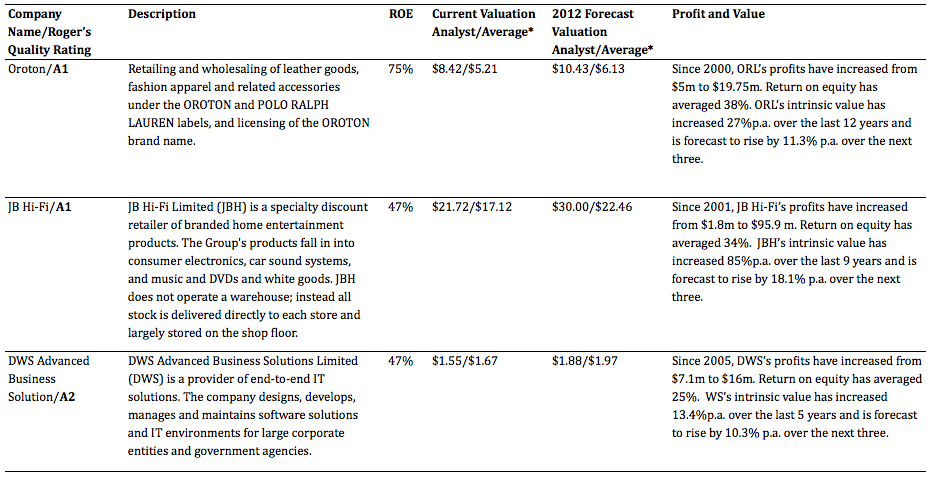

Do these three companies represent the last of good value?

Roger Montgomery

May 4, 2010

Fifteen months ago I was shouting it from the rooftops; “we will look back on this time as one of rare opportunity”. Since then, and as the All Ordinaries Accumulation Index rallied 61 per cent, there has been a fall in my enthusiasm for the acquisition of stocks.

Now, let me make it very clear that I have no idea where the market is going, nor the economy. I have always said you should never forego the opportunity to buy great businesses because of short-term concerns about those things. Even my posts earlier this year about concerns of a property bubble in China need to be read in conjunction with more recent reports by the IMF that there is no bubble in China. Take your pick!

My reluctance to buy shares today in any serious volume comes not from concerns about the market falling, or that China will cause an almighty slump in the values (and prices) of our mining giants. It comes from the fact that there is simply not that many great A1 businesses left that are cheap.

So here’s a quick list of companies that do make the grade for you to go and research, seek advice on, and on which to obtain 2nd, 3rd and 7th opinions.

* Note: Valuations shown are those based on analyst forecasts and a continuation of the average performance of the past.

In addition to these companies, investors keen to have a look at some lesser-known businesses, that on first blush present some attractive numbers, could research the list below. I have not conducted any in-depth analysis of these companies, but my initial searches and scans are suggesting at least a second look (I have put any warnings or special considerations in parentheses).

- CogState (never made a profit until 2009)

- Cash Convertors (declining ROE forecast)

- Slater&Gordon (lumpy earnings profile)

- ITX (trying to identify the competitive advantage)

- Forge (Clough got a bargain now 31% owner and a blocking stake)

- Decmil (only made a profit in last 2 years and price up 10-fold)

- United Overseas Australia (property developer).

What are some of the things to look at and questions to ask?

- Is there an identifiable competitive advantage?

- Can the businesses be a lot bigger in five, ten, twenty years from now?

- Is present performance likely to continue?

- What could emerge from an external force, or from within the company, to see current high rates of return on equity drop? For example, could a competitor or customer have an effect or are there any weak links in the balance sheets of these companies?

Of course I invite you again – as I did in last week’s post entitled “What do you know?” – to offer any insights (good, bad or in-between) that you have about these or any other company you know something about, or even about the industry you work in.

Posted by Roger Montgomery, 4 May 2010

by Roger Montgomery Posted in Companies, Consumer discretionary, Investing Education.

-

What company valuation did you ask for this Easter?

Roger Montgomery

April 1, 2010

Heading into Easter, I received an enormous pile of valuation requests and while many were little mining explorers burning through $500,000 of cash per month and with just $3 million in the bank, quite a few were solid companies that hadn’t been covered before.

Heading into Easter, I received an enormous pile of valuation requests and while many were little mining explorers burning through $500,000 of cash per month and with just $3 million in the bank, quite a few were solid companies that hadn’t been covered before.And to confess, some of the requests were quite rightly keeping me accountable and making sure I post the company valuations I said I would, when I have appeared on Sky Business with either Nina May, Ricardo Goncalves and Peter Switzer.

What are they, I hear you ask? Forge Group (FGE), Grange Resources (GRR), Arrow Energy (AOE), Cabcharge (CAB), Coca Cola (CCL), Data 3 (DTL), Hutchison (HTA), Incitec Pivot (IPL), Metcash (MTS), Sedgeman (SDM) and UXC (UXC)

I am really impressed by the frequency with which I am now receiving emails containing insights I didn’t know about companies that I have covered.

As a fund manager it was not unusual for me to adopt Phil Fisher’s ‘scuttlebutt’ approach to investing. By way of background, Warren Buffett has previously described his approach to investing as 85 per cent Ben Graham and 15 per cent Phil Fisher. Fisher advocated scuttlebutt – talking to staff, to customers and to competitors. I did the same and would often end my interview of a company’s CEO or CFO with I’d learned from reading Lynch; “if I handed you a gun with one silver bullet, which one of your competitors would you get rid of?” The answers were always revealing. Sometimes I would get; “there’s noone worth wasting a silver bullet on”, but most of the time, I would find out a lot more about the competitive landscape than I had bargained for. Occasionally, I would learn that there was another company I really should be researching.

Back to your insights, they are amazing. Now you know why I enjoy sharing my own insights and valuations with you as much as I enjoy the process of investing.

One thought for you; Many of you are sending your best work via email. I would really like to see everyone benefit from the knowledge and experiences you all have so hit reply and if you have some insights (as opposed to an opinion), just click on ‘REPLY’ at the bottom of this post and leave as much information as you would like.

So here are a few more valuations to ponder over Easter. I hope they add another dimension to your research. And before you go calling me about coal seam gas hopeful Arrow Energy, note that the valuation is a 2009 valuation based on actual results. The forecasts for Arrow for the next two years are for losses, and using my model, a company earning nothing is worth nothing. Of course Royal Dutch Shell and Petro China think its worth more and perhaps to them it is, but as a going concern its worth a lot less for some time to a passive investor.

I hope you are enjoying the Easter break and look forward to reading and replying to your insights.

Posted by Roger Montgomery, 1 April 2010

by Roger Montgomery Posted in Companies, Consumer discretionary, Health Care, Insightful Insights.

-

Should we write off Woolworths and buy Wesfarmers?

Roger Montgomery

March 8, 2010

Woolworths reported its first half 2010 results in recent weeks and the 17 per cent decline in the share price ahead of the result suggested investors may have been betting that the company was giving up ground to a revitalised Coles story. The price of Wesfarmers shares – being almost double their intrinsic value – certainly suggests enthusiasm for the latter company’s story.

Studying the results and the company however suggests any pessimism is unfounded and premature.

When I study JBH’s results there’s evidence of a classic profit loop. Cut prices to the customer, generate more sales, invest in systems and take advantage of greater buying power, invest savings in lower prices and do it again. Entrench the competitive advantage.

It would be obvious to expect Woolworths, with its history of management ties to Wal-Mart (who also engages the profit-loop) to be producing the same story, however WOW is flagging an arguably stronger position.

Where JBH’s gross profit margin keeps declining and net profit margin rising, Woolworths’ gross margin has increased every year since 2005. Revenues were 4.2% higher and gross profits rose by 6.5% in the latest half year result. Like JBH, WOW’s EBIT growth was stronger at 11%. As analysts we are mystified as to what is driving the increase in gross profit margins but standing back, you realise its a really good thing; if analysts cannot work it out then perhaps neither can the competitors and that’s good for maintaining a competitive advantage. Competitors cannot replicate something if they don’t know how its produced.

Woolworths competitive advantage – an important driver of sustainably high rates of return on equity (I expect them to average 27% for the next three years – subject to change of course at any time and without warning or notification afterwards) – is its scale and its total dominance, ownership of and class leadership in supply-chain management. The result is that a small increase in revenue even if due to inflation, results in a leveraged impact on profits.

From a cash flow perspective the other fascinating thing is the negative working capital. To those new to investing, working capital is typically an investment for a company; a business orders its products from a supplier, pays on 30 days terms and then spends the next few months selling the product it sells. If its takes a long time to sell the product and the customer takes time to pay, then there is an adverse impact on cash flow because the business is forking out cash today and not getting paid for some weeks or months.

In Woolworths case, as you might expect, the company is so strong and its buying power so dominant that it can dictate terms to its suppliers, making sure they deliver the right quantities at the right time. It can pay them when it likes and perhaps even pay them AFTER it sells the goods to consumers who buy with a debit, cash or credit card, which means Woolworths gets its money from its sales activity immediately. The difference of course can be invested.This virtuous cycle is highlighted by a negative number for working capital (WC = Inventory – Trade Payables + receivables – other creditors) which in Woolworth’s case, got even more negative! Don’t go rushing out and buying the shares because of this fact – its well known to the market and suppliers (who no doubt resent the company’s powerful market position). In the latest result, it was also attributable to timing differences in creditor payments.

The steep decline in the share price ahead of the company’s first half results suggests that many investors and analysts may have considered the company “ex-growth” and favoured Wesfarmers. Given the relative performances and valuations, this is likely to prove to be a mistake (more about that in a moment).

The company still has a lot of room to substantially increase sales and profits and the disbelief in this regard reminds me of the decade after decade in which analysts said Coca-Cola couldn’t grow anymore.

It would take a very almost illegally-informed and dedicated analyst to reach the conclusion that the company cannot continue to enlarge its coffers from further improvements to its overseas buying capability, its private label sales (both admittedly to the detriment of many smaller local owners of branded products) or its supply chain management. There’s also growth from acquisitions (speculative and don’t ever base a purchase on it), the Everyday Rewards loyalty card program and the hardware rollout (it will interesting to find out what they think their USP is).

While it will be interesting to find out what has been driving the competitor Wesfarmers sales numbers (basket size of more customers), the fact remains that it is premature to write off Woolworths. Many analysts will also be concerned about retailers cycling (comparing sales and profits to previous results) the fiscal stimulus, this is simply a short-term distraction and does not have anything to do with the long-term value of the company.

On that front, my calculated intrinsic value for Woolworths has risen every year for the last decade. When Buffett says he’s looking for companies with a “demonstrated track record of earnings power”, its because it translates to rising valuations. Woolworths was worth $2.39 in 2000. Intrinsic value rose to $14.84 in 2005 and $25.70 in 2009. Today’s value of $25.80 is expected to rise to $28.00 in 2011 and almost $30 in 2012.

The current price of $28.05 is therefore now equivalent to the valuation 15 months out and the February low prices are perhaps a better reflection of the current valuation that I have.

I have rarely been able to buy Woolworths at any significant discount to intrinsic value in the last decade and while I don’t know what the price will do next, I do know that irrespective of whether Woolworths offers lower prices in the supermarket or the share market, you would be ill advised to ignore them.

Please be reminded that my valuations for the future are based on analyst expectations, which can change at any time.

Posted by Roger Montgomery, 8 March 2010.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights.

-

What does JB Hi-Fi’s result and resignation mean?

Roger Montgomery

February 8, 2010

I have just completed a phone interview with Ross Greenwood on his Money News program at radio station 2GB. He was interviewing me and Patrick Elliott, the Chairman of JB Hi-Fi following todays result. As you have all probably noticed, the half year result was excellent but JBH has traditionally exceed the market’s expectations for earnings and sales growth. Today’s interim FY10 profit was up 29% on sales growth of 19%, and while it was at the upper end of expectations – it didn’t exceed those expectations. Believe it or not, the result will be downward revisions to analysts future estimates.

The share price decline today – it was down 6.5% at one stage – to be down 5.1% at $19.07 per share, was partly the result of the ‘voting’ machine saying; “the growth is not going to be as high as we envisaged” but probably to a greater extent, it was due to the fact that Richard Uechtritz announced his retirement in “July/August”.

Having grown revenues in ten years from $145 million to $2.8 billion, the resignation of Richard is a blow to the company. But as my restaurant owner friend says; “revenue is vanity, profit is sanity” and the new CEO will be no slouch. Terry Smart joined JBH when Richard did, as part of the private equity funded management buy in. They’ve all made millions and plenty of Terry’s money remains invested.

The changeover reminds me of the retirement of one of Australia’s retailing legends, Barry Saunders, from the Reject Shop. He handed the reins over to Jerry Masters and Jerry continued to grow and expand The Reject Shop. Jerry was an outsider and arguably not the first choice. Terry is a JB Hi-Fi insider and remember my comments that the business boat you get into is far more important than who is rowing it. I think you will find that with 210 identified stores and 140 likely to be rolled out by the end of 2010, there is still plenty of room for growth. More over, Richard’s resignation is similar to The Reject Shop in one important way; neither Barry nor Richard departed to compete. Richard, like Barry will remain a consultant and Richard on the board.

But unfortunately, it is not growth that determines intrinsic value. Its the return on equity, the payout ratio and the equity itself that determines whether the value continues to rise. The big news on this front is that the dividend payout ratio continues to rise. Now at 60%, the increased dividend is a classic response by the board to a business that is generating cash faster than it can use it. But thats a shame because the company is generating 45% returns on its equity. I would much prefer they kept the money – prepay some leases and get a discount (get the contingent liabilities down) – than hand it to me as a dividend. The best I can do with it is perhaps 8% in a 5 year term deposit. Not bad, but not 45%.

The result of not employing as much retained earnings at 45% is that the intrinsic value declines. Its still going up but not as much. The conservative intrinsic value before this result was about $20.30. Now it is $19.30. The intrinsic value next year falls from $24.14 to $22.50 and the year after from $29-ish to $26-ish. So where previously we were looking at a rise to the $30 area for intrinsic value by 2012, it now seems the value will be at best $26.50.

The sole reason for the change to intrinsic value is the increase in the payout ratio. More dividends means less profits being retained in the business, earning more than 45%. Now don’t get me wrong, this is still an amazing business – one of the best and intrinsic value is still forecast to rise by a compounded 16.3% per annum over the next 2 years or so. To get really excited however, you now want a bigger discount to the current intrinsic value.

Posted by Roger Montgomery, 8 February 2010

by Roger Montgomery Posted in Consumer discretionary.