Consumer discretionary

-

Vita Group Investor Report

Roger Montgomery

October 13, 2012

Here at the insights blog we like to encourage deep thought and facilitate genuine community. To that end we have been thinking carefully about how we publish Harley’s research report on Vita Group – or should I see ‘tome’. Its great and we really appreciate Harley’s work. I think you will too. We have resolved to produce a pdf for you to download and read at your leisure. Harley, well done and keep them coming. We now have a system and process for publishing your reports. If anyone else would like to share their research with the tens of thousands of unique investors who visit the Insights Blog each week and the hundreds of thousands who visit each month, including CEO,s planners, advisors and fund managers, then feel free to submit your reports to Feedback & Support.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights.

-

MEDIA

Retail Upheaval

Roger Montgomery

October 10, 2012

Roger discusses the recent developments in respect of Channel 9 and CVC, and the ongoing pressure on Australian retailers from online purchasing with Ticky Fullerton on this edition of ABC1’s The Business broadcast 10 October 2012. Watch here.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, TV Appearances.

-

MEDIA

What future for department stores?

Roger Montgomery

October 3, 2012

Roger Montgomery has some clear insights into the challenges facing Australian department stores, and he provides them to Ticky Fullerton on ABC’s The Business broadcast 26 September 2012. Watch here.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, TV Appearances.

-

MEDIA

Window Shopping

Roger Montgomery

September 1, 2012

In his September 2012 Money Magazine article Roger outlines ongoing declining prospects for JB Hi-Fi (JBH). Read here.

by Roger Montgomery Posted in Companies, Consumer discretionary, On the Internet.

-

MEDIA

JB HiFi’s post result rally conceals more complex reality

Roger Montgomery

August 15, 2012

Roger discusses how the JB Hi-Fi positive 2012 result conceals future structural difficulties in this Australian article published 18 August 2012. Read here.

by Roger Montgomery Posted in Consumer discretionary, In the Press, Insightful Insights.

-

JB Hi-Fi Full Year Results for 2012

Roger Montgomery

August 13, 2012

JB Hi Fi today reported its full year results. Revenue of $3.13b was 6% higher than FY11, but NPAT was down 4.6% to $104.6m. While this was the first decline in JB Hi-Fi NPAT since it listed in 2003, it was slightly better than the market had anticipated and, as I write, the share price is up over 6%.

As value investors, we are more concerned about the long-term than the intra-day outlook, and the question exercising our minds is: to what extent are the current headwinds cyclical vs. structural?

JB Hi-Fi believes that most of what is happening is cyclical, and there is some evidence that can be marshaled to support that view. However, it can also be said that retailers who previously competed locally must now compete with the best in the world. In this context, retailers that must pay Australian prices for rent, staff and utilities have some relatively big hurdles to clear.

Investors should also be aware of two interesting financial developments. Looking at the Profit & Loss statement you will see EPS has risen from 101.76 cents to 105.93 cents.

But the charts of EPS in the remuneration section reveal a very different picture. You see, the P&L includes an abnormal loss of $33 million associated with the Clive Anthony’s ‘restructure’. Take the abnormal loss out and the continuing operations made EPS of $1.247 in 2011 against this year’s $1.059. If it was ok to use $1.247 for the execs in working out their incentives, it should be ok for shareholders to use to compare this year’s P&L!

And for those investors enamoured with cash flows, don’t get too excited by the cash flow from operations jumping to more than $215 million from $105 million last year. You see, there’s been a $100 million blow out in payables. In other words JBH appears to have held off paying its suppliers a little longer.

by Roger Montgomery Posted in Companies, Consumer discretionary.

-

Deflation of fresh produce masks volume growth from Woolies and Coles

Roger Montgomery

July 31, 2012

The Woolworths Food and Liquor Division reported 3.8% sales growth to $37.5 billion for the year to June 2012. Same store sales growth increased by 1.3% for the year. For the June Quarter, sales growth was 3.8%, year on year, while same stores sales grew by 1.3%.

In comparison, Coles reported sales growth of 6.1% to $33.7b and same store sales growth of 3.7%. For the June Quarter, sales growth was 4.6%, year on year, while same store sales grew by 3.0%.

Both organisations reported price deflation of approximately 4% in fresh produce, and this masked both their strong volume growth and the increasing consolidation of the Australian supermarket industry.

The Montgomery (Private) Fund is a shareholder in Woolworths, and likes its 26% average return on equity.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights.

-

Is this a Thorny Investment?

Roger Montgomery

June 24, 2012

We all know that retailing is doing it tough and there’s hardly bright lights on the horizon. (Of course it is always darkest just before the dawn but our experience is telling us that most analysts are scraping the bottom of the barrel for opportunities when scrounging around trying to pick up scraps of returns from post announcement arbitrage opportunities. Conversely, the frequency of observations in this space suggests those with plenty of spare cash reckon we are close to the bottom).

We all know that retailing is doing it tough and there’s hardly bright lights on the horizon. (Of course it is always darkest just before the dawn but our experience is telling us that most analysts are scraping the bottom of the barrel for opportunities when scrounging around trying to pick up scraps of returns from post announcement arbitrage opportunities. Conversely, the frequency of observations in this space suggests those with plenty of spare cash reckon we are close to the bottom).One business that also happens to be a retailer (as measured by current business unit revenues) and one we have previously owned is Thorn Group but its outperformance of the retail sector is unlikely to be sustained unless its investment in new products pays off.

(NB. Later in the week I will seek permission to give you some School Holiday reading – Michael’s 20-page Magnum Opus on TGA)

The picture at left should really be of the Tortoise from Aesop’s fable The Tortoise and The Hare. You will see why shortly…

It goes without saying that Australian retailers are doing it tough. But just how tough? Compare the share price performance of some household names in retail to the performance of the All Ordinaries index over the past 12 and 24 months.

The high Australian dollar, record outbound tourism, high petrol prices, rising utility costs, indebtedness, a slowing economy, cautious consumers and a structural shift rendering bricks-and-mortar retailers less competitive have seen earnings downgrades come in thick and fast amongst retailers. As well as being tough on the businesses and their managers, retailing has also been a tough place to be an investor.

But one company appears to be bucking the trend, in business terms; that company is Thorn Group (TGA). While the past 12 months have proven just as difficult for the company’s share price as they have for its contemporaries (perhaps not pure peers), it’s the 24-month performance of this business that sets it apart. And if a business does well, the shares usually follow.

Many retailers have seen their share prices decline 40-50%, yet Thorn has delivered an impressive two-year return to shareholders.

Better still, the business continues to do well. In its latest annual report, released last week, Thorn Group reported NPAT up 26.4% (EPS was up 14% post capital raising). A retailer whose bottom line is actually growing is rare in the current environment; compare Thorn with forecasts for JB Hi-Fi (JBH), Harvey Norman (HVN), Myer (MYR) and David Jones (DJS) in 2012.

Tomorrow’s returns to shareholders however will be dependent on how the business performs in the future. So the question, of course, is whether this outperformance is sustainable? I always look for businesses with ‘bright prospects’.

A quick look under the hood reveals Thorn’s Revenue (first column each year) and EBIT (second column each year) breakdown. The key to the group’s prospects – even after the recent acquisition of NCML, which contributed 20% of EBIT growth – is the rental segment, which represents 92.5% of EBIT. It’s also identified by management as the company’s ‘core’ operations.

Clearly, given its contribution to the bottom line, it is the rental segment (not Cash First, Equipment Finance or NCML) that will help identify whether or not the business’ prospects are good. We appreciate that the other segments will/may grow but the company’s slow and steady organic approach to growth will ensure it is the prospects for the Rental/Retail business that determine investor returns in the foreseeable future). In this segment, we find Radio Rentals and Rentlo.

‘Consumer rental operations’ would be an apt description for this segment, which is responsible for the retailing of browngoods, whitegoods, PCs, furniture products and other goods such as gym equipment. The revenue breakdown by product and change in product mix is estimated as follows.

The ‘change’ column raises an eyebrow for me. Over the last two to three years, the rental segment of Thorn has experienced very strong customer growth, driven in the main by its $1 ‘Rent-Try-Buy’ promotion. High single-digit growth rates have been produced across the board.

Recently, however, this rate has fallen to the low single-digit rate of 3.1%, and as can be seen in four out of five product groups, growth is negative, flat or marginal. The hero in the product mix, however, is clearly furniture but in my observation, heroes eventually come unstuck.

I reckon the growth in furniture highlights the fact that consumers tend to ‘rent’ higher ticket items. Deflation in electronics means that the decision to buy over renting is a far less taxing one. The result is more people buying the laptop and LED TV versus renting. Indeed, much has changed in retailing because that which was once aspirational is now disposable. I like that phrase and have now trademarked it!

Couple the low rates of growth with customer churn and an increase in impairment charges on the rental book and we have a stronger case building for a period of muted to possibly negative growth. This is only offset if the company’s aim to extend furniture to outdoor product ranges and extend to new brands (eg Apple) works sufficiently.

According to a recent company presentation, 44% of customers are retained when their old rental agreement matures. That is to say, these customers purchase another product under another contract. This implies that about 56% of all customers will drop off once their first purchase is fully paid. Whether the 44% that remain are upsold and the rate that they are replaced, determines the rate of growth.

In strong growth years, churn is easily offset by more customers entering the business than leaving. And given the strong growth in customers over the past few years, this has been the case.

But when growth rates fall – a sign of a tighter marketplace, changing consumer trends and a potential maturing business (remembering that Thorn grew strongly during the GFC) – churn becomes harder and harder to fight, and the status quo tougher and tougher, as well as more expensive, to maintain.

With an average 27-month contract term, and given strong growth from 2009 onwards, from here the business will likely experience a larger proportion of their 100,000 customer rental agreements coming to term and maturing. Prior comparative period (PCP) comparisons could look less attractive.

Unless that retention rate can be materially lifted, new customers coming in must continue to exceed customers exiting. With the trend into 2013 on the up, the outcome here is likely to be a much tougher battle and flat to slightly negative growth in the core business, which generates in excess of 90% of EBIT.

The key question, therefore, becomes: how long will it take for the investment in new products – Cash First, Equipment Finance and Kiosks – to begin paying off? This will be the next leg in business performance and if that occurs, the share price will, of course, eventually follow.

Thorn is a well-managed business and has a strong balance sheet, cash flow and management, with a track record of delivering new revenue streams through differentiated business models that, with the exception of the NCML acquisition pimple, has been organic. But until those new models begin to gain traction, on my analysis it looks as though the business has a tougher couple of years ahead of it.

Before I head off on holidays I will provide a link to Michael’s Magnum Opus (POST SCRIPT: SEE MICHAEL’S 20-PAGE SPECIAL IN THE COMMENTS BELOW) on TGA where he agrees generally with this conclusion stating:

“I think that Thorn’s growth will slow for 2013, do better in 2014, then experience an up-tick as initiatives like Cashfirst, Thorn Equipment Finance and individual expansion initiatives in Radio Rentals/Rentlo and NCML move from making losses, or small profits, to being acceptably profitable. EPS will grow, but nothing like the EPS CAGR of the last five years.”

And while outperformance over the rest of the retail sector has likely to come to end, the company is one I plan to keep a close eye on.

First Published May 2012. Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 24 June 2012.

To pre-register for the soon-to-be-released Montgomery retail fund visit www.montinvest.com and click the APPLY TO INVEST button. A Pre-Registration Form will appear and after completing it, be sure to select the button “Retail Investor < $500,000″. You will then receive an automated email from my office and be registered to receive the PDS/FSG and Information Booklet as soon as it’s received all of its approvals. If you decide to proceed and/or your advisor does, we look forward to working for you. If you are a planner or advisor or responsible for dealer group approved lists or you are an executive at a research house or ratings agency and would like to discuss next steps feel free to call the Mr David Buckland at the office on (02) 9692 5700. Investments can only be made through the PDS and a Financial Services Guide (‘FSG’) will also be available.

by Roger Montgomery Posted in Consumer discretionary.

-

Has Wesfarmers got it right?

Roger Montgomery

May 28, 2012

In writing Value.able I wanted to explain return on equity almost as much as I wanted to introduce the idea of future intrinsic value estimates and Walter’s intrinsic value formula.

In writing Value.able I wanted to explain return on equity almost as much as I wanted to introduce the idea of future intrinsic value estimates and Walter’s intrinsic value formula.From Value.able, PART TWO, The ABC of Return on Equity:

Return on equity is essential for value investors for so many reasons and Wesfarmers purchase of Coles was a great case study:

“In 2007, Wesfarmers had Coles in its sights. In that same year, Coles reported a profit of about $700 million. In its balance sheet from the same year, Coles reported about $3.6 billion of equity in 2006 and $3.9 billion of equity at the end of 2007. For the purposes of this assessment we will accept that the assets are fairly represented in the balance sheet. Using only these numbers we can estimate that the return on average equity of Coles was around 19.9 per cent.

Importantly, Coles has been around a long time, is stable, very mature and established and supplies daily essentials. While its prospects may not be exciting, there is the possibility that Wesfarmers may improve the performance of the Coles business.

So the target, Coles, is a business with modest debt and $3.9 billion of good-quality equity on the balance sheet that generated a 19.9% return. The simple question is: What should Wesfarmers pay for Coles? If it gets a bargain, it will add value for the shareholders of their business. If it pays too much, it will do the opposite – destroy value and perhaps its reputation.

Now, if you were to ask me what to pay for $3.9 billion of equity earning 19.9 per cent (assume I can extract some improvements), I would start by asking myself what return I wanted. If I were to demand a 19.9 per cent return on my money, I would have to limit myself to paying no more than $3.9 billion. If I was happy with half the return, I could pay twice as much. In other words, if I was happy with a 10 per cent return, which I think is reasonable, I could pay $7.8 billion, or two dollars for every dollar of equity. And finally, if I think that I could do a much better job than present management, I could pay a little more, $9.75 billion perhaps.

Now suppose you consider yourself much better at running Coles than the present Coles management. Remember, this is one of the motivators for acquisitions. Suppose you believe that you can achieve a sustainable 30 per cent return on equity. Assume you were seeking a 10 per cent return on your investment – a modest return by the way, but justified by the risks involved.

The basic formula to calculate what you should pay for a mature business, like Coles, is:

Return on Equity/Required Return x Equity

Using this formula the estimated value of Coles is:

0.3/0.1 x 3.9 = $11.7 billionEven if I thought I was a brilliant retailer, I would not want to pay more than $11.7 billion for Coles. Given the risks, I may want a higher required return than 10 per cent. If I demanded a 12 per cent required return, I would not pay more than $9.75 billion (0.3/0.12 x 3.9 = $9.75).

I will explain this formula, which represents the work of Buffett, Richard Simmons and Walter in more detail in Chapter 11 on intrinsic value.

Of course, if we think that the balance sheet is overstating the value of the assets, the result would be a lower equity component and a higher return on equity. As Buffett stated:

Two people looking at the same set of facts, moreover – and this would apply even to Charlie and me – will almost inevitably come up with at least slightly different intrinsic value figures.

The result will be modestly different but the conclusion will be the same.

With around 1.193 billion shares on issue, the above estimates suggest Coles might have been worth between $8.17 and $9.80 per share.

Now, what did Wesfarmers announce they would pay for Coles? The equivalent of about $17 per share!

What do you think would happen to your return on equity if you paid the announced $22 billion for a bank account with $3.9 billion deposited earning 19.9 per cent? Your return on equity would decline precipitously to around 3.5%.”

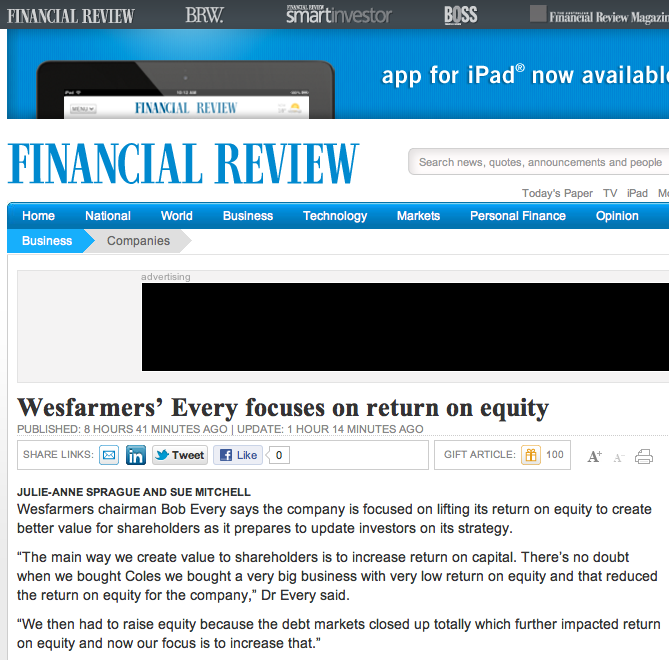

With that in mind I wonder whether the comments Wesfarmers were reported today to have made to The Financial Review (see image, I subscribe and think its great) were complete. Of particular interest is the paragraph; “The way we create value to shareholders is to increase return on capital. There’s no doubt when we bought Coles we bought a very big business with very low return on equity and that reduced the return on equity for the company.”

Assuming the comments and statistics are correct, I would argue that the reason for the decline in Wesfarmer’s Return on Equity is not because Coles had a low ROE – as Wesfarmers are reported to have suggested – but because Wesfarmers simply paid too much for Coles. Do you agree or disagree?

What are your thoughts?

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 28 May 2012.

by Roger Montgomery Posted in Companies, Consumer discretionary, Skaffold, Value.able.

-

My…Err?

Roger Montgomery

May 27, 2012

Investors don’t have to have astronomic IQ’s and be able to dissect the entrails of a million microcap startups to do well. You only need to be able to avoid the disasters.

In an oft-quoted statistic, after you lose 50% of your funds, you have to make 100% return on the remaining capital just to get back to break even. This is the simple reasoning behind Buffett’s two rules of investing. Rule number 1 don’t lose money (a reference to permanent capital impairment) and Rule Number 2) Don’t forget rule number 1! Its also the premise behind the reason why built Skaffold.

Avoiding those companies that will permanently impair your wealth either by a) sticking to high quality, b) avoiding low quality or c) getting out when the facts change, can help ensure your portfolio is protected. Forget the mantra of “high yielding businesses that pay fully franked yields” – there’s no such thing. That’s a marketing gimmic used by some managers and advisers to attract that bulging cohort of the population – the baby boomers – who are retiring en masse and seeking income.

Think about it; How many businesses owners would speak about their business in those terms? “Hi my name is Dave. I own an online condiments aggregator – ‘its a high yielding business that pays a fully franked yield’. You will NEVER hear that from a business owner. That only comes from the stock market and from those who have never owned or run a business.

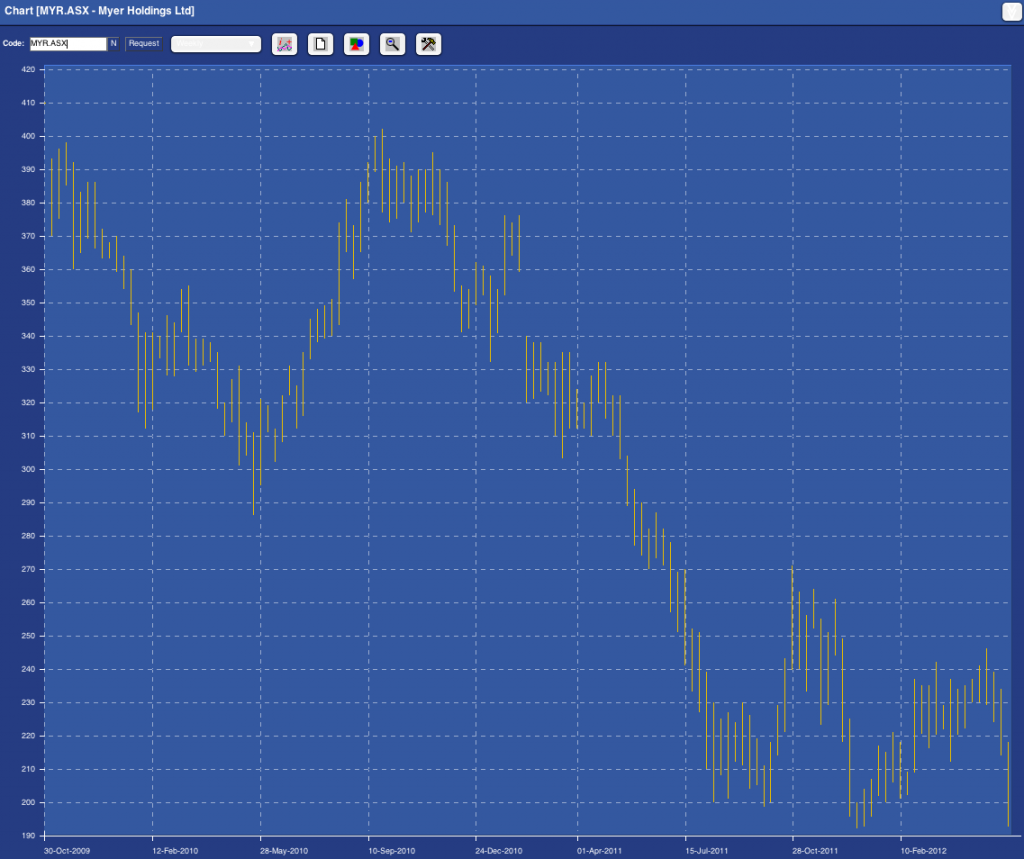

They key is not to think about stocks or talk stock jargon. Just focus on the business. Thats what we did when Myer floated in 2009. And with the market value of Myer now 50% lower than the heady days of its float, it might be instructive to revisit the column I wrote back on 30 September 2009, when I reviewed the Myer Float.

And sure, you can say that the slump in retail is the reason for the slump in the share price of Myer (I am certainy one who believes that the dearth of really high quality companies means multi billion dollar fund managers are bereft of choice meaning that a recovery in the market will make all stocks rise – not because they are worth more but because fund managers have nothing else to buy). But the whole point of value investing is to make the purchase price so cheap that even if the worst case scenario transpires, you are left with an attractive return.

It would be equally instructive to review the reason why we didn’t buy the things that subsequently went well (QRN comes to mind) so we’ll leave that for a later date.

Here’s the column from September 2009:

“PORTFOLIO POINT: The enthusiasm surrounding the Myer float is good reason for a value investor to stay clear. So is the expected price.

With more than 140,000 investors registering for the IPO prospectus, everyone wants to know whether the float of the Myer department store group will be attractive. This week I want to focus exclusively on this historic offer.

At present it is suggested the stock will begin trading somewhere between $3.90 and $4.90.

The prospect of a stag profit draws a self-fulfilling crowd. But if chasing stag profits is your game, I would rather be your broker than your business partner, for history is littered with the remains of the enthusiasm surrounding popular large floats.

Popularity, you see, is not the investment bedfellow of a bargain and being interested in stocks when everyone else is does not lead to great returns. You cannot expect to buy what is popular, travel in the same direction as lemmings and generate extraordinary results. Conversely thumb-sucking produces equally unattractive returns.

Faced with these truisms, I lever my Myer One card, obtain a prospectus and open it for you.

The Myer float is one of the hottest of the year and I am not referring to the cover adorned by Jennifer Hawkins! If those 146,000 people who have apparently registered for a Myer prospectus were to invest just $20,000 at the requested price, the vendors will have their $2.8 billion plus the $100 million in float fees in the bag.

A word about the analysis: It is the same analysis I have used to buy The Reject Shop at $2.40 (today’s close $13.35), JB Hi-Fi at $8 ($19.86), Fleetwood at $3.50 ($8.75), to sell my Platinum Asset Management shares at more than $8 on the morning they listed (at $5), and to warn investors to get out of ABC Learning at $8 (they were 54¢ when ABC delisted in August 2008) and Eureka Report subscribers to get out of Wesfarmers as it acquired Coles.

I don’t list these to boast but merely to demonstrate the efficacy of the analysis; analysis that is equally applicable to existing issues and new ones.

By way of background, TPG/Newbridge and the Myer Family acquired Myer for $1.4 billion three years ago. They copped flack for paying too much, but “only” used $400 million of their own capital; the remainder was debt. Before the first anniversary, the Bourke Street, Melbourne, store was sold for $600 million and a clearance sale reduced inventory and netted $160 million. The excess cash allowed the new owners to reduce debt, pay a dividend of almost $200 million and a capital return of $360 million. Within a year the owners had recouped their capital and obtained a free ride on a business with $3 billion of revenue. Good work and smart.

But I am not being invited to pay $1.4 billion, which was 8.5 times EBIT. I am being asked to pay up to $2.9 billion, or more than 11 times forecast EBIT. And given the free “carry”, the bulk of the money raised will go to the vendors while I replace them as owners. Ownership is a very good incentive to drive the performance of individuals.

And driven they have been. In three years, $400 million has been spent on supply chain and IT improvements, eight distribution centres have been reduced to four and supply-chain costs have fallen 45%. Amid relatively stable gross profit margins, EBIT margins improvement to 7.2% and a forecast 7.8% reflect disciplined cost identification and management. Fifteen more stores are planned for the next five years and the prospectus notes that trading performance improved significantly in the second half of 2009 and into the first half of 2010. The key individuals have indeed performed impressively, but with less skin in the game they may not be incentivised as owners in future years as they have been in the past.

And what value have all these improvements created? The vendors would like to believe about $1.4 billion, and if the market is willing to pay them that price, they will have been vindicated, but price is not value and I am interested simply in buying things for less than what they are worth.

In estimating an intrinsic value for Myer, I will leave aside the fact that the balance sheet contains $350 million of purchased goodwill and $128 million of capitalised software costs. This latter item is allowed by accounting standards but results in accounts that don’t reflect economic reality. Historical pre-tax profits have thus been inflated.

I will also leave aside the fact that the 2009 numbers and 2010 forecasts have also been impacted by a number of adjustments, including the addition of sales made by concession operators “to provide a more appropriate reference when assessing profitability measures relative to sales”; the removal of the incentive payments to retain key staff – not regarded as ongoing costs to the business; costs associated with the gifting of shares to employees; and, most interestingly, the reversal of a write-off of $21 million in capitalised interest costs – all regarded as non-recurring.

Taking a net profit after tax figure for 2010 of $160 million and assuming a 75% fully franked payout, we arrive at an owners’ return on equity of about 28% on the stated equity of $738 million, equity that could have been higher after the float if $94 million in cash wasn’t also being taken out of retained profits. Using a 13% required return, I get a valuation of $2.90.

Looking at it another, albeit simplistic way, I am buying $738 million of equity that is generating 28%. If I pay the requested $2.9 billion for that equity or 3.9 times, I have to divide the return on equity by 3.9 times, which produces a simple return on “my” equity of 7.2%. For my money, it’s just not high enough for the risk of being in business.

Importantly, the return on equity – based on the simple assumptions that three stores, each generating $40 million in sales will be opened annually over the next five years and that borrowings will decline by $60 million in each of those years – should be maintained. But the end result is that the valuation only rises by 6% per year over the next five years and delivers a value in 2015 of $3.90: the price being asked today.

My piece of Myer seems a bit hot for My money.”

That was 2009. Has anything really changed? Has the following chart reveals. Myer is now trading at close to Skaffold’s current estimate of its intrinsic value. Before you get too excited (although the shortage of large listed high quality retailers means even this company’s shares may go up in a market or economy recovery) take a look at the pattern of intrinsic values in the past and the currently anticipated path of forecast intrinsic values; Past intrinsic values have been declining (generally undesirable unless forecasts for a recovery are correct) and forecast intrinsic values are flat.

Fig.1. Skaffold Myer Intrinsic Value Line

And as the Capital History chart reveals, 2014 profits are not expected to be better than 2010. That 4 years without profit growth. Question: Would you buy an unlisted business (as a going concern) that was not forecasting profit growth for four years?

Fig. 2. Skaffold Myer Capital History Chart

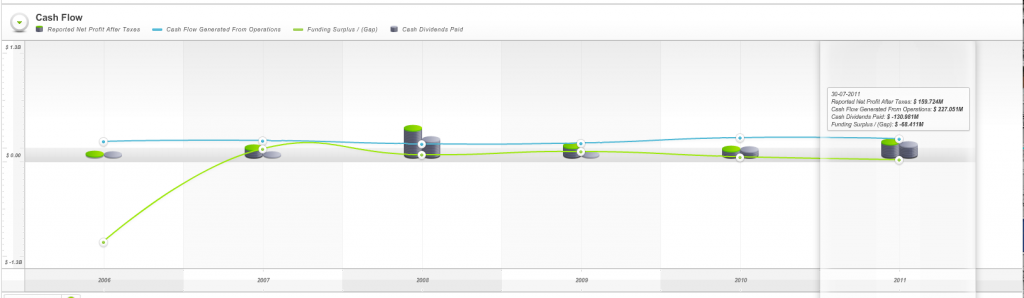

Finally the cash flow chart reveals the company has produced what Skaffold refers to as a Funding Gap. Its cash from operations have not been enough to cover the investments it has made in others or itself plus the dividends it has paid. In other words for 2010 and 2011, the two financial years it has registered as a listed company, it appears from Skaffold’s data that the company has had to dip into either 1) its own bank account, or 2) borrow more money or 3) raise capital (the three sources of funds available if a funding gap is produced) to cover this “gap”.

Fig. 3. Skaffold Myer Cash Flow Chart

I’d be interested to know if you are a loyal Myer shopper or not and why? If you don’t shop at Myer, why not? If you do shop at Myer, what do you like about the company, its stores and the experience? And I am particularly interested to hear from anyone who DOES NOT shop there but DOES own the stock!

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 27 May 2012.

by Roger Montgomery Posted in Companies, Consumer discretionary, Value.able.