Consumer discretionary

-

MEDIA

Will investment in re-structuring boost David Jones fortunes?

Roger Montgomery

March 21, 2012

David Jones will spend between 70 and 80 million dollars to restructure its businesses – is this likely to boost its flagging share price? Roger Montgomery provides his insights to the ABC’s David Taylor on this edition of the PM program, broadcast 21 March 2012. Read/Listen here.

by Roger Montgomery Posted in Consumer discretionary, In the Press, Radio.

- save this article

- POSTED IN Consumer discretionary, In the Press, Radio

-

Rejected?

Roger Montgomery

February 24, 2012

We all know retail businesses are swimming against the tide. We have written about that subject here at the blog on many occasions and below is a brief list of more recent posts:

We all know retail businesses are swimming against the tide. We have written about that subject here at the blog on many occasions and below is a brief list of more recent posts:We are not investors in momentum or sentiment however this blog allows me to share our thoughts with you and we are noticing a shift in investor sentiment now. The stock market indices with exposure to resources are underperforming the indices without. The industrial indices are rising at a faster rate and falling at a slower rate than their resource-rich bretheren. Today is a classic example, This tells us that a shift is afoot. If you have been reading this blog regularly, you will know that we are also not enthusiastic about Iron Ore prices and believe prices of $100 per tonne or less are possible in coming years. On air, I have explained that is our reason for not purchasing BHP despite optimistic earnings forecasts by analysts.

I think the lower-iron-ore price story is catching on and quietly but surely investors are reducing their relative weighting to resource heavyweights.

With that in mind, it could be that most down-in-the-dumps retail sector that now holds a few gems. Next week we’ll explore the results of the reporting season but for today I thought we should revisit The Reject SHop following its half year results.

Here’s the list of recent posts covering retail stocks and the retail sector.

http://rogermontgomery.com/invest-in-kfc-or-just-eat-it/

http://rogermontgomery.com/is-it-just-harvey-norman-or-bricks-mortar-retailing-generally/

http://rogermontgomery.com/are-bargains-available-at-woolworths/

http://rogermontgomery.com/now-waving-drowning/

http://rogermontgomery.com/not-so-high-at-jb-hi-fi/

http://rogermontgomery.com/dumped-by-the-wave-of-fashion/Way back in September 2009, I published my reason for selling The Reject Shop:

“I can’t stop thinking that the value of the business just cannot rise at a fast enough clip to justify the current price. I really don’t like trading things that I have bought but I don’t think the value of the business can continue to rise indefinitely. With a share price of $13.45 (intraday today) and a valuation of $11.27, the shares are 24% above their intrinsic value. This combination of factors tells me we are safer in cash.”

Like many value investors, I was a little premature and the price first rallied to more than $17.00. Since then the price has steadily declined to $11.80 after hitting a low of $9.12.

More recently – in December – I wrote:

“The Reject Shop still enjoys its high brand awareness but, as is typical in many store roll out stories, as the offer matures the later sites are less profitable than the early sites.

This doesn’t fully explain the fact that during a period in the economy where one would expect a bargain offering to shine, it hasn’t. Eighty percent of Australians still know the brand but I believe consumer experience and mismanagement has done it some damage.

According to one report, 20% of the population believe the company offers rubbish – cheap Chinese junk that quickly breaks after use and fills our tips. It’s the very reputation China itself is trying, but frequently failing, to shake off.

The other reason for damage to the brand is confusion brought on by mismanagement. Several years ago the average unit price was about $9 and basket size was $11, but over the years one cannot help but have noticed many higher-priced items creeping into the stores.”

Value investors are often early to buy and early to sell but over the long run, being certain of a good return is safer than being hopeful of an exceptional one and so, when it comes to buying decisions a demonstrated record is often essential.

In TRS’s FY12 earnings guidance, the company noted “Significant expenditure on increasing brand awareness”. This is a real shame because at the time the company float The Reject Shop enjoyed 90% brand recognition and thats why its store roll out was working so well – shoppers knew the company, the store and the offer even though they had never been into a store in their area.

The company has provided earnings guidance for the full year 2012 of $20.5 to $22 million and while some smart analysts will note this is a 53 week year – we don’t care about such arbitrary lines in the sand. Our approach to investing is involves treating any purchase and ownership as if we owned the whole company. In that light and over the long term it doesn’t matter whether there are 52 weeks in a year or 52.5 or 53.

Thirteen analysts cover the stock and this week, eight have upgraded (only one downgraded) their forecasts for 2012 (remember the downgrade could be an error on the part of teh analyst rather than the company disappointing) . I still believe the business will mature but there could be some value in the turnaround and a stabilisation of strong cash flows, and returns on equity over the next few years around 35%. This is the rate of return on equity the company generated on $21 million of equity in 2005 (its intrinsic value then was around $4.00). Today the company is expected to return to 35% returns on equity but on 3 times the equity. You should be able to estimate the intrinsic value from those metrics.

There have been terrific results amongst our fund holdings such as Credit Corp, Seek, Breville Group, ARB, Decmil and Maca. Have you been encouraged by any of the results? Start a discussion by clicking on the Comments button below.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 24 February 2012.

by Roger Montgomery Posted in Companies, Consumer discretionary, Value.able.

-

MEDIA

What are Roger Montgomery’s thoughts on JB Hi-Fi’s future?

Roger Montgomery

February 13, 2012

After repotting a reduced annual net profit, what does the current economy hold for JB Hi-Fi’s future performance? Roger Montgomery discusses his insights with the ABC’s David Taylor on The World Today program broadcast 13 February 2012. Read/Listen here.

by Roger Montgomery Posted in Consumer discretionary, In the Press, Radio.

- save this article

- POSTED IN Consumer discretionary, In the Press, Radio

-

Not so High at JB Hi-Fi?

Roger Montgomery

December 16, 2011

You will have noticed that since November 16 every post here at the Blog has been a cautionary one. You have not seen me post a ‘here’s possible good value’ story. There is a little method in that, even though we might be unduly conservative. But here goes again…

You will have noticed that since November 16 every post here at the Blog has been a cautionary one. You have not seen me post a ‘here’s possible good value’ story. There is a little method in that, even though we might be unduly conservative. But here goes again…Many of you have heard me discuss JB Hi-Fi and its preferred status among retailers – I believe if JBH is doing it tough everyone else is doing it even tougher. But we sold JBH from our holdings at $15.50 recently and I thought the story of why (ahead of a downgrade as it turns out) would be a good insight into the way we think. Hopefully other investors can gain some insight into the process and fill in the 1) ‘bright prospects’ part of the equation that also requires 2) extraordinary businesses and 3) discounts to intrinsic value.

Starting way back in February 2010 we commented on the impending retirement of JBH’s Richard Uechtritz (now looking as well-timed as other prominent CEO departures, such as the Moss departure from Macquarie and I am sure you can list a few more – go right ahead) and the maturing outlook for the business itself.

“If JB Hi-Fi could re-employ all of its profits at the returns of about 45% it is generating now, its value would be over $38. That’s a pipe dream. The company is generating cash faster than it can ask its employees and contractors and landlords to employ the funds to open new stores. And because the profits also produce taxes and associated franking credits that have no value for the company, shareholders are being handed back the funds, which is a disappointment. However, as chairman Patrick Elliott implied when I spoke with him on radio this week, this is a function of growth and the limited size of the Australian population.

It happens eventually to all retailers and it will happen to JB Hi-Fi in the next five to seven years. The best you can hope for is that once the stores have saturated the market, directors stick to their knitting, and the company continues to generate high returns but pays out all of those earnings out as a dividend (becoming like a bond) rather than make some grand attempt to buy something offshore or diversify too far away from their core expertise (often at the behest of some institutional shareholder) and blow up the returns.

The result of not employing as much retained earnings at 45% is that the intrinsic value declines. It is still going up but not as much.”

In August here at the blog we wrote:

“The big story however is that Terry Smart will need to start looking beyond this organic growth to other strategies if JB Hi-Fi is to avoid developing the profile of another mature Australian retail business like Harvey Norman.”

and

“JB Hi-Fi needs to establish new and emerging business models to try and counter the shift away from physical music unit sales.”

and

“Having said that, the current sales environment is probably not representative of the future. Share market investors generally use the rear view mirror when assessing the future. I have previously discussed the “economics of enough”, which David Bussau from Opportunity International introduced me to many years ago. As it applies to consumers generally, they will get sick of trying to keep up with the latest technology, be happy with their TVs and replace everything less often – opting instead to ‘experience’ travel, food, adventure and other cultures. That of course doesn’t mean JB can’t grow its share-of-wallet. In the face of declining retail sales volume growth over the last five to ten years and deflation, JB is proving it is already the market leader.”

and

“JB Hi-Fi’s quality score dropped from A1 to A3 and interestingly, this was only partly due to the increase in debt. (We really need to know whether it was just timing issues and new stores that contributed to the jump in inventory).”

In addition to these comments I wrote more recently:

“The release of the iPhone 4S seemed to underwhelm technology reviewers when launched and a portion of the population do take their purchasing cues from such quarters.

The 4S is apparently an evolution in the iPhone series, rather than a revolution, and as such, fewer users of the most recent release – the iPhone 4 – will upgrade. Instead, it is likely that they will wait until the iPhone 5 is released next year (owners of the previous model the iPhone 3GS, however, should be coming off their two-year contracts about now and are expected to upgrade). We’ll come back to that shortly.

The iPhone doesn’t contribute anything like a majority profit to JB Hi-Fi’s bottom line. This is because margins on Apple products are slim. But the iPhone does generate foot traffic and phone upgraders also buy protective covers and other accessories on which JB Hi-Fi makes much more significant margins.

So why do we care so much about the iPhone?

It’s because when JB Hi-Fi announced its full-year results the company forecast more than $3 billion in sales and management cited growth from computing, telco, and accessories. They said:

“While we anticipate the market to remain challenging, our diversified product portfolio, particularly the categories of computers, telco and accessories, from which we expect strong growth, will assist JB Hi-Fi in delivering another year of solid sales and earnings in FY12. Assuming trading conditions are comparable with FY11, we expect sales in FY12 to be circa $3.2b, an 8% increase on prior year.”

It’s the lower “telco and accessories” sales that are expected to stem from the iPhone 4S underwhelming so-called early adopters and its most ardent fans that may put pressure on that sales forecast.”

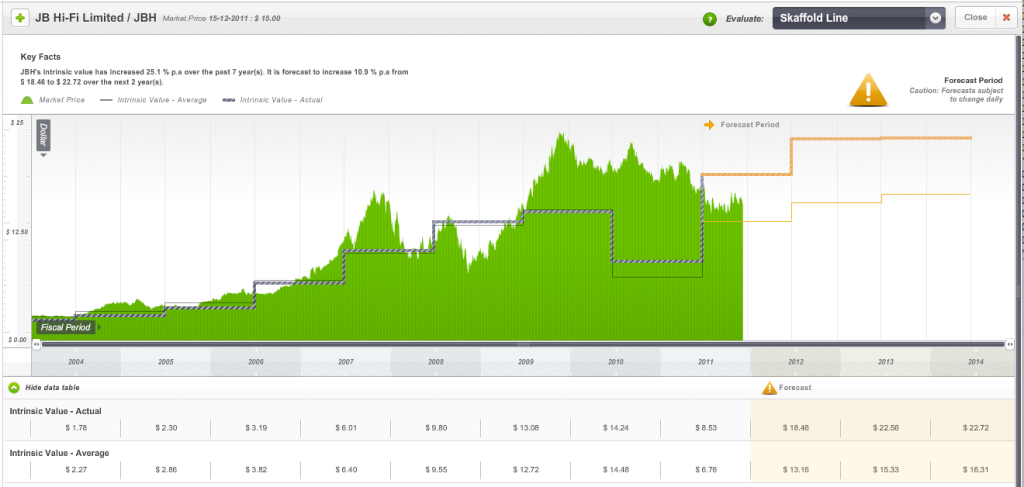

Indeed the only thing that was going for JB Hi-Fi was its discount to intrinsic value. Many investors believe that a stock I mention is below intrinsic value is a “darling’ of mine. It isn’t. A company must meet all of our criteria and it will only be held for as long as it does. Those of you using Skaffold will however have seen JBH was trading only at a discount to one of the intrinsic value estimates – the intrinsic value based on analyst forecasts – but not the more conservative Skaffold Line valuation estimate of $13.16. See Figure 1.

Figure 1.

Both valuations are now likely to decline further in coming days -even the more conservative $13.16 valuation SKaffold has been displaying – and the downgrade may also be reflected in pressure on the company’s cash flow which Skaffold members would have already seen in the 2011 results and which prompted some of the above comments. (See Figure 2. and note the negative funding gap line (international patents pending))

Figure 2. Showing declining operation cash flow and a growing Funding Gap (patents pending).

JB Hi-Fi was 5 per cent of our portfolio however we sold all of our position at $15.50 recently. Our reasoning was simple; Given present circumstances and expectations for retailing (having spoken to many retailers recently) many retailers JB Hi-Fi would have to revise their earlier outlook statements and this would produce lower future valuations. At the same time analyst forecasts are typically optimistic in the first half of the financial year (this year being no exception to that rule) and we should therefore be demanding much larger discounts and JBH was not offering that margin of safety. We also commented to our peers in conversations over the phone and in person that the delfation story – as explained by Gerry Harvey who noted selling plasma TVs for $399 this year means he has to sell three times the volume as last year to make the same money – would put pressure on profits because people already had enough plasma TVs. Finally we also believed that ANZ’s profit growth being dominated by bad debt provisioning writedowns meant that credit growth was non-existant. When you take away growth in credit card purchases – thats got to hurt discretionary retailers.

On November 7 we wrote to our Montgomery [Private] Fund investors thus:

“We aren’t so arrogant to presume we know what will happen next. We have taken earnings expectations for 2012 and beyond (expectations that are typically optimistic in the first half of a financial year) and reduced them to where we believe they could safely be regarded as conservative. The resultant estimations for intrinsic values … are significantly lower and suggest we should require larger margins of safety before committing your funds to many companies…I expect in coming months we may not be as aggressive in purchasing and you might even find our cash levels increase. It’s always preferable to protect capital because we can come back to reinvest at any time. Recovering from losses is much more challenging and demoralising for you.”A prominent media commentator and broker however wrote on December 6

“Our No.1 discretionary retail recommendation remains JB Hi-Fi (JBH). We all know 21% of JBH’s register is currently shorted, a massive short position usually reserved for financial impaired or structurally stuffed stocks. JBH is neither, and that is why we continue to be aggressively recommending buying the stock which generates 25% of its annual profit in December. JBH is trading on 11.2x bottom of the cycle earnings. Nowadays, the P/E’s of cyclical stocks compress with their earnings, meaning that both P/E and E bottom concurrently.”

So, JBH still has long term prospects that surpass many of its peers and I believe it still has a competitive advantage. And if all those short sellers cover their position, the stock could rally. That however would be speculating. On the flip side, changes to accounting reporting standards will give it a lot more liabilities – contingent liabilities such as operating leases will need to come onto the balance sheet. Also, the medium outlook, which includes deflation continuing, will put pressure on JB to sell more volume at precisely the time everyone may just have enough stuff. Finally, the market may now finally catch up to the maturity story we described way back in 2010. Of course consumers will return at some point and spending and credit growth will recover, but given the current weakness and fear among consumers the idea of requiring very, very large discounts to the more conservative estimates of intrinsic value dominates our thinking.

As always be sure to do your own research and seek and take personal professional advice.

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 December 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Investing Education, Skaffold.

-

Are bargains available at Woolworths?

Roger Montgomery

November 17, 2011

On Wednesday November 2 Woolworths held a strategy briefing for professional investors. Woolworth’s effectively asked us to adopt a longer time frame before judging its performance and revealed four strategic priorities that I will describe in a moment.

Prior to the strategy day, the company updated the stock market with a growth outlook that was the lowest in a decade. The market responded negatively to the change and it entrenched previous sentiment by professional investors to switch from Woolworths to Coles.

But Woolworths remains a superior business from a business economics perspective, with high return on equity and it also remains cheaper than its competitor as measured by the larger discount to an estimate of its intrinsic value.

The wider sentiment towards Woolworths Supermarkets is that the period of strong growth is over, and the other businesses, such as Big W, the New Zealand supermarkets, the Masters hardware venture and a possible acquisition of The Warehouse group could be the focus of earnings growth for the company. Gambling pre-committments would not be.

Meanwhile, the Woolworths-owned Dick Smith electronics business appears to have failed to excite consumers and has certainly failed to excite investment professionals. Dick Smith is a relatively weak offering in a market that has been hit particularly hard by the empowerment of the consumer through high Australian dollar.

Moreover, in many ways these businesses are peripheral since the Australian Food & Liquor division accounts for 80% of earnings before interest and tax.

The impact of the company’s lower growth profile on intrinsic value, particularly intrinsic values over the next two years, has been negative and intrinsic value does not appear to be going anywhere in a great hurry (see Skaffold chart below).

This combination of circumstances, in my experience, set Woolworths shares up to be vulnerable to any negative shocks.

Estimating intrinsic value is not the same as predicting price direction, however the above circumstances are not unique historically in putting a lead on price appreciation.

On top of the above combination of factors, there is also the continuing debate in Parliament about the introduction of preset loss limits for poker machines, which, if introduced, would negatively impact Woolworths’ gaming business. Though it is most closely associated with supermarkets, Woolworths is actually the largest poker machine owner in the country, with more than 10,700 pokies.

And a few weeks ago, The Economic Times of India also reported that Woolworths appears to have been dumped by its Indian partner, Tata Group. Woolworths enjoyed a five-year partnership with Tata, introducing Dick Smith-style electronics stores to India under the Infiniti Retail brand. Even though foreign retailers are not permitted to have a direct presence in India, Woolworths partnership offered the hope of growth – albeit with a partner – if the rules were ever relaxed.

Nonetheless, despite these accumulative negative factors, Woolworths is regarded by conventional analysts and investors as a defensive’ company. Its strong cash flows and its status as a major retailer of food makes it an ideal investment in a recessionary or slow or low growth environment. The company also enjoys entrenched competitive advantages over smaller rivals that, until now, the ACCC has done little about. One example of this are the new EFTPOS charges.

From the first of this month, the new Eftpos Payments Australia Limited (EPAL) fees mean retailers incur a 5¢ fee for every transaction over $15 (75% of all EFTPOS transactions). Previously there was no fee and that will still be the case for transactions under $15, which means 25% of transactions.

The retailer’s bank will charge the retailers, some of whom are describing the charges as an “EFTPOS tax”, and they will have no choice but to pass on to the consumer.

Unsurprisingly, EPAL’s members include the major banks, Coles and Woolworths and, because they manage their own terminals, they can opt out of the new charges.

But despite these entrenched advantages, Woolworths has been hit – or so it says – by the state of the economy, noting in its annual report: “Consumer confidence remained historically low as customers reacted adversely to rising utility costs, interest rate hikes in the first half of the year and general global uncertainty, and opted to save rather than spend their money”.

From an investment perspective it is worth noting that retail investors now have a choice of supermarkets, with Coles improving its offering to consumers and taking market share from the incumbent Woolworths.

The investment community is not convinced that further changes to private-label offerings or more innovation around the supply chain will make a dramatic difference to the growth prospects for Woolworths, which set below forecast growth in household income, population and the economy.

One other source of earnings growth is cost-cutting, but the reality is that gains from such strategies are one-offs and again unlikely to excite investors.

Having presented the negatives – which have caused the share price to fall 12% since July, one positive was the strategy briefing’s opportunity to showcase new CEO Grant O’Brien, who replaces Michael Luscombe. The company announced that it planned to extend and defend its leadership in food and liquor, act on the “portfolio” to maximise shareholder value, maintain its track record of building new growth businesses (we’ll ignore Dick Smith) and finally, put in place the enablers for a new era of growth.

In the supermarkets business WOW hopes to grow fresh produce from 28% market share to 36% market share. If achieved this would be an additional $2.5b in sales. Woolies also wants to target a doubling of home brand sales and this aim flies in the face of the ACCC’s stated concerns.

The company will also open 35 new BIG W stores in next 5 years reaching 200 by 2016.

In a reflection of the massive structural shift online, BIG W’s 85,000 in-store SKUs will be expanded and all put online.

And the topic on the tip of everyone’s tongue; Masters. There are now five stores open, another two are due to open in December/January, there are 16 under construction another 100 in the pipeline and the company reported the venture is well ahead of budget.

I also note the advertised sale of $900 million of property ($380 million of which was sold last financial year); and, most recently, the oversubscribed $500 million hybrid note raising that substantially extend the balance sheet strength of the company.

Below we examine the intrinsic value track record and prospects for Woolworths based on current expectations for earnings growth and returns on equity using Skaffold.com

Woolworths (MQR: B2) is currently trading at the same price it was in December 2006 and February 2007, despite the fact profits have risen 11.1% pa, from $1.3 billion to a forecast $2.2 billion in 2012. This growth in profit however is offset by having 16 million more shares on issue; by increased borrowings – up $1.8 billion to $4.8 billion; and by retained earnings, which have risen by $2 billion. The increase in shares on issue and retained earnings have offset the positive impact on return on equity rising profit would normally have.

The latest estimate of its intrinsic value, of $23.23, is forecast to rise modestly over the next two years. For investors looking at opportunities to investigate only when a meaningful discount to intrinsic value is presented, a price of $19 or less for Woolworths would represent at least 20 per cent.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education, Skaffold.

-

Is it just Harvey Norman or bricks & mortar retailing generally?

Roger Montgomery

November 17, 2011

You don’t normally expect to get investment tips from a mothers’ group get-together, but that’s what happened to me recently when the conversation turned to retail operations.

Relaxing with a glass of pinot gris the women, who have met regularly for a decade, were explaining why they spend less time in Harvey Norman stores than they used to. Why? Tired stores, tired layouts and uncompetitive prices have served the retailer only with the need to revamp its entire offering. And that, it hasn’t done.

Retailing in Australia has been in the eye of a perfect storm for some time. As I’ve written previously, the strong Australian dollar has encouraged overseas travel and online purchases from overseas businesses; and the two-speed economy has ensured that credit growth (the borrowing of more money to buy stuff) is muted.

I’ve always been suspicious of a company that issues a report to the market after the close of trade. On Monday 31 October, a major retail business in Australia did just that. After closing time, Harvey Norman released its sales and earnings for the first quarter of the 2012 financial year. Given its timing, the announcement was almost certain to be negative. Indeed, the stock fell 4% the next day.

Instead of focusing on the retailing offer, refreshing store designs and improving range, company representatives focus on property, horse racing (Gerry Harvey is one of the country’s biggest bloodstock owners), goading the Reserve Bank of Australia to cut rates in “the national interest” and campaigning to have Australians pay GST on items they buy overseas for less than $1000.

Harvey Norman’s first-quarter sales were down 3.8%, as were like-for-like sales. In Australia, like-for-like sales were down 2.8%, in New Zealand down 10.6%, down 8.9% in Slovenia and down 11.1% in Northern Ireland. A stronger currency against the New Zealand dollar, the Euro and the pound has exacerbated the results. Profit before tax – a very important measure to us when estimating intrinsic value – was down by … wait for it, 19.3%!

Harvey Norman claims the strong Australian dollar and the closure of 34 Clive Peeters stores contributed to the poor result. I would argue that a failure to reinvent the offering also contributed. More worryingly, this latter factor is unlikely to go away any time soon.

Compounding this problem is the very likely scenario that the declining iron ore price – recently at about $115 a tonne – will seriously crimp margins for the only sector that has been running at full capacity in this country. Australia’s stock market has become the tail that wags the dog. Its wealth-effect on Australians and the impact on sentiment are important determinants of activity and in particular, retail activity.

With the All Ordinaries index dominated by resource companies and financial services companies it is possible, if not probable, that a declining iron ore price leads to lower stock prices and lower economic activity. I am no economist, but I can understand some experts’ calls for further rate cuts.

Back to Harvey Norman, and like-for-like sales declines of 2.8% compares favourably with JB Hi-Fi’s decline of 3.5%. Indeed, if it became a trend, one would argue Harvey Norman is winning back market share from JB Hi-Fi.

But before you get too excited about this comparison, you have to realise JB Hi-Fi’s profits are higher than they were last year and last year’s profits were higher than the year before that. In Harvey Norman’s case, profits before tax are down 19.3% compared to the same time last year, and last year first-half profits were down 16.5% from the year before that! One retail analyst I know and respect made the point that at this rate Harvey Norman will produce an average profit slightly ahead of the first-half profit made back in 2004, when it generated sales revenue of 62% of today’s sales.

My intrinsic value estimate for Harvey Norman is about $2.00 a share against today’s share price of $2.17. However this is based on earnings per share of 23¢ for 2012 and that is, quite possibly, optimistic. Over the next few weeks, analysts will bring their earnings after tax estimates down for 2012 materially. This will have a negative impact on intrinsic values and I suspect we will discover a price above $2 is a premium to intrinsic value. Most interestingly, for followers of any rational approach to calculating intrinsic value, Harvey Norman’s updated intrinsic value is no higher today than it was nine years ago, in 2003.

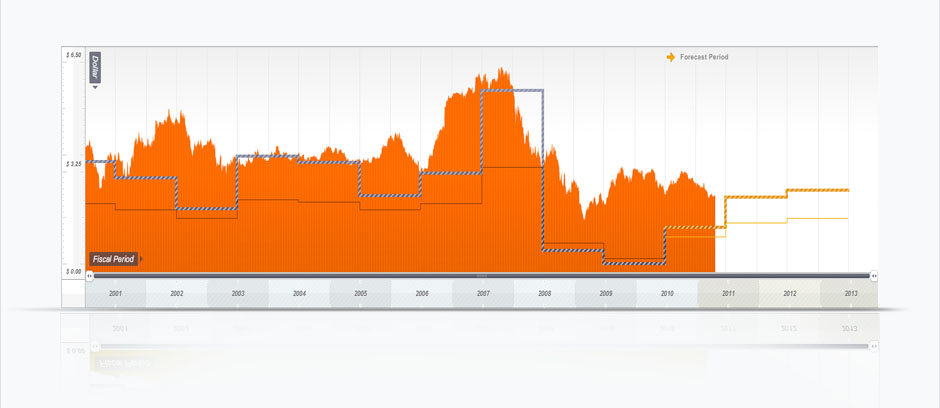

This can be seen in the following chart, which plots the share price of Harvey Norman against its estimated intrinsic value. Generally, we look for companies that have a demonstrated track record of rising intrinsic values and are available at a large discount to the current year’s intrinsic value (see 2006 in the graph).

The lack of any real change in intrinsic value and prices (which follow intrinsic value in the long run) reflects the maturation of the business. You can see that in the short run (in 2007 and again in 2009-2011) prices can get ahead of themselves thanks to many factors including irrational exuberance.

In the long run, however, the market’s weighing machine will do its thing and prices generally revert to intrinsic value. That’s why having a rational method for estimating intrinsic value is so important!

The forecast change in intrinsic value may also decline now that Harvey Norman has provided lower guidance. And it’s not unusual for analyst forecasts to be “hockey-stick” optimistic at the commencement of the financial year.

But long-term, Harvey Norman is a mature business in a small country and it continues to swim upstream against the online retailing avalanche. This is a structural shift rather than a short-term trend and Harvey Norman will need to respond by convincing Australian women in mothers’ groups all round the country that it is fresh, new and competitive.

Posted by Roger Montgomery, Value.able author and Fund Manager, 17 November 2011.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, Investing Education, Skaffold.

-

Was this float a Turkey?

Roger Montgomery

November 3, 2011

The float of Collins Foods earlier in the year at a price of $2.50 did not interest your author. The lack of interest however was not shared by others and the company listed on the ASX with a ‘Top 20 Shareholders’ list that included many if not most of the major nominee companies (Nominee companies have long been established as the mechanism by which asset managers and custodians can process transactions on behalf of their clients).

I wrote a column for Alan Kohler in which I explained why investors might want to reconsider any enthusiasm and you can find the full column here http://rogermontgomery.com/invest-in-kfc-or-just-eat-it/

Much of the commentary around the time of the float referred to the “defensive” nature of fast food restaurants but as we have always suggested here, the only truly defensive stock market investment is an extraordinary business at a large discount to a conservative estimate of its intrinsic value.

One of the issues I had with the float was articulated thus:

“To begin with it is important to note that Pacific Equity Partners (PEP) – the private equity firm behind REDgroup, the parent company of Angus & Robertson and Borders now under administration – will be exiting its stake completely.

“Perhaps more interestingly, the existing management team is cashing in, too. Managing director Kevin Perkins will reduce his holding from over 20 per cent to about 8% and the rest of management will reduce their holding, too.

“When Pacific Equity Partners paid $US210 million in September 2005 (the $US6.92 a share was a 42% premium to the then traded price of $US4.92) for Worldwide Retail Concepts, the US publicly listed company that is now Collins Foods, management then co-invested with a 48% stake. According to all reports, management will now retain just 10%. In other words, management is selling 80% of its holdings into this float.”

Shares fall 50%

The prospectus (which didn’t include the above photo of a genetically modified chook) noted Collins Foods strengths included: “Attractive market dynamics”, “Leading market position” and “strong financial track record”. But just two months after the float, Collins Foods has warned that it will miss prospectus forecasts. The shares are down 50% at the time of writing after the company stated that it would miss forecasted by almost a third (up to 27% to be precise). Collins Food said that the downgrade is due to “fragile consumer confidence and a highly competitive restaurant industry”.

Indeed. My contacts tell me that, according to analysis of credit card usage, the only place doing really well in Australia’s retail sector is…wait for it…restaurants. Meanwhile at yesterday Dominos Pizza AGM, that company confirmed that on a like-for-like basis, sales had grown by double digits.

You cannot help but wonder, what was motivating management to sell so much of their stake into the float?

If you had your hands on the prospectus for Collins Foods and followed the steps in Chapter 11 of Value.able to value the float of Collins Foods, you might have used a forecast profit of $16 million, equity of $161 million, 93 millions shares on issue (giving an equity per share of $1.73), earnings per share of 17.3 cents and dividends per share of 11.8 cents (giving a payout ratio of 68%).

Return on equity of 10% is low and this is with the benefit of leverage (total borrowings $105 million). Immediately you know that if you are using an Investor Required Return of more than the ROE of 10%, the intrinsic value will necessarily be less than the equity per share of $1.73.

Shares fall to Intrinsic Value Estimate

Using Tables 11.1 and 11.2 and an Investor Required Return of 13% Table 11.1 produces an income valuation of $1.33 and Table 11.2 produces a growth valuation of $1.08. Multiplying $1.33 by the payout ratio of 68% results in 90 cents and Multiplying $1.08 by one minus the payout ratio of 68% results in 34 cents. Adding 34 cents and 90 cents gives a valuation of $1.24. (You can see just how bullish you or I would have to be to produce, at the time of the float, a valuation of $2.50!)

You might like to download the prospectus yourself from the ASX website here and try using Value.able’s Table 11.1 and 11.2 to arrive at the same valuation. If you don’t have a copy of Value.able, you can order your copy here

I’d love to know how you go. If you have valued any ‘Turkey’s’ yourself, go right ahead and upload your thoughts about the company and your valuation, along with a comparison to its current price.

Posted by Roger Montgomery, Value.able author and Fund Manager, 03 November 2011.

by Roger Montgomery Posted in Consumer discretionary.

-

Invest in KFC or just eat it?

Roger Montgomery

October 25, 2011

Back in July I wrote the following column about the impending float of Collins Foods/KFC at between $2.50 and $2.92 per share and suggested I would not be participating in the float on behalf of investors in the Montgomery [Private] Fund. For Value.able investors, the column, along with the fact the shares now trade at a substantial reduction, offers some insights into the thinking around a new float…

Back in July I wrote the following column about the impending float of Collins Foods/KFC at between $2.50 and $2.92 per share and suggested I would not be participating in the float on behalf of investors in the Montgomery [Private] Fund. For Value.able investors, the column, along with the fact the shares now trade at a substantial reduction, offers some insights into the thinking around a new float…“As a parent I’ve never been much of a fan of fast food but I do know that many of the strong brands in this sector command enormous market share.

But I’m not here today to give you a lesson in nutrition; what I want to talk about is the opportunity to invest in the future success of KFC in Australia through the $238 million initial public offering of Collins Food Group.

The KFC brand is owned by US-based and listed Yum! Brands. Owning a strong brand is one of the best competitive advantages money cannot buy.

The value of this competitive advantage is reflected in the returns on equity, gross margins and pre-tax profit margins Yum! Brands generates of 66.2%, 33.6% and 14.3% respectively for the most recent 12-month period.

Amongst 47 listed restaurants in the United States, Yum is number two by return on equity and 17th among 790 listed services companies by the same measure. There are indeed very high returns to be made from leveraging a great brand like KFC and selling franchises.

Being the franchisee, on the other hand, is rarely as lucrative and the forthcoming listing of Australia’s largest KFC franchisee – Collins Foods Limited (CKF) – will demonstrate this to investors.

Collins has 119 KFC stores (117 of them in Queensland), along with 26 Sizzler restaurants in Western Australia, NSW and Queensland, and it’s the franchisor of maybe 60 Sizzlers in Asia.

The price point of these restaurants will inevitably have fund managers – who are participating in this week’s bookbuild – referring to Collins as a “defensive” investment. But as I have previously indicated, the only defensive investment is a brilliant one; mediocre companies need not apply.

To begin with it is important to note that Pacific Equity Partners (PEP) – the private equity firm behind REDgroup, the parent company of Angus & Robertson and Borders now under administration – will be exiting its stake completely.

Perhaps more interestingly, the existing management team is cashing in, too. Managing director Kevin Perkins will reduce his holding from over 20 per cent to about 8% and the rest of management will reduce their holding, too.

When Pacific Equity Partners paid $US210 million in September 2005 (the $US6.92 a share was a 42% premium to the then traded price of $US4.92) for Worldwide Retail Concepts, the US publicly listed company that is now Collins Foods, management then co-invested with a 48% stake. According to all reports, management will now retain just 10%. In other words, management is selling 80% of its holdings into this float.

If PEP bought the company in 2005 alongside management who owned 48%, and you buy in 2011 with management owning just 10%, do you think the deal has a whiff of fried chicken to it?

During the privatisation, PEP and the management were arguably similarly incentivised but when you buy Collins Food Group’s from PEP in the IPO, you will not have the same committed management.

And when PEP bought Worldwide Retail Concepts in 2005, the company operated, joint ventured or franchised 302 Sizzler restaurants (with 28 in Australia), 112 KFC sites (111 in Queensland) and it also owned 22 sites of the US “quick casual” or family value restaurant chain Pat & Oscars.

Worldwide Restaurant Concepts reported revenues of $US347.2 million in the year to April 30, 2004 ($A444 million at the then exchange rate of US78¢) and 70% was generated in Australia. All this for $US210 million ($A269 million).

According to reports, you are being asked to pay $A230–278 million ($US244–295 million) for 119 KFC outlets, 26 Sizzlers and around 55 franchised Sizzlers in Asia. I am not sure if the IPO company will offer a stake in the other 220 Sizzlers but I can tell you the Pat & Oscars chain was sold to management in 2009 after another buyer in 2007 failed to secure funding.

Oh, what doesn’t Google know!

Same-store sales growth has been positive while in the care of PEP and Collins Foods, and is forecast to hit $430 million in 2012, according to one report, but it is the growth in earnings since the purchase in 2005 that has been spectacular.

For the year to April 30, 2004, Worldwide Restaurant Concepts earned just $4 million. In 2011 that number might be closer to $25 million for Collins Foods and it is probably for all this hard work that management want to cash in their 38%.

Despite this wonderful growth in profits, the best (read most optimistic) estimate of intrinsic value I can give you is $2.55. This represents the low end of the expected range of possible prices at which you might be entitled to any shares.

But before you jump in like a headless chicken, remember two things: management are taking their cream; and the franchisor always makes more money than the franchisee. Just look at Yum! Brands’ return on equity and compare it to Collins Food Group’s when we see it.

Finally, it’s always interesting to follow the cash account, which can give an alternative picture of the company’s position before and after its float. For those who have access to the prospectus have a look at the pro forma cash balance prior to the float.

Let’s presume it is close to $50 million. That cash balance will first increase by the proceeds of the float – say $250 million – but any debt repayment will see the account decline again.

Then you need to look carefully. If there is a further drawdown (because all the proceeds were used to reduce debt) it will see the account restored but then payments to vendors and reimbursing costs associated with the float will result in a starting cash balance that may be a lot less than it was before any float was contemplated.

If this is indeed the scenario – and it would not be one without precedent – the drawdown would have effectively funded the payment to vendors and costs. If there is no further drawdown or refinancing, there could be no payment to the vendors including management.

The prospectus will be out shortly. The last float we looked at was MACA at $1 and we suggested participation for those lucky enough to have been offered shares.

MACA shares now trade at $2.35, after being as high as $2.96, trouncing the return of the other floats we reviewed, Myer and QR National. Will Collins Food Group be an addition to the portfolio? There’s a greater chance that my kids will be regulars at a KFC restaurant!”

Posted by Roger Montgomery, Value.able author and Fund Manager, 25 October 2011.

by Roger Montgomery Posted in Consumer discretionary.

- save this article

- POSTED IN Consumer discretionary

-

Can relationships be the foundation of business?

Roger Montgomery

May 13, 2011

Back on March 10 here at my Insights blog I pieced together a little jigsaw puzzle that served as a warning to Value.able Graduates researching Carsales.com.au:

“…Relationships it seems, matter. And so they should.

“In the end, it is not cars, boats and planes that bring joy, but the quality of the relationships you develop.

“This week (commencing 7 March 2011) I read that Carsales.com.au had been sold out of Nine Entertainment Co, the rebadged PBL Media (which is owned by CVC Asia Pacific).

“Reading Terry [McCrann’s] article caused a rumour I heard last year to become louder in my mind.

“The rumour was that a group of customers of Carsales.com.au (ASX:CRZ, MQR:A1, Value.able Margin of Safety; -24%) were thinking of leaving to start a rival that would be funded by News. You could understand News’ interest, given it is losing the online automotive classifieds race to Drive (Fairfax) and Carsales.

“If this is true, and if Terry is also on the mark with the intimacy of the relationships amongst Australia’s media barons, both individual and corporate (excluding Fairfax), then it would be reasonable to assume that the status quo should be maintained until after Carsales had been spun out of the former PBL, finding itself completely owned by institutions and private investors.

“Now that hurdle is out of the way, let’s see if Carsales does lose any major customers.”

That was the crux of my 10 March blog post – that Carsales’ biggest customers were about to leave to start a rival with Newscorp.

Just 2 months have passed and if you didn’t already know, guess what? Splitsville.

The Carsguide brand, owned by News Limited and a consortium of foundation dealers that includes Automotive Holdings Group Limited, A.P Eagers Group and Trivett, plus a few other dealerships representing a quarter of Australia’s car dealers, will hop into bed together in a joint venture and share Carsguide’s revenue.

Chairman and chief executive of News Limited John Hartigan told one journo, “We will be investing in the new company, doubling the number of staff and throwing our combined resources and expertise behind the joint venture, with the intent of aggressively growing the business.”

Please refrain from posting any banter as comments, just your highest quality thoughts and experiences investing in online businesses. How have you faired investing in online businesses?

Posted by Roger Montgomery, author and fund manager, 13 May 2011.

by Roger Montgomery Posted in Consumer discretionary, Insightful Insights, Takeovers, Value.able.

-

What did Ben Graham get right?

Roger Montgomery

April 29, 2011

If you are new to our Value.able community, Ben Graham’s concepts may be foreign to you. Ben is the author of Security Analysis. He is regarded as the father of security analysis and the intellectual Dean of Wall Street.

If you are new to our Value.able community, Ben Graham’s concepts may be foreign to you. Ben is the author of Security Analysis. He is regarded as the father of security analysis and the intellectual Dean of Wall Street.I support Ben’s revered status and what he has to say on the subject of investing, but perhaps controversially, I also believe that, had he access to a computer that allowed him to properly test his ideas, he may not have reached all of the same conclusions.

It is exactly one year since I first penned some of my thoughts about Ben Graham on this blog here: http://rogermontgomery.com/should-a-value-investor-imitate-ben-graham/

There are many things that Ben said that not only make sense, but has also made significant contributions to investment thinking. Indeed they have become seminal investment principles. These are the things to which Value.able investors should hold firm.

Ben Graham authored the Mr Market allegory and also coined the three most important words in value investing: Margin of Safety. In fact Ben said this: “Confronted with the challenge to distill the secret of sound investment into three words, I venture the motto: Margin of Safety”

These are two concepts that value investors hold dear and which have, in many different ways, become a formal part of our Value.able investing framework.

Mr. Market is of course a fictitious character, created by Ben to demonstrate the bipolar nature of the stock market.

Here is an excerpt from a speech made by Warren Buffett about Ben Graham on the subject:

“You should imagine market quotations as coming from a remarkably accommodating fellow named Mr Market who is your partner in a private business. Without fail, Mr Market appears daily and names a price at which he will either buy your interest or sell you his.

“Even though the business that the two of you own may have economic characteristics that are stable, Mr Market’s quotations will be anything but. For, sad to say, the poor fellow has incurable emotional problems. At times he feels euphoric and can see only the favorable factors affecting the business. When in that mood, he names a very high buy-sell price because he fears that you will snap up his interest and rob him of imminent gains…

“Mr Market has another endearing characteristic: He doesn’t mind being ignored. If his quotation is uninteresting to you today, he will be back with a new one tomorrow.

Transactions are strictly at your option…But, like Cinderella at the ball, you must heed one warning or everything will turn into pumpkins and mice: Mr Market is there to serve you, not to guide you.

“It is his pocketbook, not his wisdom that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence.”

If you have read Value.able you will understand Margin of Safety, know exactly what a suitable Margin of Safety is and also how to apply it to Australian stocks.

Despite the high profile of these two enduring lessons, I believe there is a third observation of Graham’s, which is equally important. Fascinatingly, with the benefit of computers, I can also demonstrate that Graham was spot on.

Graham was paraphrased by Buffett in 1993 thus:

“In the short run the market is a voting machine – reflecting a voter-registration test that requires only money, not intelligence or emotional stability – but in the long run, the market is a weighing machine”

What Graham described is something that, as both a private and professional investor, I have observed myself; in the short term the market is a popularity contest – prices often diverge significantly from that which is justified by the economic performance of the business. But in the long-term,prices eventually converge with intrinsic values, which themselves follow business performance.

Have a look at the amazing chart below.

(c) Copyright 2011 Roger Montgomery

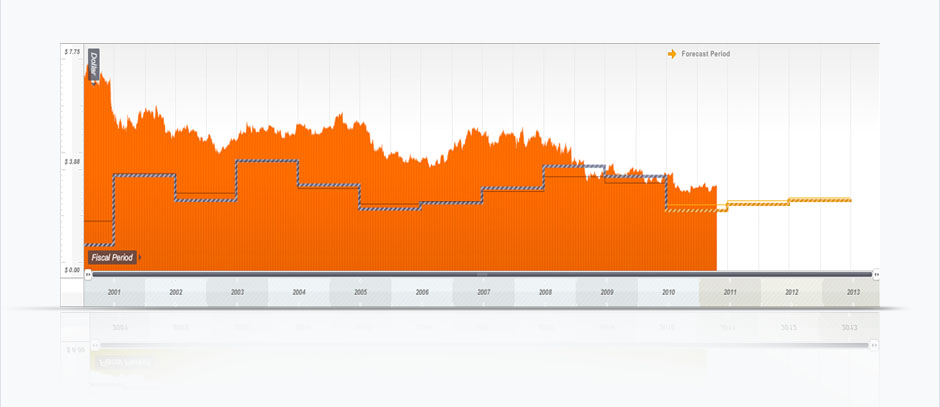

Its Qantas (ASX:QAN, MQR: B3, MOS-44%): – its my ten-year history of price and intrinsic value (and three year forecast of intrinsic value which updates daily). Now right click on the chart and open it in a new tab. Zoom in. Now stand back from your computer screen. What do you see?

First you will notice two intrinsic values – a range is produced. Next you might notice that there have been short term bouts of both optimism and despondency and this is reflected in the short term share price changes. The final observation you might make and which the charts make most powerfully, is that since 2001, the intrinsic value of Qantas, which is based on its economic performance has, at best, not changed. Look closer and you will notice that the intrinsic value of Qantas today (2011) is lower than it was a decade ago. Even by 2013, intrinsic value is not forecast to be materially different from that of 2002.

Just as Ben Graham predicted, the long-term weighing machine has correctly appraised Qantas’ worth. Unsurprisingly, the share price today of Australia’s most recognised airline, is also lower than it was a decade ago. And unbelievably, the total market capitalisation of Qantas today is less than the money that has been ‘left in’ and ‘put in’ by shareholders over the last ten years!

These charts aren’t just easy or nice to look at, they are incredibly powerful. If you can calculate intrinsic values for every listed company, you can turn the stock market off and simply pay attention to those values. Then, during those times that the market is doing something irrational, you can take advantage of it or ignore it, just as Ben Graham advised.

Unless you can see a reason for a permanent change in the prospects of Qantas, the long-term trend in intrinsic value gives you all the information you need to steer well clear of this B3 business.

Now have a look at the second chart. What does it tell you?

(c) Copyright 2011 Roger Montgomery

There have been short-term episodes of price buoyancy, but over the long run the weighing machine has done its work. The intrinsic value has not changed in ten years so, over time, the share price has once again reflected the company’s worth and gradually but perpetually fallen until it reaches intrinsic value. This is my ten-year historical price and intrinsic value chart (and three year forecast) for Telstra (ASX:TLS, MQR: B3, MOS:-32%).

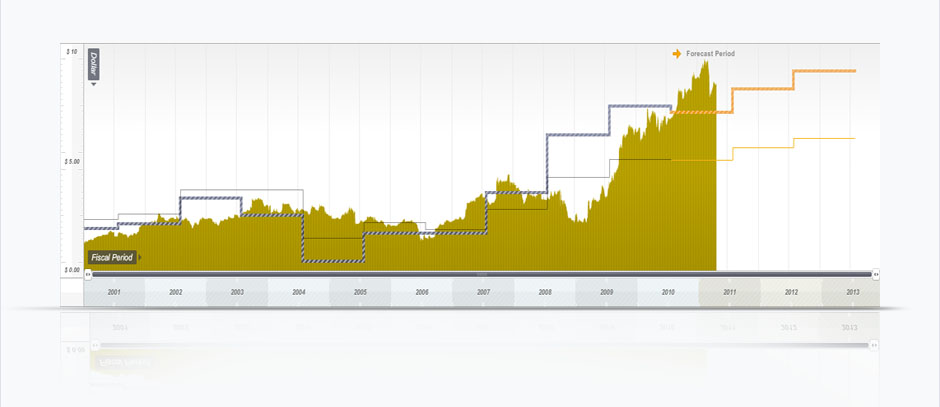

What about an extraordinary A1 business?

Sally Macdonald joined Oroton (ASX:OTN, MQR: A1, MOS:-17%) as CEO in 2005/06. Observe the strong correlation between price and value since Sally’s appointment.

(c) Copyright 2011 Roger Montgomery

I acknowledge that there are critics of the approach to intrinsic value we Value.able Graduates follow. But like me, you should be delighted there are. Indeed, we should be encouraging departure from this approach!

The critics are necessary. Not only do they help refine your ideas, but without them, how else would we be able to buy Matrix at $3.50, Forge at $2.60, Vocus at $1.60 or Zicom at $0.32! And how else would we be able to navigate around and away from Nufarm or iSoft, and not fall into the trap of buying Telstra at $3.60 because the ‘experts’ said it had an attractive dividend yield? If it was universal agreement I was after, I would just keep writing about airlines.

The Value.able approach works. If you have been visiting the blog for a while, you will know this only too well.

The above charts (automatically updated daily – and I have one for every, single, listed company) confirms what Ben Graham had discovered without the power of modern computing; In the short run the market is indeed a voting machine, and will always reflect what is popular, but in the long run the market is a weighing machine, and price will reflect intrinsic value.

If you concentrate on long-term intrinsic values and avoid the seduction of short-term prices, I cannot see how, over a long period of time, you cannot help but improve your investing.

…And in case you are wondering about the link between Ben Graham and the photograph of Comanche Indian ‘White Wolf’… the photo of White Wolf was taken in 1894 – the year Ben Graham was born.

HOMEWORK RESULTS: I will publish the holiday results homework on Monday. Thank you to all who participated. It is vital what you continue to practice your technique. With repetition you’ll get to the point where you can simply ‘eye-ball’ Value.able intrinsic value.

Posted by Roger Montgomery, author and fund manager, 29 April 2011.

by Roger Montgomery Posted in Companies, Consumer discretionary, Insightful Insights, Investing Education, Technology & Telecommunications, Value.able.