articles by Tim Kelley

-

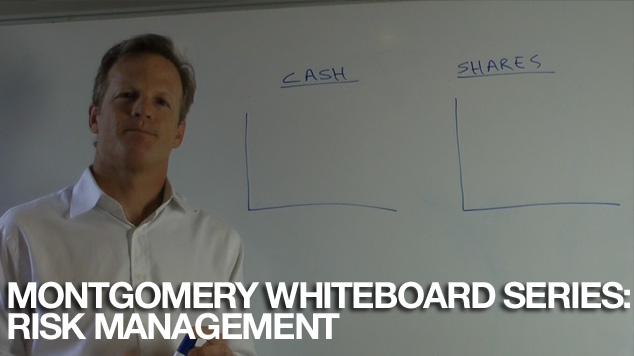

Montgomery Whiteboard Series: Risk Management (8/1/2013)

Tim Kelley

January 8, 2013

by Tim Kelley Posted in Video Insights.

- watch video

- 3 Comments

- save this article

- 3

- POSTED IN Video Insights.

-

Signs of a merry Christmas at JB Hi Fi?

Tim Kelley

December 24, 2012

JB Hi Fi (ASX:JBH) is a retailer we have followed closely over the years. What attracted us to the business was a focused and well-executed business model that delivered strong returns on equity, coupled with a store roll-out program that allowed those returns to be realized on an expanding pool of assets. Over time, this led to increasing market share and growing EPS. In fact, between 2004 and 2010 EPS grew at a rate of over 30% p.a. compound.

by Tim Kelley Posted in Companies, Insightful Insights, Value.able.

- 2 Comments

- save this article

- 2

- POSTED IN Companies, Insightful Insights, Value.able.

-

A 2012 Report Card

Tim Kelley

December 20, 2012

At this time of year, many of us are inclined to take stock of highlights and lowlights of the year gone by, and perhaps to consider what we might wish for the year ahead. Accordingly, we thought it might be interesting to look at the best and worst performing ASX stocks during the past 12 months, and see what sort of story they tell.

The list below sets out the top performers according to Bloomberg. We have limited the analysis to stocks with a market capitalization of at least $200m.

Continue…by Tim Kelley Posted in Insightful Insights, Market Valuation, Value.able.

-

Are Large Caps Becoming Expensive?

Tim Kelley

December 17, 2012

We have the luxury of a broad mandate in the Montgomery Fund. We are not tied to small caps or large caps, but can allocate capital to the best opportunities we find, wherever they may be.

Recently, we have found better value at the smaller end of the market, and the chart below may help explain why.

Continue…by Tim Kelley Posted in Insightful Insights.

- 6 Comments

- save this article

- 6

- POSTED IN Insightful Insights.

-

Heads in the Sand on LNG Economics?

Tim Kelley

December 12, 2012

One of the issues attracting media and analyst commentary recently is the potential impact of American shale gas exports to the economics of Australia’s large LNG projects.

The theme of many of the comments is that there is no cause for alarm, at least for the time being. Some of the reasons advanced include: the reluctance of US policymakers to permit exports; the time taken to ramp up supply if the US does export; and the fact that LNG contracts tend to be linked to oil, rather than gas prices.

by Tim Kelley Posted in Energy / Resources, Insightful Insights, Value.able.

-

Surprising on the Upside

Tim Kelley

November 27, 2012

We’re delighted to see CSL announce this morning that it expects NPAT in FY13 to be 20% higher (in constant currency terms) than in FY12. Previous guidance was for 12% growth.

CSL is exactly the sort of business we like at Montgomery. Its impressive balance sheet and financial performance have earned it a Montgomery quality rating of A1 or A2 for each of the last 6 years. In addition, the strong financial position of the business has allowed it to buy back shares. As a result, earnings per share will grow faster in FY13 than the estimated 20% rate of profit growth.

High quality businesses tend to be rewarding investments for long-term investors. While the broader market sits currently at about the same level it held in 2005, CSL shares are some 250% higher. The Montgomery [Private] Fund is happy to own shares in this excellent business.

by Tim Kelley Posted in Insightful Insights, Technology & Telecommunications.

-

Lamenting the Australian Index

Tim Kelley

November 24, 2012

One of the strategies available to people who lack the time or inclination for active portfolio management is to “buy the index”. This is normally done via an index fund, which invests in companies according to their index weights. These funds have a certain intuitive appeal, as they typically charge low fees and are easy to understand.

However, if you step back and think about it, we think some serious issues arise. In essence, an index fund invests in a company, simply because it is there. This may be a satisfactory rationale for climbing a mountain, but we think it falls short as an investment strategy, particularly in the Australian context.

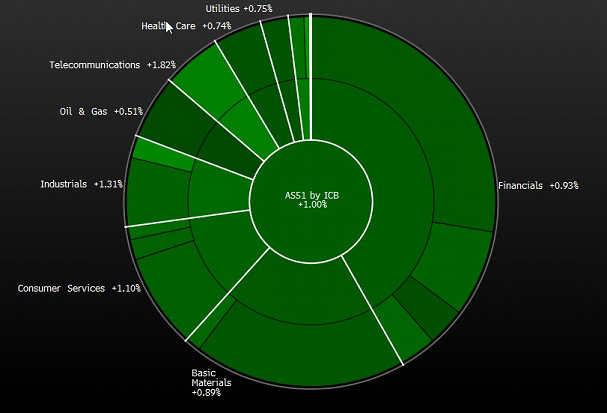

The chart below shows the industry composition of the ASX200 index. Ignore the % numbers – they are the daily price changes from yesterday – and look at the size of the slices. What stands out is that financials and basic resources together account for more than 60% of the total. If you buy the Australian index, your returns will be dominated by the big 4 banks and a handful of large resources companies. This doesn’t look like a sensible portfolio construction to us, and the rationale “because they’re there” doesn’t provide much comfort.

ASX200 Index Composition

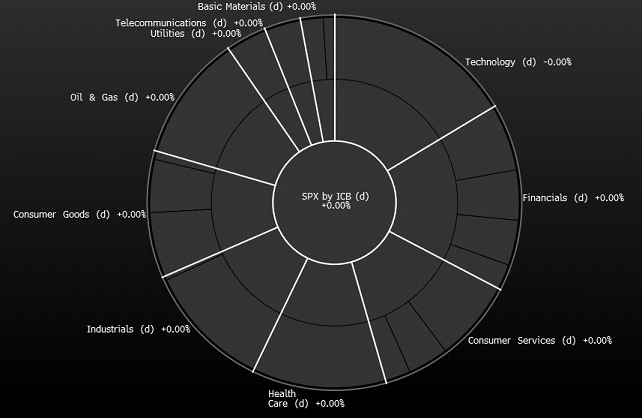

For comparison, the second chart, below, shows the composition of the US S&P500 index. A few things to note:

– Firstly, the US index has a much more even distribution, with 7 different industry groups representing a material part of the whole.

– Secondly, it’s interesting to note that technology is the largest single component of the US index, but is nothing more than a rounding error in the Australian index. In an age where commerce is being transformed by technology, is it good enough for Australian investors to have a <1% allocation to this sector ?

S&P500 Index Composition

by Tim Kelley Posted in Insightful Insights, Technology & Telecommunications.

-

The Clever Country?

Tim Kelley

November 23, 2012

We have been preparing some statistics today as part of an external review being done on The Montgomery Fund. One thing the reviewers want to know is how our portfolio differs to the index in terms of its exposure to different industry sectors.

The answer is that it differs markedly. We are far more interested in owning great businesses than in minimising our index “tracking error”. One striking example is the information technology sector, where The Montgomery Fund has identified some interesting opportunities and has allocated almost 15% of its capital. By comparison, information technology makes up less than 1% the ASX300 index.

The real issue of course is what this second number says about the composition of the Australian economy. Our competitive advantage in digging things out of the ground has now been lost to high costs. As a nation, what other tricks do we have up our sleeve?

by Tim Kelley Posted in Insightful Insights, Technology & Telecommunications.

-

Hybrid Securities – Equity Downside for Fixed Interest Returns

Tim Kelley

November 16, 2012

We often hold a material amount of cash in our funds management operation and, with deposit rates at painfully low levels, we have been considering ways we might work the cash a bit harder. Like many investors, we have focused attention on hybrid securities as one possibility.

Having studied this possibility for a short time we are now focusing elsewhere. Analysis of the terms of some of the recent offerings reveals highly complex instruments with concealed downside risks and an interest rate that falls well short of compensating investors for the hidden downside. A cynical observer might think that some of these products are designed to exploit retail investors who are unable to fully assess the downside risks they are taking on.

by Tim Kelley Posted in Insightful Insights, Investing Education.

-

RBA favours ‘riskier’ investments?

Tim Kelley

November 7, 2012

In the wake of the RBA’s decision to leave interest rates unchanged it’s interesting to see some of the commentary on the attractiveness of fixed interest versus ‘riskier’ investments, including property and shares. RBA governor Glenn Stevens is reported to favour investors moving into these asset classes away from low-yielding term deposits.

We have recently been doing some interesting analysis to better understand the long-term value proposition currently offered by the Australian equity markets. We will share the results of the analysis here when completed, but the emerging view – for those with a long-term perspective – is that governor Stevens has a valid point.

by Tim Kelley Posted in Insightful Insights, Investing Education.

- save this article

- POSTED IN Insightful Insights, Investing Education.