It’s not unusual for stock market investors, including Value.able Graduates, to assume, incorrectly, that I’m against high dividends.

It comes from the position I take: companies that generate high rates of return on equity would make their shareholders a lot more money in the long term if they retained their profits (rather than paid them out as dividends) and continued to earn those high rates.

Not all companies, however, have the ability to sustain high rates of return on incremental equity, and so not all companies have the ability to retain all their profits at high rates of return.

A man with a hammer thinks every problem is a nail, and so given large amounts of cash, a CEO may go and do something silly. Understandably, many Australian investors prefer their Boards of Directors to pay the cash out in the form of a dividend.

There is another method that produces similarly attractive returns as retaining and compounding, but allows for the distribution of accumulated franking credits. For investors on tax rates lower than the corporate tax rate, it makes sense for a company to pay out all of its profits (to the extent that they are fully franked, which rules out a few companies) and replace the capital by way of a renounceable rights issue.

Arguably, a non-renounceable rights issue would be less dilutive on your stake in the business, but may fail to replace all the capital paid out.

As a Value.able Graduate confirmed recently, this only works where the costs associated with the capital raising are less than the tax benefit from paying fully franked dividends out. But that is not the subject of this post.

Don’t get me wrong, I like dividends!

Simply, I prefer to see companies with the ability to generate high rates of return on incremental equity (i.e. strong growth opportunities) retain more capital, borrow less and raise less capital. Borrowing increases risk and capital raisings (acknowledging of the above discussion) dilute ownership.

Dividends are Boring

Stepping aside from the stock market rollercoaster and taking the long-term view, a ‘growing dividends’ route to wealth is hardly an exciting proposition. Indeed, it’s akin to walking around Ikea without a wallet.

Yet many investors who lose money on the stock market, going for the quick buck, keep going back for more (akin to going back to Ikea again) and fail to realise that there is a slow but sure way to riches.

Did you know the stock market is trading about where it was in December 2004? Googling that shocked me – nearly seven years of zero appreciation… it seems zero is indeed the new normal!

Over those same seven years many companies have significantly increased their dividends (I should say that comparison is commonly used by the advisory community and the commentariat but it fails to recognise that there are many companies whose share prices are up three, four and seven fold in the last seven years).

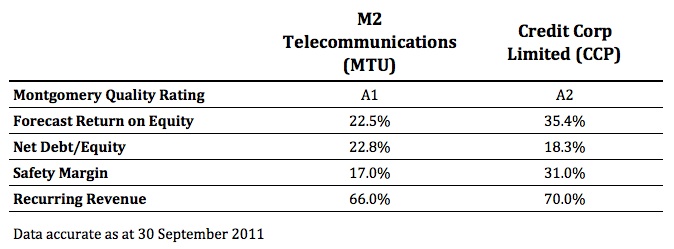

Notwithstanding the weak comparison, it is indeed true that some companies have grown dividends significantly, despite a generally lacklustre market. The Reject Shop grew dividends by 394 per cent between 2005 and 2010 from 17 cents per share to 67 cents; M2 by 800 per cent from 2 cents to 16 cents and JB Hi-Fi by 1100 per cent from 7 cents to 77 cents.

Identifying extraordinary companies – those that generate lots of cash – has the power to make you very happy, just not overnight. In that sense it’s pretty unexciting. Mind you, I am yet to find a book or manual that says investing has to be exciting.

When it comes to investing, what is exciting is the effect of compounding. If you could find a portfolio of companies that paid a 5 per cent dividend yield and was able to grow those dividends by 10 per cent per year, your initial $20,000 portfolio earning $1000 would be generating $6,727 in 20 years – a 34 per cent yield on the initial purchase price. And if The Reject Shop could keep growing dividends at 31 per cent per year (unlikely without hiccoughs), they’d be generating dividends of $53.95 in another 15 years (you see why I said unlikely).

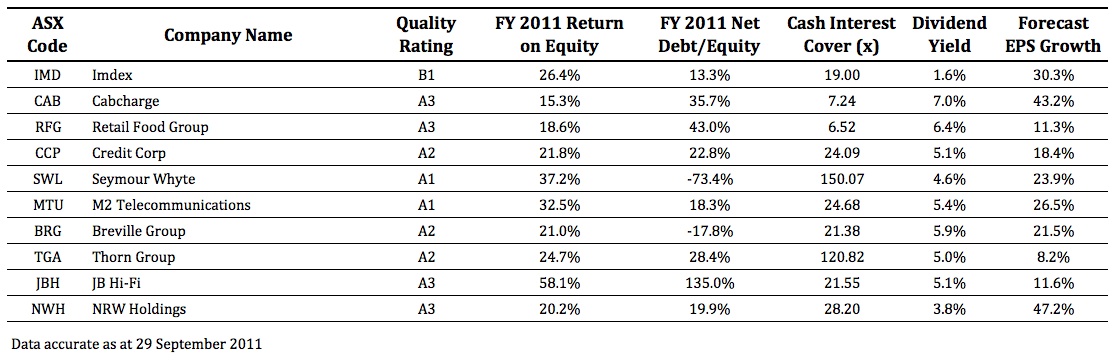

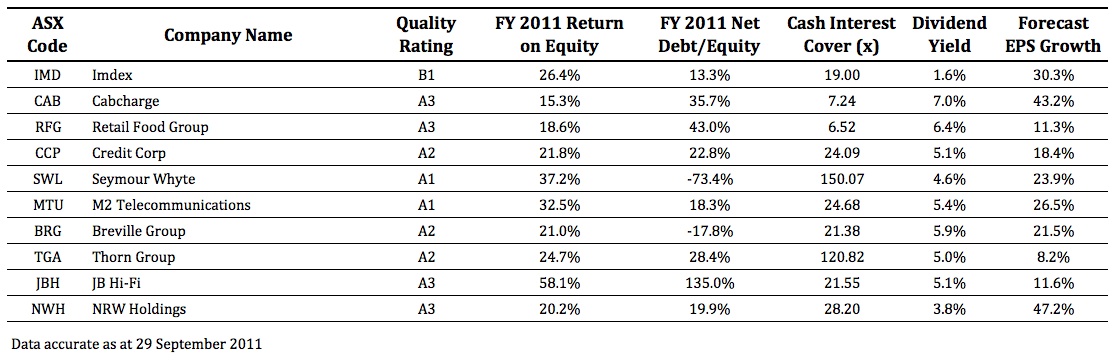

Extraordinary businesses paying attractive dividends

Following you will discover ten extraordinary companies that meet the criteria for high return on equity combined with attractive dividend yields: Imdex (B1), Cabcharge (A3), Retail Food Group (A3), Credit Corp (A2), Seymour Whyte (A1), M2 Telecommunications (A1), Breville Group (A2), Thorn Group (A2), JB HiFi (A3), NRW Holdings (A3).

How did I produce this list?

The goal was to find companies with the potential to significantly increase their dividends in the future. I logged into Skaffold® and refined my search to companies that generate high rates of return on equity (>15 per cent), have little or no debt (interest cover of more than 4 times) and have the strongest expected growth in earnings for at least the next year (EPS growth > 5 per cent).

And because I simply cannot advocate paying more than intrinsic value, I have also selected those that appear to be trading at a rational price (Safety Margin > 15 per cent).

For the record, I only selected A1, A2 A3, B1, B2 and B3 companies. From 1 November, you will be able to conduct searches like this yourself – high ROE, low debt, specified safety margin – the parameters are endless. Your resultant list of companies will quickly help you navigate the 2080 listed companies to find your own income champions.

What other companies make your income champion list?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 29 September 2011.

Skaffold® is a registered trademark of Skaffold Pty Limited.