By Praveen J on 9th January 2012 and updated Feb 20 2012

By Praveen J on 9th January 2012 and updated Feb 20 2012

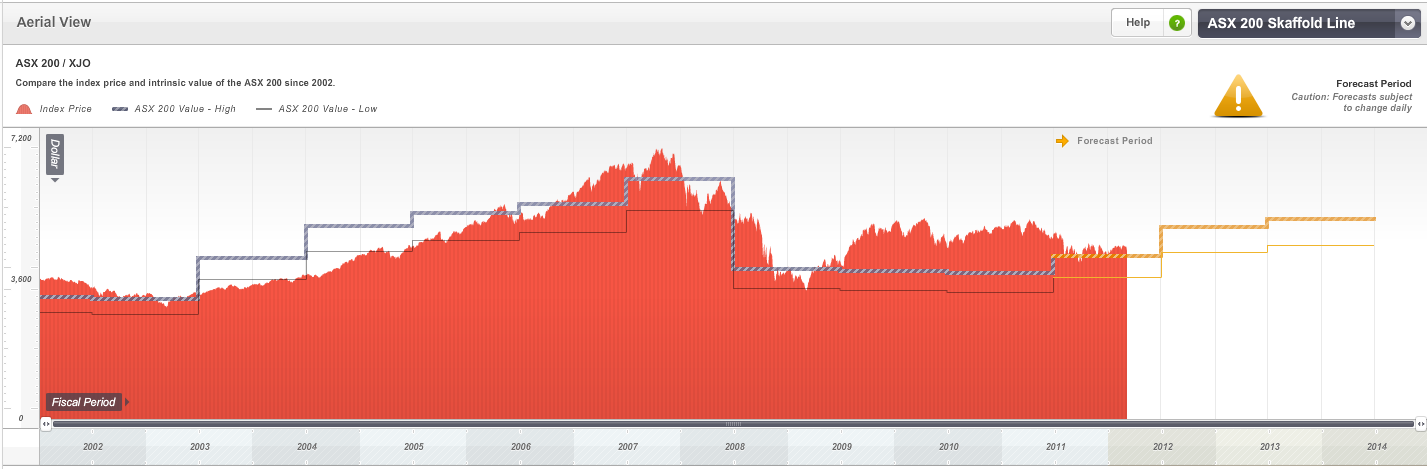

This year I have been given an opportunity to write about my experiences in applying what I have learnt as a Value.able graduate and Skaffold member. At the moment I am looking to invest in stocks with a market capitalisation under $2 billion (small to micro caps). Key MINIMUM criteria for me include: Return on Equity > 15%, Net Debt/Equity < 50%, and forecast change in Intrinsic Value > 5%. I will also be focussing on investment grade companies across ALL Industry Sectors/Groups that have Skaffold Quality Scores between A1 to A3, and B1 to B3. This will encompass my “investment universe” of stocks on the ASX. I will of course require a decent margin of safety, but I will be watching stocks that are trading close to their Intrinsic Value or at a small premium, in the event of a decline in price over the next 3 to 6 months. Initial screening using Skaffold reveals over 100 stocks, a more aggressive filter would reduce this number even further. Amongst the results are 10 stocks in the Basic Materials Sector and Gold & Silver Group, 6 of which are predominantly involved in gold exploration, development and production:

• Ramelius Resources (ASX:RMS)

• Medusa Mining Limited (ASX:MML)

• Silver Lake Resources (ASX:SLR)

• Dragon Mining (ASX:DRA)

• CGA Mining (ASX:CGX)

• Regis Resources Limited (ASX:RRL)

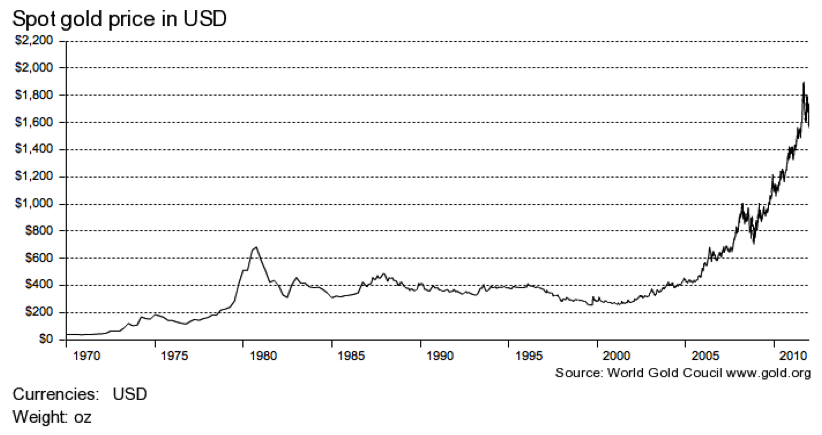

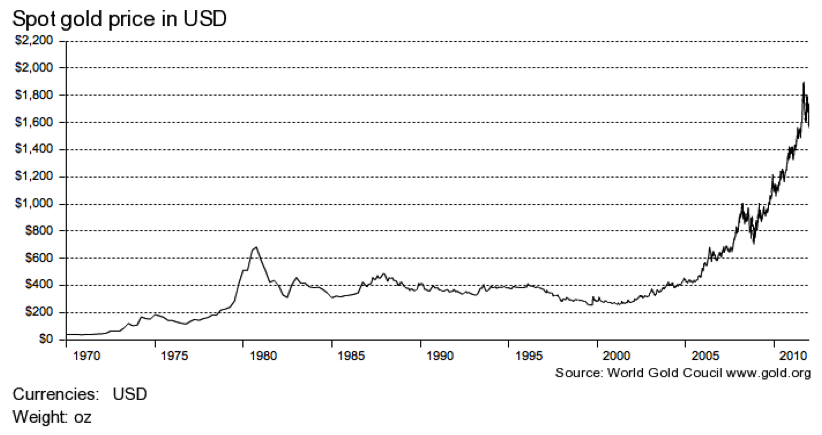

Table 1. Stocks listed by safety margin (highest to lowest, 9th January 2012) (Source: Skaffold):

Although Ramelius Resources (RMS) meets my initial screening criteria and is an A1 company, it has a NEGATIVE forecast EPS growth. So in this blog post I will be discussing and comparing Medusa Mining Limited (MML) and Silver Lake Resources (SLR). Here we have two companies that have commenced production of gold (they are making money), they are fundamentally healthy, they have good prospects for Intrinsic Value appreciation, AND are both trading at a discount to their Intrinsic Value. Being commodity businesses, the question I have to ask is whether either really have any competitive advantage. I will discuss this later.

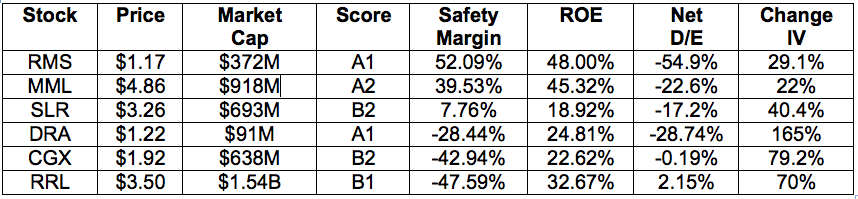

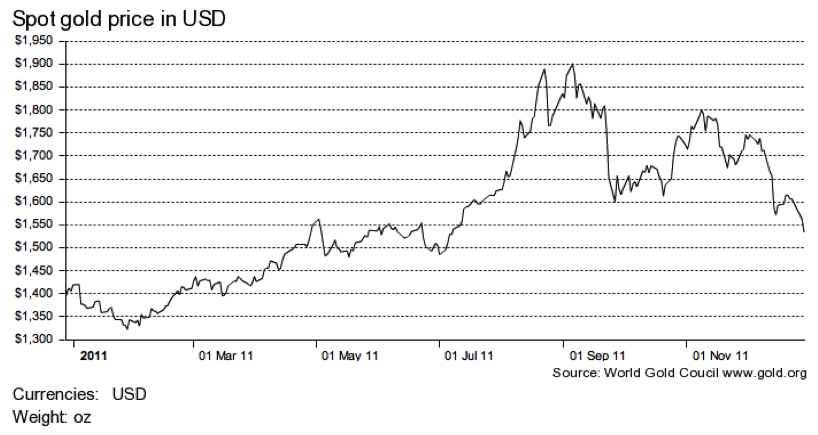

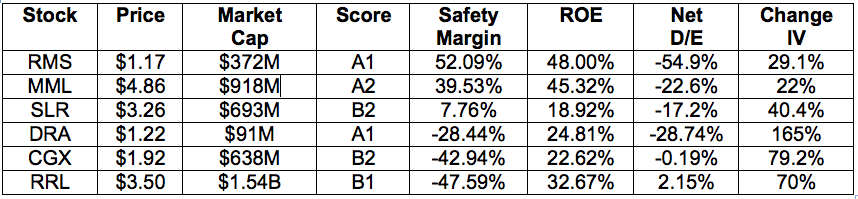

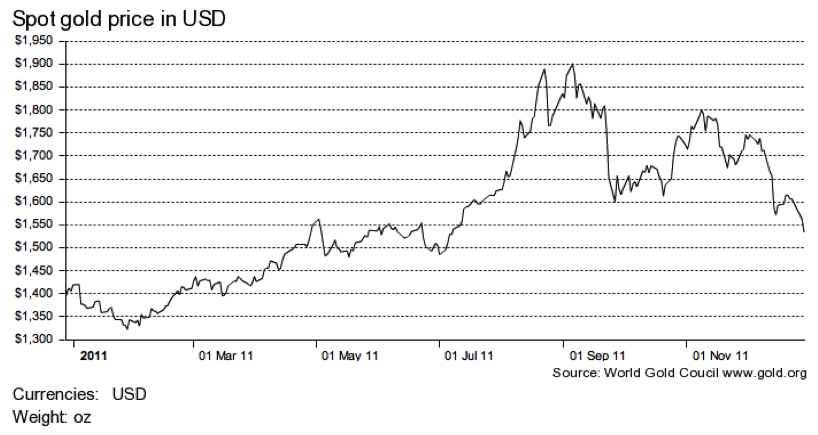

Now in the context of the European sovereign debt crisis, anaemic growth in the US, and concerns of a slowdown in the Chinese economy, I am wary about investing directly in a small cap Australian mining company. However, in this case we are dealing with a commodity that may benefit in this time of uncertainty, with gold long being regarded as a “safe-haven”. Having said that, the future price of gold is still a significant element of risk. At the time of writing the price had dropped down to around US$1600/ounce, after a peak of close to US$1900/ounce in September 2011. Below are some charts of historical gold prices, I’m not going to try and analyse them, but they may serve as a point of discussion. Certainly investing in gold equities requires a bullish stance on the future price of gold in the medium to long term.

Figure 1. Spot gold price chart last 1 year:

Figure 2. Spot gold price chart long-term:

GOLD PRIMER:

Annual reports and AGM presentations for gold and other mining companies assume a level of pre-existing knowledge. Without this, they really make no sense at all. So let me start with some bare basics before I discuss each stock in detail:

What is an Element? An element is a pure chemical substance. You may have heard of something called the periodic table (maybe in your high school science class), this is actually a list of all chemical elements. Examples of elements include carbon, oxygen, aluminum, iron, copper, lead, and of course gold.

What is a Mineral? A mineral is a naturally occurring solid chemical substance that is a combination of elements.

What is an Ore? An Ore is a type of rock that contains minerals. Most individual elements are found in the form of a mineral, though there are some elements that can be found in their elemental state, gold is one of them. Gold is also found in combination with silver and occasionally copper.

What is an Ore Deposit? This is an accumulation of Ore.

JORC? This is the Joint Ore Reserves Committee. The Code for Reporting of Mineral Resources and Ore Reserves (the JORC Code) is widely accepted as a standard for professional reporting purposes.

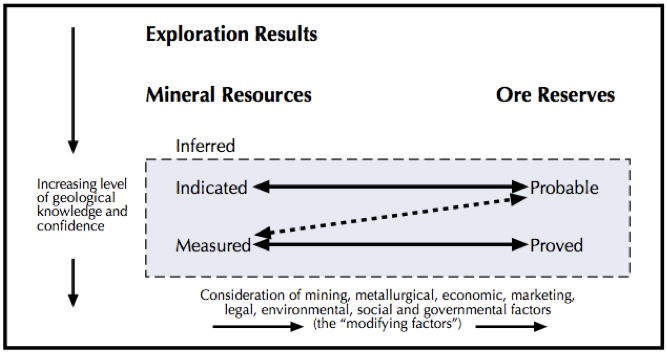

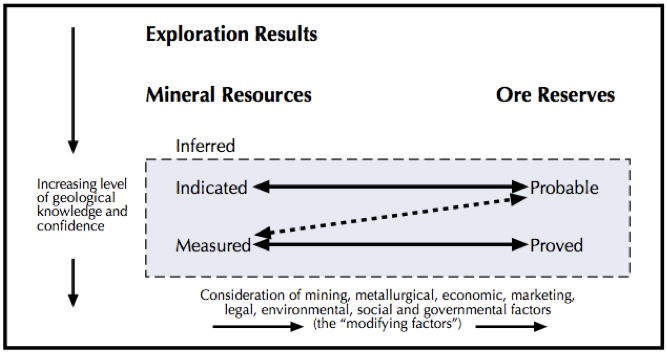

What is a Mineral “Resource” and what is an Ore “Reserve”? These terms are often incorrectly used interchangeably, the exact JORC definitions are below:

Figure 3. Resources versus Reserves (Source: JORC):

RESOURCE; “A CONCENTRATION OR OCCURRENCE OF MATERIAL OF INTRINSIC ECONOMIC INTEREST IN OR ON THE EARTH’S CRUST IN SUCH FORM, QUALITY AND QUANTITY THAT THERE ARE REASONABLE PROSPECTS FOR EVENTUAL ECONOMIC EXTRACTION. THE LOCATION, QUANTITY, GRADE, GEOLOGICAL CHARACTERISTICS AND CONTINUITY OF A MINERAL RESOURCE ARE KNOWN, ESTIMATED OR INTERPRETED FROM SPECIFIC GEOLOGICAL EVIDENCE AND KNOWLEDGE. MINERAL RESOURCES ARE SUB-DIVIDED, IN ORDER OF INCREASING GEOLOGICAL CONFIDENCE, INTO INFERRED, INDICATED AND MEASURED CATEGORIES.”

RESERVE; “THE ECONOMICALLY MINEABLE PART OF A MEASURED AND/OR INDICATED MINERAL RESOURCE. IT INCLUDES DILUTING MATERIALS AND ALLOWANCES FOR LOSSES, WHICH MAY OCCUR WHEN THE MATERIAL IS MINED. APPROPRIATE ASSESSMENTS AND STUDIES HAVE BEEN CARRIED OUT, AND INCLUDE CONSIDERATION OF AND MODIFICATION BY REALISTICALLY ASSUMED MINING, METALLURGICAL, ECONOMIC, MARKETING, LEGAL, ENVIRONMENTAL, SOCIAL AND GOVERNMENTAL FACTORS. THESE ASSESSMENTS DEMONSTRATE AT THE TIME OF REPORTING THAT EXTRACTION COULD REASONABLY BE JUSTIFIED. ORE RESERVES ARE SUB-DIVIDED IN ORDER OF INCREASING CONFIDENCE INTO PROBABLE ORE RESERVES AND PROVED ORE RESERVES.”

What is the difference between high and low-grade gold Resource? There aren’t any fixed definitions that I could find, but generally < 4.0 grams/tonne is low-grade, >8.0 grams/tonne is high-grade, and everything in between is about average. A large amount of low-grade gold could be just as profitable as having high-grade gold, as it could be cheaper and easier to mine the low-grade gold (for example low-grades in “open pit” or near surface mines, versus high-grades in “narrow vein” or deep underground mines).

Stages of mining: exploration, development, or production? Exploration involves primarily drilling activity in order to discover ore deposits and then define the Resource and Reserve levels, as well as feasibility studies, development involves primarily engineering / construction work, and production involves the mining, processing at the mill, and selling of the commodity.

Junior, mid-tier, or senior gold producers? Junior gold producers are generally considered as those producing under 200,000 ounces per annum of gold, seniors over 1,000,000 ounces, and the mid-tier producers in between.

What is a mining tenement? This is basically a license/permit granted by the Government to undertake exploration, development, and/or mining activities in a specific area.

What are royalties? Royalties are an expense that needs to be paid to the State Government in Australia for any minerals that are mined. In Western Australia for example, royalties are 2.5% of the value of gold produced.

What are cash costs? This is the operating cost required to produce one ounce of gold. Average worldwide cash costs are around US$620/ounce. Cash costs do not include capital expenditure. TOTAL cash costs include royalties.

What is hedging? Agreeing on the sale price of a certain volume of gold ahead of producing it, it is done to protect the company from the short-term volatility of the market gold price, but will reduce return when the price is rising.

Quick comparison of gold producing companies… First of all, make sure you compare similar companies, i.e. a junior producer with another junior producer, not a junior with a senior. Look at the total amount of resources they have, quoted in ounces, look at the cash costs, and look at how much ounces they have produced per year, and what level is expected in the future. Look for companies that are actively drilling to expand their resource base and find new ore deposits. A company may have one site producing gold, another being developed, and several others under exploration. This ensures that when Resources deplete at one site, there are other potential mines in the wings.

ANALYSIS: MEDUSA MINING LIMITED (ASX:MML)

MML is an un-hedged gold producer listed on the ASX and LSX and is currently operating in the Philippines.

Figure 4. MML’s Skaffold Line (Source: Skaffold 6th January 2012):

Looking at the figure above we can see that the share price has been on the climb since early 2009. The ACTUAL Intrinsic Value (which is based on analyst forecasts) has also followed suit since then, and has generally remained above market price. Market price reached a peak of $8.35 in September 2011 but has since been on a downward slope. More importantly though, the ACTUAL Intrinsic Value is expected to continue rising. In this instance however, the AVERAGE Intrinsic Value (a more conservative estimate), which is based on past performance with an emphasis on the last 3 years, is not expected to rise as strongly. As this value does not necessarily take into account all possible future events, what I need to find out is what future prospects the company has that could have contributed to the analyst’s forecasts. Another important thing to consider is why has the market price dropped almost 50% in just a few months? I’ll come back to this last point later…

Currently MML’s production is focussed on the Co-O mine in the Mindanoa Island area. A second potential gold production centre is under exploration at the Bananghilig deposit. MML currently have JORC code compliant mineral Resource of 21.3 million tonnes, at a grade of 9.6 grams/tonne (g/t) at Co-O and 1.3 g/t at Bananghilig, for a total of 2.6 million ounces (mOz). The company aims to keep Resource and Reserve levels at the Co-O mine stable year to year (by replacing whatever is used up each year), and in doing so avoid spending too much money on expanding this base to levels that will not get mined for several years. Exploration budget for 2012FY is US$27 million. Gold production for 2011FY was 101,474 ounces. Total cash costs for 2011FY were an extraordinarily low US$189/ounce (includes royalties). This could be due to the fact that mining is done predominantly via hand-held equipment, and labour costs are low. The site is also adjacent to a highway with close access to the port, and has grid power via hydropower.

Production for 2012FY was expected to be around 90,000 to 100,000 ounces. This will be ramped up to 200,000 ounces per annum by 2014FY after completion of the Co-O mine expansion. Exploration continues at Bananghilig, MML are targeting production of 200,000 per annum at this site by 2016FY. Near future expansion related capital expenditure will be funded from existing cash rather than through capital raisings and debt facilities, which is great and not surprising given their huge operating margins. Having said that, with regards to Bananghilig, no announcement has been made yet regarding whether feasibility studies are to take place, and whether this deposit will go into production phase at all. Further to this, based on current Reserves at Co-O, its mine life is only about 5 years. The risk here is if they are unable to continue replenishing the Resource and Reserve base over the coming years to extend the mine life further. However published analyst research reports are suggesting a possible mine life of over 25 years, indeed a similar mine south of Co-O (Diwalwal) has been mining for 20 years. There is also the risk of political/social instability in this country. MML is targeting 400,000 ounces per annum of production of gold by 2016FY.

Figure 5. Production timetable in ounces (Source: MML AGM Presentation November 2011):

ANALYSIS: SILVER LAKE RESOURCES (ASX:SLR)

SLR is also an un-hedged gold producer that currently operates in 2 key regions of Mount Monger and Murchison in Western Australia, approximately 50km south east of Kalgoorlie.

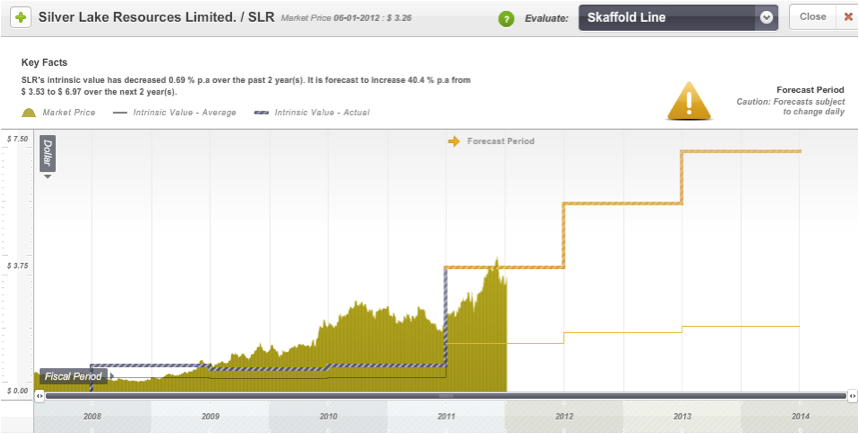

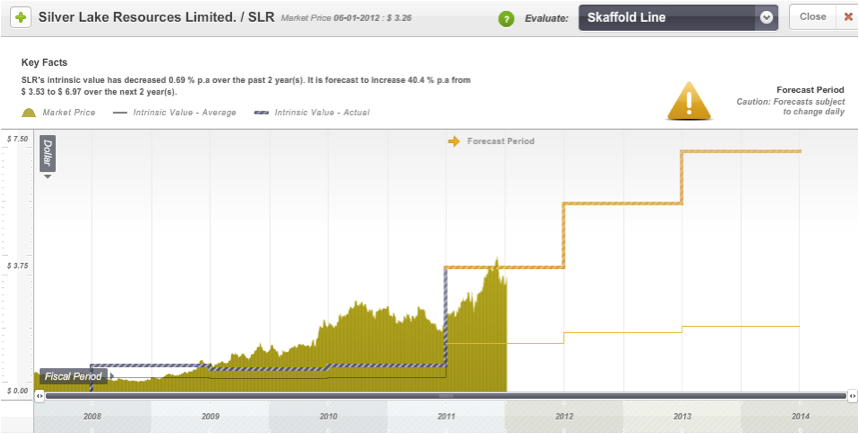

Figure 6. SLR’s Skaffold Line (Source: Skaffold 6th January 2012):

From the figure above what I can see is that the market price has generally been above the ACTUAL Intrinsic Value, although it appears that a great opportunity to buy would have been at the start of 2011. The ACTUAL Intrinsic Value has increased significantly since then, and looks like rising quite rapidly over the coming few years. Market price reached a peak of $3.87 in December 2011, and in fact SLR was one of the best performing stocks on the ASX for the year, significantly outperforming the S&P ASX 200 Index. However, the market price has since dipped down, and a buying opportunity has once again presented itself! The AVERAGE Intrinsic Value is also rising, but as with MML, the growth here is more conservative. Note that as these two lines become closer together, our confidence in the Intrinsic Value estimate is increased.

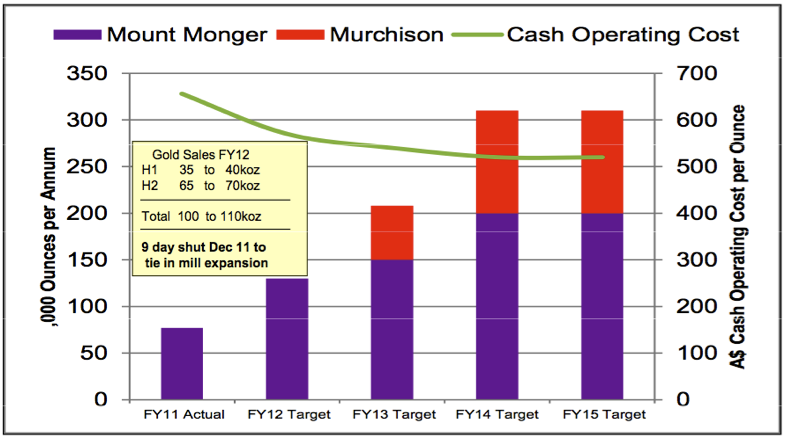

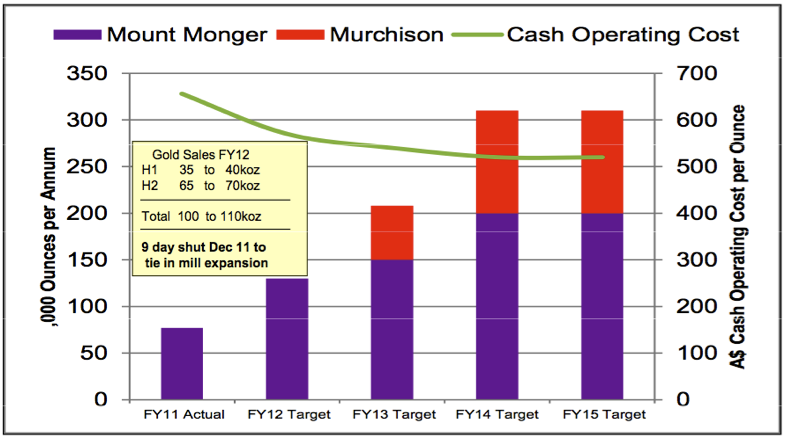

SLR currently has 24.1 million tonnes of JORC Resource at grades of 8.9 (g/t) at Mount Monger and 2.8 g/t at Murchison for a total of 3.3 mOz as at June 2011. The company is aiming to build the Resource base for 2012FY to 5 mOz. In the last 2 financial years, they have increased this Resource base by 1 mOz each year. This has been via an extensive drilling programme each year that is part of their long-term exploration budget ($18 million per annum). Total production of gold for 2011FY was 63,425 ounces. Total cash costs for 2011FY were US$674/ounce (includes royalties). The Mount Monger operations are targeting production of 100,000 to 110,000 ounces for 2012FY. The company expects to ramp up production here to 200,000 ounces per annum by 2014, with an expected mine life > 10 years. The Murchison operations will start production in Q3 2013FY, and is expected to produce 100,000 ounces per annum (from 2014FY) with an 8-10 year mine life. Mining at these locations is predominantly underground. Open pit productions have recently commenced at their Wombola Dam site. SLR has also recently reported high-grade copper discoveries at their Hollandaire site within the Eelya Complex that could provide added value. SLR is targeting 300,000 ounces per annum of production of gold by 2014FY.

Figure 7. Production timetable in ounces (Source: SLR AGM Presentation November 2011):

REVENUE, NET PROFIT, CASH FLOW, RETURN ON EQUITY:

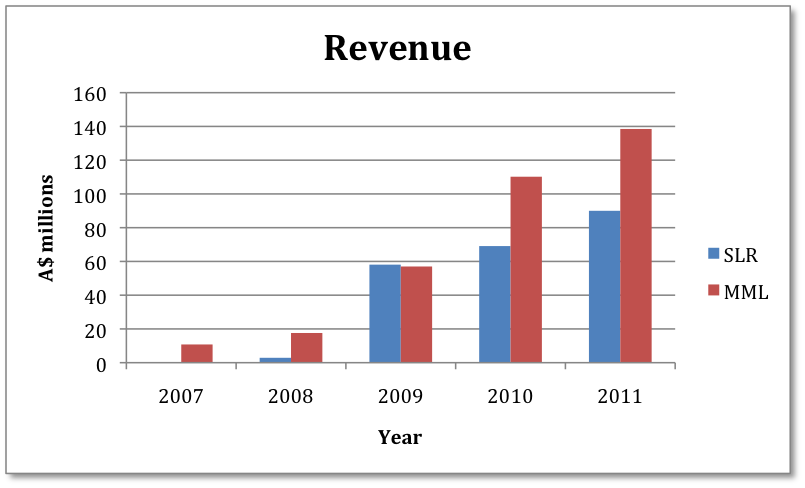

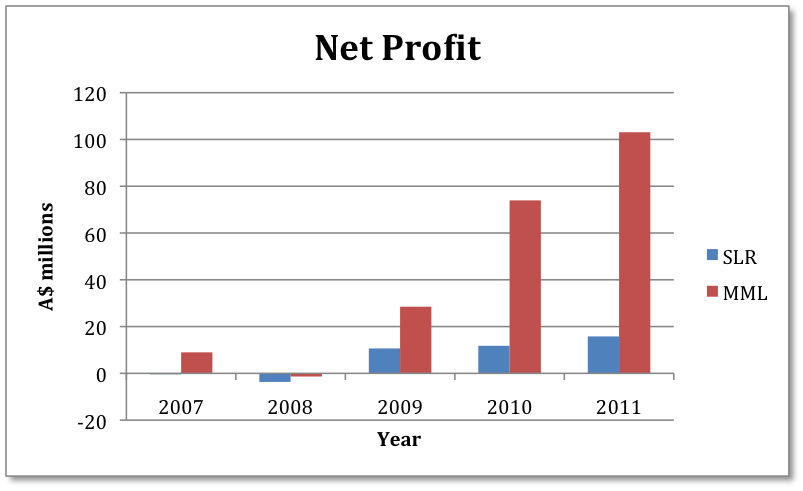

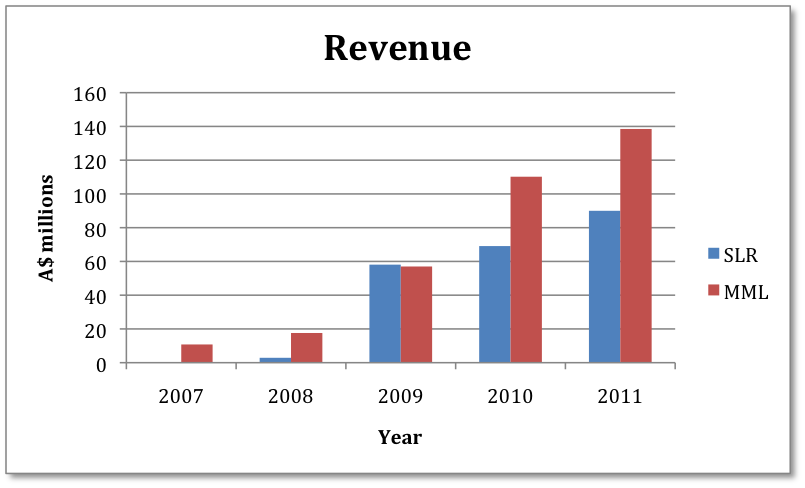

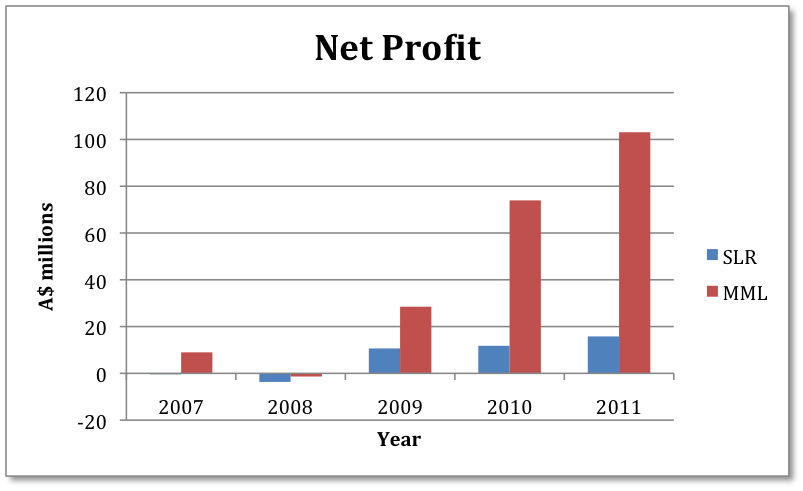

Figures 8 & 9. Comparison of Annual Revenue & Reported Net Profit:

Revenue levels for both companies look excellent, but we can clearly see that MML’s net profit figures are significantly larger than SLR’s, and is a reflection of their low operating costs. But as with any business, we need to delve deeper and look at their overall cash flow. With an impending “credit crunch” in 2012, and a degree of caution in the market with equity investing, a healthy cash flow could be essential in order for junior companies to be able to confidently fund their exploration and development activities.

Figure 10. MML Skaffold Cash Flow (Source: Skaffold 30th December 2011):

Figure 11. SLR Skaffold Cash Flow (Source: Skaffold 30th December 2011):

Both companies have rising levels of cash flow from operations (blue line). MML has an overall funding surplus (green line) that is increasing, and has also managed to pay dividends for 2011FY. Whilst at SLR the overall funding surplus is decreasing, to the point that there is now a funding GAP. This suggests that they have used up more cash in investments and financing than they have received directly from their operations. According to Skaffold, money to account for this spending has come from shareholder equity raisings and increased debt or a reduction in the cash at bank (if there is any). Looking at the Skaffold Data Table sheds more light on recent cash movements for each company…

MML generated a net cash flow of $90 million from its operating activities for 2011FY. However, it also spent a net cash flow of $49 million on investment activities, as well as $18 million for dividend payments (un-franked, low payout ratio). Investment activities were predominantly capital expenditure related to exploration, evaluation, and development activities. Despite the large amount of cash flow invested outside operating activities, after taking into account foreign exchange effects and equity capital movements (add ~ $5 million total), the company was able to increase it’s Bank Account balance by $28 million dollars. This left a 2011FY balance of $58 million (UP from $30 million 2010FY). SLR generated a net cash flow of $33 million from its operating activities for 2011FY. It also spent a net cash flow of $46 million on investment activities, clearly more than it’s operating cash flow. This is once again predominantly capital expenditure related to exploration, evaluation, and development activities. Consequently, despite a rise in revenue, net profit, and operating cash flow, the company actually had a net decrease in its Bank Account balance of $13 million, which left the 2011FY balance at $16million (DOWN from $29 million 2010FY).

MML’s last capital raising was in February 2009 for $20 million, about 3 years ago now. SLR’s last capital raising was as recently as November 2011 for $70 million, this was to help develop their Murchison project and accelerate copper exploration activities. Prior to this it had conducted capital raisings of $19 million during 2010FY and $30 million during 2008FY. Although neither company has significant debt, I think this reiterates that MML is in a better cash flow position at this stage. It appears that continued capital raisings have been required by SLR to help meet ongoing investment demands, unfortunately this could dilute shareholder ownership. Even if capital raisings were issued at a price above equity per share, I would prefer if they were able to fund their investments predominantly from existing cash flow.

A LITTLE ABOUT CAPITAL EXPENDITURE:

As I learnt with these examples, gold mining companies spend a great deal of their retained earnings and cash flow on exploring for gold and developing new mines. These expenses do not go immediately into the Income Statement, instead you will see the total expenditure in the Balance Sheet, as an Asset! These companies may have exploration happening at multiple different sites at any one time, if drilling results prove unsatisfactory, or mining is deemed not technically or financially feasible, part of these expenses will be written-down, and will affect future reported Net Profit. Similarly, cumulative exploration and development expenses will become incurred or amortised only once the mine goes into production. All this capital expenditure is not yet generating any profit, yet it adds to the equity. So unless the company is generating sufficiently higher profits each year from the mines that are in production (e.g. by producing more ounces of gold, at a higher average price, or doing it more efficiently), the Return on Equity will decline. From looking at the annual reports, I noted that MML had listed capital expenditure of US$116 million for 2011FY, and SLR A$76 million. Cleary these are highly capital-intensive businesses, though at the very least it gives their competition a high barrier to entry.

RETURN ON EQUITY:

Figure 12. MML Skaffold Capital History (Source: Skaffold 6th January 2012):

Figure 13. SLR Skaffold Capital History (Source: Skaffold 6th January 2012):

The Skaffold Capital History for MML tells me that although its Net Profits (green line) are forecast to rise over from the next few years, the shareholder equity is expected to rise even more, and thus Return on Equity (blue line) is forecast to decline from 45% 2011FY to 33% in 2014FY. Although a Return on Equity of 33% is still excellent. On the other hand, SLR’s Return on Equity is forecast to rise from 19% 2011FY, and remain stable at around 36% until 2014FY. I suspect that a stable Return on Equity is difficult to achieve in this industry given that there are often several projects on the go at different stages, some generating profits and others not, but at the very least the overall returns must always be high.

FINAL COMMENTS:

What attracts me to MML are its high margins and excellent cash flow that should insulate it against any significant changes in the gold price. A number of things may have contributed to the fall in market price, macroeconomic factors aside. Certainly the market price plunge happened not long after a mining fatality in October 2011. This, along with increased development to prepare the Co-O mine for higher production has resulted in lower production guidance for 2012FY. There was also some weather damage from a tropical storm to parts of their mill in December 2011, the scope of the effect on production will be available in the December 2011 Quarterly. Regardless, these are abnormal once-off events that should not impact on the long-term prospects of the company. For me the key is whether the Bananghalig deposit has a large enough Resource base, and whether it will be mined, as this will determine whether MML can grow from a junior to a mid-tier producer.

The advantage that SLR offers is that it already has a second mine that has progressed further in the development phase, and will commence production earlier. Though there are two things that concern me at this stage. The first being the relatively high operating costs that make SLR far more sensitive to gold price volatility. And the second is the company’s cash flow, and in particular its requirement for capital raisings to fund exploration and development activities. Having said that, forecast EPS Growth is 217%, and I expect that this should improve cash flow over the coming few years. Further to this, as with MML, the management team appears to have significant experience behind it, and in SLR’s case I noted that all the Directors hold significant shareholdings in the company, each owning over 4 million fully paid ordinary shares each.

But is either of these companies truly extraordinary? What does this mean? Well Chapter 5 in Value.able tells me that in an extraordinary business I must find the following factors; Bright long-term prospects, high Return on Equity driven by sustainable competitive advantage, solid cash flow, little or no debt, and first-class management. I think that MML comes closest to meeting all these factors, but others might disagree. The key factor for me is having a sustainable competitive advantage. In the Co-O mine they are sitting on a Resource that could last over 25 years, is extraordinarily low in operating cost, and could generate an enormous amount of cash that could easily fund future expansions, and perhaps even acquisitions. In a business that can be highly capital-intensive, the ability to fund exploration and development with cash flow rather than capital raisings and debt is a great advantage. The question mark of course is how sustainable this will be. And of course, I am no Geologist! What I do know is that this is a fundamentally healthy and profitable business, and despite this, the market is significantly undervaluing it. If I were to invest in this business, I would need to accept that there is level of risk involved, but by buying it at a significant margin of safety, and allocating such an investment in a reasonable manner within my portfolio, I think this risk could be significantly reduced.

POD’s (points of discussion):

1. Has gold’s bull run come to an end, or will it rise to new highs?

2. In your opinion, do MML or SLR have any sustainable competitive advantage?

3. What are the benefits/risks of mining in the Philippines versus Australia?

Since writing this post there have been a number of key announcements made by each company. Their share price’s and safety margins have also changed. Most notably, MML has now downgraded its 2012FY production guidance to 75,000 ounces, citing delays due to effects of tropical storms and torrential rain in December 2011 and January 2012. Also, SLR has announced a the acquisition of Phillips River Mining.

LINKS:

Skaffold

www.skaffold.com

World Gold Council

www.gold.org

JORC

www.jorc.org

DISCLOSURE:

I do not hold any shares in any of the companies mentioned in this blog post.