To visit the February 2026 reporting season calendar Click here .

-

Dividends do not make a good company – Part 2

Roger Montgomery

November 9, 2023

With annual general meeting (AGM) season underway, what is becoming clear, yet again, is that great managers are good at two things. The first is running the business, the second is allocating capital. Some might be able to run a business, but many managers are incompetent at allocating capital. Continue…

by Roger Montgomery Posted in Investing Education, Market commentary.

- 2 Comments

- save this article

- 2

- POSTED IN Investing Education, Market commentary.

-

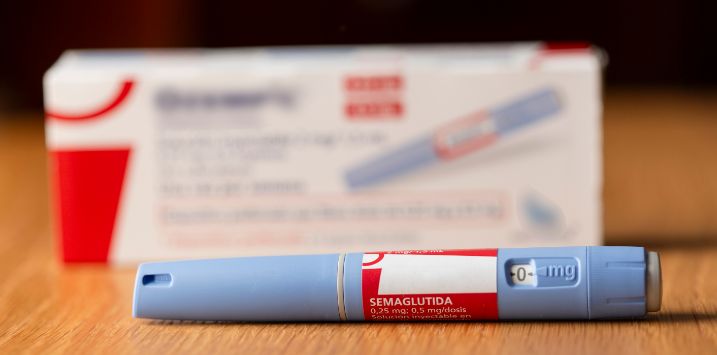

The market’s “weighty” overreaction

Roger Montgomery

November 8, 2023

Markets often resemble their participants, and the stock market is particularly vulnerable to the human psyche, prone to bouts of elation and despondency with each new trend. The recent euphoria surrounding a novel class of weight-loss and diabetes management drugs is a textbook example of this phenomenon. Continue…

by Roger Montgomery Posted in Companies, Editor's Pick, Health Care, Market commentary.

- save this article

- POSTED IN Companies, Editor's Pick, Health Care, Market commentary.

-

Why are property prices surging as rates are rising?

Roger Montgomery

November 8, 2023

In the thriving metropolises of Australia, the real estate horizon is gleaming brighter than ever. House prices have surpassed previous highs, putting a final nail in the coffin of those pessimistic forecasters who predicted 25-30 per cent declines. Continue…

by Roger Montgomery Posted in Editor's Pick, Market commentary, Property.

- save this article

- POSTED IN Editor's Pick, Market commentary, Property.

-

MEDIA

ABC The Business – Insights into Wesptac’s performance, RBA meeting, and Newcrest mining takeover

Roger Montgomery

November 7, 2023

During my recent interview on ABC’s The Business with Kirsten Aiken, I delved into several key topics. We explored Westpac’s (ASX: WBC) recent financial results, highlighting an overall improvement for the year, albeit with a slight decline from their first-half results. Additionally, we discussed the outlook in the context of the Reserve Bank of Australia’s (RBA) meeting and the consensus regarding potential rate increases. Furthermore, we touched upon the noteworthy takeover of Newcrest Mining by Newmont. Continue…

by Roger Montgomery Posted in Companies, Market commentary, TV Appearances.

- save this article

- POSTED IN Companies, Market commentary, TV Appearances.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Private Credit: Where collateral is king

Dean Curnow

November 7, 2023

Private credit, in your author’s opinion, will feature in the top ten most used investment phrases for 2023. My BBQ conversations on weekends this year have gone from penny stock recommendations to weird and wonderful ways to get exposure to private markets, notably through credit. Continue…

by Dean Curnow Posted in Investing Education, Market commentary.

- save this article

- POSTED IN Investing Education, Market commentary.

-

Pressure from the IMF to raise rates further

Brett Craig

November 6, 2023

The International Monetary Fund (IMF) have called on the Reserve Bank of Australia (RBA) to raise interest rates further. Continue…

by Brett Craig Posted in Aura Group, Market commentary.

- save this article

- POSTED IN Aura Group, Market commentary.

-

Dividends do not make a good company – Part 1

Roger Montgomery

November 6, 2023

I once relished receiving my dividend when they were sent as cheques in the mail. I liked tearing along that perforated line and took delight in those that were especially large in comparison to the price I had paid for the shares. I remember my shares in Fleetwood, whose dividend cheques were equal to 20 to 27 per cent of the investment I made. How silly of me then to ever hold a view about dividends that would cut out the fun of opening those innocuous, white, windowed envelopes that arrived the letter box twice a year. Continue…

by Roger Montgomery Posted in Investing Education, Market commentary.

- save this article

- POSTED IN Investing Education, Market commentary.

-

MEDIA

Ausbiz – Does the recent rally have legs?

Roger Montgomery

November 3, 2023

In this week’s interview with Ausbiz, I wanted to discuss the potential for a continued equity rally. I cited a report from a Canaccord strategist who believes the environment does set the stage for a further rally. This is partly because, in the strategist’s view, the U.S. economy will slow down very rapidly. In fact, they put the probability of a recession at 99.9 per cent, and with stocks outside of the Magnificent Seven already lower – the U.S. Bank equity index has already been smashed by 50 per cent – it’s way too late to be negative now. So is the bad news already priced in? Watch the full interview here Ausbiz – Does the recent rally have legs?

by Roger Montgomery Posted in Market commentary, TV Appearances.

- save this article

- POSTED IN Market commentary, TV Appearances.