To visit the February 2026 reporting season calendar Click here .

-

MEDIA

Ausbiz – The market’s ‘weighty’ overreaction…

Roger Montgomery

November 13, 2023

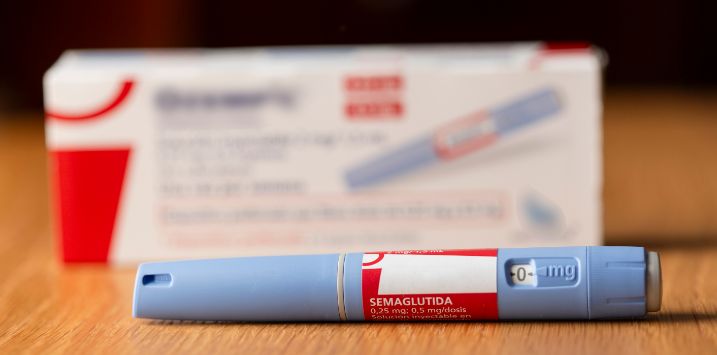

In last week’s Ausbiz interview, I explored investor sentiment surrounding the latest GLP-1 medications, specifically on Ozempic and its implications for companies like CSL (ASX: CSL) and ResMed (ASX: RMD). While the drop in CSL’s share value suggests market concerns about competing Ozempic-style drugs, I argue that these anxieties may be unfounded. My perspective rests on the belief that such medications might not be as transformative in addressing the weight of the U.S. population as investors might anticipate and the affordability surrounding it. Watch the full interview here. Ausbiz – The market’s ‘weighty’ overreaction… Continue…

by Roger Montgomery Posted in Companies, Market commentary, TV Appearances.

- save this article

- POSTED IN Companies, Market commentary, TV Appearances.

-

Would you like some sugar with your mortgage?

Roger Montgomery

November 13, 2023

The Reserve Bank of Australia’s (RBA) latest rate rise has serious consequences for consumers and investors. There can be no argument that the RBA’s battle against inflation dominates investment commentary. Continue…

by Roger Montgomery Posted in Economics, Global markets, Market commentary.

- save this article

- POSTED IN Economics, Global markets, Market commentary.

-

MEDIA

Nabtrade Your Wealth – The bucket strategy – a research-based plan for protecting your wealth in retirement

Roger Montgomery

November 10, 2023

I had the pleasure of joining Gemma Dale on Nabtrade’s Your Wealth podcast where we discussed the bucket strategy, its development and how it works, the simple methods for limiting the downside when you’re no longer working, the importance of investing for the short, medium and long term in retirement, and the tips and strategies for making the most of your accumulated wealth. Have a listen to the full podcast below.

by Roger Montgomery Posted in Podcast Channel.

- save this article

- POSTED IN Podcast Channel.

-

Australia leads the world in the annual pace of disposable income decline

Roger Montgomery

November 10, 2023

In its fight against persistent inflation, the Reserve Bank of Australia (RBA) has just introduced its 13th rate hike in this cycle at the same the financial strain on Australian households intensifies. According to a disturbing report published in The Australian Financial Review (AFR) this week, the Organisation for Economic Co-operation and Development (OECD) has discovered Australia leads the world in the annual pace of disposable income declines globally. Continue…

by Roger Montgomery Posted in Economics, Market commentary.

- save this article

- POSTED IN Economics, Market commentary.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Finding stability in uncertain times: private credit’s status grows

Roger Montgomery

November 10, 2023

In the current financial climate, retirees and those approaching retirement are often caught between the Scylla and Charybdis of relatively low-interest rates and equity market volatility. The quest for a stable income solution has never been more pressing. Continue…

by Roger Montgomery Posted in Aura Group, Market commentary.

- save this article

- POSTED IN Aura Group, Market commentary.

-

MEDIA

Firstlinks – Why the ASX 200 has gone nowhere in 16 years

Roger Montgomery

November 9, 2023

In my recent article with Firstlinks, I wanted to highlight why the S&P/ASX 200 has shown minimal capital gain over the past 16 years, with only a 0.02 per cent total capital gain and an annualised capital gain of 0.00182 per cent per annum. The main reason as to why this is the case, dividends. Continue…

by Roger Montgomery Posted in On the Internet.

- READ ONLINE

- save this article

- POSTED IN On the Internet.

-

Dividends do not make a good company – Part 2

Roger Montgomery

November 9, 2023

With annual general meeting (AGM) season underway, what is becoming clear, yet again, is that great managers are good at two things. The first is running the business, the second is allocating capital. Some might be able to run a business, but many managers are incompetent at allocating capital. Continue…

by Roger Montgomery Posted in Investing Education, Market commentary.

- 2 Comments

- save this article

- 2

- POSTED IN Investing Education, Market commentary.

-

The market’s “weighty” overreaction

Roger Montgomery

November 8, 2023

Markets often resemble their participants, and the stock market is particularly vulnerable to the human psyche, prone to bouts of elation and despondency with each new trend. The recent euphoria surrounding a novel class of weight-loss and diabetes management drugs is a textbook example of this phenomenon. Continue…

by Roger Montgomery Posted in Companies, Editor's Pick, Health Care, Market commentary.

- save this article

- POSTED IN Companies, Editor's Pick, Health Care, Market commentary.