To visit the February 2026 reporting season calendar Click here .

-

Aura High Yield SME Fund: Low dispersion of returns and no negative months (to date)

David Buckland

December 13, 2023

The standard deviation, or measure of the amount of variation, of the S&P/ASX 300 Accumulation Index over the period between 1 August 2017 and 31 October 2023 was 15.2 per cent. One standard deviation (or plus or minus 15.2 per cent) means the dispersion around the average occurs 68 per cent of the time, whilst two standard deviations (or plus or minus 30.4 per cent) means the dispersion around the average occurs 95 per cent of the time. Continue…

by David Buckland Posted in Market commentary.

- 8 Comments

- save this article

- 8

- POSTED IN Market commentary.

-

Are small caps finally taking off?

Roger Montgomery

December 12, 2023

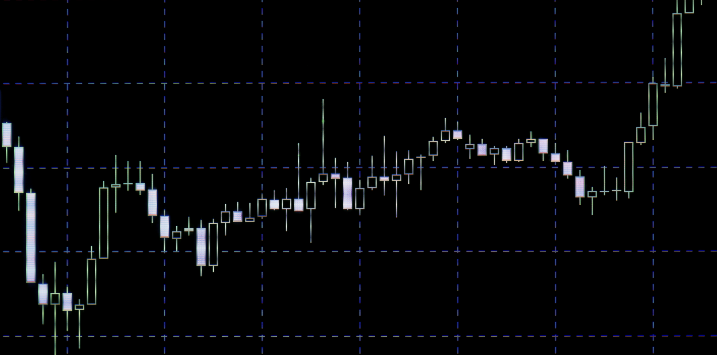

Back in July, I wrote about the historically large gap between large and small-cap companies, noting that the extremely narrow rally in the largest technology companies, now more commonly referred to as the Magnificent Seven, resulted in many smaller caps being relatively undervalued. The highest-quality names with earnings growth may present a compelling opportunity, especially if professional investors conclude the macroeconomic and interest-rate backdrop is supportive. Continue…

by Roger Montgomery Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary.

-

The interest rate conundrum: Conflicting forecasts from banking giants

Roger Montgomery

December 11, 2023

In this week’s video insight I wanted to discuss the contrasting predictions from Australia’s major banks regarding interest rates, painting a nuanced picture of the economic landscape. Shayne Elliott from ANZ anticipates sustained rate hikes amid escalating growth pressures. In contrast, NAB’s Ross McEwan suggests rates might have peaked, while CBA hints at a possible rate cut. These varied perspectives hold significant implications for households with mortgages and investors. Continue…

by Roger Montgomery Posted in Economics, Video Insights.

- watch video

- save this article

- POSTED IN Economics, Video Insights.

-

What can we expect from stocks and bonds in 2024?

Roger Montgomery

December 8, 2023

Since late October, financial markets have witnessed a significant shift, adjusting to a softer labour market and persistent disinflation. As an aside, the latter – disinflation – was a condition we wrote about a year ago, suggesting it should support the share prices of innovative growth companies, especially those with pricing power. Continue…

by Roger Montgomery Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Could deflation be the next surprise?

Roger Montgomery

December 7, 2023

After the well-documented U.S. money printing spree of 2020-21, something interesting happened in the U.S.: Inflation started picking up in 2021-2022. Just as it takes time for water to fill a bucket, it took time for inflation to emerge, but when it did, annualised inflation averaged 7.7 per cent for 18 months from January 2021 to July 2022 (Figure 1). Continue…

by Roger Montgomery Posted in Companies, Global markets, Market commentary.

- 2 Comments

- save this article

- 2

- POSTED IN Companies, Global markets, Market commentary.

-

Except for AI, private equity and VC investors are sitting on the sidelines

Roger Montgomery

December 6, 2023

Private market data provider Pitchbook recently released their quarterly Emerging Technology Indicator (ETI) insights, revealing the subsectors in which private equity deals, and angel, seed, and early-stage venture capital (VC) fund-raising rounds are being completed. Continue…

by Roger Montgomery Posted in Market commentary.

- save this article

- POSTED IN Market commentary.

-

Worried about rising rates creating choppy conditions? Not everyone is in the same boat

Roger Montgomery

December 5, 2023

Investors in the Aura High Yield SME Fund (for wholesale investors) have experienced returns of 9.61 per cent per annum, since inception, earning monthly cash income with no negative months nor loss of capital. *

In a world where the interest rate tide has been rising, savvy investors are sailing towards more stable horizons. The Aura High Yield SME Fund, designed for wholesale investors, has emerged as a beacon of consistent returns, offering a compelling case for investors looking to diversify their portfolios away from volatile seas. Continue…

by Roger Montgomery Posted in Aura Group.

- save this article

- POSTED IN Aura Group.

-

Analysing Australia’s October CPI: Unexpected trends

Brett Craig

December 4, 2023

The latest monthly consumer price index (CPI) read released last week, came in unexpectedly lower than anticipated, at 4.9 per cent in the 12 months to October. This follows the previous read of 5.6 per cent in September. With the 8.4 per cent peak recorded in December, inflation is continuing to follow a downward trend off the back of the Reserve Bank of Australia’s (RBA) best efforts to raise interest rates in order to achieve a slowdown in inflation. Continue…

by Brett Craig Posted in Aura Group.

- save this article

- POSTED IN Aura Group.