Except for AI, private equity and VC investors are sitting on the sidelines

Private market data provider Pitchbook recently released their quarterly Emerging Technology Indicator (ETI) insights, revealing the subsectors in which private equity deals, and angel, seed, and early-stage venture capital (VC) fund-raising rounds are being completed.

Investors might also see the list as a prelude to the types of ETI companies that will come to the public markets via initial public offerings (IPO) in years since. The companies mentioned, especially those raising larger amounts, may be the ones to watch in the future.

Perhaps unsurprisingly, AI features heavily in the deals completed in the third quarter ending September 30.

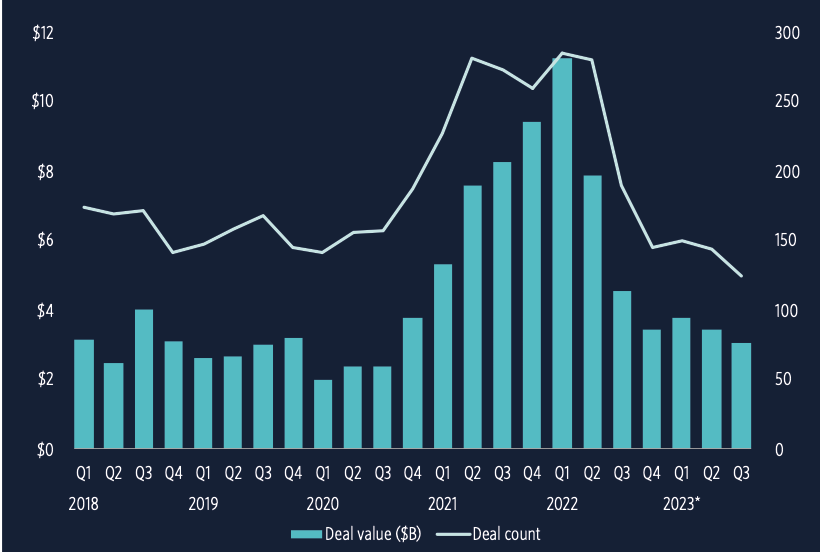

According to Pitchbook, however, the third quarter of 2023 witnessed a notable downturn in ETI deal activity, dropping to $3 billion across 124 transactions, a decline from the previous quarter’s $3.4 billion involving 143 deals.

This trend of reduced activity has persisted since early 2022 and could be a function of the substantial fall in public market multiples, which private companies and price earnings (PE) firms would have to reflect in valuations if they conducted deals.

For context, the September quarter’s deals reflect a 73.2 per cent decrease in deal count and a significant 56.3 per cent dip in deal value when measured against the peak of the first quarter of calendar 2022.

Figure 1. ETI deal activity (quarterly)

Source: Pitchbook Emerging Tech Research

Source: Pitchbook Emerging Tech Research

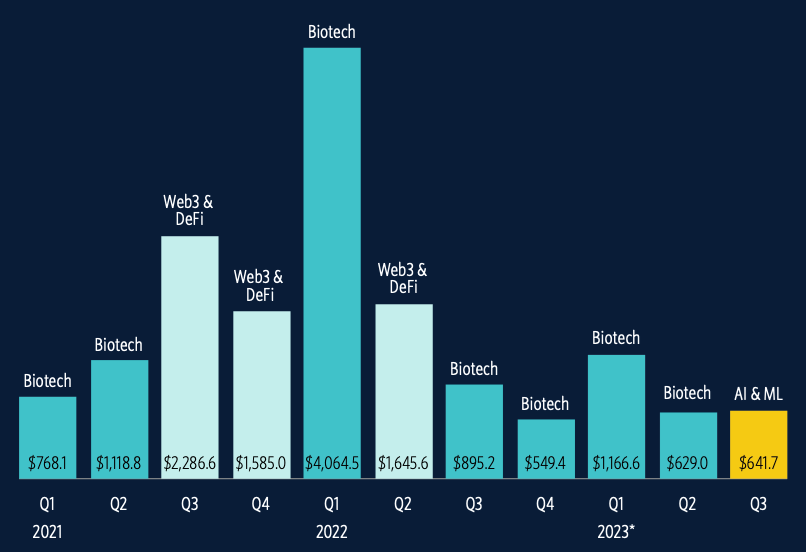

Pitchbook reports that, within the investment landscape, Artificial Intelligence (AI) and Machine Learning (ML) continued to dominate, commanding a substantial $641.7 million across 16 deals. Biotechnology followed closely behind, amassing U.S.$580 million across six transactions, while Healthtech and Wellness secured U.S.$248.4 million through 13 deals. Fintech and infosec sectors were also significant contributors, with U.S.$237.3 million across 17 deals and U.S.$153 million across six deals, respectively.

The number of large-scale deals normalised during Q3, with only six ETI deals surpassing the U.S.$100 million mark. This marks a slight reduction from the eight deals observed in the previous quarter but remains consistent with the historical average of six such deals.

Figure 2. Top ETI segments by deal value globally (U.S.$ million)

Source: Pitchbook Emerging Technology Research

Source: Pitchbook Emerging Technology Research

This heightened activity in AI and machine learnings owes much of its vitality to the remarkable strides in generative AI we have reported on here at the blog. However, it’s noteworthy that most transactions in the September quarter centred around machine learning operations and the meticulous management of data, rather than the creation of content.

Pitchbook reported a notable transaction was Helsing successfully securing U.S.$225.9 million in a Series B funding round, catapulting the company’s valuation to U.S.$1.9 billion. Helsing specializes in an AI-driven defence data integration platform, signalling continued faith in the defence sector embracing AI technologies.

In parallel Poolside, a platform dedicated to software development for AI deployment, raised U.S.$126 million in a seed funding round. Additionally, Modular, with its focus on AI model development software, achieved a notable milestone by securing U.S.$100 million in a Series B round, boasting a post-investment valuation of U.S.$600 million. This surge in investment underscores the growing enthusiasm among investors for tools that facilitate the democratisation of AI development.

Elsewhere, Pitchbook reported that MindsDB attracted substantial attention with U.S.$46.5 million secured in a seed funding round, reflecting confidence in the demand for accessible predictive analytics tools in the decision-making landscape. Duckbill, through its unique blend of AI and human-assisted management services, successfully closed a Series A round, amassing U.S.$33 million and accentuating the hybrid approach of combining AI capabilities with human expertise.

Meanwhile Replicate, specializing in a Python library tailored for machine learning version control, raised U.S.$32.5 million in early-stage venture capital, illuminating the burgeoning demand for tools that streamline the intricacies of ML operations. Finally, Cleanlab’s commitment to enhancing data quality through AI garnered U.S.$25 million in a Series A funding round, leading to a valuation of U.S.$100 million. This particular transaction underscores the pivotal role that high-quality data plays in the effectiveness of AI applications.

In Australia, stock market investors and their advisers appear to be sitting on the sidelines, perhaps awaiting clarity about the direction of the economy, inflation and interest rates. Globally, given the substantial decline in deal count and deal value since the peak in 2022, it seems private equity and VC investors are doing the same. One exception seems to be AI and ML, hinting at the makeup of future IPOs.

You can keep up to date with global private equity and VC deals on Pitchbook.