To visit the February 2026 reporting season calendar Click here .

-

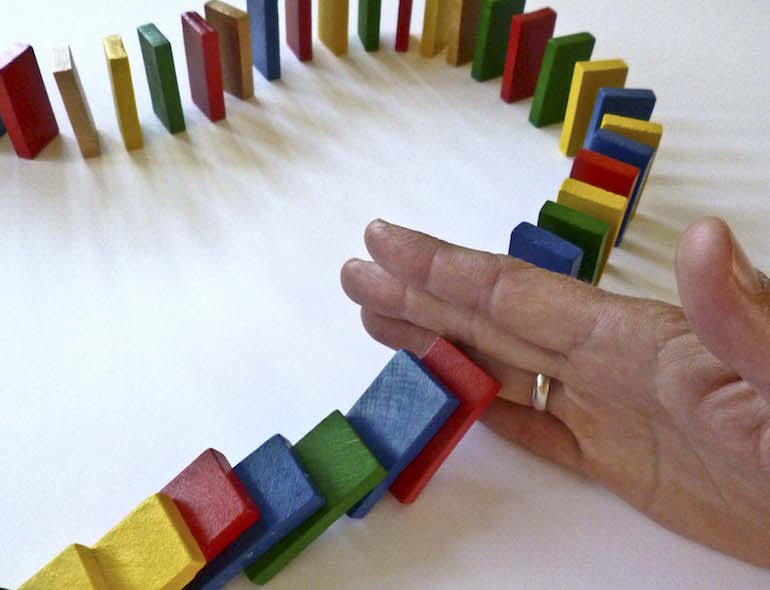

How you can become a ‘superforecaster’

Ben MacNevin

August 14, 2017

According to the renowned US researcher, Philip Tetlock, elite forecasters (or ‘superforecasters’) have two traits in common. First, they update their forecasts more often than other forecasters. Second, they update in smaller increments. His findings have important implications for all long-term investors wanting to sharpen their forecasting skills. Continue…

by Ben MacNevin Posted in Investing Education.

- save this article

- POSTED IN Investing Education.

-

The disruption with forever consequences

Roger Montgomery

August 11, 2017

By now, we’re all well versed on the subject of Amazon disrupting retail, Aldi disrupting supermarkets and fintechs disrupting banking (admittedly to a significantly lesser extent). However, the most significant disruption is occurring right under our noses without us really noticing. Continue…

by Roger Montgomery Posted in Market commentary.

- 13 Comments

- save this article

- 13

- POSTED IN Market commentary.

-

Is there hidden upside in Carsales?

Tim Kelley

August 11, 2017

Carsales.com (ASX:CAR) has enjoyed a strong run since floating in 2009 at $3.50 per share and it’s a business we’ve held in high regard for some time. Continue…

by Tim Kelley Posted in Companies.

- save this article

- POSTED IN Companies.

-

Time for caution as the Dow hits 22,000

David Buckland

August 10, 2017

In just five years, spurred on by emergency low interest rates, the Dow Jones Industrial Average has raced from around 13,000 to 22,000 points. Little wonder some market analysts are saying US stocks are now in ‘nose-bleed’ territory. And this is borne out by key valuation indicators. Continue…

by David Buckland Posted in Market commentary.

- 1 Comments

- save this article

- 1

- POSTED IN Market commentary.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

-

MEDIA

Money News 08.08.2017

Roger Montgomery

August 9, 2017

Roger Montgomery joined Ross Greenwood on Money News to discuss the reporting season and the current accusations against Commonwealth Bank and if they will impact its share price.

by Roger Montgomery Posted in Radio.

- LISTEN

- save this article

- POSTED IN Radio.

-

REA’s profits will keep growing even if property falls

Roger Montgomery

August 9, 2017

Conventional wisdom would suggest that, in a softening property market, any company exposed to property will suffer operationally. While that might be true for developers and builders, it might not be true for REA Group. Continue…

by Roger Montgomery Posted in Property.

- save this article

- POSTED IN Property.

-

How the market misinterpreted Resmed’s results

Andreas Lundberg

August 8, 2017

In this week’s video insight Andreas discusses Resmed’s results and how the market sometimes acts irrationally to new information which can present opportunities.

by Andreas Lundberg Posted in Editor's Pick, Video Insights.

- save this article

- POSTED IN Editor's Pick, Video Insights.