Time for caution as the Dow hits 22,000

In just five years, spurred on by emergency low interest rates, the Dow Jones Industrial Average has raced from around 13,000 to 22,000 points. Little wonder some market analysts are saying US stocks are now in ‘nose-bleed’ territory. And this is borne out by key valuation indicators.

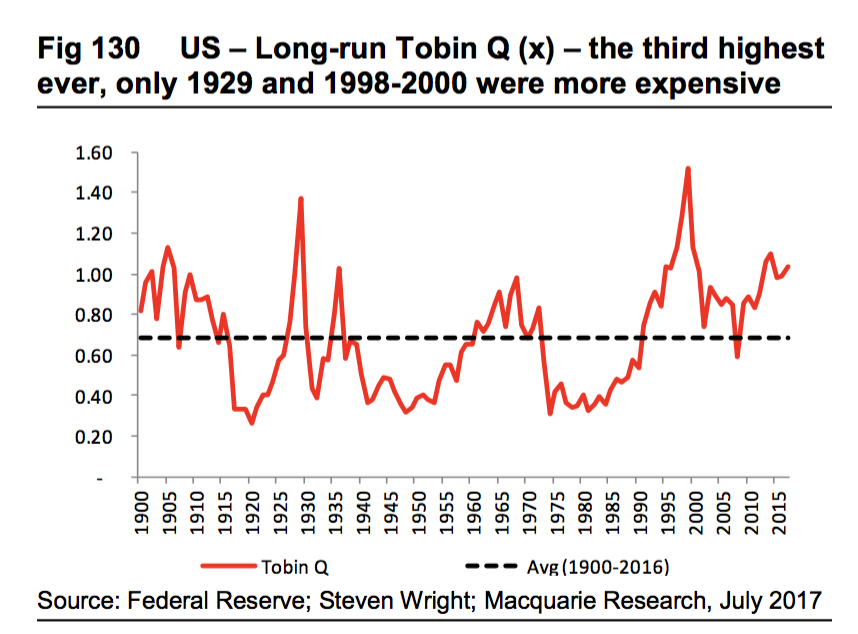

- Tobin Q Ratio

Given stocks represent a title to the ownership of real assets, they should, if fairly valued in a competitive economy, have a market value equal to their cost of production. Q is the ratio of the market value of companies (net of debt) to the replacement cost of their assets. Nobel Laureate James Tobin’s “A general equilibrium approach to monetary theory”, Journal of Money, Credit and Banking, demonstrated the relationship between market value and replacement cost of assets.

The Tobin Q ratio is at the third highest level in 120 years, only exceeded in 1929 and 1998-2000, and compares with the historical average of 0.69.

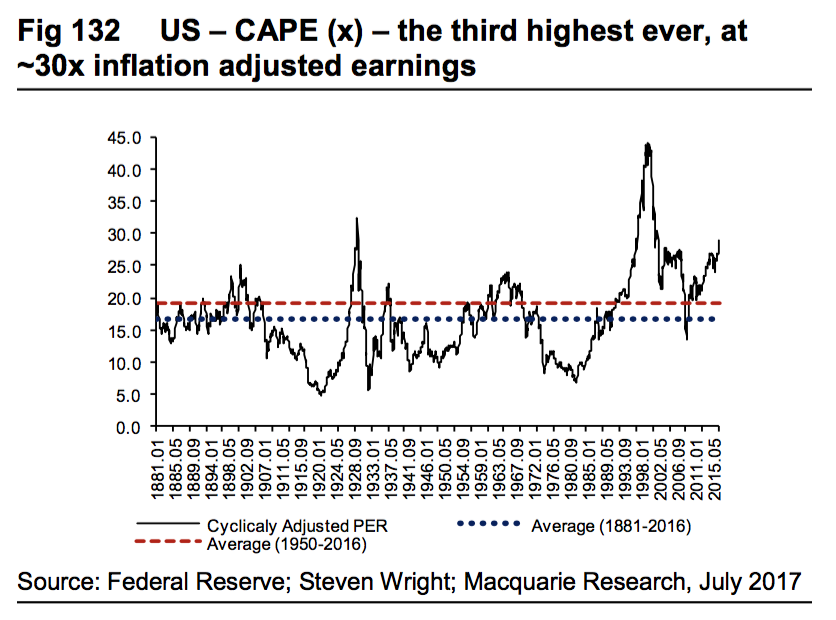

- Shiller CAPE

The Shiller Cyclically Adjusted PE (CAPE) allows for the cyclical fluctuations in profits and takes the average of the past ten years of earnings. Eminent Yale economist Robert Shiller (2000), explains this in his book Irrational Exuberance.

After hitting 32X in 1929 and exceeding 40X in 2000, CAPE is now trading at 30 times, the third highest level since 1881. The average in the past 135 years is 16.7X and the average since 1950 is around 19X.

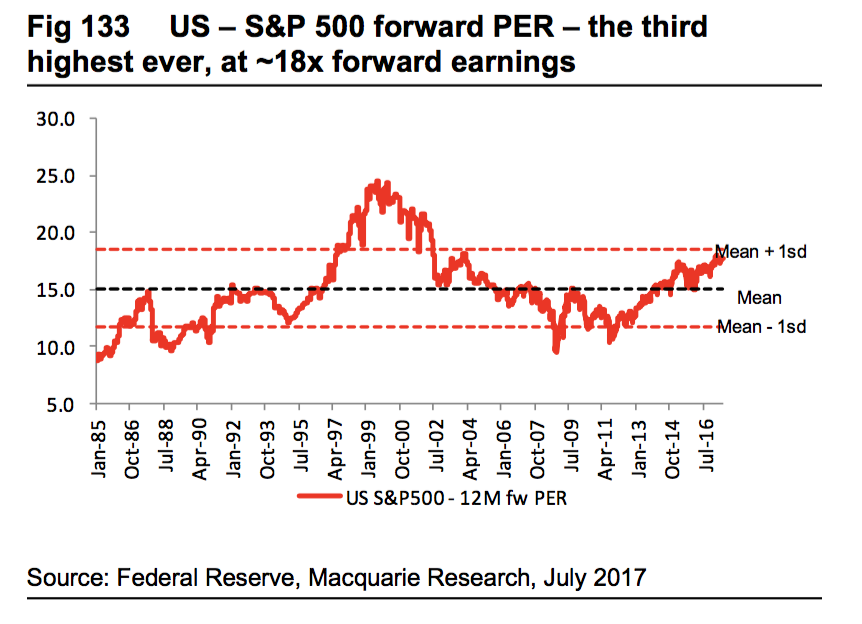

- Forward PE

While I believe this indicator has quite shaky foundations – the forward PE may look very expensive in the middle of a very deep recession or may look cheap when a company/ sector is “over-earning” – the S&P 500 is currently trading at 18X prospective earnings versus its long-term average of 15X.

While many commentators argue US companies generally are “over-earning” relative to “labour”, this is unlikely to go on for an extended length of time without a lot of “weak competitors” falling by the wayside.

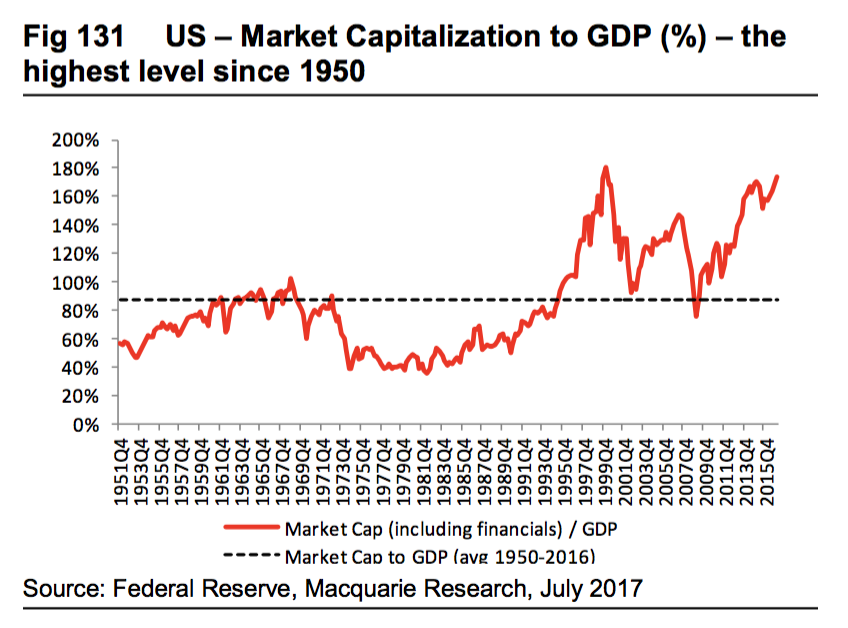

- Market Capitalisation to GDP Ratio

The US equity market total capitalisation to GDP ratio is now trading at its highest level since 1950 at 175 per cent (or closer to 130 per cent of GDP for non-financial businesses). The historical average (including financials) is 87 per cent of GDP.

While it is impossible to predict the factors likely to cause a mean reversion, or when they will occur, some caution is clearly warranted.

Paul

:

Hi David,

it’s interesting to note that the charts seem to indicate reasonably “safe times” just prior to “Black Monday 1987”, but are accurate earlier in the 1970’s when stocks were in fact “cheap”.