Is the market rally built to last? WATCH THE LATEST VIDEO INSIGHT HERE.

-

Is there more weakness ahead for discretionary retailers?

Roger Montgomery

July 2, 2019

Since we alerted investors some two years ago that an oversupply of property would ultimately result in a collapse of activity in residential construction, additional nails have been hammered into the fortunes for companies exposed to housing and retailing. Continue…

by Roger Montgomery Posted in Consumer discretionary, Property.

- save this article

- POSTED IN Consumer discretionary, Property.

-

Tough times for quantitative managers

Tim Kelley

July 2, 2019

Anyone following the financial media will probably know that the going has been tough for active managers recently, with only a smallish minority managing to outperform the market. Continue…

by Tim Kelley Posted in Market commentary.

- 2 Comments

- save this article

- 2

- POSTED IN Market commentary.

-

Farewell Fiscal 2019, Hello Fiscal 2020

David Buckland

July 1, 2019

As fiscal 2019 has drawn to a close, let’s take a look at the year that was. In sporting parlance, it was definitely “a game of two halves.” Virtually all major indexes declined in the December 2018 half-year, however this proved temporary and the recovery in the June 2019 half-year was quite extraordinary. Continue…

by David Buckland Posted in Editor's Pick, Market commentary.

- 2 Comments

- save this article

- 2

- POSTED IN Editor's Pick, Market commentary.

-

Caltex under the pump

Joseph Kim

July 1, 2019

The 20 June announcement by Caltex clearly caught the market by surprise, let’s look at the evolving landscape in Australian petrol retailing, the competitive dynamics and how this has impacted Caltex’s profit and share price. Continue…

by Joseph Kim Posted in Companies, Consumer discretionary.

- save this article

- POSTED IN Companies, Consumer discretionary.

-

Discover how to value the best stocks and buy them for less than they’re worth.

NOW FOR JUST $49.95

buy nowSUBSCRIBERS RECEIVE 20% OFF WHEN THEY SIGN UP

“This is a book you simply must read.

The very best investors in the world are “value” investors.” -

Recently listed US tech stocks about to face their moment of truth

Roger Montgomery

June 28, 2019

Many high-profile US tech companies – like Uber, Pinterest and Lyft – are about to see the expiry of their share lockups, which are akin to our escrows. If the past is anything to go by, this should lead to some precipitous share price falls. Continue…

by Roger Montgomery Posted in Companies, Technology & Telecommunications.

-

MEDIA

Why are so many equity investors bearish about property?

Roger Montgomery

June 27, 2019

Veronica Morgan & Chris Bates host the The Elephant In The Room Property Podcast with Roger joining to discuss how to apply the principles of value investing to the property market. Listen here. (60 minutes)

Here’s a snapshot of what you’ll learn from listening:

-

How to identify the 3 phases to a boom in the market.

-

Why a focus on the calibre of any asset is so important.

-

How to apply the principles of value investing to a property purchase.

-

What happens to prices when population growth in Australia is underestimated.

-

Why access to credit & interest rates are the ultimate driver of asset price.

-

When you know what something is worth, you know when you are paying too much!

-

What is the impact on property prices with a slow down in construction?

by Roger Montgomery Posted in Podcast Channel, Radio.

- save this article

- POSTED IN Podcast Channel, Radio.

-

-

-

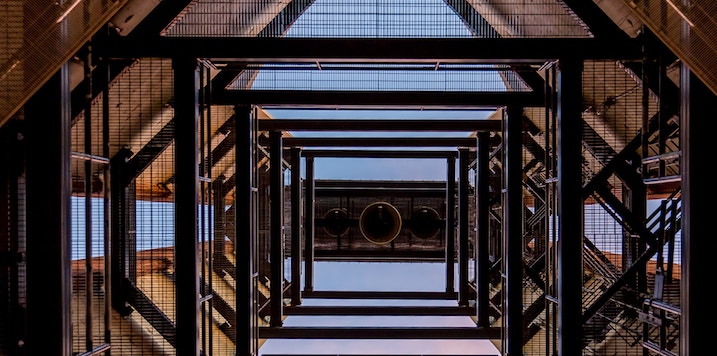

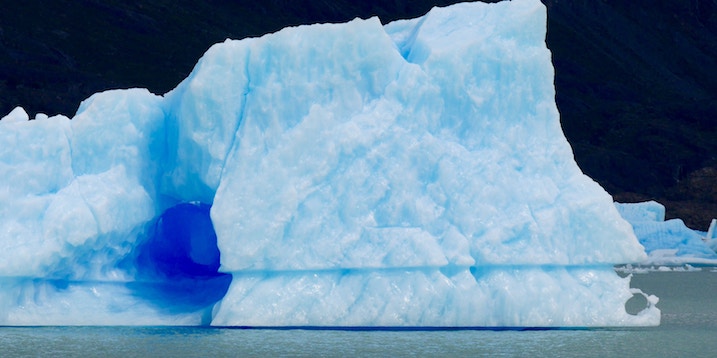

Who should pay when your apartment block ‘moves in a downward motion’?

Andreas Lundberg

June 27, 2019

The recent, and well reported, examples of shoddy construction practices on high rise buildings have led some experts to warn that this is just the tip of the iceberg. The question for society is: who is responsible, and who should pay the costs of rectification? Continue…

by Andreas Lundberg Posted in Market commentary.

- 3 Comments

- save this article

- 3

- POSTED IN Market commentary.