Value.able

-

How close for Europe?

Roger Montgomery

May 27, 2012

Important viewing for the start of the week. Here’s the link if you’d like to view it at its source: http://www.cbc.ca/video/swf/UberPlayer.swf?state=sharevideo&clipId=2239470660&width=480&height=322

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 27 May 2012.

by Roger Montgomery Posted in Value.able.

- 10 Comments

- save this article

- POSTED IN Value.able

-

My…Err?

Roger Montgomery

May 27, 2012

Investors don’t have to have astronomic IQ’s and be able to dissect the entrails of a million microcap startups to do well. You only need to be able to avoid the disasters.

In an oft-quoted statistic, after you lose 50% of your funds, you have to make 100% return on the remaining capital just to get back to break even. This is the simple reasoning behind Buffett’s two rules of investing. Rule number 1 don’t lose money (a reference to permanent capital impairment) and Rule Number 2) Don’t forget rule number 1! Its also the premise behind the reason why built Skaffold.

Avoiding those companies that will permanently impair your wealth either by a) sticking to high quality, b) avoiding low quality or c) getting out when the facts change, can help ensure your portfolio is protected. Forget the mantra of “high yielding businesses that pay fully franked yields” – there’s no such thing. That’s a marketing gimmic used by some managers and advisers to attract that bulging cohort of the population – the baby boomers – who are retiring en masse and seeking income.

Think about it; How many businesses owners would speak about their business in those terms? “Hi my name is Dave. I own an online condiments aggregator – ‘its a high yielding business that pays a fully franked yield’. You will NEVER hear that from a business owner. That only comes from the stock market and from those who have never owned or run a business.

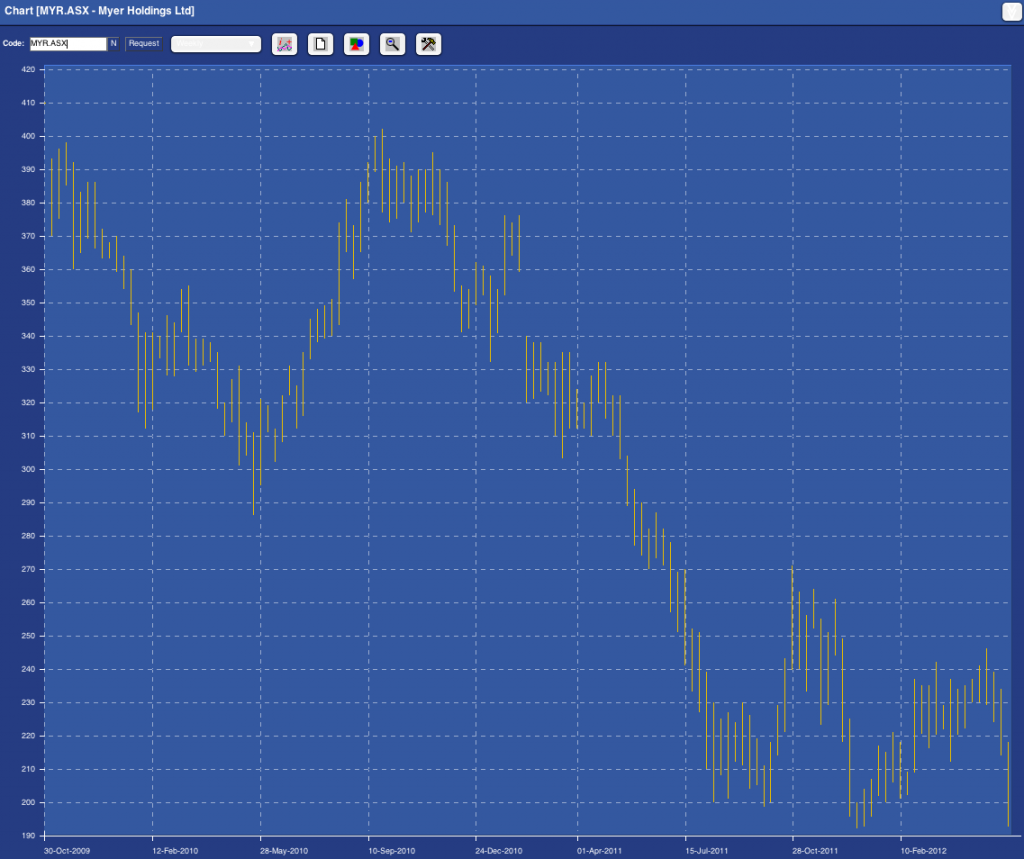

They key is not to think about stocks or talk stock jargon. Just focus on the business. Thats what we did when Myer floated in 2009. And with the market value of Myer now 50% lower than the heady days of its float, it might be instructive to revisit the column I wrote back on 30 September 2009, when I reviewed the Myer Float.

And sure, you can say that the slump in retail is the reason for the slump in the share price of Myer (I am certainy one who believes that the dearth of really high quality companies means multi billion dollar fund managers are bereft of choice meaning that a recovery in the market will make all stocks rise – not because they are worth more but because fund managers have nothing else to buy). But the whole point of value investing is to make the purchase price so cheap that even if the worst case scenario transpires, you are left with an attractive return.

It would be equally instructive to review the reason why we didn’t buy the things that subsequently went well (QRN comes to mind) so we’ll leave that for a later date.

Here’s the column from September 2009:

“PORTFOLIO POINT: The enthusiasm surrounding the Myer float is good reason for a value investor to stay clear. So is the expected price.

With more than 140,000 investors registering for the IPO prospectus, everyone wants to know whether the float of the Myer department store group will be attractive. This week I want to focus exclusively on this historic offer.

At present it is suggested the stock will begin trading somewhere between $3.90 and $4.90.

The prospect of a stag profit draws a self-fulfilling crowd. But if chasing stag profits is your game, I would rather be your broker than your business partner, for history is littered with the remains of the enthusiasm surrounding popular large floats.

Popularity, you see, is not the investment bedfellow of a bargain and being interested in stocks when everyone else is does not lead to great returns. You cannot expect to buy what is popular, travel in the same direction as lemmings and generate extraordinary results. Conversely thumb-sucking produces equally unattractive returns.

Faced with these truisms, I lever my Myer One card, obtain a prospectus and open it for you.

The Myer float is one of the hottest of the year and I am not referring to the cover adorned by Jennifer Hawkins! If those 146,000 people who have apparently registered for a Myer prospectus were to invest just $20,000 at the requested price, the vendors will have their $2.8 billion plus the $100 million in float fees in the bag.

A word about the analysis: It is the same analysis I have used to buy The Reject Shop at $2.40 (today’s close $13.35), JB Hi-Fi at $8 ($19.86), Fleetwood at $3.50 ($8.75), to sell my Platinum Asset Management shares at more than $8 on the morning they listed (at $5), and to warn investors to get out of ABC Learning at $8 (they were 54¢ when ABC delisted in August 2008) and Eureka Report subscribers to get out of Wesfarmers as it acquired Coles.

I don’t list these to boast but merely to demonstrate the efficacy of the analysis; analysis that is equally applicable to existing issues and new ones.

By way of background, TPG/Newbridge and the Myer Family acquired Myer for $1.4 billion three years ago. They copped flack for paying too much, but “only” used $400 million of their own capital; the remainder was debt. Before the first anniversary, the Bourke Street, Melbourne, store was sold for $600 million and a clearance sale reduced inventory and netted $160 million. The excess cash allowed the new owners to reduce debt, pay a dividend of almost $200 million and a capital return of $360 million. Within a year the owners had recouped their capital and obtained a free ride on a business with $3 billion of revenue. Good work and smart.

But I am not being invited to pay $1.4 billion, which was 8.5 times EBIT. I am being asked to pay up to $2.9 billion, or more than 11 times forecast EBIT. And given the free “carry”, the bulk of the money raised will go to the vendors while I replace them as owners. Ownership is a very good incentive to drive the performance of individuals.

And driven they have been. In three years, $400 million has been spent on supply chain and IT improvements, eight distribution centres have been reduced to four and supply-chain costs have fallen 45%. Amid relatively stable gross profit margins, EBIT margins improvement to 7.2% and a forecast 7.8% reflect disciplined cost identification and management. Fifteen more stores are planned for the next five years and the prospectus notes that trading performance improved significantly in the second half of 2009 and into the first half of 2010. The key individuals have indeed performed impressively, but with less skin in the game they may not be incentivised as owners in future years as they have been in the past.

And what value have all these improvements created? The vendors would like to believe about $1.4 billion, and if the market is willing to pay them that price, they will have been vindicated, but price is not value and I am interested simply in buying things for less than what they are worth.

In estimating an intrinsic value for Myer, I will leave aside the fact that the balance sheet contains $350 million of purchased goodwill and $128 million of capitalised software costs. This latter item is allowed by accounting standards but results in accounts that don’t reflect economic reality. Historical pre-tax profits have thus been inflated.

I will also leave aside the fact that the 2009 numbers and 2010 forecasts have also been impacted by a number of adjustments, including the addition of sales made by concession operators “to provide a more appropriate reference when assessing profitability measures relative to sales”; the removal of the incentive payments to retain key staff – not regarded as ongoing costs to the business; costs associated with the gifting of shares to employees; and, most interestingly, the reversal of a write-off of $21 million in capitalised interest costs – all regarded as non-recurring.

Taking a net profit after tax figure for 2010 of $160 million and assuming a 75% fully franked payout, we arrive at an owners’ return on equity of about 28% on the stated equity of $738 million, equity that could have been higher after the float if $94 million in cash wasn’t also being taken out of retained profits. Using a 13% required return, I get a valuation of $2.90.

Looking at it another, albeit simplistic way, I am buying $738 million of equity that is generating 28%. If I pay the requested $2.9 billion for that equity or 3.9 times, I have to divide the return on equity by 3.9 times, which produces a simple return on “my” equity of 7.2%. For my money, it’s just not high enough for the risk of being in business.

Importantly, the return on equity – based on the simple assumptions that three stores, each generating $40 million in sales will be opened annually over the next five years and that borrowings will decline by $60 million in each of those years – should be maintained. But the end result is that the valuation only rises by 6% per year over the next five years and delivers a value in 2015 of $3.90: the price being asked today.

My piece of Myer seems a bit hot for My money.”

That was 2009. Has anything really changed? Has the following chart reveals. Myer is now trading at close to Skaffold’s current estimate of its intrinsic value. Before you get too excited (although the shortage of large listed high quality retailers means even this company’s shares may go up in a market or economy recovery) take a look at the pattern of intrinsic values in the past and the currently anticipated path of forecast intrinsic values; Past intrinsic values have been declining (generally undesirable unless forecasts for a recovery are correct) and forecast intrinsic values are flat.

Fig.1. Skaffold Myer Intrinsic Value Line

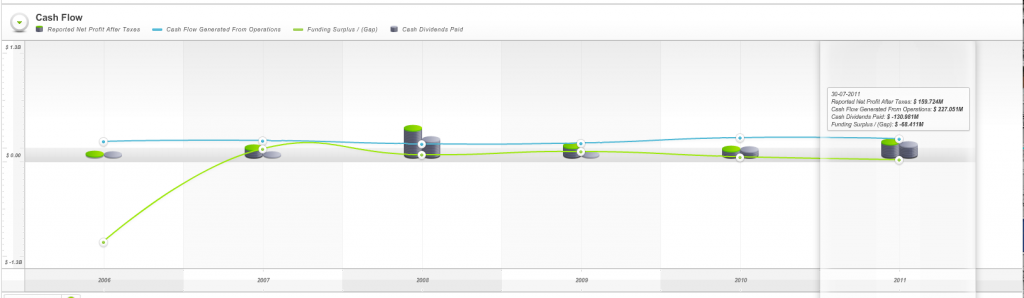

And as the Capital History chart reveals, 2014 profits are not expected to be better than 2010. That 4 years without profit growth. Question: Would you buy an unlisted business (as a going concern) that was not forecasting profit growth for four years?

Fig. 2. Skaffold Myer Capital History Chart

Finally the cash flow chart reveals the company has produced what Skaffold refers to as a Funding Gap. Its cash from operations have not been enough to cover the investments it has made in others or itself plus the dividends it has paid. In other words for 2010 and 2011, the two financial years it has registered as a listed company, it appears from Skaffold’s data that the company has had to dip into either 1) its own bank account, or 2) borrow more money or 3) raise capital (the three sources of funds available if a funding gap is produced) to cover this “gap”.

Fig. 3. Skaffold Myer Cash Flow Chart

I’d be interested to know if you are a loyal Myer shopper or not and why? If you don’t shop at Myer, why not? If you do shop at Myer, what do you like about the company, its stores and the experience? And I am particularly interested to hear from anyone who DOES NOT shop there but DOES own the stock!

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 27 May 2012.

by Roger Montgomery Posted in Companies, Consumer discretionary, Value.able.

-

MEDIA

Why does Roger Montgomery think Qantas’ accountants are so creative?

Roger Montgomery

May 23, 2012

Learn Roger’s Value.able insights into the recent Qantas corporate restructure in this discussion with Radio 2GB’s Ross Greenwoood broadcast on 23rd May 2012. Listen here.

by Roger Montgomery Posted in Investing Education, Radio, Value.able.

- save this article

- POSTED IN Investing Education, Radio, Value.able

-

MEDIA

What are Russell Muldoon’s Value.able Insights into Seven West Media and Qantas?

Roger Montgomery

May 22, 2012

Do Jumbo Interactive (JIN), Seven West Media (SWM), Matrix Composites (MCE), Toll Holdings (TOL), Blackmores (BKL), Seek (SEK), Silverlake resources (SLR), Paladin Energy (PDN) and Qantas (QAN) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 22 May 2012 to find out. Watch here.

by Roger Montgomery Posted in Airlines, Companies, Investing Education, TV Appearances, Value.able.

-

What is HFT and Algo trading?

Roger Montgomery

May 21, 2012

Facebook floated last week and amazingly it has been holding above its IPO price of $38 per share. I say amazingly because I reckon its value to be substantially lower. I will publish my completed calculations in the near future

Facebook floated last week and amazingly it has been holding above its IPO price of $38 per share. I say amazingly because I reckon its value to be substantially lower. I will publish my completed calculations in the near futureHere’s a taster: “For a purchaser of Facebook shares today and wanting 15 percent per year over the next five years (doubling your money), Facebook’s market capitalization has to double to $200 billion without any additional shares being issued (options to be exercised will put paid to any fairy tale notions about that). Google is valued by the market today at $200 billion. Both businesses are similar in terms of margins etc so arguably Facebook needs to increase its sales tenfold in the next five years to achieve the same valuation as Google today. But keep in mind, Google has about $40 billion of cash in its accounts. Facebook has nothing like that.”

For now I thought the trading in Facebook on its first day was a useful entrée to the world of High Frequency and Algorithmic trading and I also thought that comic Andy Borowitz’s tongue-in-cheek look at Facebook provided a welcome break from the doom and gloom pervading investment markets.

From: http://www.borowitzreport.com/

MENLO PARK, CA (The Borowitz Report) – On the eve of Facebook’s IPO, Founder and CEO Mark Zuckerberg published the following letter to potential investors:

Dear Potential Investor:

For years, you’ve wasted your time on Facebook. Now here’s your chance to waste your money on it, too.

Tomorrow is Facebook’s IPO, and I know what some of you are thinking. How will Facebook be any different from the dot-com bubble of the early 2000’s?

For one thing, those bad dot-com stocks were all speculation and hype, and weren’t based on real businesses. Facebook, on the other hand, is based on a solid foundation of angry birds and imaginary sheep.

Second, Facebook is the most successful social network in the world, enabling millions to share information of no interest with people they barely know.

Third, every time someone clicks on a Facebook ad, Facebook makes money. And while no one has ever done this on purpose, millions have done it by mistake while drunk. We totally stole this idea from iTunes.

Finally, if you invest in Facebook, you’ll be far from alone. As a result of using Facebook for the past few years, over 900 million people in the world have suffered mild to moderate brain damage, impairing their ability to make reasoned judgments. These will be your fellow Facebook investors.

With your help, if all goes as planned tomorrow, Facebook’s IPO will net $100 billion. To put that number in context, it would take JP Morgan four or five trades to lose that much money.

One last thing: what will, I, Mark Zuckerberg, do with the $18 billion I’m expected to earn from Facebook’s IPO? Well, I’m considering buying Greece, but that would still leave me with $18 billion. LOL.

Friend me,

Mark

Following that lighthearted distraction, if you are interested in how High Frequency Trading and [some examples] of Algorithmic (Algo) Trading looks in the real world, watch this:

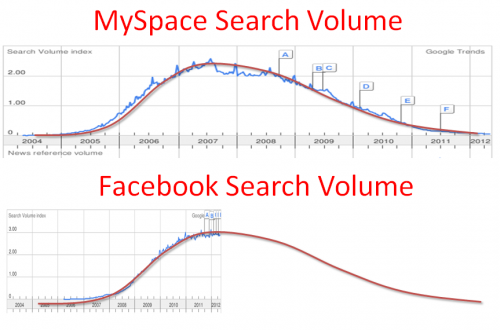

As the following chart reveals (you will have to suspend reality and imagine that the future always looks exactly the same as the past) some analysts think Facebook’s growth will mimic that of other high profile social networks. No doubt the underwriters of Facebook will hope they’re wrong.

Either way it will be more than a little interesting to watch. Did you buy shares in Facebook? If not, why not? And if you did, what were the reasons?

Posted by Roger Montgomery, Value.ableauthor, SkaffoldChairman and Fund Manager, 21 May 2012.

by Roger Montgomery Posted in Insightful Insights, Value.able.

-

What’s the big Idea?

Roger Montgomery

May 21, 2012

Matthew was so disappointed about the April takeover offer for a company he owned, that he wrote a letter to his rep – the CEO

More of us should be doing likewise, remembering the words of Richard Puntillo; “in theory, publicly traded corporations have shareholders as their kings, boards of directors as thesword–wielding knights who protect the shareholders and managers as the vassals who carry out orders. In practice, in the past decade, managers have become kings who lavish gold upon themselves, boards of directors have become fawning courtiers who take coin in return for an uncritical yes-man function and shareholders have become peasants whose property may be seized at management’s whim.”

Has a company you owned shares in been taken over and left you disappointed rather than elated? Its simplistic and a sign of immaturity as an investor to celebrate a takeover when the price paid does not justify the prize. Its far too easy for investors to do the ‘Wall Street walk’ when a bid is received. Matthew’s actions serve as a reminder that their are issues beyond the immediate return that must also be considered.

Hi Roger and team,

I sent the following letter to the CEO of a company today that I am a shareholder in called IDEAS International. They are a small company but very successful and operate in an area that is experiencing huge growth. They are little known, very thinly traded and not appropriate for most investors. Perfect for me!

IDEAS International was formed in 1981 and listed on the ASX in 2001. The IDEAS business is essentially one of analysing computer resource usage. This is important for companies who operate servers because this information allows these companies to increase efficiency and get value for money from their IT purchases. In a commodity like business (i.e. cloud servers) companies that can assist you to squeeze out another 1% in efficiency or when buying $20m of hardware to buy the correct servers for the job, paying a small fee to a company like IDEAS is a no-brainer. They provide independent advice based on real-world scenarios. They collect this information from the other part of their business which is in providing independent monitoring and analysis services to the same companies. Cloud computing is a huge growth area at the moment and it will get bigger. IDEAS is only just making a dent in this business and the demand for their services will grow as the cloud computing business is increasingly commoditised.

On wednesday they went in to a trading halt pending the release of information regarding a control transaction. Today they released a takeover bid by a large international IT outfit called Gartner with the full support of the board. No premium to current prices has been offered, the takeover is at $1.40, the same as the trading price for the last month. The quality of this company is high, it is cheap and Gartner are getting away with robbery.

The below letter doesn’t fit the theme of the recent “Guest Posts” but I thought you might consider it anyway. I won’t be at all concerned if you don’t think it is appropriate.

Kind Regards,

Matthew Rackham

**********

IDEAS InternationalASX Code: IDE“Takeover Disappointment”

Dear Mr Bowhill,

I read with interest the takeover proposal by Gartner for IDEAS released to the ASX this morning.

I am a private investor and I will be up front and say that I am very disappointed to hear that you are recommending the proposal.

IDEAS is a fantastic business. There are very few businesses as good as IDEAS in Australia, let alone on the ASX. Not only is this a fantastic business but by what I have read it seems to be run very well by management. Overlay this on the growth in the server space which IDEAS is in and my impression is this company has many exciting years of growth ahead of it.

In comparison Gartner looks to me to be a lousy business. Significant debt, slim profit margins and poor return on assets are the lot of Gartner’s management and shareholders.

But maybe these could be forgiven if the sale price rewarded current shareholders equally to future shareholders. Sadly however, it does not. If something close to recent performance continues I expect IDEAS to be worth in excess of $3 per share and maybe up to $4.20 in four years time. If the AUD drops this figure will be higher. Looking at your financial statements IDEAS will have the capacity to pay much larger dividends in the very near future as well. Net of cash Gartner are buying our company for $13.1 million and with earnings of $1.9 million and cash flow of $2.8 million – Gartner are making a steal. I expect Gartner will get their purchase outlay back within 4 years, and much earlier when they leverage their much larger distribution network.

I have to ask the question: Why if Gartner are so keen to use the resources of IDEAS do the management of IDEAS not license Gartner as a reseller/agent/partner ? This would ensure the value of IDEAS stays with the shareholders of IDEAS, allow IDEAS management to achieve their aspirations of making IDEAS a globally significant business and Gartner can continue on as, albeit slightly less so than before, a lousy performing business. In this scenario everyone gets the value they are entitled to.

Longstanding shareholders of IDEAS may feel that the performance of IDEAS share price has not been all that great for many years and this is a chance to “cash out” at a good price. What I would say to them is that (1) this is not the time to “cash out” given IDEAS is on the cusp of a large ramp up in use of it’s services – if they have waited this long surely they can hold on a few more years to realise the benefits of their patience and (2) higher share prices in normal circumstances result in greater liquidity in the shares so if they want to cash out they will be able to in a few years anyway. New shareholders from the GFC period have nothing to lose either way (good luck to them!).

I am very frustrated by this opportunistic offer for our company,

Kind Regards,

Matthew Rackham

by Roger Montgomery Posted in Insightful Insights, Value.able.

-

Is this what they mean?

Roger Montgomery

May 16, 2012

When pundits talk of blood in the streets, is this what they mean?

When pundits talk of blood in the streets, is this what they mean?The chart above is a Market Heat Map for the All Ordinaries. The brightest green is a move up of more than 6% on the day. Not many fit that bill today. The brightest red is a move down of more than 6%. The size of each box is related to market capitalisation. You can see the four big boxes in the lower middle of the heat map – thats the big four banks.

And if you are wondering what the little bright green stock is at the lower right of the Heat Map, that’s Industrea (ASX: IDL, Skaffold Quality Score A3). A year ago IDL was trading at $1.57 but its intrinsic value in Skaffold was just $1.13. Based on expected 2012 results Skaffold’s intrinsic value was just 83 cents and on May 9 this the share price fell to 80 cents. So it a took a year to get there but the price traded at a 4% discount to intrinsic value – admittedly not a very wide discount. And today IDL is bright green in a sea of red ink because it received a takeover offer from GE at $1.27.

Turning back to the Heat Map and the red appearing everywhere (it could all be very bright green tomorrow – we are not in the business of predicting prices) the fact is that it’s not common for us to look at prices with this much interest unless things are indeed getting interesting. We know the companies we’d like to own and the prices we’d like to pay – all that’s left to do is to turn the market on and see if anyone is prepared to do something silly today.

Today might just have been one of those days. Only time will tell and of course never bet the farm on one throw of the dice. So are we looking at a market on the precipice (the same precipice many of you have indicated you believe house prices are sitting on)? Or if you are reading this after the close, have you missed the boat? WHat are your advisers telling you?

There are some incredibly learned and articulate readers that regularly visit and I’d be delighted to hear your thoughts.

Posted by Roger Montgomery, Value.ableauthor, SkaffoldChairman and Fund Manager, 16 May 2012.

by Roger Montgomery Posted in Investing Education, Value.able.

-

MEDIA

What Value.able Insights does Roger have on Flight Centre?

Roger Montgomery

May 9, 2012

Do Indochine Mining (IDC), Silverlake Resources (SLR), Iluka Resources (ILU), Horizon Oil (HZN), Boart Longyear (BLY), Newcrest Mining (NCM), BHP Billiton (BHP), Rio Tinto (RIO), Think Smart (TSM), New Hope Coal (NHC), Ludowici (LDW), Alumina (AMC), Flight Centre (FLT), Hawkley Oil & Gas (HAG), M2 Communications (MTU), Northern Star (NST), Codan (CDA) or Onesteel (OST) make Roger’s coveted A1 grade? Watch this edition of Sky Business’ Your Money Your Call broadcast 9 May 2012 to find out. Watch here.

by Roger Montgomery Posted in Companies, Investing Education, Skaffold, TV Appearances, Value.able.

-

Should you watch director’s dealings?

Roger Montgomery

May 8, 2012

Once upon a time JB Hi-Fi was a category killer: its returns on equity were unassisted by debt and stratospheric and it was all reflected in a strong share price. But something has changed. I wrote previously, and commented elsewhere, that JB Hi-Fi was maturing, that returns on equity were flattening and that the sun was setting on the ability of the business to reinvest profits at the very high returns of the past. The impact of this of course is flatlining intrinsic values. Indeed take a look at the Skaffold valuation line chart below. You can see that even by 2014, JBH’s intrinsic values are expected to show no appreciation from 2009/2010. Maturity.

Once upon a time JB Hi-Fi was a category killer: its returns on equity were unassisted by debt and stratospheric and it was all reflected in a strong share price. But something has changed. I wrote previously, and commented elsewhere, that JB Hi-Fi was maturing, that returns on equity were flattening and that the sun was setting on the ability of the business to reinvest profits at the very high returns of the past. The impact of this of course is flatlining intrinsic values. Indeed take a look at the Skaffold valuation line chart below. You can see that even by 2014, JBH’s intrinsic values are expected to show no appreciation from 2009/2010. Maturity.That of course hasn’t prevented me from buying a few shares around$15.00. Fortunately however we were quick to change our mind and even secured a small profit.

I wonder whether the first signs of business performance beginning to mature, is often the point when it becomes worth watching what directors do with their shares for some further insights?

JB Hi-Fi’s CEO, Richard Uechtritz, had been at the company for a decade prior to his retirement in 2010 and those watching his share dealings may have drawn a different conclusion to those being lulled by a bullish share price.

At the outset let me say there is no impropriety in a director selling their shares and none is suggested here. Directors are free to sell shares within the bounds of their staff trading policy and are required to report their dealings to the market.

And it’s through these announcements that the investor can see what directors are doing with their shares.

On August 20, 2009, JB Hi-Fi’s CEO held 2 million shares and 627,000 options

and he exercised options to buy another 180,048 shares at $7.27. A week later, JB Hi-Fi’s CEO had sold all of shares he had just purchased the week before for an average price of $17.65.

Then, between September 2 and 3, 2009, another 500,000 shares were sold at an average price of $18.22. By now JB Hi-Fi’s CEO held 1.5 million shares (down from 2 million on AUgust 20) and 447,267 options (down from 627,000).

Skaffold’s Valuation Line Evaluate screen for JBH reveals a maturing intrinsic value – little growth and lower IV in 2014 than 2010.

To alleviate the need to read thousands of annual reports, for every listed company, going back a decade try www.skaffold.com

Now back to our regular programming…

Between August 20 and September 3, there are just 13 days – call it two weeks.

Another 174,656 options were granted on 14 October 2009, and then, in early February 2010, JB Hi-Fi announced the retirement of its CEO.. Having sold 680,048 shares in the seven months before the announcement, JB Hi-Fi’s CEO sold another 500,000 shares during the first five days of March 2010 at an average price of $19.74 leaving him with 1 million shares and 621,923 options.

In his final director’s interest notice in May 2010, the retiring CEO of JB Hi-Fi listed his direct equity interest in the company at 1 million shares and the 621,923 options. For investors who are interested in gaining a possible inside track on the prospects and potential of a business, it may be useful to watch directors’ dealings in their shares.

Of course sometimes the selling can mean nothing at all but my observation is that watching the selling offers some insights. If motivated by urgency, a desire to lock in lofty share prices or grim expectations, information about director’s selling can be more useful than watching their buying.

In April 2011 (about a year later), Richard Uechtritz returned to JB Hi-Fi as a Non-executive director. Until his return, he didn’t have director’s obligations so he was not obliged to make public any of his private share dealings. Upon his return, however, he revealed that he owned only 421,000 options. In other words, he appears to have subsequently sold the one million shares he held at the time of his retirement.

JB Hi-Fi shares do not enjoy the lofty levels they once commanded and investors who tracked the sale of shares by its CEO may have been given a prompt to look deeper into the company, its prospects or at least the impact of those prospects on its shares. Of course it could all be happenstance, company CEO’s have no particular insights and their selling is purely a reflection of the need to diversify. ANy subsequent share price declines may just be coincidental.

JB Hi-Fi’s latest results were less than spectacular and, while the company will continue to win in the race against its listed peers, the reality is its margins remain under increasing pressure, it’s losing share to the internet and its remaining store rollout plan is contributing to a maturing set of metrics. Oh, and the share price now? Just above $9.30.

So do you think you should keep an eye on director’s dealings? What have been your observations? Can you nominate some companies in which directors dealings having given you cause to pause…

Posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 9 May 2012.

by Roger Montgomery Posted in Consumer discretionary, Skaffold, Value.able.

-

Can a picture tell a thousand words?

Roger Montgomery

May 3, 2012

Harvey Norman today gave its third quarter results reporting LFL (Like-for-like) sales down 6.6% and profit before tax down 24.8%. We think a picture tells a thousand words and offer the following two images (above, of the Apple Store in Sydney’s George Street and below, of the Harvey Norman Store in Bell Street Preston…yes, yes I know different foot traffic etc.) as an invitation for you to comment about what it takes a for a retailer to succeed. If branding and customer experience are two to keys to success….

One wonder’s whether reinvestment is a priority at HVN because we believe thats what retailing constantly needs.

Posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 3 May 2012.

by Roger Montgomery Posted in Value.able.

- 71 Comments

- save this article

- POSTED IN Value.able